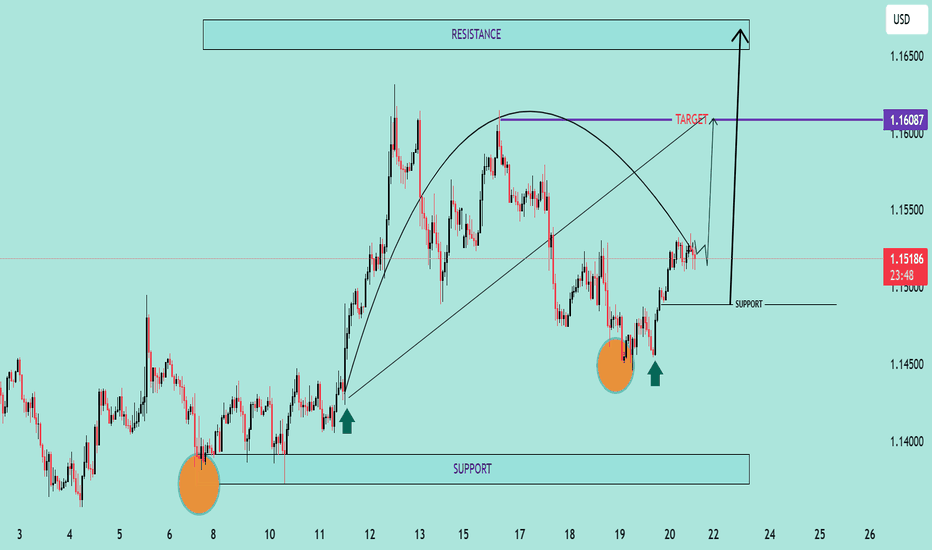

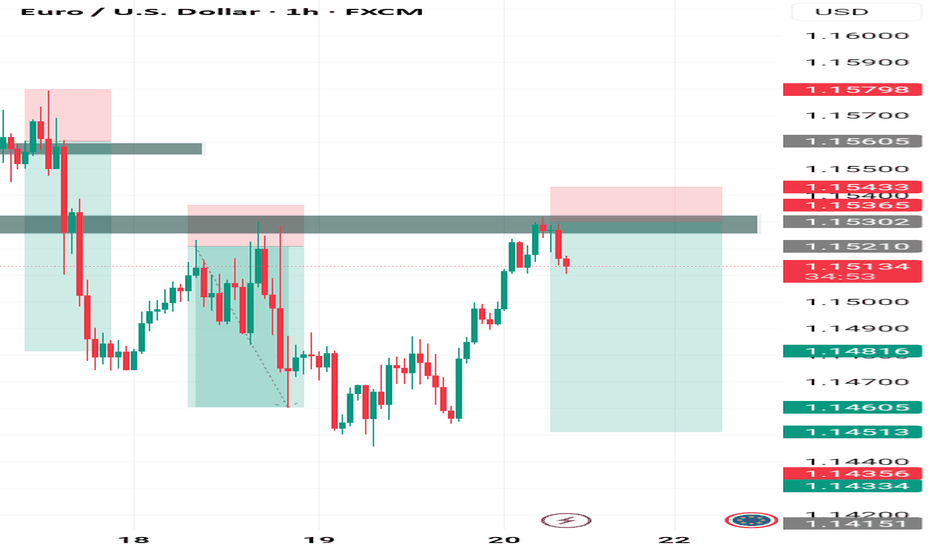

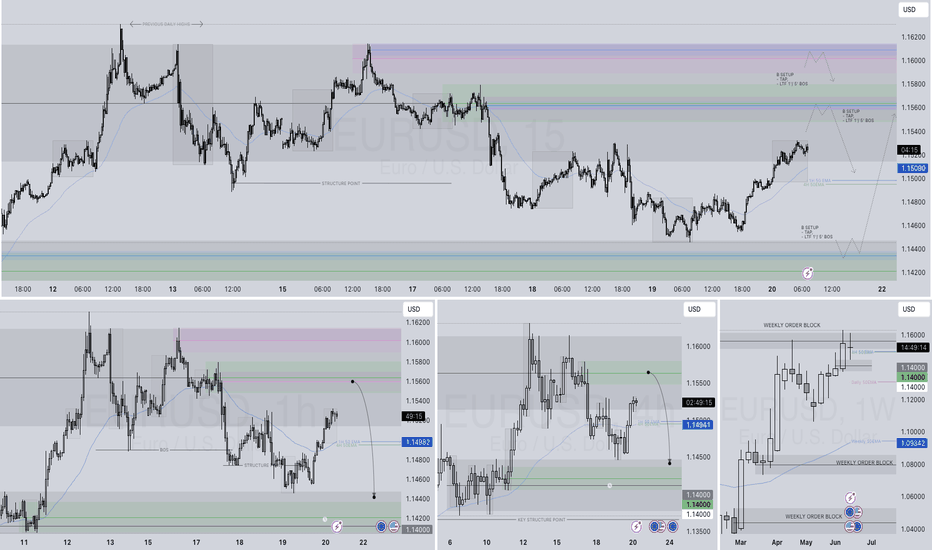

EURUSD is moving within the 1.14000 - 1.16330 range👀 Possible scenario:

The euro inched up near 1.1500 on June 19, supported by safe-haven flows as Israel-Iran tensions deepened and fears of U.S. involvement grew. Despite slight euro strength, demand for the U.S. dollar remained firm following the Fed’s decision to hold rates and warn of near-term inflation risks driven by Trump’s tariffs. The Fed also forecast slower growth and reaffirmed expectations for two rate cuts in 2025.

Markets now await U.S. data for further rate clues, while attention stays on the Middle East as Trump reportedly issued Iran a final ultimatum to avoid conflict.

✅ Support and Resistance Levels

Now, the support level is located at 1.14000

Resistance level is located at 1.16330

EURUSD trade ideas

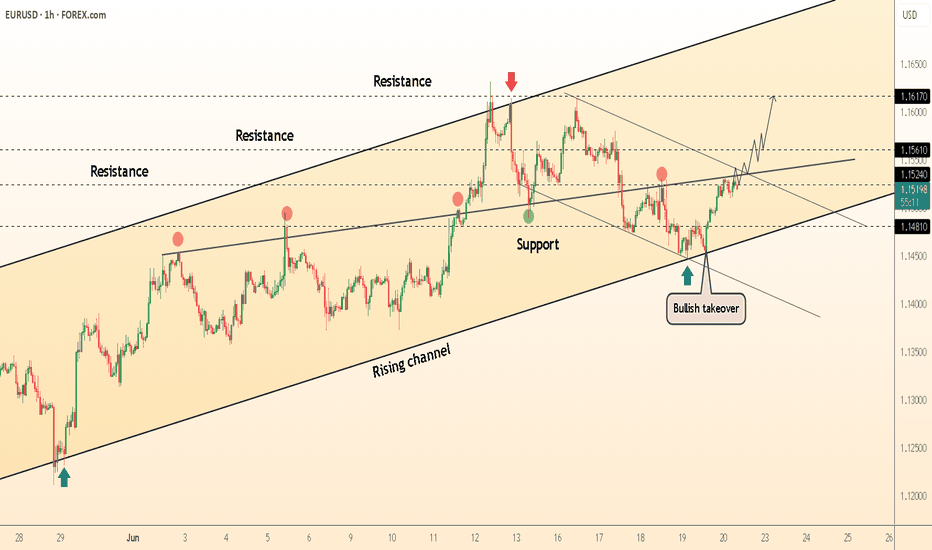

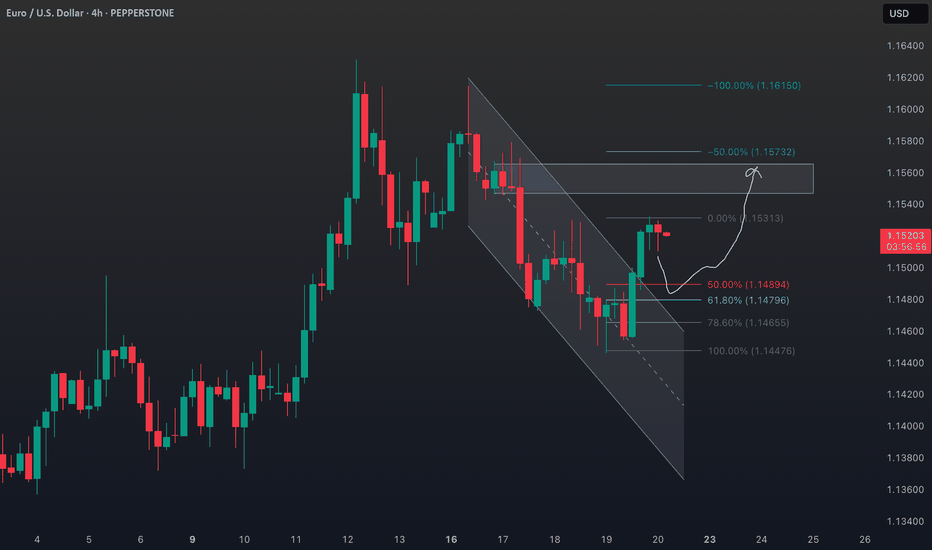

EUR/USD Bullish Reversal Breakout Pattern Technical Analysis Summary:

The chart illustrates a strong bullish reversal pattern forming on the EUR/USD pair:

🔹 Double Bottom Formation (🔶🔶):

Two clear bottom zones are marked with orange circles near the 1.14400–1.14500 area, indicating strong buying interest and support.

The second bottom confirms the double bottom pattern, often a precursor to an upward trend.

🔹 Support Zone (📉):

Firm support around 1.14450, as highlighted on the chart.

Price has respected this zone twice, bouncing back with bullish momentum each time.

🔹 Neckline Breakout (🔼):

Price is approaching the neckline zone at 1.16087, which acts as the bullish target.

A break and close above this neckline will confirm the reversal and open the way toward the resistance zone around 1.16500.

🔹 Projected Move (🎯):

If the neckline breaks, price is expected to surge towards 1.16500, aligning with the historical resistance.

This move completes the measured target projection from the double bottom structure.

🔹 Bullish Structure:

Higher lows and strong bullish candles are reinforcing the uptrend momentum.

Curved trajectory shows accumulation followed by a breakout phase.

📌 Key Levels to Watch:

Support: 1.14450 – 1.14500

Neckline/Target: 1.16087

Resistance: 1.16500

🛑 Invalidation:

A strong breakdown below support (1.14450) would invalidate this bullish setup.

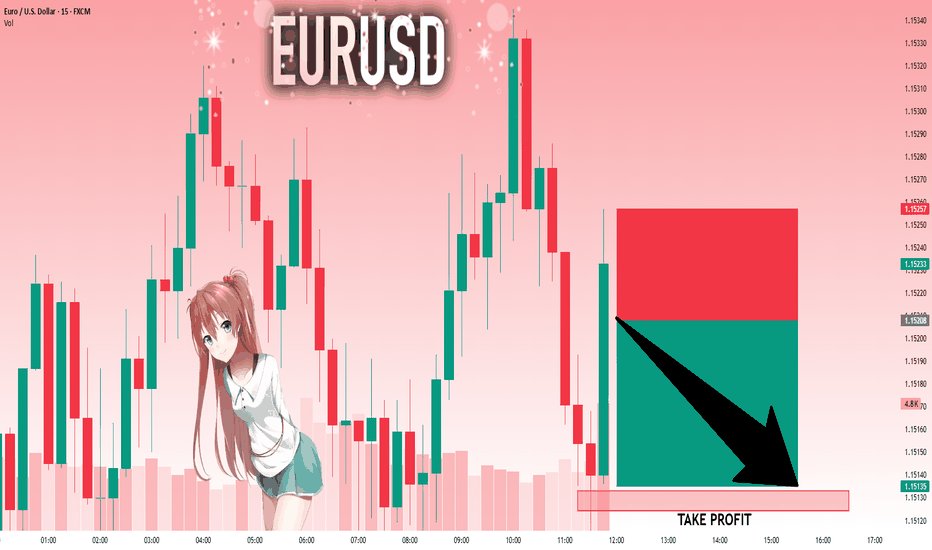

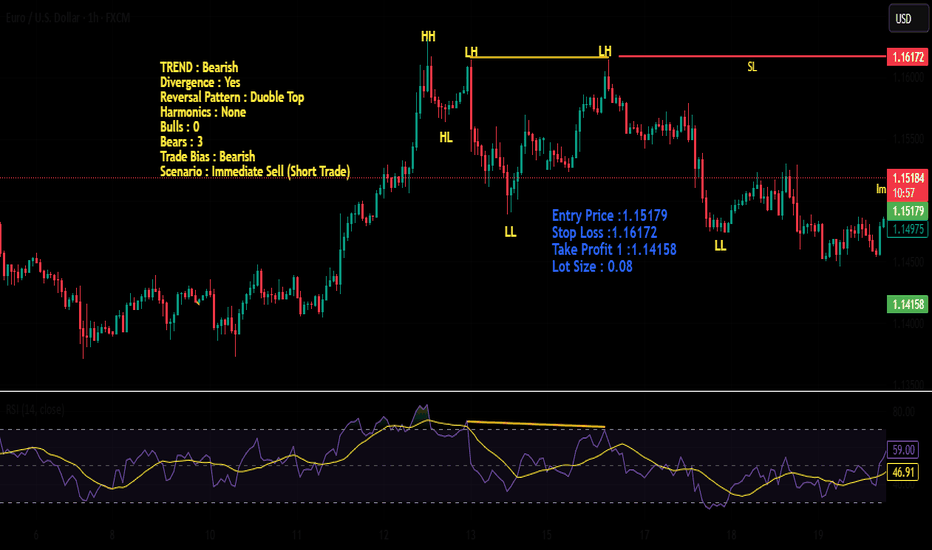

EURUSD: Move Down Expected! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.15208 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.15133..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

EUR/USD Slips as Fed Stays HawkishEUR/USD hovered near 1.1520 during Friday’s Asian session, extending gains for a third day as the US dollar weakened, likely due to a technical pullback. However, the greenback may rebound as safe-haven demand grows amid rising tensions between the US and Iran.

Citing senior US intelligence, The New York Times reported that Iran hasn’t yet decided to pursue nuclear weapons, despite having enriched uranium reserves. Meanwhile, the Senate Intelligence Committee Chair said President Trump is set to offer Iran one final window to negotiate before considering military action, potentially delaying any decisions for up to two weeks.

Markets are also awaiting Friday’s Monetary Policy Report from the Federal Reserve, which will provide fresh insights into the Fed’s stance. On the Euro side, the ECB’s hawkish outlook offered additional support, with President Christine Lagarde suggesting rate cuts may soon end as the central bank remains “well positioned” to handle persistent risks.

Resistance is located at 1.1530, while support is seen at 1.1450

DeGRAM | EURUSD reached the resistance level📊 Technical Analysis

● Bulls defended the rising-channel mid-line (≈1.1480), turning it into support and snapping the intraday falling wedge; hourly closes now print higher highs above the reclaimed 1.1520 pivot.

● A tight bull flag is forming against 1.1560; its 1.618 swing coincides with the upper rail / 1.1617 resistance, keeping the channel’s momentum bias pointed north.

💡 Fundamental Analysis

● Softer US housing starts and a slide in 2-yr yields pulled the DXY to two-week lows, while ECB’s Knot warned “premature cuts risk inflation flare-ups,” widening the short-rate gap in the euro’s favour.

✨ Summary

Long 1.1515-1.1530; flag break >1.1560 targets 1.1617, stretch 1.1670. Bias void on an H1 close below 1.1480.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

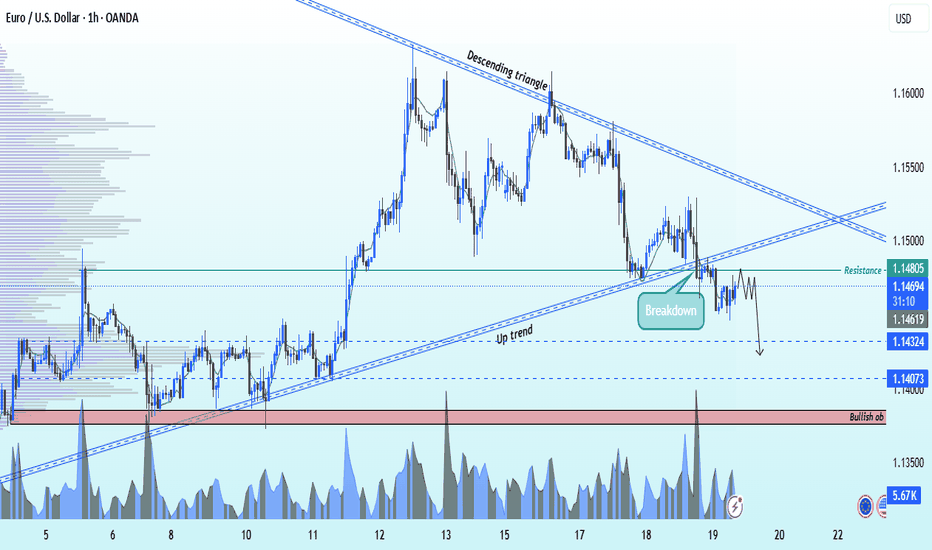

EURUSD Bullish trend breakdown ahead selling possible shortEUR/USD Technical Breakdown 🚨

The bullish trendline has been broken, along with the descending triangle support — signaling a potential shift in momentum. 📉

🔍 Entry Level: 1.14800 (Previous Resistance)

🎯 Target Zones: 1️⃣ 1.14300 – Key Demand Zone

2️⃣ 1.14000 – Next Demand Area

3️⃣ 1.13800 – Bullish Order Block (OB)

📊 Timeframe: 1H

We're watching price action closely as it approaches these zones — expect reactions! ⚠️

💬 Drop your thoughts in the

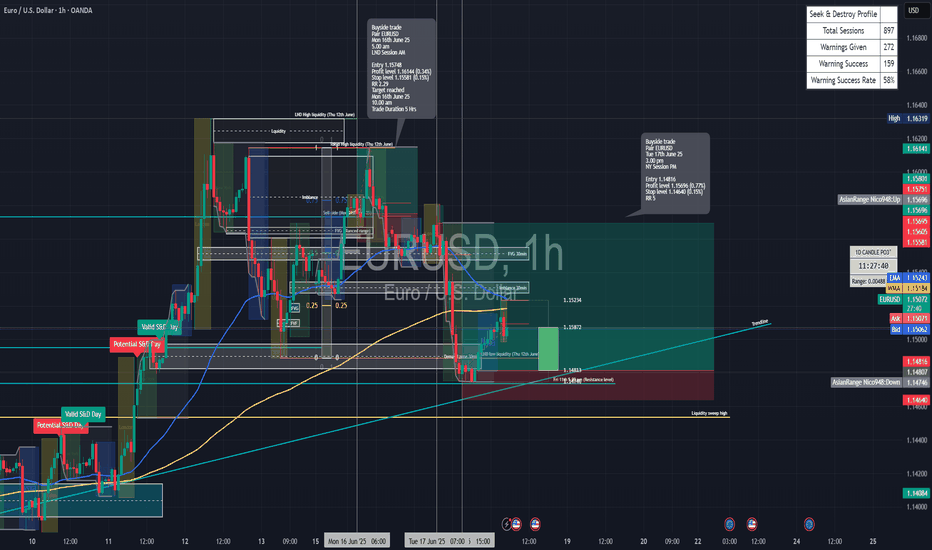

Long trade

📍 Pair: EURUSD

📅 Date: Tuesday, June 17, 2025

🕒 Time: 3:00 PM (NY Session PM)

⏱ Time Frame: 1 Hour

📈 Direction: Buyside

📊 Trade Breakdown:

Entry Price 1.14816

Profit Level 1.15696 (+0.77%)

Stop Loss 1.14640 (−0.15%)

Risk-Reward

Ratio 5:1

🧠 Context / Trade Notes:

1H Structure Entry:

Trade initiated at a key bullish order block on the 1hr timeframe, following higher-timeframe trend alignment.

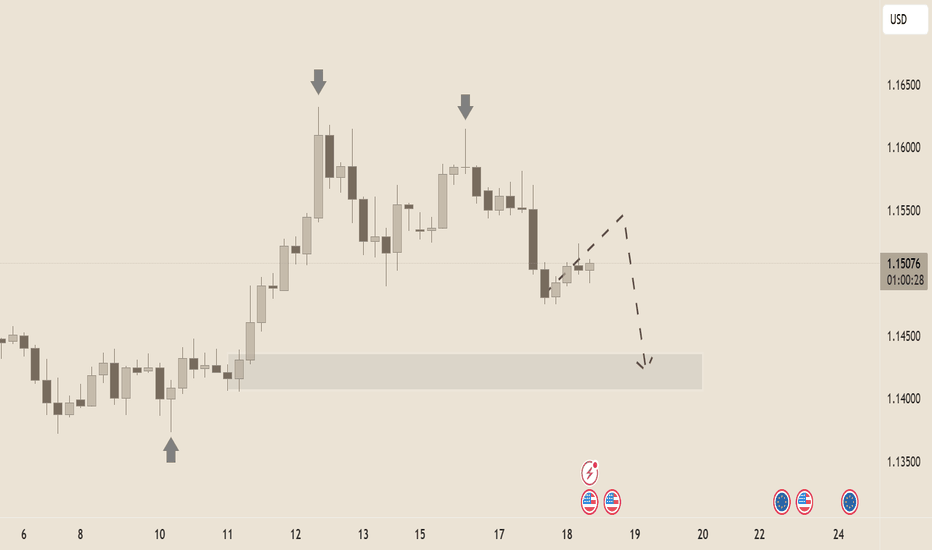

EUR/USD – Technical Price Forecast🔍 EUR/USD – Technical Price Forecast

As of June 18, 2025

Current Price: 1.15040

Bias: Bearish (Short-term)

Timeframe Context: Likely 4H or Daily

🧩 Market Structure Breakdown

🔺 Trend Context

Primary Trend (recent weeks): Bullish impulse from early June

Current Phase: Retracement / potential reversal

⬇️ Recent Price Action

Lower highs forming (arrows mark swing failure at ~1.1650 and ~1.1600).

Price has broken market structure to the downside around 1.1550 with a strong bearish candle.

Current retracement is weak and corrective, lacking momentum.

📐 Key Technical Levels

Level Type Observation

1.1650 Resistance Swing high / aggressive rejection

1.1600 Resistance Lower high + supply zone

1.1550 Supply zone Breakdown area

1.1500 Current zone Minor consolidation

1.1450–1.1400 Demand zone Prior accumulation zone (support)

1.1350 Next support Clean inefficiency below

📉 Liquidity & Order Flow Insight

Sell-side liquidity likely rests below 1.1400.

The recent bullish pullback appears to be a liquidity grab, not a reversal.

Imbalance created by recent bearish move remains unfilled.

📊 Candlestick Behavior

Strong bearish engulfing candle on the move from 1.1550 to 1.1480 indicates supply absorption.

Current candles are corrective and small-bodied — suggesting weak buying and potential continuation down.

🔮 Price Prediction / Forecast

Time Horizon Forecast Summary

Short-term (1–3 days) Expect minor bullish retracement to 1.1530–1.1550, followed by rejection.

Medium-term (3–7 days) Breakdown toward 1.1450, targeting liquidity below support zone.

Extended scenario If 1.1400 breaks cleanly, expect a drop toward 1.1350 and possibly 1.1300 as next support.

📌 Invalidation Level: A daily close above 1.1600 would invalidate this bearish scenario and imply further upside potential.

🧠 Strategy Implications (Pro Traders)

Sell the rally into 1.1530–1.1550 supply with stops above 1.1600.

Take profit levels:

TP1: 1.1450

TP2: 1.1400

TP3 (extension): 1.1350

Risk Management:

Risk-to-reward ratio ≥ 2:1. Confirm entry with bearish price action on lower timeframes (e.g., 1H).

⚠️ Macro Consideration

Multiple economic events approaching (U.S. and EU flags shown) — expect volatility. Hold trades cautiously around high-impact news.

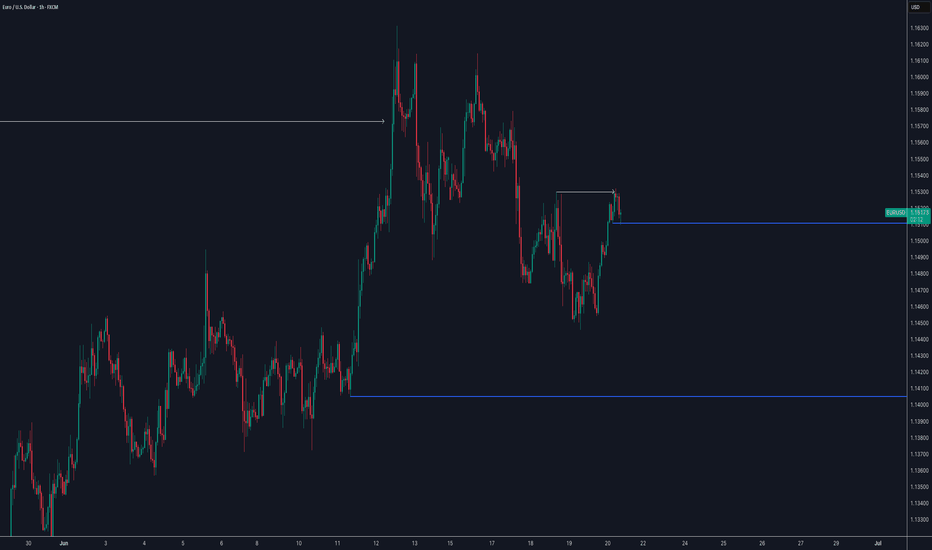

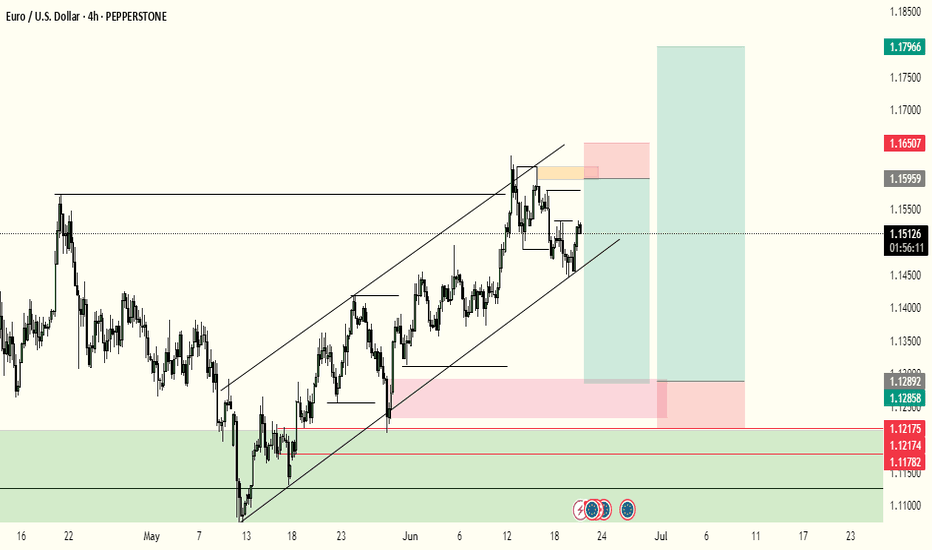

EURUSD Breaks Structure: Bullish Continuation Opportunity💶 EUR/USD Analysis – Bullish Momentum Builds 📈

Taking a look at the EUR/USD on the daily chart, it’s clear the pair is currently in a strong bullish trend 🚀. Momentum has been building consistently, reflecting underlying euro strength and continued USD weakness.

🕓 On the 4H timeframe, we’ve now seen a clear shift in market structure to the upside, confirming bullish intent. Look for a continuation entry after a retracement back into equilibrium — ideally around the 50% level of the current price swing 🔄📐.

🎯 Trade Plan Idea:

Wait for price to pull back into equilibrium 🌀

Entry: Long from the discounted zone 🟩

Stop loss: Just below the recent swing low 🔻

Target: Previous high as a logical take-profit zone 🎯📊

⚠️ Disclaimer:

This content is for educational and informational purposes only and should not be considered financial advice. Always do your own research and consult with a qualified financial advisor before making any trading decisions. 📚💼

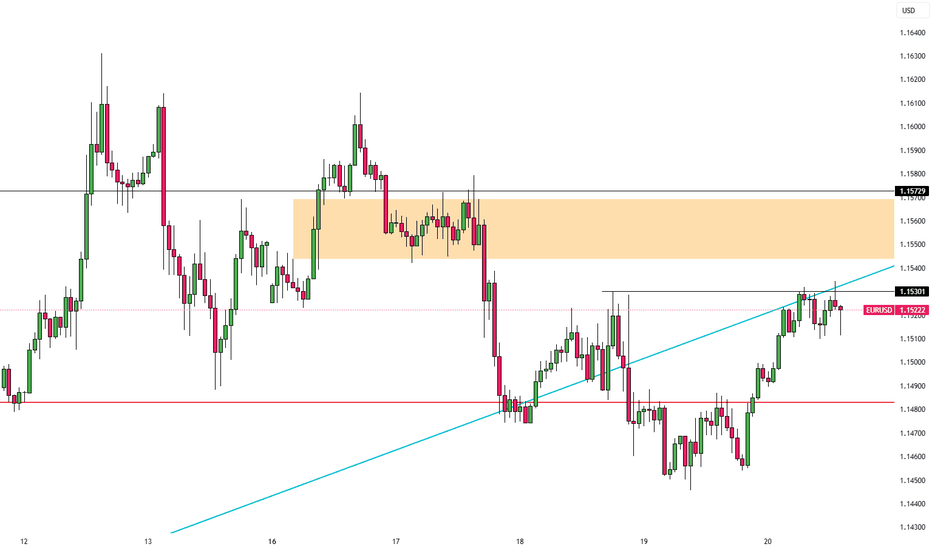

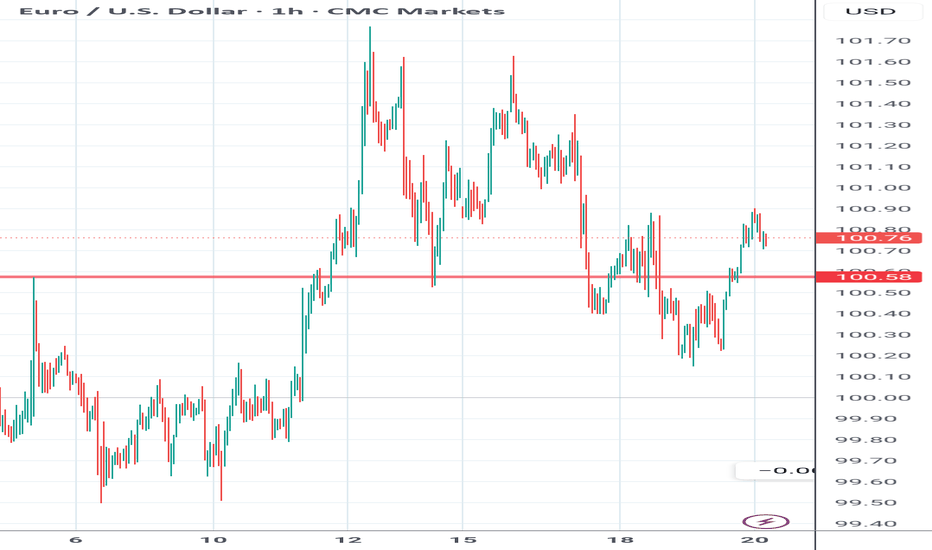

DeGRAM | EURUSD double bottom📊 Technical Analysis

● The price is currently testing the upper resistance of a descending wedge pattern after forming a clear double bottom formation. This double bottom occurred precisely at a confluence of support, where the long-term ascending support line intersects with the lower boundary of the wedge, indicating a strong potential for a bullish reversal from the 1.1450-1.1470 area.

● This recent bullish price action follows a prior "double top" pattern that initiated the corrective move downwards into the current wedge. A decisive breakout and hold above the wedge's resistance would invalidate the recent bearish pressure and confirm that buyers are taking control, with the first significant target being the horizontal resistance line near 1.1523.

💡 Fundamental Analysis

● Market attention is centered on the upcoming U.S. Federal Reserve policy meeting. While no rate change is expected, forward guidance is key. Current market sentiment, as noted by analysts at RoboForex and FreshForex, is pricing in the possibility of a Fed rate cut later this year, which could place downward pressure on the US Dollar.

● Conversely, the Euro is finding support from a comparatively hawkish European Central Bank (ECB). Recent reports indicate that the probability of an ECB rate cut has diminished, suggesting a policy divergence that favors EUR strength against the USD, underpinning the technical case for a move higher.

✨ Summary

Long entry on a confirmed 30-minute candle close above the descending wedge resistance (~1.1485); initial target 1.1523 → 1.1560. The bullish outlook is invalidated on a close below the double bottom support at 1.1450.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

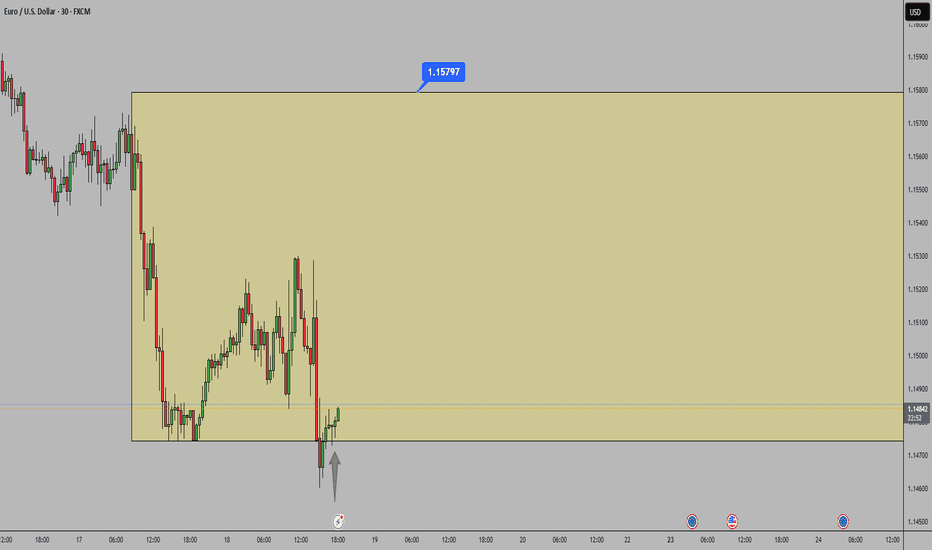

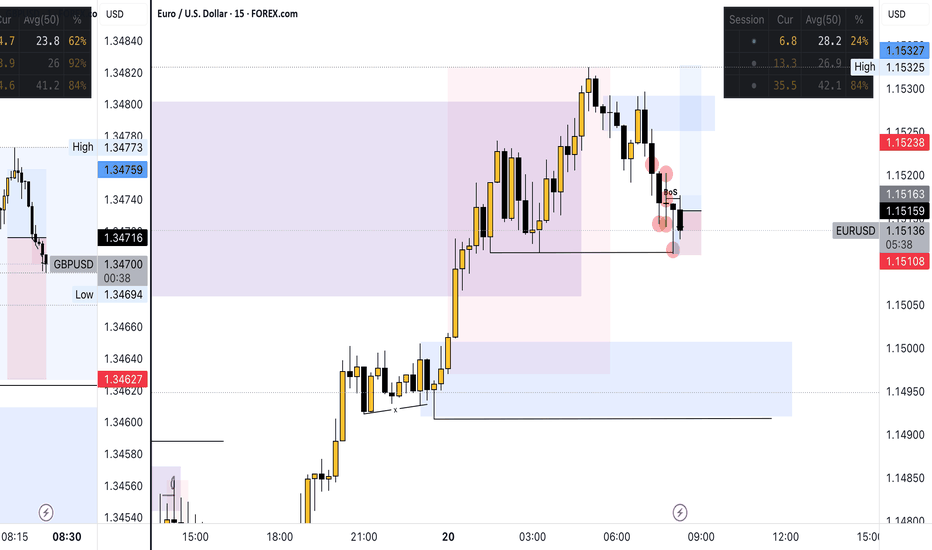

EURUSD SHORT FORECAST Q2 W25 D20 Y25EURUSD SHORT FORECAST Q2 W25 D20 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅15' order block

✅4 hour order block identified

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

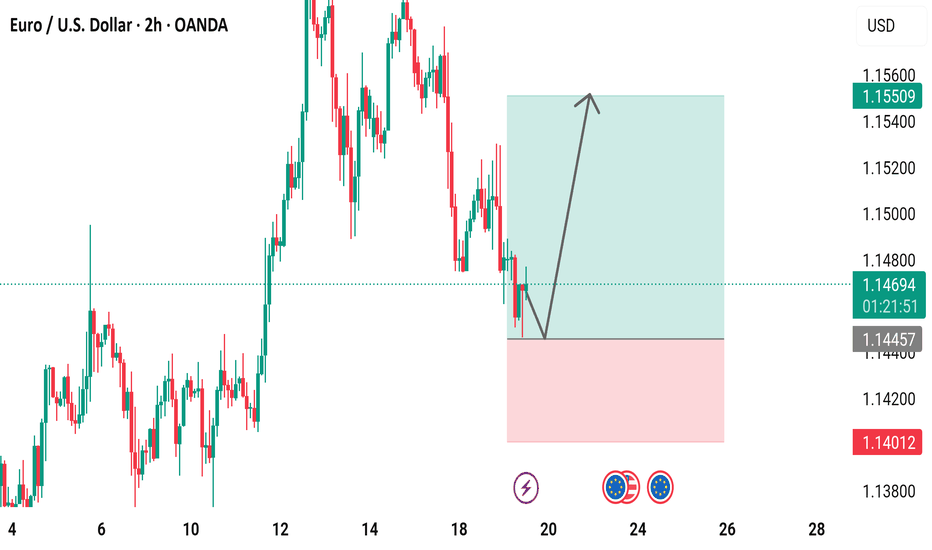

EUR/USD 2-Hour Chart Analysis2-hour performance of the Euro/U.S. Dollar (EUR/USD) currency pair, showing a recent decline with a change of -0.00134 (-0.12%) to a current value of 1.14676. The chart includes key levels such as a support zone around 1.14012-1.14457 and a resistance zone near 1.15000-1.15509. A breakout above the resistance could indicate a potential upward trend, as suggested by the highlighted area.

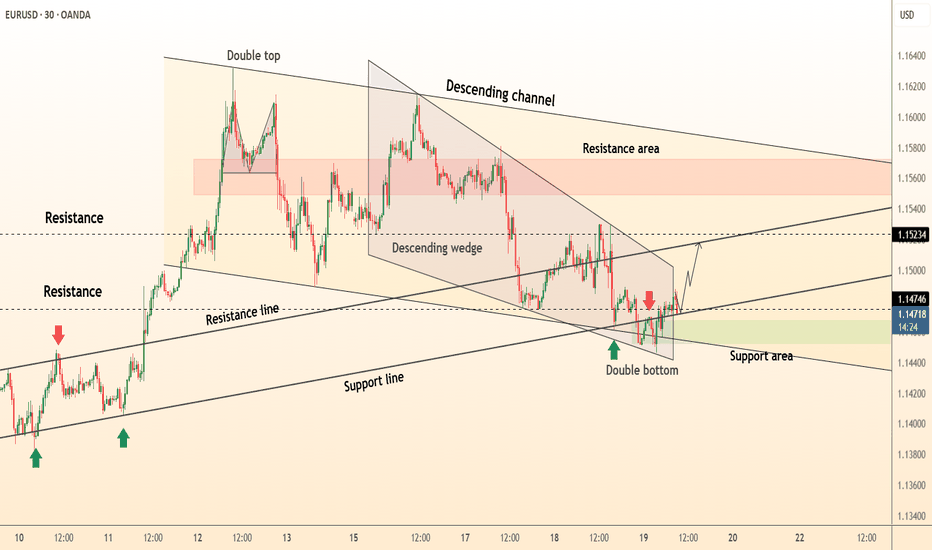

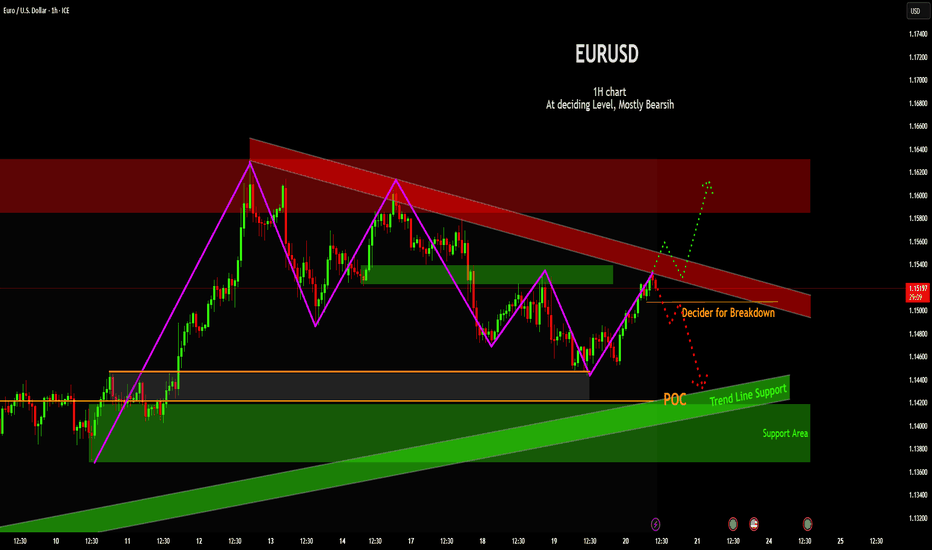

EURUSD: Deciding Point for Bearish BiasCurrent Price at Critical Resistance : The price action is currently challenging a significant downward-sloping resistance channel (highlighted in red). This zone has historically acted as a ceiling for price movements, and the current location is explicitly labeled as a "Decider for Breakdown," indicating a pivotal point for future direction.

Implied Bearish Bias : The overall sentiment indicated by the chart's title "At deciding Level, Mostly Bearish" suggests a lean towards downside continuation, although the price is currently pushing against resistance.

Identified Support Confluence : Below the current price, a layered support structure is identified. This includes an upward-sloping "Trend Line Support" channel (green) and a prominent horizontal "POC" (Point of Control), likely derived from volume profile analysis, both residing within a broader "Support Area" (green shaded zone).

Potential Future Pathways : Two immediate potential scenarios: a bearish continuation (red dotted path) if the current resistance holds and lower support levels are broken, or a bullish reversal (green dotted path) if the price successfully breaks above the descending resistance channel.

Swing Structure Visibility : Its kind of Flag and Pole pattern on larger picture, but there is also downward trending line. Purple line indicates the overall market structure interpretation.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

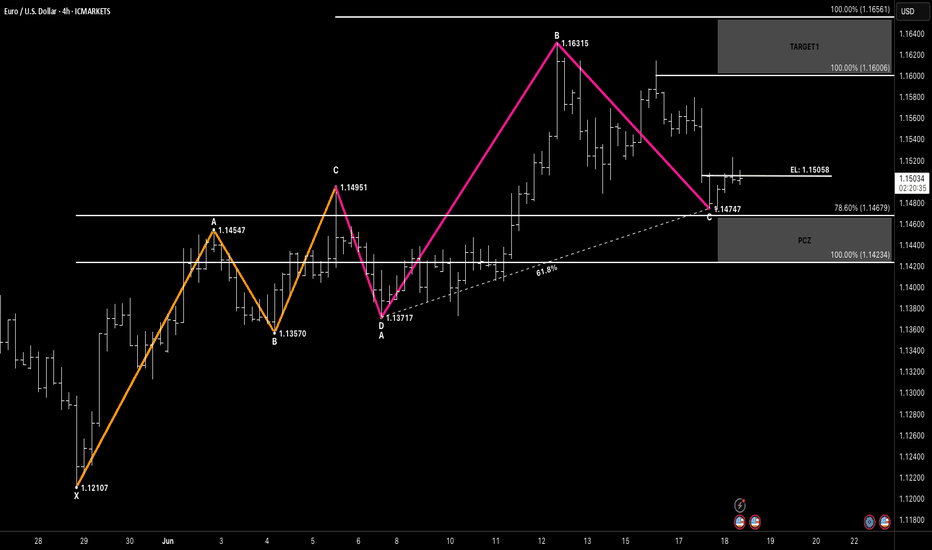

ABC Bullish Hello awesome traders, hope you're having a great week!

We’ve got a clean ABC bullish setup unfolding beautifully on EURUSD 4H:

🔶 Pattern: ABC Bullish

🕓 Timeframe: 4H

⚡️ Structure: AB=CD completion at 61.8% with PRZ confluence

📍 Entry Level: 1.15058 (confirmed breakout + retest)

🎯 Target 1: 1.16006 (AB=CD)

🎯 Target 2: 1.16561 (extended projection)

🛑 Invalidation: Below 1.13717 (D-point)

Technical Highlights:

✅ 61.8% retracement support at D

✅ 78.6% BC retracement

✅ Price bounced cleanly and is consolidating above EL

✅ Momentum build above structure, higher lows in play

📊 Watching for continuation toward 1.1600 and beyond if structure holds.

Trade smart, protect capital, and let the pattern do the work!

EURUSD on the riseYesterday, EURUSD failed to continue its pullback and has already recovered the drop caused by the news.

This suggests the correction might be over, and we could be seeing the start of a new bullish move.

The target is a breakout above the previous highs, aiming for 1,1706.

All positions we’re looking for are only in the direction of the main trend.

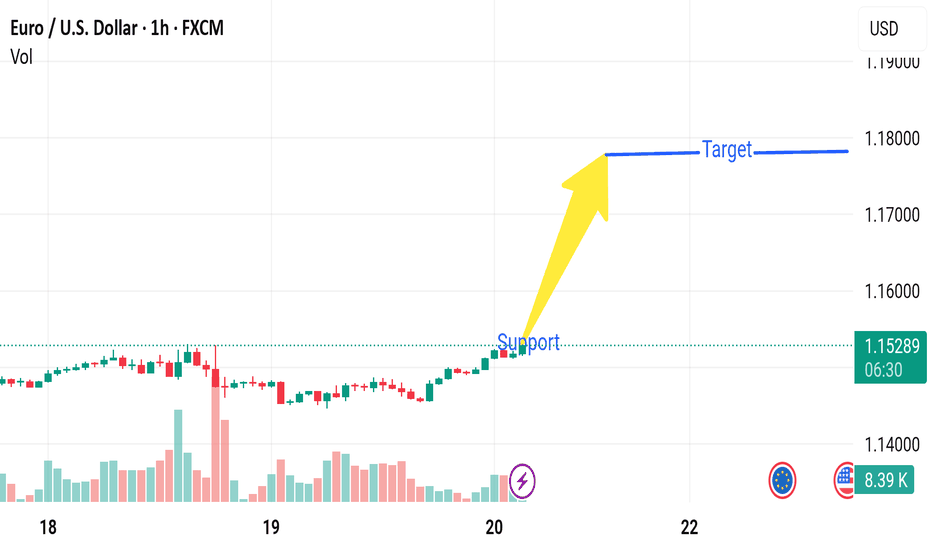

Market next move 🟥 Disrupted Analysis: Bearish Divergence on EUR/USD (1H)

Weak Support Zone:

The price labeled as "Support" was never a well-tested zone. It appears to be a minor structure, and the bounce lacks strong confirmation or significant volume.

Volume Decline During Rise:

The recent upward candles show shrinking volume, a sign that the buying momentum is weakening, not strengthening. Bulls are losing energy.

Potential Double Top Formation:

If price action near current levels stalls, a double top could form, which is a classic bearish reversal pattern. Watch for rejection below 1.1550.

Bearish Target Zone (if reversal begins):

First target: 1.1450 (minor support)

Break below that opens 1.1370 zone (volume support area)

---

📉 Disrupted Price Path (Opposing the Yellow Arrow)

Rejection

↓

┌─────────┐

│ ▼

│ Pullback to "Support"

▼ │

Breakdown │

▼ │

Target Zone ▼