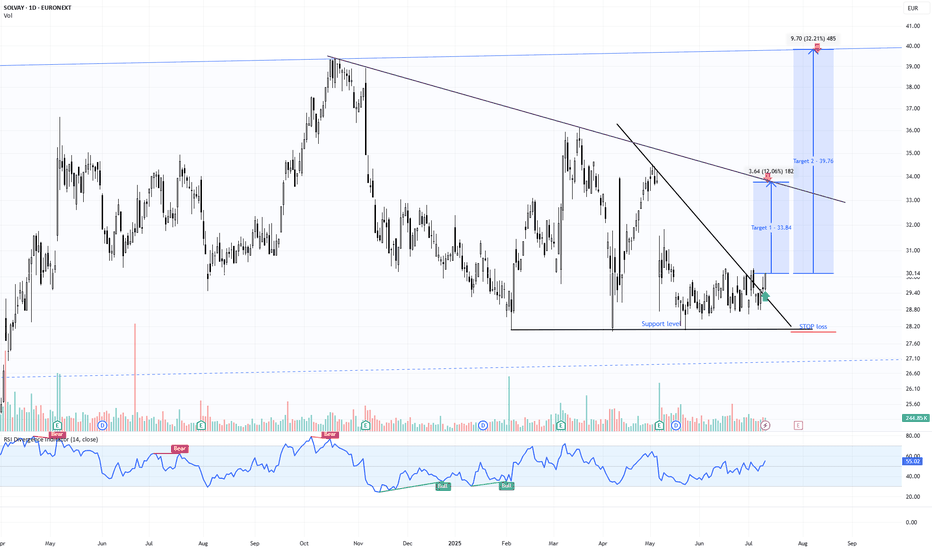

SOLB | Confirmed Descending Triangle Breakout – 32% Target📍 Ticker:

SOLB (Solvay SA – Euronext Brussels)

📆 Timeframe: 1D (Daily)

📉 Price: €30.14

📈 Pattern: Descending triangle breakout confirmed on daily close

📊 Breakout Probability estimation: ~73% (short-term triangle breakout upward)

🔍 Technical Setup (Updated on Daily Chart):

Solvay has now confirmed the breakout on the daily timeframe, closing above both the horizontal support and the descending trendline. This marks a multi-timeframe confluence breakout, increasing confidence in the projected move toward upper resistance levels.

✅ Daily candle close above descending resistance

✅ RSI breakout above 55, building momentum

📉 Stop clearly defined under €27.90 → optimal risk profile

📊 Volume expanding, validating move

🧠 Updated Trade Plan:

📥 Entry Zone: €29.90–€30.50 (daily confirmation)

⛔ Stop-Loss: Below €27.90

🔁 Hold while structure remains above descending trendline support

🎯 Upside Targets & Potential Return (from €30.14)

🎯 Target Price Return

Target 1 €33.84 +12.06%

Target 2 €39.76 +32.21%

📊 Pattern Probability – Daily Structure:

📐 Pattern: Descending Triangle Breakout

🔺 Upward breakout probability: ~73%

🎯 Full measured move supports Target 2 if buyers remain active

⚠️ Technical Signals to Watch:

🔎 Retest of descending line on lower volume = strong

✅ RSI > 55 with bullish structure

📈 Rising volume → growing institutional interest

📊 Price reclaiming structure from broader daily consolidation

💬 Solvay is transitioning from a textbook 4H breakout to a multi-day continuation setup. The alignment of pattern, structure, and momentum makes this one of the cleaner swing setups on the European market right now.

🔔 Follow @TargetTraders for high-probability technical trades.

#SOLB #BreakoutSetup #DescendingTriangle #TechnicalPattern #SwingTrade #Euronext #TargetTraders #VolumeBreakout #ChartAnalysis

4SOLBM trade ideas

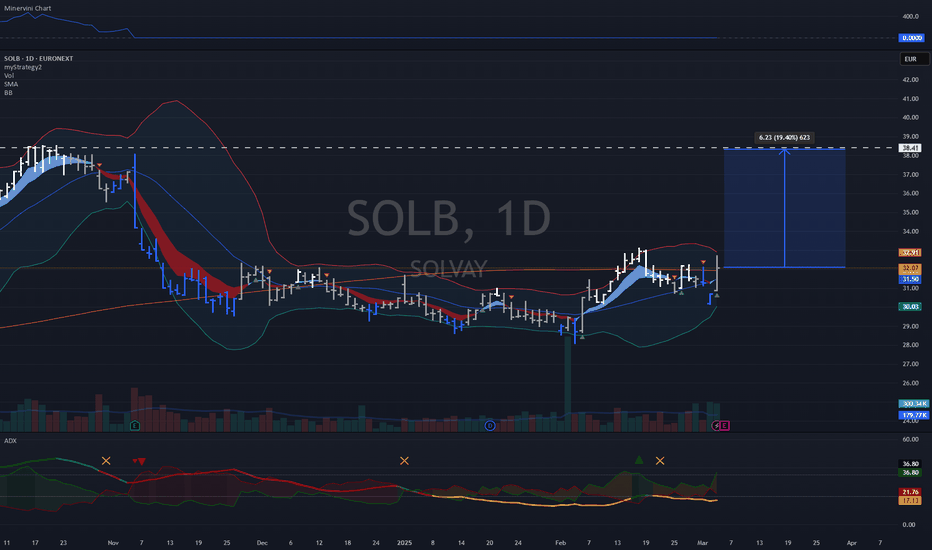

SOLB | Descending Triangle Breakout – Targeting +34% MoveTicker: EURONEXT:SOLB (Solvay SA – Euronext Brussels)

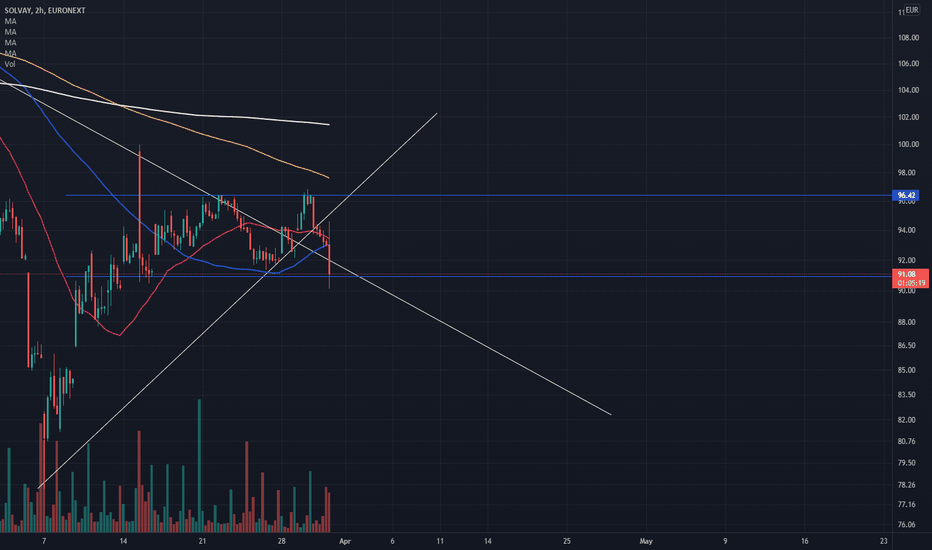

📆 Timeframe: 4H (4-hour)

📉 Price: €31.58

📈 Pattern: Descending triangle breakout from horizontal support

📊 Breakout Probability : ~73% upward breakout (short-term triangle)

🔍 Technical Setup:

SOLB has successfully broken above a descending resistance line, bouncing off a solid horizontal support level near €28.00. This forms a bullish descending triangle breakout – a structure that historically resolves upward in short- to mid-term timeframes.

✅ Confirmed breakout from descending triangle

🟢 RSI pushing above 56 = bullish short-term momentum

📉 Defined support below = favorable risk/reward

🧠 Trade Plan:

📥 Entry Zone: €31.40–€31.70 (post-breakout confirmation)

⛔ Stop-Loss: Below €27.90 (under support base and triangle invalidation)

🎯 Upside Targets & ROIC (from €31.58):

Target Price Return

🎯 Target 1 €33.84 +7.15%

🎯 Target 2 €39.76 +25.9%

📊 Pattern Probability – Based on Bulkowski:

📐 Pattern: Descending Triangle (short-term breakout)

🔺 Upward breakout probability: ~73%

💹 Measured move confirms Target 2 if volume remains elevated

⚠️ Technical Signals to Watch:

🔎 Strong green candle breaking the triangle → initial confirmation

✅ RSI breakout with no bearish divergence = supports continuation

📈 Volume spike = buyer interest returning

💬 Solvay’s breakout is a classic textbook move off strong horizontal support.

This is a high-probability swing setup with tight risk and excellent upside potential.

#SOLB #BreakoutSetup #DescendingTriangle #TechnicalPattern #SwingTrade #TargetTraders

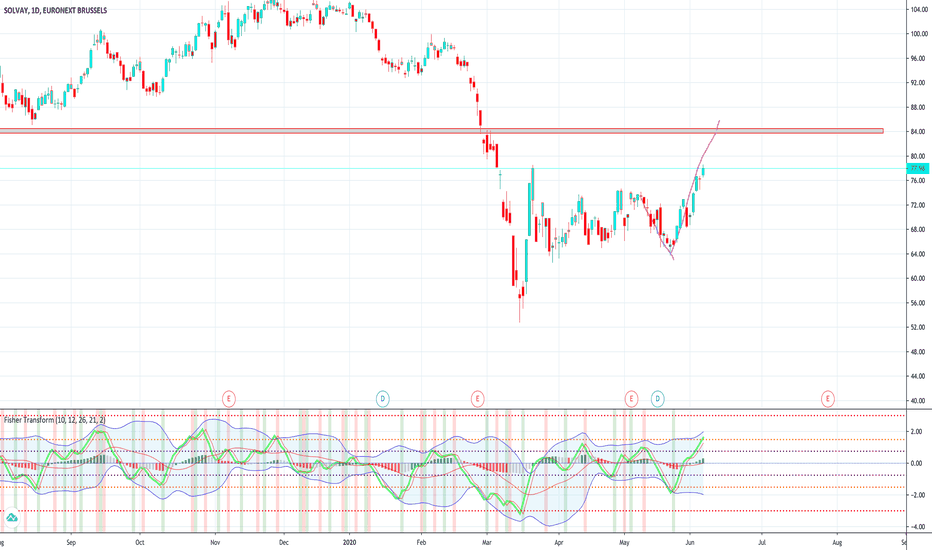

Solvay Europe Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

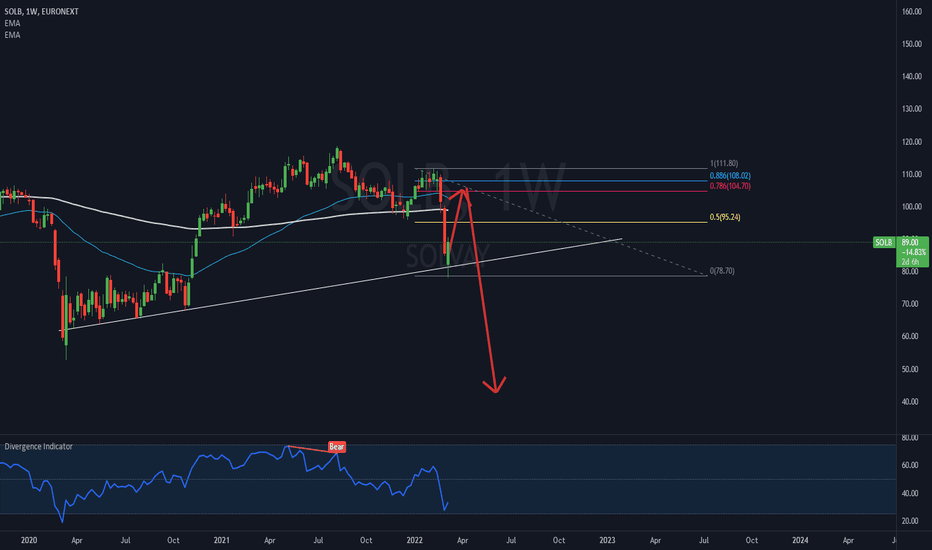

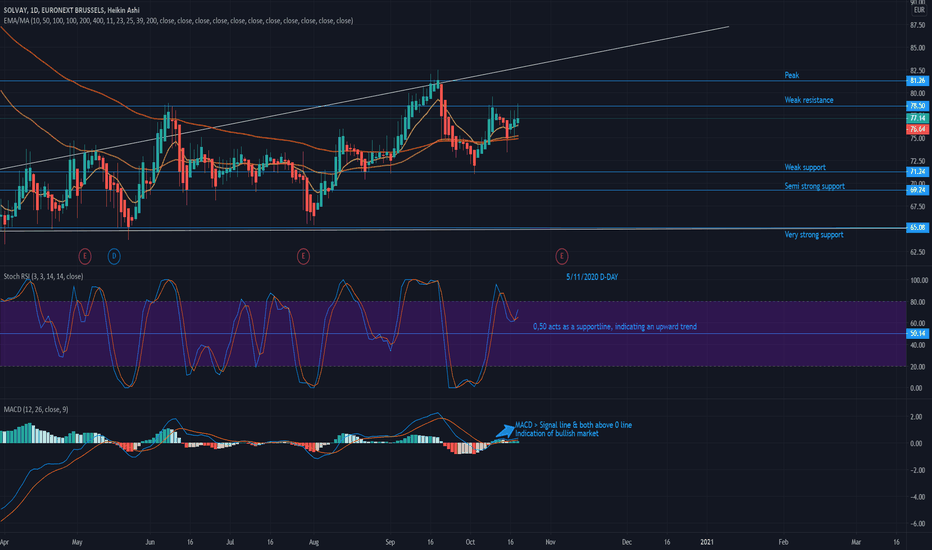

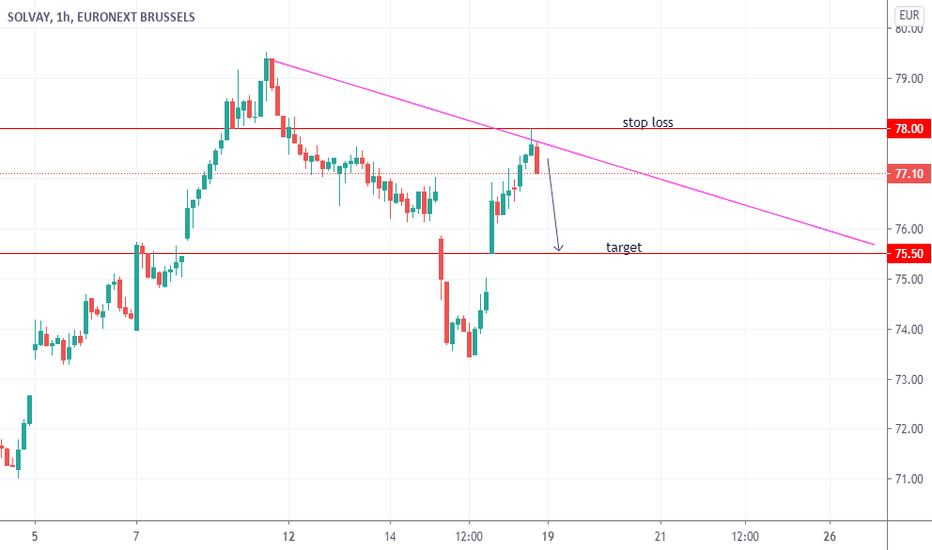

Hold Solvay-Weak bullish trendline

-Current price close to resistance level (€78 & €82).

Considering uncertainties regarding financial releases Q3 (05/11) and the impact of COVID (most likely limited) on the financials I would hold Solvay.

=> Will it break resistances after financial releases?

To revisit per 05/11.