EURNZD trade ideas

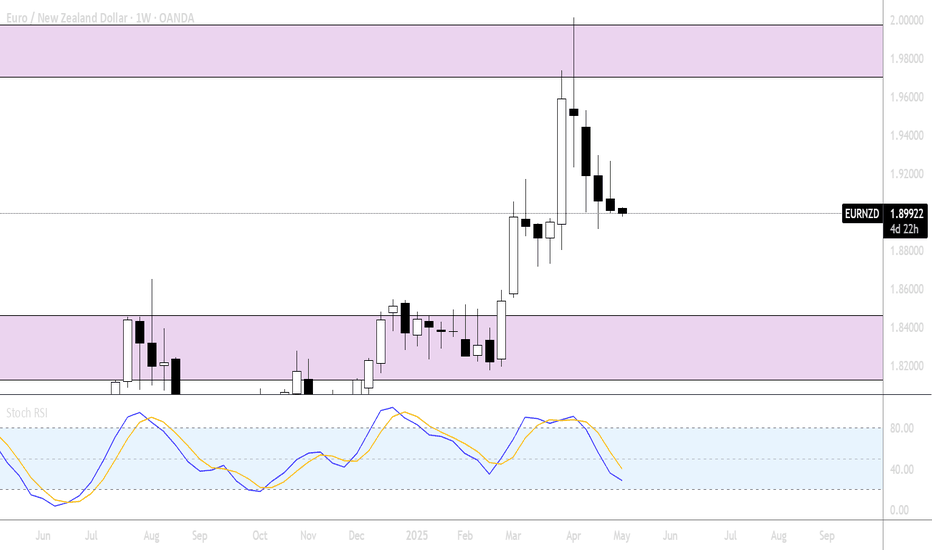

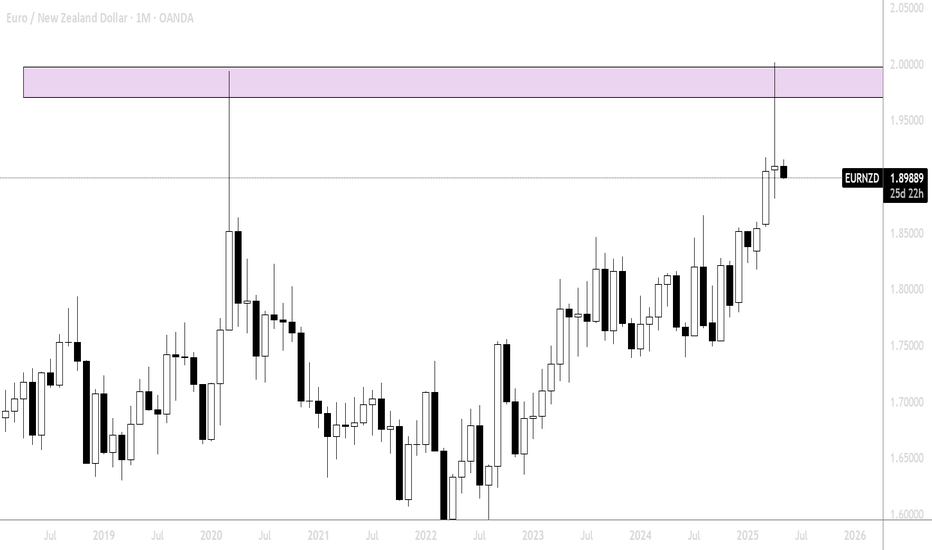

EURNZD MONTHLY TIMEFREAMEKey monthly level spotted but what we liked most was the massive rejection candle close for last month where buyers pushed so much high but couldn't win the sellers as sellers pushed price down that made the past month candle close with little to no body but with long rejection wick candle telling us that sellers took control!

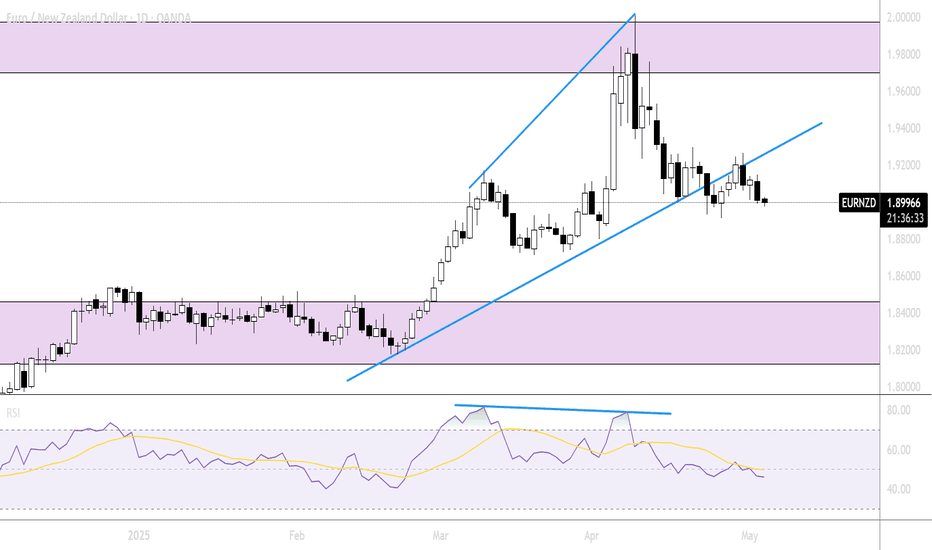

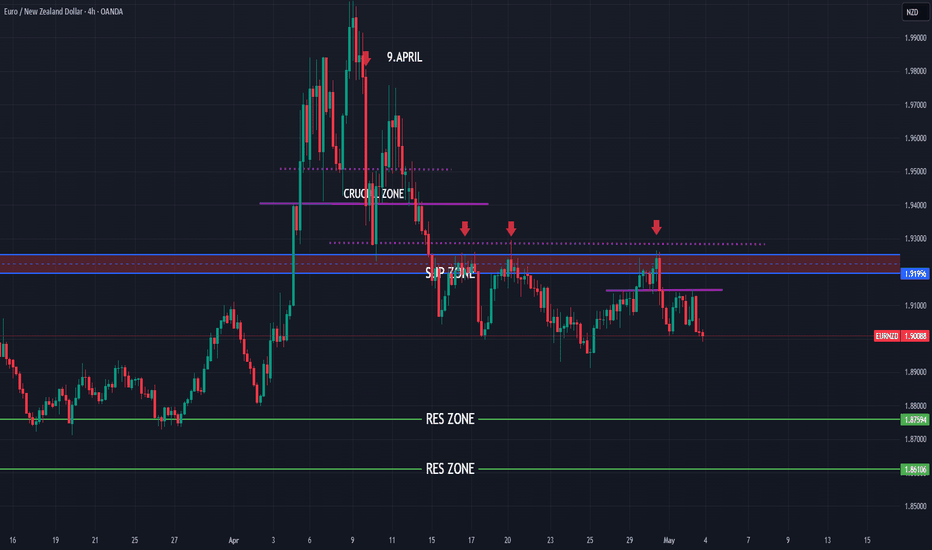

EURNZD expected higher fall for new week

OANDA:EURNZD strong bearish candle on 9.April, bearish momentum, price is break and crucial zone there, in last periods we are have three times bounce on now strong zone.

For new week here stilll expecting to see bearishnes

SUP zone: 1.91550

RES zone: 1.87600, 1.86000

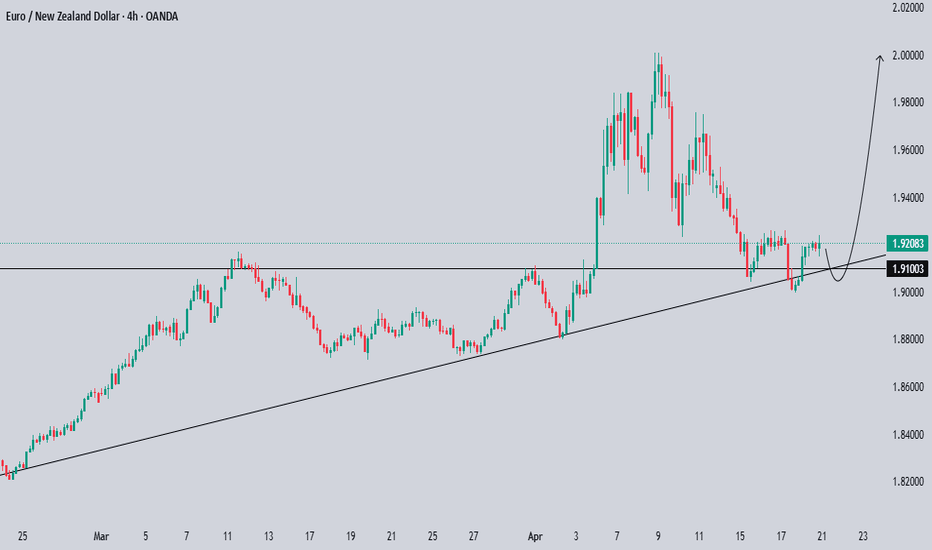

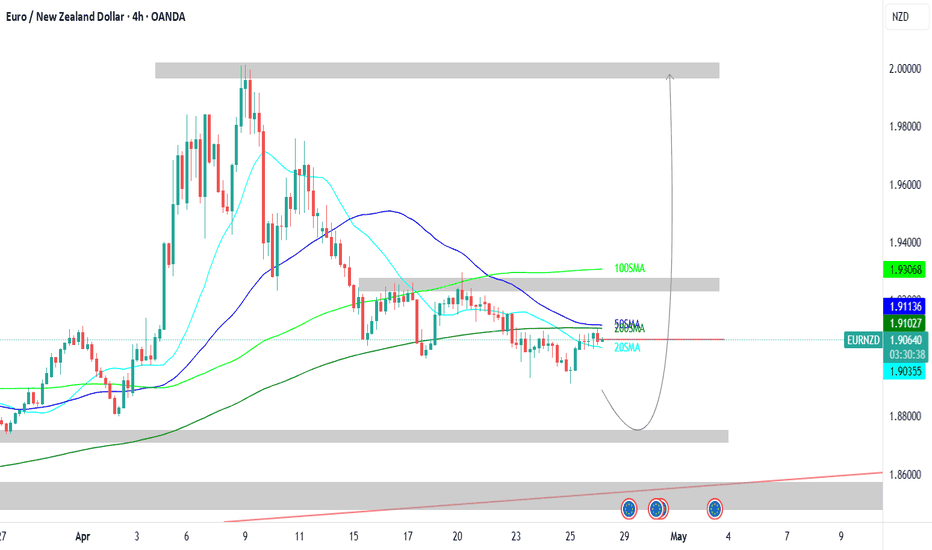

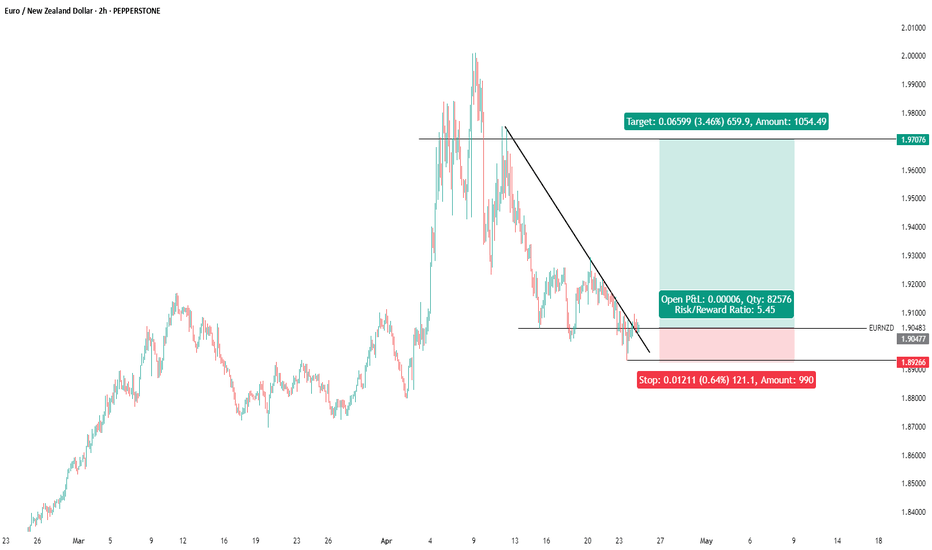

EURNZD Technical & Order Flow Analysis (Swing Trading)Our analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view, the price will rise to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

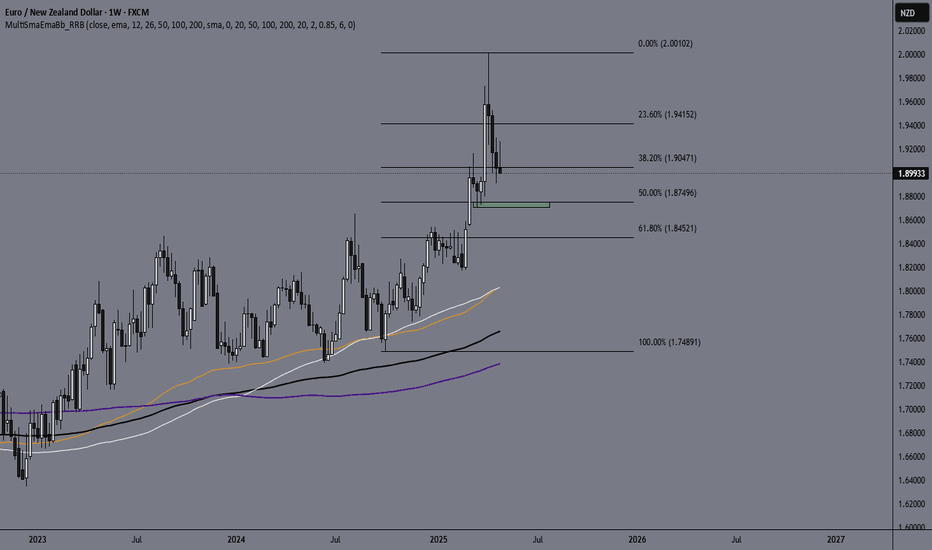

Heading into overlap resistance?EUR/NZD is rising towards the resistance level which is an overlap resistance level that is slightly above the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 1.9286

Why we like it:

There is an overlap resistance level that is slightly above the 38.2% Fibonacci retracement.

Stop loss: 1.9500

Why we like it:

There is a pullback resistance level that lines up with the 71% Fibonacci retracement.

Take profit: 1.8813

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

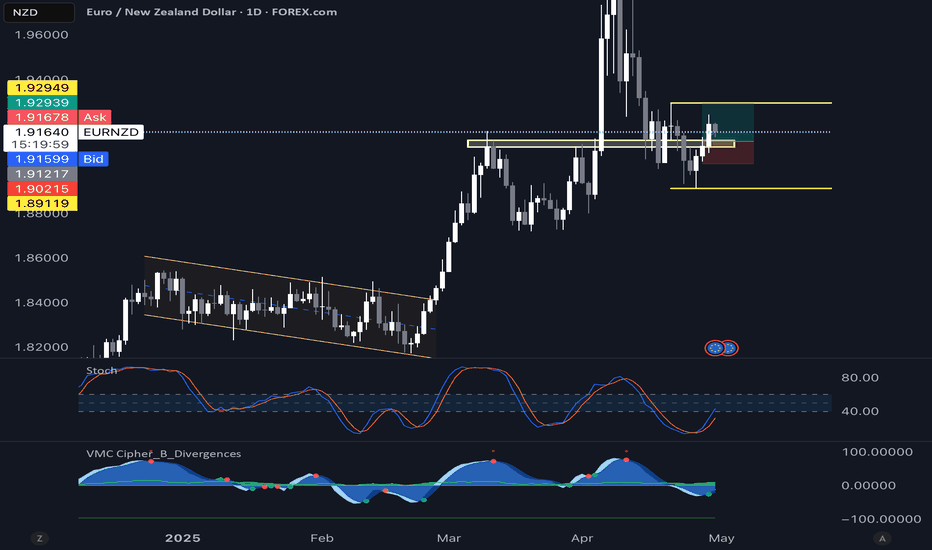

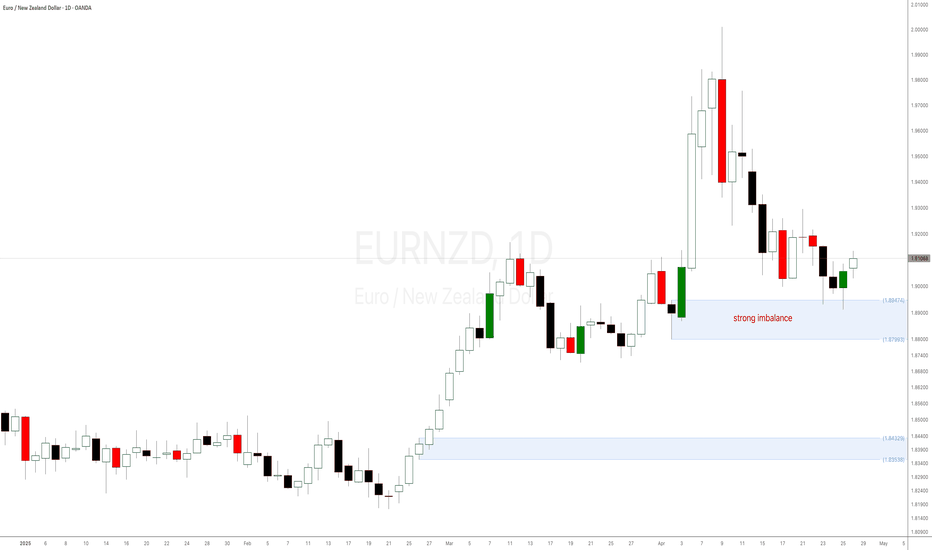

EURNZD strong daily demand level at 1.89. Long biasSupply and demand imbalances are the driving forces behind price movements in the Forex market. By identifying these key zones or imbalances, traders can anticipate high-probability reversal or continuation setups. Today, we’ll analyze the EURNZD cross pair, which has recently formed a strong demand imbalance at $1.89—the most significant impulse in months.

The Power of Supply & Demand Imbalances

Supply and demand trading revolves around identifying areas where price has made a strong, impulsive move (demand or supply zone) and then waiting for a retracement into that zone for a potential reversal or continuation.

Key Characteristics of a Strong Imbalance:

✅ Extended Range Candles (ERC): Strong, wide-bodied candles indicate institutional buying/selling.

✅ Strong Imbalance: A clear shift in market structure after a strong rally or drop.

✅ Fresh Zone: The imbalance has not been tested yet or has only been tested once.

EURNZD Trading Idea EURNZD Trading Idea Bullish market sign from the zone break above the 1.92755 with strong confirmations

While the most probable zone for bullish market will be 1.8750. Use pending order in the current situations. With 50-60 Pips Stop loss. The current price momentum will not clear the market conditions just wait and open trade as per given zone.

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

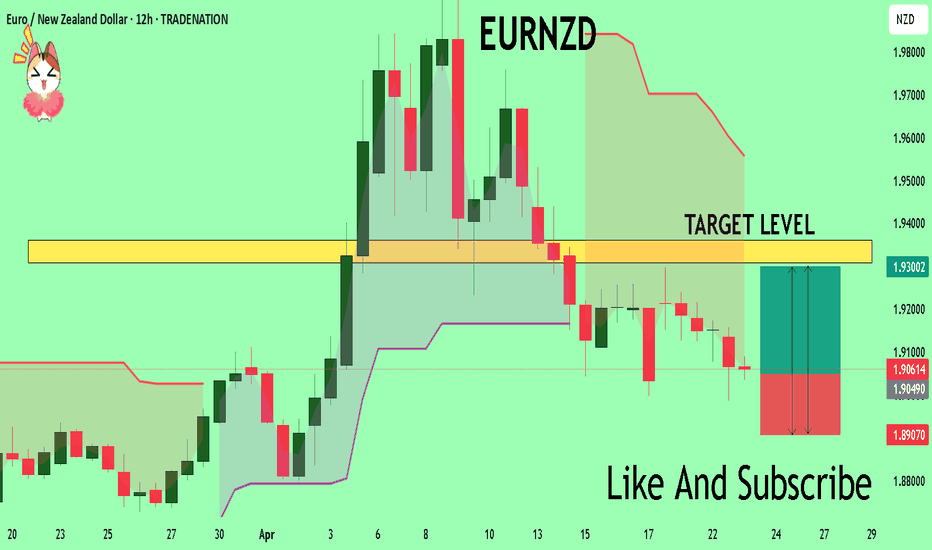

EURNZD What Next? BUY!

My dear subscribers,

This is my opinion on the EURNZD next move:

The instrument tests an important psychological level 1.9047

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.9308

My Stop Loss - 1.8907

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

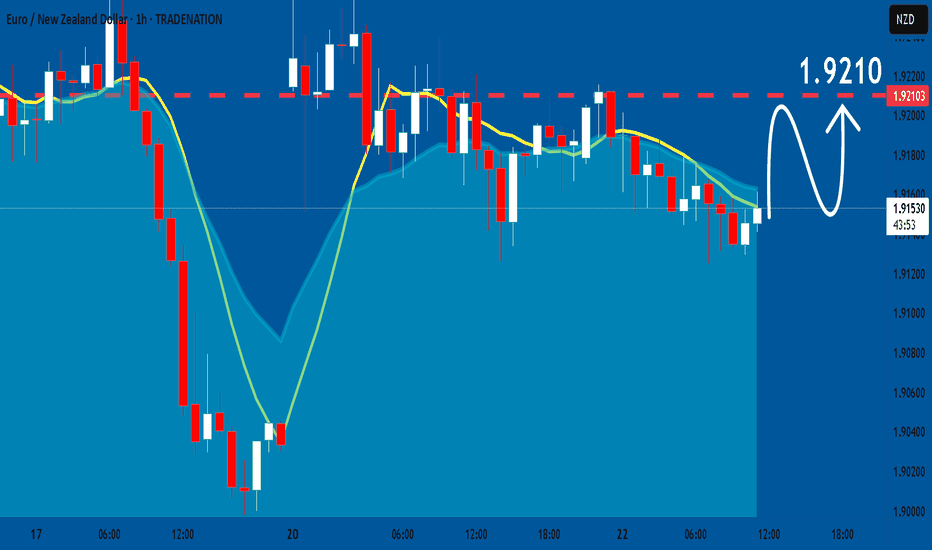

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

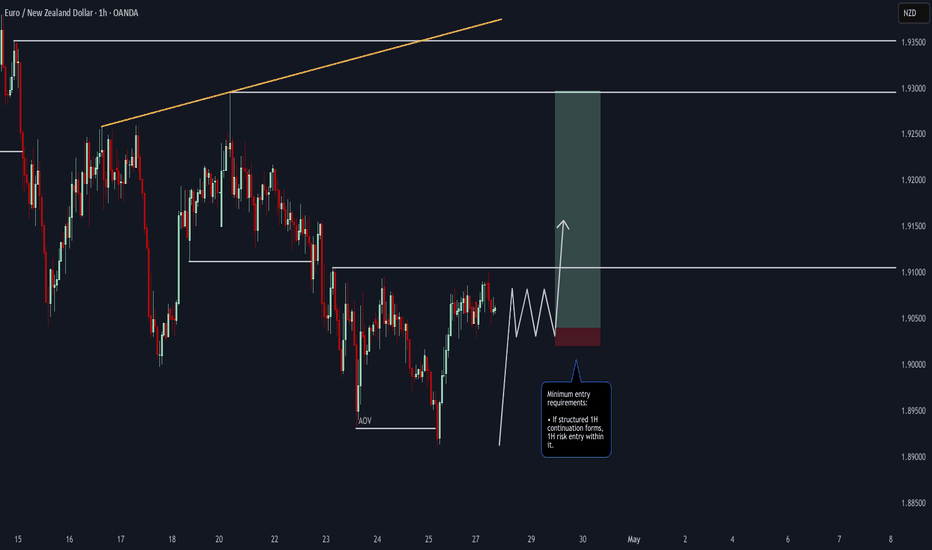

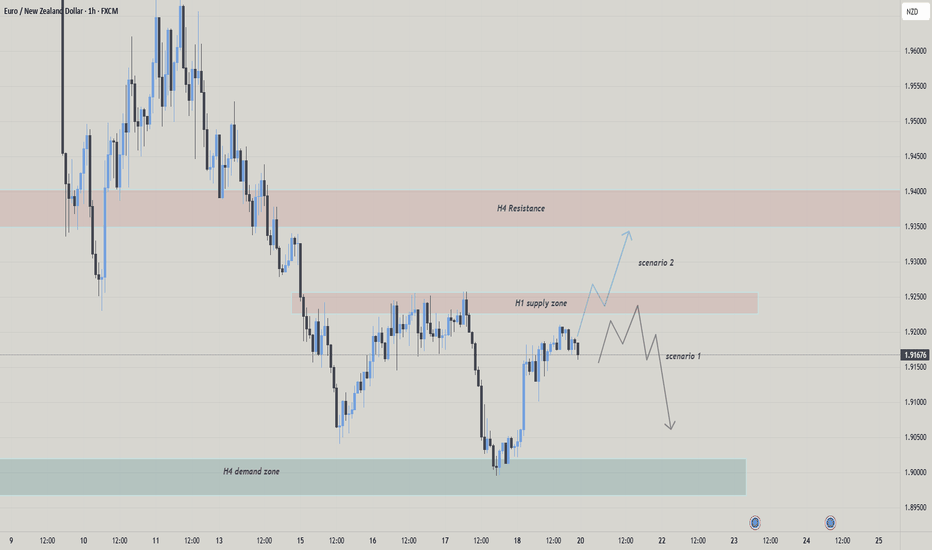

EURNZD market outlookFX:EURNZD

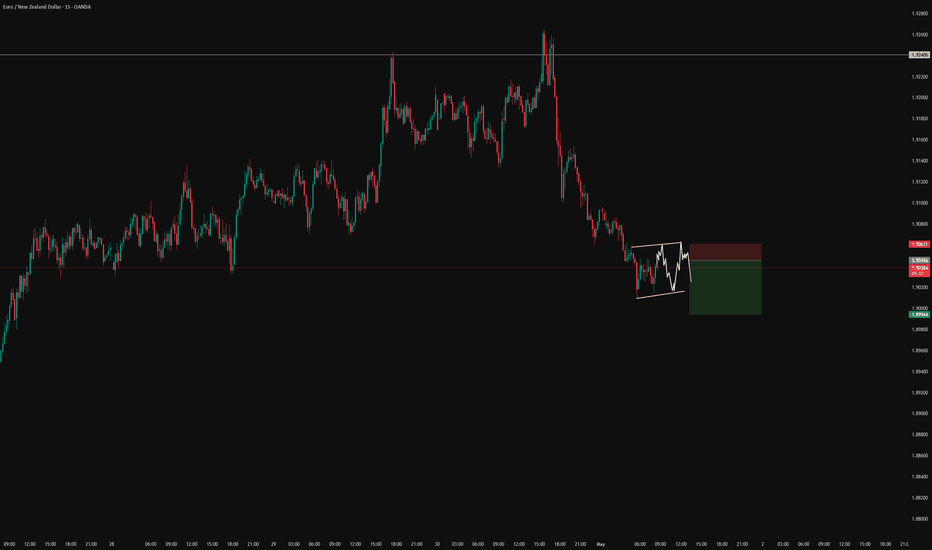

EURNZD is placing out some possible setups for the following week, price tapped in the 4-hour demand zone below and played out nicely towards the upside without signs of weak buying momentum. But because the H4 demand zone below was respected, there are two possible scenarios we should expect. We should not get into sells on the H1 supply zone directly but instead should wait for lower timeframe confirmation. If price broke above H1 supply zone and closed with strong bullish candle, we could look for buy opportunities on small timeframe pullbacks up to H4 resistance zone. However, as we are still on a high timeframe bearish structure, we should prioritise looking for sell opportunities.

tradingview.sweetlogin.com

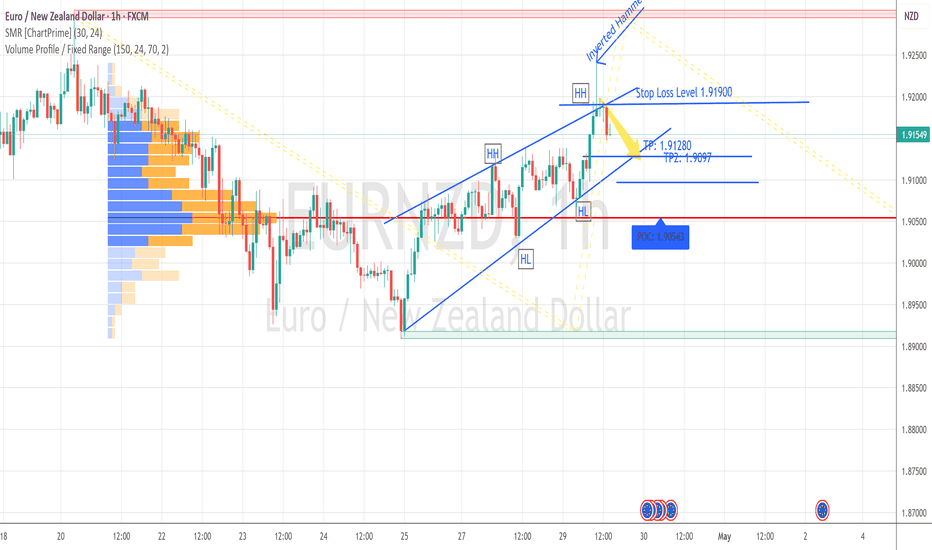

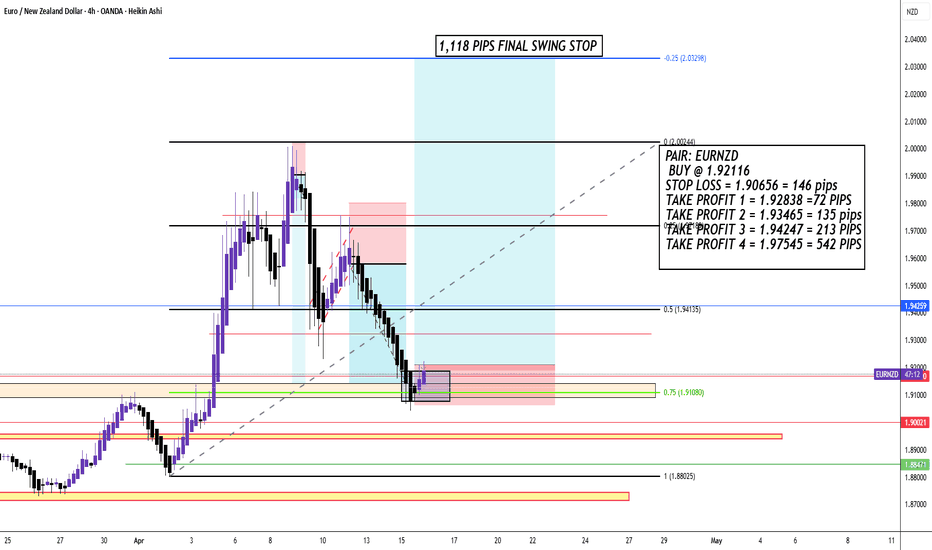

EURNZD BUY SETUP GREAT POTENTIAL TRADE 4HR SETUP. PRICE consolidated for a bit. and now has presented a nice entry area with master candle creating support. now we just need a close above into our buy area and we should atleast get to tp1 if this level holds and provides a confirmation with a close above the bullish engulfing as well for a breaker block for double confirmation

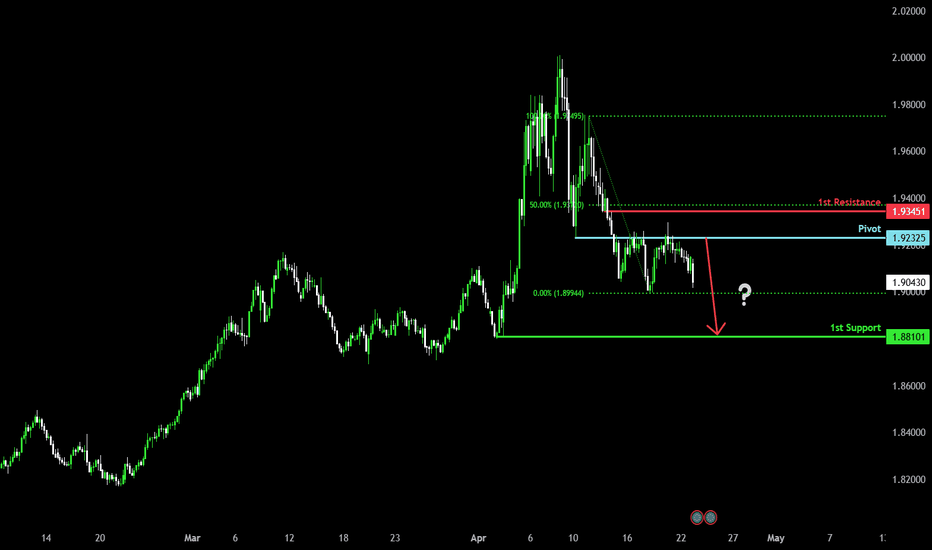

Bearish drop?EUR/NZD has rejected off the pivot and could drop tothe 1st support.

Pivot: 1.92325

1st Support: 1.88101

1st Resistance: 1.93451

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURNZD: Bullish Forecast & Outlook

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current EURNZD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

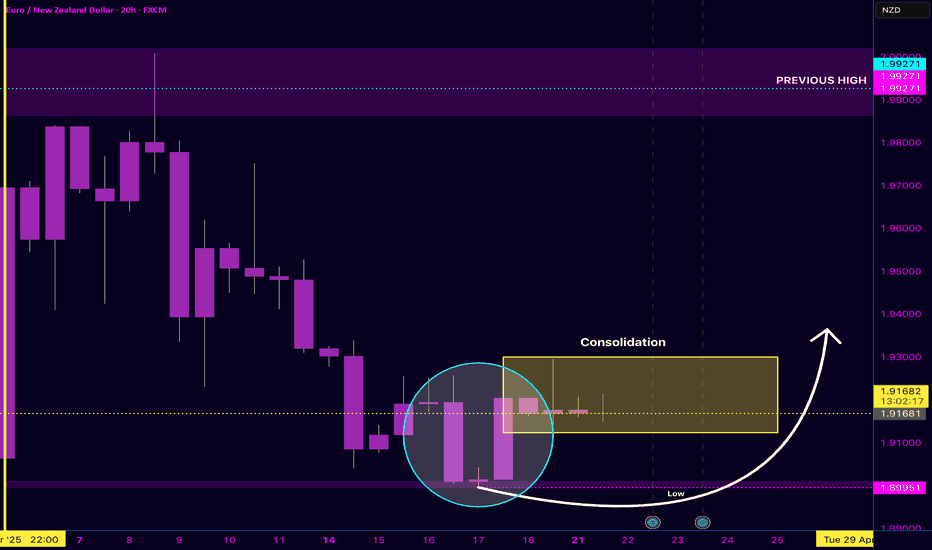

EUR/NZD 20H Outlook📊 EUR/NZD 20H Outlook

After a clear bearish move and price tapping into a key low at 1.8995, we’re seeing consolidation in a tight range. This is a classic sign of accumulation and indecision before the next push.

👀 I'm watching: • Low respected ✅

• Consolidation box forming 🟨

• Potential reversal setup forming from the demand zone

If this structure holds, we could see price retest the 1.93+ area, and eventually target the previous high near 1.992.

I don’t chase moves.

I study behavior, observe zones, and react to the candle—not emotions.

🧠 Structure first. Emotion last.