EURGBP trade ideas

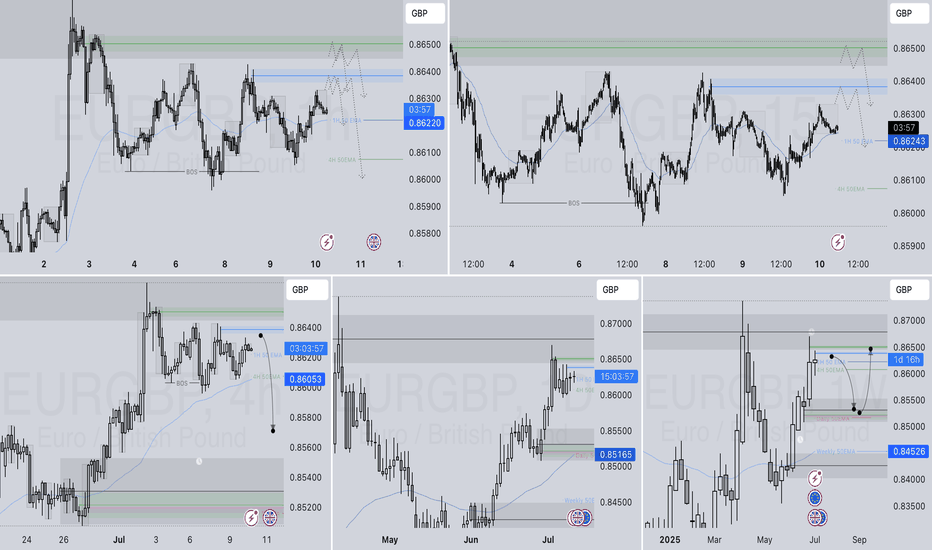

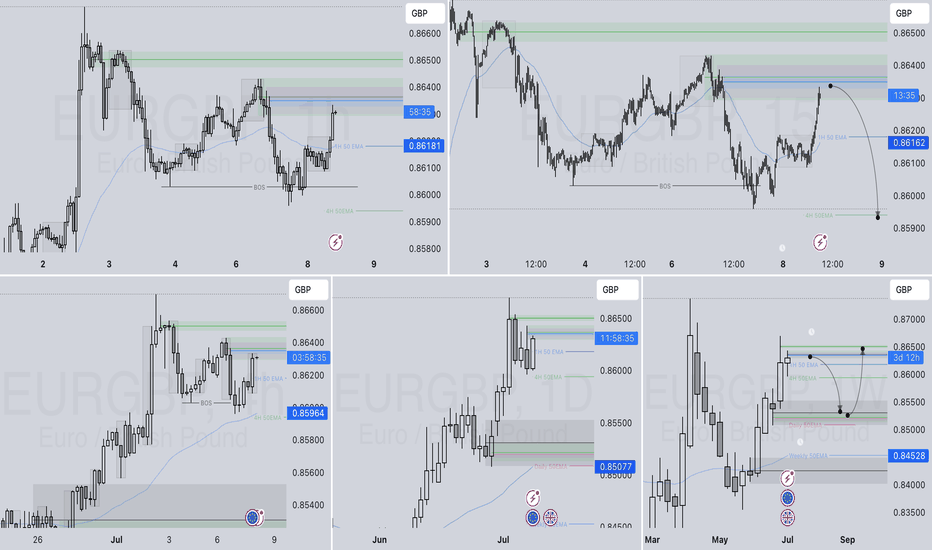

EURGBP SHORT DAILY FORECAST Q3 D11 W28 Y25EURGBP SHORT DAILY FORECAST Q3 D11 W28 Y25

It’s Fun Coupon Friday! 💸🔥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

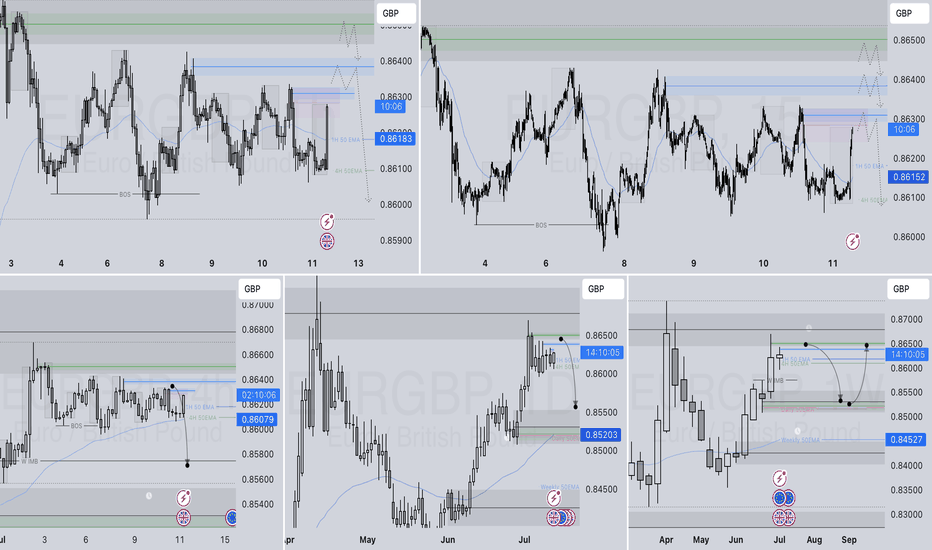

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

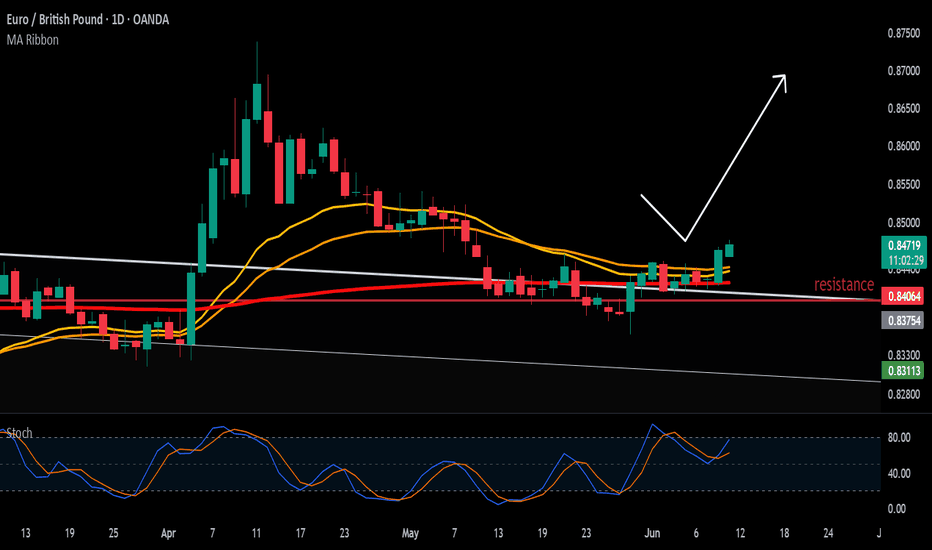

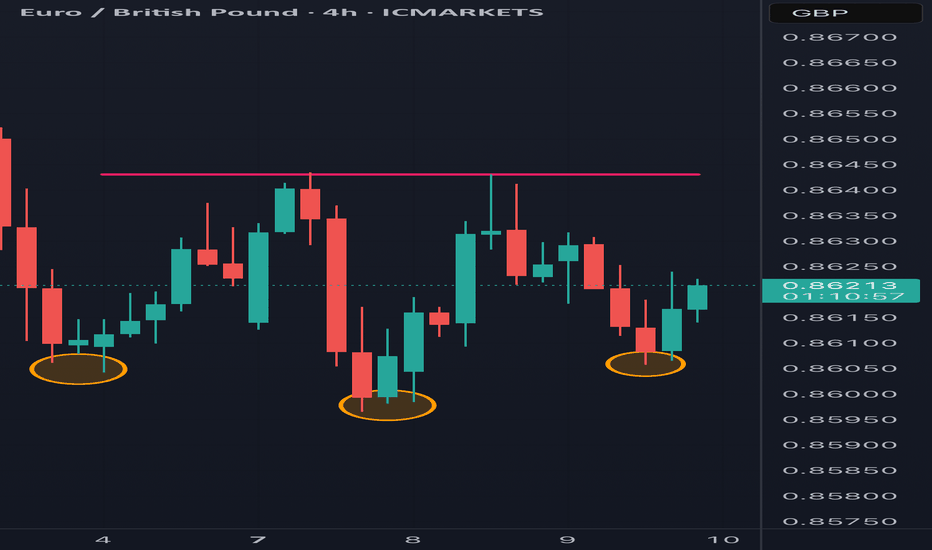

Bullish bounce off overlap support?EUR/GBP is falling towards the pivot, which has been identified as an overlap support and could bounce to the 1st resistance, which acts as a pullback resistance.

Pivot: 0.8569

1st Support: 0.8538

1st Resistance: 0.8640

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

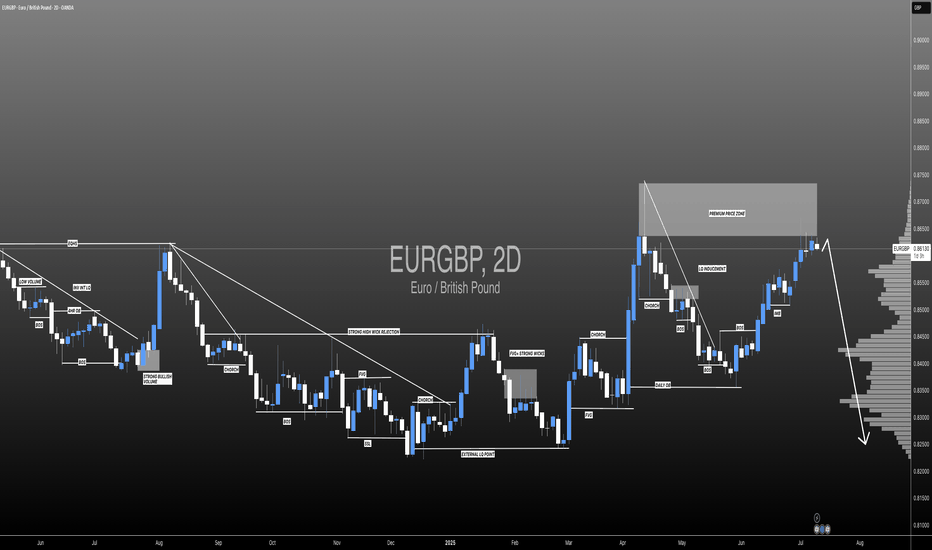

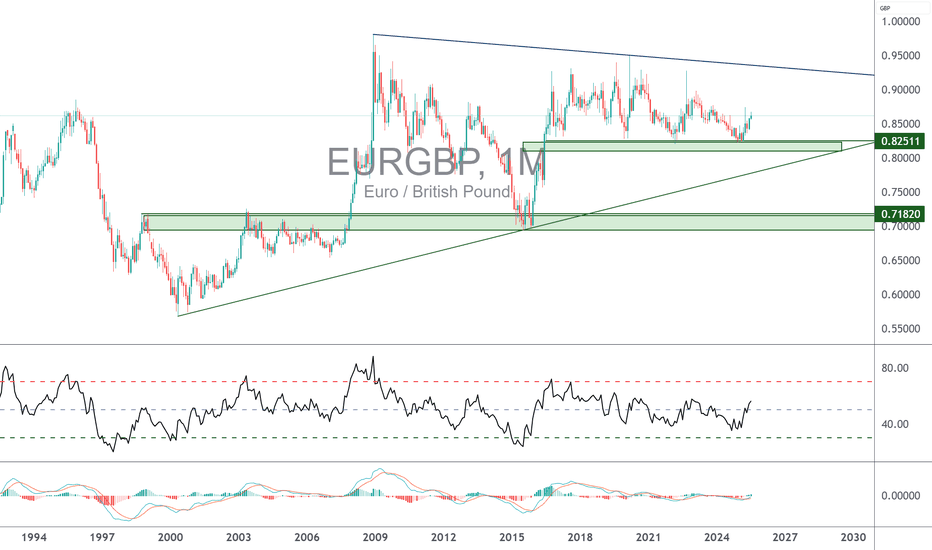

EURGBP: Is This The End Of The Bulls? The GBP/USD pair has exhibited a consistent bullish trend, driven by a remarkable price momentum that is unprecedented in recent history. However, we anticipate a potential bearish reversal, as the market is witnessing a confluence of bearish indicators and increasing volume. Historically, the British pound has held a dominant position in this market, and long-term bears are likely to gain control.

Therefore, it is crucial to closely monitor the incoming market volume and, most importantly, the prevailing market sentiment. Your continued support throughout this journey is greatly appreciated. If you wish to encourage us, kindly like and comment on our ideas.

Team Setupsfx_

❤️❤️🚀🚀

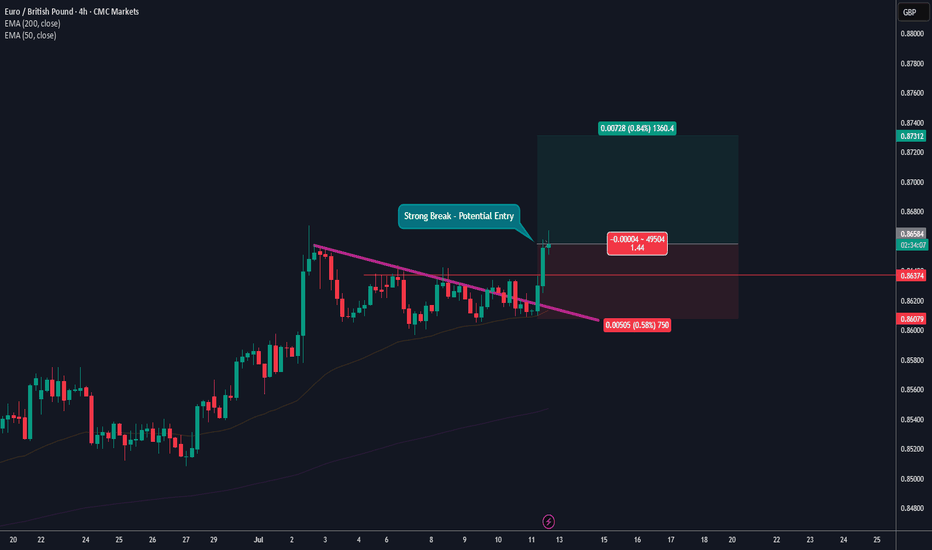

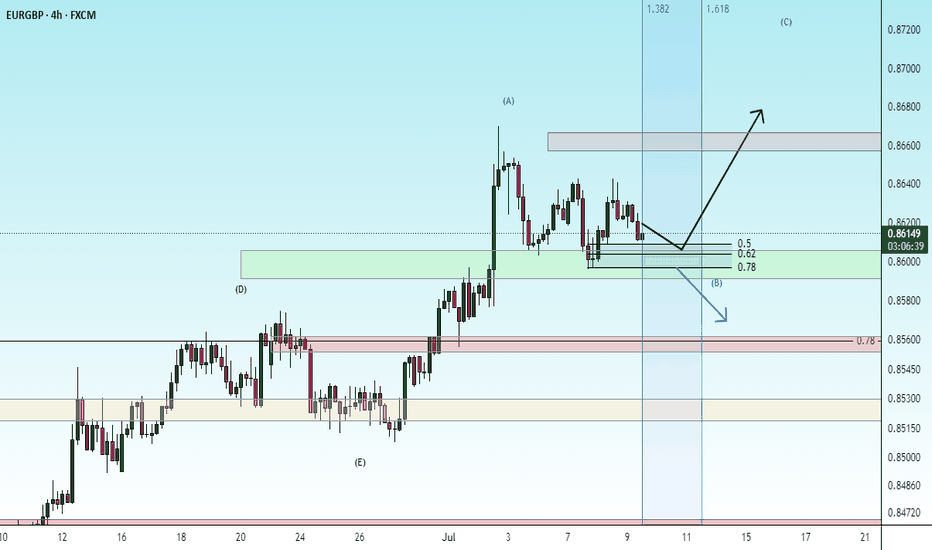

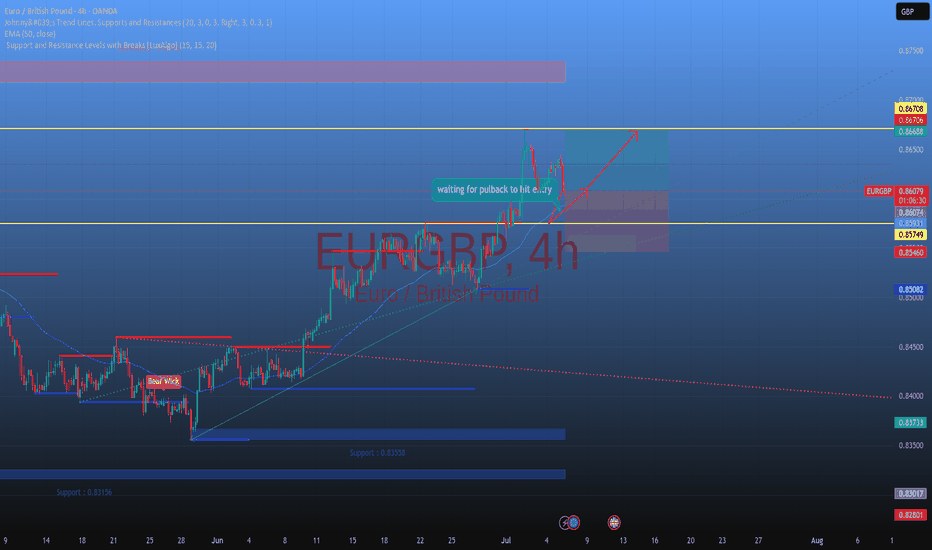

EURGBP Uptrend continuation breakout?The EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8600 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8600 would confirm ongoing upside momentum, with potential targets at:

0.8670 – initial resistance

0.8700 – psychological and structural level

0.8720 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8600 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8590 – minor support

0.8570 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8600. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURGBP SHORT DAILY FORECAST Q3 D10 W28 Y25EURGBP SHORT DAILY FORECAST Q3 D10 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

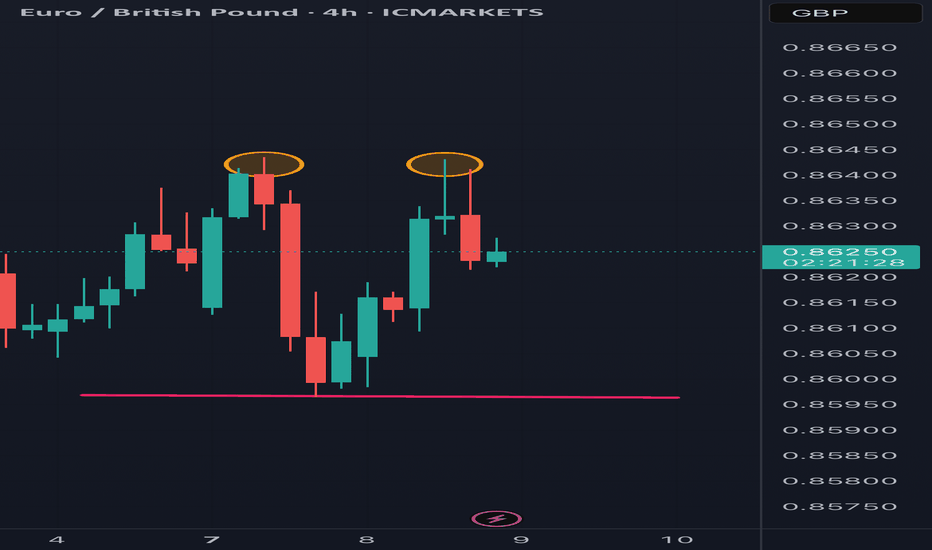

Inverted head and shoulder gives buy -ForexBDA double top pattern has formed on the EURGBP H-4 timeframe. If the price breaks the neckline of this pattern, the market will go into a downtrend.

You can share your opinion.

⭕️Risk Warning : Trading on financial markets carries risks!

©FXBD Official Team

The Day AheadEconomic Data Highlights:

🇺🇸 US Wholesale Sales (May):

Signals business demand.

Weaker = bearish USD, growth worries.

Stronger = supports USD, may lift yields.

🇨🇳 China Inflation (June CPI & PPI):

Key for deflation risks.

Low CPI/PPI = bearish CNY, AUD, metals, more rate cut talk.

Stronger numbers = risk bounce, may lift AUD and commodities.

🇯🇵 Japan Machine Tool Orders & Money Supply (M2/M3):

Shows capex and liquidity.

Weak orders = bearish JPY, signs of slowdown.

Limited impact unless there's a surprise.

Central Bank Focus:

🇺🇸 FOMC Minutes:

Hawkish tone = stronger USD, weaker stocks/gold.

Dovish tone = bullish risk, weaker USD.

🇳🇿 RBNZ Rate Decision:

Expected hold at 5.50%, but tone matters.

Hawkish = NZD up, especially vs AUD/JPY.

Dovish = NZD drops, AUDNZD could rise.

🇪🇺 ECB’s Nagel & Guindos:

Watch for rate cut clues.

Dovish = EUR weakens.

Hawkish = EUR support, esp. vs JPY/CHF.

Trade Setups to Watch:

USD trades post-FOMC (DXY, EURUSD, USDJPY).

NZD crosses after RBNZ (NZDUSD, AUDNZD).

AUD & metals reacting to China inflation.

EUR pairs ahead of more ECB talk Thursday.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

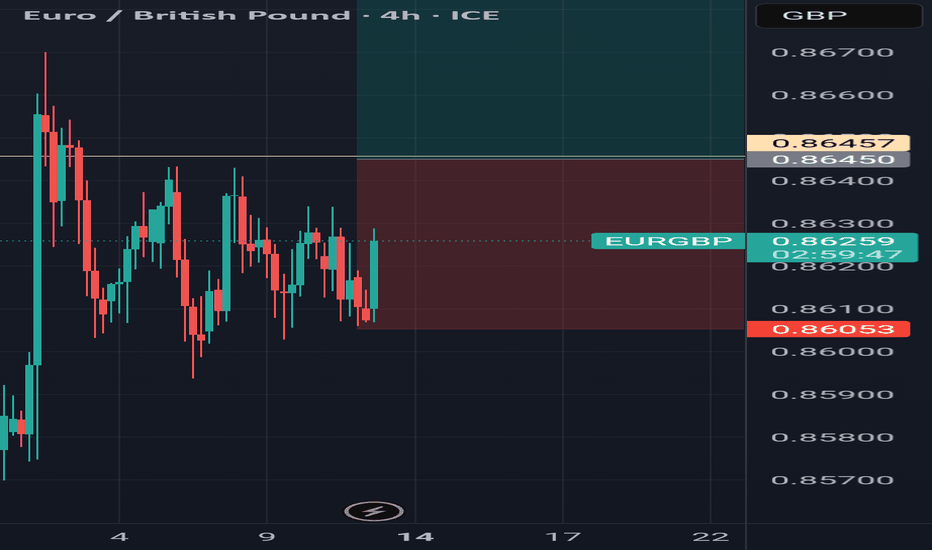

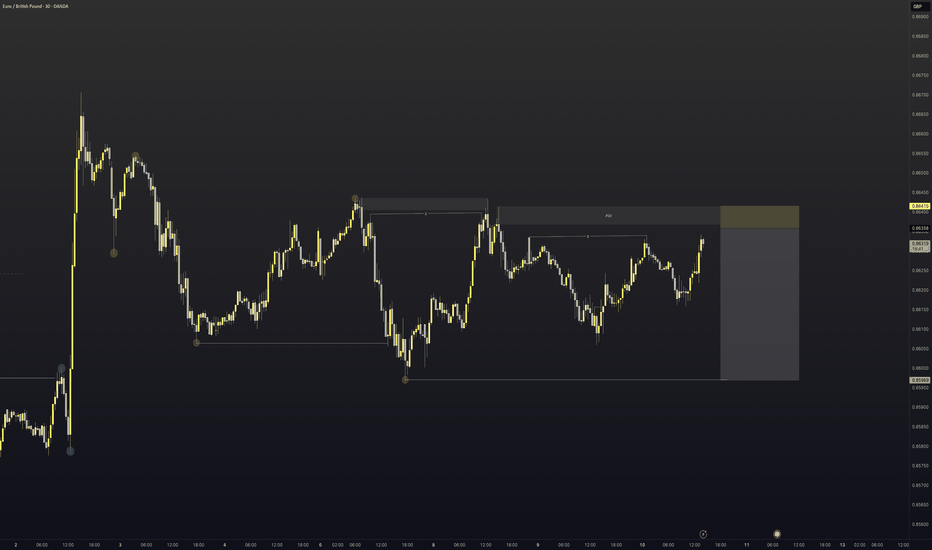

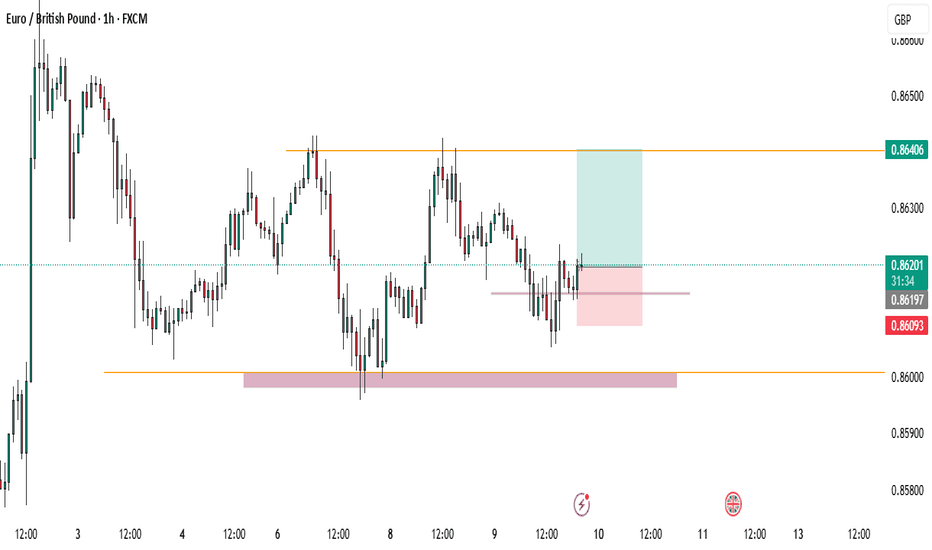

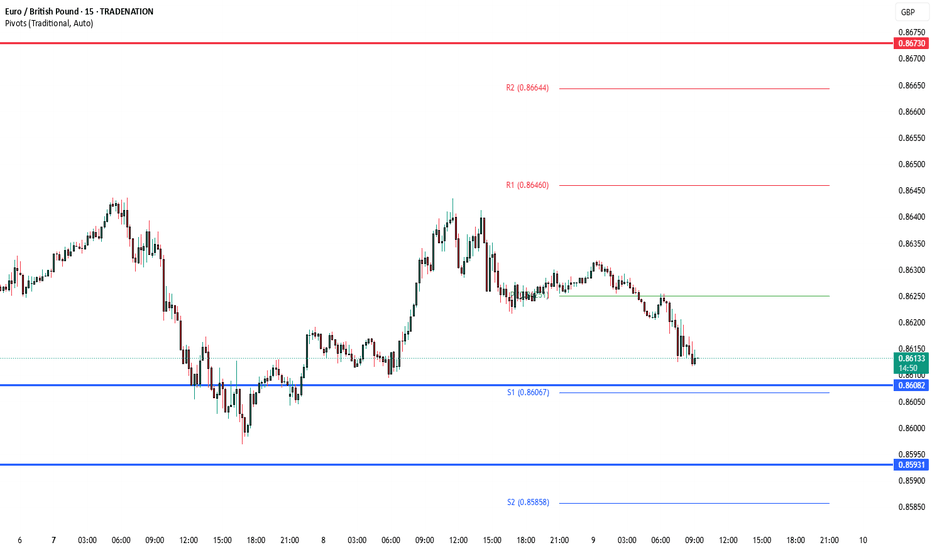

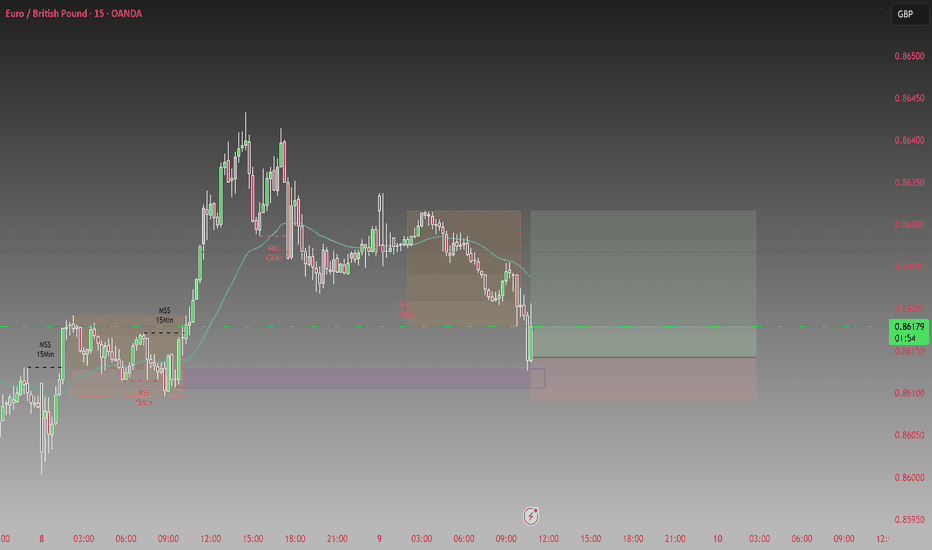

EG longs from previous day session lowsFound this long trade completely on the go as price was droping into previous day asian session OB and seeing how price moved quite impulsively up from that same area on tuesday 8th July, I expected another impulsive reaction from the OB.

I'm already in the trade with a 5 pip stop, targeting tokyo session high from this morning, giving a RR at 1:3 at just 0.35% risk.

Stop is already in BE, so letting this one run its course.

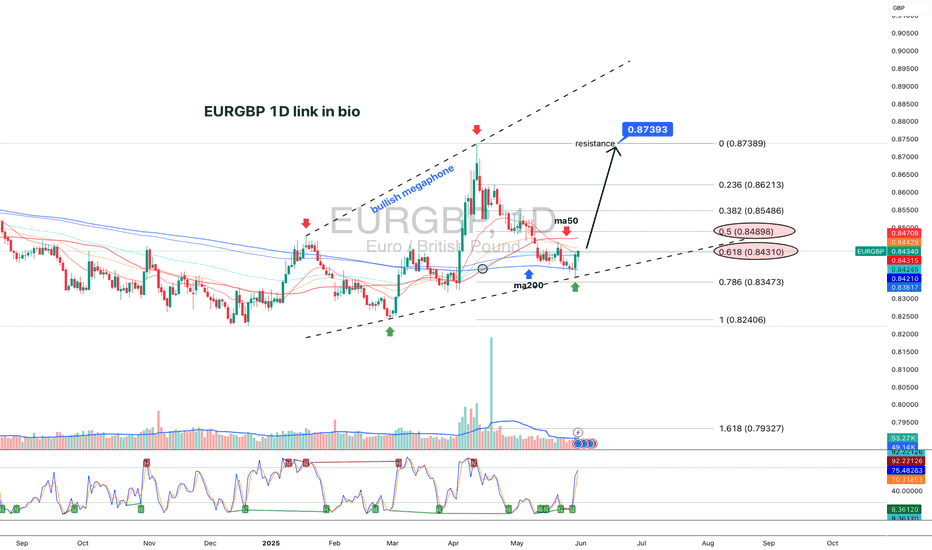

EURGBP 1D: This isn't a breakoutEURGBP 1D: This isn't a breakout — it's a deep reaction before the real move

EURGBP continues to form a textbook bullish megaphone, a structure designed not to trend, but to destabilize — forcing liquidity on both sides while smart money quietly positions. Two touches above (January and April), two below (February and May) — clean geometry, expanding volatility. Price is now reacting from the lower boundary, but we are still inside the pattern — and that matters.

The reaction zone sits right on the 0.786 Fibonacci level, near 0.8350, precisely where price meets the lower trendline and the 200-day moving average. The bounce didn’t come from noise — it came from confluence. Candle structure is clean, volume slightly expands — not panic, but controlled demand. As long as price holds above the MA200, the scenario remains intact. A break below kills the setup — but that hasn’t happened.

We’re not in breakout mode — yet. But price action is shifting. Pullbacks are weak, candles are full-bodied, and sellers don’t press. Momentum indicators confirm early recovery, but the real signal lies in how price holds its ground at key structure without struggle. Buyers aren’t running — they’re holding position.

If the market pushes above 0.8430–0.8480 and confirms — acceleration begins. Until then, we remain in balance. Every candle is a stress test — and so far, the structure is holding strong. If smart money controls 0.8350, the breakout won’t just be bullish — it’ll be aggressive.

Two interesting FX technical strategies under close watchWhile the US dollar is the weakest major currency on the foreign exchange (FX) market this year 2025, and the question of its low point arises, two other currencies seem important to me to put under close watch for this month of July: the Pound Sterling (GBP) and the Hong Kong dollar (HKD). To begin with, you can reread our latest analysis below (by clicking on the chart), which raises the question of a possible future low point for the US dollar on the FX.

The British pound, which was buoyed by positive momentum at the start of the year, is now facing fiscal and bond risks that are weakening it. At the same time, the Hong Kong dollar is testing the solidity of its parity mechanism with the greenback, forcing the local monetary authority to step up interventions to preserve its credibility. The EUR/GBP rate could be a good strategy for hedging against the risk of a fall in sterling. As for the USD/HKD rate, the upper end of the PEG could once again provide good resistance for a trading strategy.

1) Sterling is under pressure from UK bond yields, and the EUR/GBP rate presents an interesting chart configuration

The EUR/GBP rate, a barometer of confidence in the British currency, could come under upward pressure if UK budget fears persist. Tensions intensified after Keir Starmer's Labour government abandoned several budget-saving measures, deepening an already worrying deficit. As a result, yields on 30-year British government bonds jumped 19 basis points in a single session, their biggest rise since April, triggering a sharp decline in the pound. This context is reminiscent of the episodes of 2022 under Liz Truss, when British fiscal credibility wavered sharply. In the short term, the prospect of an autumn tax hike by Chancellor Rachel Reeves could fuel volatility.

From a technical analysis point of view, the EUR/GBP rate is following an underlying uptrend, and the guarantor of this trend is support at 0.8250. We must therefore keep a close eye on the evolution of British long rates and tax announcements, which will condition the trajectory of the EUR/GBP rate. If British debt continues to worry the market, then the EUR/GBP rate could continue its rise towards resistance at 0.90. Breaking support at 0.8250 would invalidate this chart scenario.

2) The USD/HKD rate is testing the upper end of the PEG defended by the Hong Kong monetary authorities

The USD/HKD rate is once again testing the upper limit of the “peg” set between 7.75 and 7.85 HKD per US dollar. Since the end of June, the weakness of local interest rates, with the one-month Hibor falling to 0.86%, i.e. almost 350 basis points below the cost of the dollar, has encouraged speculative positions against the Hong Kong dollar. To defend parity, the Hong Kong Monetary Authority (HKMA) intervened on several occasions, repurchasing a total of 59 billion Hong Kong dollars and significantly reducing the liquidity of the banking system. The latest operation, for HK$29.6 billion, is testimony to the extent of the pressure on the peg.

For traders, this context offers short-term technical opportunities, by playing the bounces near the upper limit of the convertibility band. Nevertheless, the persistence of a high interest-rate differential between the United States and Hong Kong raises the risk of prolonged tension. In recent years, the Hong Kong Monetary Authority has always succeeded in preventing the 7.85 resistance level from being breached, but caution and risk awareness are required before using this resistance for FX trading strategies.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

EURGBP SHORT DAILY FORECAST Q3 D8 W28 Y25EURGBP SHORT DAILY FORECAST Q3 D8 W28 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Daily Order block identified

✅4H Order Block identified

✅1H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

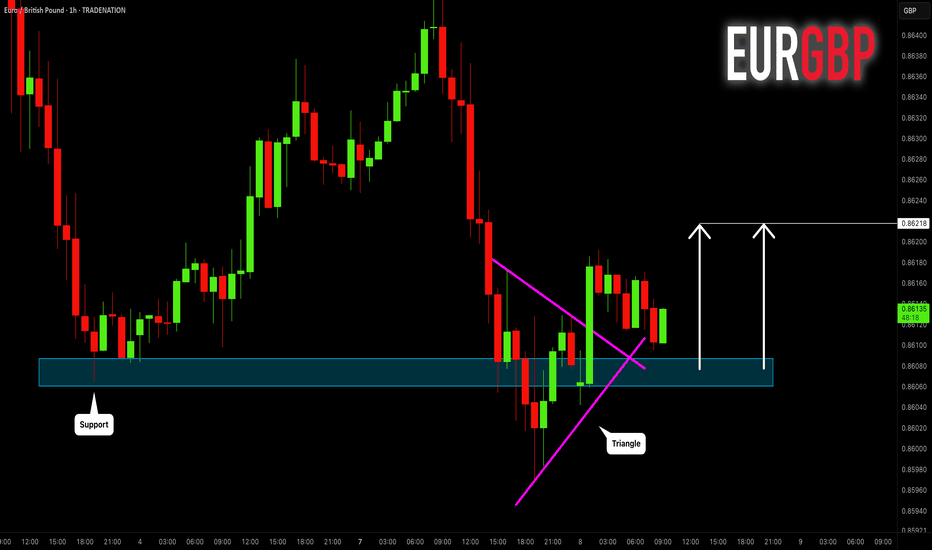

EURGBP: Bullish Move After False Breakout 🇪🇺🇬🇧

EURGBP will likely go up from a key daily/intraday support,

following a bullish breakout of a resistance line

of a bullish triangle on an hourly time frame.

The price may go up to 0.86218 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

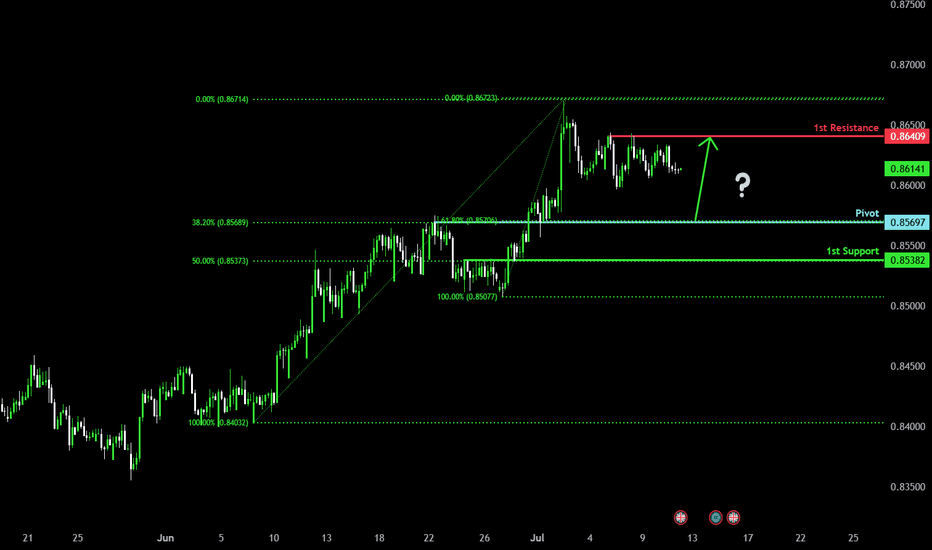

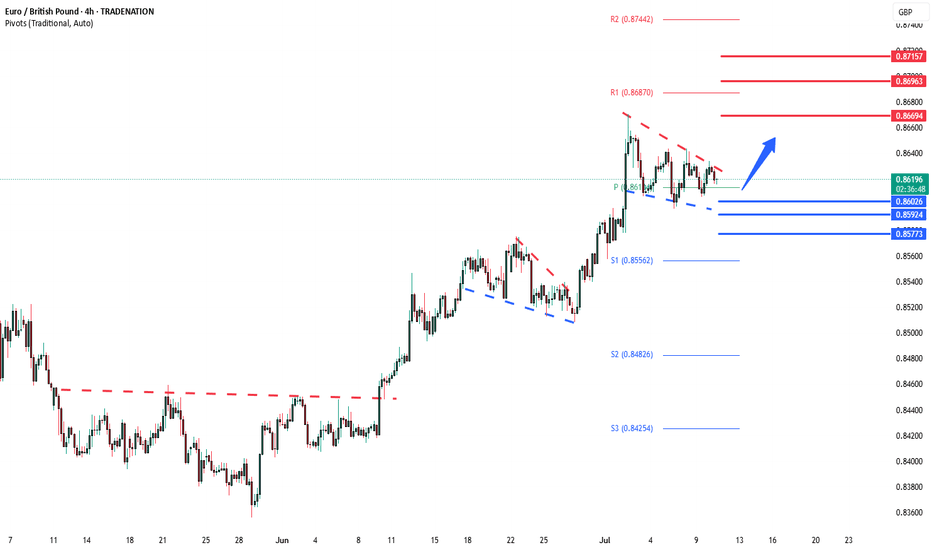

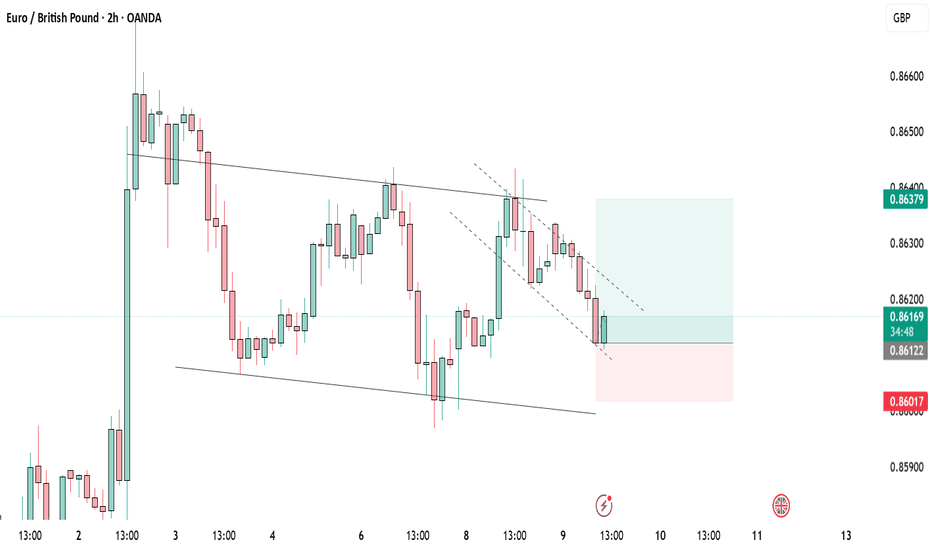

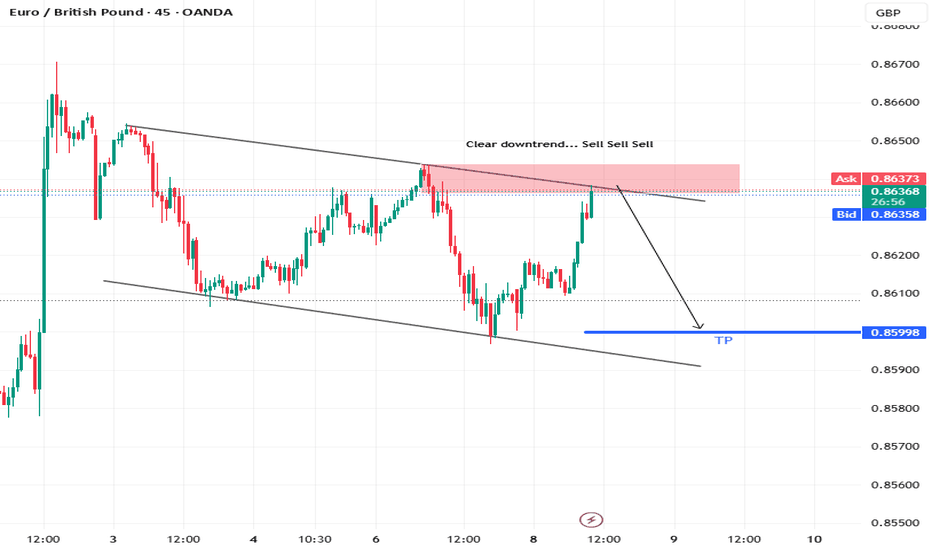

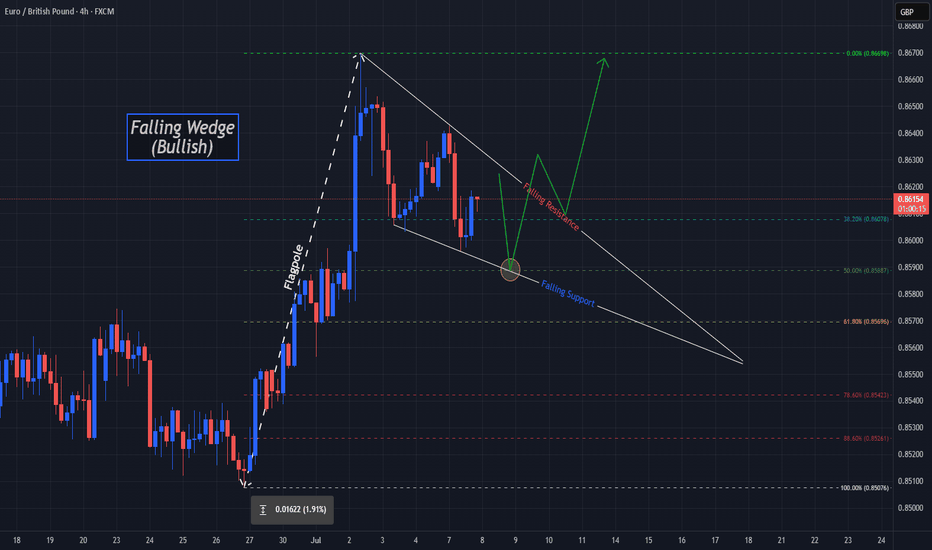

Bulls Could "Wedge" Their Way Into Higher Prices On EGOANDA:EURGBP has made some impressive moves up since the Low from May 29th and Price just fell short of the Highs of April 11th before falling into a very familiar Bullish Pattern, the Falling Wedge!

The Falling Wedge is typically a Bullish Pattern where we expect Price to give us a Bullish Break of the Falling Resistance and Successful Retest of the Break before Price heads Higher!

Wedge Patterns can play both Reversal and Continuation Patterns dependent upon the location they form and surrounding Major Support/Resistance or Highs/Lows. In this case, we will be looking for a Continuation with Price being in an Uptrend before pausing slightly for a Consolidation Phase to form the "Triangle" of the Pattern.

*It is important to note that both the Falling Resistance and Falling Support have only been tested twice where three tests of both Trendlines should point to a strong equilibrium from both Bears and Bulls, validating the legs of the Triangle and strengthening the Consolidation Bias. ( So we could see Price test the Falling Resistance one last time before falling down to the Falling Support for a 3rd test! )

Lastly, when it comes to a Wedge Pattern, we should suspect that once Price makes a 3rd Test of the Falling Support and Retraces to the 50% Fibonacci Level @ .85887, this will signal the End of the Consolidation Phase!

- And this will be the time to enter!

**Once the Pattern is Confirmed and Breakout is Validated, based on the "Flagpole" or Rally prior to Price falling into the Consolidation Phase we can anticipate Price to potentially rise to the most recent High on April 11th of .87374 and give the next Previous High on November 16th 2023 of .87657 a try!

Fundamentally, news is light this week for both currencies in the pair with GDP m/m releasing for GBP on Friday, July 11th with a Forecast of .1%, a .4% increase from June's -.3%

Also, CPI y/y for GBP will be released the following week on Wednesday, July 16th.