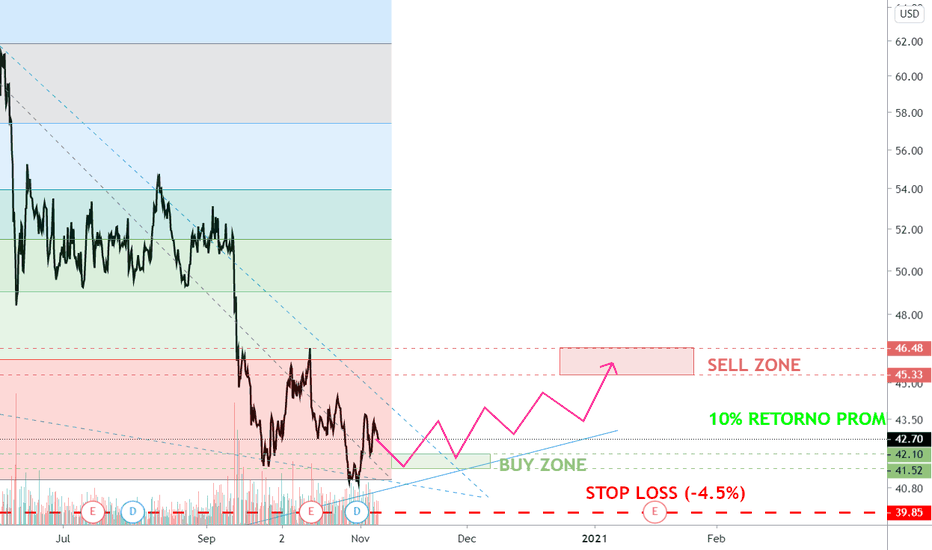

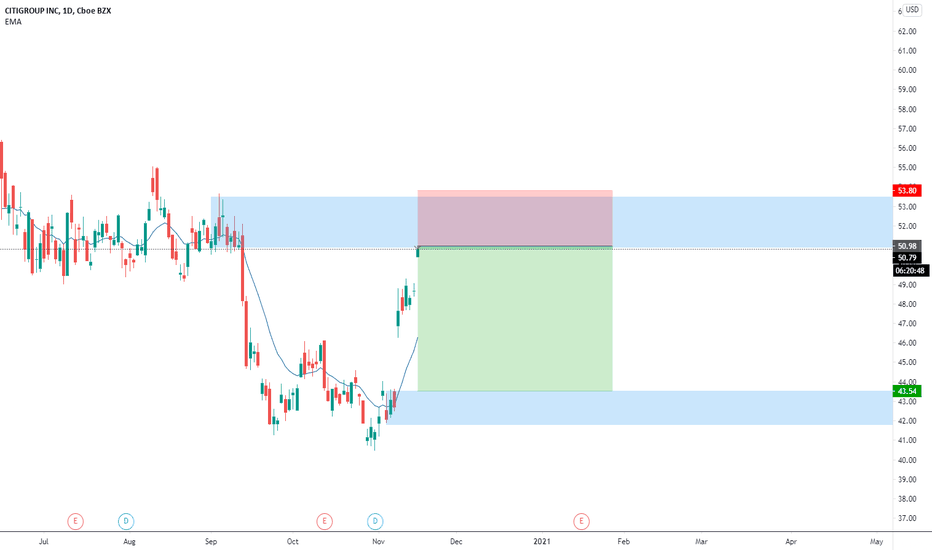

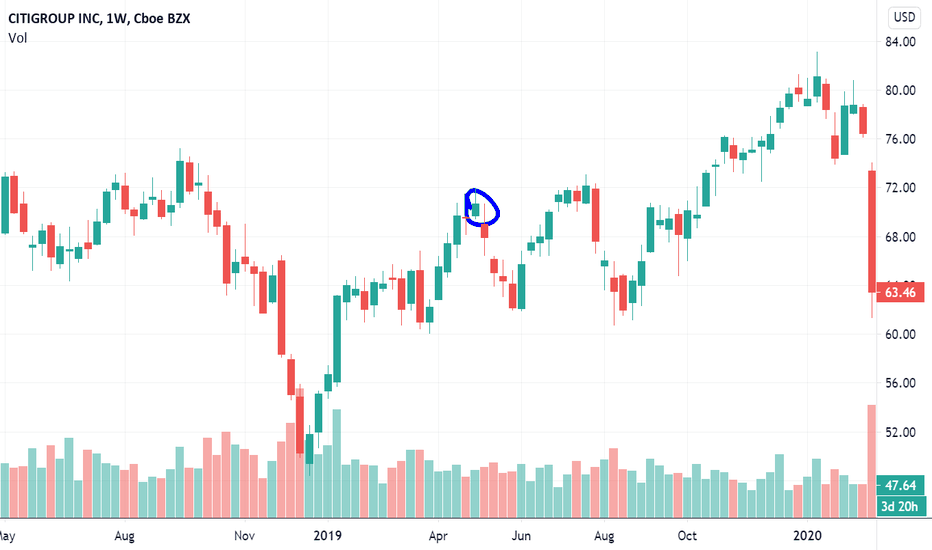

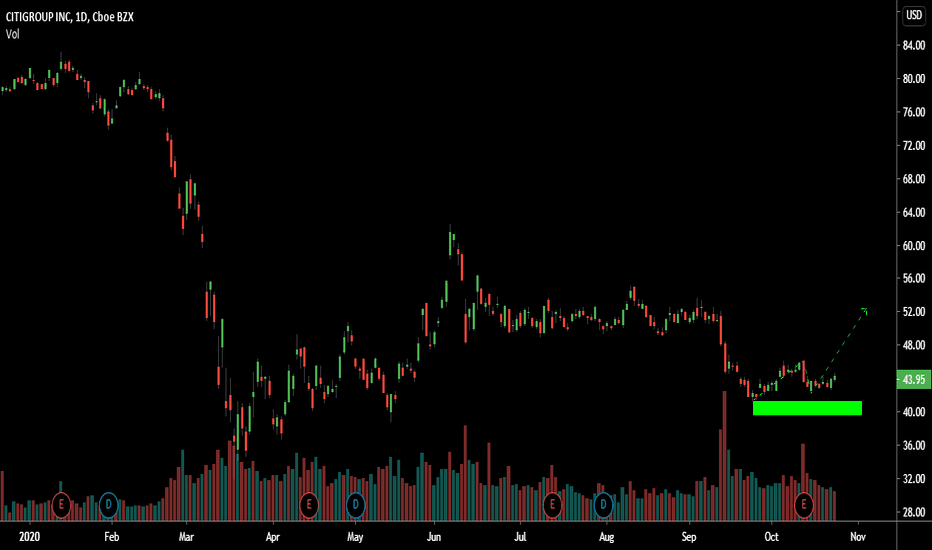

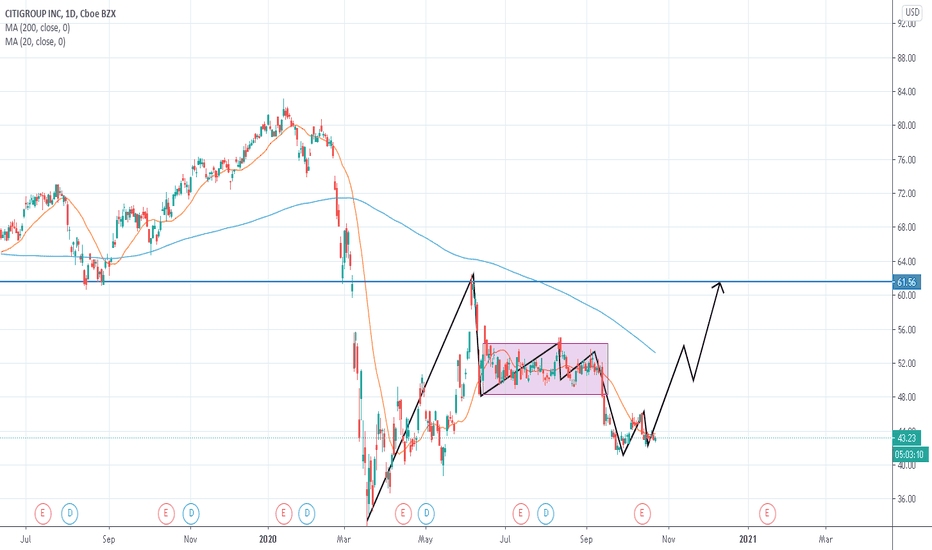

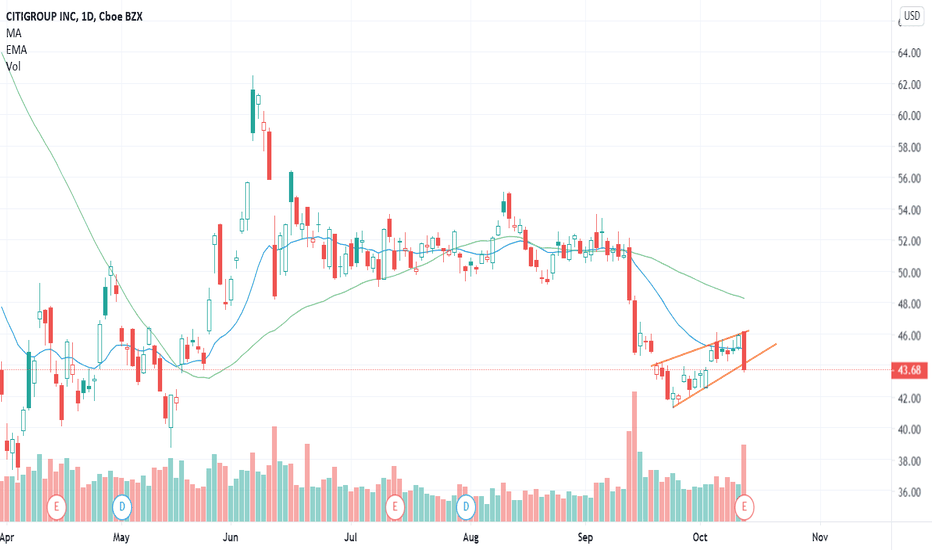

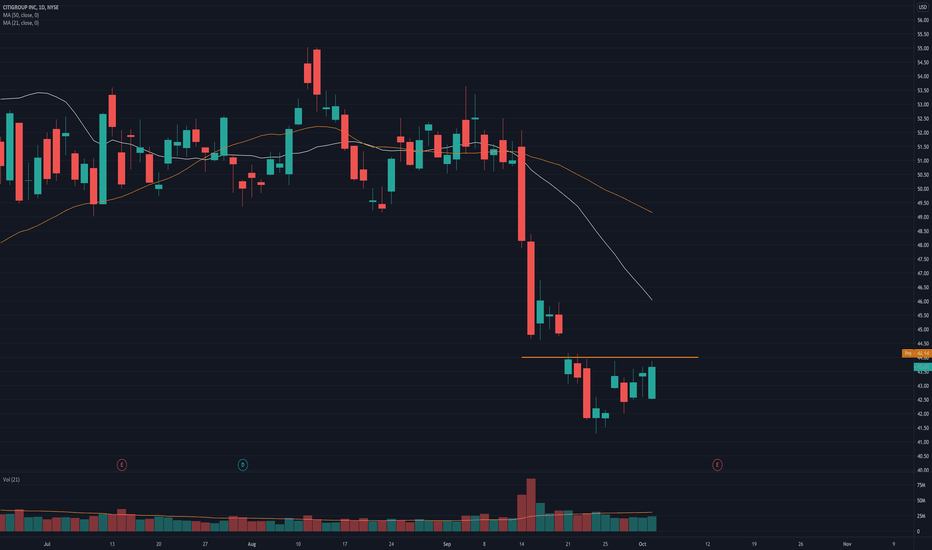

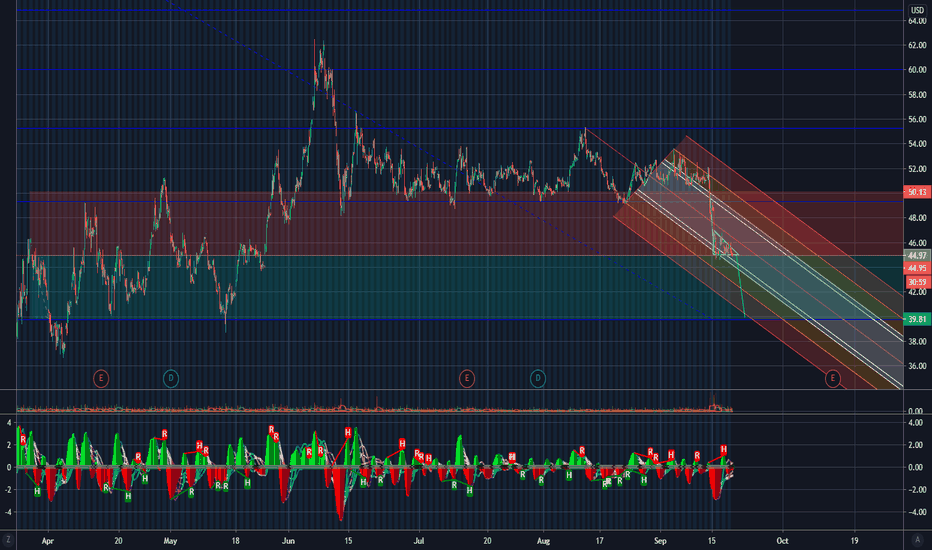

$C - NRPicks Nov 11Citigroup resistió nuevamente los $40 que ha sido un nivel clave durante eñ presente año. Es un banco global con operaciones en más de 100 países y sus segmentos no solo están orientados a banca comercial si no también tiene servicios en banca de inversión. Presentó resultados trimestrales registrando 1.40 EPS superando ampliamente las expectativas.

4C trade ideas

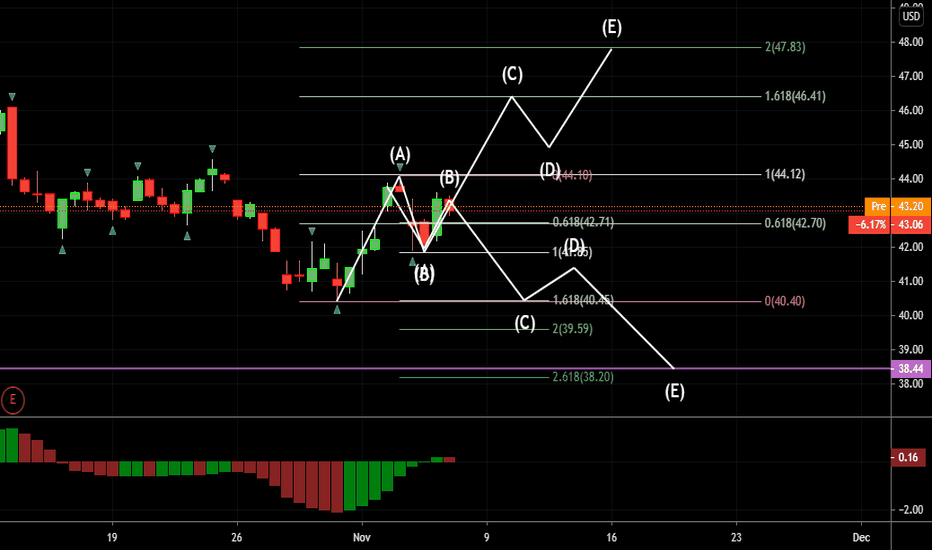

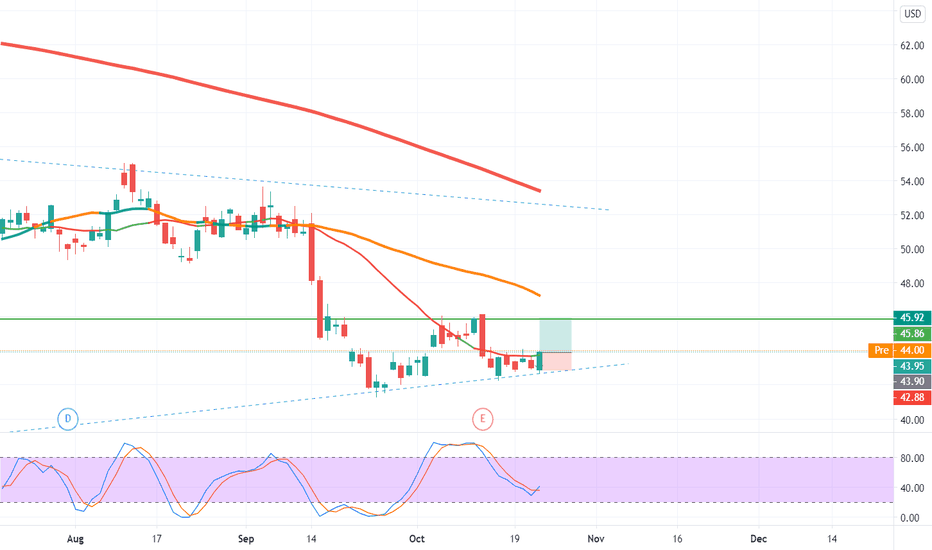

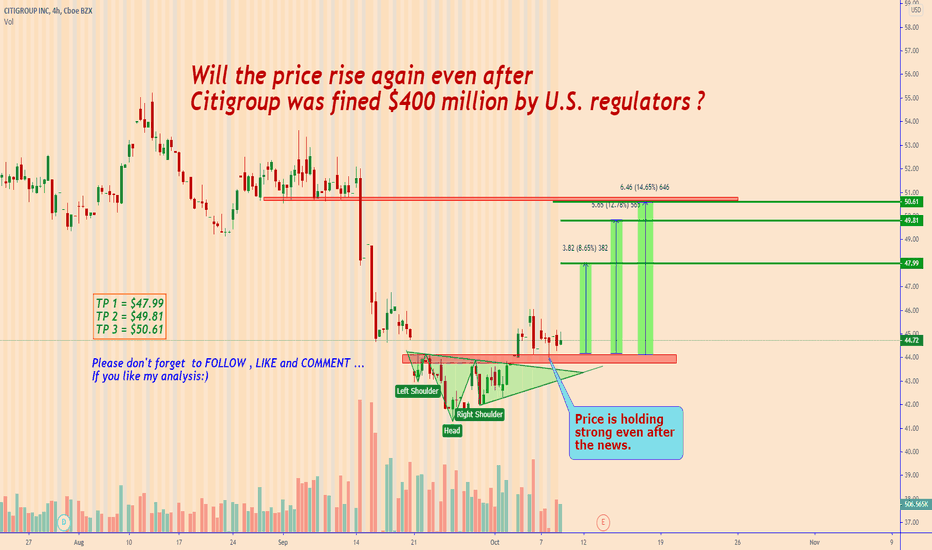

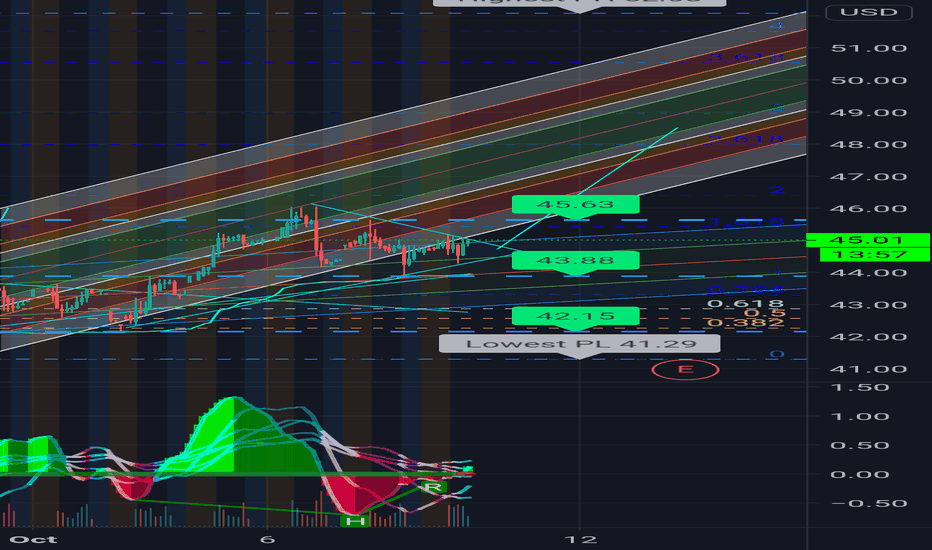

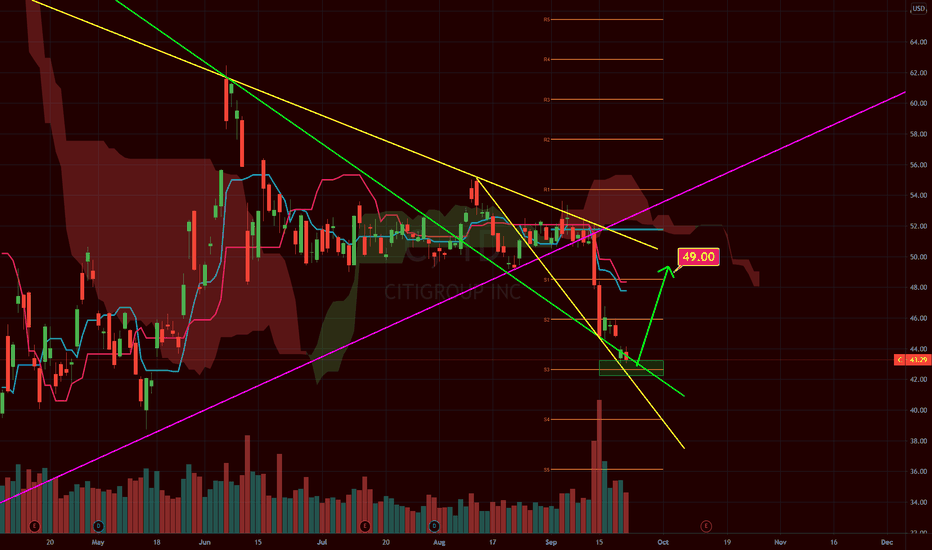

Citigroup Inc. ideas📈 NYSE:C LONG H4

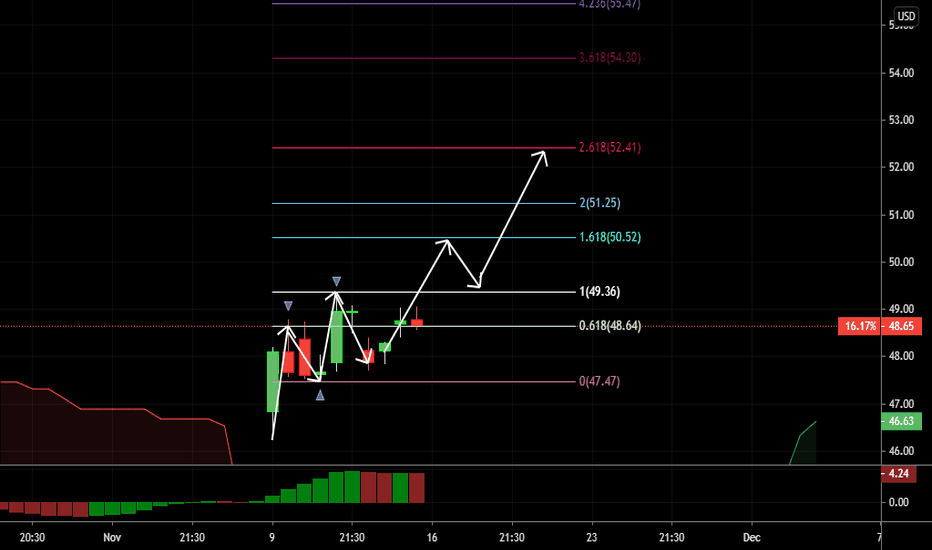

🛒BUY above = 44.12

🎯Target1 = 46.41

🎯Target2 = 47.83

🛑Trailing Stop loss = 40.45

❌Cancel trade and open reverse trade = 40.45

🙈Recommended risk = 1-2%

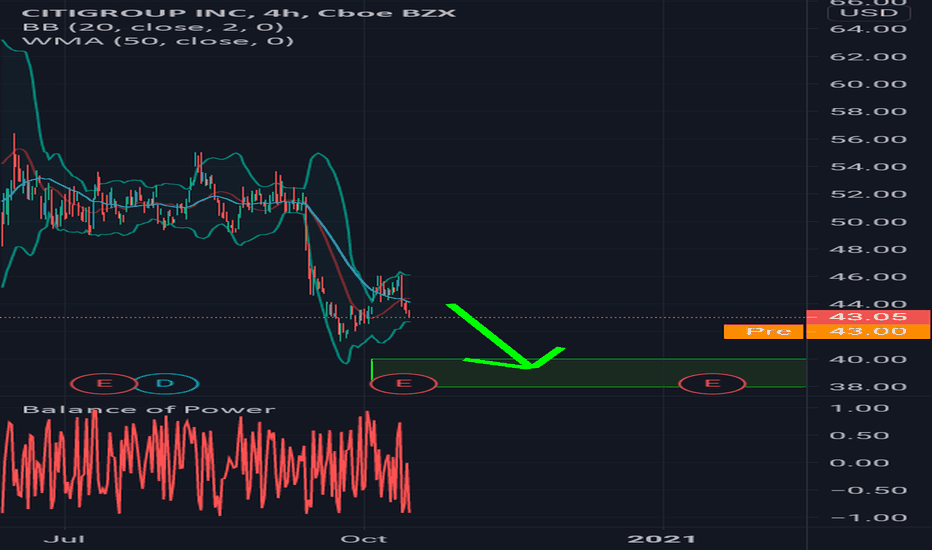

📉 NYSE:C SHORT H4

🛒SELL BELOW = 41.85

🎯Target1 = 40.45

🎯Target2 = 39.59

🎯Target3 = 38.20

🛑Trailing Stop loss = 44.12

❌Cancel trade and open reverse trade = 44.12

🙈Recommended risk = 2-3%

#C #Citigroup

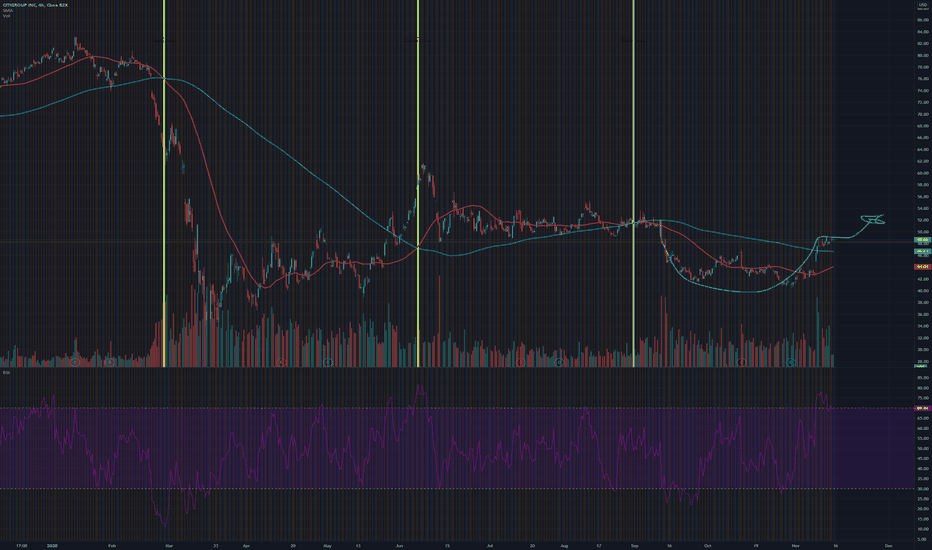

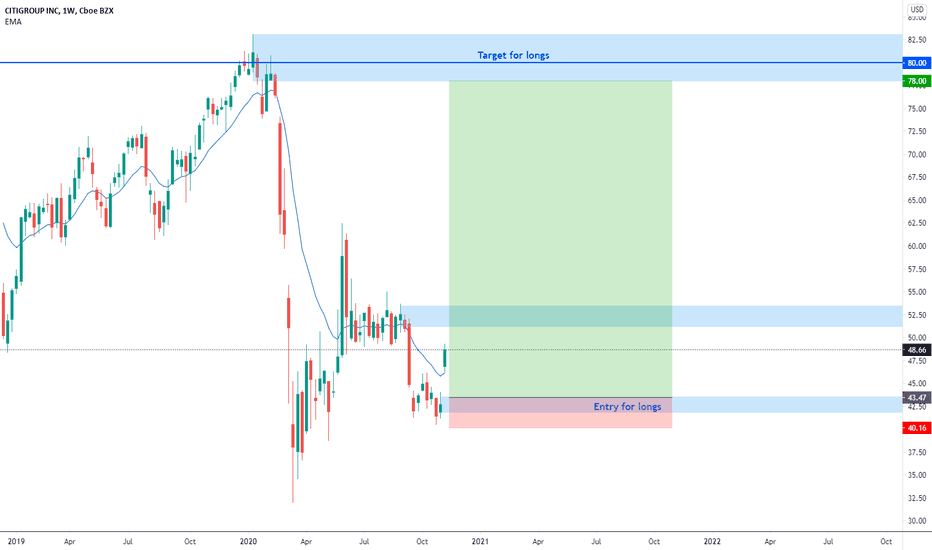

Despite recent fines and underperformanceDespite recent fines and underperformance Citi maybe be forming a potential bottom. Bank shares seem to be on the rise so there can be sector tailwinds for the name. Director Jay Jacobs has made the largest public stock purchase in over 5 years. Although the narrative on financials seems to be more positive we will let the model signal when to buy.