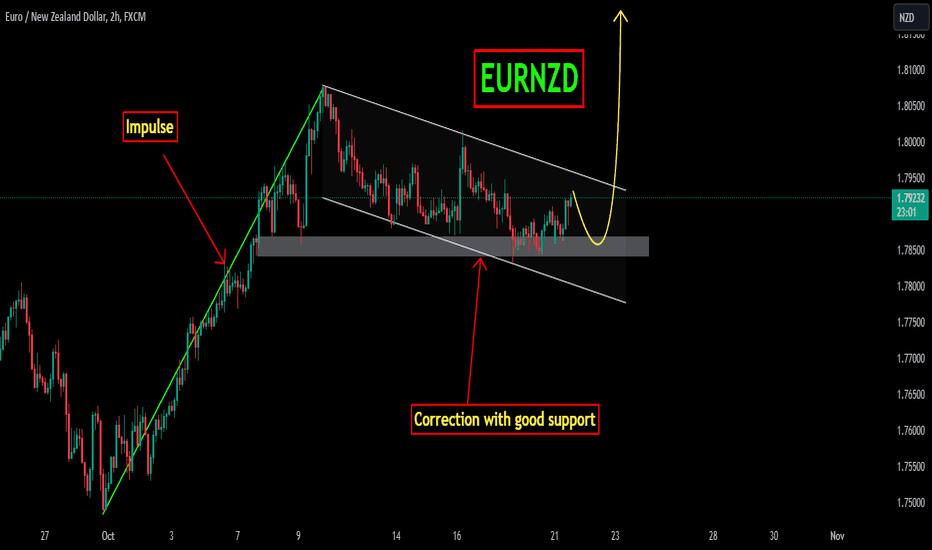

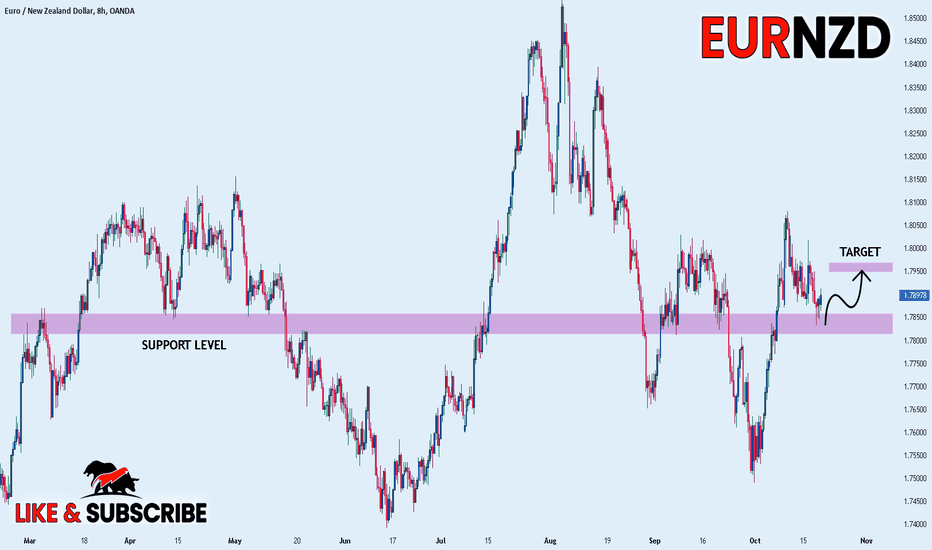

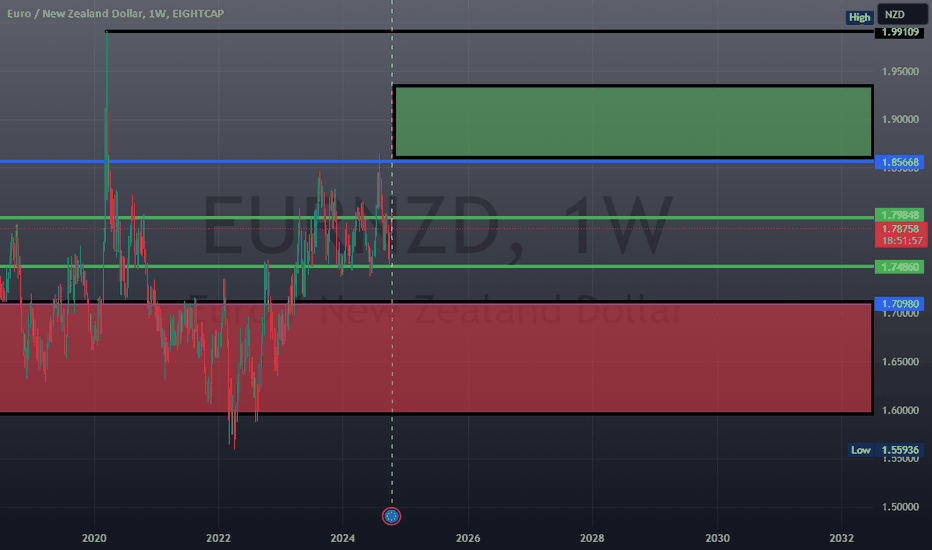

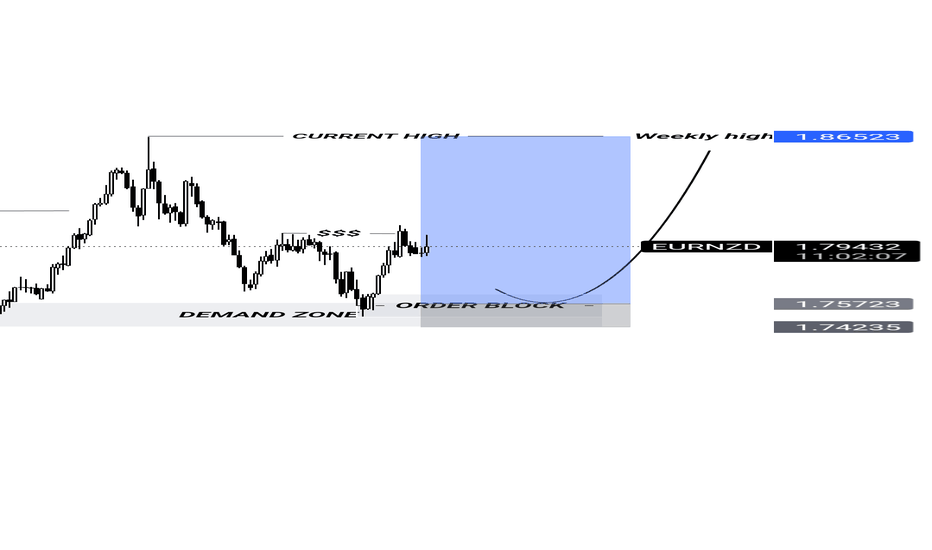

EURNZDEURNZD is in strong bullish trend.

As the market is consistently printing new HHs and HLs.

currently the market is retracing a bit after last HH, which is also the 50% Fib retracement level and local support as well. if the market successfully sustain this buying confluence the next leg up could go for new HH.

What you guys think of this idea?

EURNZD trade ideas

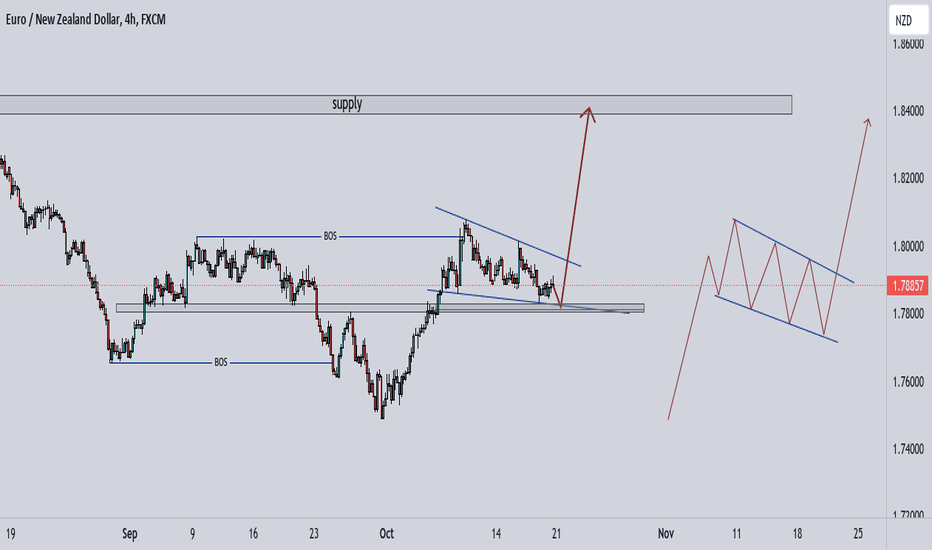

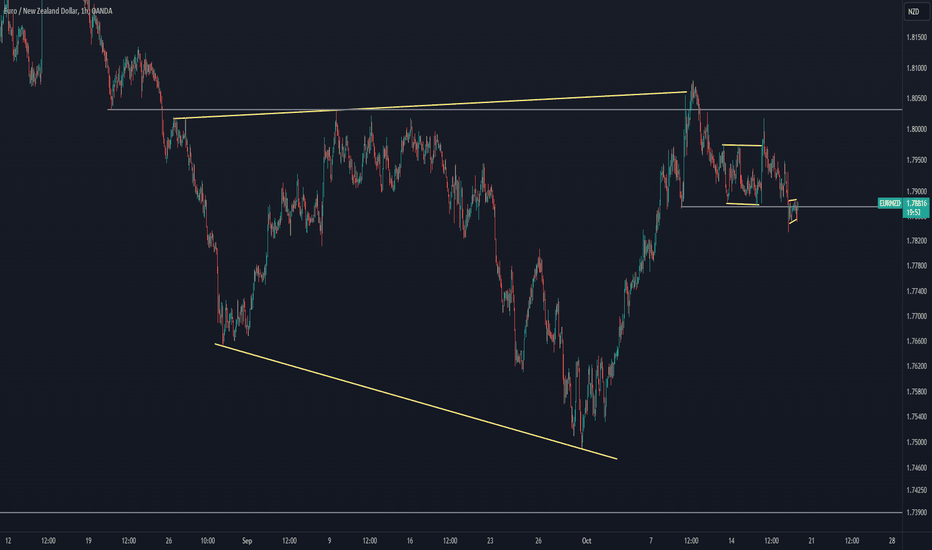

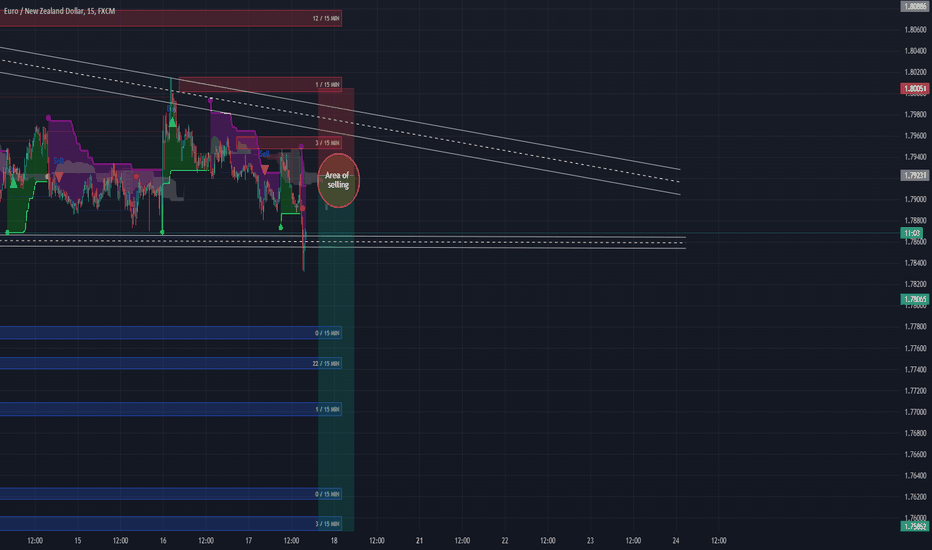

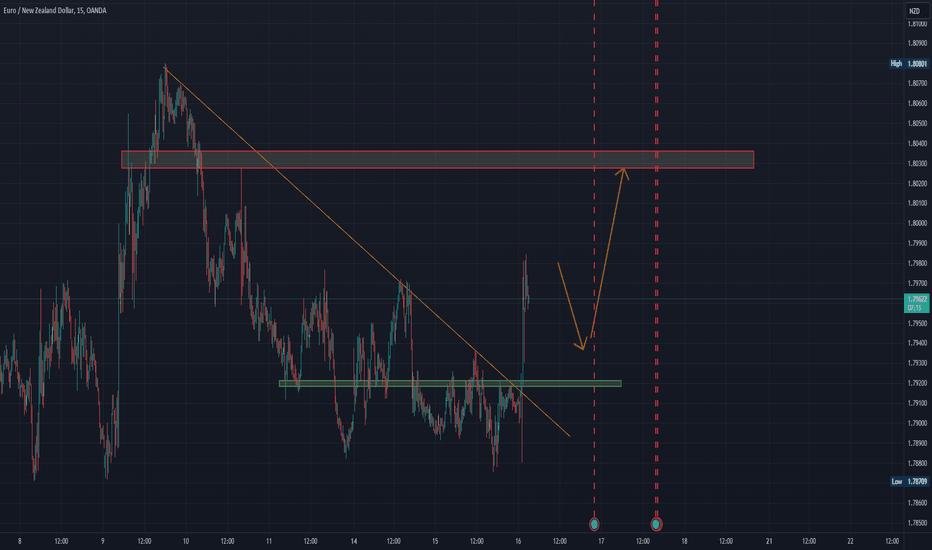

EURNZDTraders! This pair is impressing guys! We can see a bigger moves to the downside and one of the trades, that will be good for those who like to swing when we have the confirmation that we are waiting. I love the way structures are, everything has been confirmed so its the matter of waiting for the clear point to enter the market

EURUSD CHARTING IDEA W/ AMILIA

We're looking for the market to do a sell sweep, and then push back into a buy, so we're going to be looking at volatile buys and sharp bull engulfs.

We're going to use this chart to send out vault and team trades for the next 30 days and potentially plus, if it doesn't break out the demand era and our major resistance location.

2024-10-17

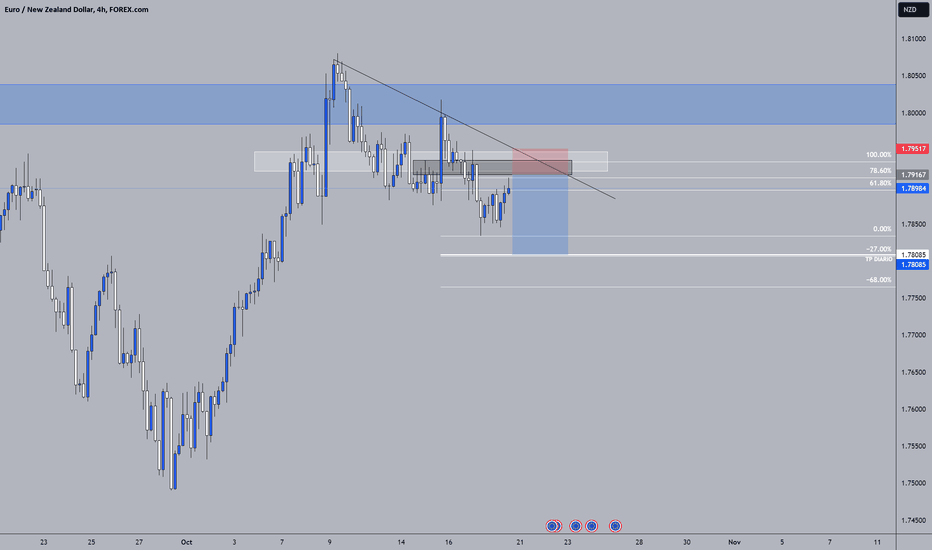

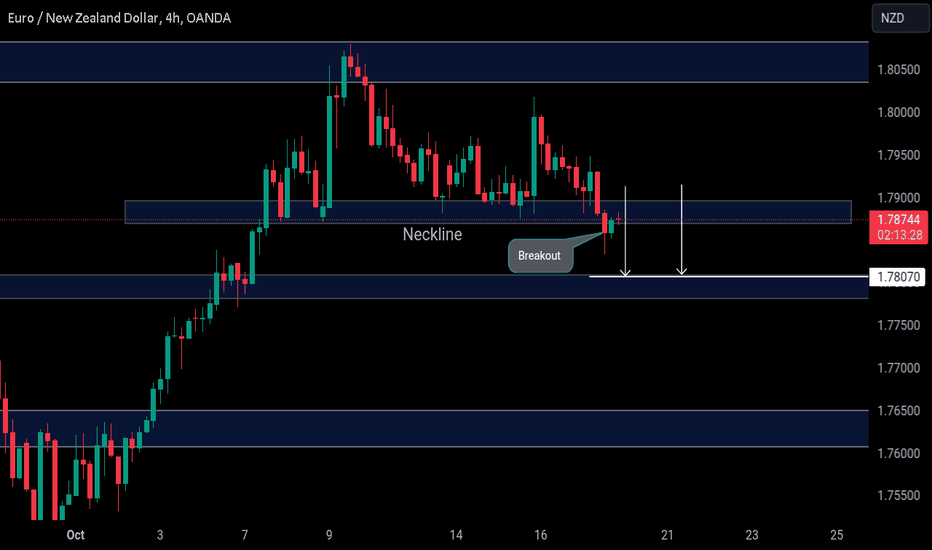

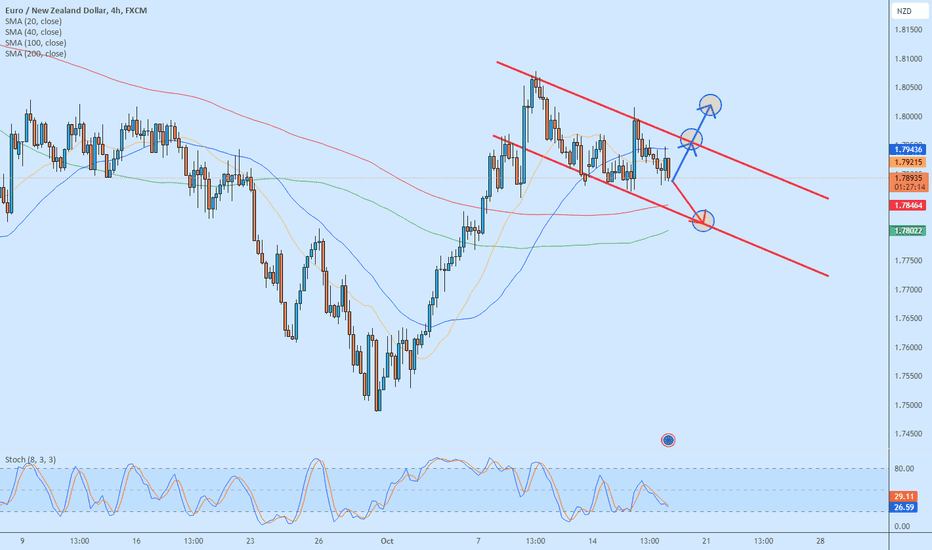

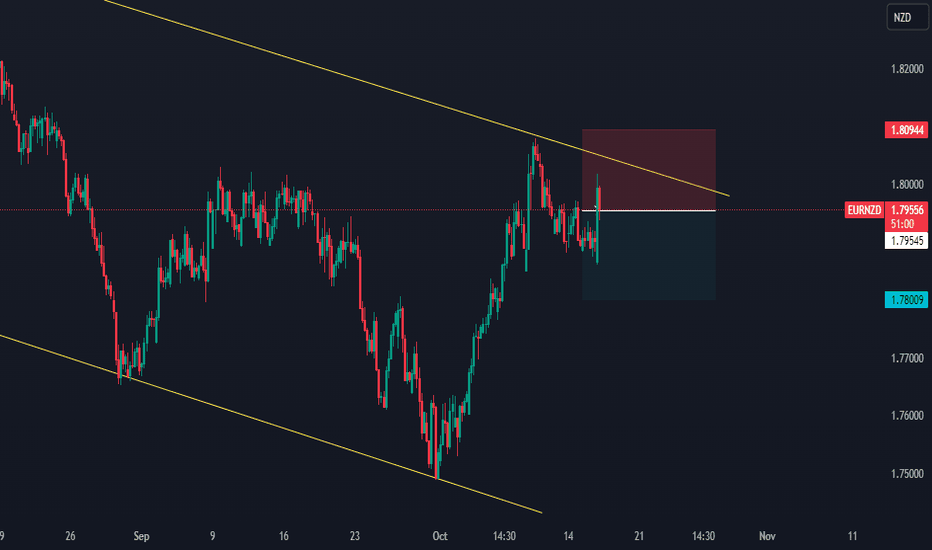

EURNZD: Time to Fall?!EURNZD has established a cup and handle pattern and has broken through its neckline on the 4-hour chart.

This breakout confirms a Change of Character (CHoCH) and indicates a potential bearish reversal in the near term.

The price is likely to decline, potentially reaching the support level at 1.7807.

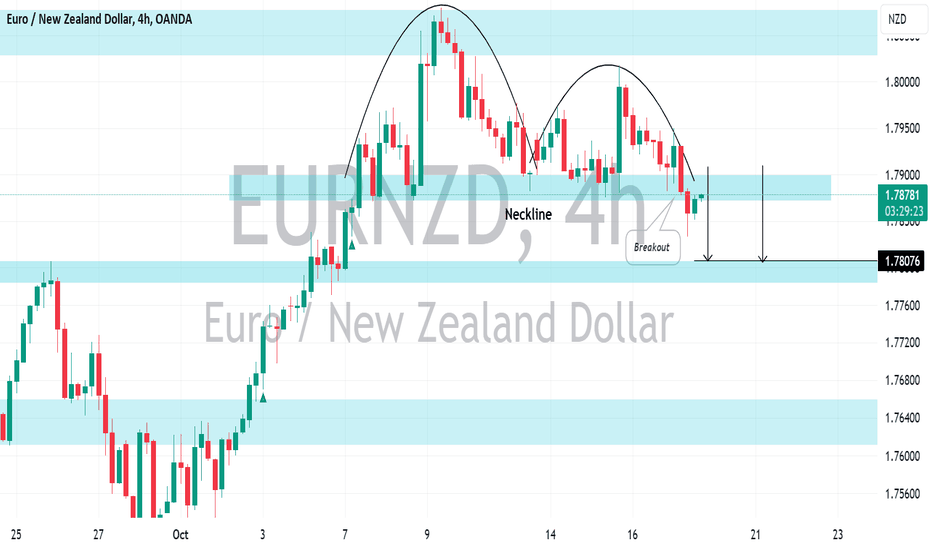

EURNZD: Time to Fall?!EURNZD has successfully formed a cup & handle pattern and has broken through its neckline on the 4-hour time frame.

This violation confirms a Change of Character (CHoCH) and suggests a potential bearish reversal in the near term.

The price is expected to decrease and potentially reach the support level at 1.7807.

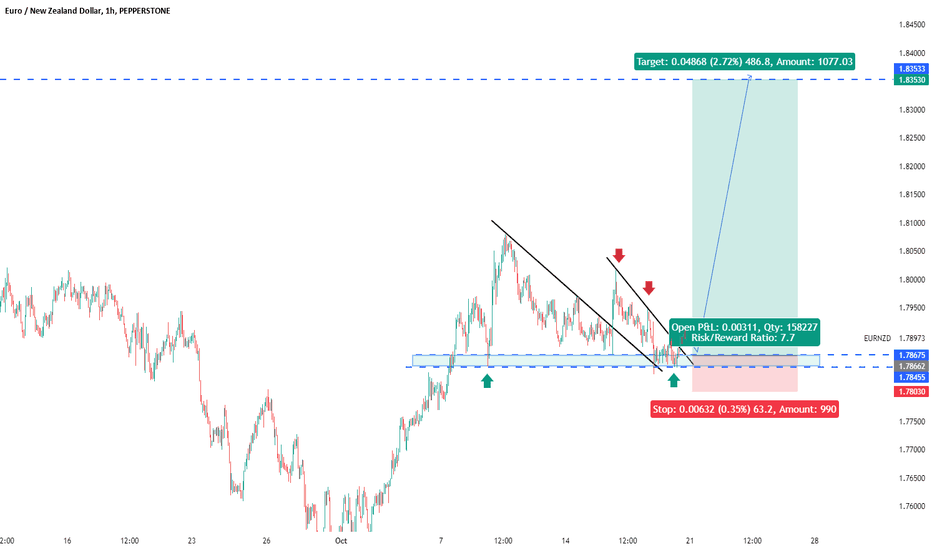

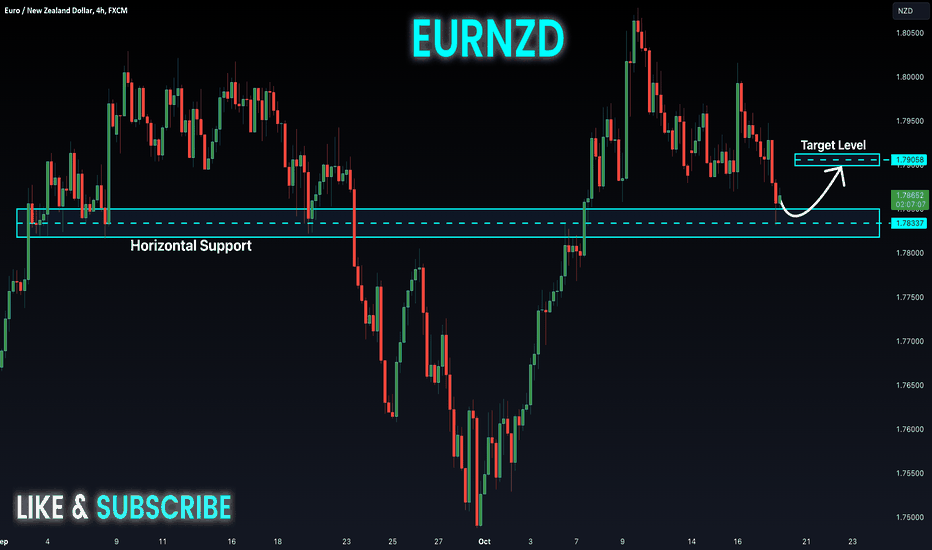

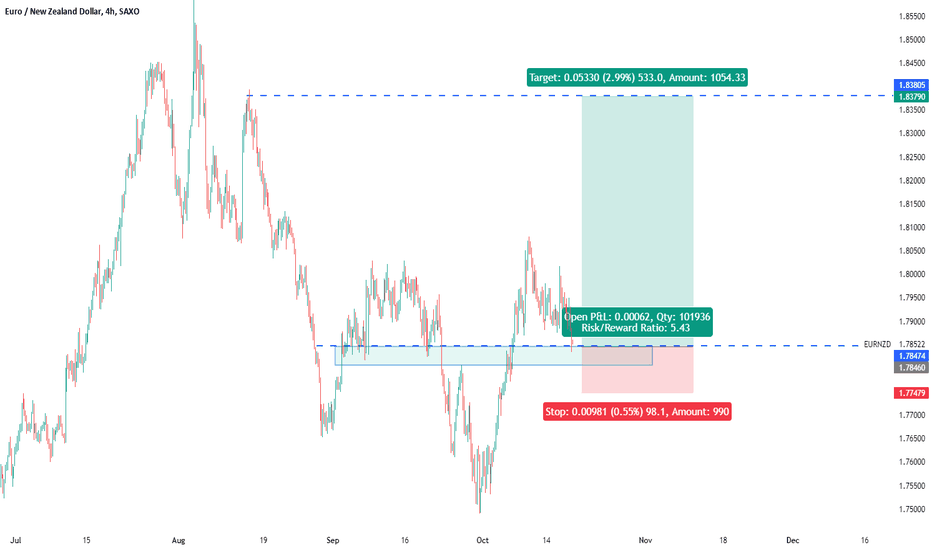

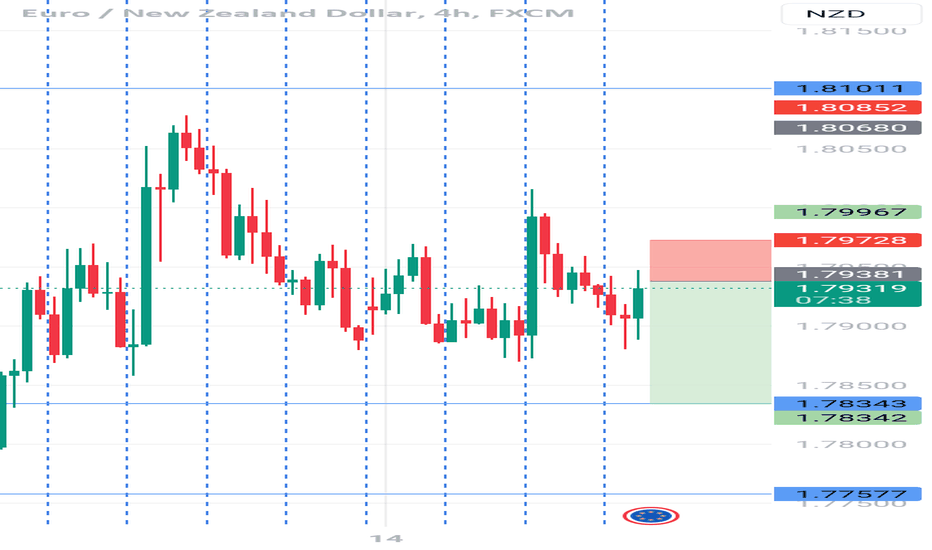

EURNZD BUY signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

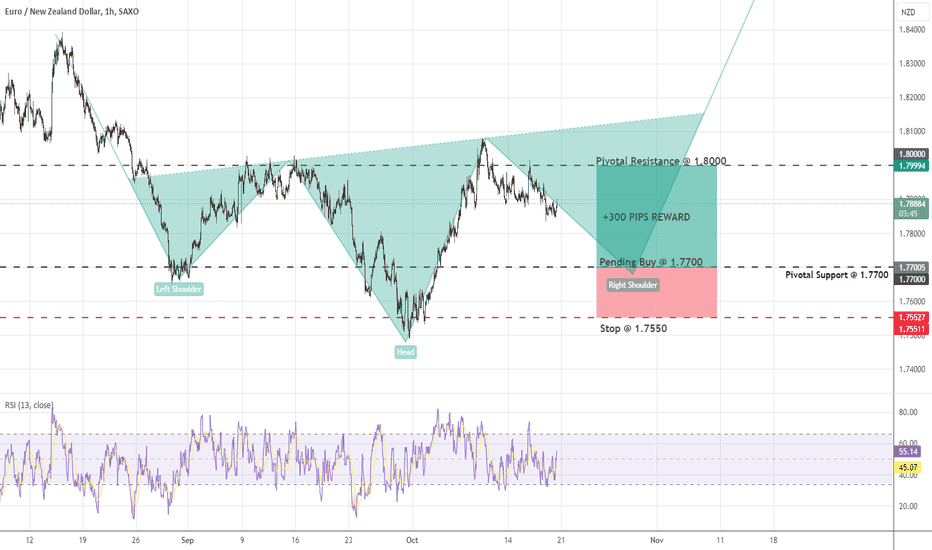

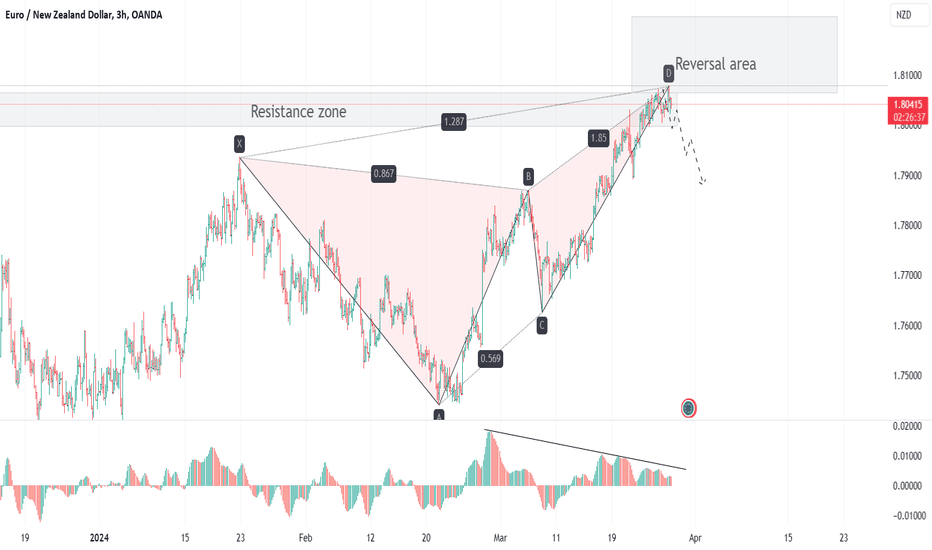

Technical Analysis: EURNZD Bearish ButterflyHello Traders,

Below is my Technical Analysis of EURNZD.

EURNZD has formed a bearish butterfly pattern with points X: 1.79369, A: 1.7442, B: 1.78702, C: 1.76273, D: 1.80786. The current price is 1.80379. Expectation for a drop to 1.78808 in the coming weeks. Additionally, a bearish divergence is noted on the Awesome Oscillator, indicating weakening bullish momentum.

Cheers and Happy Trading.

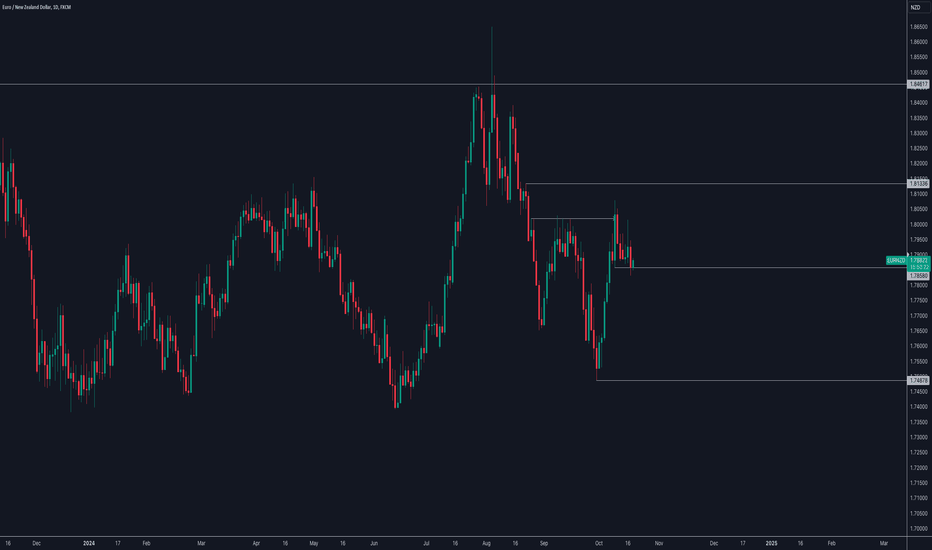

EURNZD: Preparing for a larger descentHello Traders,

We have an interesting setup on EURNZD. Between 23rd of Feb and 1st of May, we saw an upward move identified as a corrective wave ABC, with Wave C forming an ending diagonal. Recently, we saw a break of the ending diagonal pattern in wave C, setting the stage for a decline. The break of wave 1 to the downside further confirms our bearish outlook. As such I expect EURNZD to continue the downward movement.

However, if the price goes above 1.81557, my analysis of a drop will be invalid.

Cheers and happy trading!

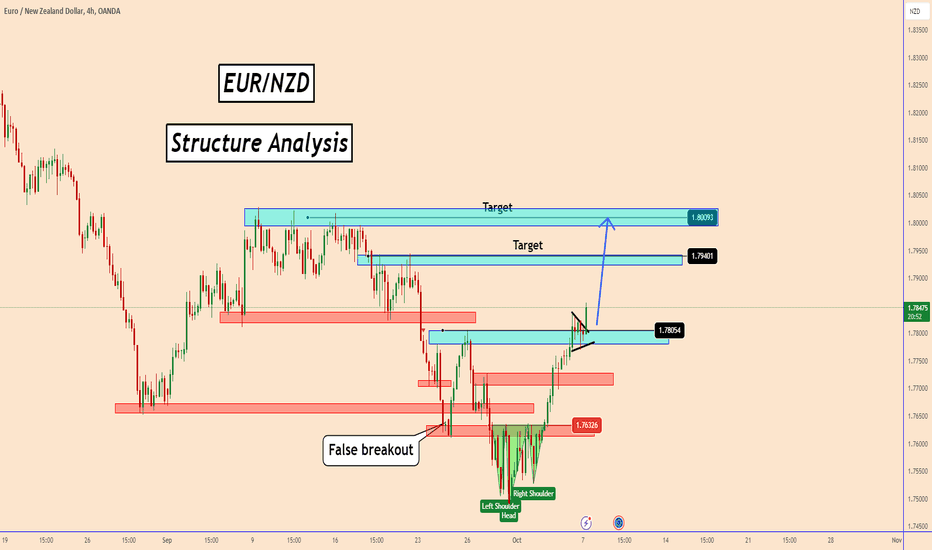

EURNZD Structure Analysis Ahead of RBNZ Rate DecisionEURNZD Structure Analysis Ahead of RBNZ Rate Decision

In this video, I analyze the price behavior of EURNZD, considering past price developments and potential movements ahead of the Reserve Bank of New Zealand (RBNZ) interest rate decision on Wednesday, October 9.

The market anticipates that the RBNZ will cut rates by 50 basis points, from 5.25% to 4.75%.

You may watch the video for further details.

Thank you and Good Luck!

eurnzd bullish around 1200 pipsThe EUR/NZD currency pair has exhibited some bullish trends recently, but for a comprehensive bullish analysis, it’s important to consider multiple factors, such as technical analysis, macroeconomic fundamentals, and market sentiment. Here's an overview of what typically drives a bullish case for EUR/NZD:

1. Technical Analysis

Uptrend Continuation: If EUR/NZD is forming higher highs and higher lows on a daily or weekly chart, this is a signal of an ongoing uptrend. Key indicators to watch would include:

Moving Averages (50-day, 200-day): If the short-term moving averages are crossing above long-term moving averages (a “golden cross”), it signals bullish momentum.

Fibonacci Levels: Fibonacci retracement levels can help identify support and resistance areas for potential entry points.

RSI (Relative Strength Index): An RSI value below 70 but trending upwards could suggest that bullish momentum is building without being overbought.

MACD (Moving Average Convergence Divergence): A bullish crossover in the MACD line above the signal line is a strong confirmation of upside momentum.