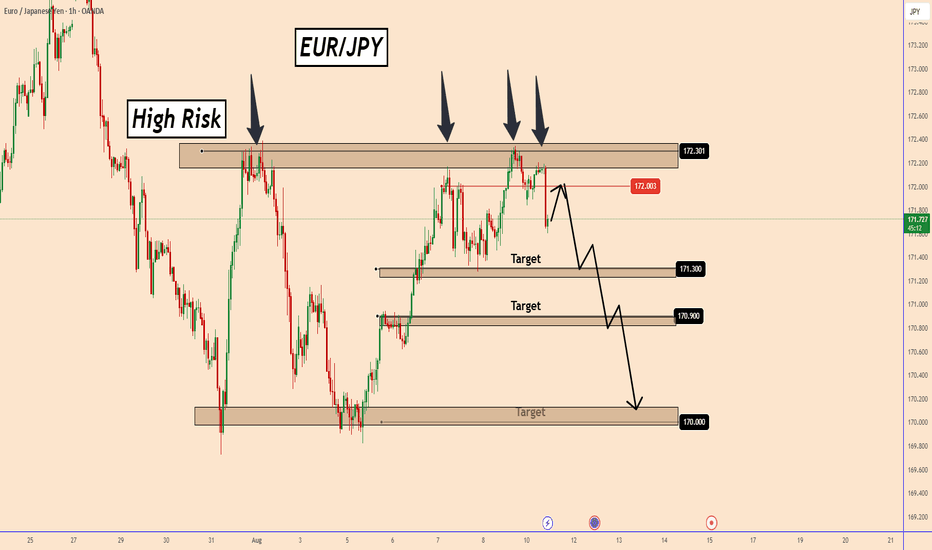

EURJPY Faces Repeated Rejection at Key ResistanceEURJPY Faces Repeated Rejection at Key Resistance

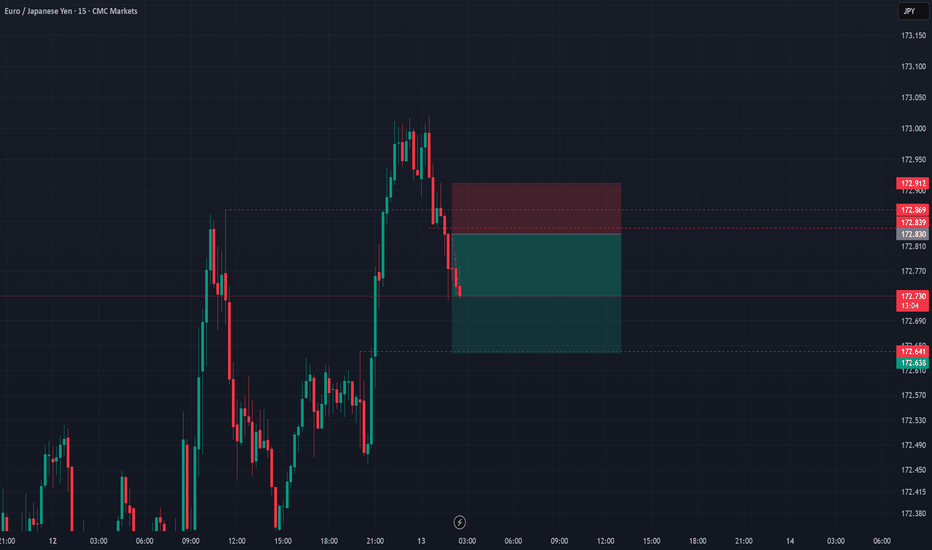

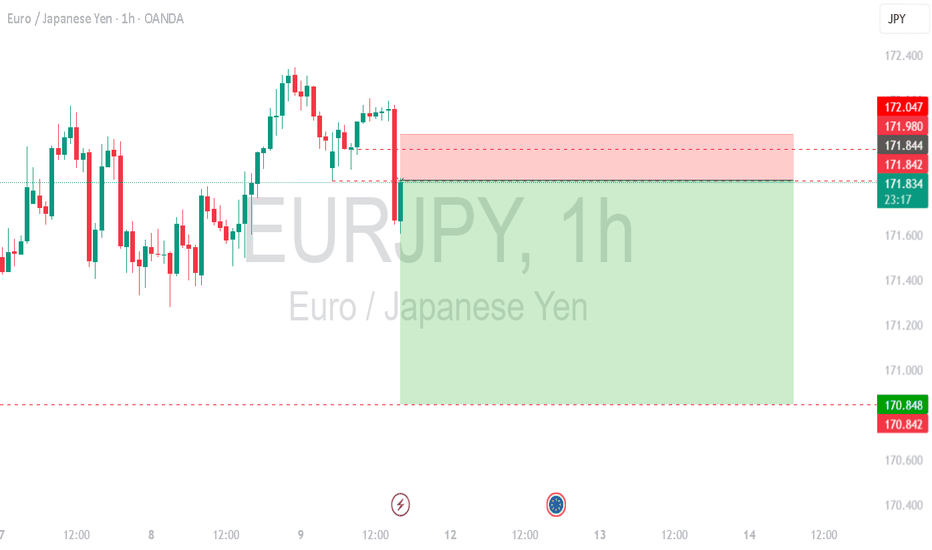

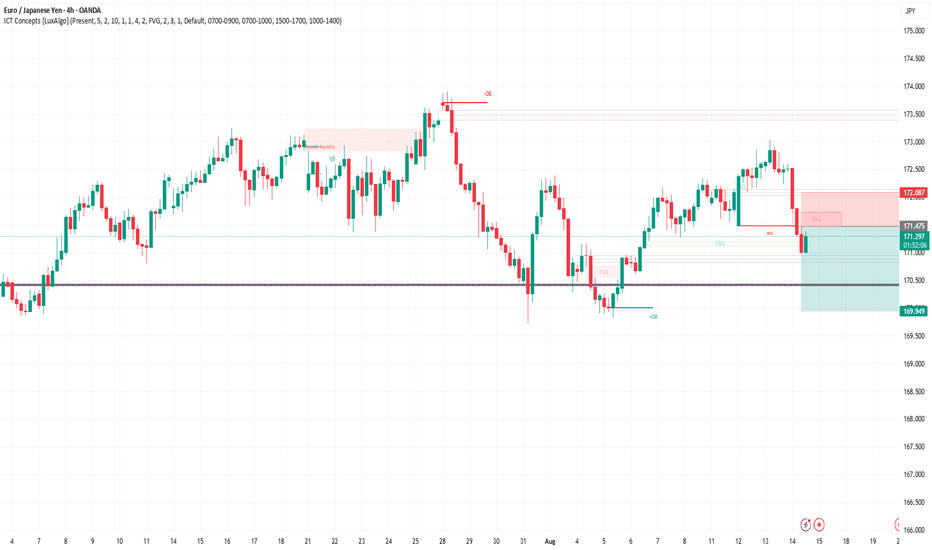

EURJPY has faced multiple rejections near the 172.30 structure zone, signaling strong resistance at that level.

If price continues to hold below 172.30, the likelihood of a deeper decline increases, as suggested by the current chart setup.

It’s also possible that EURJPY may retest the 172.00 zone before extending its drop toward the next support levels at 171.30, 170.90, and 170.00.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

EURJPY trade ideas

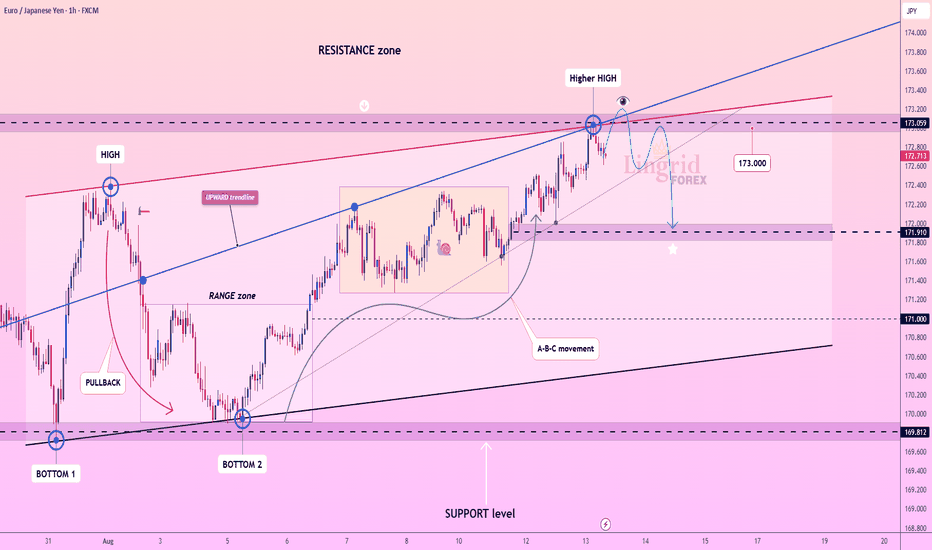

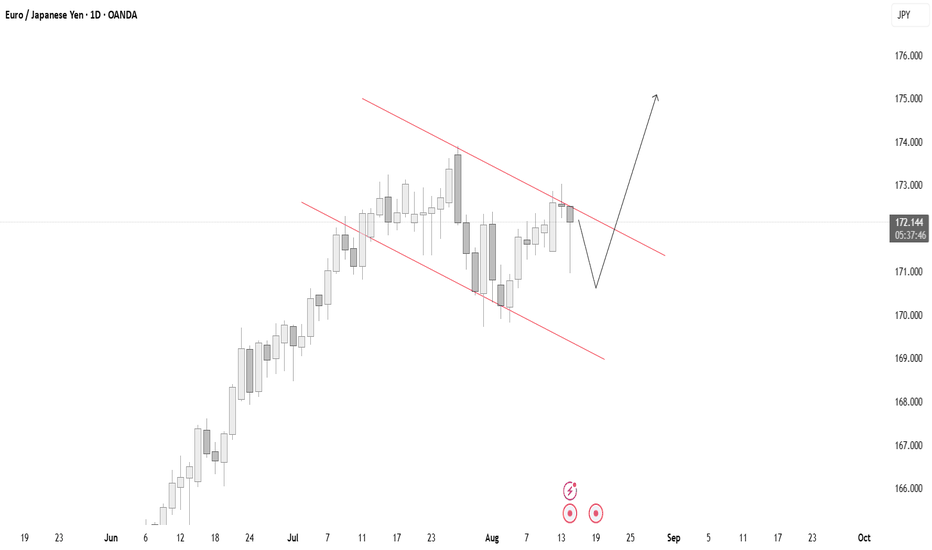

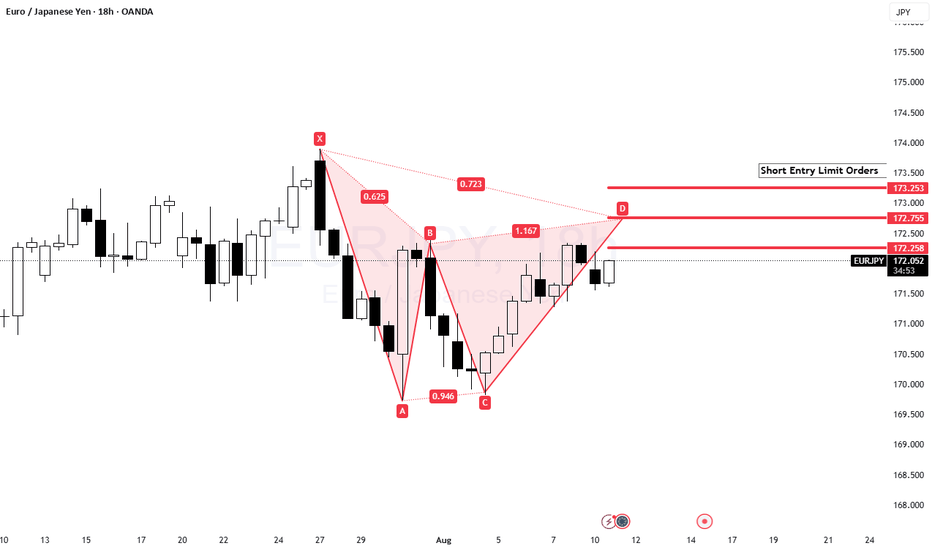

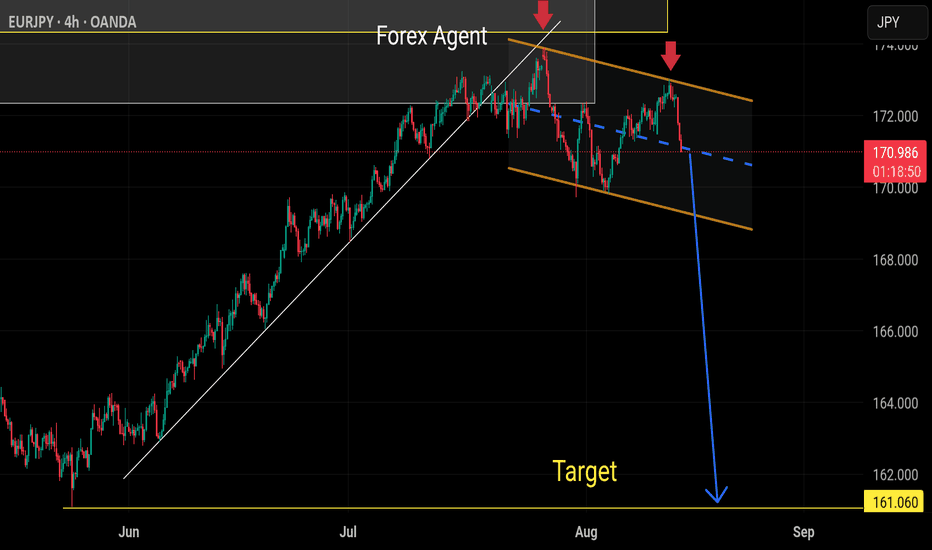

Lingrid | EURJPY Possible Correction From Key Resistance ZoneThe price perfectly fulfilled my previous idea . FX:EURJPY is rejecting the upper resistance zone after forming a higher high near 173.000. Price structure shows an upward channel with multiple touchpoints and an A-B-C corrective movement. A breakdown toward 171.910 is likely as long as price remains under 173.200. Overall momentum suggests a short-term retracement within the broader trend.

📉 Key Levels

Sell trigger: Break below 172.700

Sell zone: 172.950 – 173.200

Target: 171.910

Invalidation: 173.300

💡 Risks

Failure to sustain breakdown could trigger a squeeze toward 173.400.

Broader uptrend may overpower short-term bearish setup.

Unexpected macro news could reverse sentiment rapidly.

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

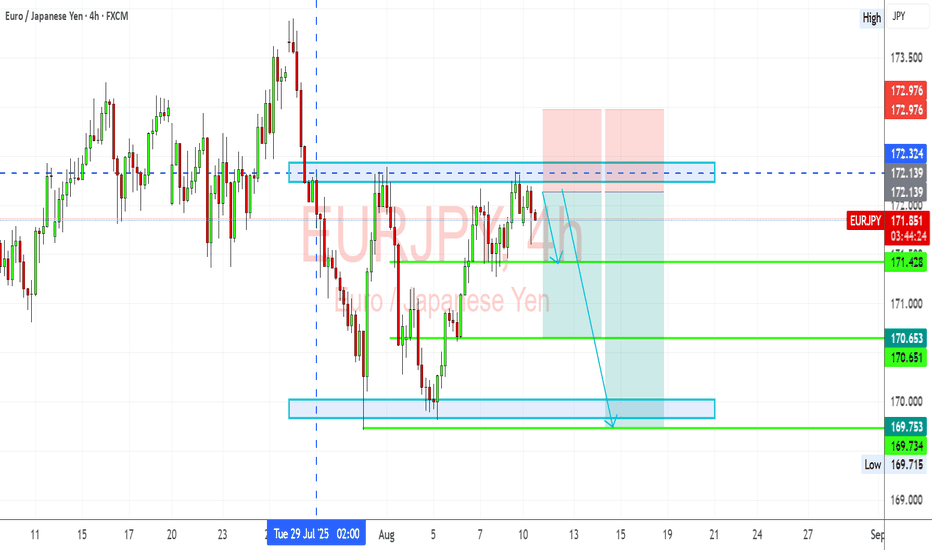

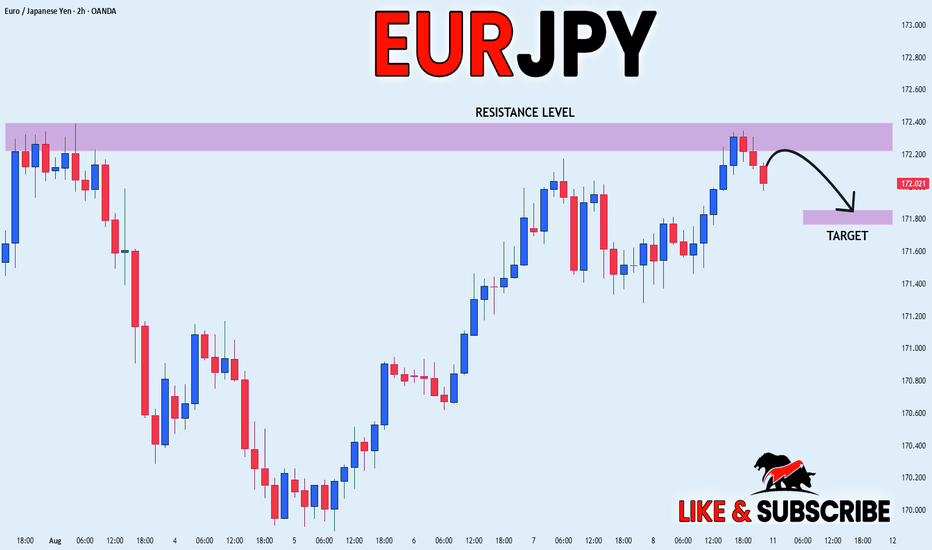

EURJPY – Bearish Reversal Looming from Key Resistance ZoneAfter a strong recovery rally, EURJPY has once again hit the 172.30 resistance zone a level that has repeatedly acted as a ceiling for price action. This latest retest comes with signs of momentum fading, and I’m eyeing a potential reversal that could send the pair back toward key support zones. With broader yen strength creeping in on safe-haven flows and the euro’s upside capped by a cautious ECB, this setup is looking primed for sellers to step in.

Current Bias

Bearish – The pair is struggling to break and hold above the 172.30 resistance zone. Price action is showing rejection wicks on the H4 chart, indicating potential distribution before a move lower.

Key Fundamental Drivers

Euro Side: The ECB remains cautious on further tightening, with growth concerns in the eurozone limiting the upside for EUR. Recent industrial production softness and muted inflation expectations cap bullish momentum.

Yen Side: The BoJ’s shift toward a slightly less accommodative stance, combined with safe-haven demand amid global trade tensions and Trump’s tariff rhetoric, supports JPY strength.

Risk Sentiment: Ongoing uncertainty around global growth and trade flows benefits JPY as a defensive asset, putting downside pressure on EURJPY.

Primary Risk to the Trend

A surprise hawkish tilt from the ECB or strong eurozone economic data could fuel renewed buying pressure, forcing a breakout above 172.98.

A sudden drop in risk-off sentiment or a rebound in global equities could weaken JPY demand and negate the bearish bias.

Most Critical Upcoming News/Event

Eurozone GDP and Industrial Production data – Any significant beat could temporarily lift EUR.

Japan CPI and BoJ commentary – Inflation beats or hawkish language could accelerate JPY gains.

Geopolitical headlines – Trade tensions between the US and China remain a key driver for yen demand.

Leader/Lagger Dynamics

EURJPY is acting as a lagger in the current yen move, with USDJPY leading the direction for JPY crosses. Any decisive move in USDJPY—especially a break lower—would likely spill over into EURJPY. The pair also tends to mirror risk sentiment shifts seen in equity indices like US500, making global sentiment a secondary driver.

Summary: Bias and Watchpoints

I’m maintaining a bearish bias on EURJPY as long as price stays below the 172.30 resistance zone. My stop-loss is placed just above the 172.98 swing high to protect against a bullish breakout. First targets sit at 171.43, then 170.65, with an extended downside target near 169.73 if momentum builds. A clean break below 170.65 would open the path for deeper declines, while any sustained break above 172.98 would invalidate this setup. In short, I’m watching for rejection confirmation from resistance and will be tracking USDJPY closely as the leader for yen sentiment.

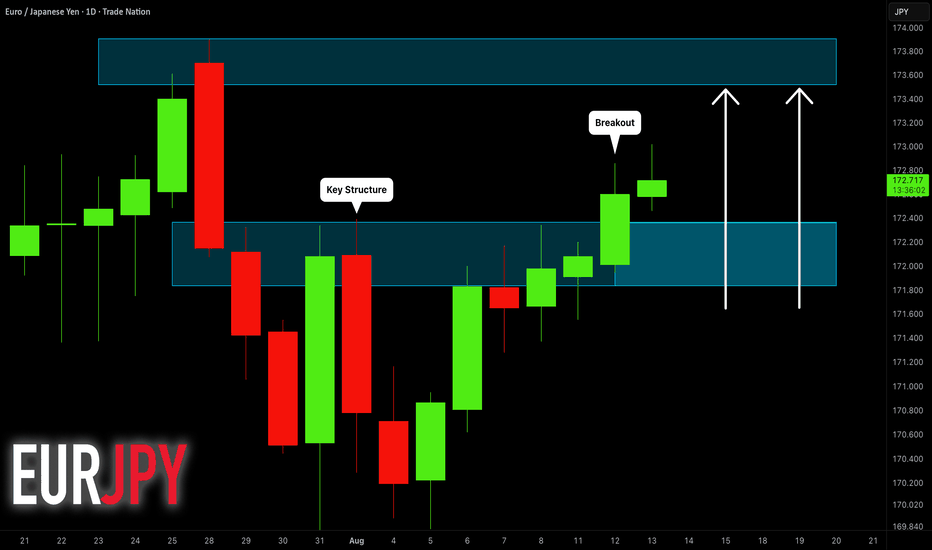

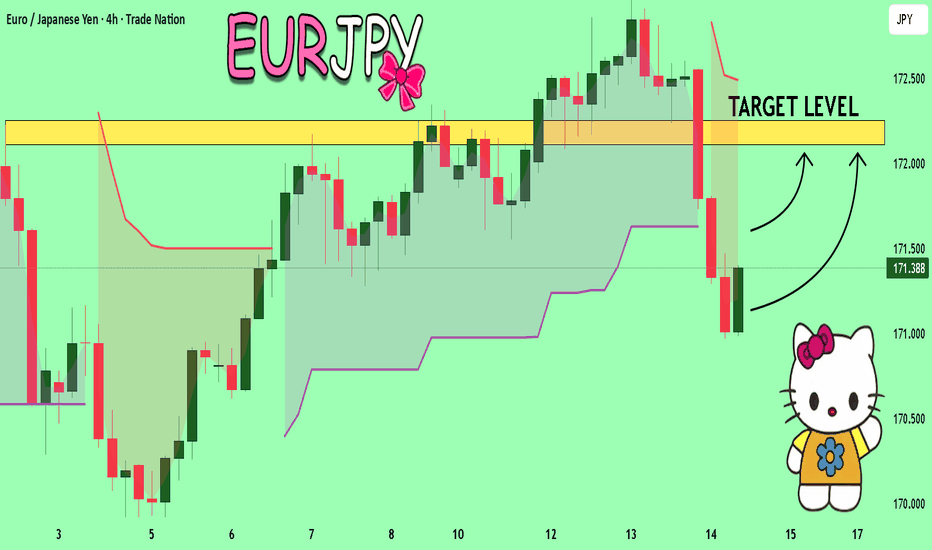

EURJPY: Important Breakout 🇪🇺🇯🇵

EURJPY successfully violated a significant daily resistance cluster.

With a high probability, it turned into a strong support now.

We can expect a bullish continuation from that.

Next resistance - 173.5

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

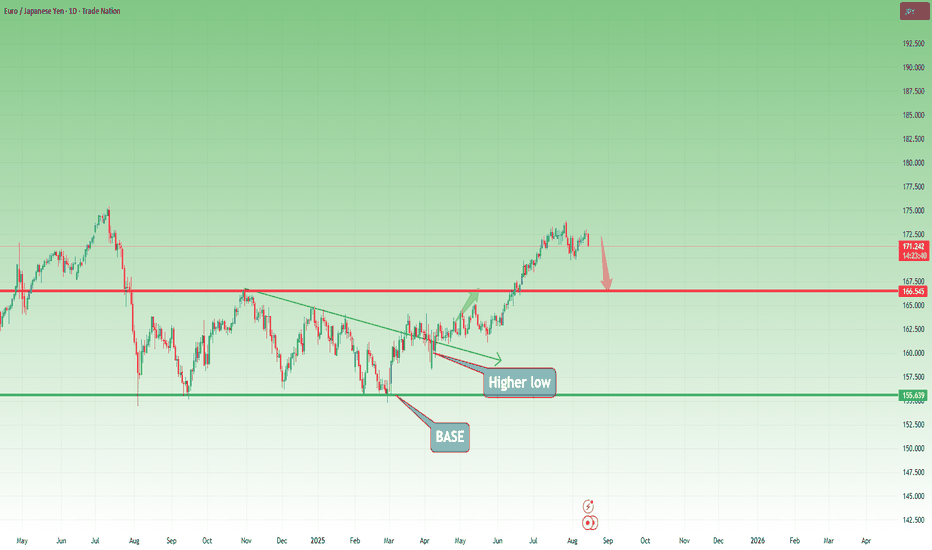

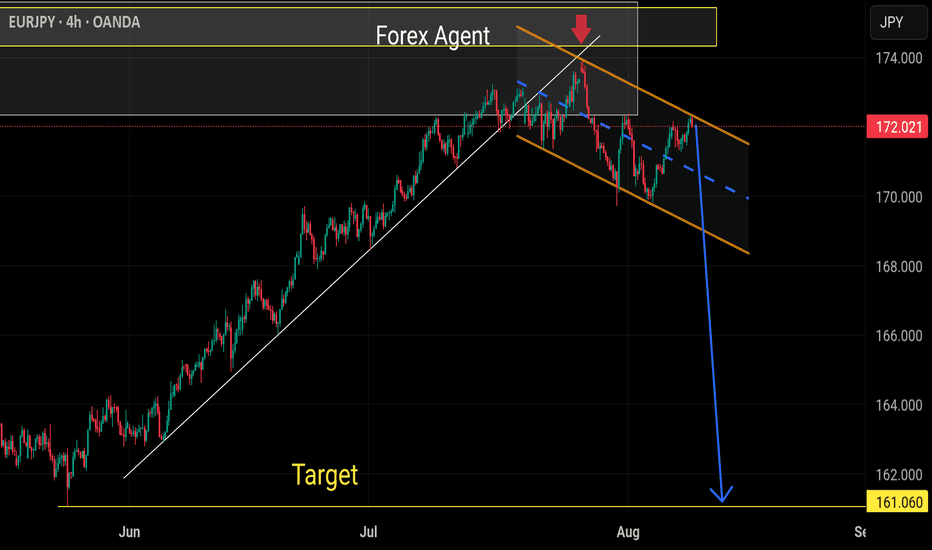

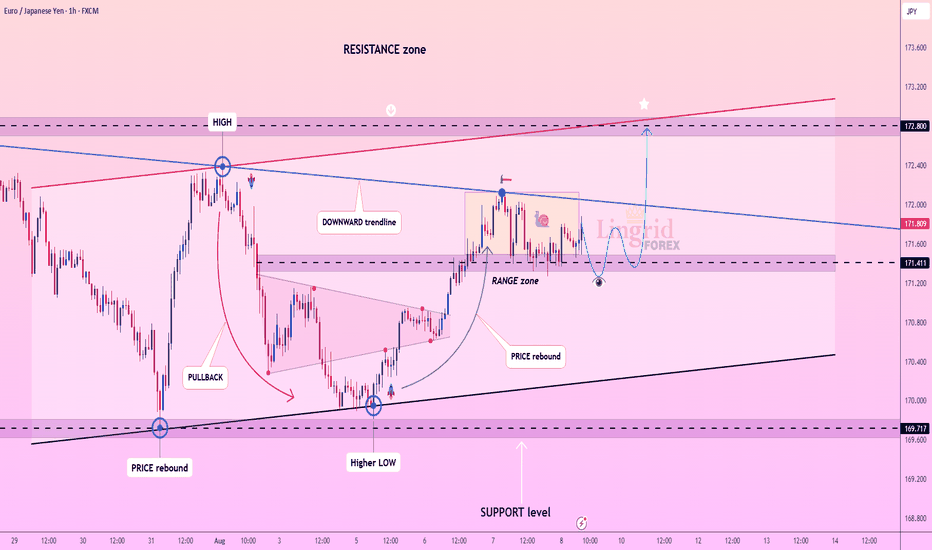

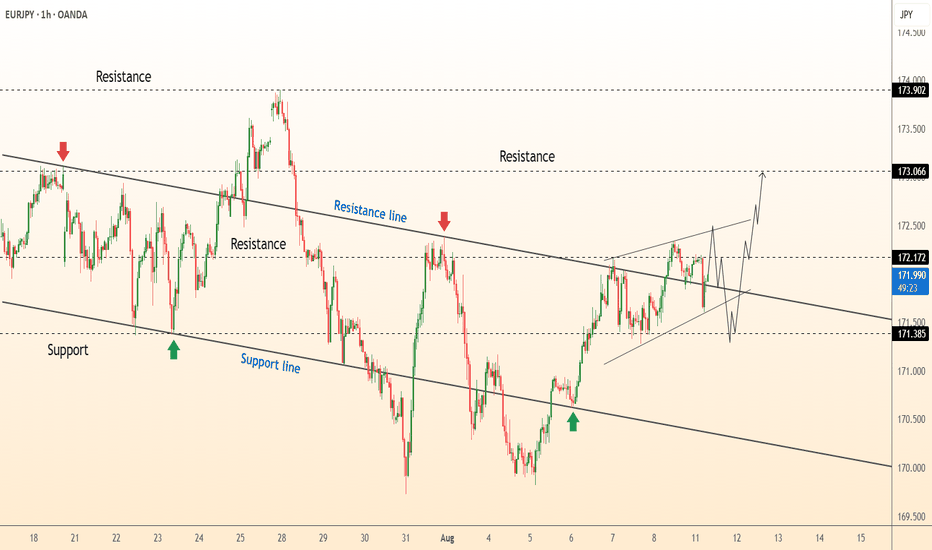

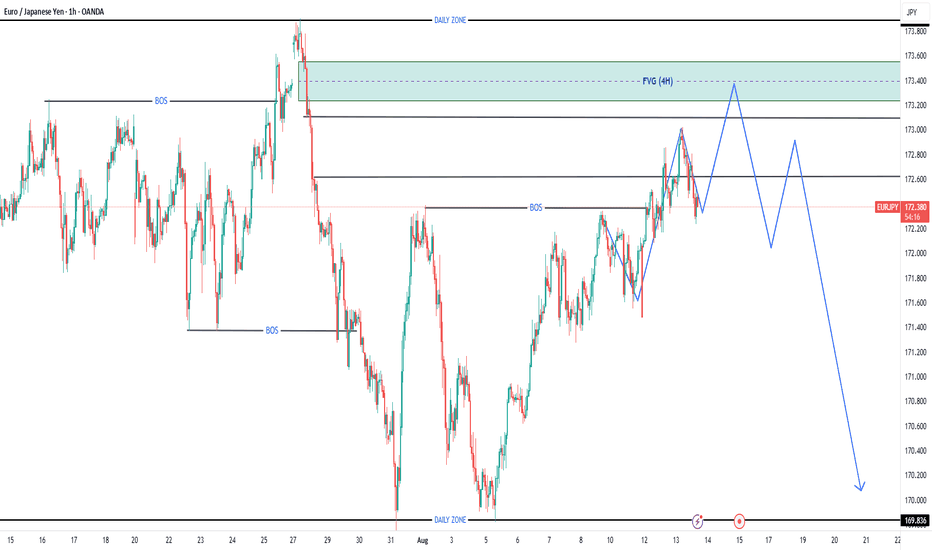

EUR/JPY – Lower High in the Making?As explained in my JPY Index analysis , alongside GBP/JPY, EUR/JPY is another strong candidate for a meaningful drop.

From the chart: after reaching a high near 174 — close to the 2024 ATH — the pair had its first leg down. When price dipped to the 170 psychological level, bulls stepped in, attempting a push to new highs.

However, at 173, it was the bears’ turn. The pair reversed again, potentially forming a lower high.

I believe we are in the early stage of a stronger drop, and in my view, rallies around 172 should be sold. The downside target is around 166.50, with this scenario negated on a break above the recent high. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

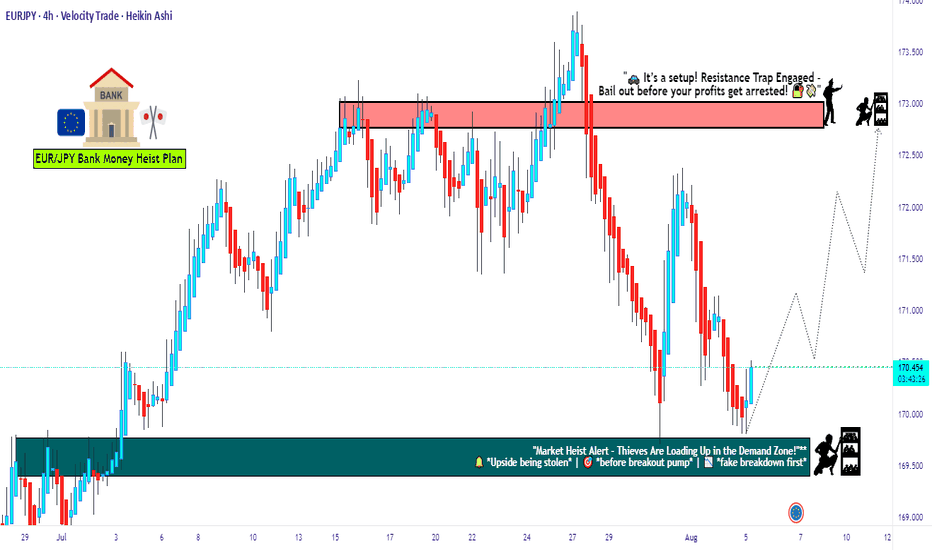

EUR/JPY Setup: Thief Trader's Stealth Bull Run to 173.000🔥💶 EUR/JPY Bullish Heist Plan 💶🔥

🧠 New Plan Unlocked – The EUR/JPY Bullish Mission is LIVE!

Thief Trader style means: No noise, no fluff — just pure sniper precision with layered limit orders. 🧤🔫

This isn’t trading… it’s a planned market robbery 💼💣

🧩 Asset: EUR/JPY

📊 Strategy: Bullish Bias with Stealth Layered Entries (Limit Order Gameplan)

🎯 Target: 173.000 — That’s the vault we’re cracking!

🛑 Stop Loss: 169.100 — Tight security, keep your escape route clean.

📍 Entry: No fixed door — we’re setting traps (limit orders) across key levels. Patience pays thieves.

Watch for pullbacks on lower timeframes: 15m, 30m, or even 1H — strike near support bounces & fakeout wicks. 🐍💥

🔍 Thief Logic:

This ain’t random — price is setting up for a high-stakes move north with JPY weakness fueling the getaway car.

Think smart, layer deep — sniper entries, not shotgun chaos. 🎯🔍

📌 Notes from the Safe House:

Trade with position sizing discipline – the market doesn’t owe you.

News events are motion sensors — avoid them or stay light! 🕵️♂️📉

Use trailing SLs once in profit — secure the bag and vanish. 💼💨

💣 Ready to steal pips, not hope? Hit that 👍, drop a 💬, and join the crew.

This is Thief Trading — we don’t follow markets, we outsmart them. 🧠💵

Stay sharp, stay silent… profit loud. 🐱👤📈💸

🔥 Tap Boost. Support the Heist. Run the Charts. #ThiefTrader 🧤💰

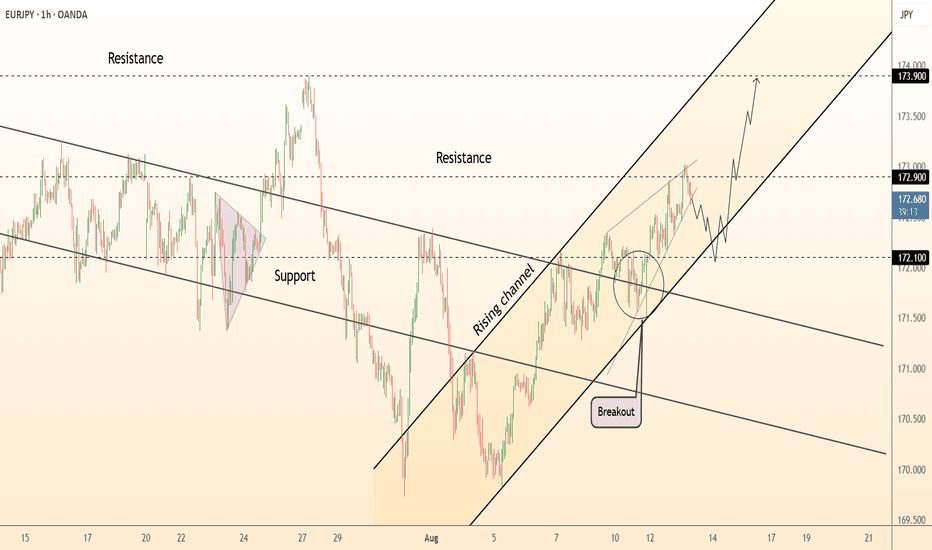

DeGRAM | EURJPY is moving in an ascending channel📊 Technical Analysis

● Price is climbing within a rising channel after confirming a breakout retest at 172.10, turning former resistance into support.

● Structure favors continuation toward 172.90 and channel top at 173.90, with minor pullbacks likely staying above the breakout base.

💡 Fundamental Analysis

● Improved eurozone PMI data and firm ECB stance reinforce euro strength, while BoJ’s unchanged ultra-loose policy keeps the yen under pressure.

✨ Summary

Long above 172.10; targets 172.90 → 173.90. Invalidation below 172.00.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

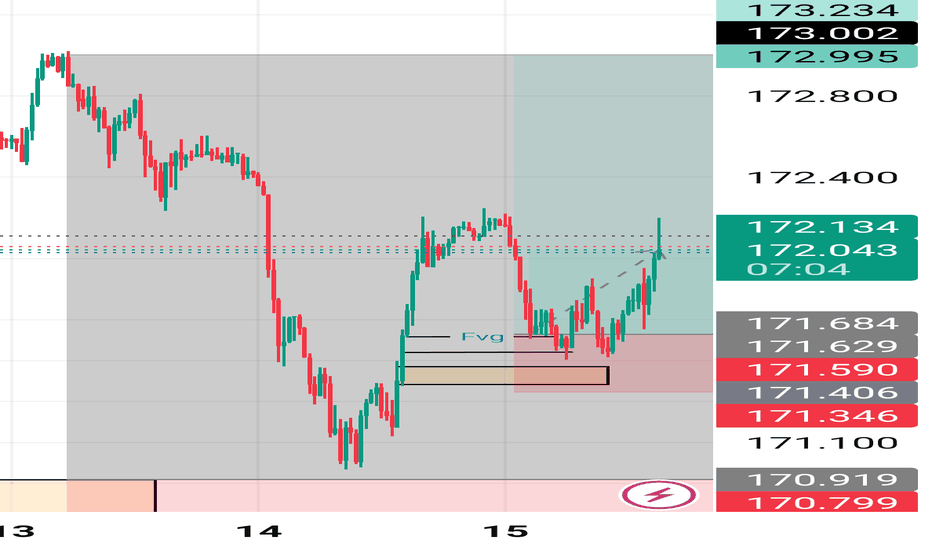

Lingrid | EURJPY Trendline Breakout. Long From SupportThe price perfectly fulfilled my previous idea . FX:EURJPY is consolidating inside a tight range between 171.411 support and the downward trendline after rebounding from a higher low. Price is testing the upper boundary of this range, and a breakout could signal continuation toward the 172.800 resistance zone. Holding above 171.411 keeps the bullish bias intact, while rejection from the trendline could bring another retest of support. Momentum favors buyers if the breakout comes with strong volume.

📉 Key Levels

Buy trigger: Break and hold above 171.775

Buy zone: 171.411–171.775

Target: 172.800

Invalidation: Drop below 171.411

💡 Risks

Failure to break the downward trendline could spark a deeper pullback

Rejection at 172.800 could trigger range-bound movement

Weak euro sentiment from macroeconomic data may weigh on upside potential

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

EURJPY Massive Long! BUY!

My dear friends,

Please, find my technical outlook for EURJPY below:

The price is coiling around a solid key level - 171.15

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 172.11

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

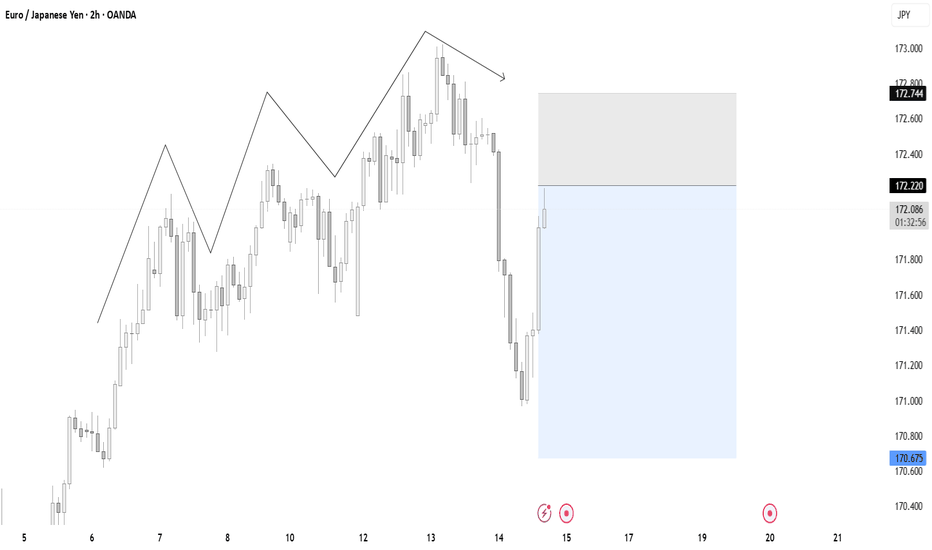

DeGRAM | EURJPY exited from the channel📊 Technical Analysis

● EURJPY broke above the descending channel’s resistance line near 171.38, holding within an ascending wedge that favors bullish continuation.

● A sustained move above 172.17 opens the way toward 173.06, with intraday pullbacks likely retesting the breakout area for support.

💡 Fundamental Analysis

● The euro gained as ECB officials signaled no immediate rate cuts, while the yen remains pressured by Bank of Japan’s commitment to ultra-loose policy despite rising inflation expectations.

✨ Summary

Buy above 171.38; target 173.06. Setup remains valid while price stays above 171.00.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

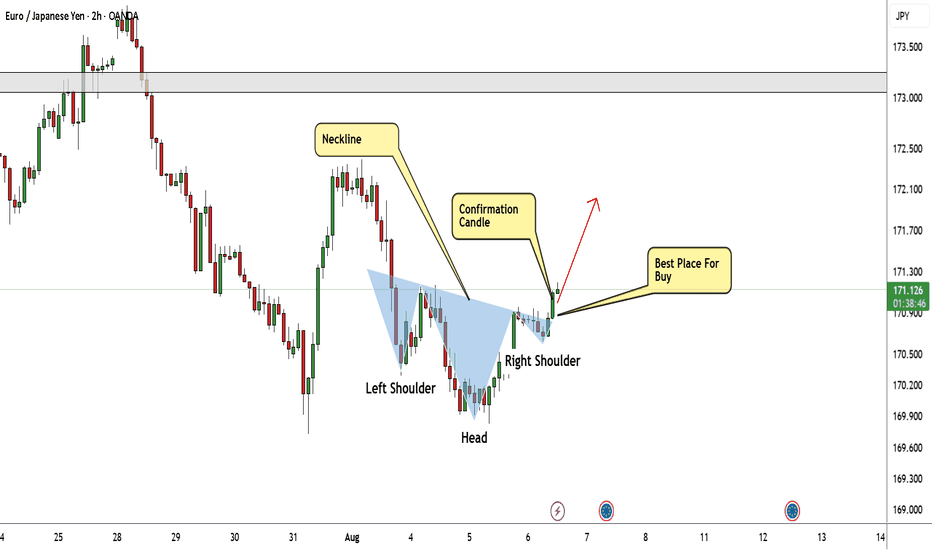

EUR/JPY Made Inverted H&S Pattern , Time To Buy And Get 150 PipsHere is my 2H Chart On EUR/JPY , The price created a very clear reversal pattern ( inverted head and shoulders pattern ) and the price closed above neckline so the pattern confirmed and we can buy it and targeting from 100: 200 pips , if we have a daily closure above 171.000 it will be a great confirmation telling us the price will continue to upside .

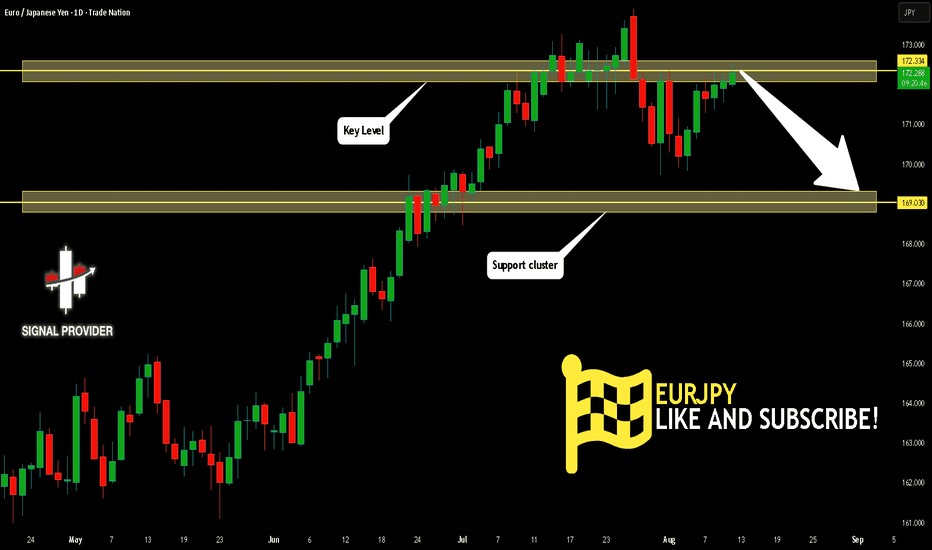

EURJPY Is Very Bearish! Short!

Here is our detailed technical review for EURJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 172.334.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 169.030 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

POSSIBLE UJ MOVEUJ is about to fill up a FVG arounf 173,400.

It might push higher from current price point to fill up that FVG before it start selling (Bearish).

Another scenarion is that, it might drop right away without filling that price imbalance.

lets monitor the pair and enter after confirmations.