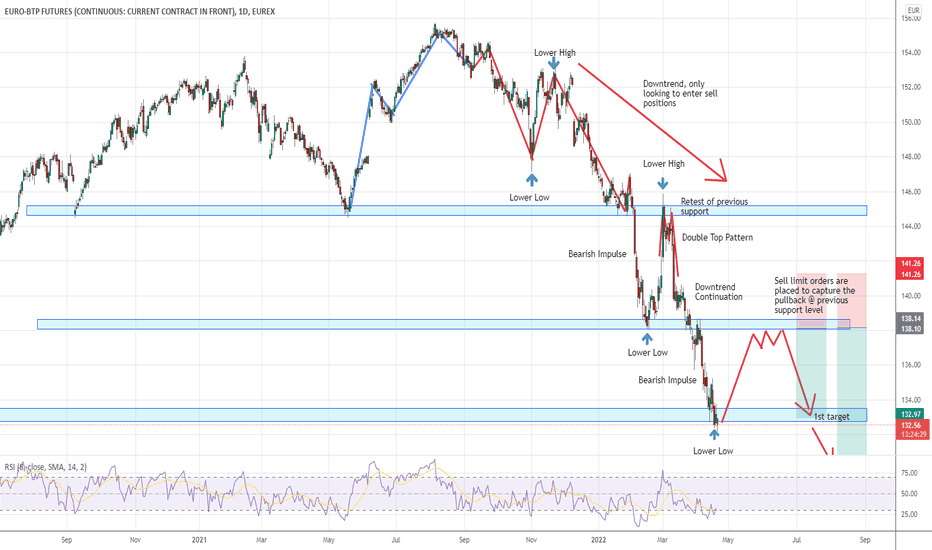

A Simple Swing Trade Setup for Euro-BTP FuturesSince earlier this year, all European bonds have extended losses due to the impact of Ukraine war. The downtrend is persistent; therefore, the only trading action we will take is to short the market. Among all European bonds, the Italian government bond (Euro-BTP Futures) drops somewhat in an orderl

Related futures

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Frequently Asked Questions

The current price of Long-Term Euro-BTP Futures-Fixed Income Fut Futures is 119.64 EUR — it has risen 0.17% in the past 24 hours. Watch Long-Term Euro-BTP Futures-Fixed Income Fut Futures price in more detail on the chart.

Track more important stats on the Long-Term Euro-BTP Futures-Fixed Income Fut Futures chart.

The nearest expiration date for Long-Term Euro-BTP Futures-Fixed Income Fut Futures is Mar 6, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Long-Term Euro-BTP Futures-Fixed Income Fut Futures before Mar 6, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Long-Term Euro-BTP Futures-Fixed Income Fut Futures this number is 0.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Long-Term Euro-BTP Futures-Fixed Income Fut Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Long-Term Euro-BTP Futures-Fixed Income Fut Futures. Today its technical rating is strong buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Long-Term Euro-BTP Futures-Fixed Income Fut Futures technicals for a more comprehensive analysis.