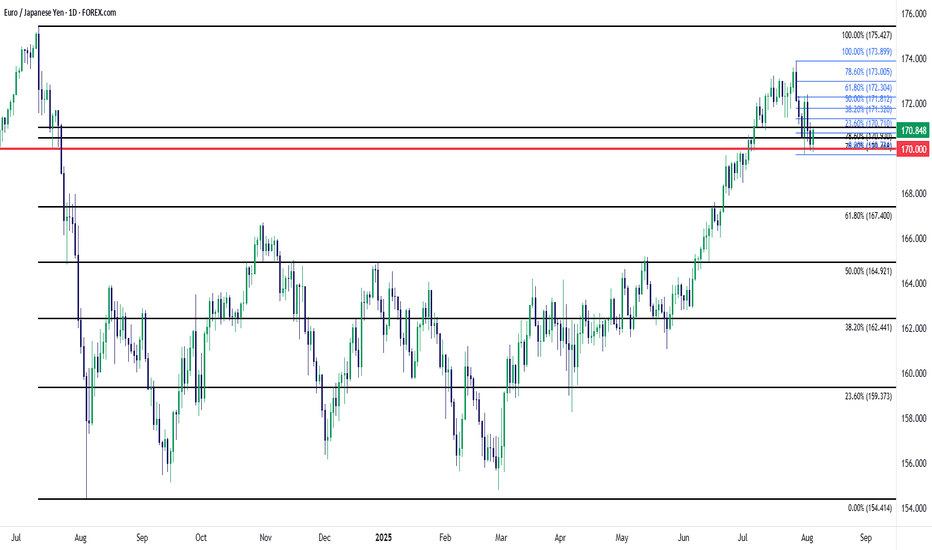

EUR/JPY 170.00 TestEUR/JPY was a high-flyer into late-July as the pair put in a very rare test above the 170.00 level. That price was almost in play back in 2007 and 2008, but ultimately the pair held about five pips below the big figure before plummeting on the back of the financial collapse.

Sixteen years later EUR/JPY was finally able to mount above 170, albeit temporarily, as price climbed above last summer until the massive reversal developed in July, sending prices spiraling all the way down to support around 155.00.

More recently, as Yen-weakness returned in the latter portion of Q2, combined with Euro strength as EUR/USD climbed to three-year-highs, EUR/JPY once again was able to push above the 170.00 handle.

Last week saw a bearish engulfing candlestick develop on Monday, and given the overbought backdrop at the time, the door quickly opened for bears. But since then, buyers have put up a stand around that same 170.00 level with an assist from last week's BoJ meeting.

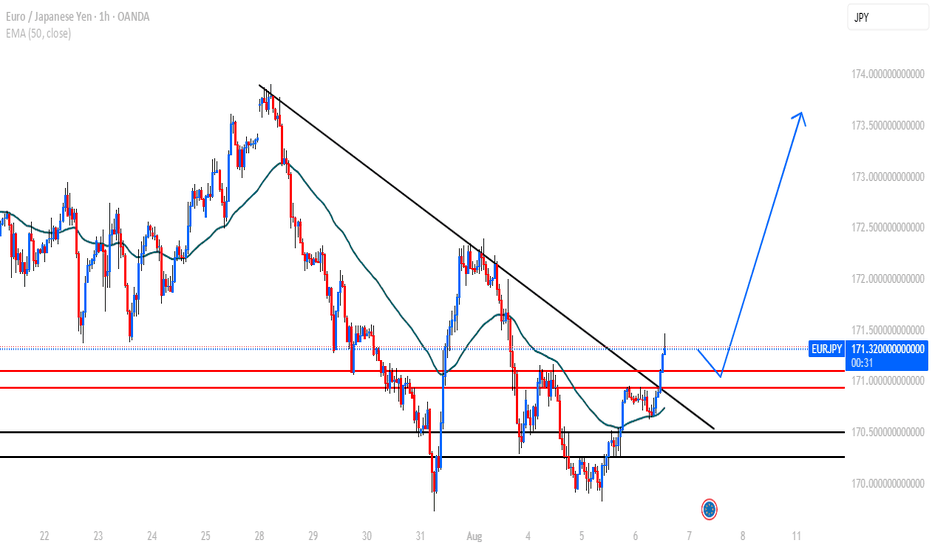

At this point there's been a hold of higher-lows with the 170.00 psychological level coming into play to hold support. This keeps the door open for bullish continuation and the Fibonacci retracement produced by last week's pullback remains of interest with a few important levels of note. The 172.30 area is the spot for bulls to beat, as this would mark a higher-high and that would then open the door for a re-visit of 173.00 and if bulls can muster that, there's the potential for more as it'll look like a move of broader trend continuation. - js

EURJPY trade ideas

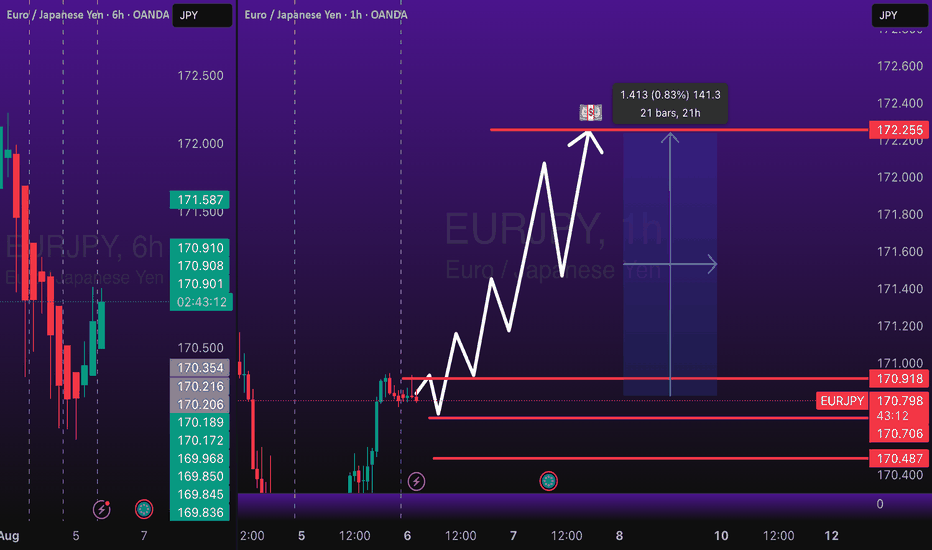

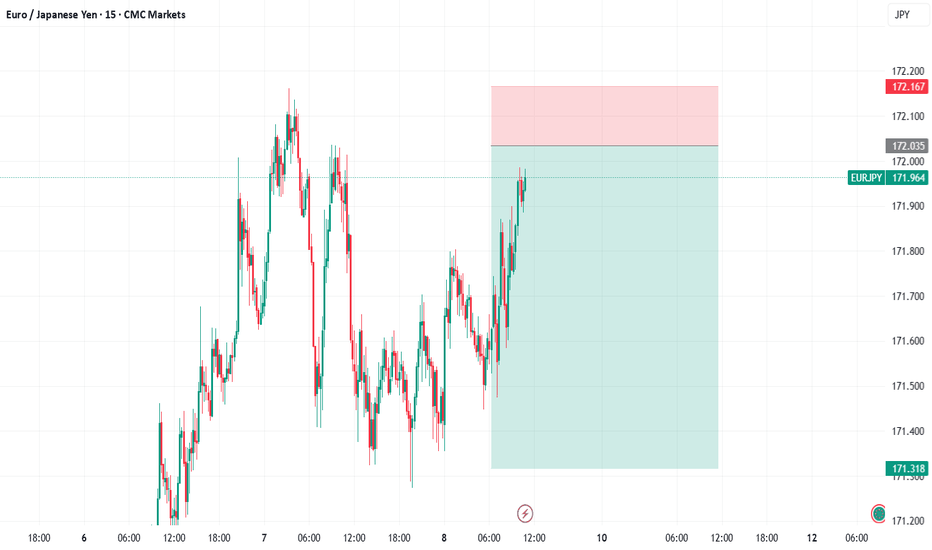

EURJPY to hit 172.250 Market Correction EURJPY Long trade, with my back testing of this strategy, EURJPY will hit 172.250

This is good trade.

Don't overload your risk like Greedy gambler!!!

Be Disciplined Trader, what what you can afford.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

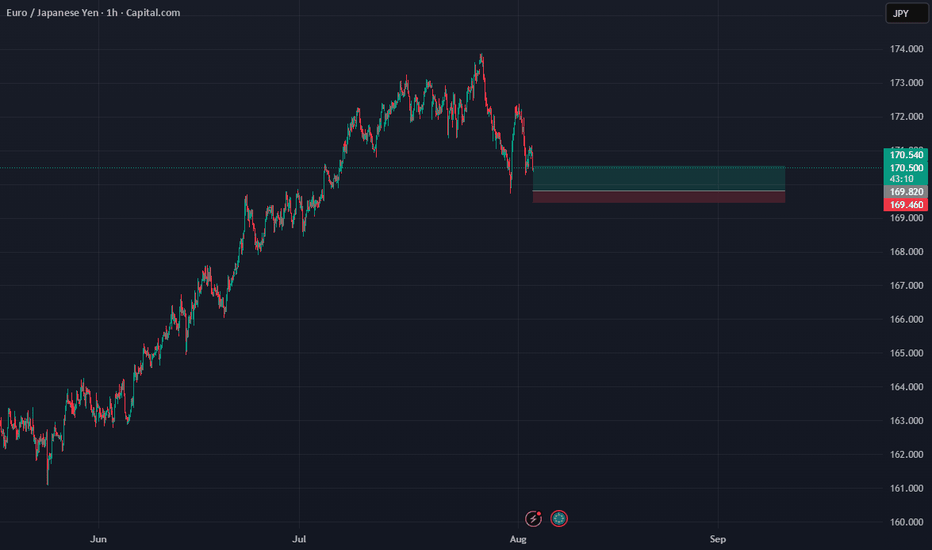

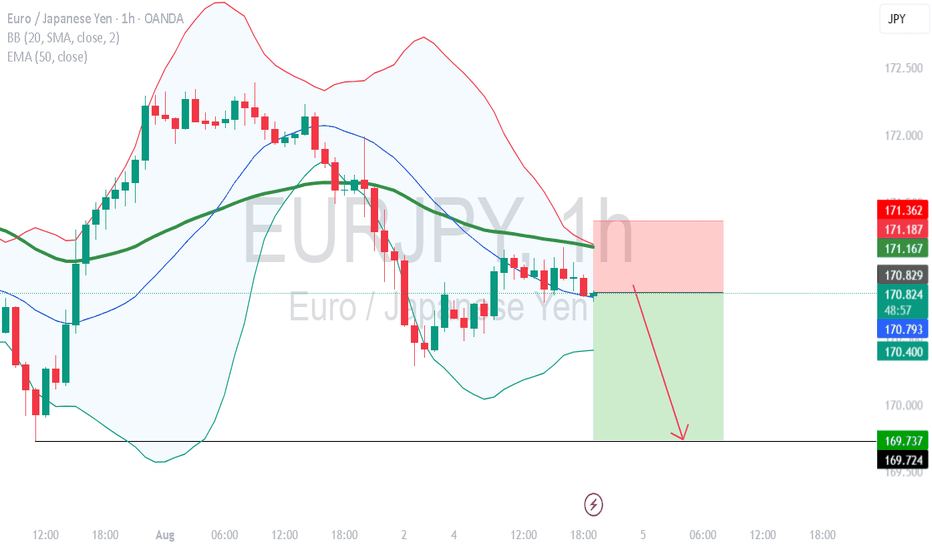

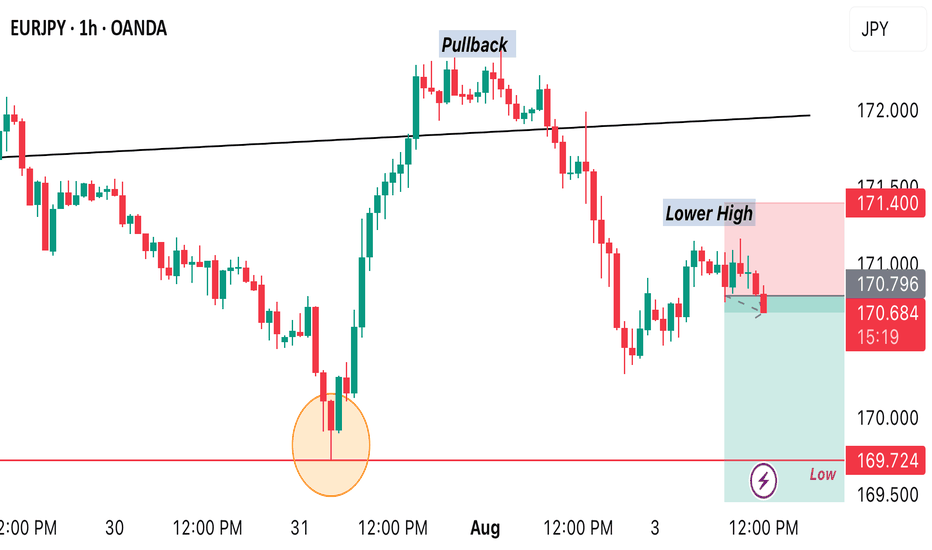

EUR_JPY SUPPORT AHEA|LONG|

✅EUR_JPY is going down now

But a strong support level is ahead at 169.757

Thus I am expecting a rebound

And a move up towards the target of 170.400

LONG🚀

✅Like and subscribe to never miss a new idea!✅

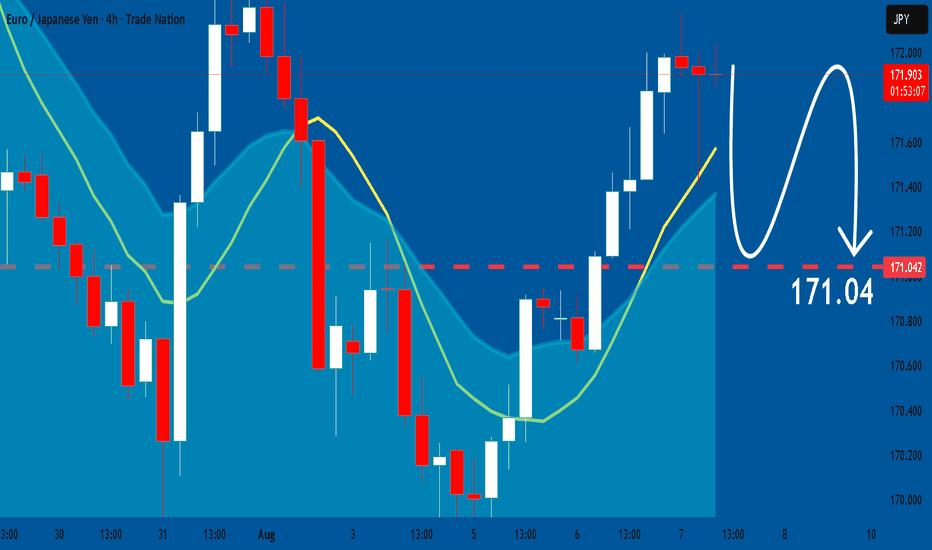

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

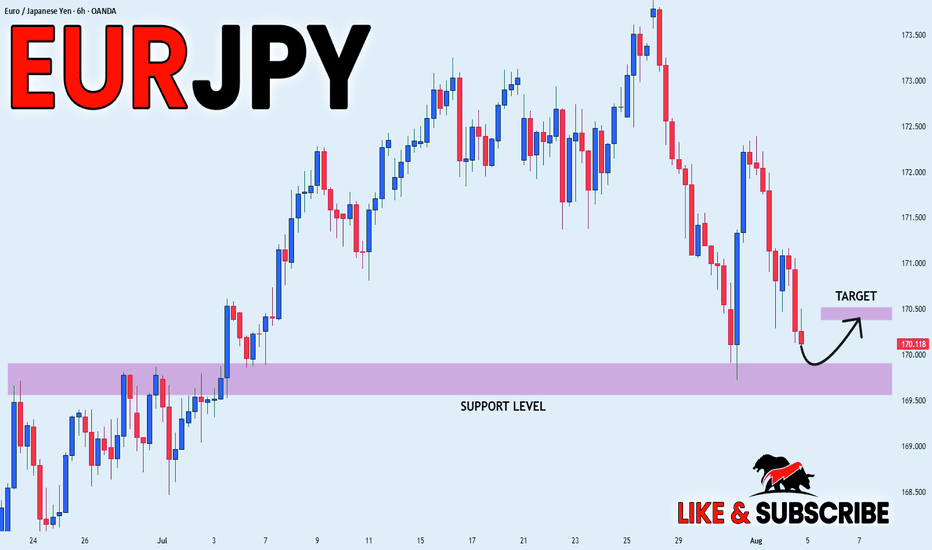

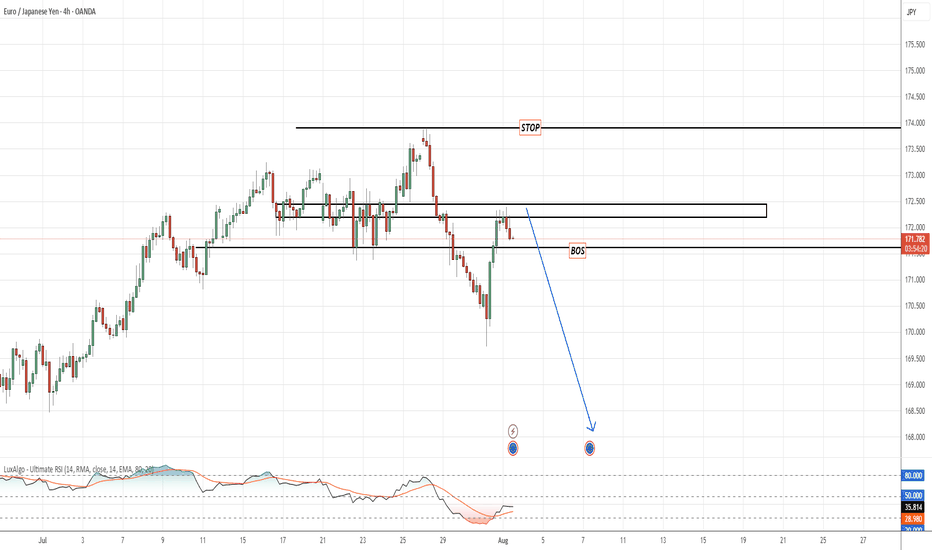

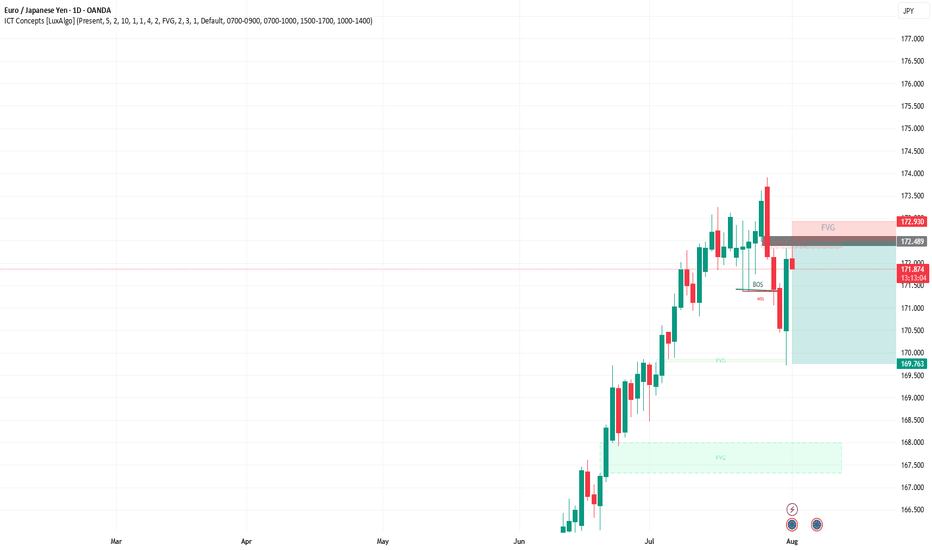

EURJPY: Market Sentiment & Forecast

The recent price action on the EURJPY pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

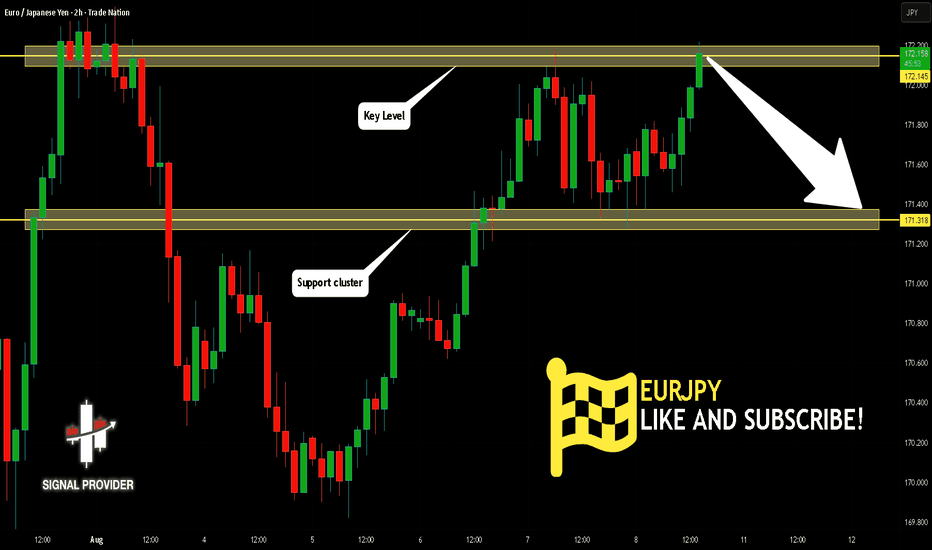

EURJPY Will Go Lower From Resistance! Sell!

Here is our detailed technical review for EURJPY.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 172.145.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 171.318 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

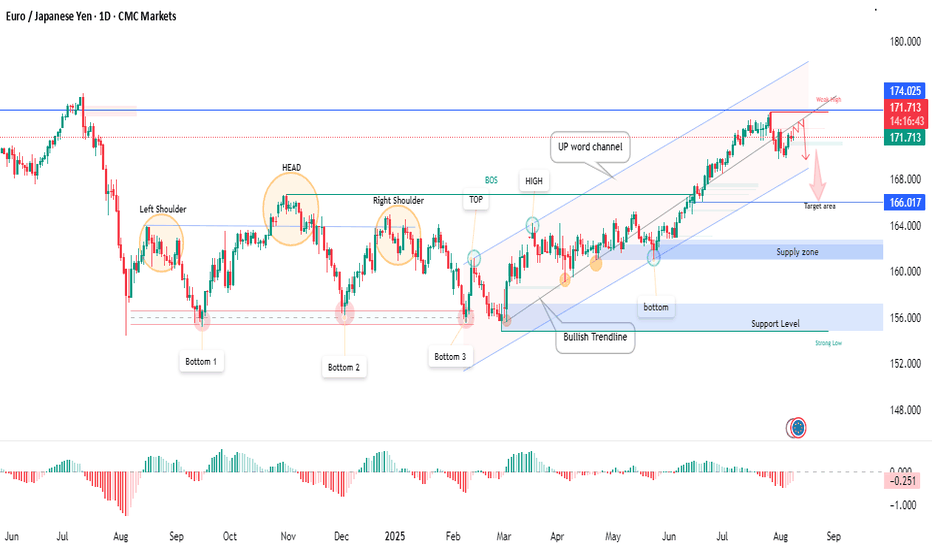

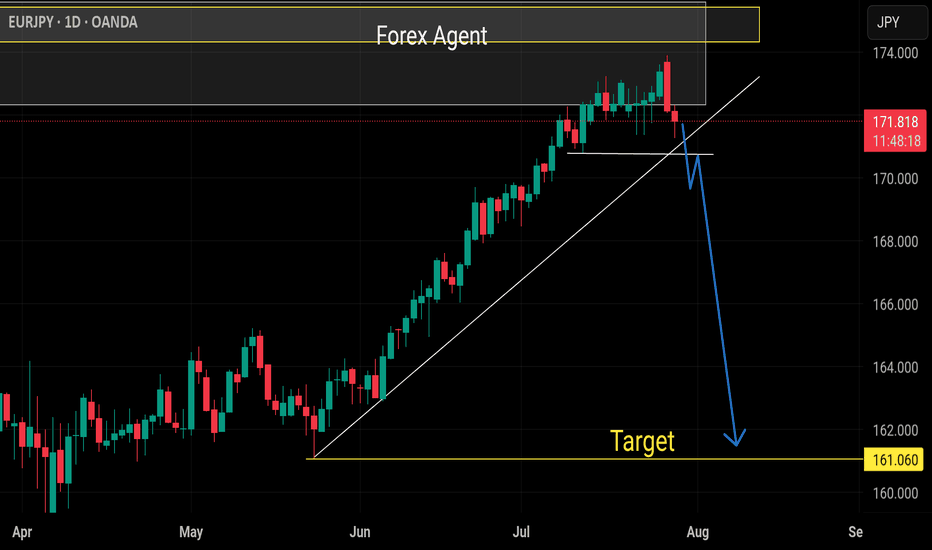

EURJPY–Rising Channel Weak High Reversal Setup/Targeting 166.00EURJPY on the Daily chart has been moving within a well-defined upward channel, but price is now testing a weak high near 174.025.

Key observations:

Head & Shoulders Structure: Formed earlier with three clear bottoms acting as strong historical support.

Bullish Trendline: Intact throughout the rally, now showing signs of slowing momentum.

Supply Zone: Overhead resistance aligning with channel top.

Potential Pullback: A break below recent highs could trigger a move toward the 166.017 target area.

Market Structure: Break of structure (BOS) and lower high formation could signal reversal.

📉 Bearish Scenario: Rejection from 174.025 and a breakdown below trendline support may lead to a deeper correction.

⚠ Invalidation: A daily close above 174.025 could extend the rally further.

Analysis is for educational purposes only, not financial advice.

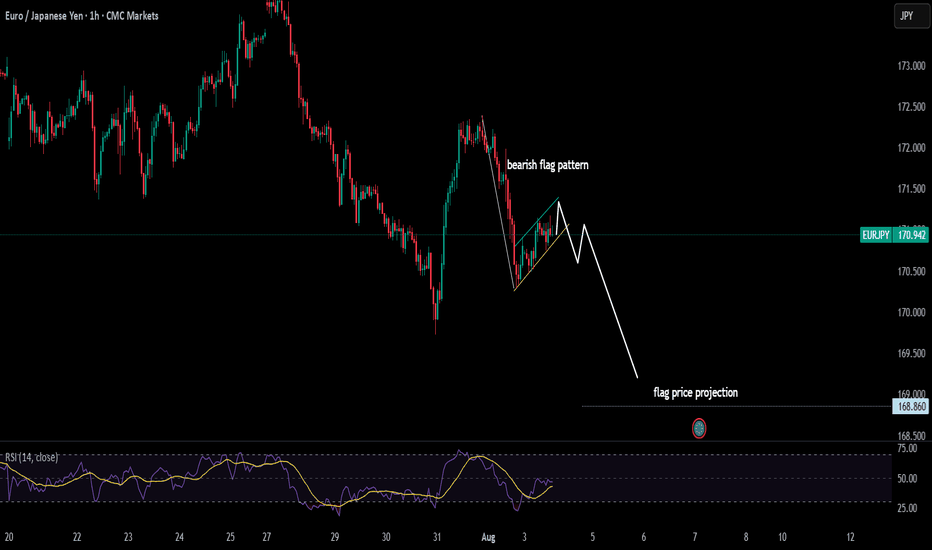

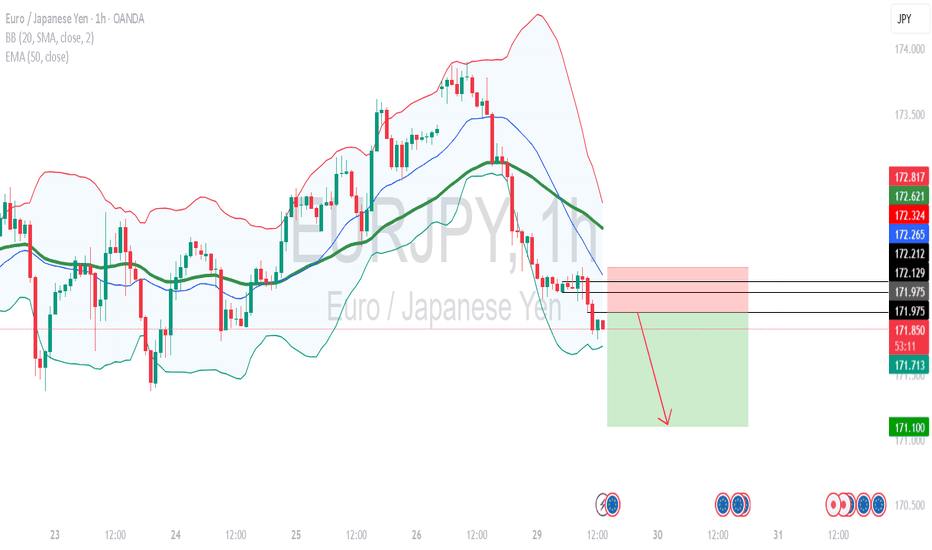

EURJPY POTENTIAL SELL OPPORTUNITY-H1 timeframe!Price is set for a sell from the current market price! Technically, we can identify the already existing bear trend. Couple of hours ago, we saw price rejection around 171.162 that rejection could be a H1 lower high which potentially means price might drop back to the low. Therefore, a sell opportunity is envisaged from the current price

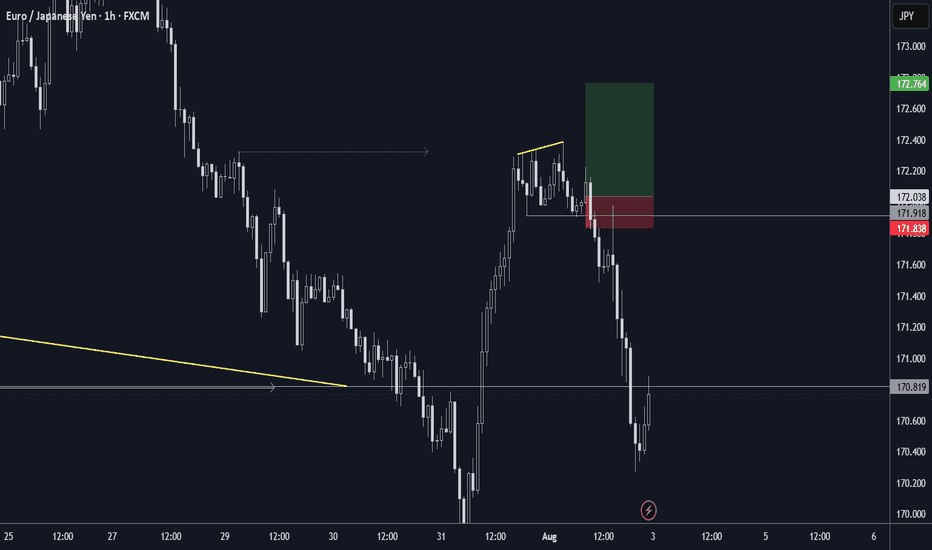

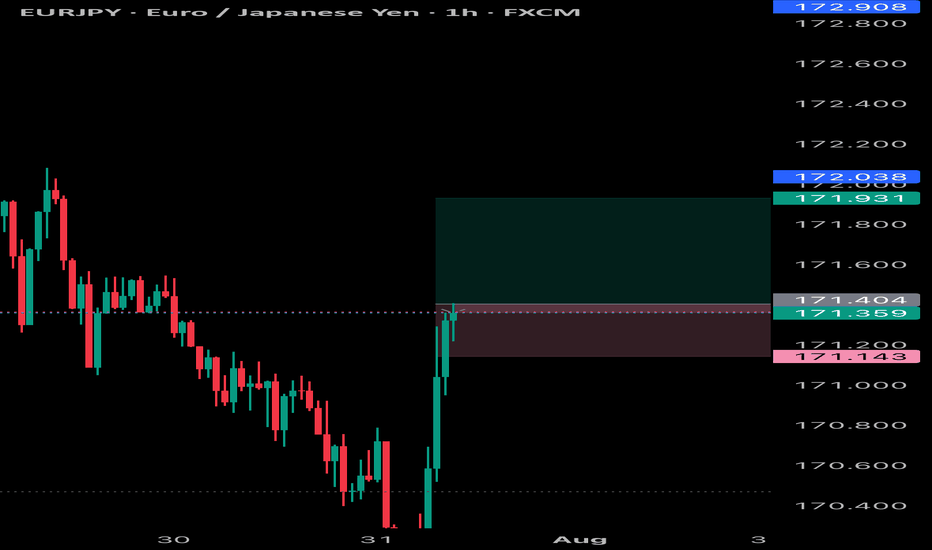

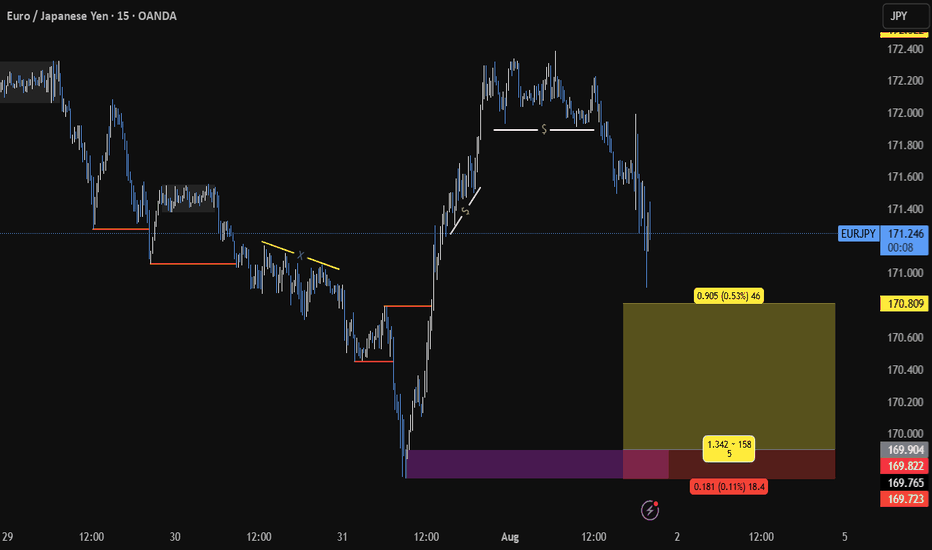

EURJPYPrice just broke key internal structure with a clear BoS (Break of Structure) after liquidity sweep above the previous highs. We're now watching for a clean retracement to the supply zone to execute a sniper short.

📍 Setup Details:

BoS Confirmed: 172.00 level cleanly broken

Area of Interest: Supply zone 172.90–173.60

Stop: Above liquidity zone ~174.55

Target: Downside continuation toward 168.00–167.00

📉 RSI shows momentum weakness on the pullback

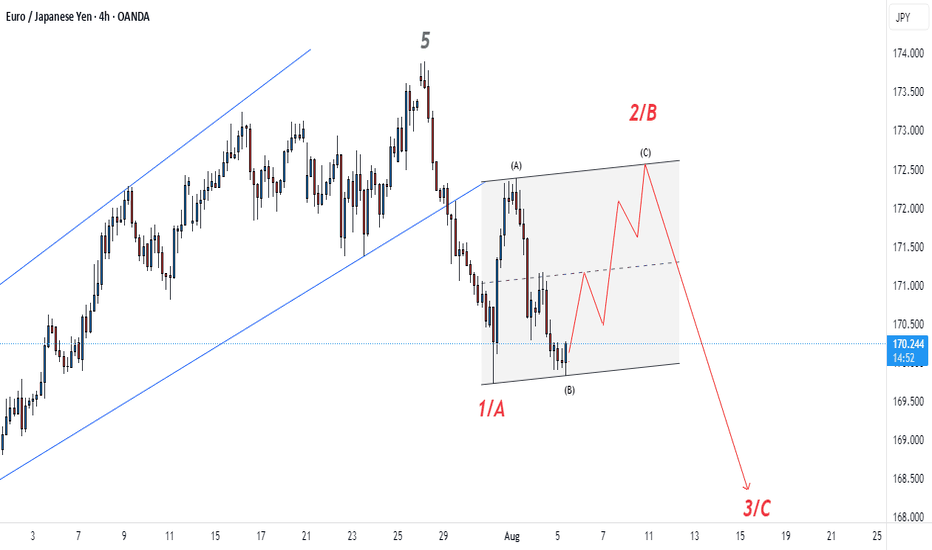

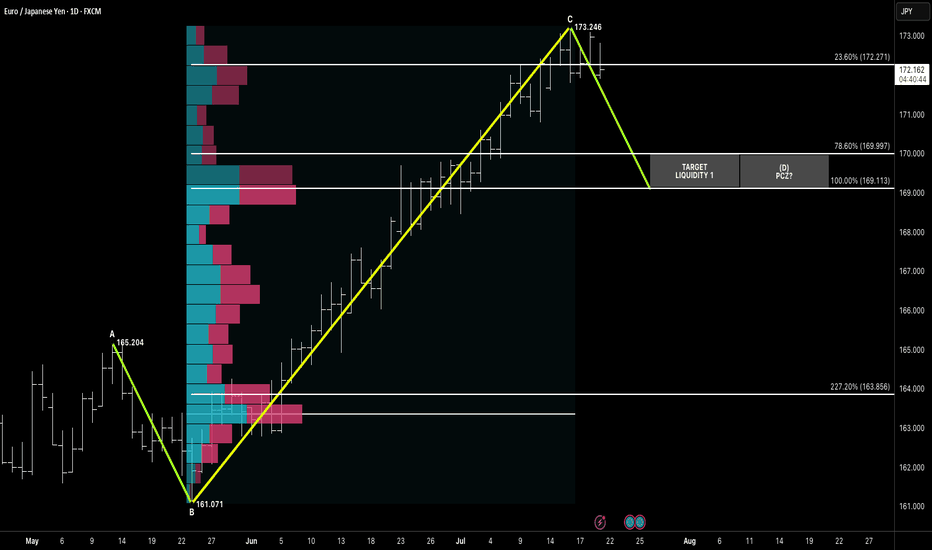

Symmetry Bearish Setup Targeting PCZ Liquidity Zone 1HELLO awesome traders, I hope y'all have had a great weekend!! What a beginning of trading week, ha? lets crack on by droping some chart here for yall.

After completing a clean ABC symmetry leg, EURJPY is now showing signs of exhaustion just below 173.250, with price stalling at the high-volume node. The projected Potential Completion Zone (PCZ) aligns at 169.997 (78.6%) and 169.113 (100%), backed by volume profile voids and confluence from prior structure.

This symmetrical move offers a classic liquidity sweep play, with target zones sitting below price in thin auction areas.

📌 Pattern Structure:

A: 165.204

B: 161.071

C: 173.246

D Target = 1:1 Symmetry → PCZ = 169.997–169.113

🔻 Bearish Trigger:

Break below 23.6% retracement (172.271) = early momentum shift

Liquidity likely rests between 170.00–169.00

🎯 Targets:

T1: 169.997

T2: 169.113 (let's do T1, Them will see)

🧠 Context:

JPY strength resurfaces amid macro uncertainty. Volume profile suggests fast price drop once liquidity is triggered below 171.00. Watching for confirmation candle or rejection below 172.20 zone.

“Symmetry leads the setup, but liquidity confirms the move.”

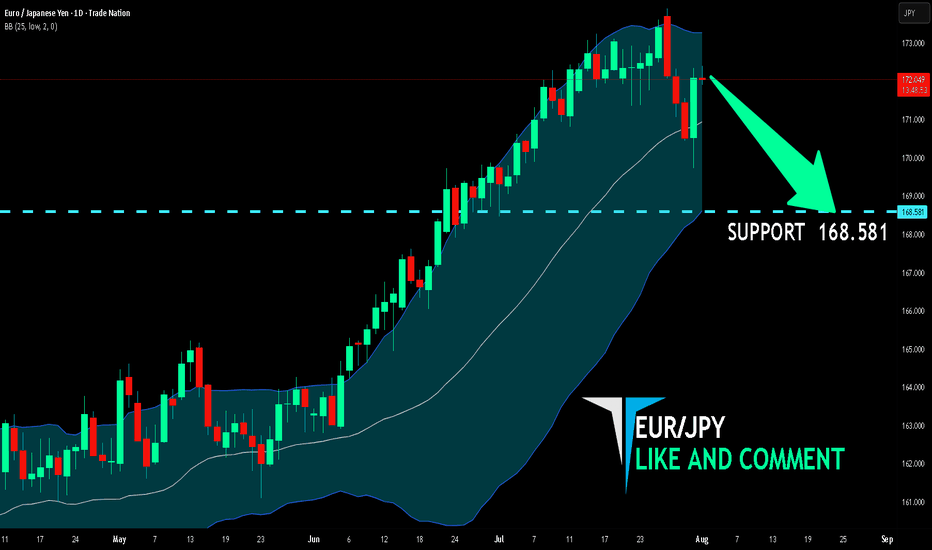

EUR/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

We are now examining the EUR/JPY pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 168.581 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

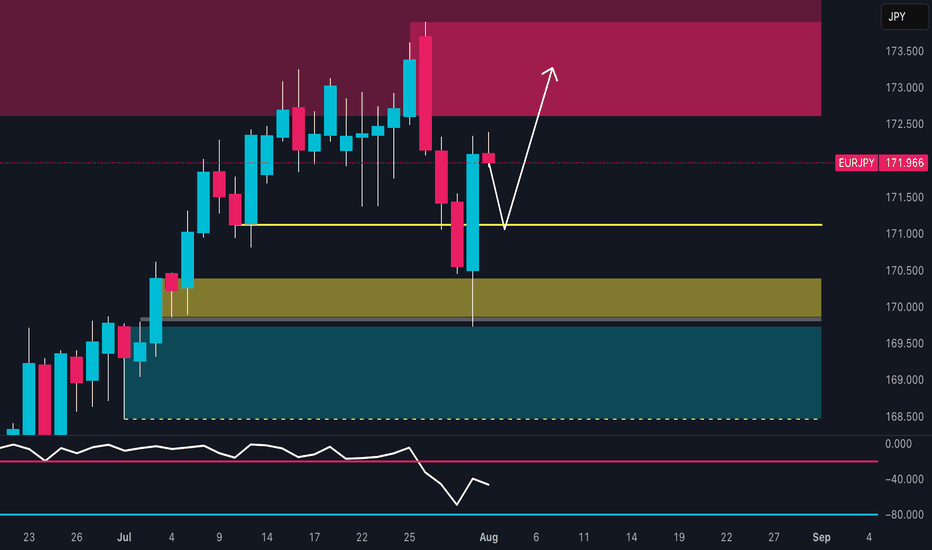

EUR/JPY Setup: Retail is 82% Short – Squeeze First, Drop After?🔹 Technical Context

Price reacted with a strong bullish wick in the 169.50–170.30 demand zone, signaling clear buyer defense. The RSI bounced from weakness but remains subdued, showing limited momentum.

📍 Current price action suggests a potential retest of the 172.50–173.30 area, which aligns with a supply zone, before a possible directional decision is made.

🗓️ Seasonality

Historically, August tends to be bearish for EUR/JPY:

5Y average: -0.48%

10Y average: -0.12%

15Y/20Y averages: -1.3% and -1.2%

📉 Seasonality indicates potential weakness, especially in the second half of the month.

🪙 COT Report (EURO & YEN) – July 22

EURO: Strong long accumulation by non-commercials (+6,284) and commercials (+17,575)

JPY: Net decline in both longs (-1,033) and shorts (-4,096), with a drop in total open interest

🧠 The market is heavily positioned on the Euro, while Yen positioning is fading. This creates a divergence between the two currencies, favoring a short-term technical bounce on EUR/JPY, though downside risks remain in the mid-term.

📉 Sentiment

82% of retail traders are short EUR/JPY

Volume: 1,564 lots short vs 352 lots long

📣 This extreme sentiment imbalance suggests a potential short-term squeeze against retail traders.

📊 Market Mood & DPO

Overall mood: Neutral

DPO at -9.0, Wyckoff score below 50

Momentum remains weak, but not showing a clear divergence.

🧩 Operational Summary

Retest of the 172.50–173.30 supply zone

Likely exhaustion in that area

Ideal setup: rejection + bearish confirmation

→ Targets: 170.30, then 169.00