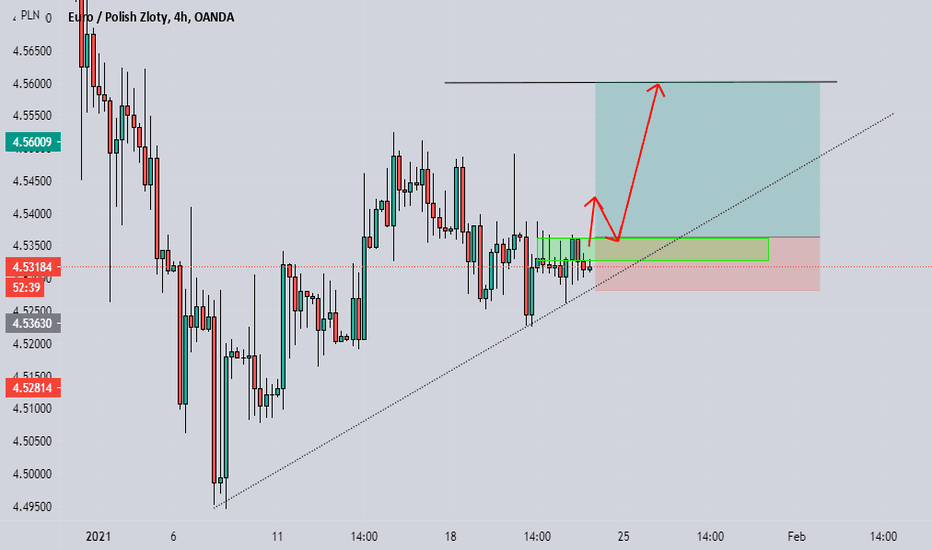

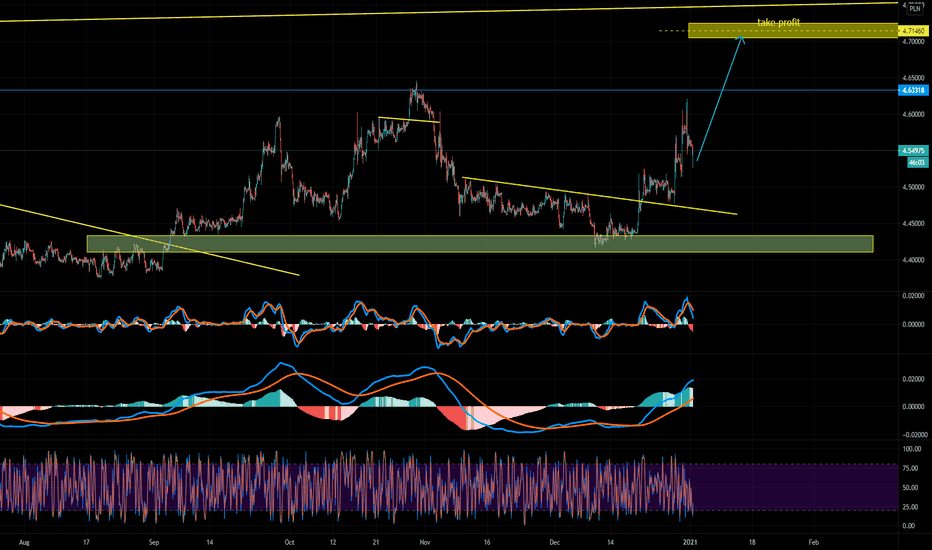

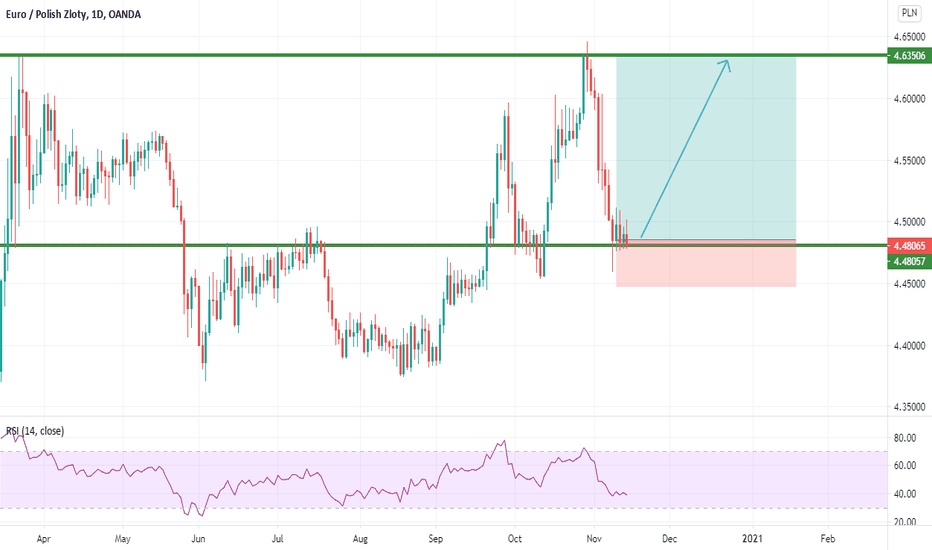

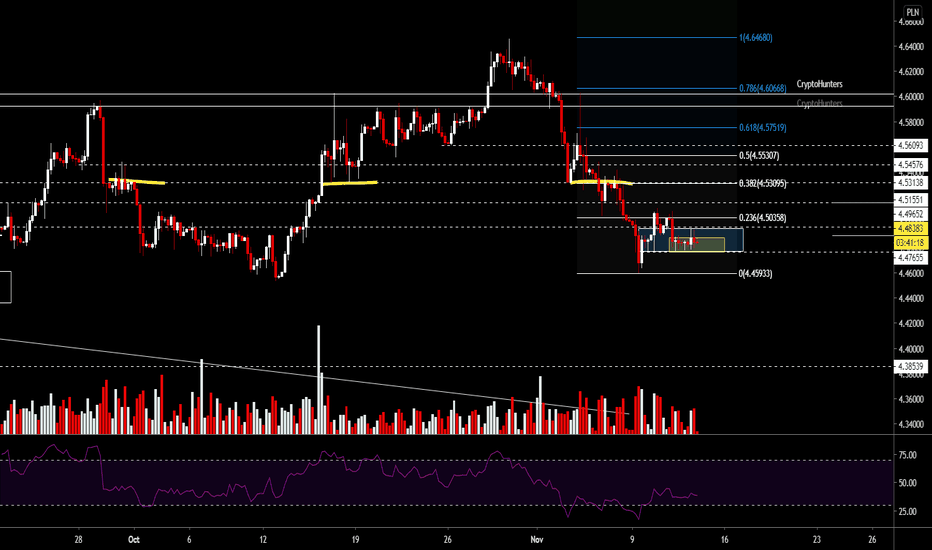

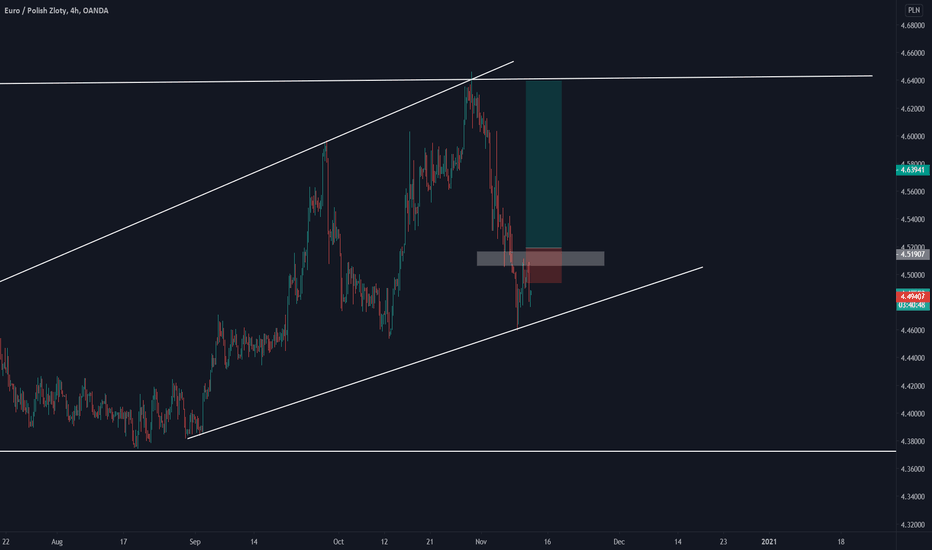

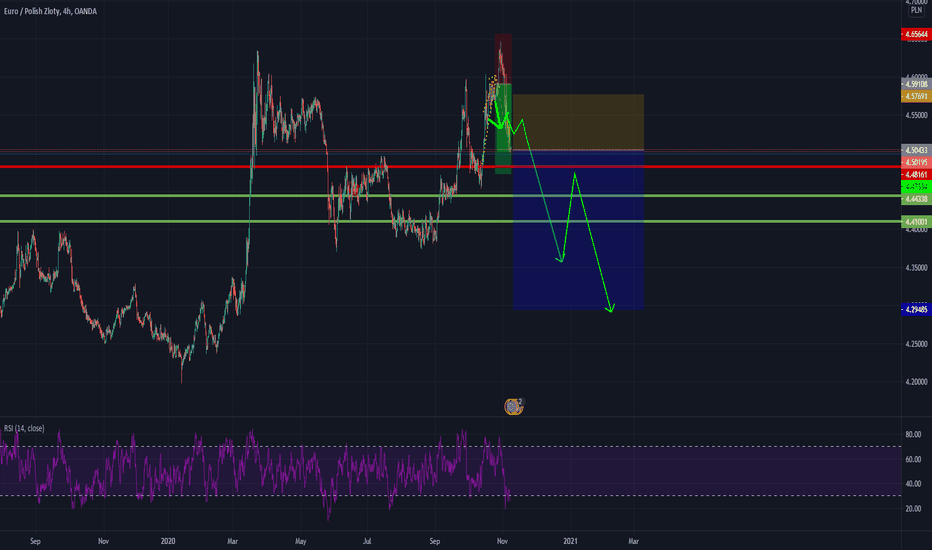

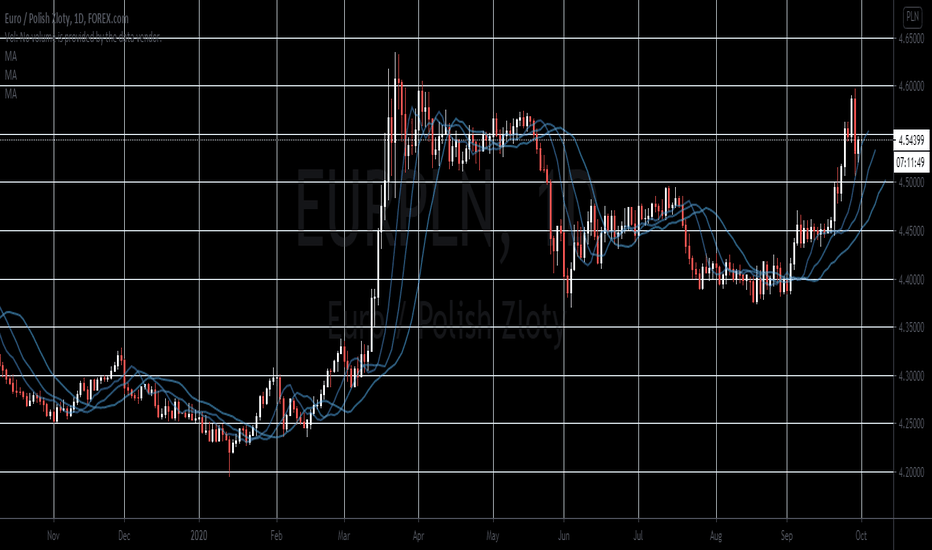

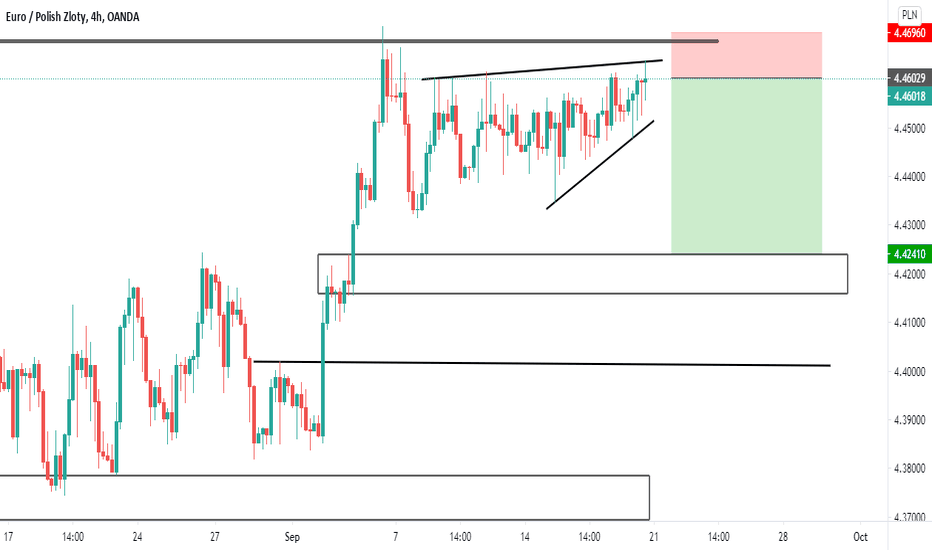

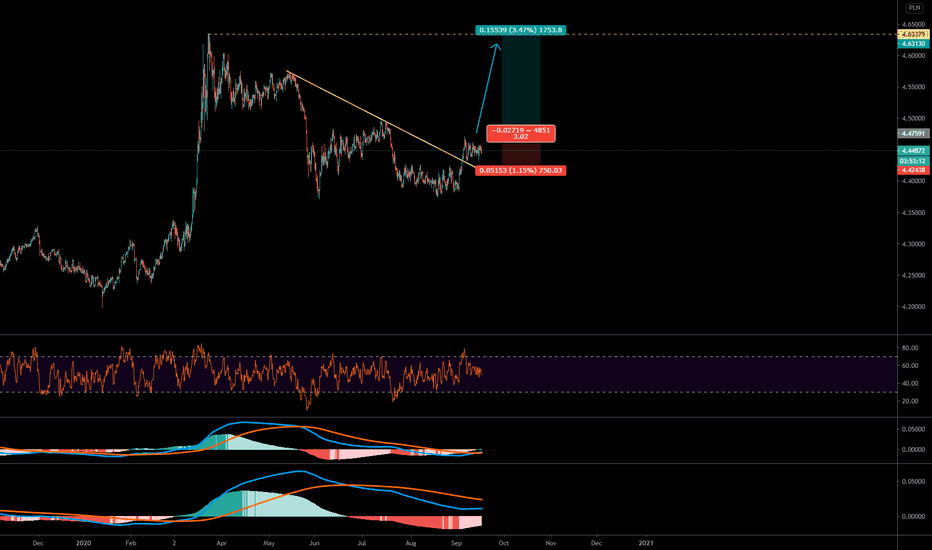

EURPLN long setup.On the weekly timefame market is in a uptrend and last weeks cande closed with a stong bullish candle were the next one should fill in the wick, on the daily market is also in a nice uptrend and recently broke above resistance with a bullish impulse followed by a nice correction to the 0.382 fibonacci, now we are expecting to see a second impulse and market to form a new higher high from a daily perspective and fill in the wick from a weekly perspective.On the 4hr we are waiting for a break above the previous high so a new higher high to form then on the retest we can look for entries.

EURPLN trade ideas

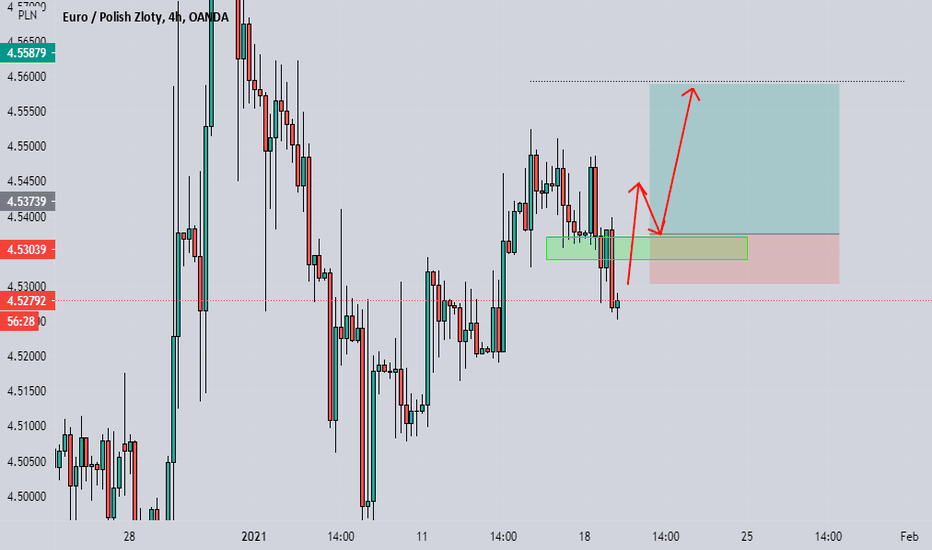

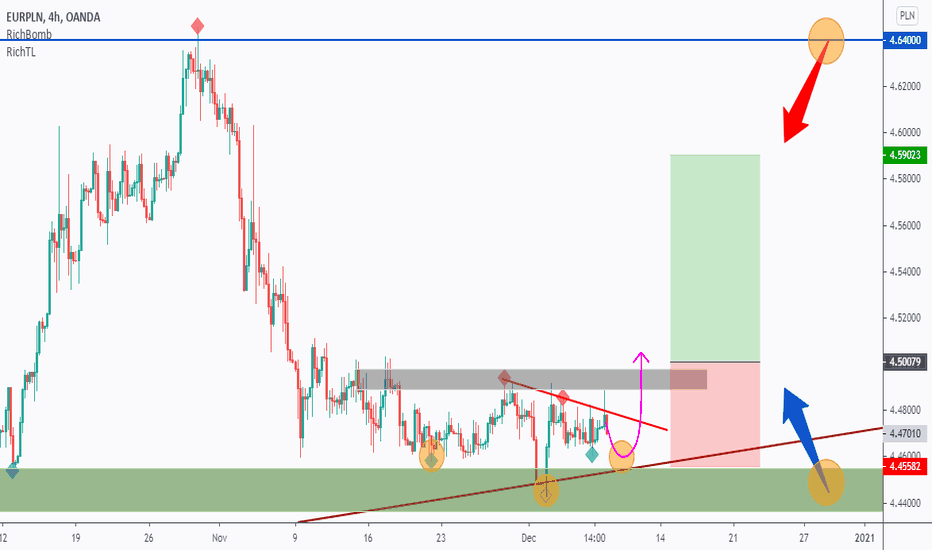

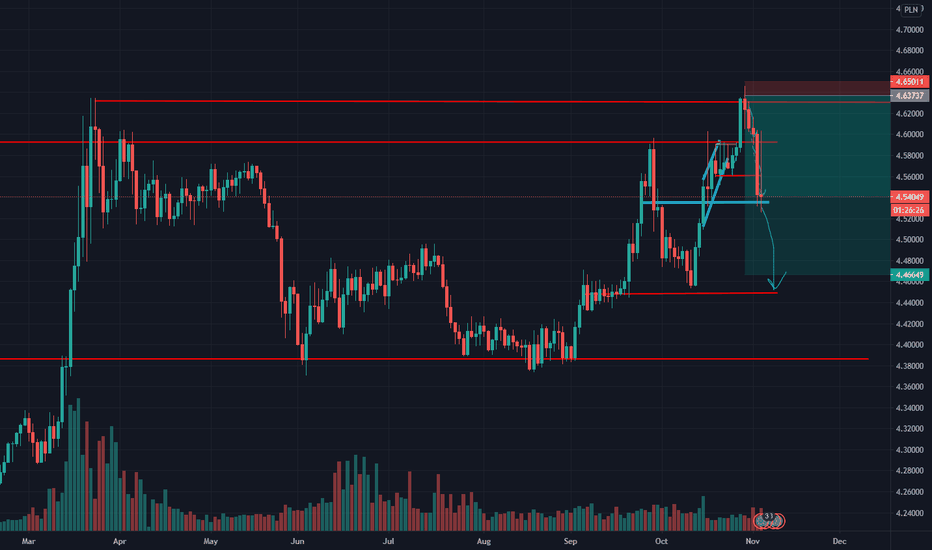

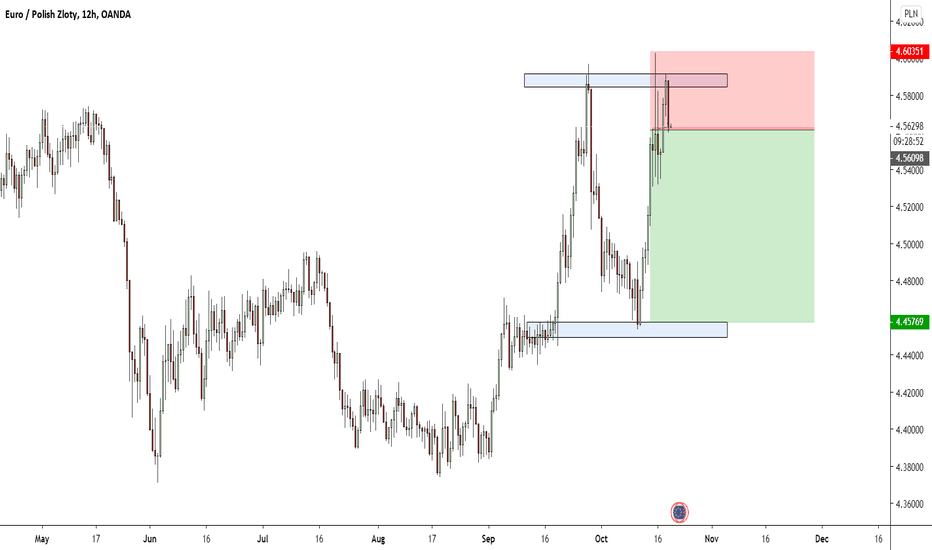

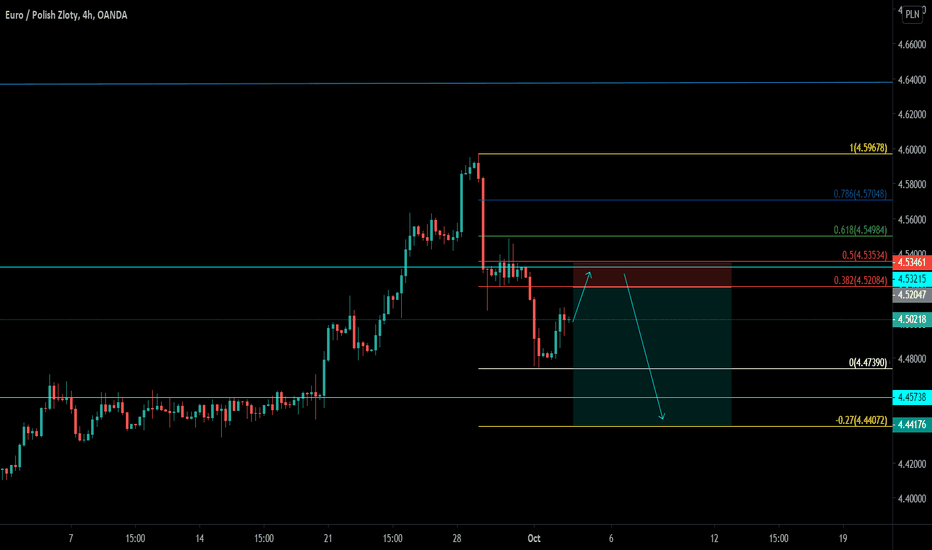

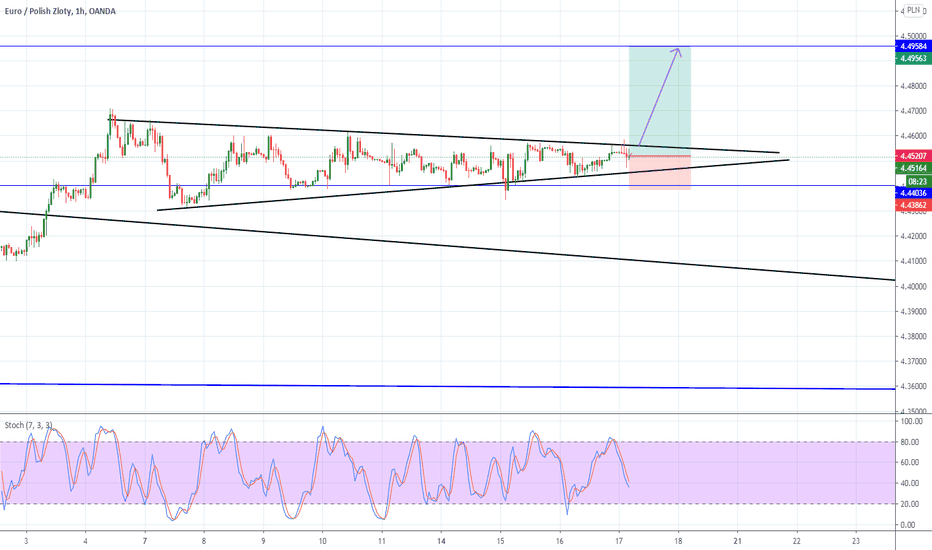

EURPLN possible long.On higher TF market is bullish, on the daily market has broke above daily structure with a bullish impulse, followed by a correction to the 0.382 fibonacci which is also aliging with structure, now i am expecting the continuation to the upside and market to form a higher high from a daily perspective, on the 4hr market is still bearish during the correction, i am waiting for a break back above resistance so a new higher high to form on the 4hr then on the retest if all rules are satisfied we will be taking a nice long.

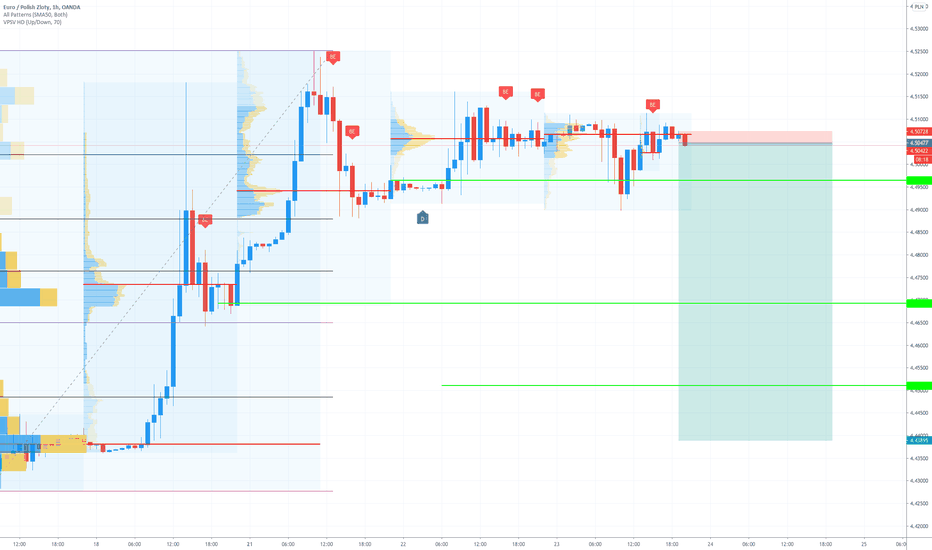

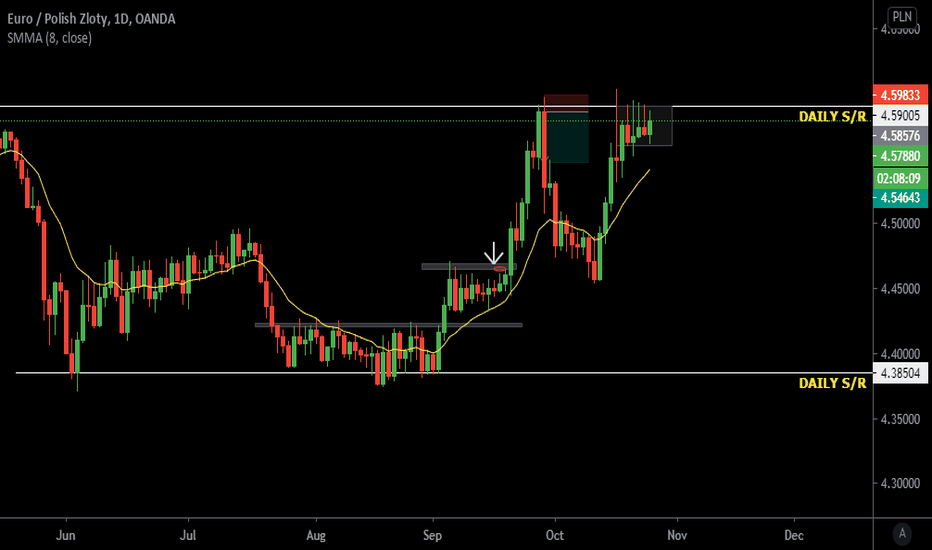

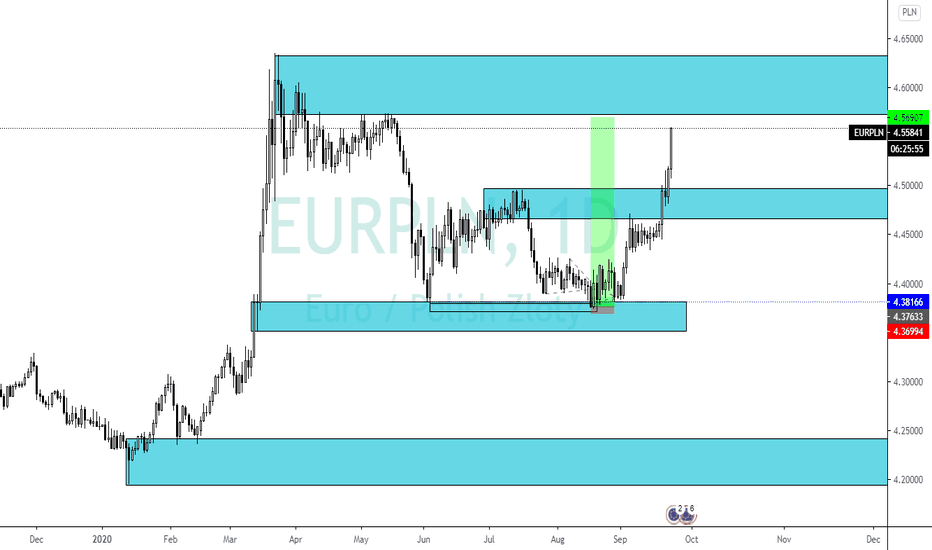

Germany’s retail sales MoM reportThe pair failed to break out from a major resistance line, sending the pair lower towards a major support line. Germany’s retail sales MoM report recorded its second-highest monthly growth since July 2011. However, this optimism quickly turned into pessimism as the country’s year-over-year result for the report recorded a 3.1% improvement. This represents the second consecutive decline for the report, which contradicts the MoM report for the month of August. While western Europe’s economy remains uncertain with its future, eastern Europe led by Poland is on the rise. A recent report showed the country shrinking by less than 3.0% this year. Analysts also see a strong rebound for the economy in 2021. A major catalyst for this was the country’s strict tax collection. Moreover, the recently passed 2021 budget for Poland includes a budget deficit of up to 4.6% to help businesses and individuals to cope up with the economic impact of COVID-19.