July 6, 2025: Strategic Forex Weekly OutlookWelcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

Higher timeframe trend analysis

Key zones of interest and potential setups

High-precision confirmations on lower timeframes

Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

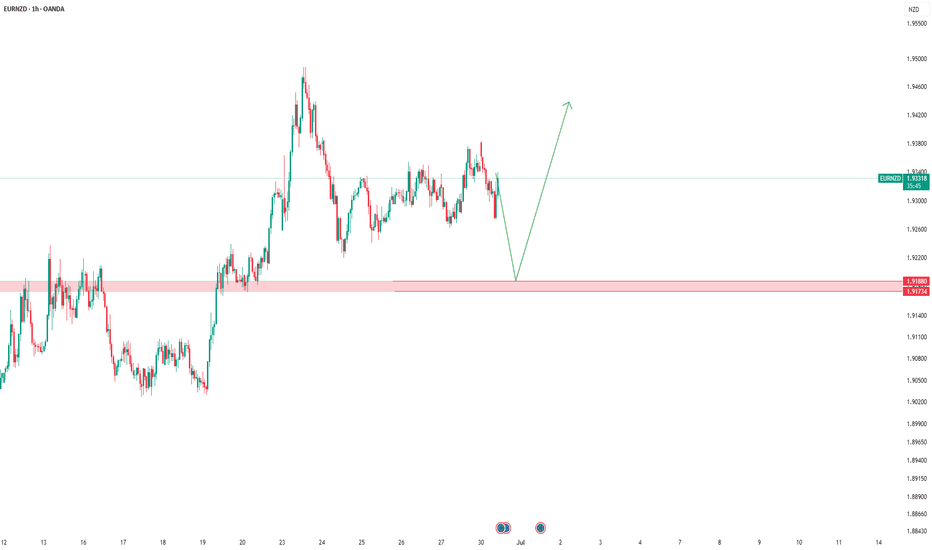

EURNZD trade ideas

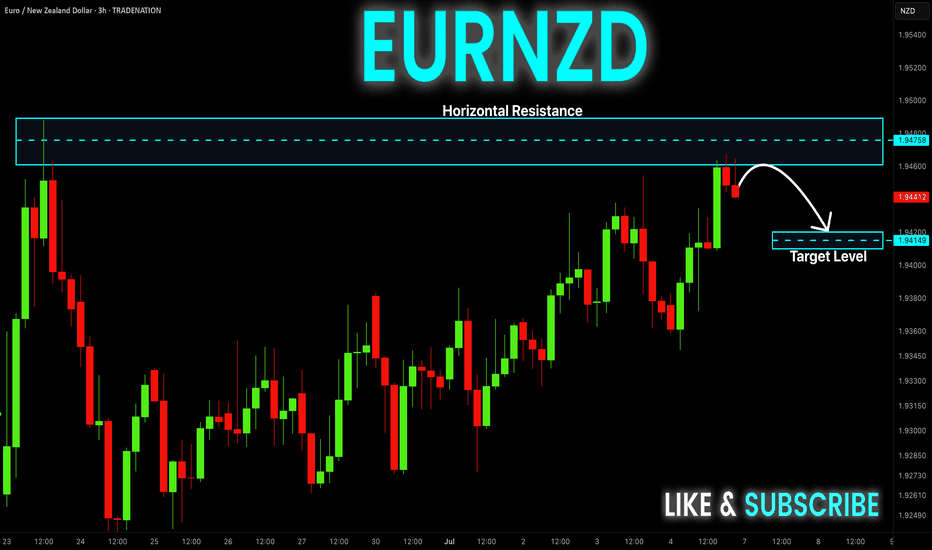

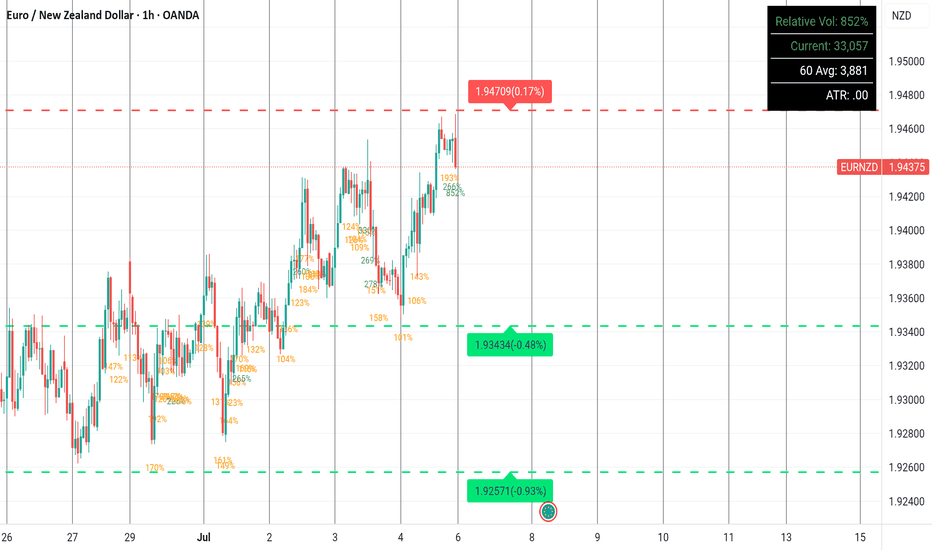

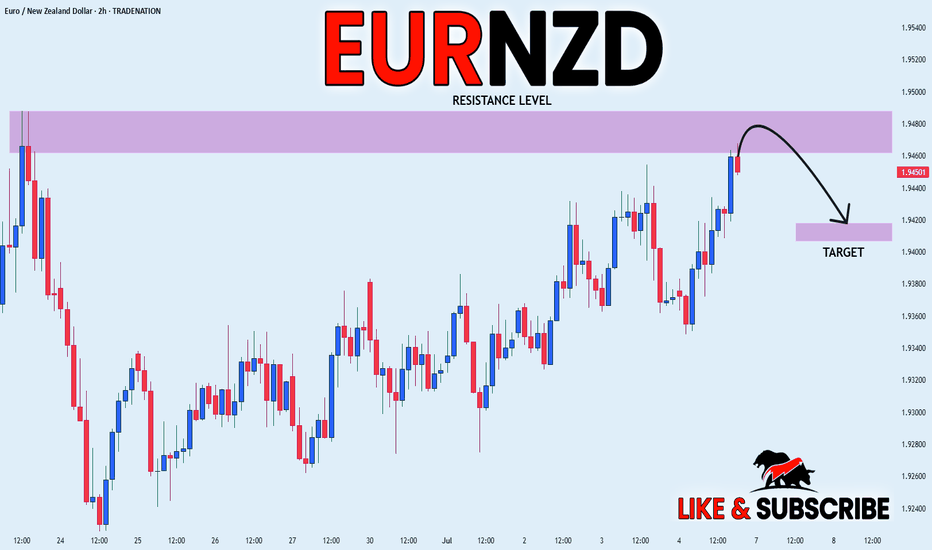

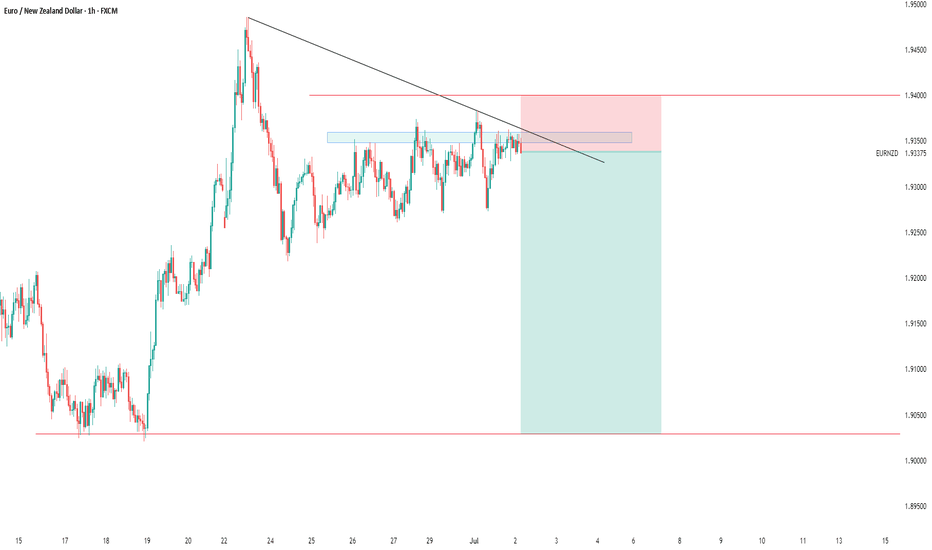

EUR-NZD Risky Short! Sell!

Hello,Traders!

EUR-NZD made a retest

Of the local horizontal resistance

Of 1.9485 so despite the uptrend

We are locally bearish biased

And we will be expecting a

Local bearish correction

On Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

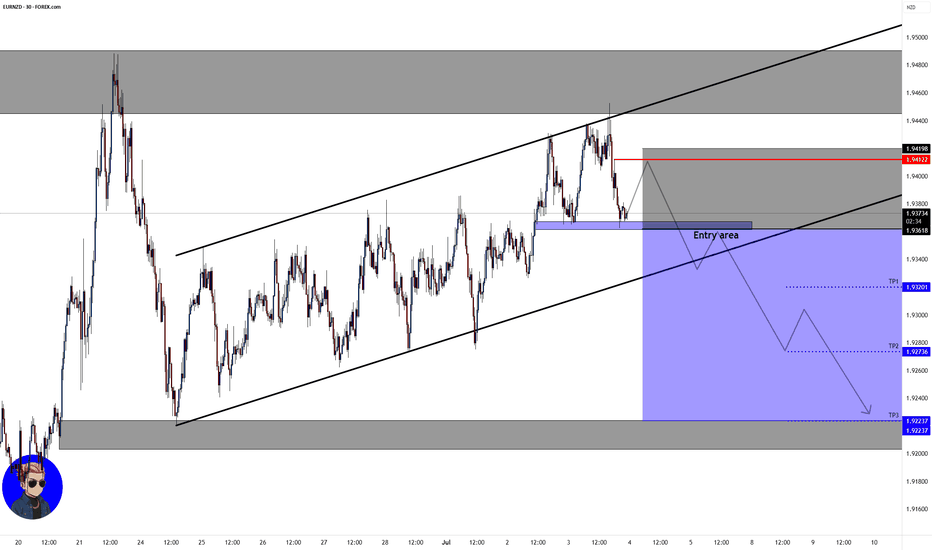

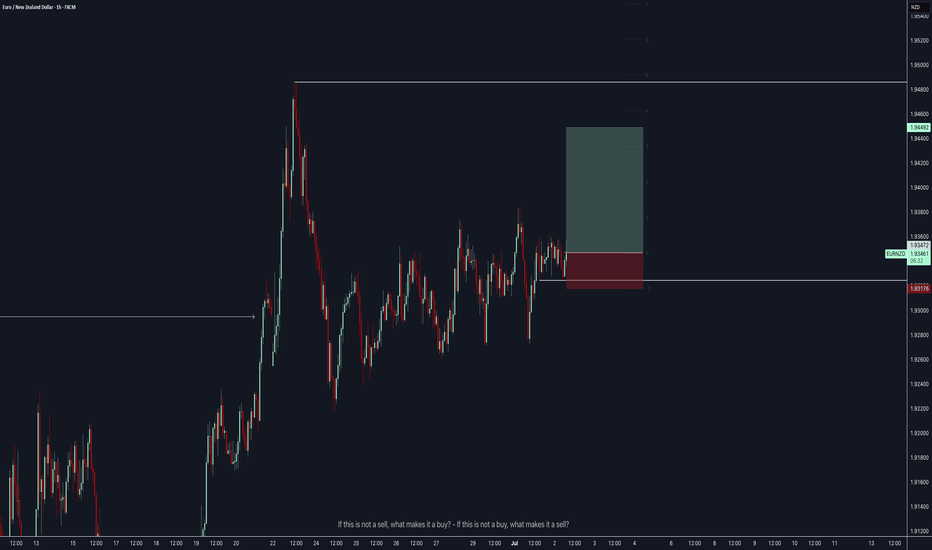

EURNZD: Bears Will Push Lower

Balance of buyers and sellers on the EURNZD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

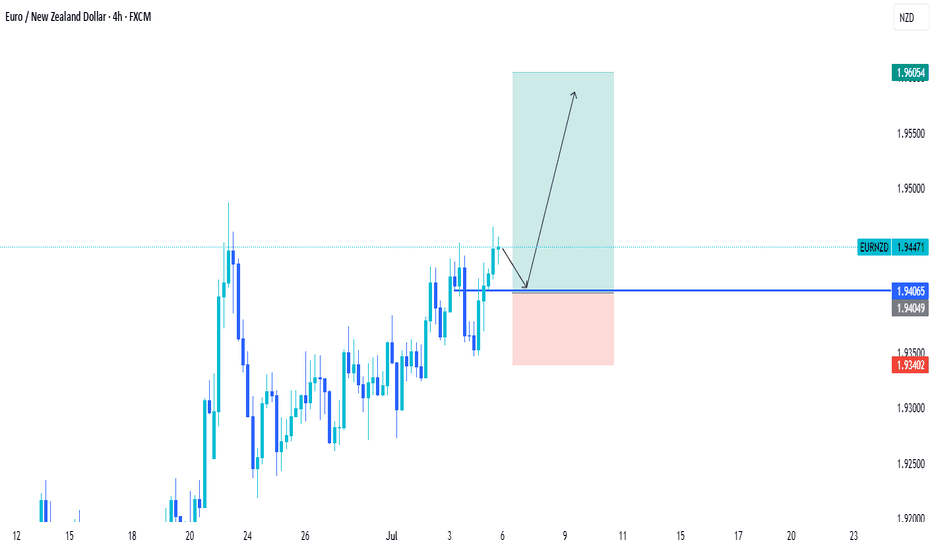

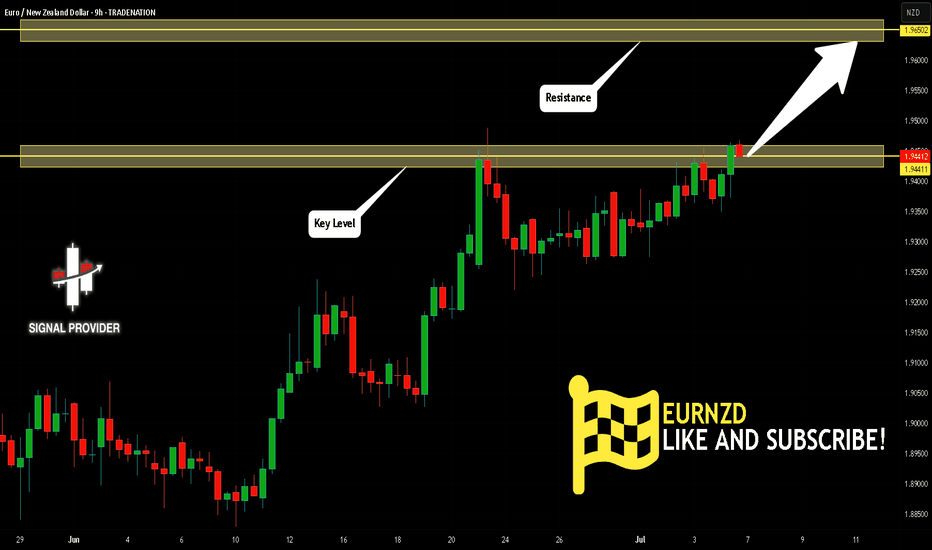

EURNZD Is Bullish! Long!

Please, check our technical outlook for EURNZD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1.944.

Considering the today's price action, probabilities will be high to see a movement to 1.965.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

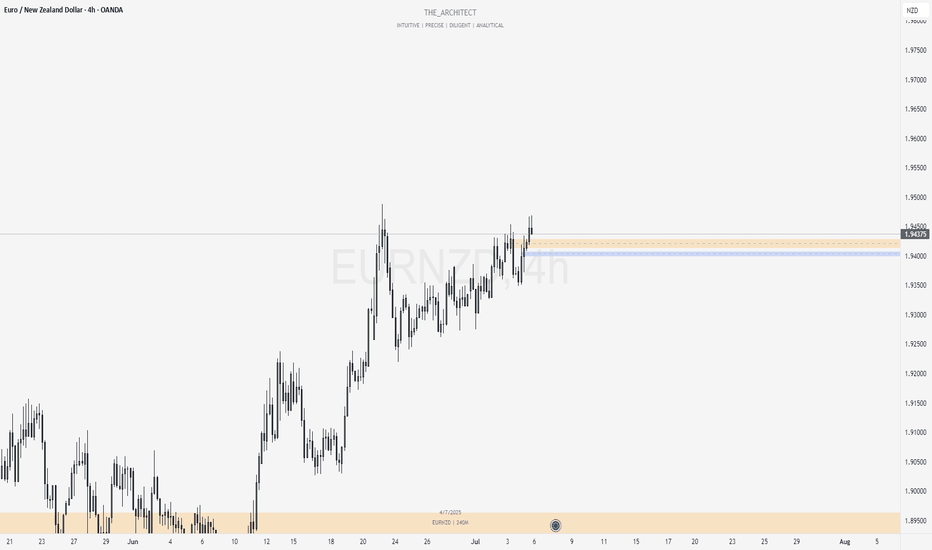

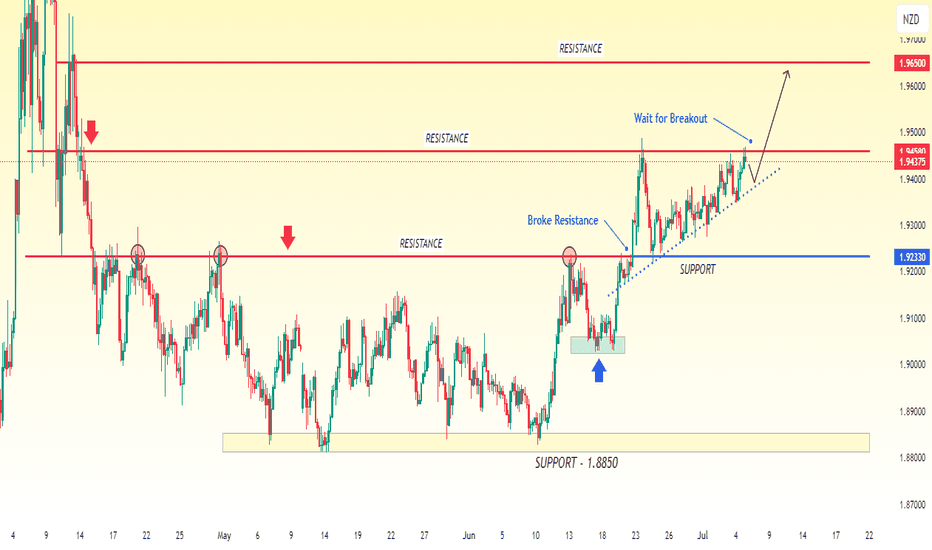

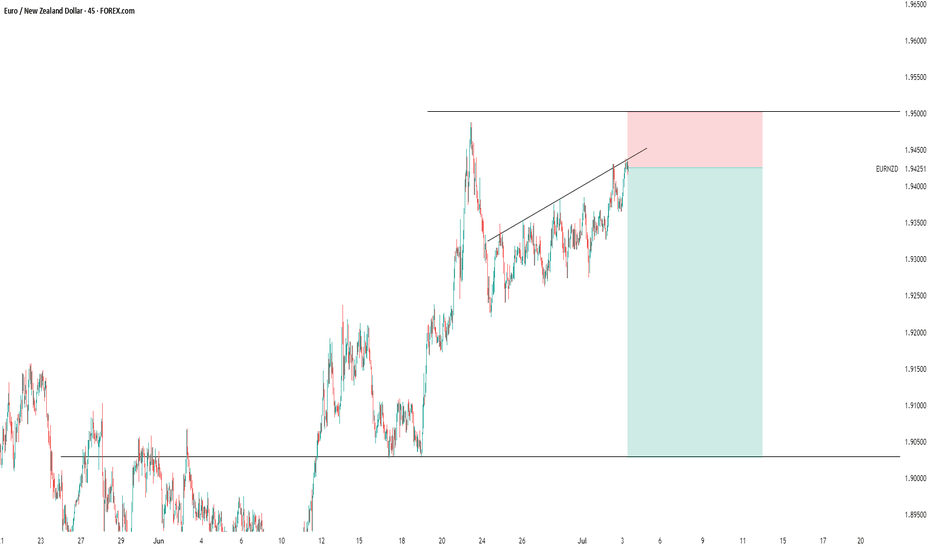

EUR/NZD Eyes Further Gains After 600-Pip RallyEUR/NZD became bullish after dropping to the 1.8850 area. Since then, the price has moved up by about 600 pips. Right now, it is at an important resistance level. If the price breaks above this resistance and holds, it could continue to rise toward the next target around 1.9650. This breakout could be a sign that buyers are still strong and aiming for higher levels.

EUR_NZD LOCAL SHORT|

✅EUR_NZD is set to retest a

Strong resistance level above at 1.9488

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 1.9420

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

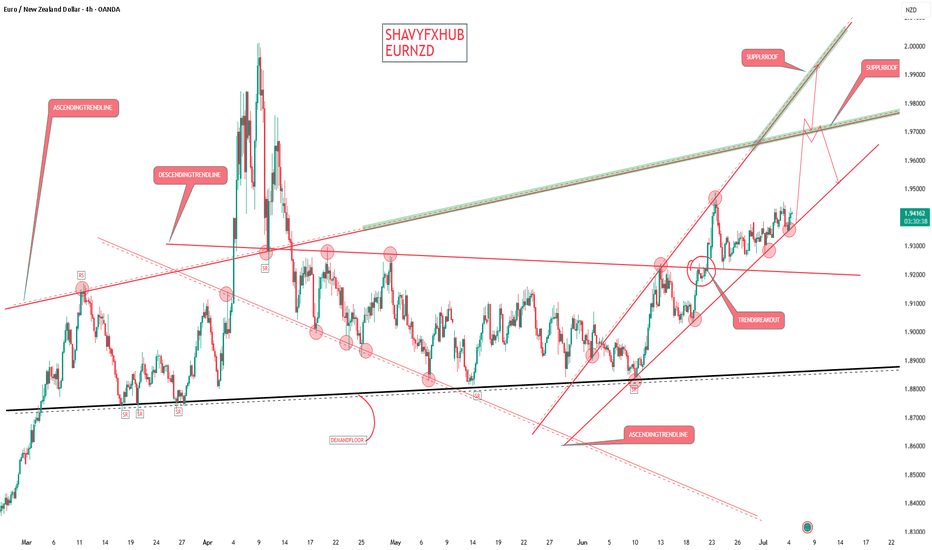

EURNZDEU10Y= 2.602%

EUR INTEREST RATE after governing council decision 25basis point on deposit facility 2% main refinancing operation 2.15% and marginal lending facility 2.40%

NZ10Y=4.56%

NZD INTEREST RATE =3.25%The current Official Cash Rate (OCR) in New Zealand is 3.25%. The Reserve Bank of New Zealand (RBNZ) last updated this rate on May 28, 2025, with the next update scheduled for July 9, 2025..

The OCR is the main tool used by the RBNZ to manage inflation and maintain price stability. A higher OCR generally leads to higher interest rates across the economy, which can help to cool down inflation. Conversely, a lower OCR can stimulate economic activity by lowering interest rates.

What is the OCR? official cash rate is used to achieve and maintain price stability.

New Zealand's central bank is called Reserve Bank of New Zealand (RBNZ)

BOND YIELD DIFFERENTIAL =1.96%

INTEREST RATE DIFFERENTIAL=1.25%

CARRY TRADE ADVANTAGE= FAVOUR EURNZD sell , but the internal demand structure break of supply roof shows that buying will continue despite yield and interest rate differential in favor of NZD

The technicality of sell will be on the confluence on ascending trendline supply roof .

UPCOMING FUNDAMENTAL DATA REPORT.

New Zealand

Reserve Bank of New Zealand (RBNZ) Monetary Policy Review

Date: July 9, 2025

Consensus: RBNZ is widely expected to hold the Official Cash Rate at 3.25%. Most major banks and economists forecast no change, though a minority expect a 25 basis point cut. Markets anticipate only one more cut this year, likely in Q3.

Q2 2025 Inflation Data

Date: July 21, 2025

Significance: This release will be closely watched for signs of persistent or easing price pressures, which could influence future RBNZ policy decisions.

Labor Market Data

Next Release: Early August 2025 (Q2 data)

Recent Trend: Unemployment rate stable at 5.1% in Q1, with employment growth of 0.1%.

Eurozone

ECB Policy Announcements

Next Meeting: July 18, 2025

Focus: Markets are watching for signals on the pace of further rate cuts, with the ECB expected to continue a gradual easing cycle as inflation moderates.

Eurozone Inflation (CPI)

Next Flash Estimate: July 17, 2025

Recent Data: June inflation at 2.0% year-on-year, in line with expectations.

Eurozone GDP and Employment

Next Release: July 30, 2025 (Q2 preliminary)

Recent Data: Q1 GDP growth at 0.6% quarter-on-quarter; employment up 0.2%.

Other Events to Watch

Commodity Prices: Dairy auction results and global commodity trends can impact NZD.

Chinese Economic Data: As a major trading partner, Chinese data releases (trade, GDP) can influence NZD and thus EURNZD.

Summary Table: Major Upcoming Data

Date Event/Release Region Expected Impact on EURNZD

July 9, 2025 RBNZ Policy Decision New Zealand High (rate hold/cut)

July 17, 2025 Eurozone Flash CPI Eurozone Moderate (inflation, ECB outlook)

July 18, 2025 ECB Policy Meeting Eurozone High (rate guidance)

July 21, 2025 NZ Q2 Inflation New Zealand High (future RBNZ moves)

July 30, 2025 Eurozone Q2 GDP/Employment Eurozone Moderate

Early Aug NZ Q2 Labor Market New Zealand Moderate

Market Outlook

EURNZD is sensitive to central bank policy divergence, inflation trends, and labor market data from both regions.

RBNZ’s July 9 decision and Q2 inflation will be pivotal for NZD direction, while ECB’s July meeting and Eurozone inflation will shape EUR moves.

Traders should also monitor commodity prices and Chinese economic releases for additional NZD volatility triggers.

In summary:

The next two weeks feature several high-impact events for EURNZD, led by the RBNZ policy review (July 9), Eurozone inflation and ECB meeting (July 17–18), and New Zealand’s Q2 inflation (July 21). These releases will set the tone for the cross, with policy signals and inflation data likely to drive volatility.

#eurnzd

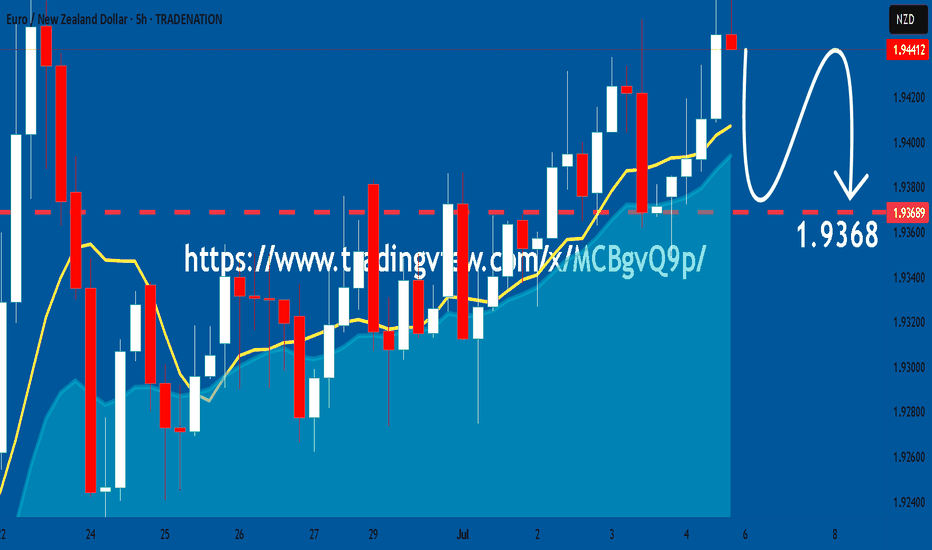

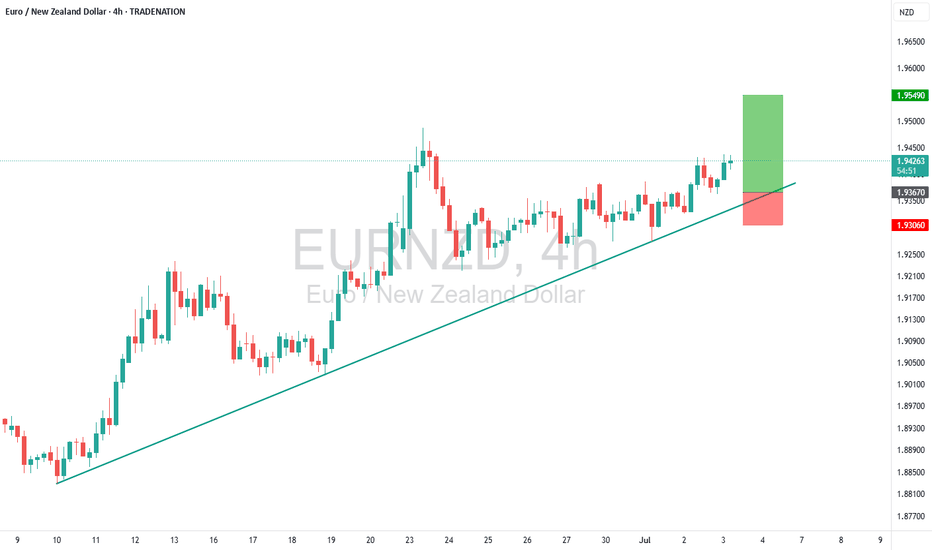

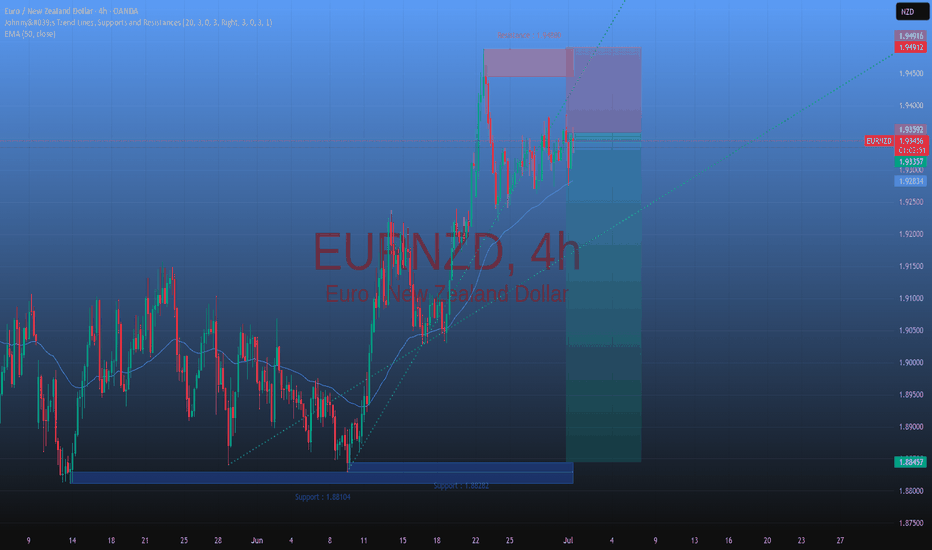

EURNZD – Buy the Dip at Trendline and EMA SupportTrade Idea

Type: Buy Limit

Entry: 1.9367

Target: 1.9549

Stop Loss: 1.9306

Duration: Intraday

Expires: 04/07/2025 06:00

Technical Overview

The short-term bias remains positive, with intraday dips consistently attracting buyers.

Price action suggests that the sequence of higher lows and higher highs is still intact, with no clear sign of trend exhaustion.

Trendline support at 1.9330 and the 20-period 4H EMA at 1.9366 align near the proposed entry, strengthening the support zone.

A rebound from this area could confirm continuation toward resistance at 1.9549.

No major economic events are expected in the next 24 hours, allowing technical factors to dominate intraday price action.

Key Technical Levels

Support: 1.9360 / 1.9327 / 1.9262

Resistance: 1.9438 / 1.9488 / 1.9550

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

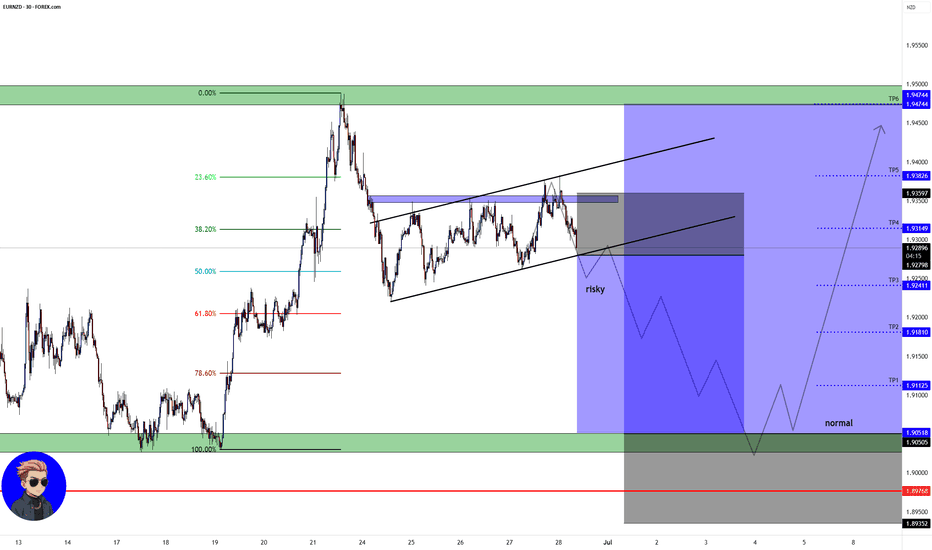

EURNZD SELL Signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

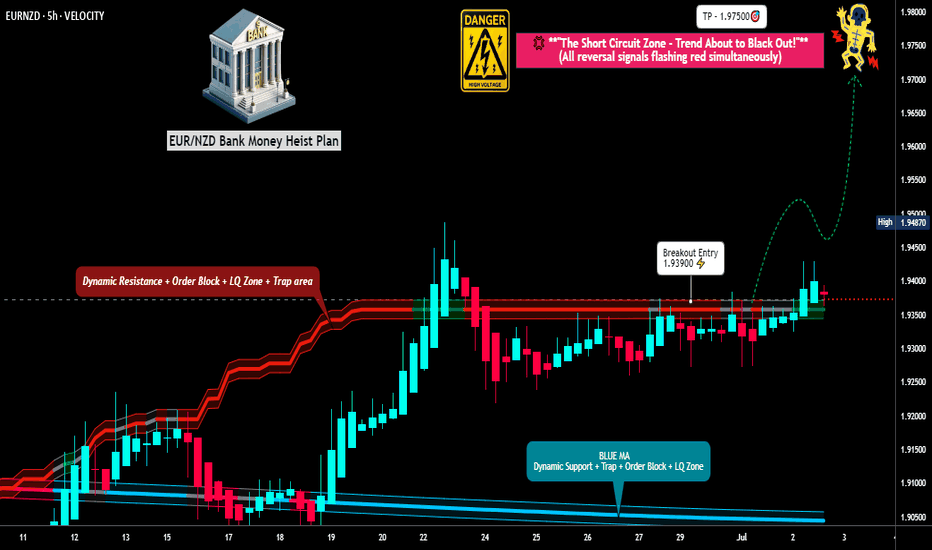

EUR/NZD Robbery Blueprint – Targeting Pink Zone Profits💰EUR/NZD Robbery Setup: The Bullish Breakout Blueprint for Euro vs Kiwi Heist! 🚨📈

(Targeting High-Risk Zones With Dynamic Entry & Exit Tactics – Long Setup Explained)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Pirates & Chart Bandits, 🏴☠️💸📊

Ready to rob the Kiwi vaults with precision? Based on our 🔥Thief Trading Strategy🔥 (technical + fundamental), here’s the grand blueprint for the EUR/NZD Long Heist. We’ve scoped the market, sniffed out consolidation traps, and locked eyes on that Pink Zone of high-risk, high-reward. The bulls are regrouping. This is our moment. 📍

🎯 ENTRY PLAN – “The Breakout Is The Lock Pick”

📈 Strike Price: 1.93900

Wait for a clean candle close above the Major Dynamic Resistance (MA level).

Once breached, place buy stop orders above the MA line — entry must align with breakout rules.

🔁 Optional: For early robbers, place buy limits on the nearest swing low within the 15M or 30M timeframe (confirmation from wick rejections).

📌 Set alerts (📳) at breakout zones. Stay sharp. Opportunity doesn't knock—it smashes doors.

🛑 STOP LOSS – “Protection Is Power”

Set your SL near the previous swing High/Low wick (4H chart zone), aligning it with your personal lot size, risk %, and number of trades.

📍“SL is your vault lock. Set it smart, not soft. You’re not gambling — you’re robbing with logic.”

🔥 Reminder: No premature SL on pending orders—wait for breakout validation.

🧨 TARGET – “Escape Plan”

🎯 Profit Target: 1.97500

Or dip out early if resistance alarms start ringing. 🏃♂️💨

⚖️ OVERVIEW – “The Scoreboard”

The EUR/NZD is currently in a neutral chop, but multiple trend reversal signs are emerging.

🔥 Oversold zones, squeeze structure, and a potential bull charge all support this heist-worthy long setup.

📚 BONUS INTEL

Unlock the deeper story:

🧠 Sentiment Analysis

💼 COT Report Data

🌍 Macro Insights

🔍 Intermarket Correlations

📊 Quant Metrics

👉 Followw the 🔗 in the idea for more details and thief-style scoring!

🚨 NEWS ALERTS & POSITION MANAGEMENT

🗞 Avoid new trades during high-impact news. Use trailing SL to protect and lock in gains as the plan moves. Stay adaptive — markets shift fast.

💥 FINAL WORD – “Boost The Gang, Fuel The Plan”

If this heist plan fuels your trading journey, smash the Boost button 💥💖

Help more traders rob the market, not each other.

We operate clean, with precision and thief-style logic.

Let’s get this bag. 💰💼🎉

🧠 Stay tuned for the next operation. Till then — rob smart, rob safe. 🐱👤🤑📈

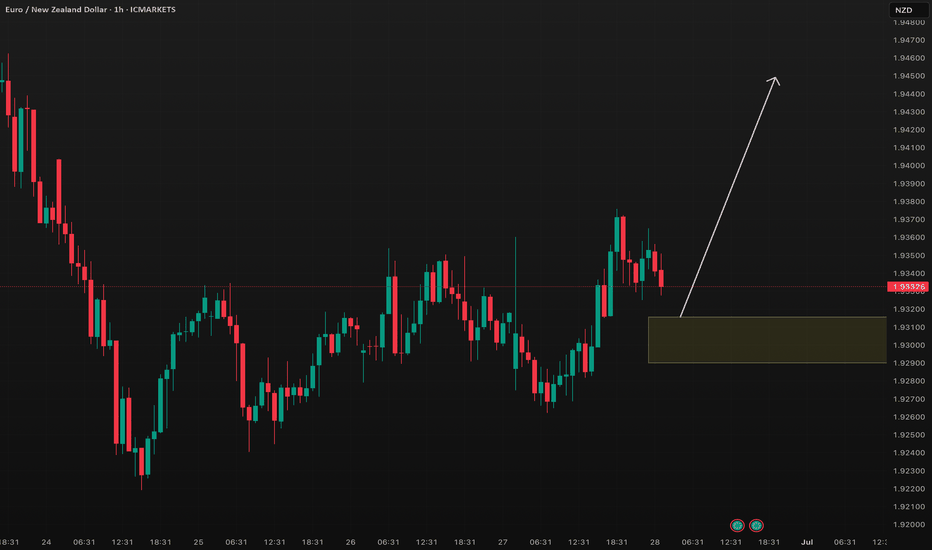

EURNZD BUY TRADE PLAN🔥 EUR/NZD – 28 June 2025 TRADE PLAN 🔥

📋 Plan Overview

Parameter Details

Type Intra-Day

Direction Long

Status Pending (Awaiting zone tap + confirmation)

R:R 1:3+

Confidence High (85%)

📈 Market Bias

EUR/NZD remains in a bullish structure on H4/D1, consolidating after the breakout above 1.9300 zone. We are looking at a continuation play from a refined M15-H1 demand zone after a minor retrace.

🔰 Confidence Factors

✅ HTF confluence: D1 + H4 bullish structure

✅ M15 OB + H1 BOS

✅ Clear volume alignment — recent breakout supported by high volume

✅ No macro/fundamental contradictions

📍 Entry Zone(s)

🟩 Primary Buy Zone: 1.9315 – 1.9290

(H1 OB + M15 refinement + volume base + inducement layer)

❗ Stop Loss Reasoning

SL: 1.9255

Placed well below the OB + liquidity sweep low, outside minor wicks, beyond noise zone.

🎯 Take Profit Targets

🥇 TP1: 1.9365 (minor H1 structure high, ~50 pips / ~1.5R)

🥈 TP2: 1.9400 (HTF resistance, ~90 pips / ~3R)

🥉 TP3: 1.9450 (extended runner, swing high test)

🧠 Management Logic

Risk 1% of account on this setup

Take 33% at TP1 → move SL to breakeven

Take 33% at TP2 → trail remainder on H1 fractals

Exit all if H1 BOS down confirmed

⚠️ Entry Confirmation Conditions

M15 bullish engulfing or BOS in zone

NY or London session volume spike

Preferable: SMT divergence with correlated pairs

⏳ Trade Validity Window

H1 setup = 12-24 hours

❌ Invalidation

Clean close below 1.9260 on H1

HTF shift bearish (D1 rejection candle, H4 BOS down)

🌐 Macro Snapshot

EUR relatively supported by broader risk tone

NZD quiet macro tone, no key news

Cross: EUR/USD holding above supports

Sentiment score: +7/10 (risk-on bias, no major headwinds)

✅ Summary

👉 Entry Zone: 1.9315–1.9290

👉 SL: 1.9255

👉 TP1: 1.9365

👉 TP2: 1.9400

👉 TP3: 1.9450

👉 Risk: ~30-50 pips

👉 Reward (TP2): ~90+ pips → R:R = 1:3+

Status: Pending zone tap + confirmation

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

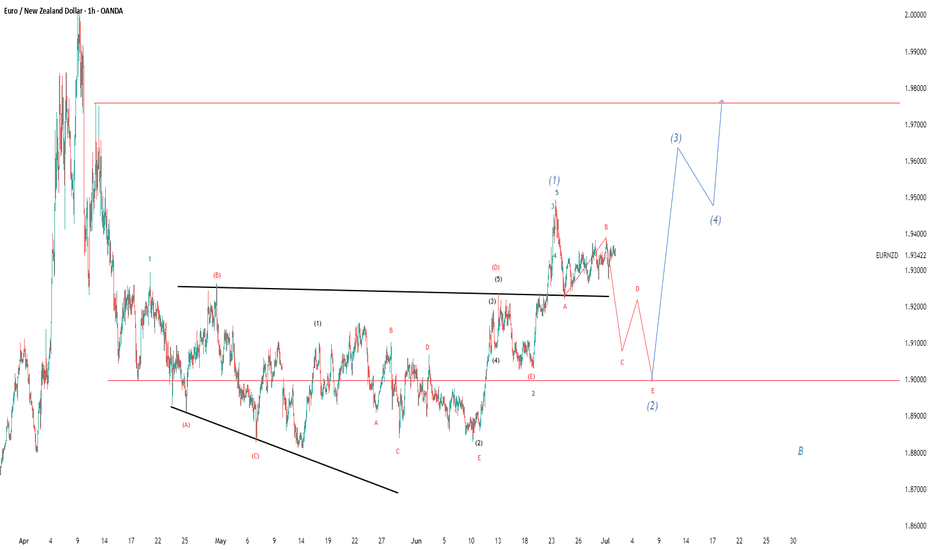

EURNZD analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

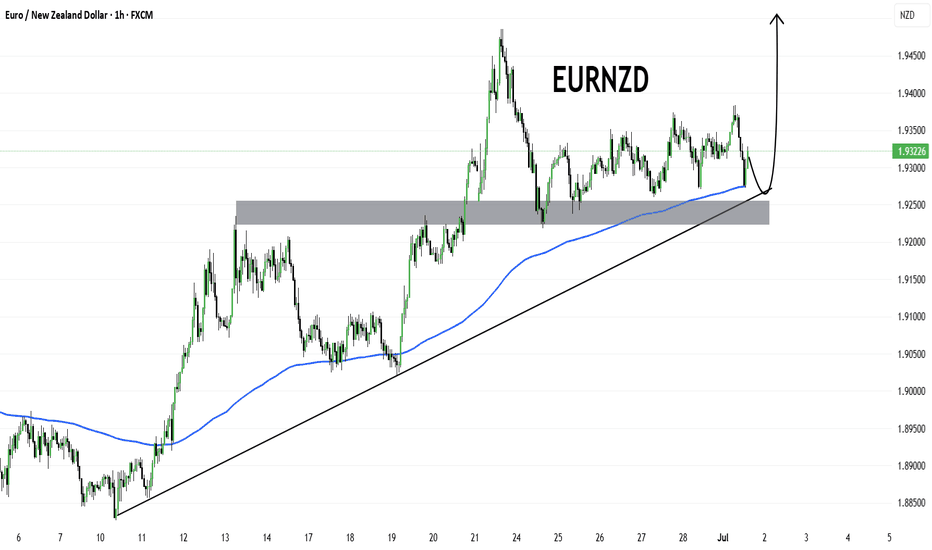

EURNZDEURNZD is maintaining a strong bullish structure, supported by a clean ascending trendline and the 200 EMA, both acting as dynamic support. Price recently pulled back into a key demand zone, which also aligns with trendline support and the EMA — creating a confluence area. As long as this zone holds, we can expect bullish continuation toward the previous swing highs, potentially targeting the 1.9450+ area. A strong rejection from the current level could confirm a fresh impulsive wave upward