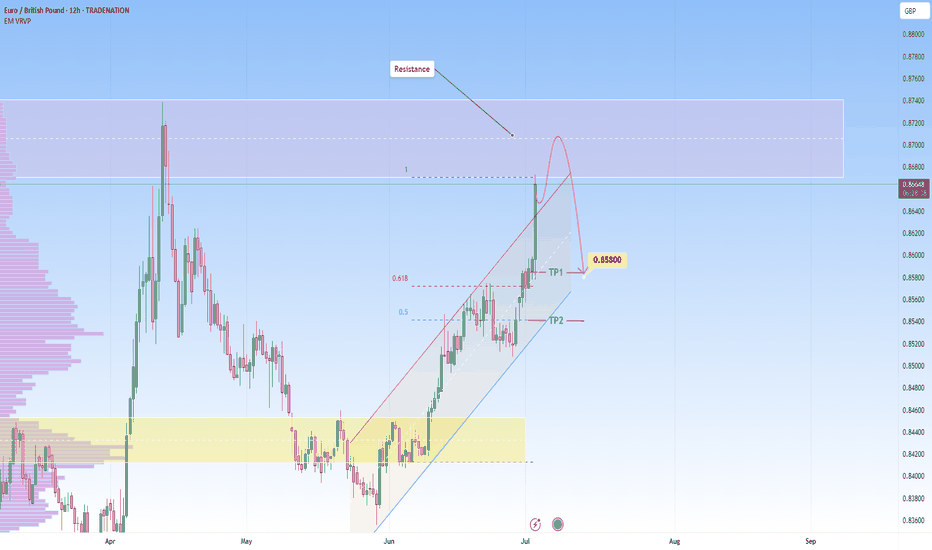

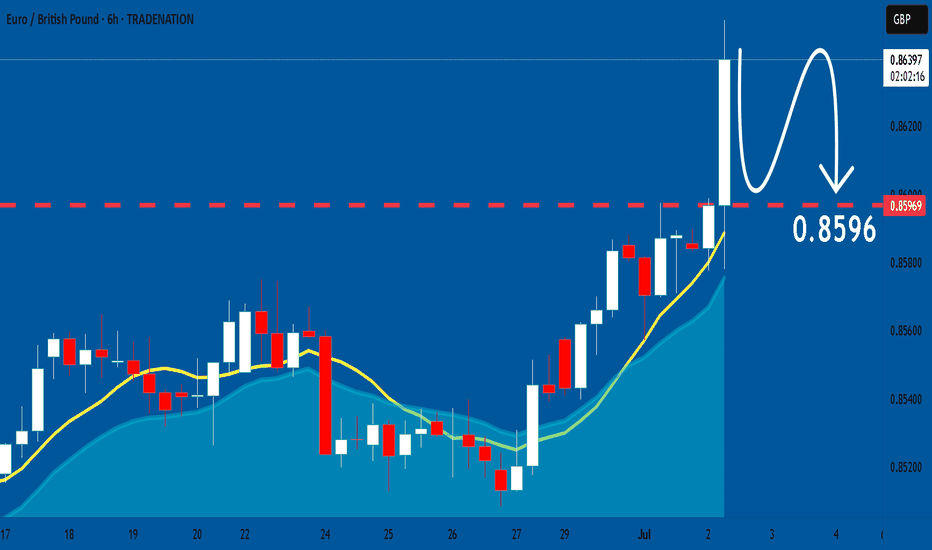

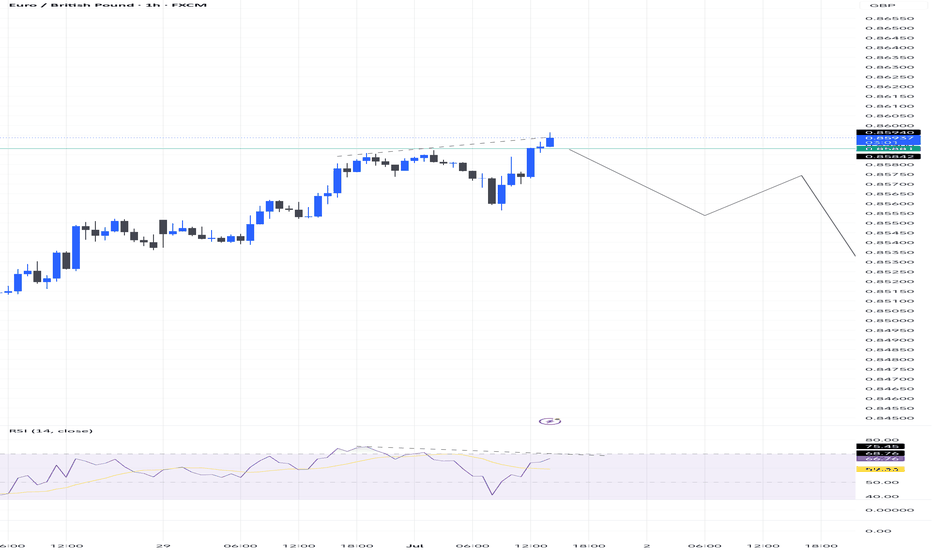

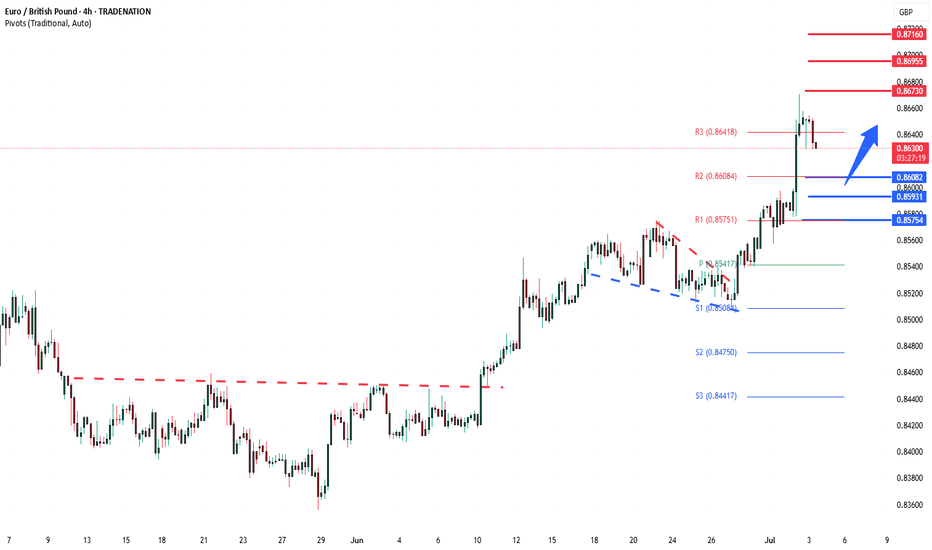

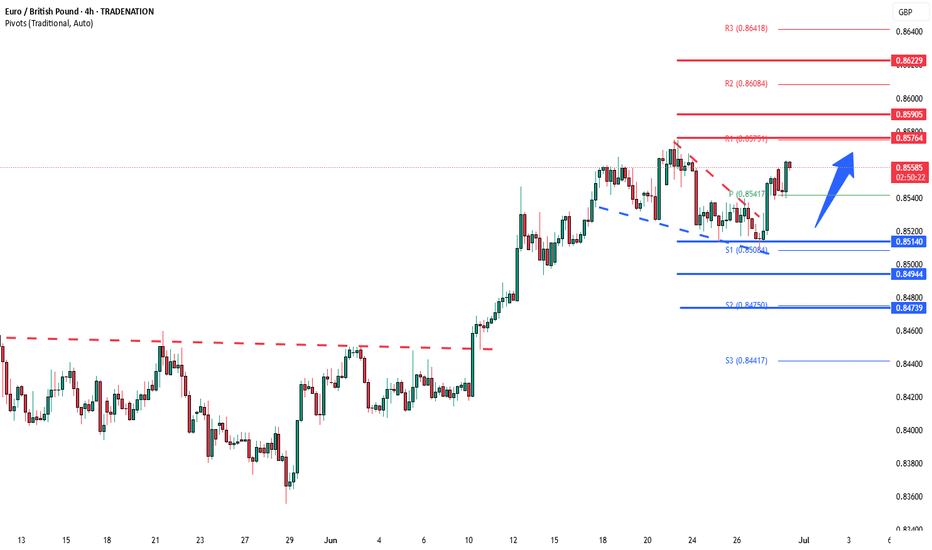

EURGBP reached strong resistance: Likely reversal incomingPrice has been in a strong impulsive rally, pushing aggressively into a well established resistance zone. This zone is marked by a prior sharp sell-off, suggesting it could trigger selling interst again.

The current move appears overextended in the short term. The ascending channel is extremly vertical, showing momentum, but this type of movement often leads to exhaustion, especially when met with a key zone like so. Volume profile shows a lack of recent trading activity at these levels, which can exaggerate volatility once price enters this area.

Given how clean and one-sided the climb has been, a pullback is not only likely, but it would be healthy. The projected reaction toward the 0.85800 area makes sense technically: it corresponds with key Fibonacci retracement levels (between 0.5 and 0.618), adding confluence to the idea of a corrective move before any continuation or reversal.

Until there’s a clear break above the upper bound of this zone with sustained volume, this remains a high-probability area for short-term rejection or distribution.

If price starts printing long upper wicks, slowing momentum, or bearish engulfing patterns on lower timeframes, that could offer early signals of weakness and a shift in momentum.

Just sharing my thoughts on support and resistance, this isn’t financial advice . Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP trade ideas

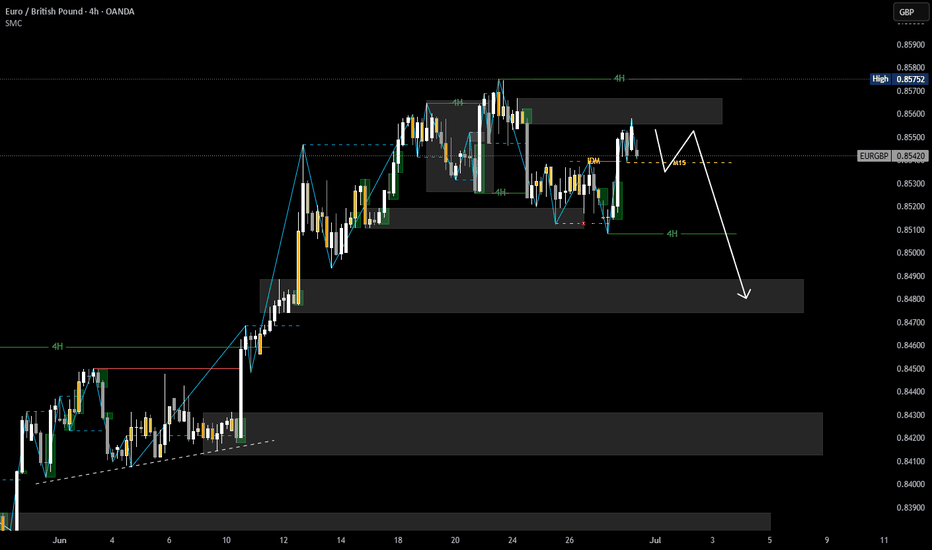

EURGBP - Follow The Bulls!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

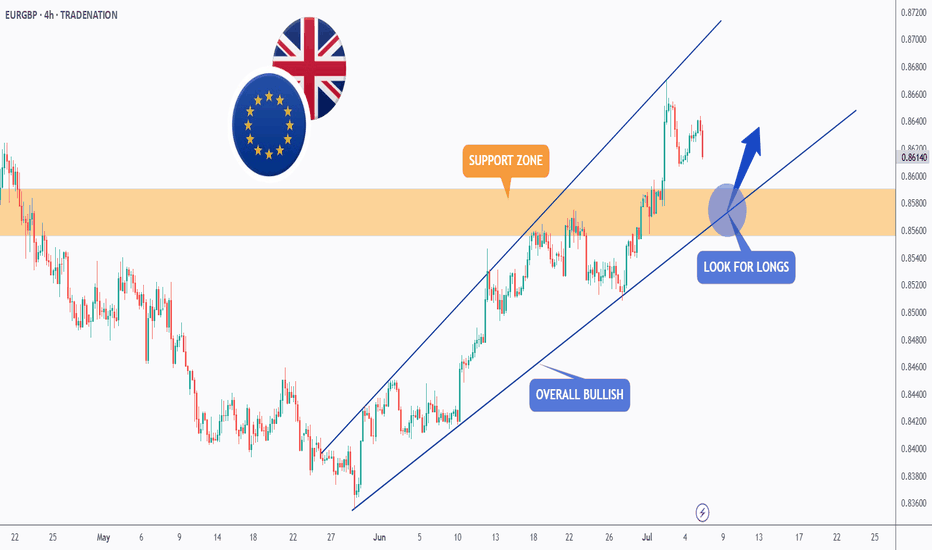

📈EURGBP has been overall bullish trading within the rising channel marked in blue. And it is currently retesting the lower bound of the channel.

Moreover, the orange zone is a strong daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and support.

📚 As per my trading style:

As #EURGBP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP – Trading the Price Where It Is, Not Where You Want It toWhen trading price movements, traders always strive to determine where the price will go.

This compulsion leads most of them to close losing positions!

The strong urge that comes from this — that price must do what the trader predicted — is what ruins the position.

Price must always be handled as and where it is! This we know. This is certain.

Until 2016, EURGBP was my favorite pair. I traded it with a very well-functioning and manageable strategy. However, Brexit changed its movement.

In the 9 years since, I haven’t given up, and I’m still a trader! A trader who builds everything around personal development.

Thanks to this mindset, I can use the simplest strategy. I always analyze the chart based on existing information and make decisions according to the levels visible there.

The entry point is not the most important!

Our exit point is what matters! Because if that’s in profit, then even 100 points can be enough as annual profit. You just need a high lot size for that. But if you knew you’d have 100 points, how much would you risk? A lot! Everything…

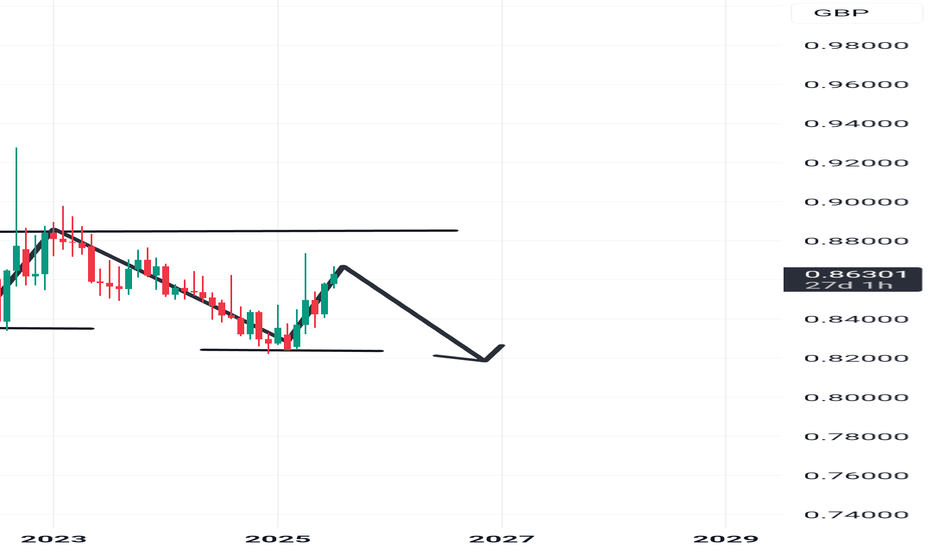

So in the image, you can see the “sideways” channel formed over the past 9 years of EURGBP, yet you can still identify a series of lower highs and lower lows.

Currently, it’s moving within a 600-point range upward from the most recent low after the confirmation of the latest high. It's now only 200 points away from that point.

If a new lower high forms here, then in time, price could close below the previous low.

A tight stop can be used at this entry point and a very large limit. I aim to achieve a 1:20 position with this trade this year.

Follow the price, and if proper confirmation occurs, a short entry may be made.

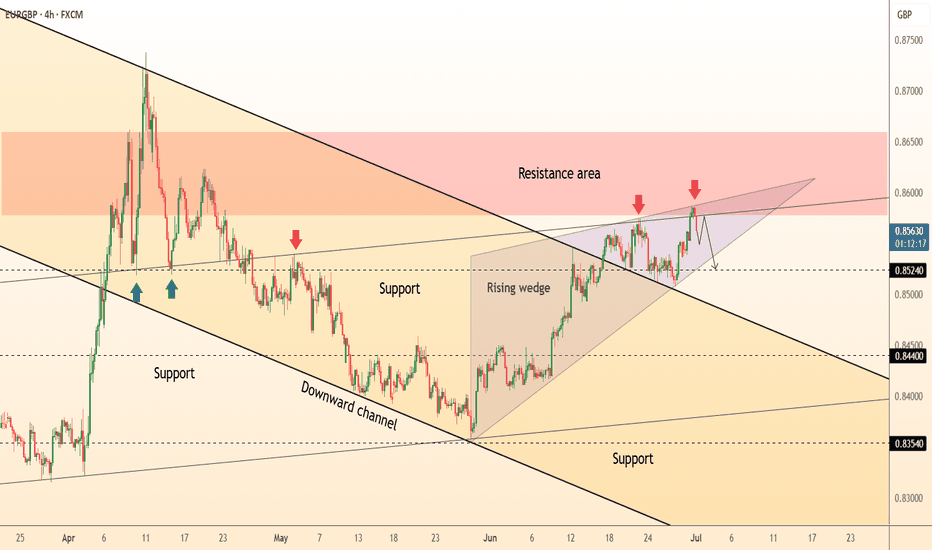

DeGRAM | EURGBP correction from the resistance area📊 Technical Analysis

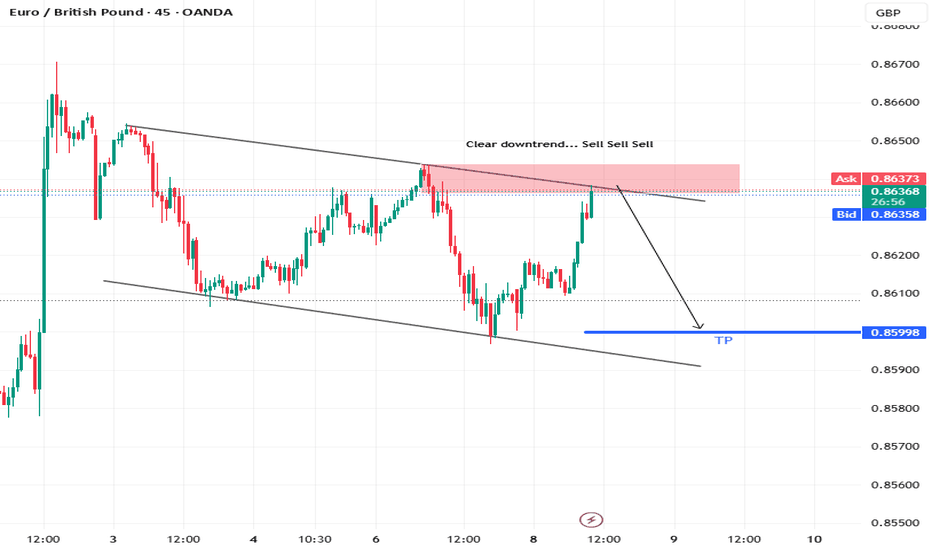

● Price failed twice at 0.8580-0.8600 supply, completing a rising-wedge inside the larger downward channel; bearish divergence accompanies the second rejection.

● A clean drop back under the former breakout line (≈0.8560) turns it into fresh resistance; wedge depth and channel mid-line converge at 0.8525, with the April floor 0.8440 as next objective.

💡 Fundamental Analysis

● French election risk premium is pressuring the euro, while stronger-than-expected UK GDP proxy (ONS monthly estimate) narrows growth gap and supports sterling.

✨ Summary

Sell 0.8560-0.8570; hold below 0.8560 targets 0.8525 → 0.8440. Short view invalidated on an H4 close above 0.8600.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP: Weak Market & Bearish Forecast

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to sell EURGBP.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

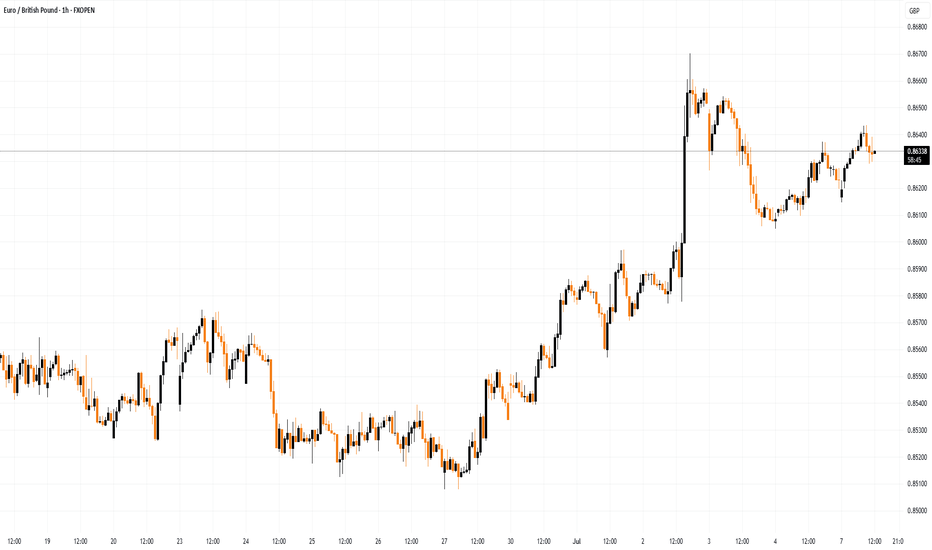

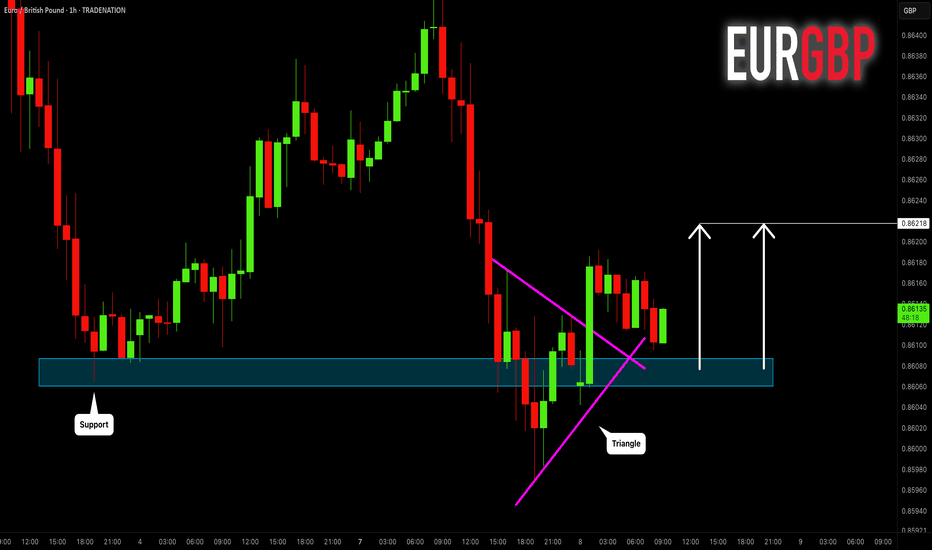

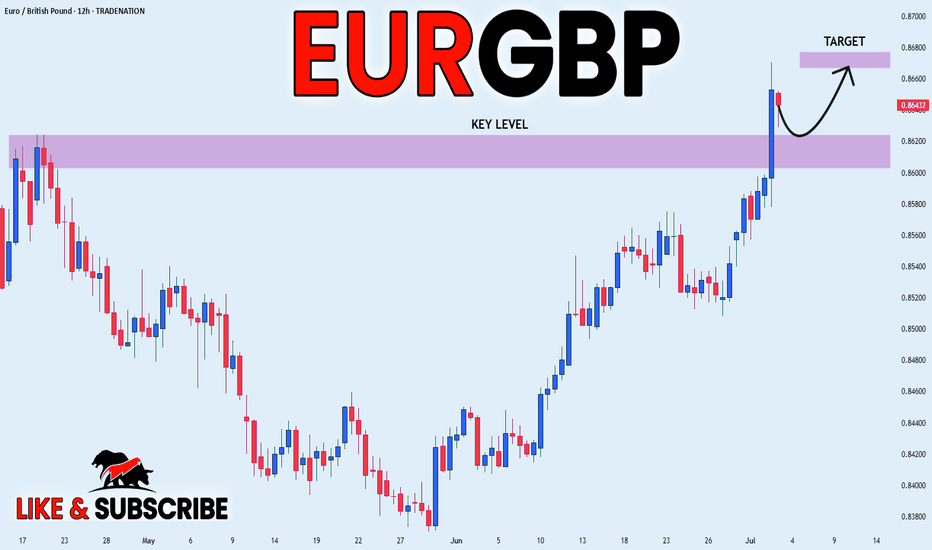

Market Analysis: EUR/GBP Accelerates HigherMarket Analysis: EUR/GBP Accelerates Higher

EUR/GBP is rising and might climb above the 0.8670 resistance.

Important Takeaways for EUR/GBP Analysis Today

- EUR/GBP is gaining pace and trading above the 0.8600 zone.

- There was a break above a contracting triangle with resistance at 0.8630 on the hourly chart at FXOpen.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP at FXOpen, the pair started a decent increase from the 0.8500 zone. The Euro traded above the 0.8580 resistance level to enter a positive zone against the British Pound.

The pair settled above the 50-hour simple moving average and 0.8620. It traded as high as 0.8670 before a downside correction. There was a move below the 23.6% Fib retracement level of the upward move from the 0.8507 swing low to the 0.8670 high.

However, the pair is stable above the 0.8600 support zone. The next major support is near the 50% Fib retracement level of the upward move from the 0.8507 swing low to the 0.8670 high at 0.8590.

A downside break below 0.8590 might call for more downsides. In the stated case, the pair could drop toward the 0.8545 support level. Any more losses might call for an extended drop toward the 0.8505 pivot zone.

The EUR/GBP chart suggests that the pair is facing resistance near the 0.8635 zone. A close above the 0.8635 level might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8670. Any more gains might send the pair toward the 0.8700 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Weekly Uptrend, Daily Uptrend, H4 Uptrend - It's a BUY????All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

tradingview.sweetlogin.com

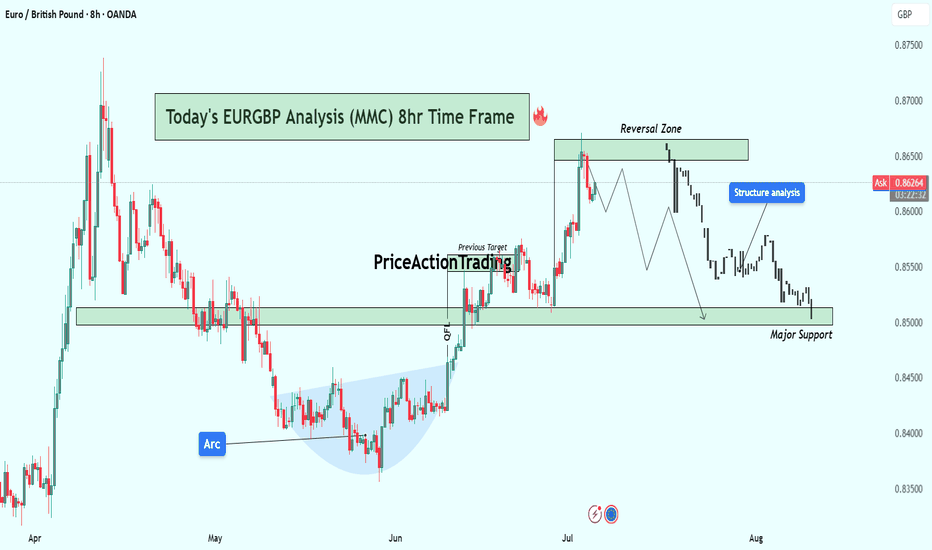

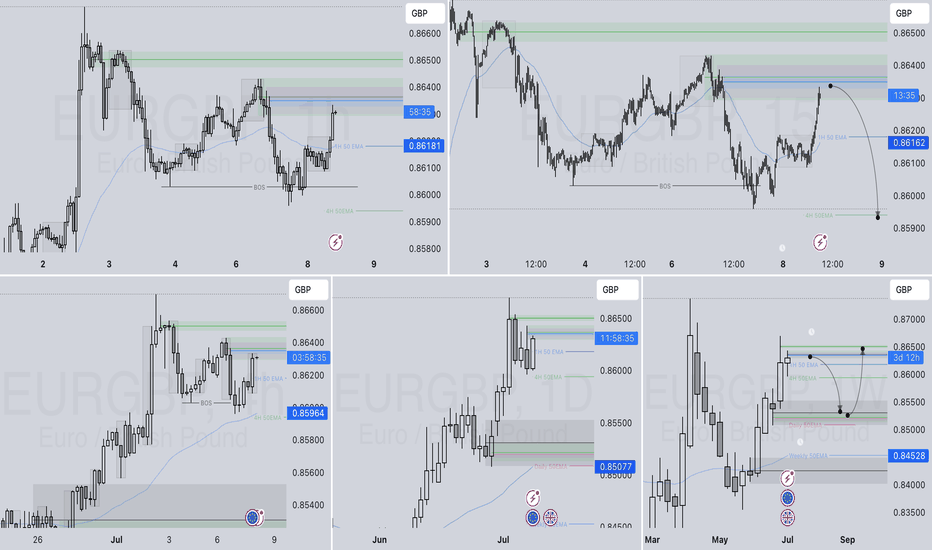

EURGBP 8H Analysis : Breakdown + Smart Money Structure + Target🧠 Phase 1: Arc Formation – Accumulation by Smart Money

The arc (May to June) reflects an accumulation base where price made higher lows with consolidative wicks and slow momentum, ideal conditions for institutional orders to build long positions.

Liquidity is swept below swing lows, stopping out early longs — this is classic smart money accumulation.

Volume compression during the arc followed by expansion on breakout confirms smart interest.

🔑 Psychology: Retail was likely selling here due to lower highs, while smart money was accumulating quietly at the bottom of the arc.

🚀 Phase 2: Breakout & Rally to Previous Highs

Price cleanly breaks above the arc’s neckline and previous resistance (labeled as Previous Target).

Momentum accelerates rapidly toward the reversal zone, likely due to stop hunts and FOMO buyers entering after confirmation.

Structure shifts bullish, creating strong impulsive candles — but these are often final exit points for smart money.

📌 Key Sign: Breakout aligns perfectly with market inefficiencies being filled, often a sign of a short-term top formation brewing.

🔄 Phase 3 : Reversal Zone – Distribution Phase

Inside the Reversal Zone (0.8650–0.8680), price shows exhaustion with multiple upper wicks and slowing bullish momentum.

Distribution signs: choppy movement, lower highs, and eventual breakdown.

Retail is often caught entering longs here on confirmation, while institutions offload their positions.

🧠 MMC Insight: This is where Mind Market Curve transitions from bullish impulse to corrective leg down — phase of deception.

📉 Phase 4: Structure Breakdown & Bearish Market Behavior

Price breaks through short-term higher low structure — confirmation of bearish intent.

The formation of lower highs and lower lows marks the beginning of a bearish trend shift.

Market is now targeting Major Support (0.8500–0.8520 zone), which is currently being tested.

🧭 If price breaks below 0.8500 with volume and aggression, next level is likely near 0.8430–0.8450.

⚖️ Current Price Location: Major Support Test

We’re at a critical decision point.

If support holds → expect a bounce to 0.8600–0.8620.

If it breaks → expect continuation to next liquidity pool below 0.8450.

This zone is where buyers and sellers will battle. Wait for:

Bullish confirmation (reversal pattern / engulfing candle) to go long.

Bearish breakout (close below zone + retest) to go short.

🔁 Summary of Scenarios

Scenario Conditions Target

✅ Bullish Bounce Rejection at support with bullish engulfing/pin bar 0.8600–0.8620

❌ Bearish Break Close below 0.8500 + retest as resistance 0.8430–0.8450

🔖 Educational Takeaway

This chart teaches how to:

Identify accumulation via arc and understand smart money behavior.

Recognize false confirmation zones (where retail enters late).

Understand structure shift as a trend reversal signal.

Execute trades based on reaction zones, not emotions.

If you follow MMC (Mind Market Curve), this is a textbook transition from:

Accumulation →

Expansion →

Distribution →

Breakdown

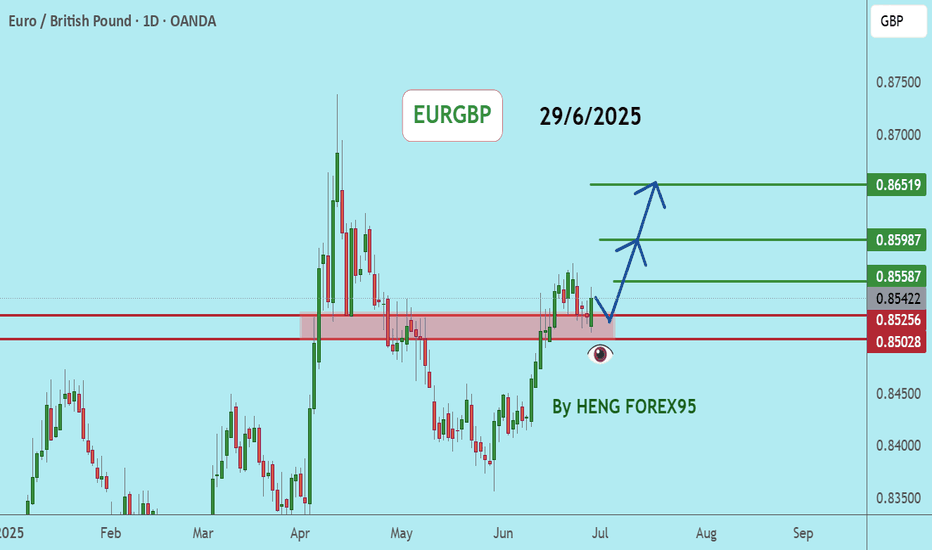

EURGBPEURGBP If the price can stay above 0.85028, it is likely to increase.

Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

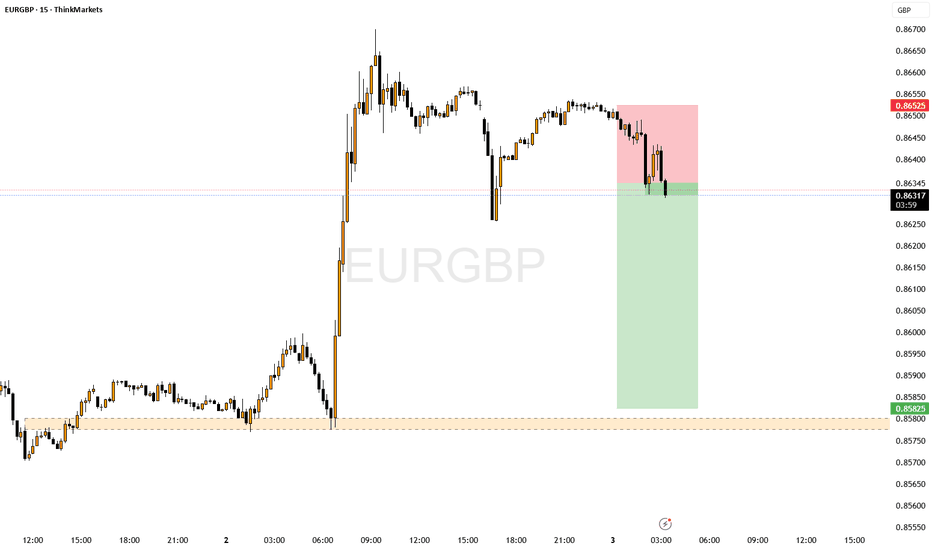

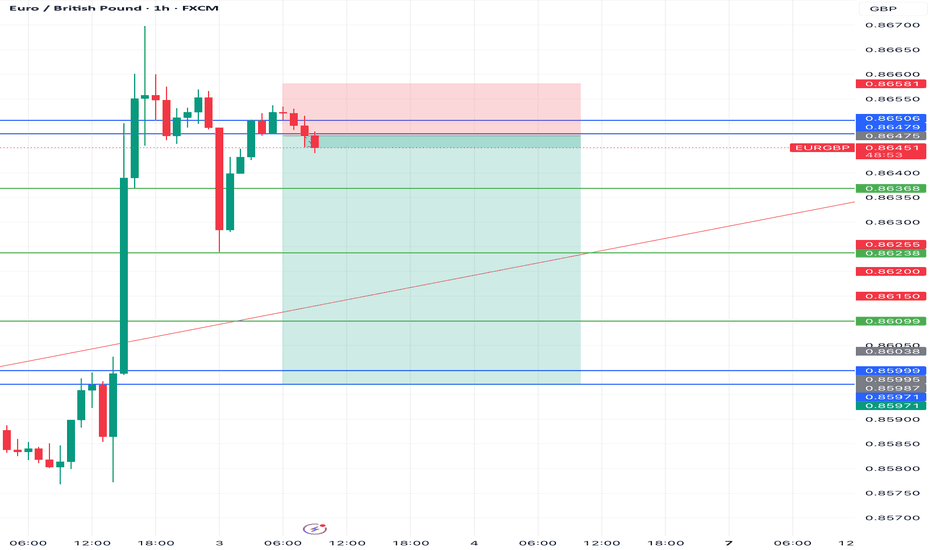

EURGBP: Bullish Move After False Breakout 🇪🇺🇬🇧

EURGBP will likely go up from a key daily/intraday support,

following a bullish breakout of a resistance line

of a bullish triangle on an hourly time frame.

The price may go up to 0.86218 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

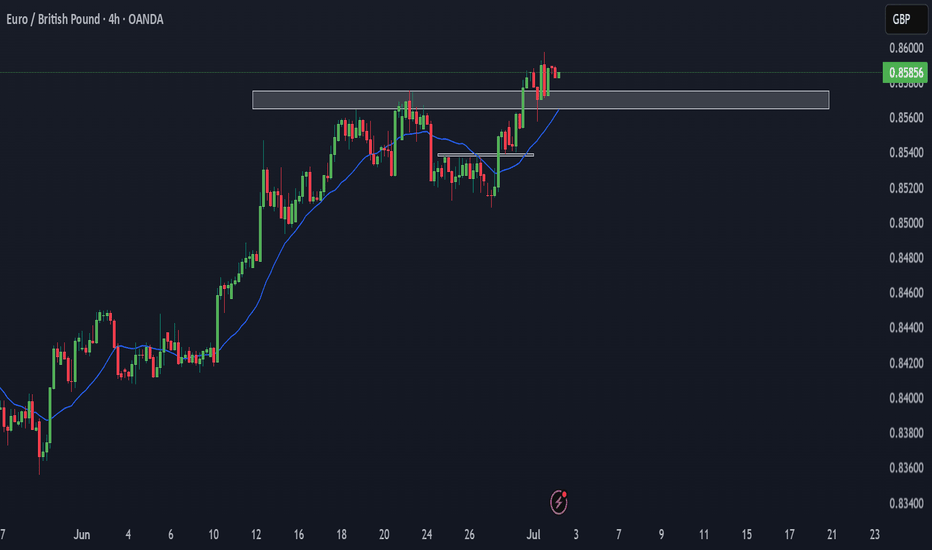

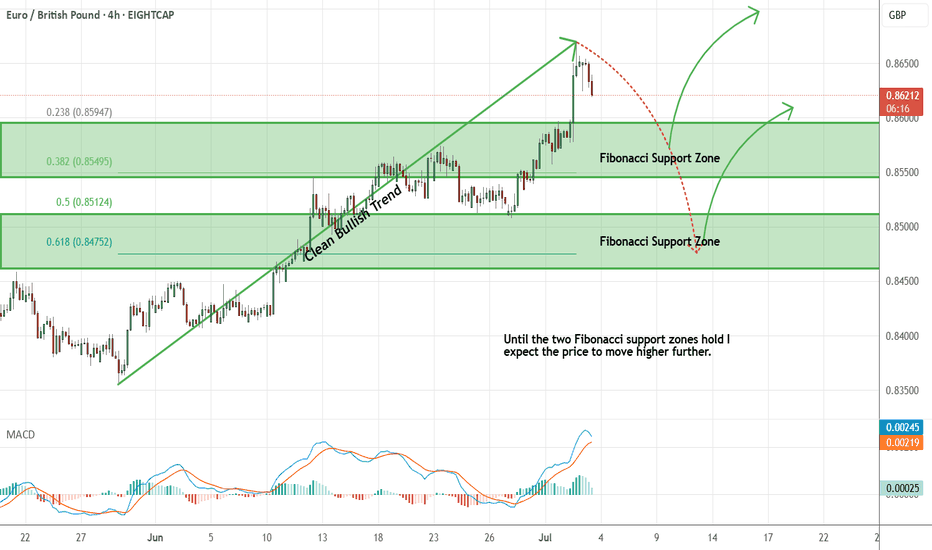

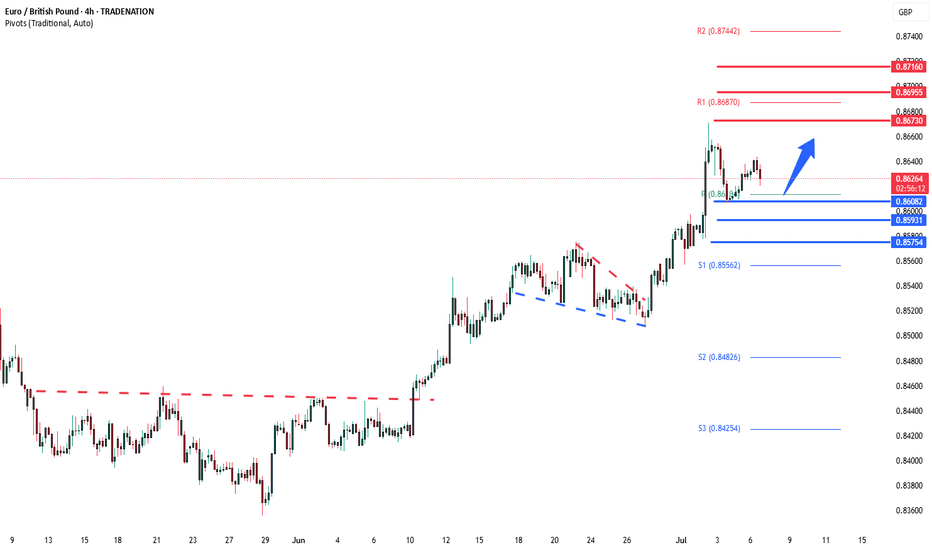

EURGBP - Expecting Bullish Continuation In The Short TermH4 - We have a clean bullish trend with the price creating a series of higher highs, higher lows structure.

This strong bullish momentum is followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

EUR_GBP BULLISH BIAS|LONG|

✅EUR_GBP broke the key

Structure level of 0.8620

While trading in an local uptrend

Which makes me bullish

And I think that after the retest

Of the broken level is complete

A rebound and bullish continuation will follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

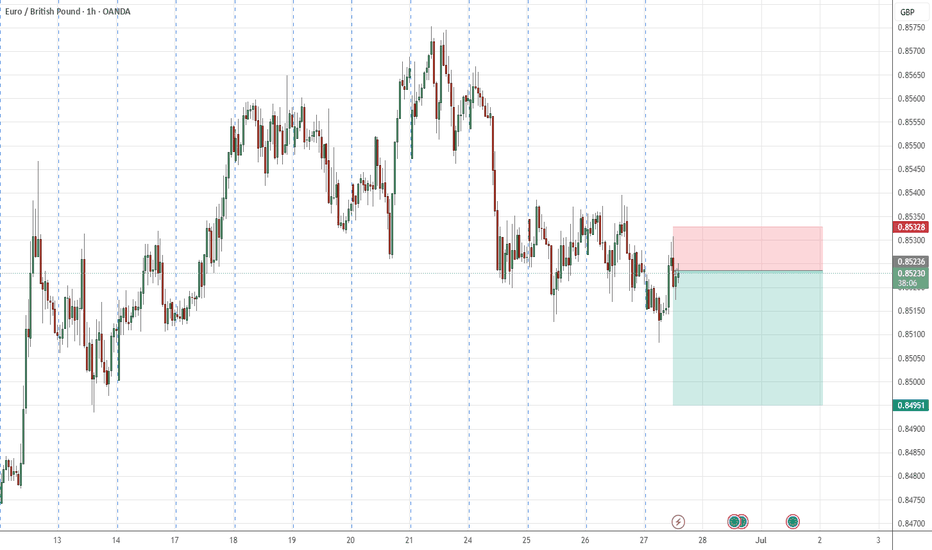

EURGBP short trade Idea with divergence 💶 EURGBP SHORT SETUP – Clean Supply Rejection 📉🔥

Looking at a fresh opportunity to short EURGBP based on recent price action and structure:

🔹 Market Context:

Price recently pushed into a key supply zone or resistance around 0.84800–0.85000.

Multiple rejections spotted at that level – suggesting weak bullish momentum and engineered liquidity.

🔹 Setup Bias: Bearish

We’re anticipating a short-term correction or continuation to the downside, targeting recent demand zones or imbalances.

🔹 Trade Setup (Example):

Entry: ~0.84800

Stop Loss: ~0.85100 (above supply wick)

Take Profit: ~0.84100 (demand/imbalance fill area)

Risk to Reward: ~1:3 potential

🔹 Confluences:

Rejection candle at supply

Divergence

Price broke structure (BOS) to the downside earlier

Overbought signals (if using RSI/Stoch)

Clean imbalance zone below

📊 Execution Tip:

Wait for confirmation (M15 bearish engulfing / lower high break) to avoid early entries.

EURGBP corrective pullback support at 0.8600The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8600 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8600 would confirm ongoing upside momentum, with potential targets at:

0.8670 – initial resistance

0.8700 – psychological and structural level

0.8720 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8600 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8590 – minor support

0.8570 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8600. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

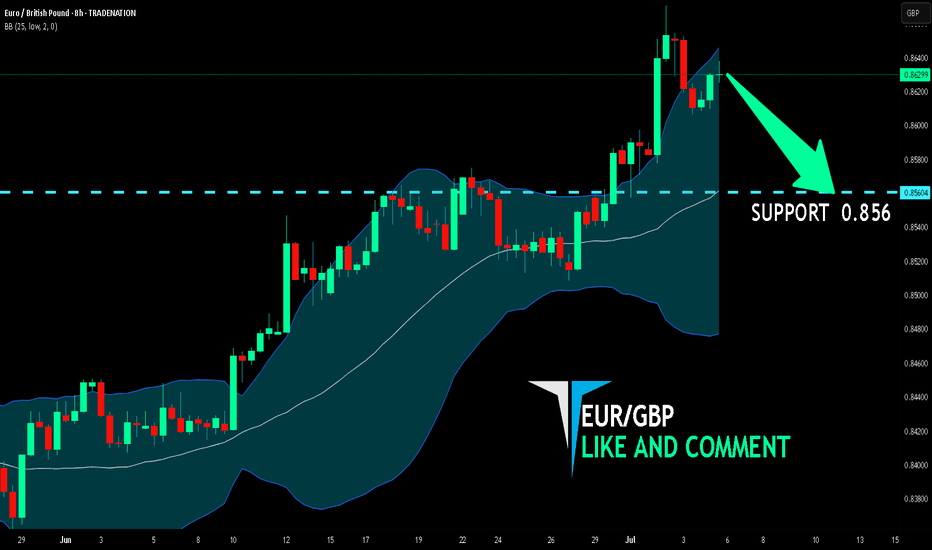

EUR/GBP BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

The BB upper band is nearby so EUR-GBP is in the overbought territory. Thus, despite the uptrend on the 1W timeframe I think that we will see a bearish reaction from the resistance line above and a move down towards the target at around 0.856.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURGBP uptrend support retest at 0.8600The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8600 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8600 would confirm ongoing upside momentum, with potential targets at:

0.8670 – initial resistance

0.8700 – psychological and structural level

0.8720 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8600 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8590 – minor support

0.8570 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8600. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURGBP SHORT DAILY FORECAST Q3 D8 W28 Y25EURGBP SHORT DAILY FORECAST Q3 D8 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURGBP Bullish continuation supported at 0.8510Trend Overview:

EURGBP remains in a bullish trend, characterised by higher highs and higher lows. The recent intraday price action is forming a continuation consolidation pattern, suggesting a potential pause before a renewed move higher.

Key Technical Levels:

Support: 0.8510 (primary pivot), followed by 0.8490 and 0.8470

Resistance: 0.8570 (initial), then 0.8590 and 0.8620

Technical Outlook:

A pullback to the 0.8510 level, which aligns with the previous consolidation zone, could act as a platform for renewed buying interest. A confirmed bounce from this support may trigger a continuation toward the next resistance levels at 0.8570, 0.8590, and ultimately 0.8620.

Conversely, a daily close below 0.8510 would suggest weakening bullish momentum. This scenario would shift the bias to bearish in the short term, potentially targeting 0.8490 and 0.8470 as downside levels.

Conclusion:

EURGBP maintains a bullish structure while trading above the 0.8510 support. A bounce from this level would validate the consolidation as a continuation pattern, with upside potential toward the 08570 area. A breakdown below 0.8510, however, would invalidate this view and suggest deeper corrective risk.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.