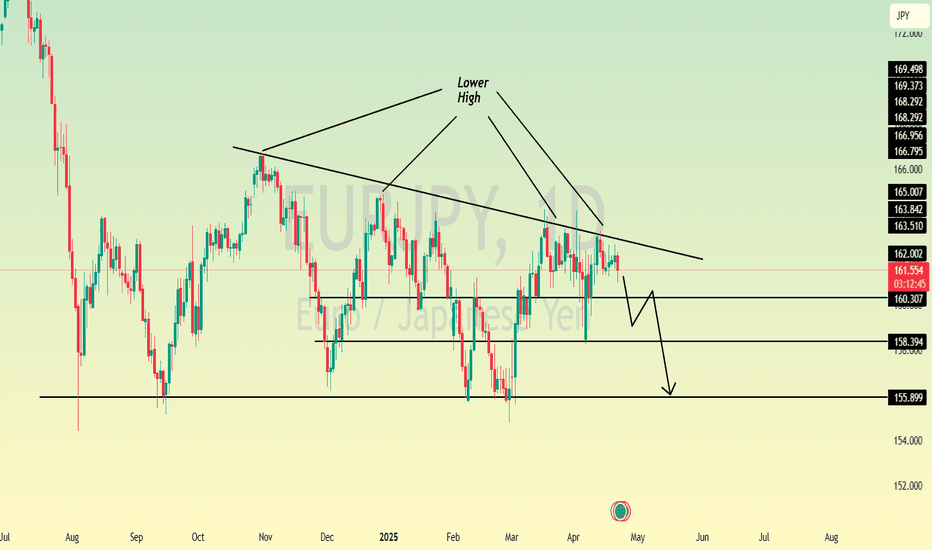

EURJPY is in the Sell Trend after testing Lower HighHello Traders

In This Chart EURJPY HOURLY Forex Forecast By FOREX PLANET

today CADJPY analysis 👆

🟢This Chart includes_ (EURJPY market update)

🟢What is The Next Opportunity on EURJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURJPY trade ideas

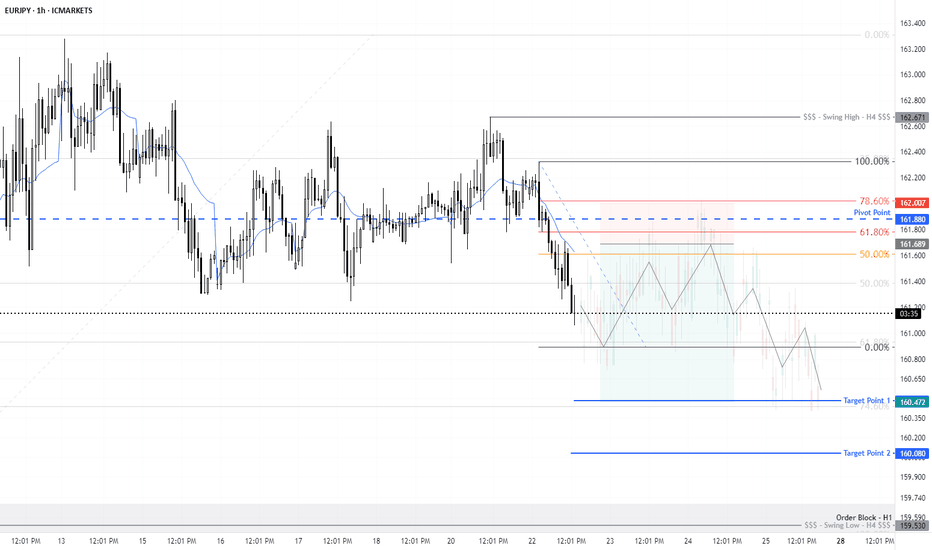

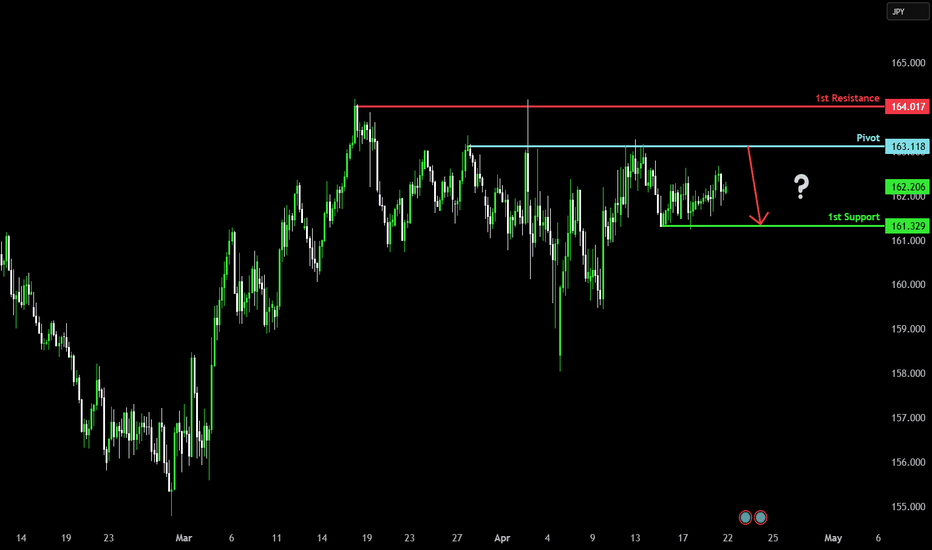

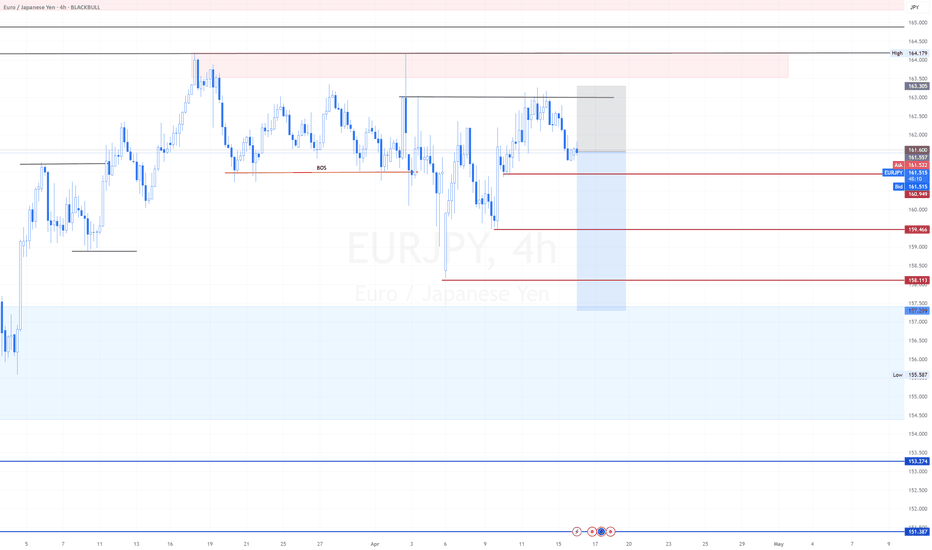

Bearish reversal off pullback resistance?EUR/JPY is rising towards the pivot which has been identified as a pullback resistance and could drop to the 1st support.

Pivot: 163.11

1st Support: 161.32

1st Resistance: 164.01

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

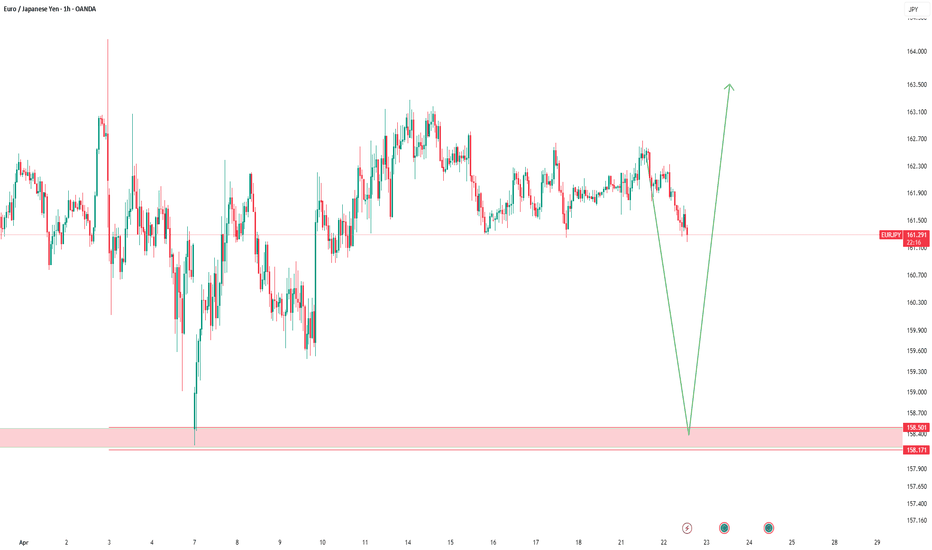

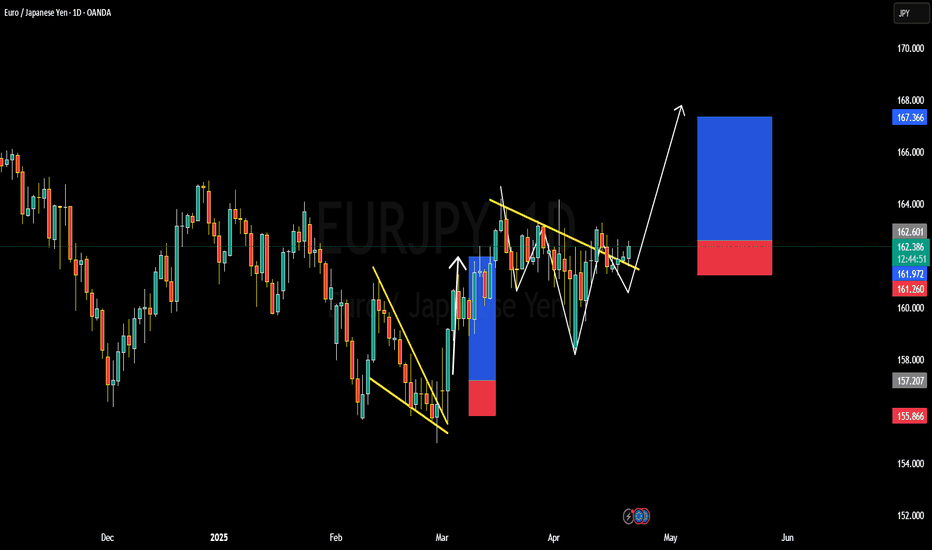

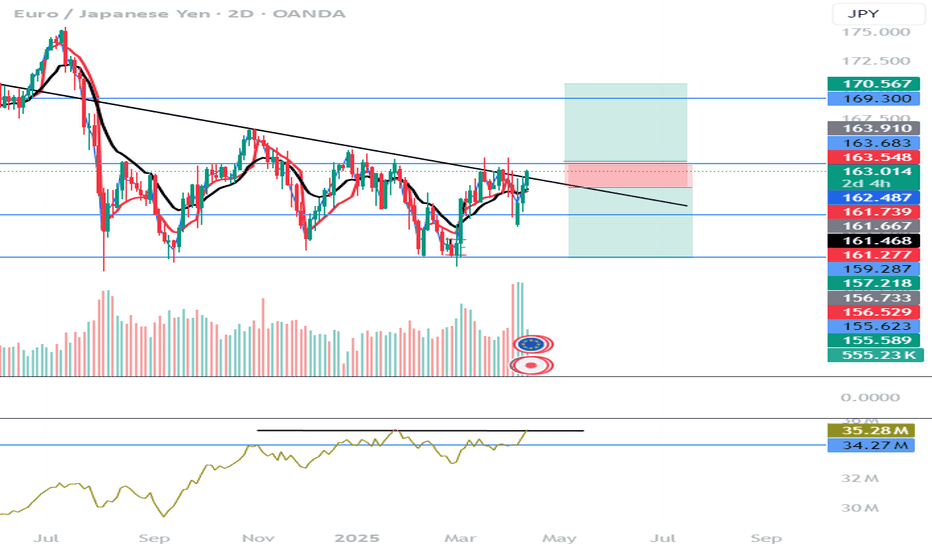

EURJPY --- bullish or bearish detailed analysis EURJPY is currently offering a high-conviction long opportunity as the pair completes a classic falling wedge breakout pattern on the daily timeframe. Price is now trading around 162.45 and has just broken out of a well-defined descending trendline, validating the bullish momentum shift. With the recent higher low formation and the wedge breakout confirming bullish market structure, the next leg toward the 167.36 zone is on the table, aligning with a clean resistance level and historical price reaction zone.

Fundamentally, the Euro is underpinned by the ECB’s cautious stance on rate cuts, as inflation in the Eurozone remains above the 2% target. Meanwhile, the Japanese Yen continues to weaken amid growing divergence between the Bank of Japan’s ultra-loose monetary policy and other global central banks maintaining relatively tight conditions. BoJ’s reluctance to tighten, combined with consistent intervention threats, hasn’t been enough to halt the Yen’s decline, making EURJPY an attractive long in the current macro backdrop.

Technicals align perfectly here—after a solid rally from the wedge bottom, EURJPY consolidated in a descending channel and has now broken out for a second time, repeating a bullish continuation pattern. The structure remains clean with clear invalidation below 161.26, offering a strong reward-to-risk ratio on continuation toward 167+. The multiple confluences of trendline breakouts, bullish market structure, and macro divergence make this a premium swing setup.

Highly searched keywords like “EURJPY breakout,” “falling wedge pattern,” and “JPY weakness” will drive additional traffic to this idea. With both price action and fundamentals in sync, this trade idea is structured to maximize upside potential while keeping risk controlled. A clean, strategic long setup that reflects disciplined execution and market awareness.

EURJPY

Eurozone: European Central Bank (ECB)

Current Head: Christine Lagarde (President since November 2019)

Recent Policy Stance:

On April 17, 2025, the ECB unanimously decided to cut its three key interest rates by 25 basis points, including the deposit facility rate, signaling a dovish monetary policy stance aimed at supporting growth amid deteriorating economic outlook and rising trade tensions. Inflation in the euro area is declining and expected to settle around the 2% medium-term target, with wage growth moderating and services inflation easing. However, the ECB remains data-dependent and cautious, emphasizing a meeting-by-meeting approach without committing to a fixed rate path. The rate cut reflects concerns about weakening growth and tighter financing conditions due to global uncertainties and trade tensions.

Directional Bias:

The ECB is currently easing monetary policy, indicating a dovish bias to stimulate growth and ensure inflation stabilizes sustainably at target. This suggests a softer euro in the near term, as rate cuts typically reduce currency appeal relative to higher-yielding currencies.

Japan: Bank of Japan (BoJ)

Current Head: Haruhiko Kuroda (Governor since March 2013; note: no recent change indicated in the search results)

Policy Context (inferred from current macroeconomic environment and typical BoJ stance):

The BoJ has historically maintained an ultra-loose monetary policy with negative interest rates and yield curve control to support inflation and economic growth. Given global uncertainties and persistent low inflation in Japan, the BoJ is likely to maintain or cautiously adjust its accommodative stance.

Directional Bias:

The BoJ’s policy remains highly accommodative/dovish, aiming to stimulate inflation and growth. This generally keeps the Japanese yen relatively weaker compared to currencies of countries tightening monetary policy. However, if global risk aversion rises, the yen may strengthen as a safe-haven currency.

Summary Table

Central Bank Head Recent Policy Action Directional Bias Likely Currency Impact

European Central Bank Christine Lagarde 25 bps rate cut (April 2025) Dovish, easing Euro likely to weaken near term

Bank of Japan Haruhiko Kuroda Maintains ultra-loose policy Dovish, accommodative Yen generally weak, but safe-haven demand possible

Conclusion

The ECB under Christine Lagarde is easing policy with rate cuts to address slowing growth and inflation nearing target, signaling a dovish bias that may pressure the euro lower in the short term.

The BoJ under Haruhiko Kuroda continues an accommodative stance to stimulate inflation, keeping the yen subdued except during risk-off episodes when it can strengthen as a safe haven.

Investors should watch incoming data closely as both central banks emphasize data dependency, making their future moves contingent on inflation and growth developments amid global uncertainties.

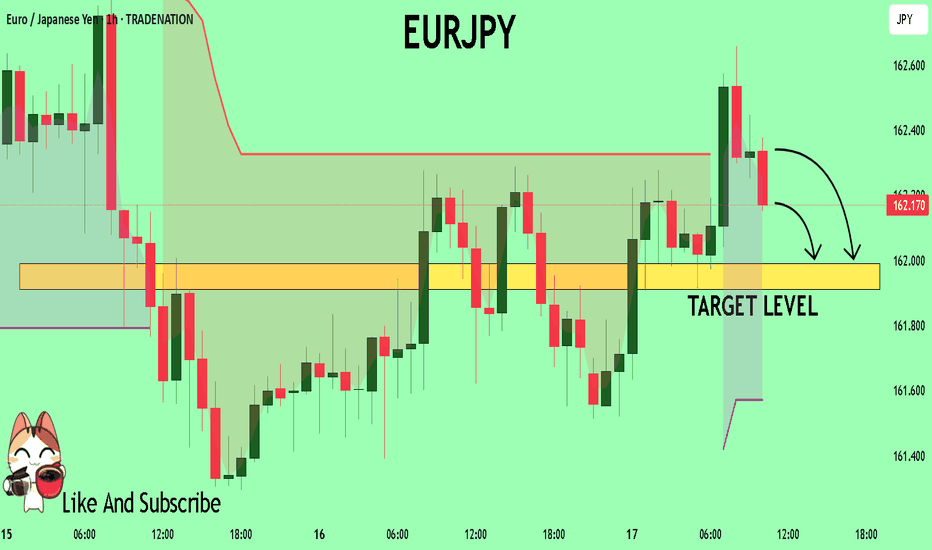

EURJPY Will Collapse! SELL!

My dear subscribers,

This is my opinion on the EURJPY next move:

The instrument tests an important psychological level 162.22

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 161.99

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

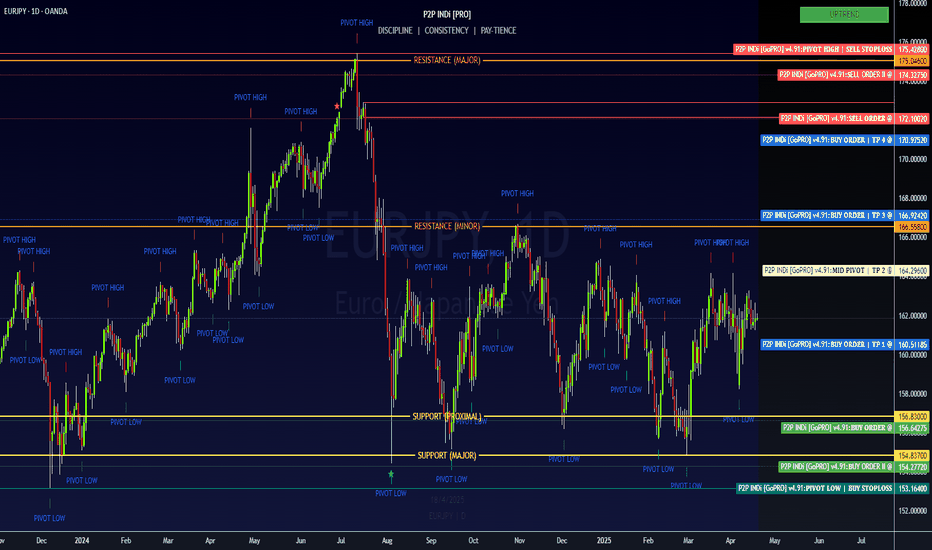

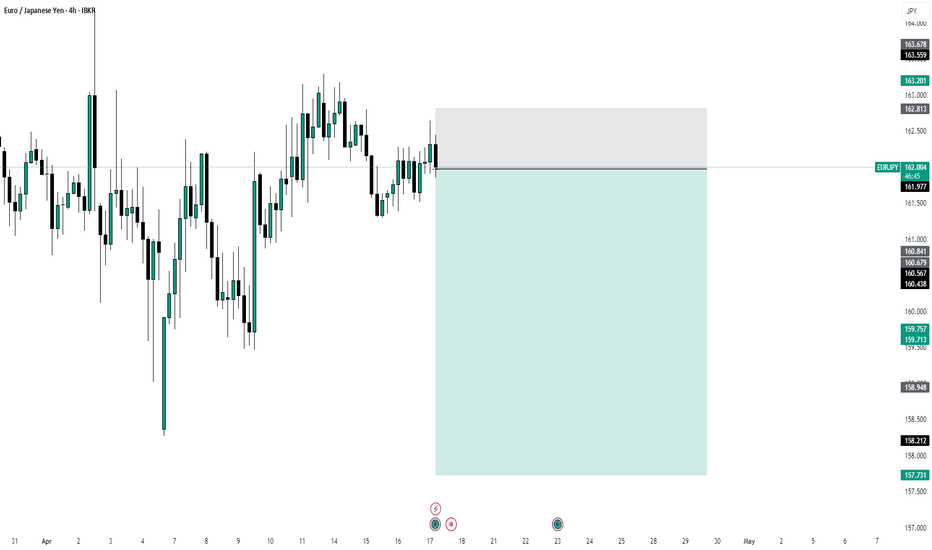

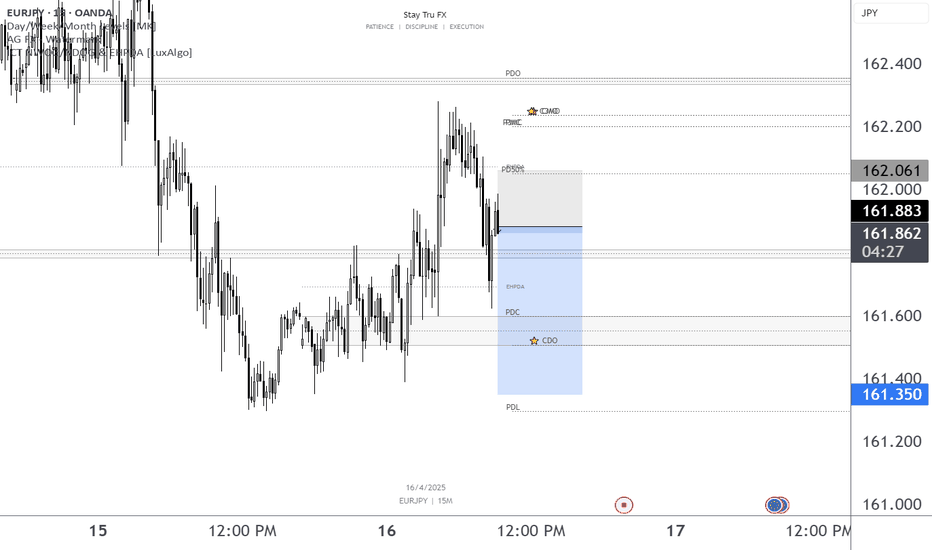

EURJPY Hovers Near Mid-Range — Buyers Reload Below 162EURJPY DAILY TECHNICAL ANALYSIS 🎯

🧠 EURJPY Hovers Near Mid-Range — Buyers Aim to Reload Below 162

OVERALL TREND

📈 UPTREND — Price structure is forming higher pivot lows with rejection from the March 2024 lows. Bullish intent is sustained unless structure breaks below 153.16.

🔴RESISTANCE

🔴 175.428 — SELL STOPLOSS | PIVOT HIGH

🔴 175.046 — RESISTANCE (MAJOR)

🔴 174.327 → 172.100 — SELL ORDER RANGE

🔴 166.558 — RESISTANCE (MINOR)

🎯ENTRIES & TARGETS

🎯170.975 — BUY ORDER & TP 4

🎯166.924 — BUY ORDER & TP 3

🎯164.296 — BUY ORDER & TP 2 (MID PIVOT)

🎯160.511 — BUY ORDER & TP 1

🟢SUPPORT

🟢 156.830 — SUPPORT (PROXIMAL)

🟢 156.642 → 154.277 — BUY ORDER RANGE

🟢 154.837 — SUPPORT (MAJOR)

🟢 153.164 — BUY STOPLOSS | PIVOT LOW

📌STRUCTURAL NOTES

Price recently stalled beneath the 162.000 zone — consolidation here indicates indecision, but no structural break yet

Triple rejection noted between 160.51 → 166.92 range, with multiple higher lows beneath — suggesting accumulation

Sellers activated at 172.10 and 174.32 levels, both aligned with visible pivot highs

Mid Pivot at 164.296 is a key inflection point — watch for buyer-seller battle here

TRADE OUTLOOK 🔍

📈 Long bias maintained above 160.51 and especially if price confirms a bounce from 156.64 or 154.27 zones.

📉 Bearish momentum could resume if price fails to hold above 153.16, breaking the most recent pivot low.\

🏆 High reward setups exist between 154.27 → 160.51 for re-entry into the broader uptrend

🧪STRATEGY RECOMMENDATION

CONSERVATIVE SWING SETUP (Trend-Following):

— Buy Entry: 160.51

— TP Levels: 164.29 / 166.92 / 170.97

— SL: 153.16

AGGRESSIVE REVERSAL SCALP:

— Buy Zone: 154.27 or 156.64

— TP: 160.51 / 164.29

— SL: Below 153.16

“Discipline | Consistency | PAY-tience™”

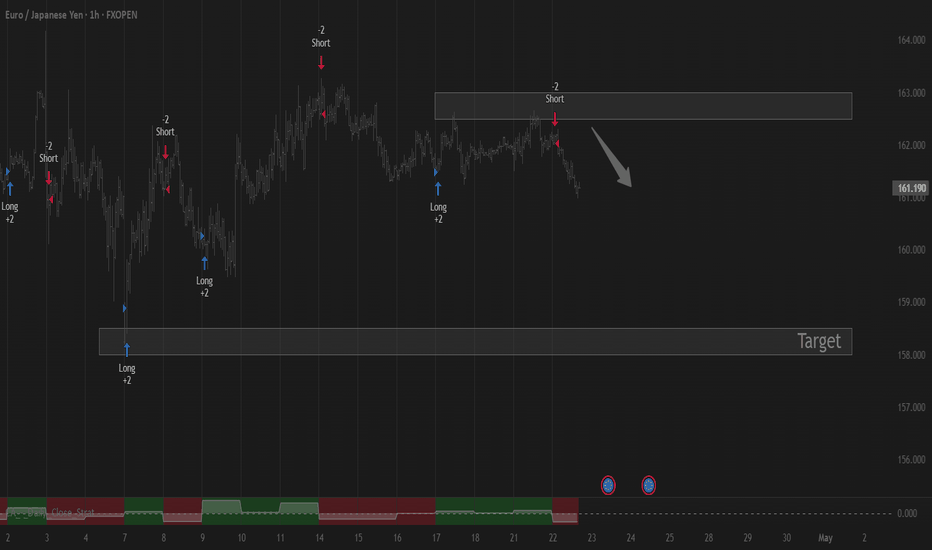

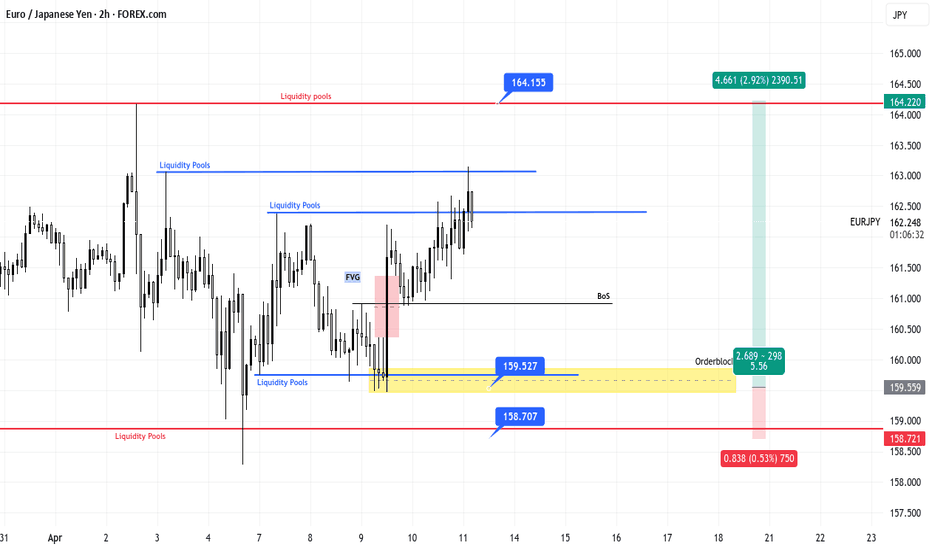

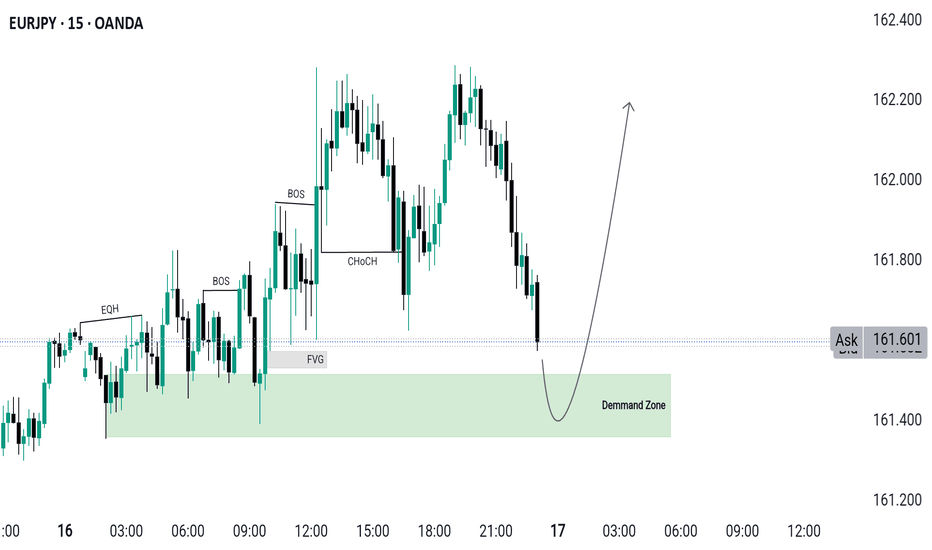

EUR JPY #0007 Long Swing Trade- The trade is heavily reliant on the liquidity pools exist along the structures

- Fair Value Gap coupled by an order block indicates an Imbalanced in price movement.

- Multiple failed attempts to break the Intra-Liquidity Pools (towards Bullish), indicating exhaustion in the bullish bias.

- customary, a fair value gap presents an imbalance in price, where the market will react to it by a set of corrections, and we aim to capitalize on that.

- The Buy Limit is placed at the price within the order blocks and SL is placed outside the Larger Liquidity Pool,s giving enough room for price "play-around".

- TP target will be on the Larger Liquidity Pools

- Trade is Swing in Nature.

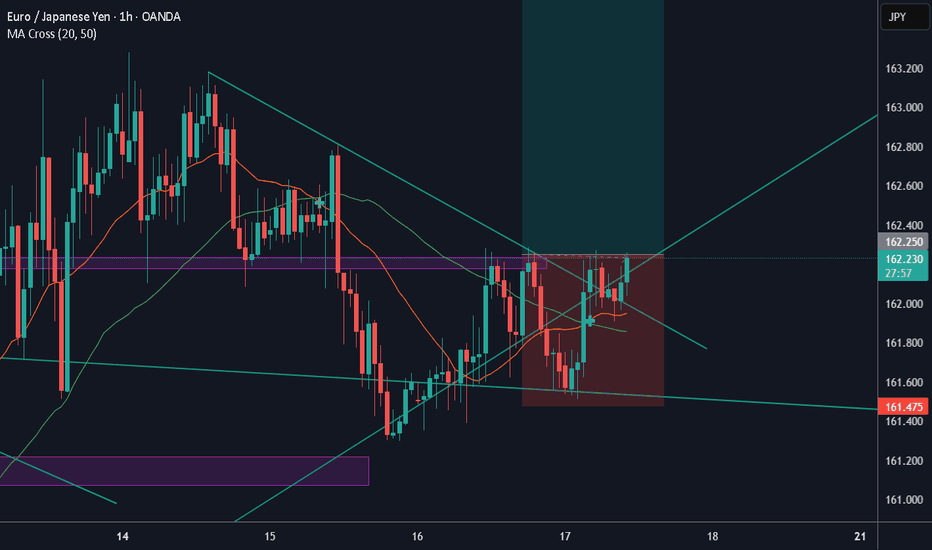

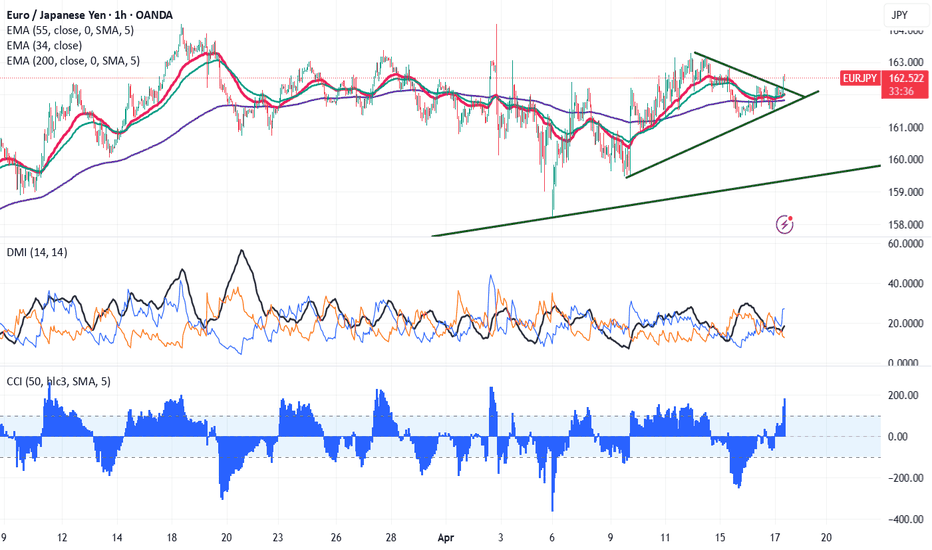

EUR/JPY Technical Outlook: Poised for Breakout Above 162.60The EUR/JPY trades higher ahead of ECB monetary policy today. It hits an intraday high of 162.57 and is currently trading around 162.45. The intraday outlook is bullish as long as the support 161.50 holds.

Technical Analysis:

The EUR/JPY pair is trading above 34, below 55 EMA and 200-4H EMA in the 15 min chart.

Near-Term Resistance: Around 162.60 a breakout here could lead to targets at 163/163.30/164.20/165/166.65/167.

Immediate Support: At 162 if breached, the pair could fall to 161.50/161/160.50/160/ 159.25/158.85/158.25.

Indicator Analysis 1-hour chart):

CCI (50): Bullish

Average Directional Movement Index: Bullish

Overall, the indicators suggest the bullish trend

Trading Recommendation:

It is good to buy on dips around 162.38-40 with stop loss at 162.750 for a TP of 164.18.

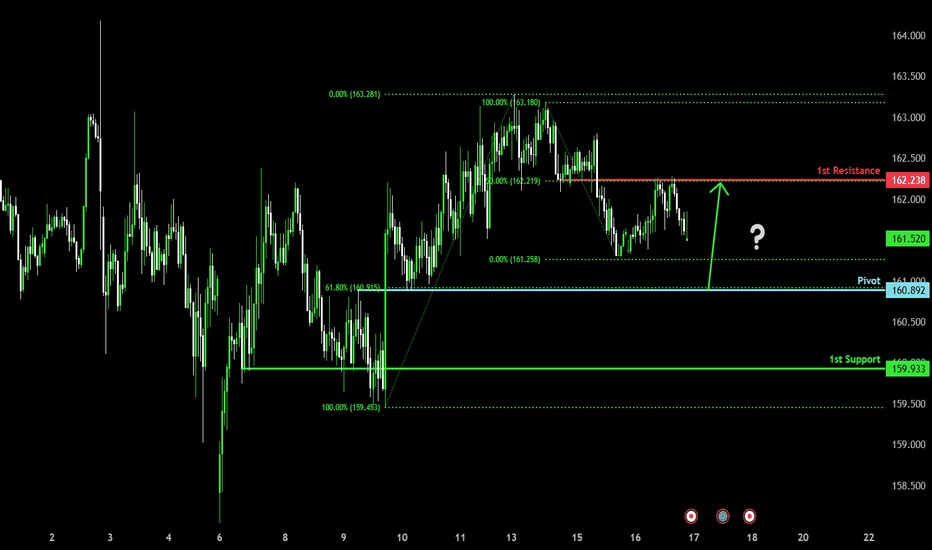

Bullish bounce?EUR/JPY is falling towards the pivot which acts as an overlap support and could bounce to the 1st resistance which is also an overlap resistance.

Pivot: 160.89

1st Support: 159.93

1st Resistance: 162.23

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

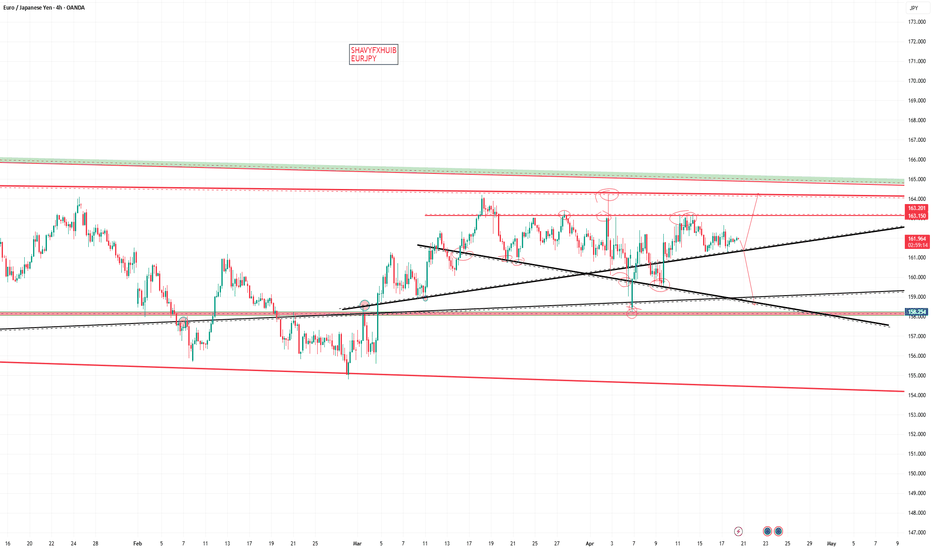

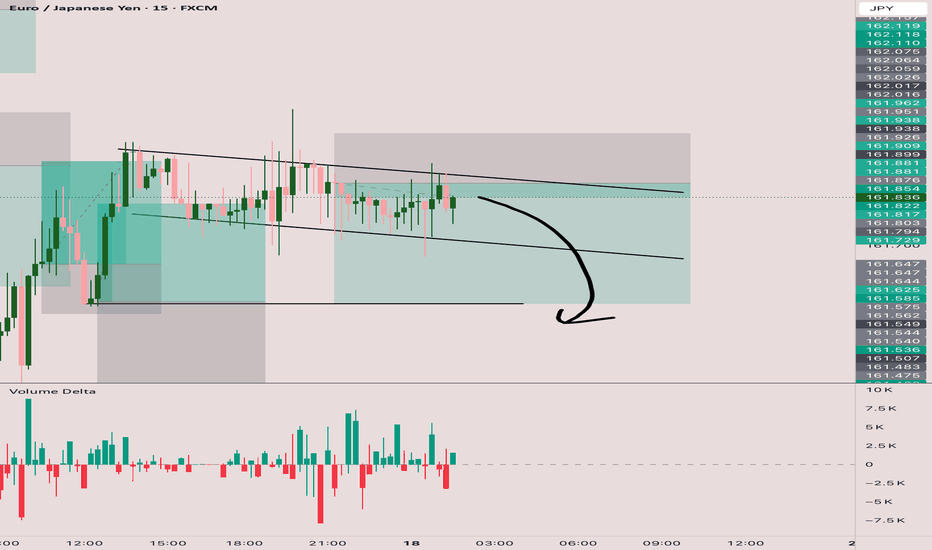

EURJPY Potential DownsidesHey Traders, in today's trading session we are monitoring EURJPY for a selling opportunity around 162.100 zone, EURJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 162.100 support and resistance area.

Trade safe, Joe.

EUR change to bullish which will leads for strong bullish trend Hello Traders,

straight to the point we all saw the strong bearish pattern for the head and shoulders which indicates strong bearish movement and change in the trend however ! that was before the trade war that changes every thing and the way the market react is very clear we all saw strong movement on the bearish pairs and the opposite

*i saw strong gab to the down side was easily recovered and closed and continue to grow the up trend

*strong double bottoms and retest

*i break and close above the trend line will give us very clean move to the 170 again

*fake break and close under the trend line another clean move to the 161

and you how do you see the next move ? please share your ideas and tell me what could work better

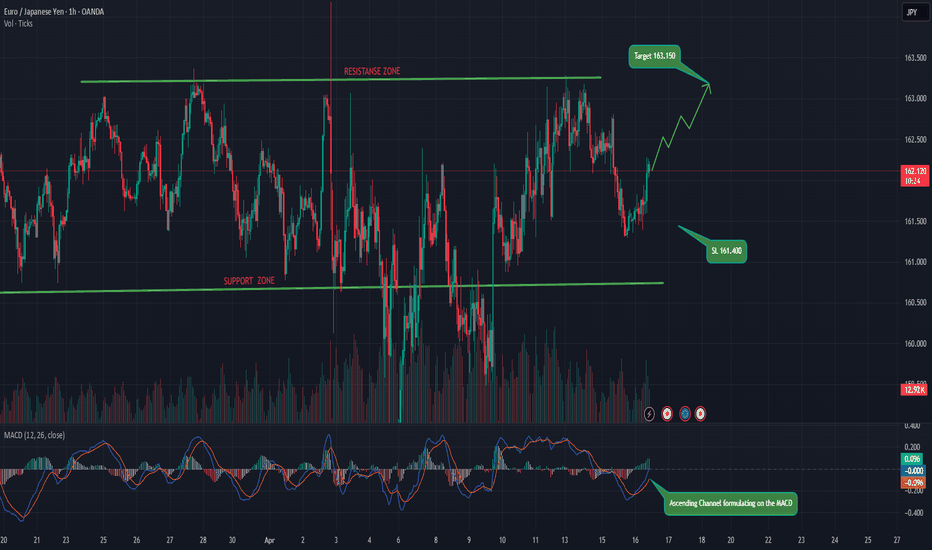

EUR/JPY - Positive uptrend formulating!Hi guys please find below our analysis over EUR/JPY

1. Technical Momentum

EUR/JPY has recently broken above key resistance levels, suggesting bullish momentum. The pair is trending above its 50-day and 100-day moving averages, a signal of continued strength. RSI levels remain in bullish territory without being overbought, indicating room for further upside.

2. Diverging Monetary Policy

The European Central Bank (ECB) remains cautious on policy easing despite market expectations, while the Bank of Japan (BoJ) continues its ultra-loose stance with only minimal steps toward normalization. This policy divergence has been a significant driver for EUR/JPY strength and is likely to persist in the near term.

The BoJ’s slow exit from yield curve control and a historically dovish posture mean the yen remains weak relative to the euro, which benefits from steady economic resilience in the eurozone.

3. Improving Risk Sentiment

Global equity markets have been rebounding, and risk sentiment is turning positive. In such environments, the yen—traditionally a safe-haven currency—tends to weaken as investors move capital toward higher-yielding assets like the euro.

4. Economic Stability in the Eurozone

Recent Eurozone data, particularly out of Germany and France, has surprised to the upside. PMI figures and business confidence indices are beginning to recover, suggesting that the worst of the economic slowdown may be behind. This improves investor sentiment toward the euro.

Conclusion - Due to the positive Fundamental news coming from the Eurozone gives us a positive indication to showcase growth potential in this pair. From a technical overview, the analysis is supported by the MACD and RSI giving positive indication of a Ascending Channel formulating.

📌 Trade Plan

📈 Entry: 162.115

✅ Target 163.150

❌ SL: 161.400

EURJPY Is Very Bullish! Buy!

Please, check our technical outlook for EURJPY.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 162.005.

Considering the today's price action, probabilities will be high to see a movement to 163.310.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

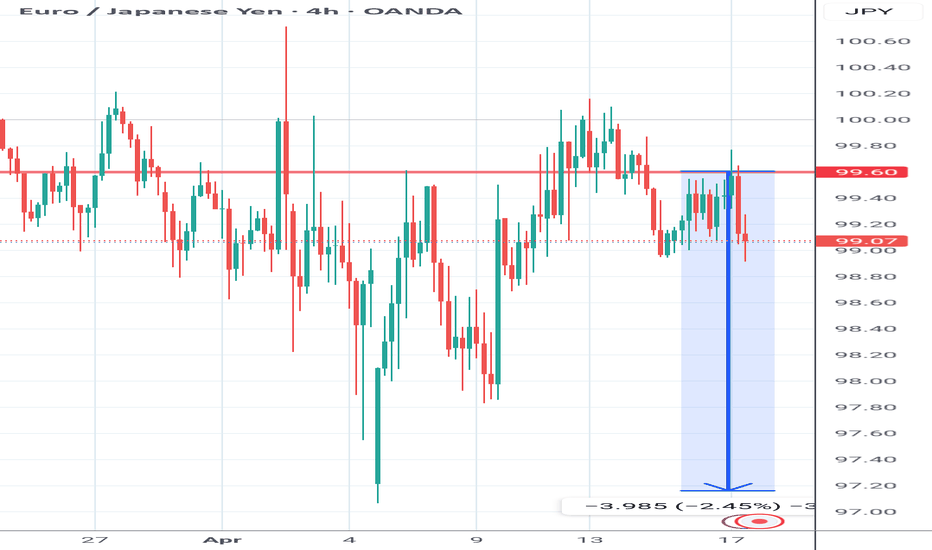

EJ Short

---

EUR/JPY – Short Entry @ 161.316

Entry Justification

Price rejected off the upper boundary of a well-defined range that has held since early April. The area aligns with a supply zone formed after the last impulsive sell-off. A Break of Structure occurred a few days prior, shifting internal order flow bearish and invalidating the prior bullish leg.

Today’s entry capitalized on a textbook retest of the range high, where price wicked into the upper liquidity pocket and immediately sold off, confirming continued seller interest. This entry offered high reward-to-risk potential with tight invalidation parameters and clear structure control.

Macro Alignment

- Euro weakened by dovish ECB tone, increasing likelihood of June rate cuts

- JPY gaining mild strength on recent risk-off shifts and flight to safety behavior

- Global equity market hesitations support further downward pressure on EUR/JPY

Trade Logic:

-Range-top rejection with bearish order flow confirmation

-BOS already printed prior to entry, offering structure-based conviction

-Macro + sentiment alignment supports short bias

-Technical entry aligned with bearish liquidity cycle and exhaustion at highs

---