EURGBP trade ideas

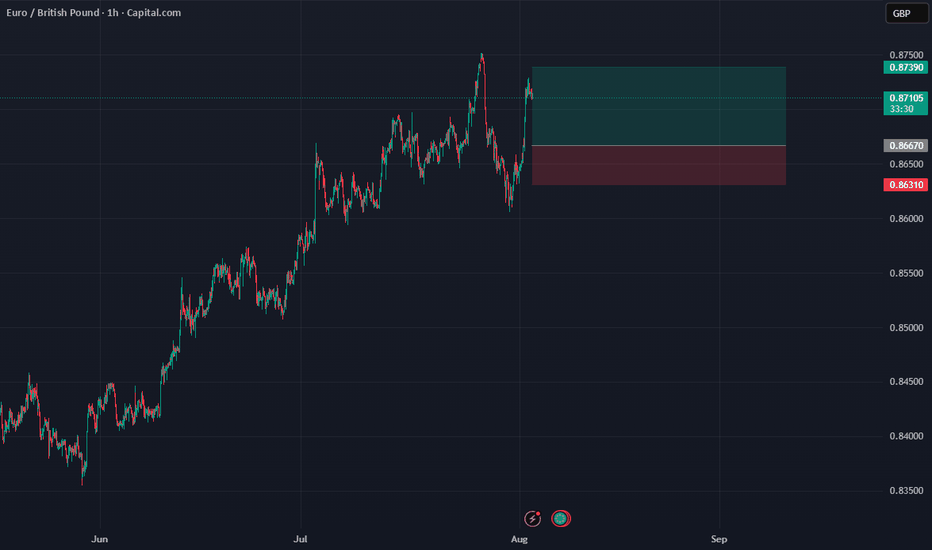

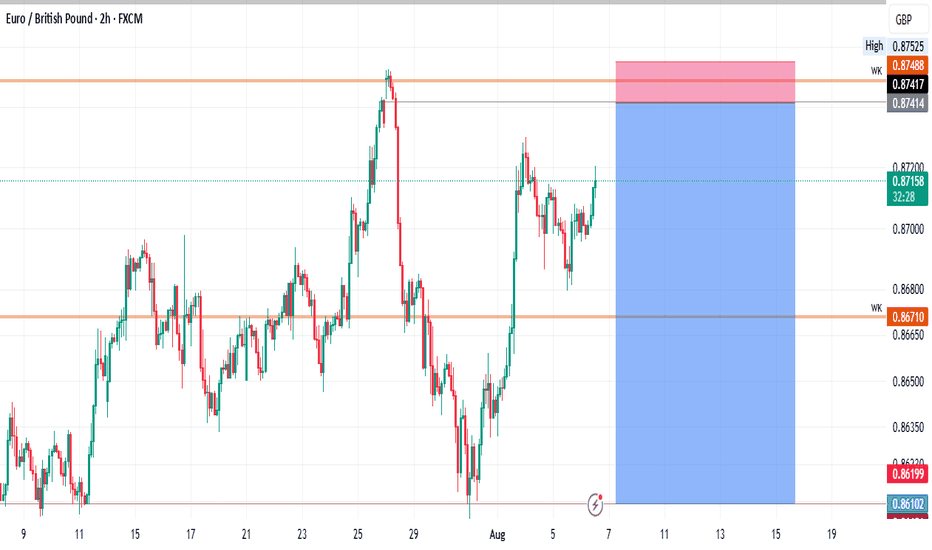

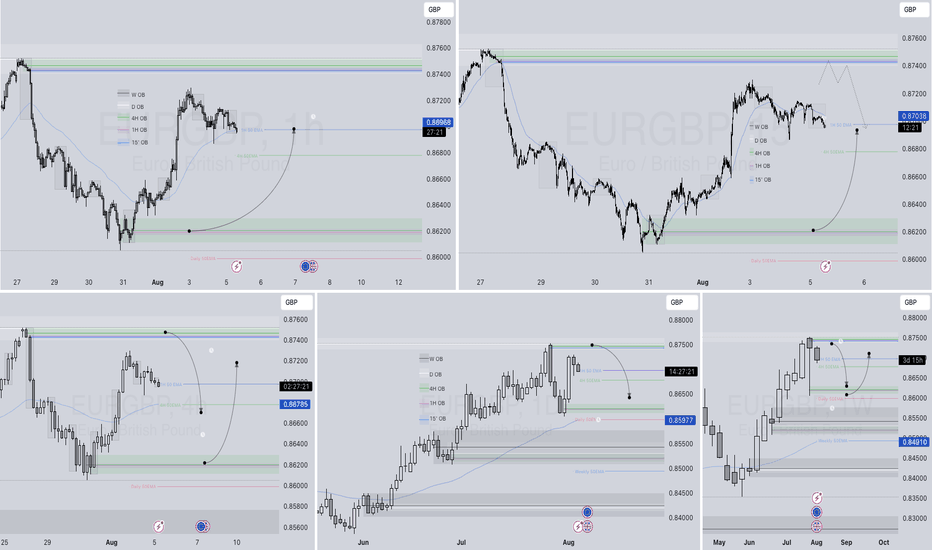

EURGBP – CHART EXPLANATION & FULL TOP DOWN ANALYSIS BREAKDOWN 📊 EURGBP – CHART EXPLANATION & FULL TOP DOWN ANALYSIS BREAKDOWN

Q3 | W32 | D6 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

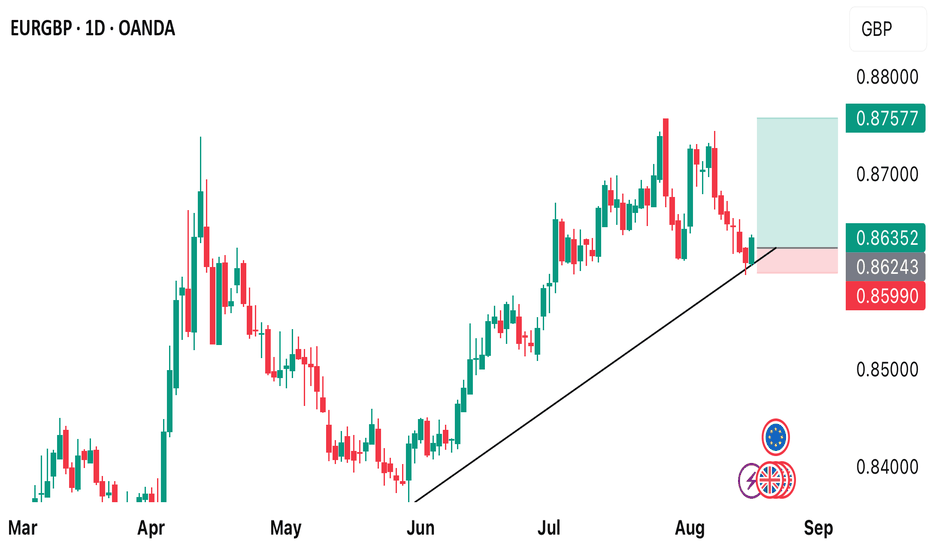

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

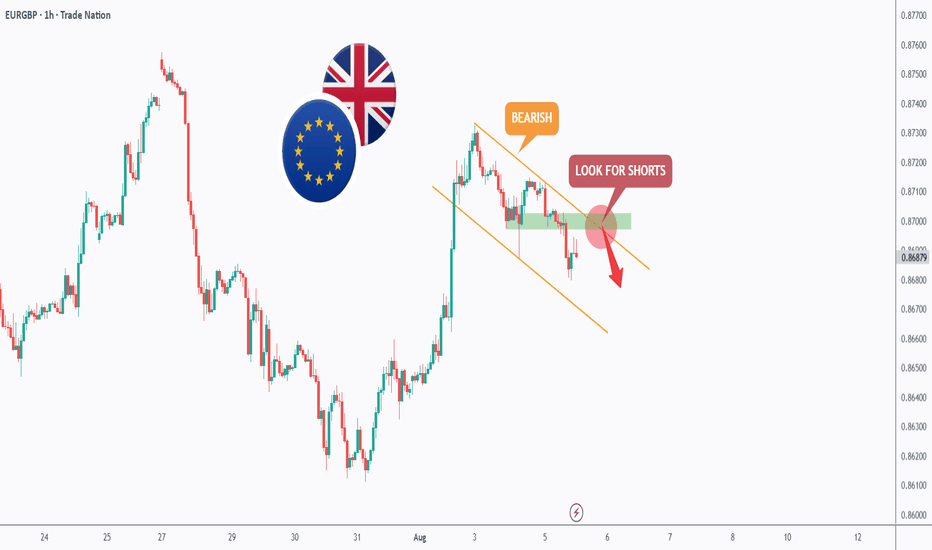

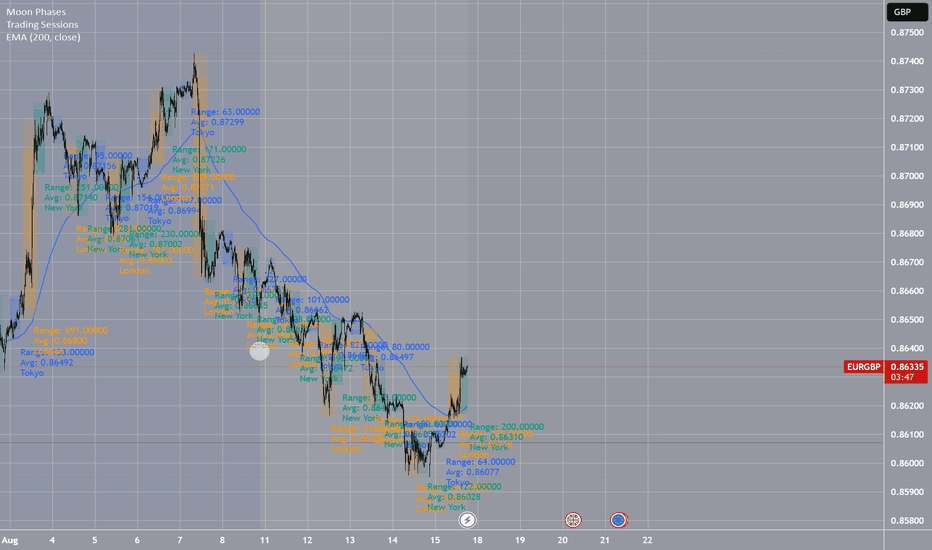

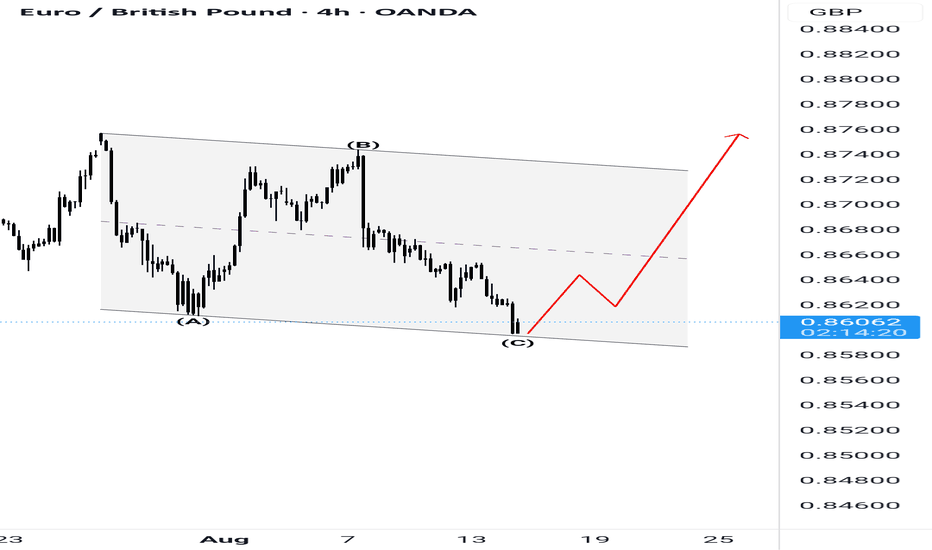

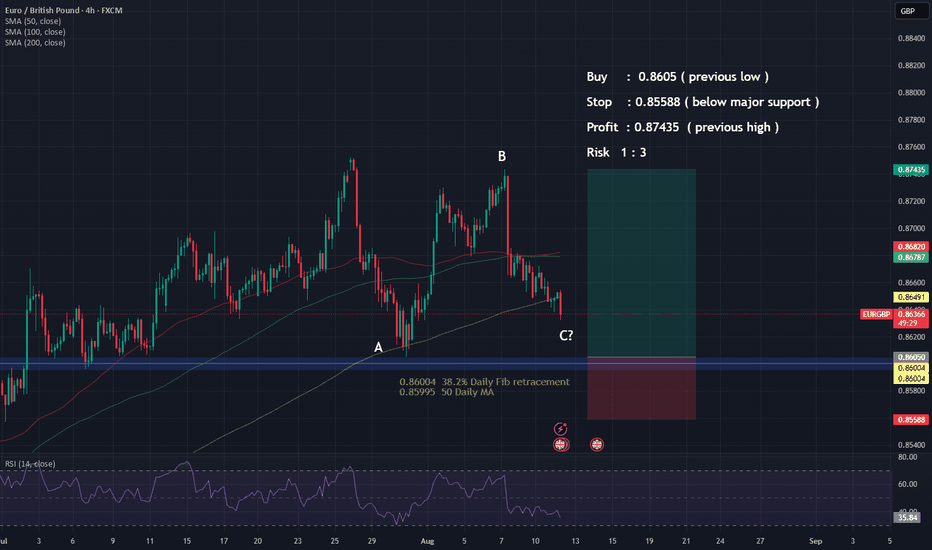

EURGBP – Bearish Continuation in Play?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURGBP has been overall bearish trading within the falling channel marked in orange.

Moreover, the green zone is a strong structure.

📚 As per my trading style:

As #EURGBP approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

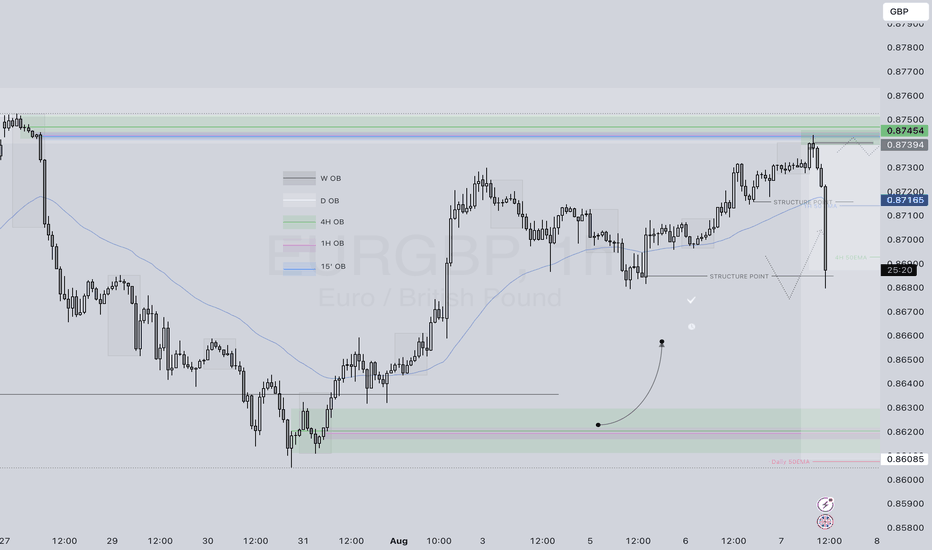

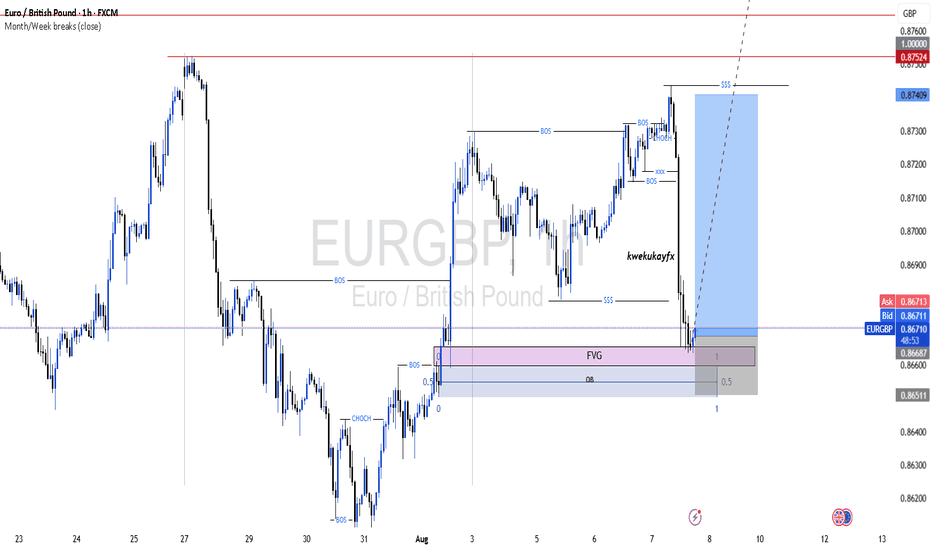

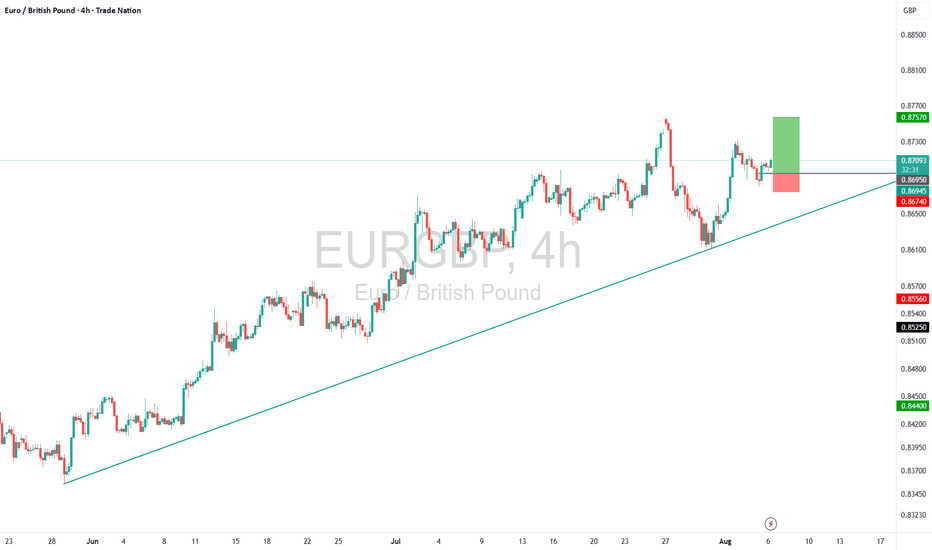

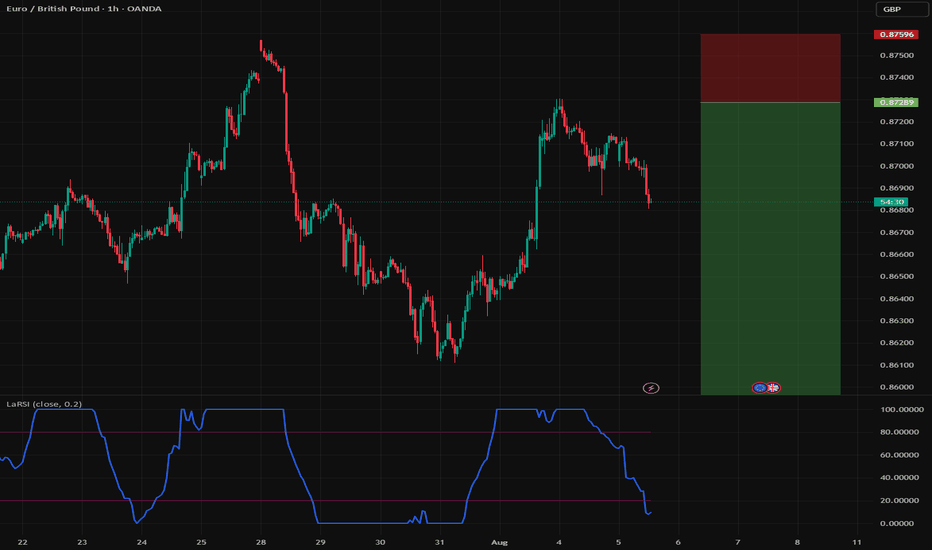

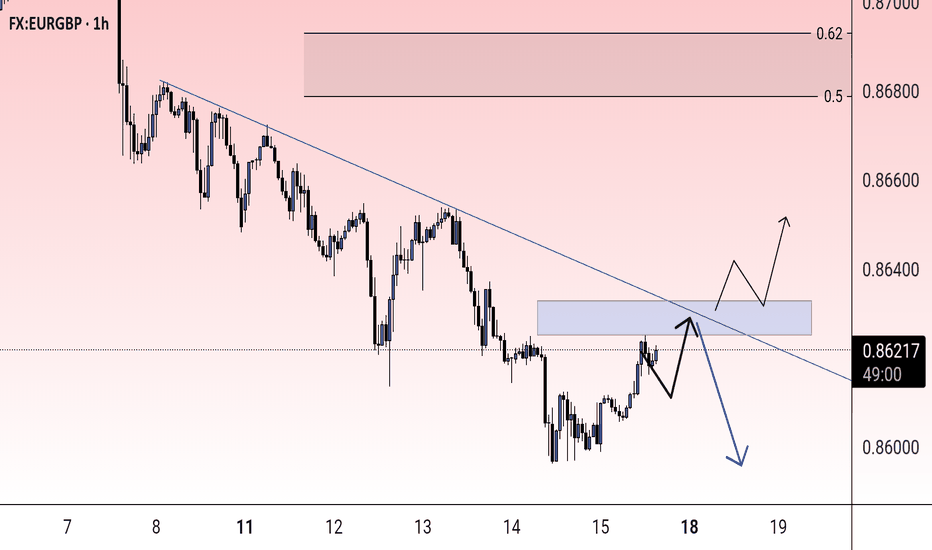

EURGBP – Buy the Dip from Morning Doji Star BaseTrade Idea

Type: Buy Limit

Entry: 0.8695

Target: 0.8757

Stop Loss: 0.8674

Duration: Intraday

Expires: 07/08/2025 06:00

Technical Overview

Morning Doji Star printed at the lows, signalling potential bullish reversal.

Previous resistance at 0.8690 now acts as support; confluence with 20-period 4H EMA at 0.8694.

Short-term bias remains positive; daily signals are bullish.

Structure offers ample risk/reward to buy on a modest pullback toward support.

Key Technical Levels

Resistance: 0.8709 / 0.8731 / 0.8757

Support: 0.8697 / 0.8680 / 0.8660

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

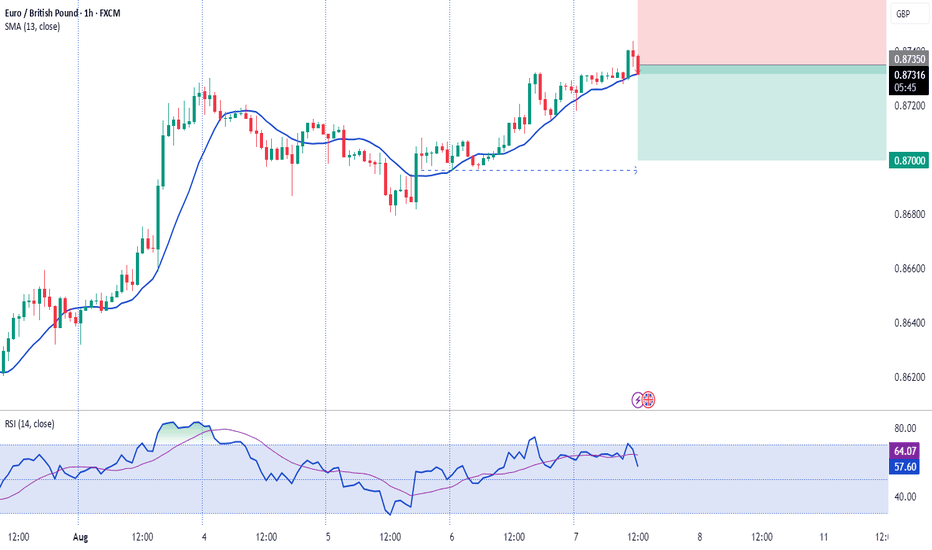

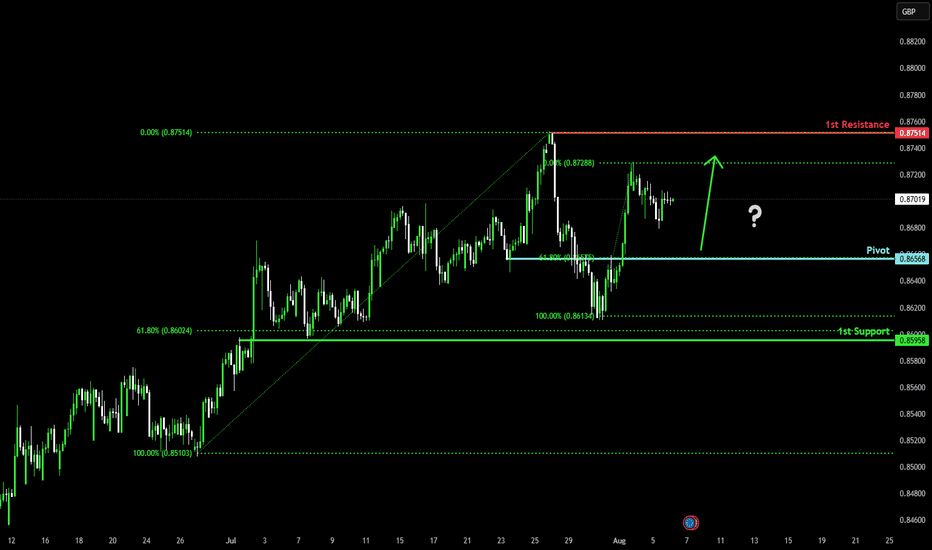

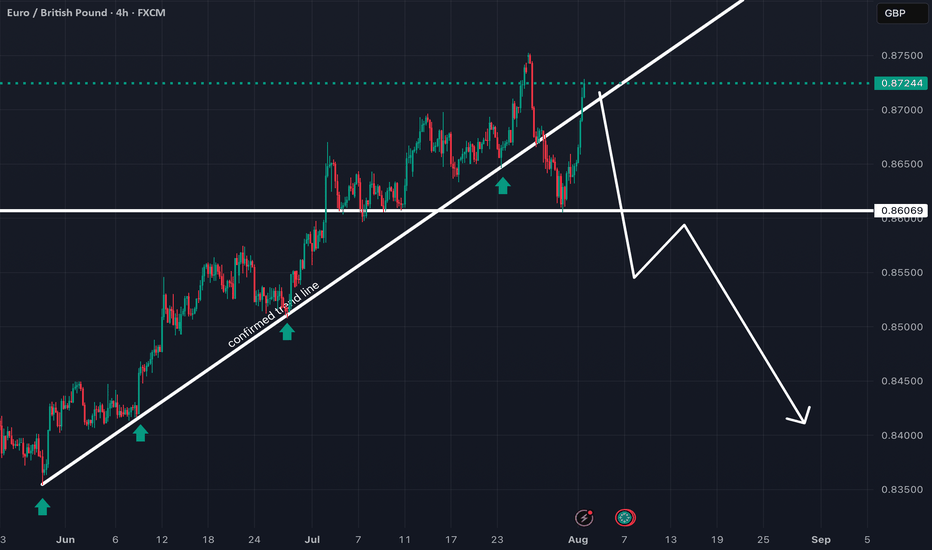

Falling towards 61.8% Fibonacci support?EUR/GBP is falling towards the pivot and could bounce to the 1st resistance which is a swing high resistance.

Pivot: 0.8656

1st Support: 0.8595

1st Resistance: 0.8751

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

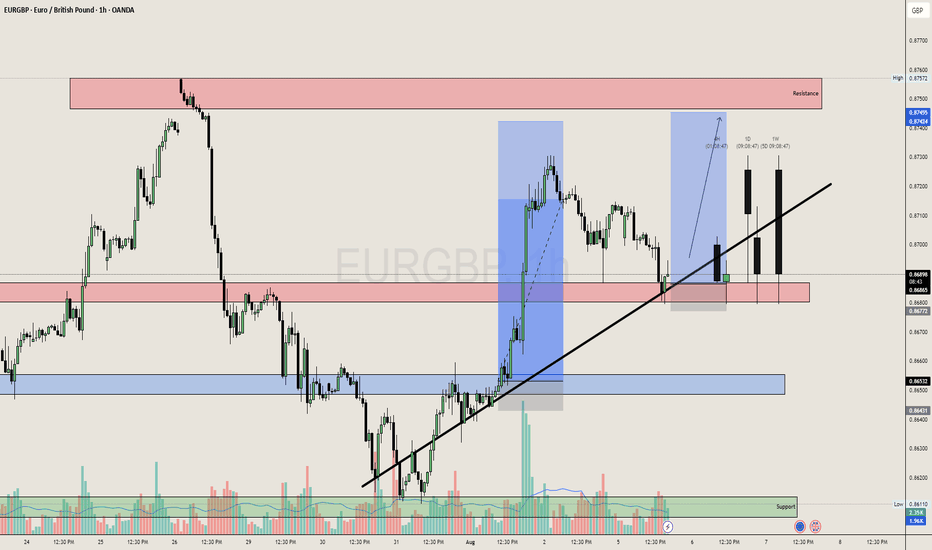

EURGBP Trend Line SupportEURGBP is Bullish and currently at trend line support we can expect a buy movement in EURGBP.

The pair is bullish and also sentiments are suggesting to go long as retails are short heavily short so we can target their SL at top.

Keep GBP Bank Rates are also upcoming and we can expect a 25 bps cuts to 4% from 4.25% which can make EURGBP fall so keep SL tight.

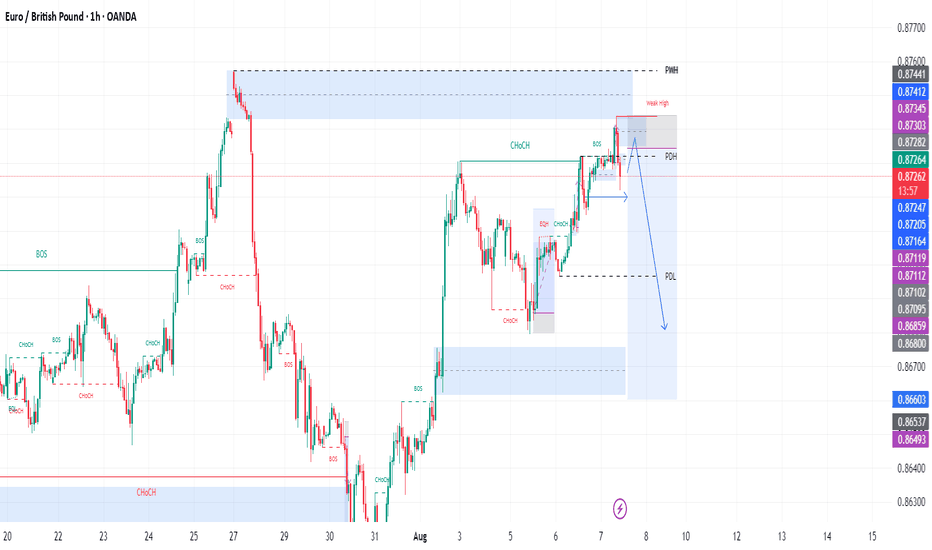

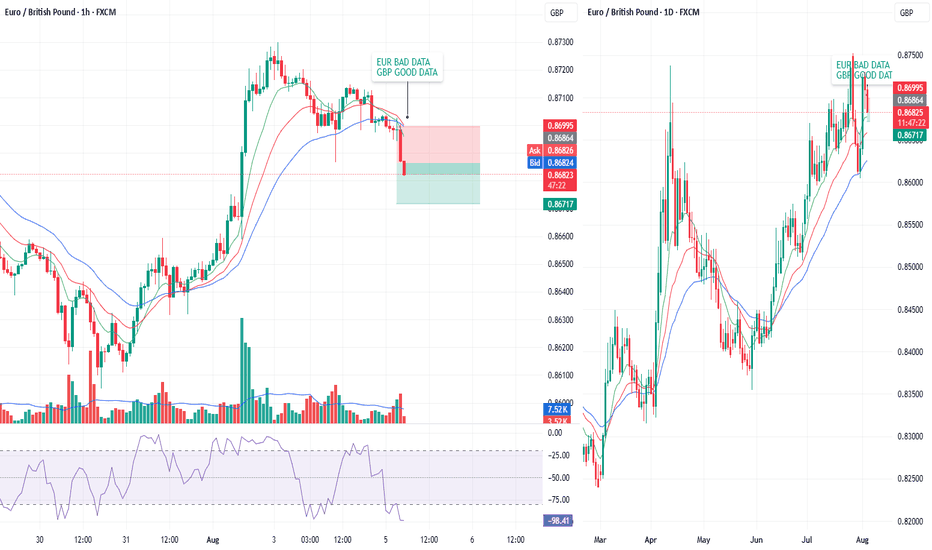

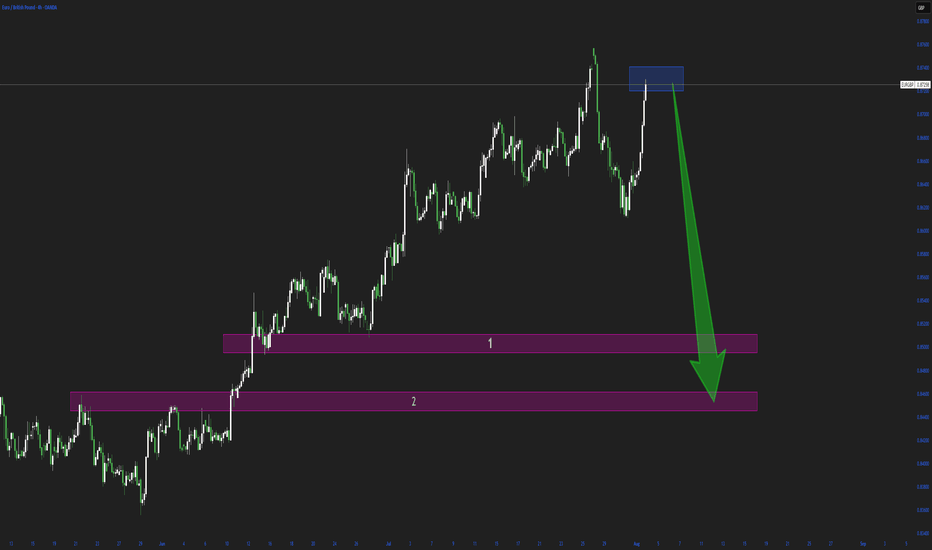

EURGBP – Climbing a Hill That Might Give WayEURGBP – Climbing a Hill That Might Give Way ⛰️⚠️

EURGBP is climbing a hill that might soon give way. The pair has been grinding higher, but the move feels tired — and momentum is now wobbling on lower timeframes. This is a sell idea against the crowd: a counterpunch at weekly resistance, with price action flashing warning signs 🚨.

📉 I’m bearish on EURGBP — looking to short this overbought market as momentum stalls.

Here’s what’s fueling the setup:

📍 The weekly chart is at major resistance

💡 Price is overbought and pausing with sell signals on the 4H

📈 EUR’s recent rally is built more on sentiment than substance

🇬🇧 GBP fundamentals remain steady despite a recent dip in sentiment

⚖️ This is a clean counter-trend short with favorable risk-to-reward

Zooming out 🔍

The Eurozone isn’t in great shape. Growth is flat 📉, consumption is weakening 🛒, and the ECB has paused rate cuts 🧊 — not because conditions are improving, but because uncertainty is high. Inflation is drifting below target 🎯, and the Euro’s sharp appreciation (+17% since February 📊) risks damaging exports just as US tariff threats re-emerge 🚧.

On the GBP side 🇬🇧, the UK’s story is steadier. GDP growth is modest, investment is picking up 📈, and the BoE is gradually easing 🧭. More cuts may be coming, but they’re largely priced in 💷. Despite weaker recent sentiment, the Pound still has recovery potential — especially if Eurozone fragilities resurface 🕳️.

✅ Technically and fundamentally, this trade lines up. EURGBP is stretched, softening, and ripe for a short.

🤔 Agree with this fade? Or are you still riding the Euro train 🚂? Let’s debate it.

EURGBP – DAILY FORECAST Q3 | W32 | D5 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W32 | D5 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

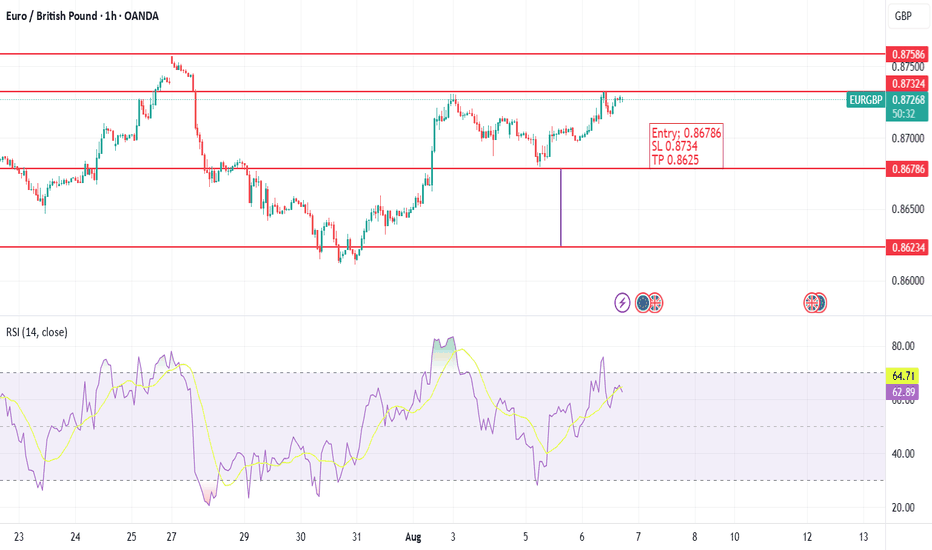

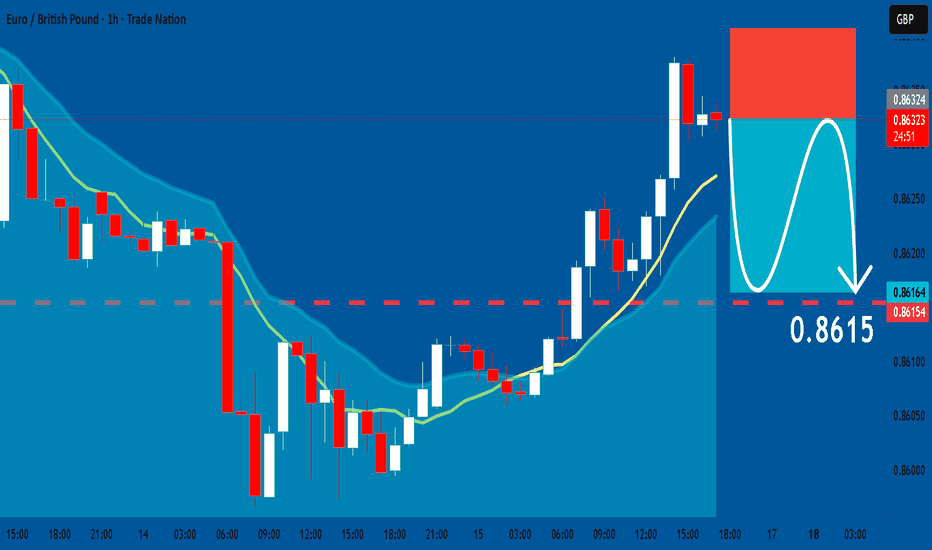

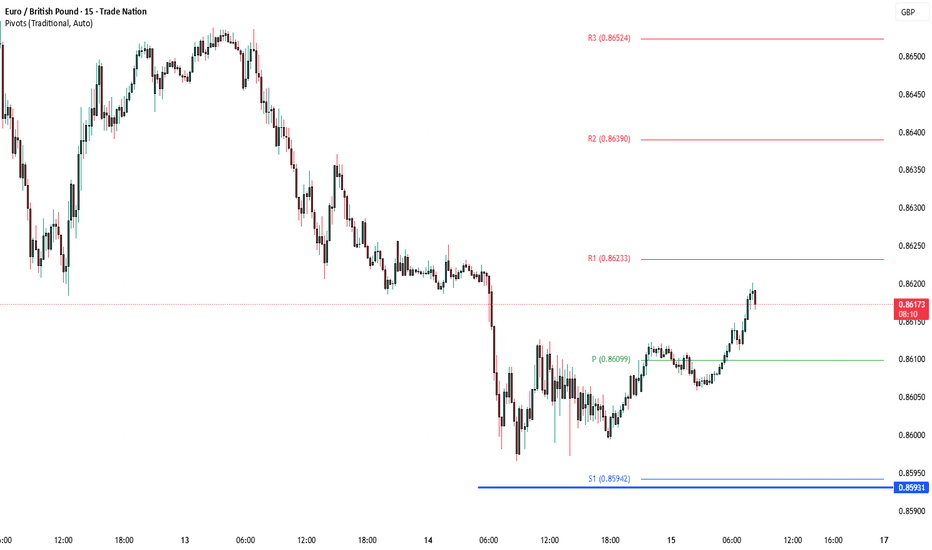

EURGBP: Trading Signal From Our Team

EURGBP

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURGBP

Entry Point - 0.8632

Stop Loss - 0.8640

Take Profit - 0.8615

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

The Day AheadKey Data Releases

US (July): Retail sales, industrial production, capacity utilisation, import & export price indexes.

US (August): University of Michigan survey, Empire manufacturing index.

US (June): Business inventories, total net TIC flows.

China (July): Retail sales, industrial production, home prices, property investment.

Japan: Q2 GDP, June capacity utilisation.

Canada: July existing home sales, June manufacturing sales.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.