Key facts today

Meta Platforms settled an $8 billion trial over privacy violations and resolved a lawsuit linked to the Cambridge Analytica scandal, avoiding court testimonies from board members.

KeyBanc Capital has raised its price target for Meta Platforms (META) shares to $800.00 from $655.00 while maintaining an overweight rating.

Meta Platforms is scheduled to report its second-quarter earnings on July 30, 2025, marking a key date in the tech earnings calendar.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.4 EUR

60.24 B EUR

158.90 B EUR

2.17 B

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

FIGI

BBG007FH8HD0

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

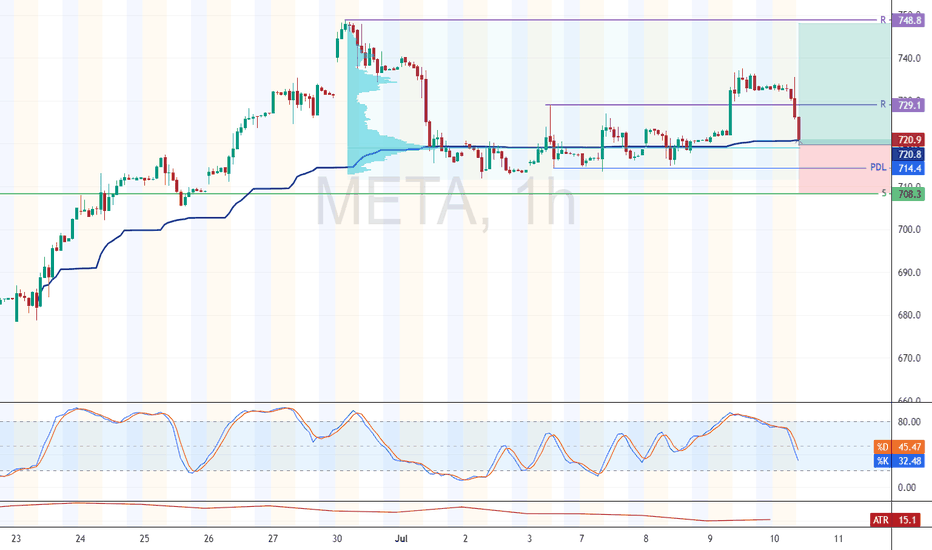

MetaSince the last post I made price has yet to make a new high. It has managed to chop in this area with a slight downward bias. If we're on the verge of the top of the indices, there is no reason to think Meta will continue higher much longer. This pattern, which is clearly corrective in nature, is wa

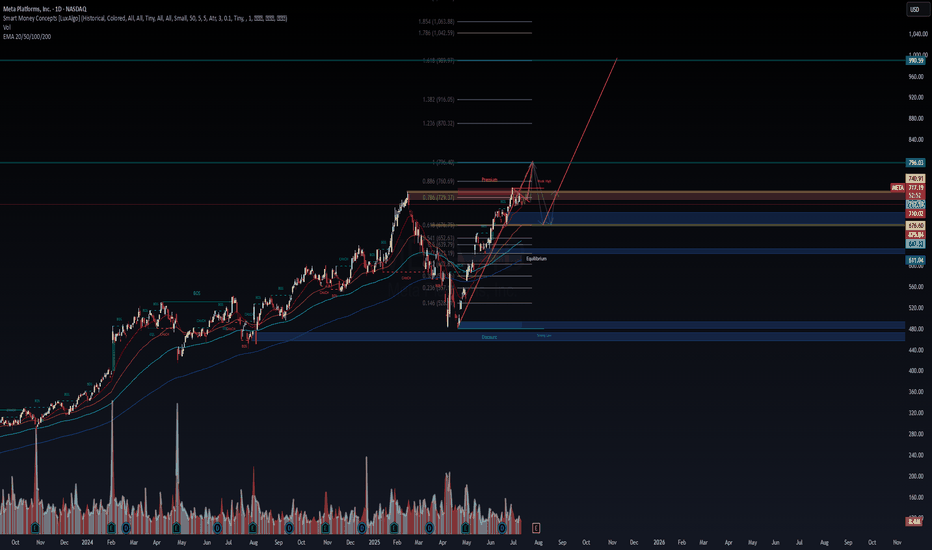

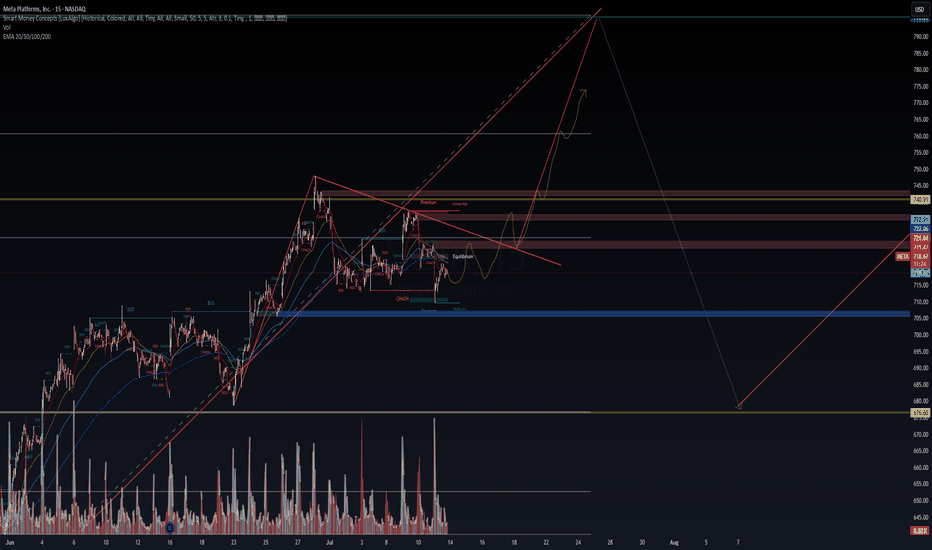

META (Meta Platforms Inc.) – Macro Compression Before Expansion META sits at a decisive macro juncture:

A clean SMC structure combined with Fibonacci premium zones signals an imminent directional expansion.

🧠 Macro Thesis:

Price is coiled just under 0.786–0.886 Premium Zone ($729–$760)

↳ This is a known trap area for retail liquidity – institutions often engine

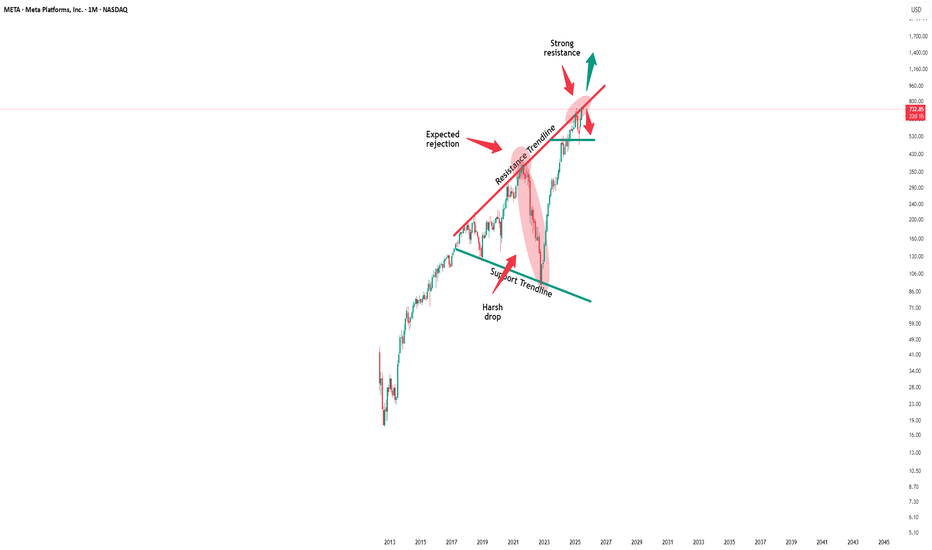

Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time wil

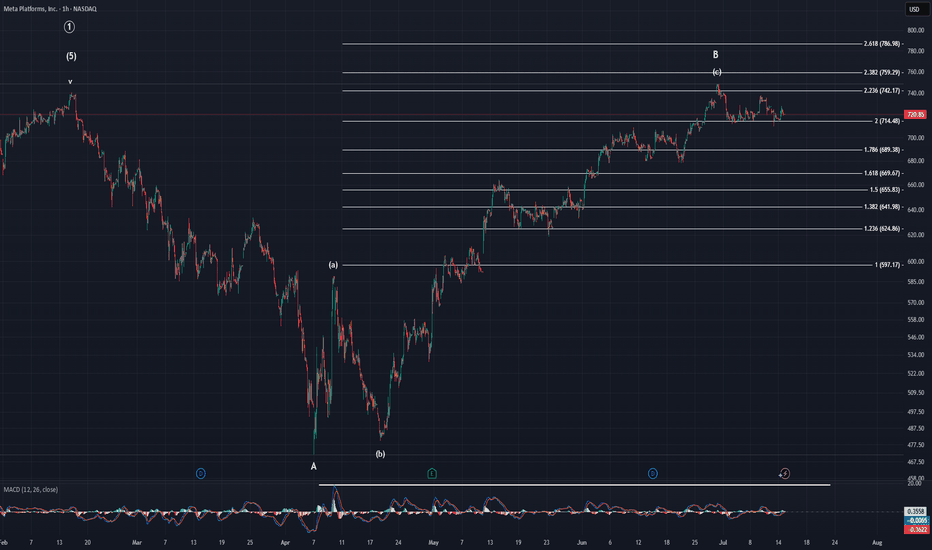

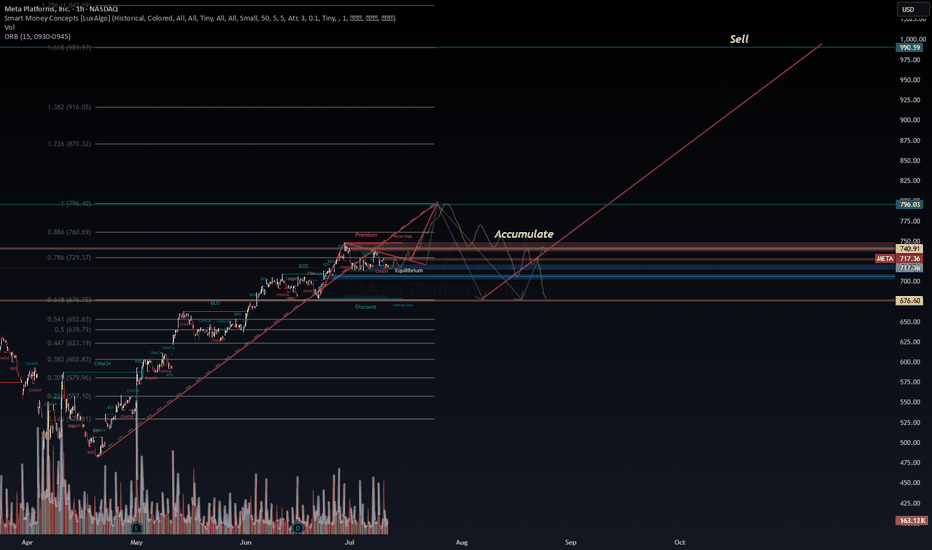

META | Accumulation Zone Identified — Road to $990?🧠 META | Accumulation Zone Identified — Road to $990?

📊 Ticker: META (Meta Platforms Inc.)

🕒 Timeframe: 1H

📍 Current Price: $717.36

📈 Bias: Bullish accumulation → Expansion

🔍 WaverVanir DSS Thesis

Our system has flagged a liquidity harvesting and accumulation phase between $676–$740. Institutional

META (Meta Platforms) – Battle at the Premium | WaverVanir Resea🚨 META is coiling at a critical inflection zone.

We're observing textbook Smart Money Concepts (SMC) behavior on both the daily and intraday timeframes:

🧠 Key Observations:

Price is hovering below the Premium Zone (0.786–0.886 Fibonacci: ~$729–$760) – a known liquidity trap.

15M structure shift s

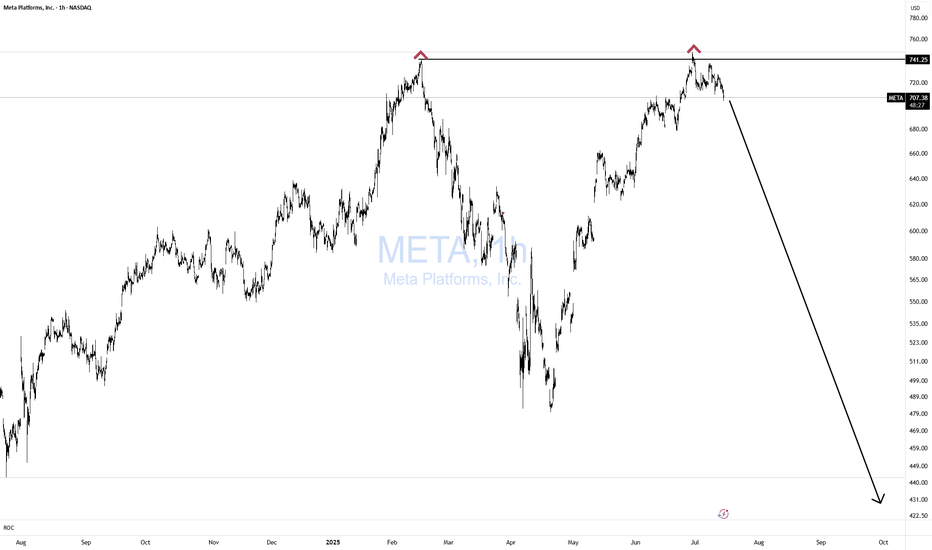

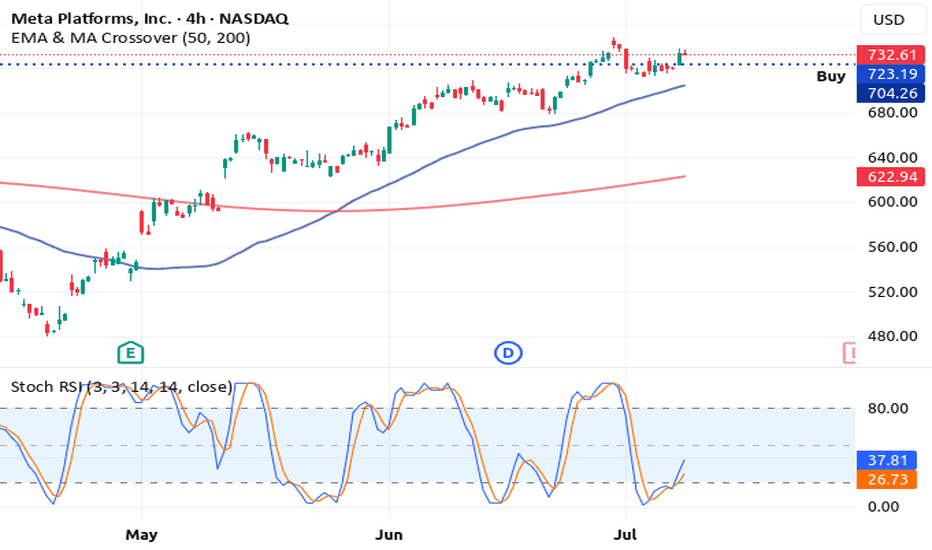

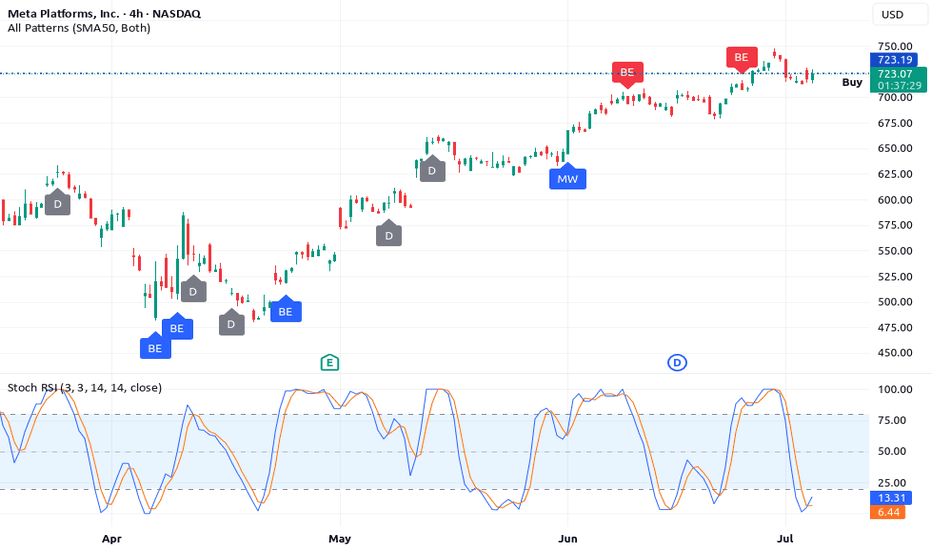

4H Chart: How Meta's Double Top Turned Into a Reversal Buy How Meta's Double Top Turned Into a Reversal Buy Signal on the 4H Chart

Meta Platforms Inc. (META) recently formed a classic double top pattern, which is often interpreted as a bearish reversal signal.

The price touched a key resistance level twice and then pulled back, triggering caution among

3 Reasons the Meta (META) Double Top Is a Buy Signal3 Reasons the Meta (META) Double Top Is a Buy Signal – Rocket Booster Strategy Explained

Meta Platforms Inc. (META) recently printed what looks like a double top pattern on the 4-hour chart.

Many traders are expecting a reversal. But from my perspective, this setup could actually be a trap for e

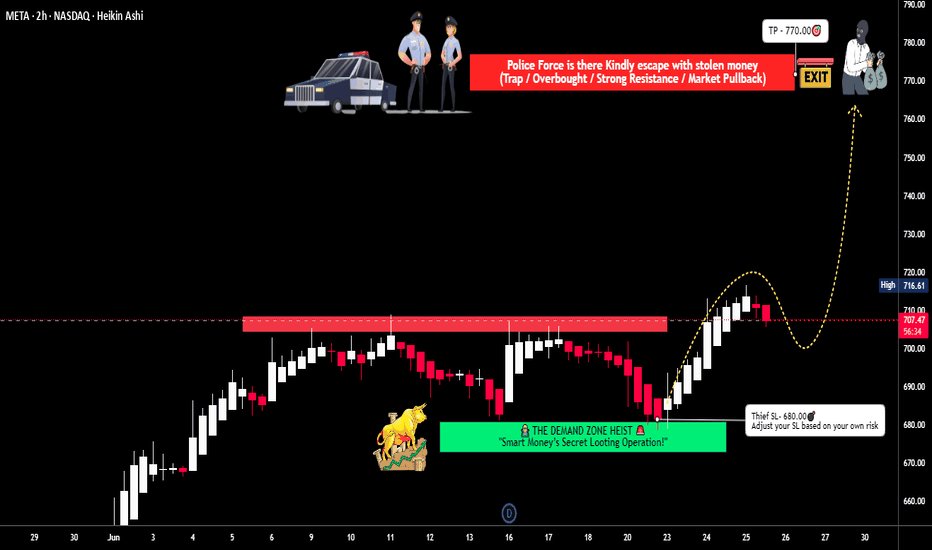

META Platforms Long Setup – Ready for the Next Move?💣 META Masterplan: Bullish Break-In Activated! 💼📈

🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Silent Strategists, 🤑💰💸✈️

We’ve locked in on our next high-value digital vault: META Platforms Inc.

Built on our signature Thief Trading Style™ — where fundamentals meet stealth technical precisio

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

META PLATF. 22/32 144AYield to maturity

15.49%

Maturity date

Aug 15, 2032

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.31%

Maturity date

Aug 15, 2062

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.27%

Maturity date

Aug 15, 2062

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.19%

Maturity date

Aug 15, 2052

FB5458293

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.11%

Maturity date

Aug 15, 2052

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

5.96%

Maturity date

Aug 15, 2064

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

5.88%

Maturity date

May 15, 2063

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.86%

Maturity date

Aug 15, 2054

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.82%

Maturity date

May 15, 2053

FB5458289

Meta Platforms, Inc. 3.5% 15-AUG-2027Yield to maturity

5.28%

Maturity date

Aug 15, 2027

FB5458291

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

5.23%

Maturity date

Aug 15, 2032

See all 4FB bonds

Curated watchlists where 4FB is featured.

Big software stocks: Red pill gains

9 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 4FB is 606.2 EUR — it has increased by 0.55% in the past 24 hours. Watch META PLATFORMS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on EUROTLX exchange META PLATFORMS stocks are traded under the ticker 4FB.

4FB stock has fallen by −2.59% compared to the previous week, the month change is a 0.98% rise, over the last year META PLATFORMS has showed a 37.99% increase.

We've gathered analysts' opinions on META PLATFORMS future price: according to them, 4FB price has a max estimate of 789.01 EUR and a min estimate of 451.23 EUR. Watch 4FB chart and read a more detailed META PLATFORMS stock forecast: see what analysts think of META PLATFORMS and suggest that you do with its stocks.

4FB stock is 2.56% volatile and has beta coefficient of 1.38. Track META PLATFORMS stock price on the chart and check out the list of the most volatile stocks — is META PLATFORMS there?

Today META PLATFORMS has the market capitalization of 1.52 T, it has decreased by −2.78% over the last week.

Yes, you can track META PLATFORMS financials in yearly and quarterly reports right on TradingView.

META PLATFORMS is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

4FB earnings for the last quarter are 5.94 EUR per share, whereas the estimation was 4.84 EUR resulting in a 22.83% surprise. The estimated earnings for the next quarter are 4.97 EUR per share. See more details about META PLATFORMS earnings.

META PLATFORMS revenue for the last quarter amounts to 39.11 B EUR, despite the estimated figure of 38.21 B EUR. In the next quarter, revenue is expected to reach 37.97 B EUR.

4FB net income for the last quarter is 15.38 B EUR, while the quarter before that showed 20.13 B EUR of net income which accounts for −23.57% change. Track more META PLATFORMS financial stats to get the full picture.

Yes, 4FB dividends are paid quarterly. The last dividend per share was 0.45 EUR. As of today, Dividend Yield (TTM)% is 0.29%. Tracking META PLATFORMS dividends might help you take more informed decisions.

META PLATFORMS dividend yield was 0.34% in 2024, and payout ratio reached 8.38%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 17, 2025, the company has 74.07 K employees. See our rating of the largest employees — is META PLATFORMS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. META PLATFORMS EBITDA is 82.53 B EUR, and current EBITDA margin is 51.83%. See more stats in META PLATFORMS financial statements.

Like other stocks, 4FB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade META PLATFORMS stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So META PLATFORMS technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating META PLATFORMS stock shows the buy signal. See more of META PLATFORMS technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.