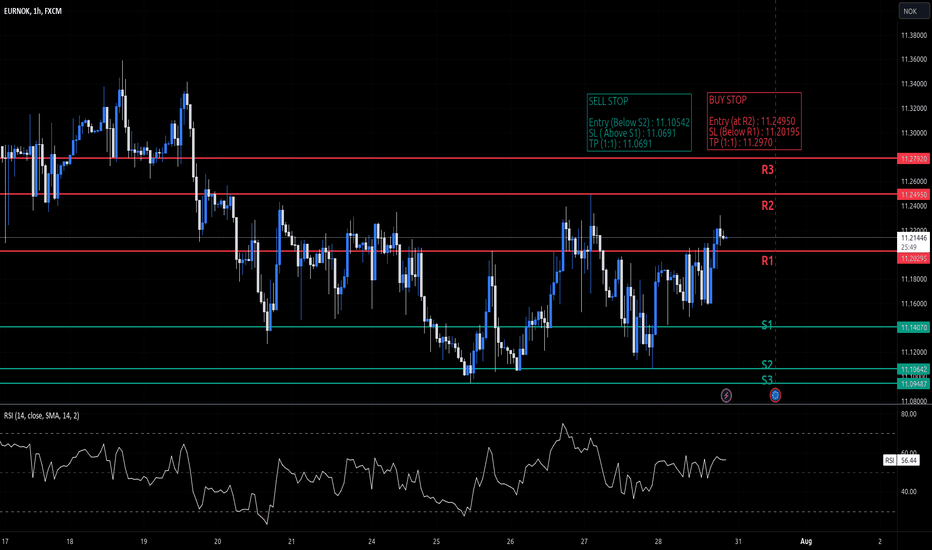

Technical Analysis: #EURNOK Sideways Trading Strategy!📈 Technical Analysis: #EURNOK Sideways Trading Strategy! 📉

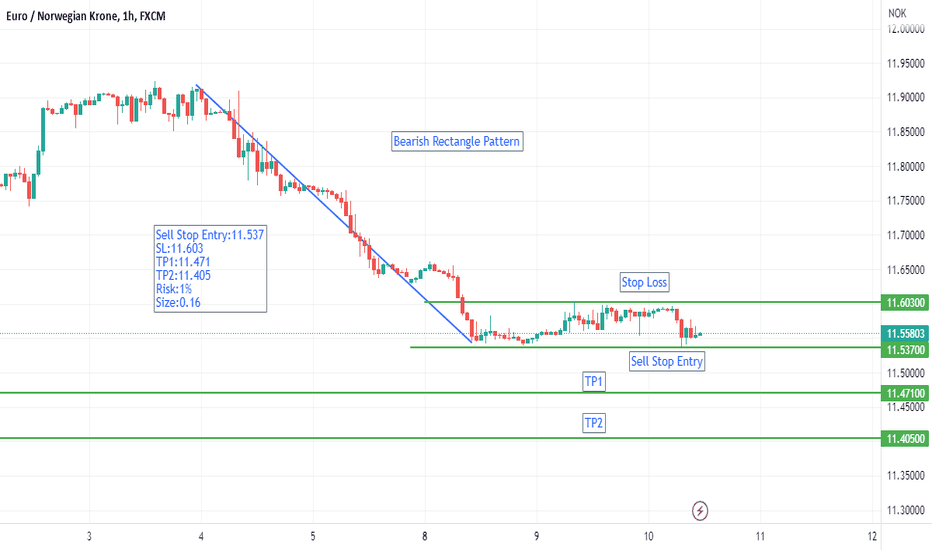

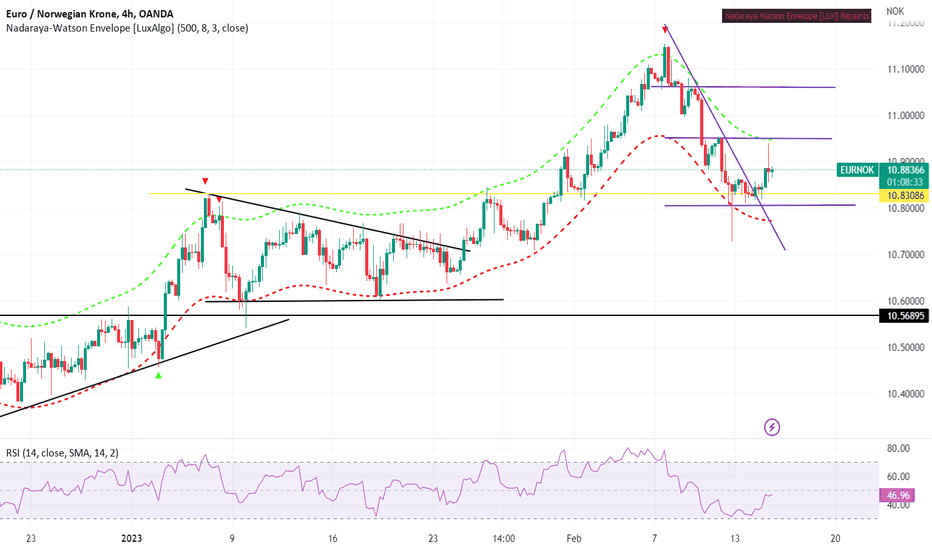

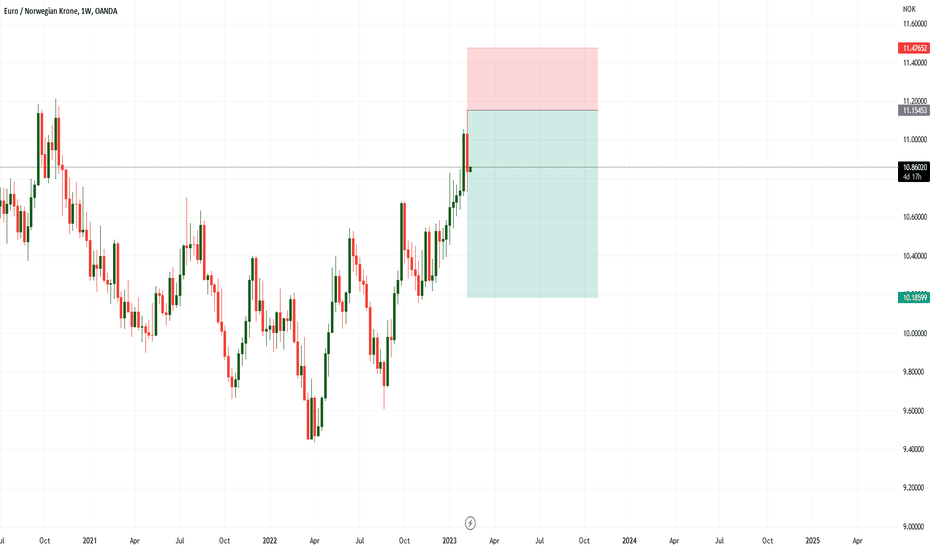

Hey traders! 🌟 Today, I present to you a fascinating opportunity in the EUR/NOK forex currency pair. The 1-hour chart suggests that the pair is currently moving sideways, lacking a clear bullish or bearish trend. But fear not, as we can capitalize on this situation by employing two smart trade plans with buy and sell stop orders, targeting key support and resistance levels. Let's dive into the details:

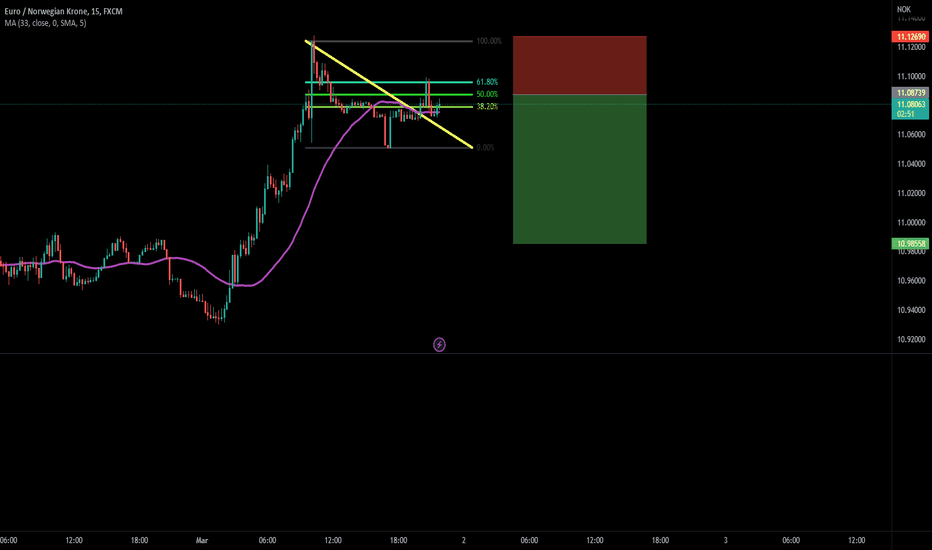

Trade Plan 1: #SellStop 🛒

🎯 Entry (Below S2): 11.10542

🛑 SL (Above S1): 11.0691

🎯 TP (1:1): 11.0691

Trade Plan 2: #BuyStop 🛒

🎯 Entry (At R2): 11.24950

🛑 SL (Below R1): 11.20195

🎯 TP (1:1): 11.2970

The logic behind these trades is simple. For Trade Plan 1, we expect the pair to break below the S2 support level, triggering a potential bearish movement. The Stop Loss (SL) is set above S1 to manage risk, and the Take Profit (TP) level is placed at the same distance as the SL, aiming for a 1:1 risk-reward ratio.

On the other hand, for Trade Plan 2, we anticipate a bullish move if the pair breaches the R2 resistance level. The SL is placed below R1 to protect our investment, and the TP is set at the same distance as the SL, ensuring a 1:1 risk-reward ratio.

⚠️ Investment Advice: Remember, trading involves risk, and it's crucial to manage your positions carefully. Always use appropriate risk management techniques, such as position sizing and setting stop-loss levels, to safeguard your capital. Consider using these trade plans as a part of a diversified trading strategy and avoid risking more than you can afford to lose.

Trade with discipline and patience, and never let emotions dictate your decisions. Stay updated with the market developments and adjust your trades accordingly.

Good luck on your trading journey! 🍀💹

(Note: This analysis is for educational purposes only and not financial advice. Make sure to do your own research before making any investment decisions.) #Forex #TradingOpportunity #SidewaysMarket #TechnicalAnalysis #RiskManagement #TradingStrategies

EURNOK trade ideas

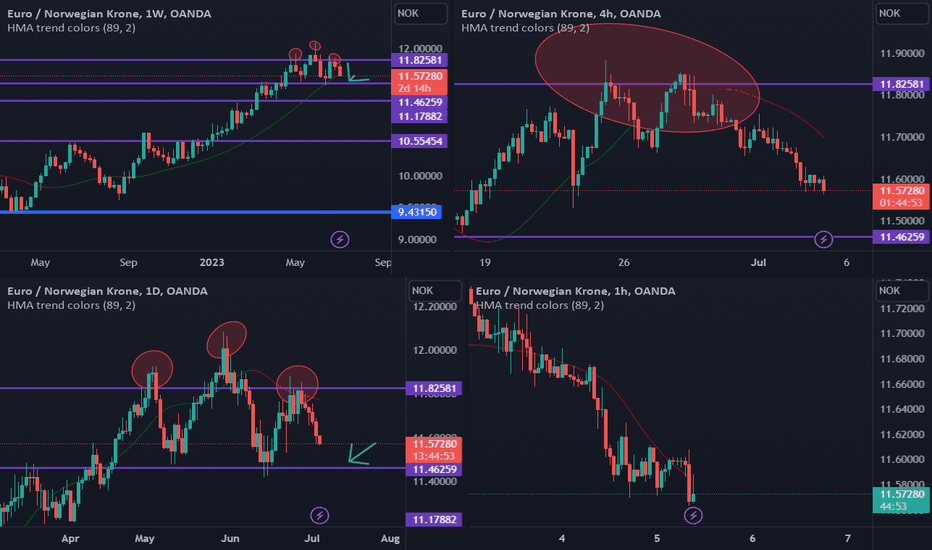

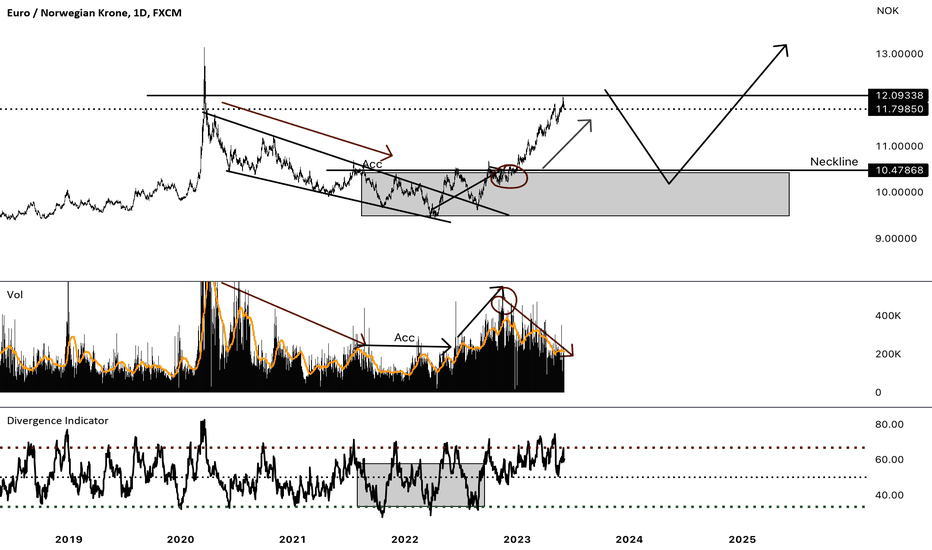

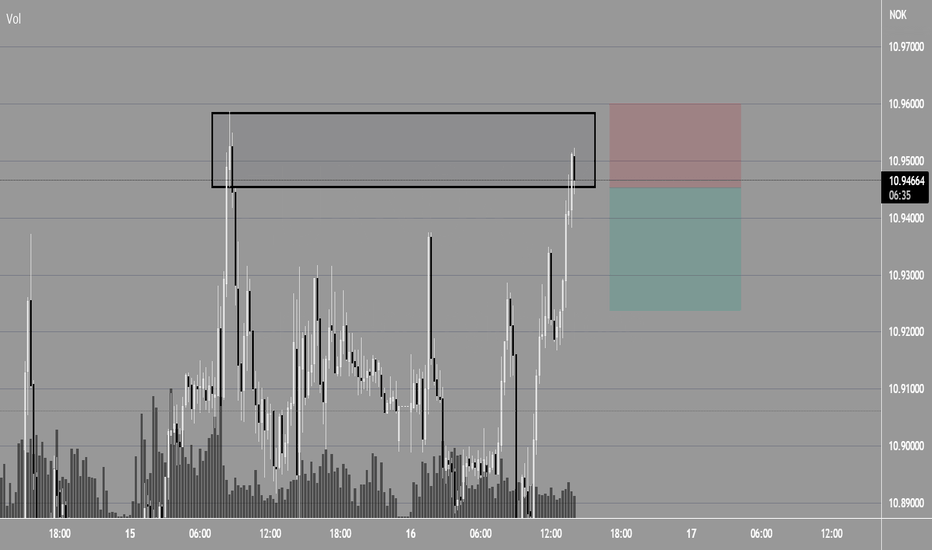

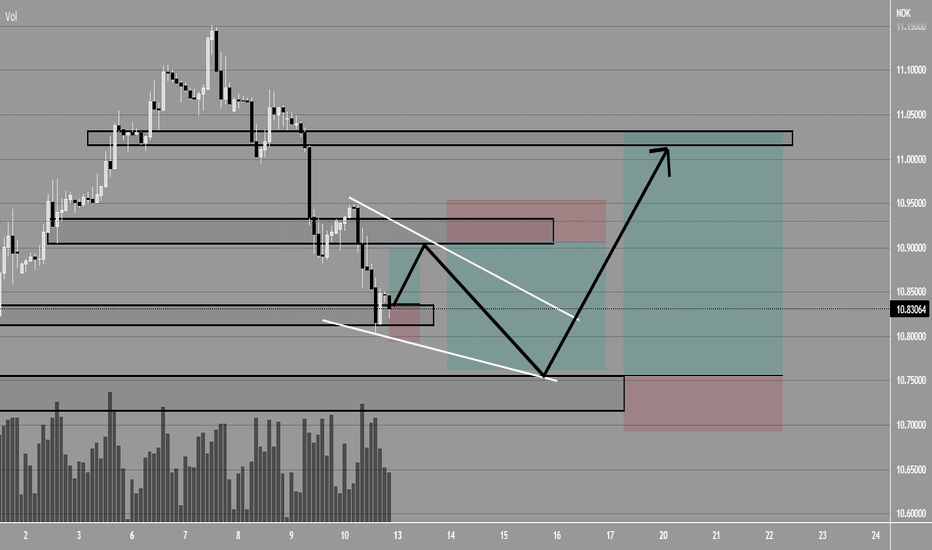

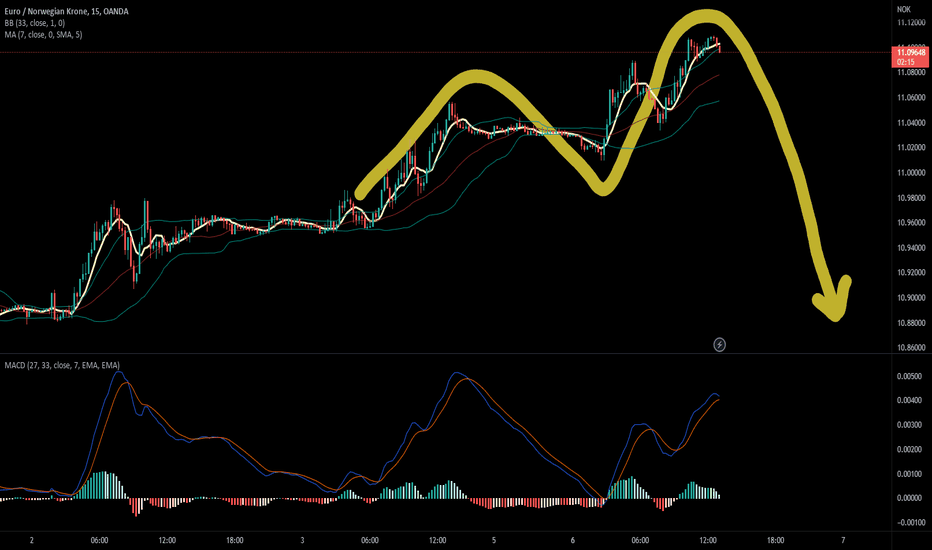

EURNOK: very clear head and shouldersYou can clearly see it better in the daily chart. Price is fast approaching neckline which was a support and resistance line I had long put there before I noticed this pattern. It's not my style to risk a trade betting on the price going down to the neckline, but it seems pretty clean so... will give it a second thought.

I will, however, short the pair if it breaks the neckline or put a long position if it makes a reversal pin bar or other candle pattern that clearly indicates bullish tendency.

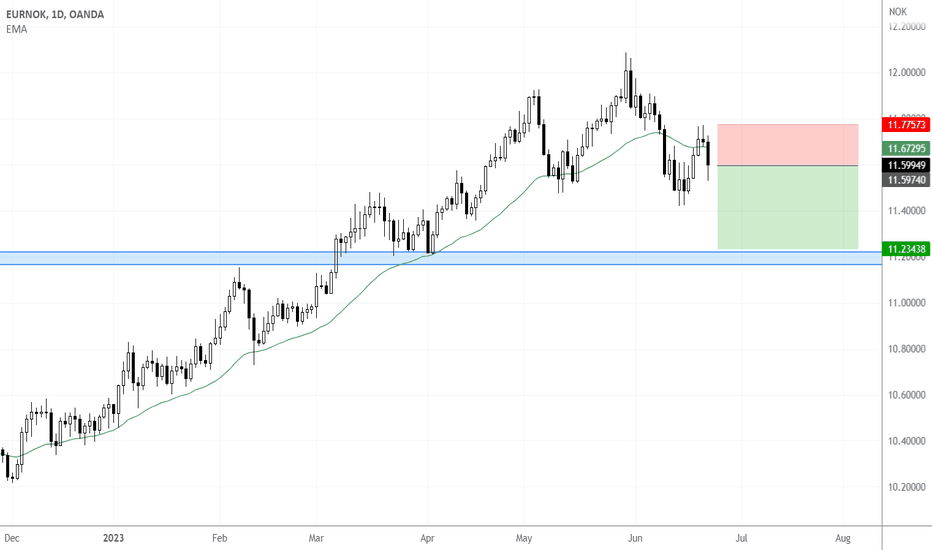

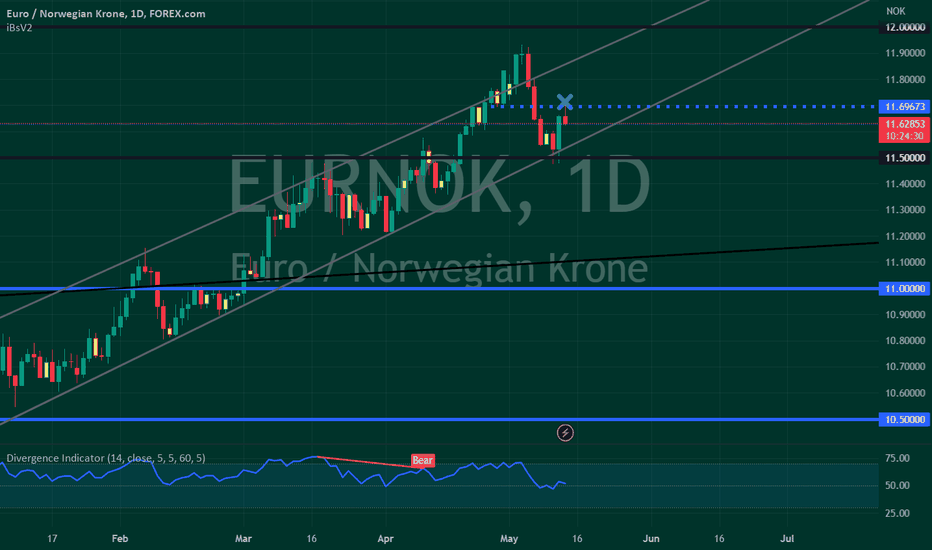

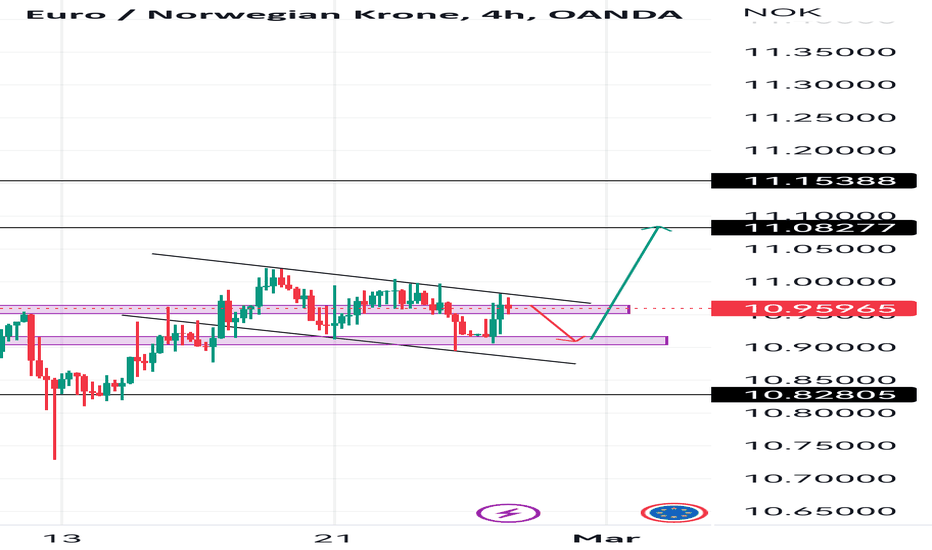

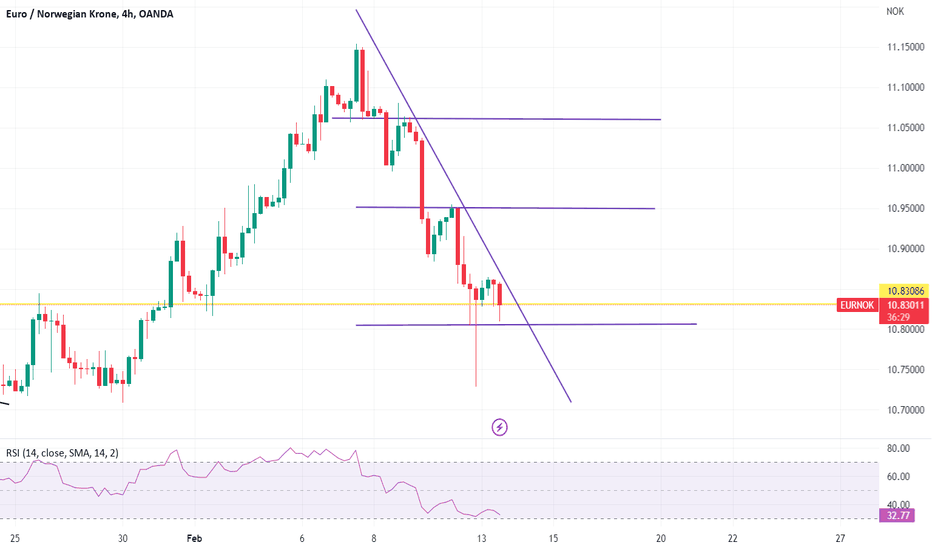

EUR/NOK can the trend hold? Commentary

EUR/NOK multi-week higher tops and higher bottoms on price indicate a dow pattern uptrend; provided price can hold above the 10.9 key support the potential for a continuation of the prevailing uptrend remains for a move towards 11.05 in the short term (5-13 days), otherwise if price fails to hold above the 10.9 key support then scope for a price correction lower can not be ruled out.

Not investment advice. Past performance is not indicative of future results.

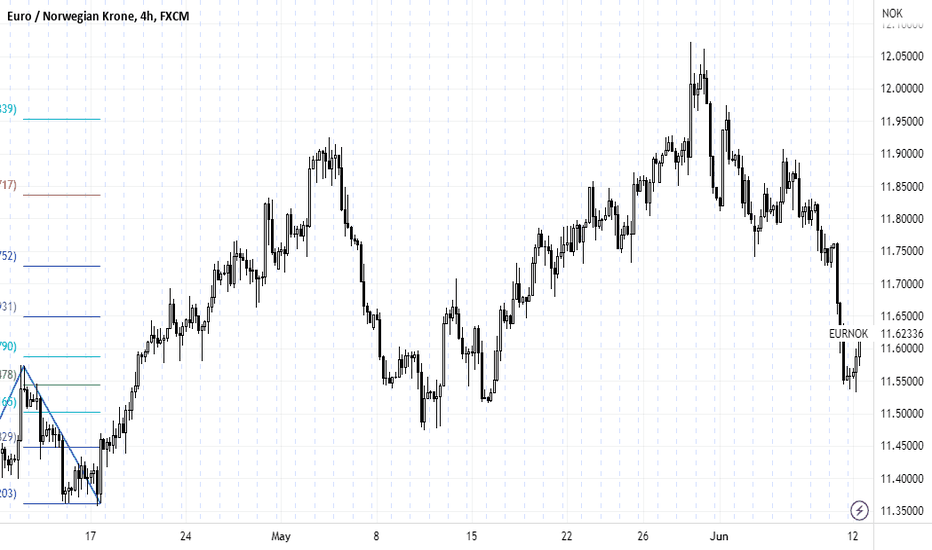

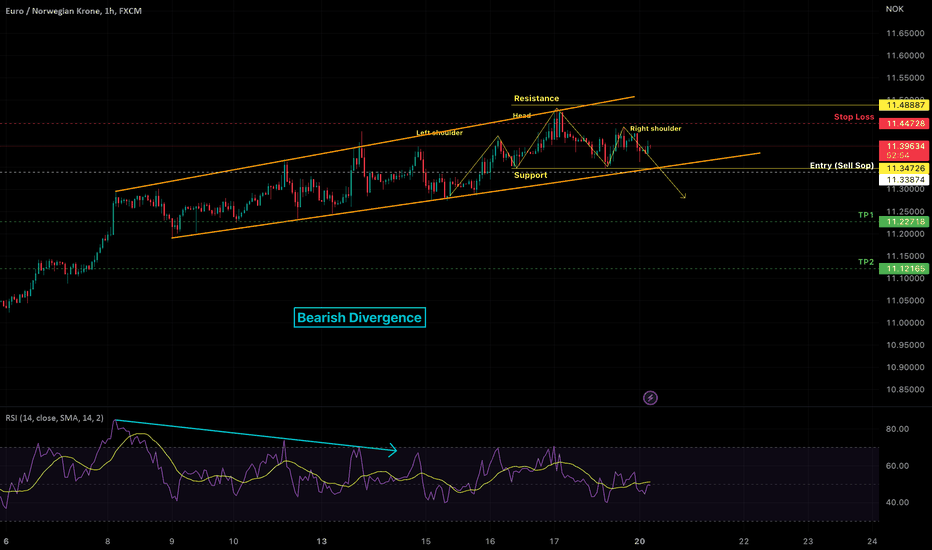

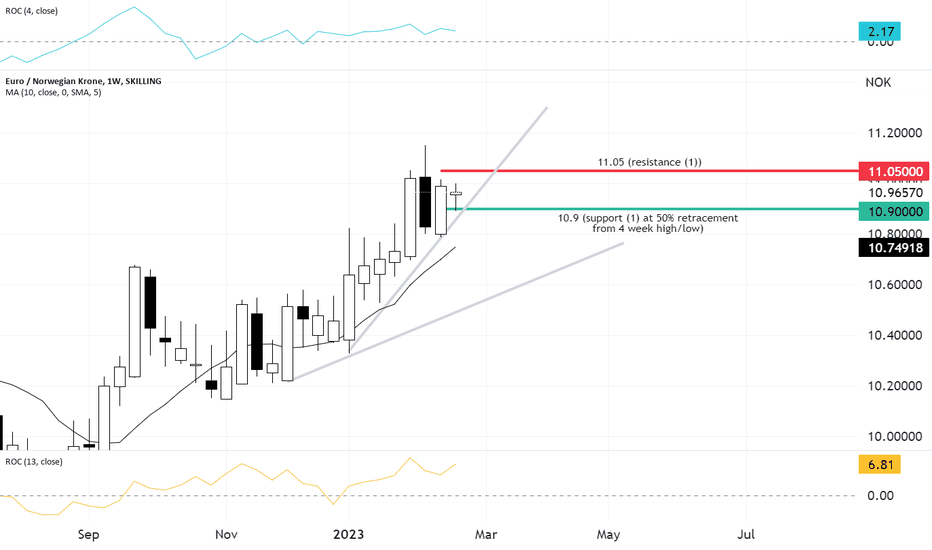

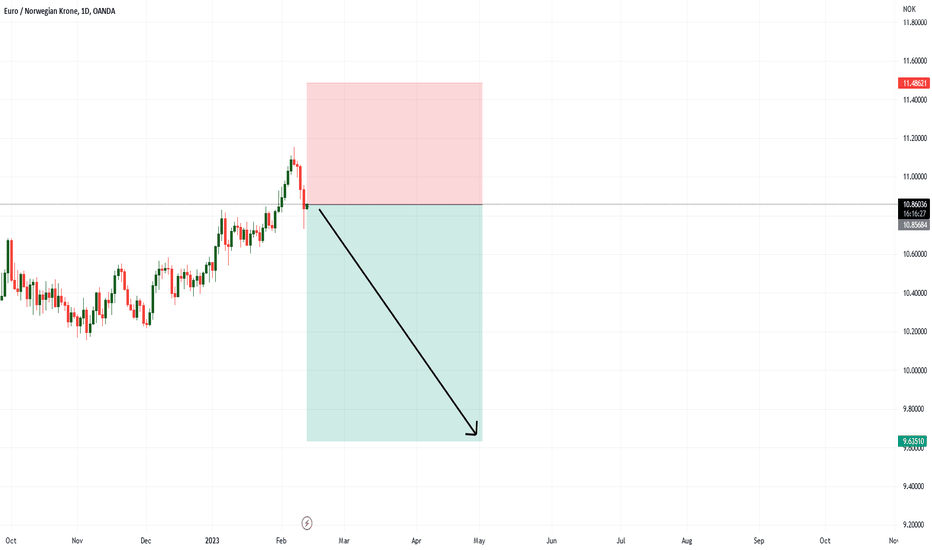

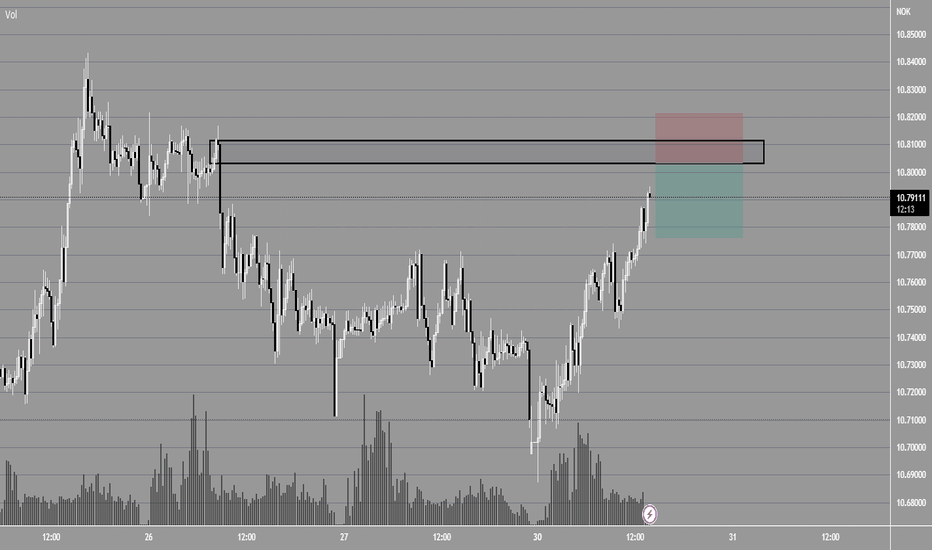

EURNOK - To valhalla!First things first: all hail the vikings!

Why I like this trade:

- NOK with the MUCH better fundamentals

- NOK clearly undervalued on a longterm timeframe

- Norges Bank quite dovish in their last meeting but could get hawkish again in march as

-> inflation has massively surprised to the upside

- inflation expectations on thursday will be key for NB

- NB could reduce NOK selling

- oil and nat gas with upward potential

- EUR optimism is overpriced

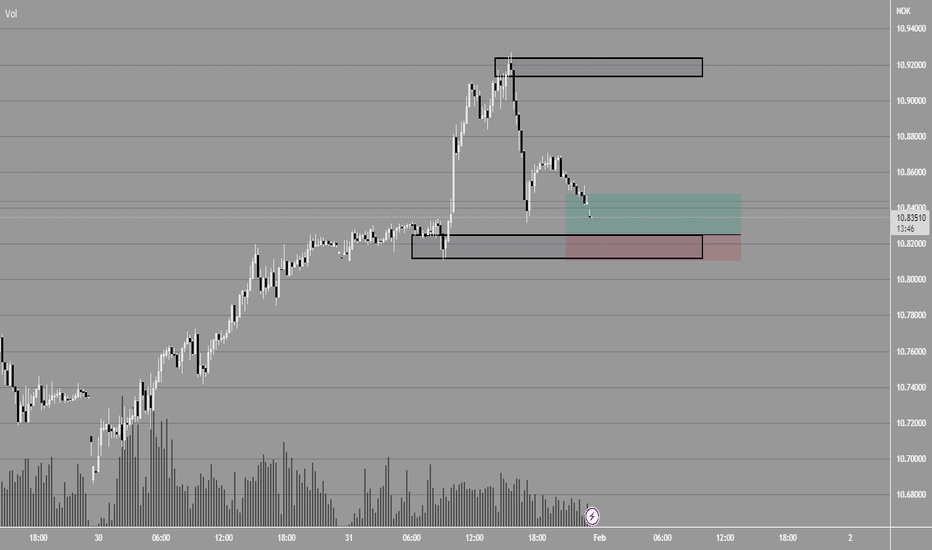

Short EURNOK - the vikings will win!First things first: all hail valhalla!

Why I like this trade:

- NOK with the MUCH better fundamentals

- NOK clearly undervalued on a longterm timeframe

- Norges Bank quite dovish in their last meeting but could get hawkish again in march as

-> inflation has massively surprised to the upside

- inflation expectations on thursday will be key for NB

- NB could reduce NOK selling

- oil and nat gas with upward potential

- EUR optimism is overpriced