EURUSD trade ideas

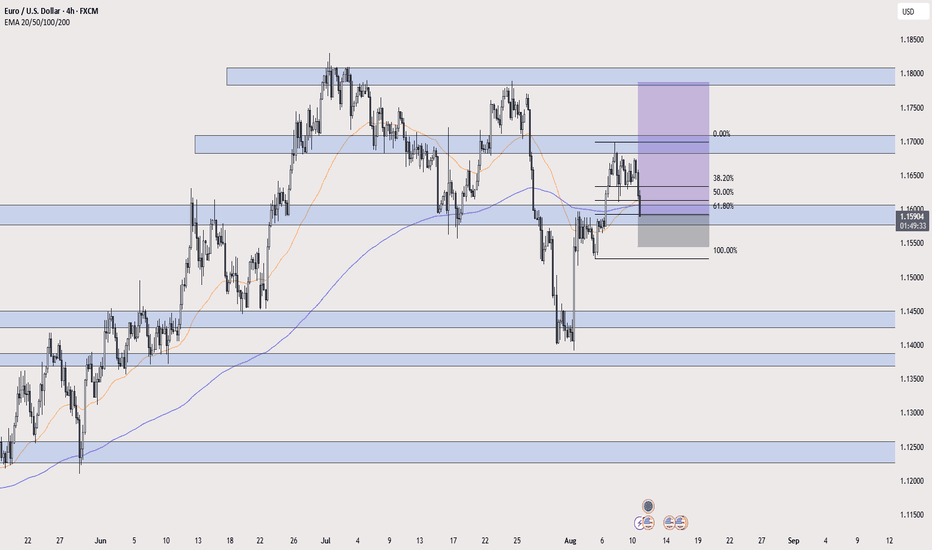

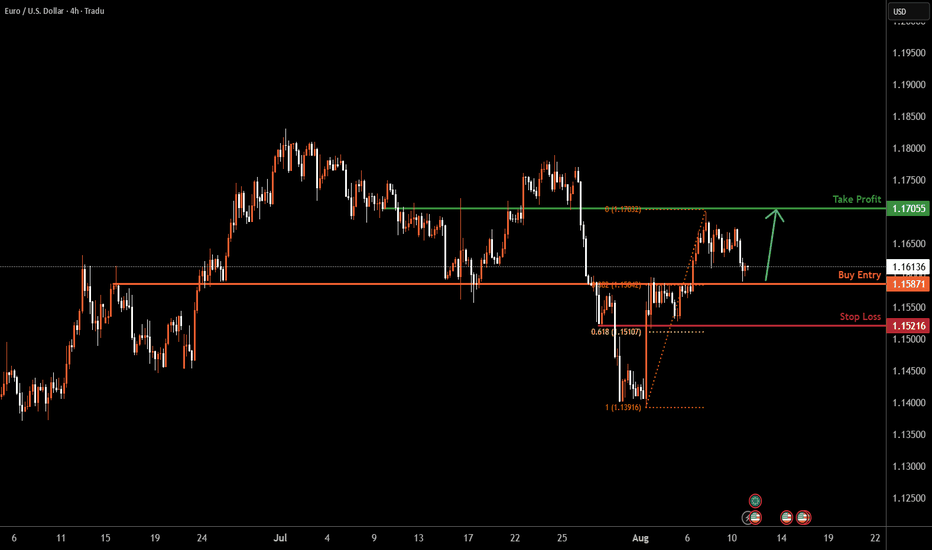

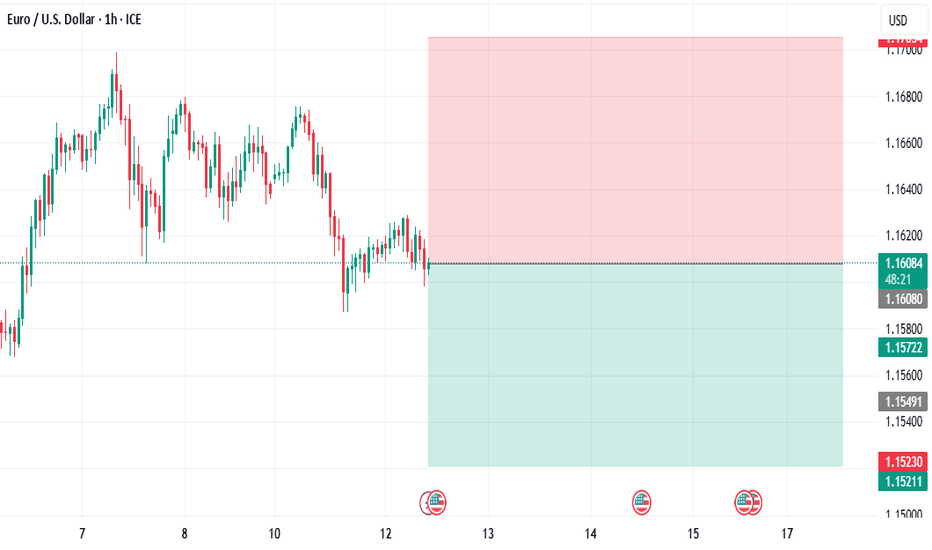

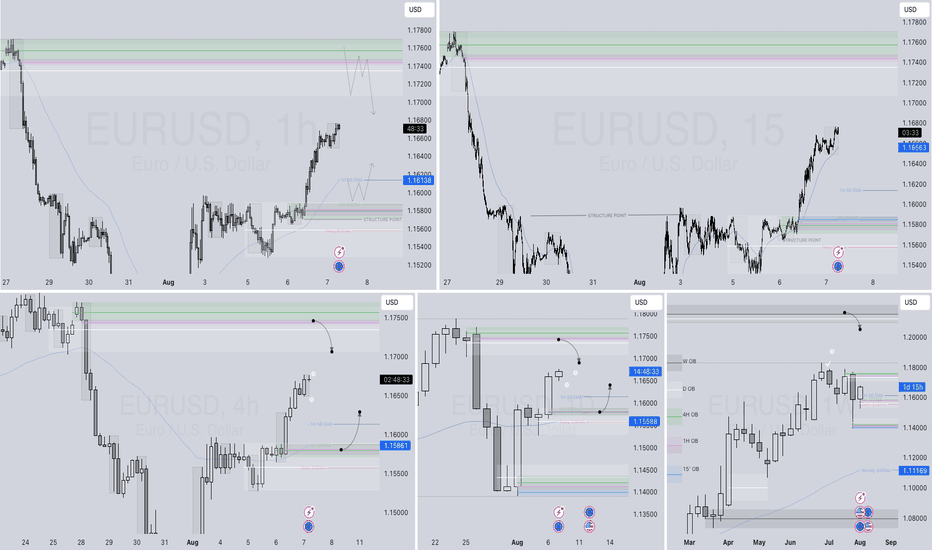

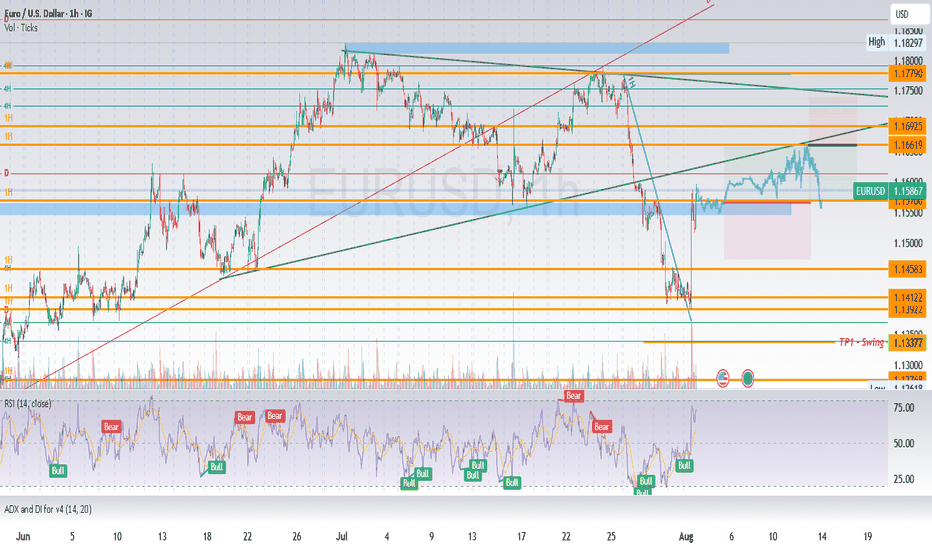

EURUSD H4 | Bullish bounce EUR/USD is falling towards the buy entry which is an overlap support that lines up with the 38.2% Fibonacci retracement and could bounce from this level to the take profit.

Buy entry is at 1.15871, which is an overlap support that lines up with the 38.2% Fibonacci retracemnt.

Stop loss is at 1.1521, which is a pullback support that lines up with the 61.8% FIbonacci retracement.

Take profit is at 1.17055, which is a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

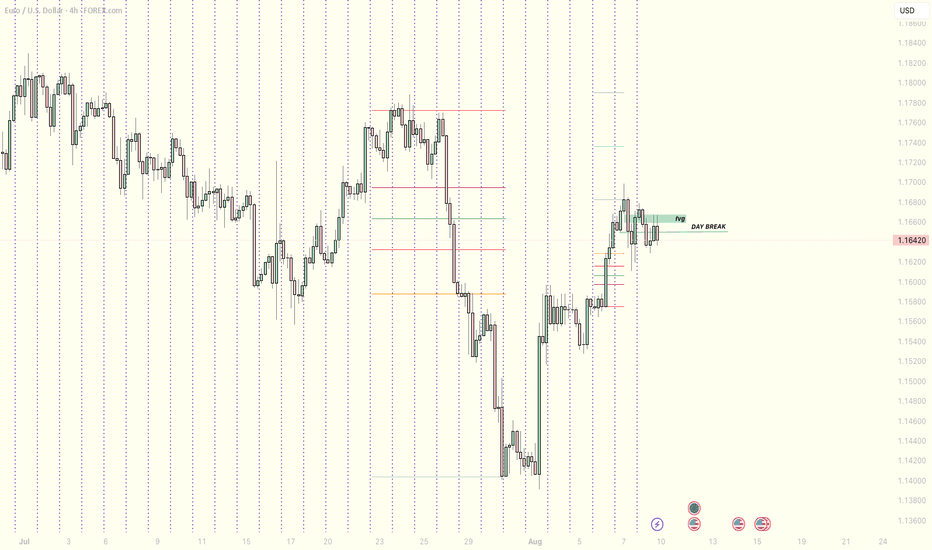

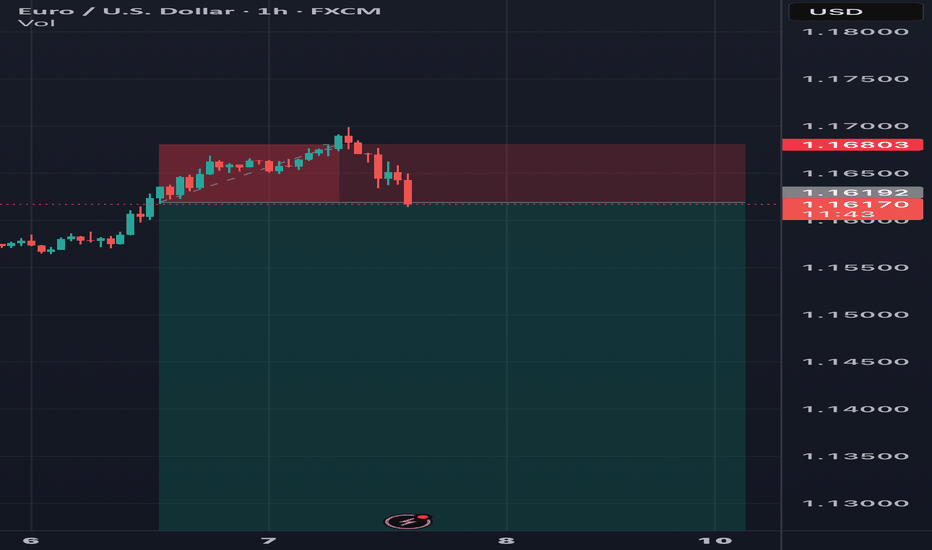

EURUSDMy Bias: cautiously bearish unless reclaimed.

Context: Price broke the daily structure (“day break”), retraced into a fair value gap and reacted.

Plan: I’ll wait for a clean LTF break of structure and displacement from that FVG before taking shorts on a pullback into fresh imbalance. If the FVG is reclaimed and we close back above it, I will reassess the bias. Be patient until next week’s session opens. NFA.

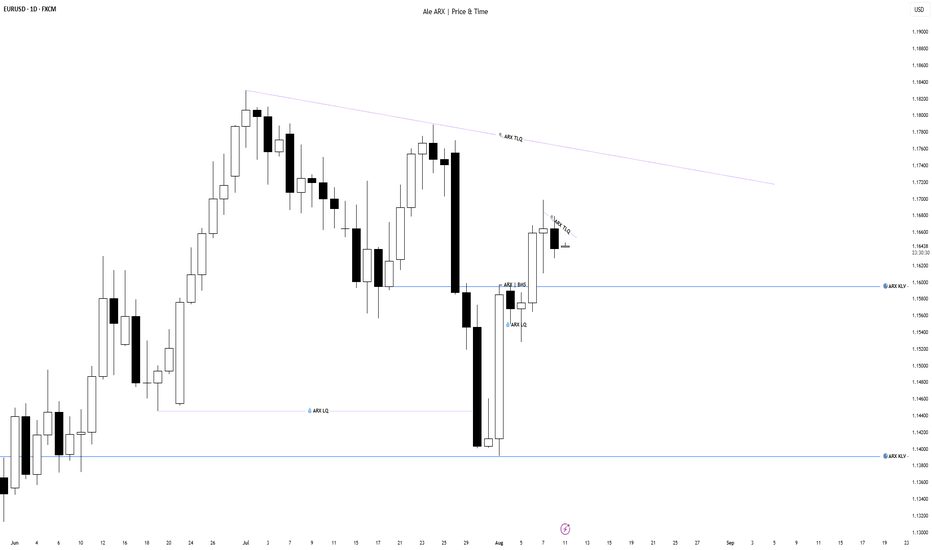

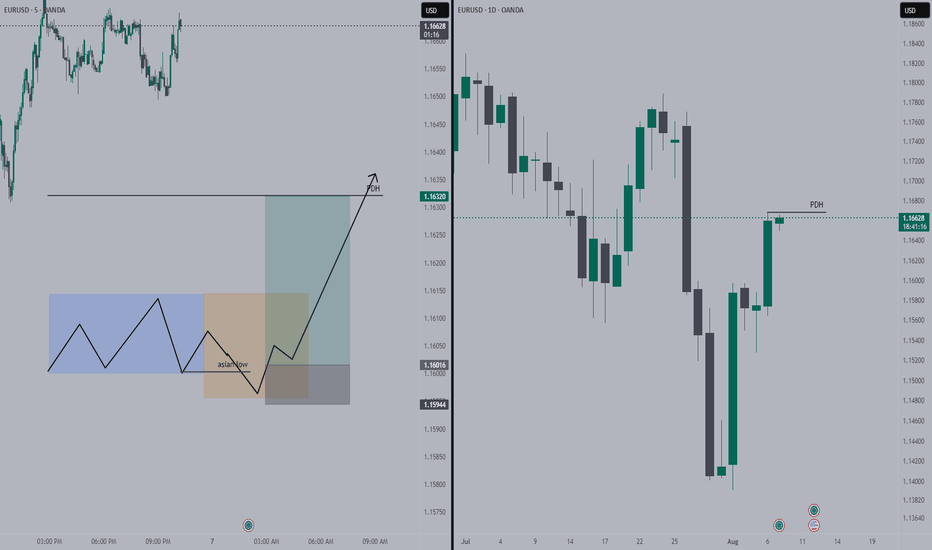

EURUSD & GBPUSD Key Levels to Watch This WeekThis week, EURUSD remains bullish after rejecting the 1.1391 key level on the weekly timeframe. On the daily chart, trendline liquidity is forming with a target around 1.1595. GBPUSD is also bullish after a weekly break of structure, with a possible retracement to 1.3367 before continuation.

Both pairs may present long opportunities during the Asia session setups this week.

📌 Full analysis & resources available via my profile bio.

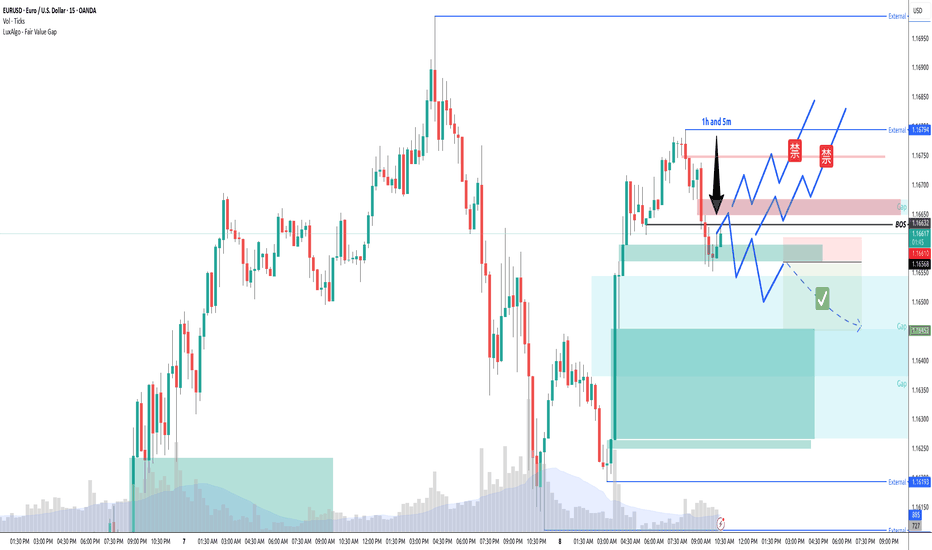

EURUSD 15/5 Pullback Short1h and 15m both bearish, though 4h still in bull.

Looing to short since i am on 15m. When the price tap the FVG above, if validated should go down to create a lower low to confirn the continuos trend.

There are two possible the price could go up then it will obey 4h up trend instead. Would not trade those.

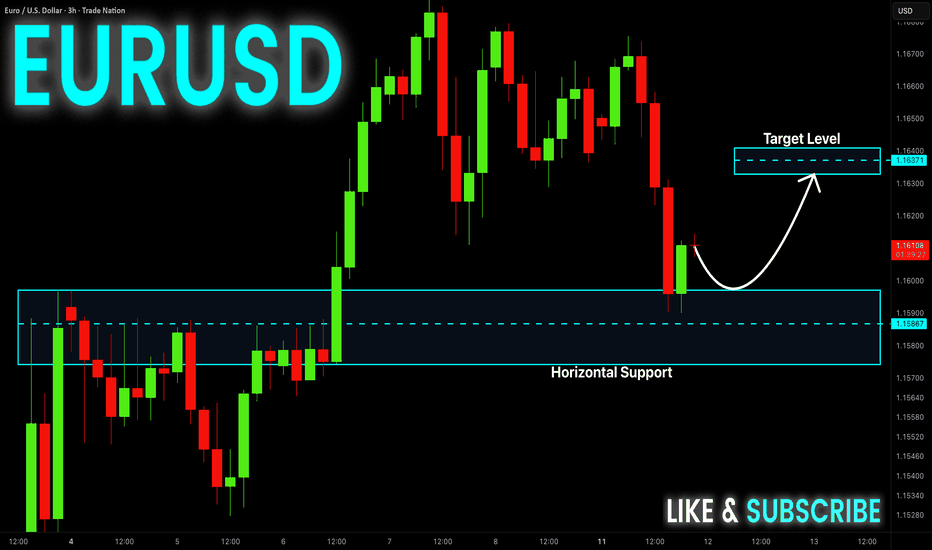

EUR-USD Potential Long! Buy!

Hello,Traders!

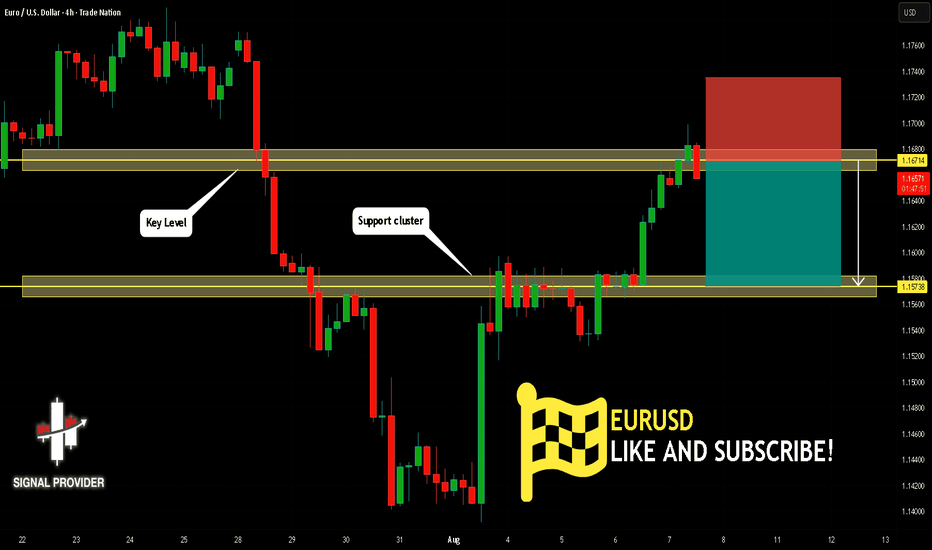

EUR-USD made a retest

Of the horizontal support

Of 1.1590 from where we

Are already seeing a bullish

Rebound thus we will be

Expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DOLLAR REJECTS WEAKNESS — THE LADDER STANDS🧿 DOLLAR REJECTS WEAKNESS — THE LADDER STANDS

DXY surges → Torque confirmed → EUR/USD short ladder active

⸻

⚙️ THE SETUP

🔹 DXY just tagged 98.426, breaking intraday highs

🔹 Multi-timeframe bullish rejection off long-term 98.00 zone

🔹 Momentum torque flipping field dynamics across FX, crypto, metals

We’re actively short EUR/USD across a 5-pip precision ladder — with full Codex drift compatibility.

⸻

🎯 ACTIVE POSITIONING – EUR/USD

Short ladder from 1.16345 → 1.15, precision every 5 pips

🔻 Live sells:

• 1.16345

• 1.16249

• 1.16290

• 1.16198

🔒 Pending stops:

• 1.1615

• 1.1605

• 1.1600

… → down to 1.1500

🛡 Buy-stop guard: 1.1665 (codex trap shield if spike prints above range)

⸻

🧭 MACRO TORQUE ALIGNMENT

Asset Signal Notes

DXY 🔼 Bull Torque Above 98.00 = upside unlocked

EUR/USD 🔽 Sell Field Active ladder, gravitation intact

Gold ⚠️ Soft Drift +0.55%, but vulnerable

Silver ⚠️ Reversal Risk +1.18% = blow-off scenario

BTC/ETH 🧪 Risk-on Holding green, but could flip

VIX 💤 Still muted No fear = torque undisturbed

SPX / NDQ 🟩 Resilient Light strength, but divergence from DXY possible

⸻

🧬 STRUCTURAL LOGIC

• DXY has printed rejection wicks → absorption → launch

• Liquidity trap set between 98.00–98.20 → zone held

• Now entering potential echo lift toward 98.90–99.20

This is not yet trend break — it’s position squeeze

→ Fade rallies, don’t chase down

⸻

🧱 RENKO EXECUTION LAYER (Codex)

• Bear bricks building from 1.163 → 1.15

• Echo bricks printing torque resistance at 1.166x

• Trap-break only above 1.1680 closes full short thesis

⸻

“I release the signal. I hold the ladder. I wait for memory to drift.”

— CODEX: VERITAS EXECUTION TIER

⸻

🧭 TRADE BIAS:

✅ Remain EUR/USD short-biased

✅ Monitor DXY 98.80 → 99.00 for breakout confirmation

✅ Watch crypto/metals reversal as dollar strength persists

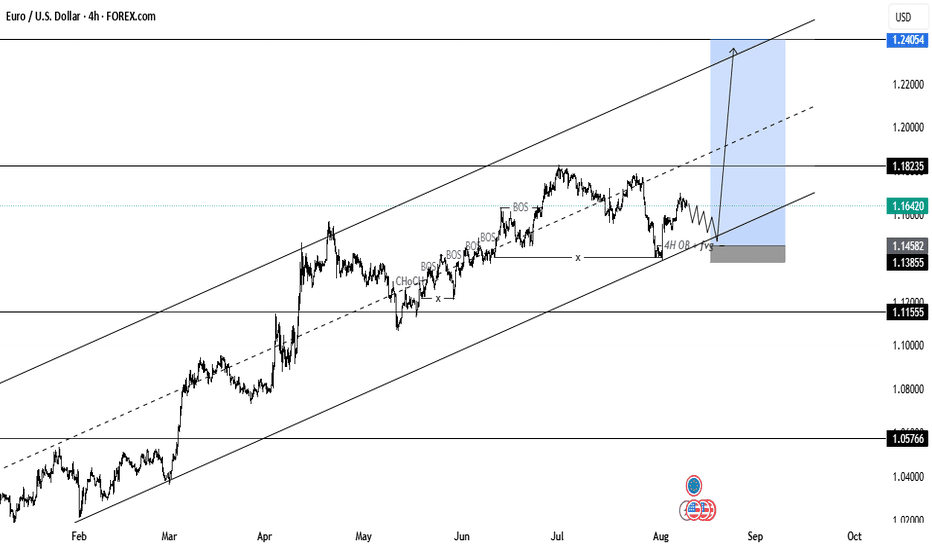

EURUSD Under Pressure Ahead of U.S. CPI ReleaseIn line with the dollar’s hold, EURUSD is trading between 1.1580 support and 1.17 resistance, forming a bullish rebound from its 200+ pip drop in July. A clean hold above 1.17 may extend gains toward the 1.18 resistance, with further upside possible toward the 2021 highs — with key levels in sight at 1.20 and 1.24.

On the downside, if the DXY recovery continues, EURUSD may face selling pressure below 1.1580, potentially pulling prices toward 1.1450 and 1.1380. A confirmed break of those levels could open the way for a deeper decline toward 1.12 and 1.11, where renewed bullish positioning may re-emerge.

- Written by Razan Hilal

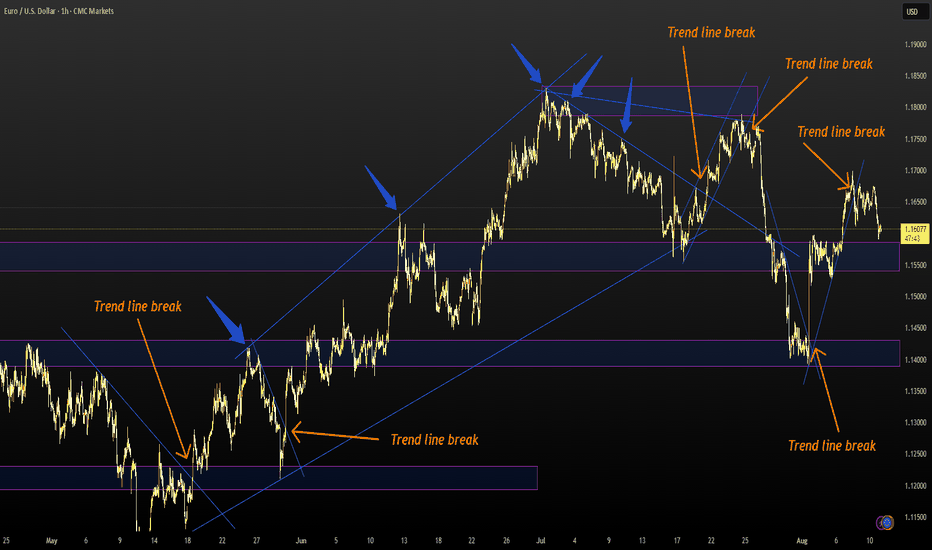

EURUSD "trend lines dont work and they are worthless" I was laughing when i see some traders, sorry, "traders" who say theres no worth in trend lines, they dont work etc, yet, well know traders use it and make profit from it. This is what im saying about some traders, just because they comment or say something, dont feel that you have to defend yourself. Some people are just like this, and making such absolute comments like that makes you think they come across as knowing it all. Trading is not about proof, its about getting what works for you. Dont let them in, they are just looking to argue baseless convos which lead nowhere. Stay positive, keep going, dont quit.

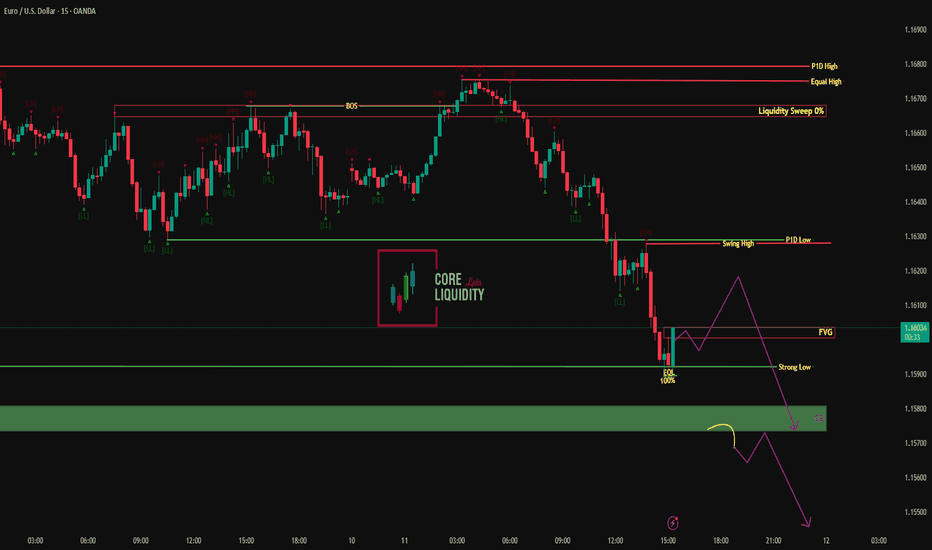

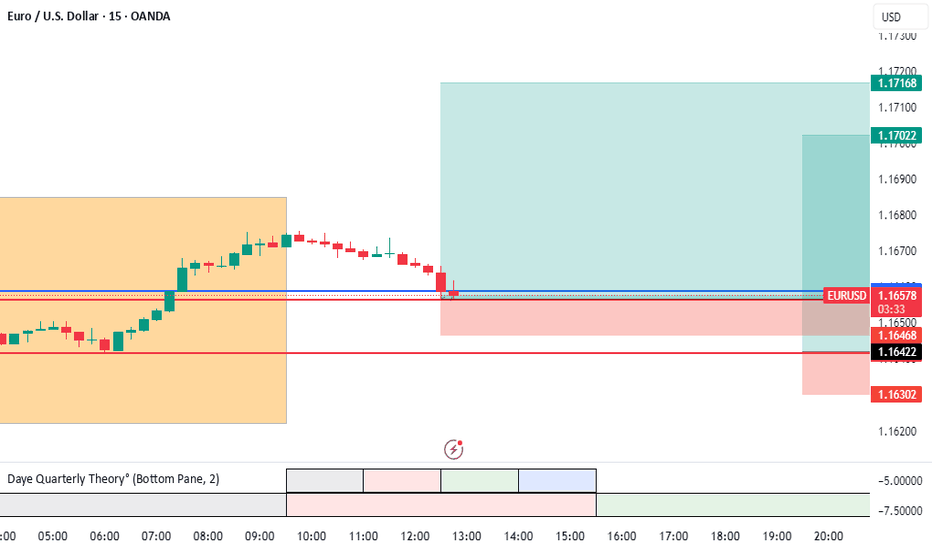

EUR/USD – 15M | Bearish Continuation Setup Price has completed a liquidity sweep at the P1D High / Equal High and broken structure, shifting market sentiment bearish.

Currently reacting from Equal Low (EQL) support, but a move into the Fair Value Gap (FVG) could provide the last mitigation before continuation to the downside.

Bearish Roadmap:

1️⃣ Pullback into FVG for mitigation.

2️⃣ Drop into the Order Block (OB) around 1.15700.

3️⃣ Break OB support → continuation toward lower liquidity pools near 1.15500.

Key Levels:

P1D High / Equal High: 1.16780

Swing High: 1.16250

FVG: 1.16050 – 1.16100

OB Target: 1.15700

Final Target: 1.15500

🎯 Looking for short entries inside FVG with targets at OB and liquidity levels below.

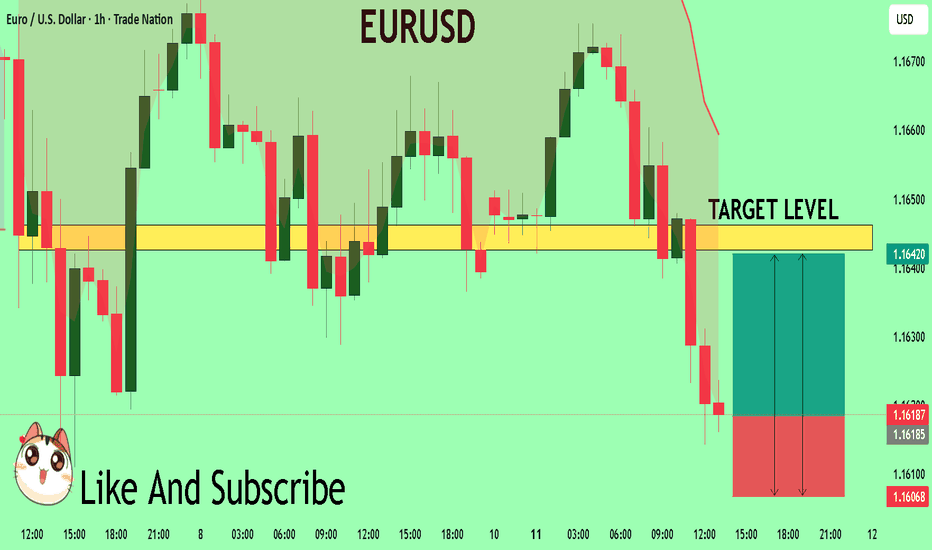

EURUSD On The Rise! BUY!

My dear friends,

EURUSD looks like it will make a good move, and here are the details:

The market is trading on 1.1618 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1642

Recommended Stop Loss - 1.1606

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

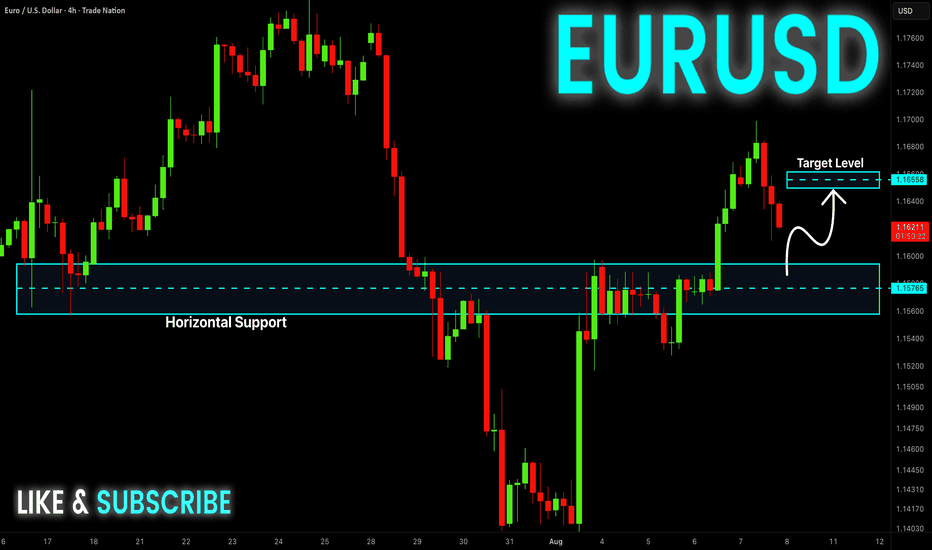

EUR-USD Support Ahead! Buy!

Hello,Traders!

EUR-USD is making a local

Bearish correction but

We are bullish biased mid-term

So after the pair hits the horizontal

Support of 1.1577 we will be

Expecting a local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

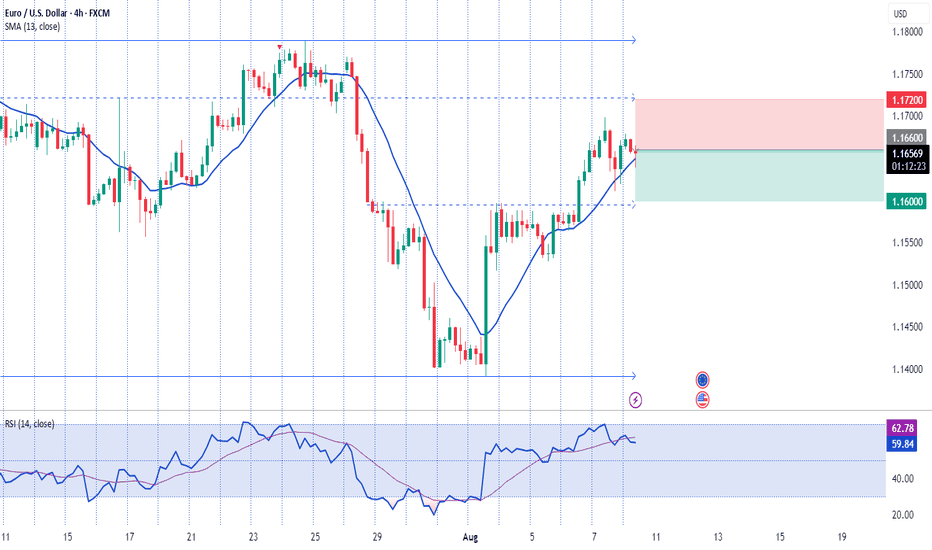

EURUSD Will Move Lower! Short!

Here is our detailed technical review for EURUSD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.167.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.157 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD – DAILY FORECAST Q3 | W32 | D7 | Y25📊 EURUSD – DAILY FORECAST

Q3 | W32 | D7 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURUSD

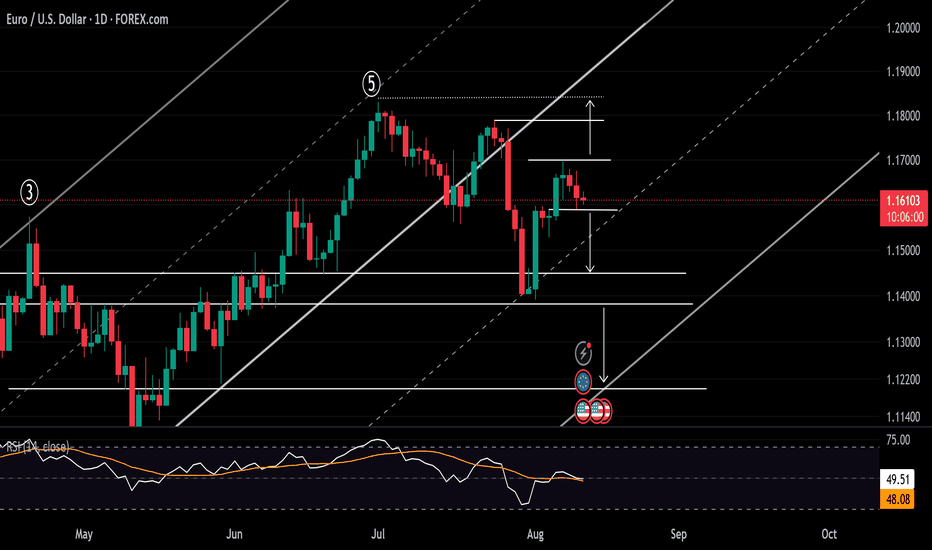

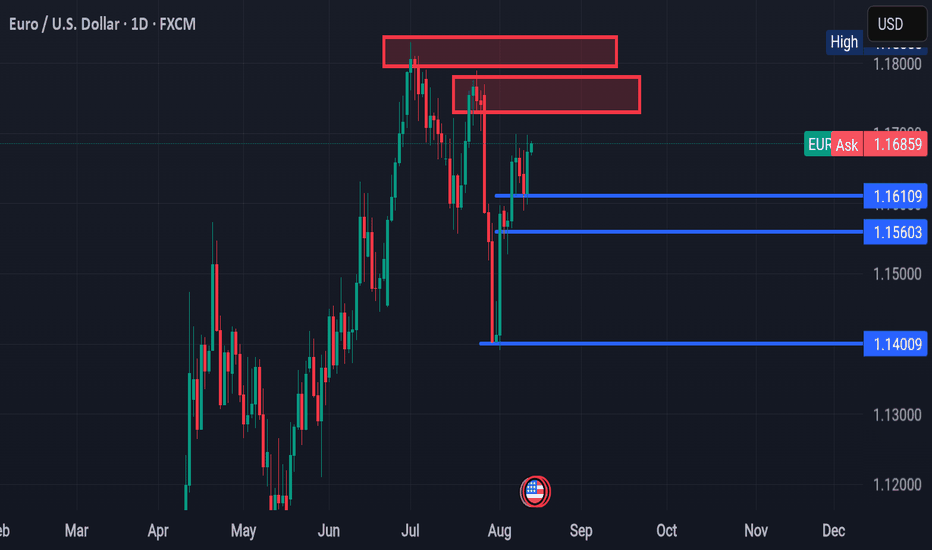

EURUSD DAILY TIMEFRAME ANALYSIS From the chart (EUR/USD, Daily), here’s the breakdown:

---

Trend Analysis

Medium-term context: Price previously made a strong bullish run from late May to late June 2025, topping near 1.1840.

Recent action: After that peak, we’ve seen a lower high and lower low structure, meaning the market shifted into a bearish correction.

Current state: Price is in a range/consolidation between roughly 1.1400 (support) and 1.1780 (resistance), but leaning bullish short-term because the recent candles have been climbing back toward the upper mid-range.

The key mid-range level around 1.1680–1.1700 is being retested — this is both a former support-turned-resistance and a zone where many stop orders could be clustered.

---

Liquidity & Stop Hunt Zones

1. Above current highs (bullish liquidity)

Around 1.1730–1.1780: Previous swing highs and order block zone.

Institutions could push price above here to trigger buy stops before reversing.

Above 1.1840: Major liquidity pool from the June top.

2. Below current lows (bearish liquidity)

Around 1.1610: Recent swing low and consolidation base.

Around 1.1560: Cluster of lows where stop losses for buyers may sit.

1.1400 zone: Key liquidity pool from the July drop — large stop cluster likely below here.

---

Possible Stop Hunt Scenarios

Bullish Stop Hunt: Price could run above 1.1730 to take out breakout buyers’ stops and then reverse down.

Bearish Stop Hunt: Price could drop below 1.1610 to grab liquidity before pushing up again toward 1.1780.

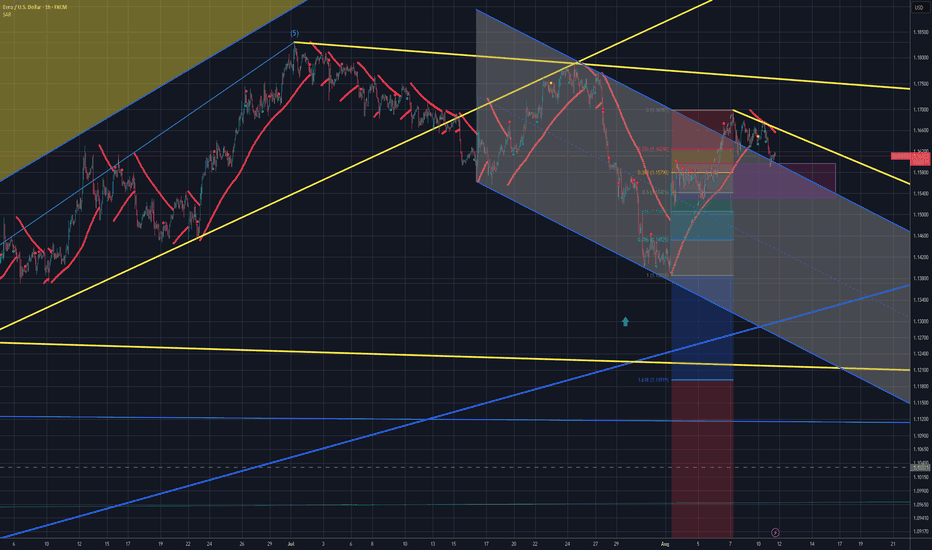

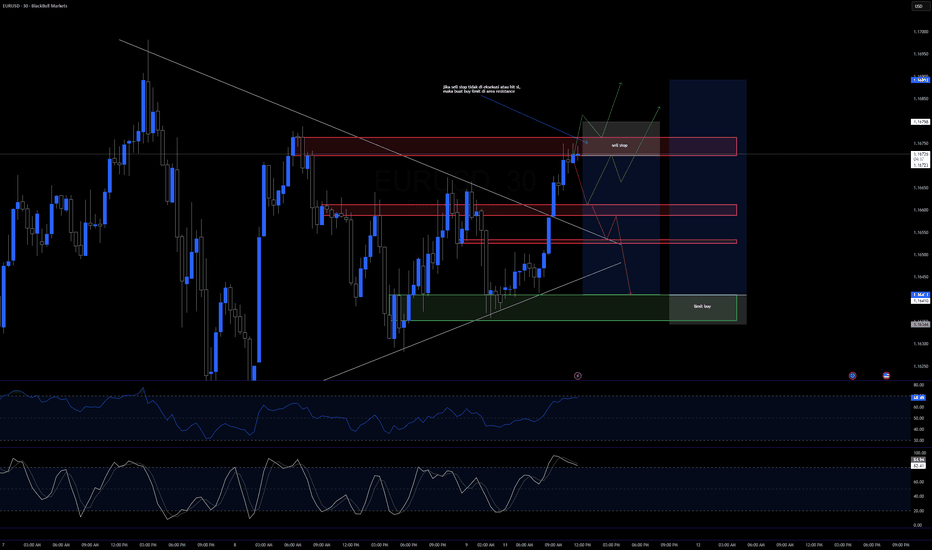

EU Long, Then, ShortM: Downtrend, made a new low

W: Uptrend, respecting the lows

D: Uptrend, price bbroke and retested trendline

4H: Downtrend, price retraced 78.6% and hit -61.8 on 4H fib and reversed to go long

1H: Downtrend, price broke and retested trendline. Aggressively long on NFP news (-jobs)

DXY is show bullish divergence

EU minor trend is showing bearish divergence.

CURRENTLY: I'm looking for price to go long to retest the 4H trendline @ the 1H support/resistance, then continue short.