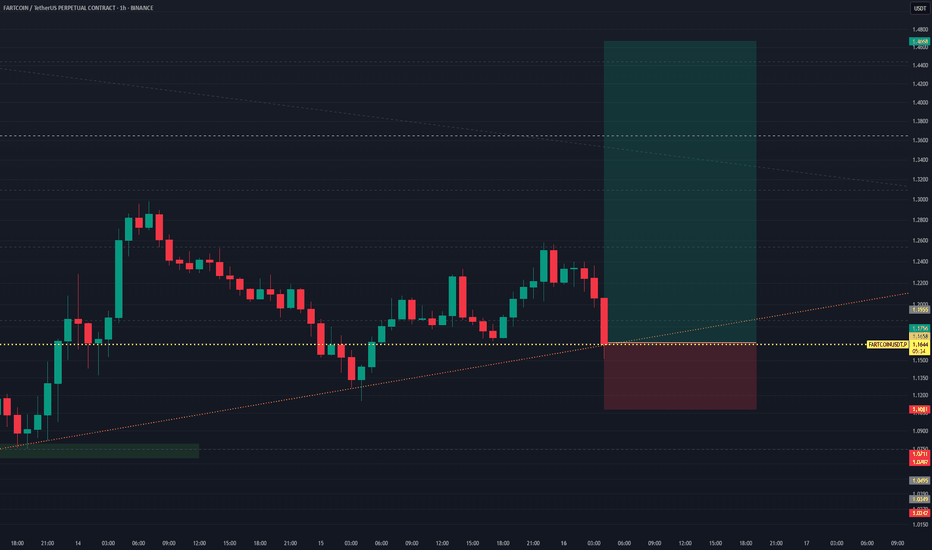

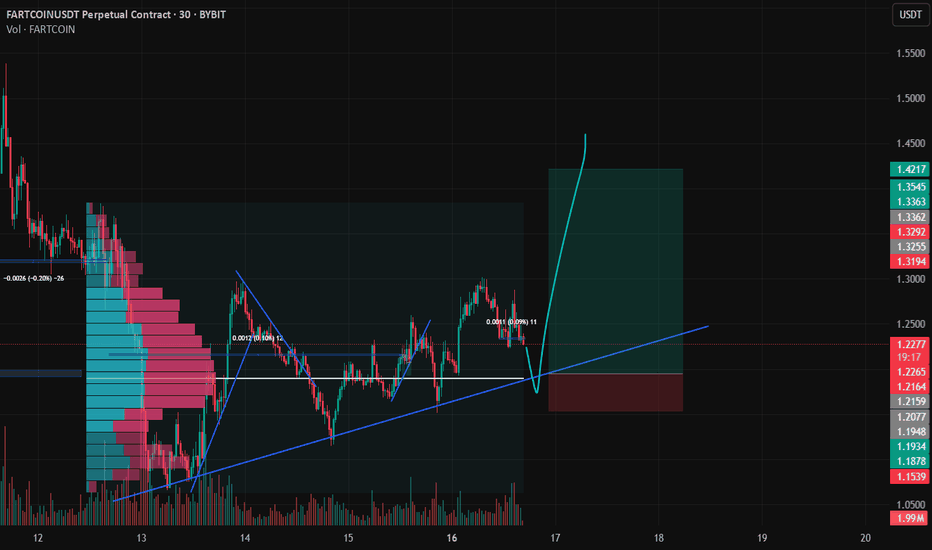

FARTCOINUSDT Perpetual – Trendline Bounce PlayThis chart presents a long position setup on FARTCOINUSDT.P, aiming for a rebound off a confluence of support levels.

Trade Details:

Position: Long

Entry Price: $1.1651

Stop Loss: $1.1081

Take Profit: $1.4668

Risk-to-Reward (RRR): ~5.32

Timeframe: Likely 4H or 1H

Setup Rationale:

Entry is p

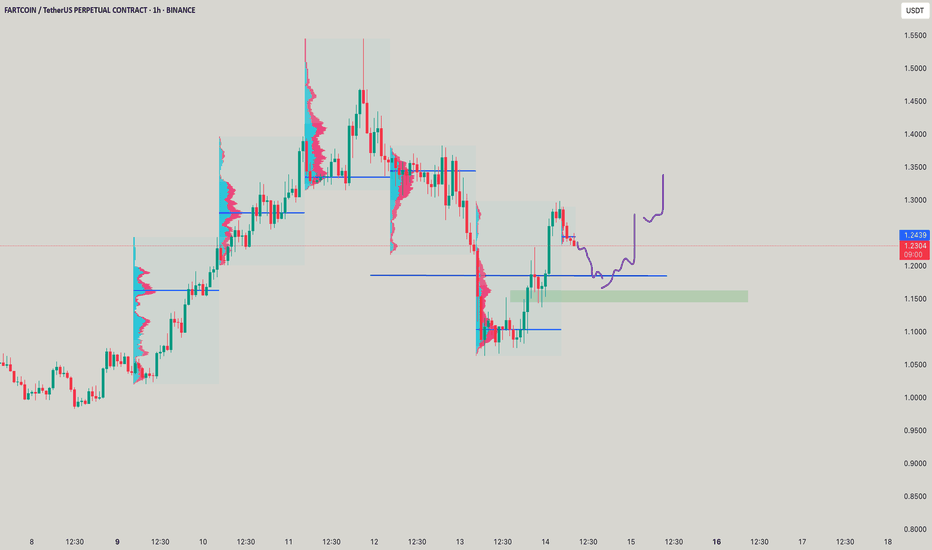

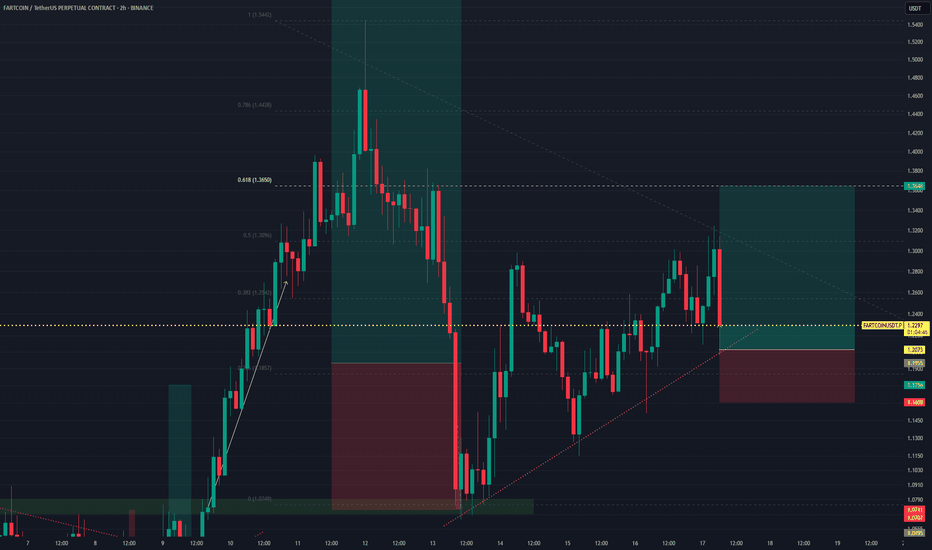

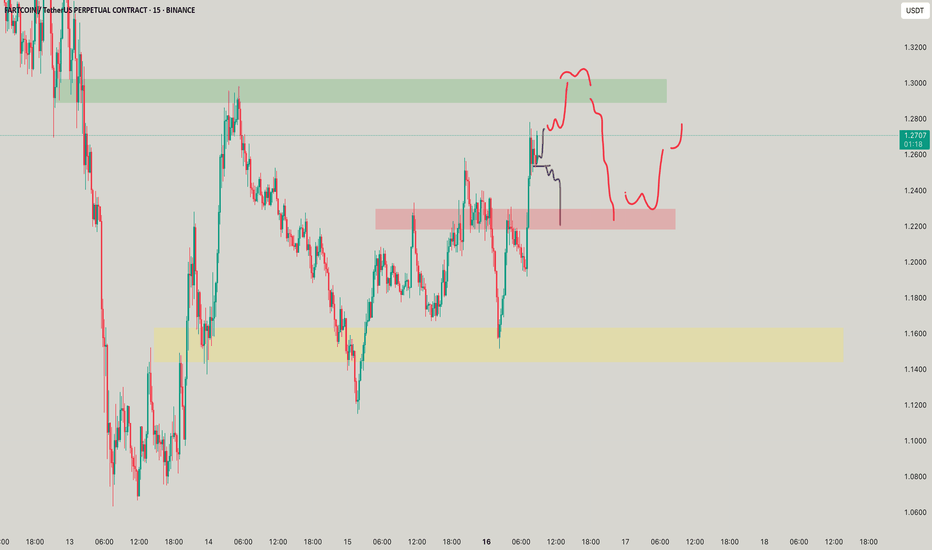

FARTCOINUSDT Bullish Breakout Setup – Retest OpportunityFARTCOINUSDT shows a potential bullish breakout from a falling wedge pattern. Price action breaks the descending trendline and comes back for a clean retest at a key confluence zone near horizontal support and wedge resistance turned support. This offers a high-probability long entry with minimal do

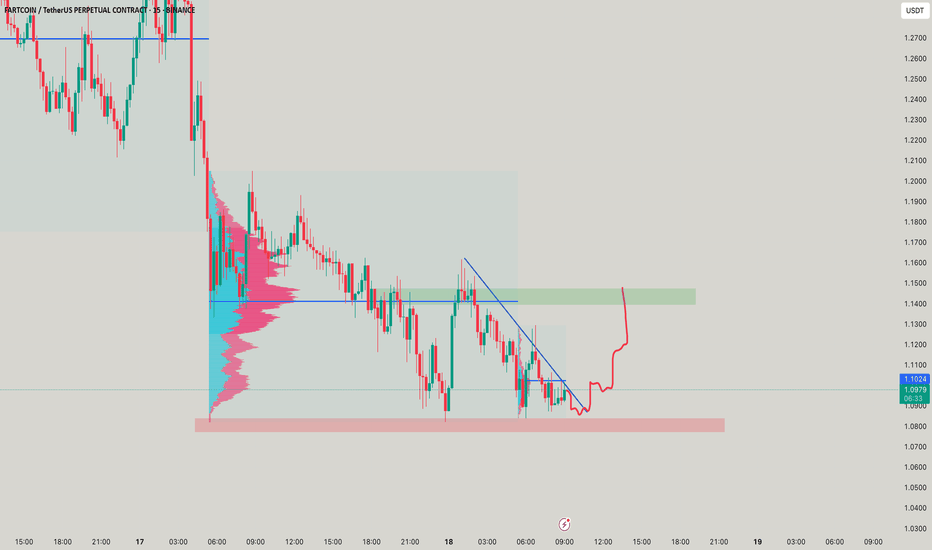

They laughed at the name. I loaded the setupPrice action doesn’t care about branding — it cares about imbalance, volume, and delivery. And FARTCOIN just hit a prime liquidity pocket with mechanical precision.

The structure:

After a fast drop, price tagged the 0.618 fib at 1.1607, which also aligns with the high-volume node (visible range) —

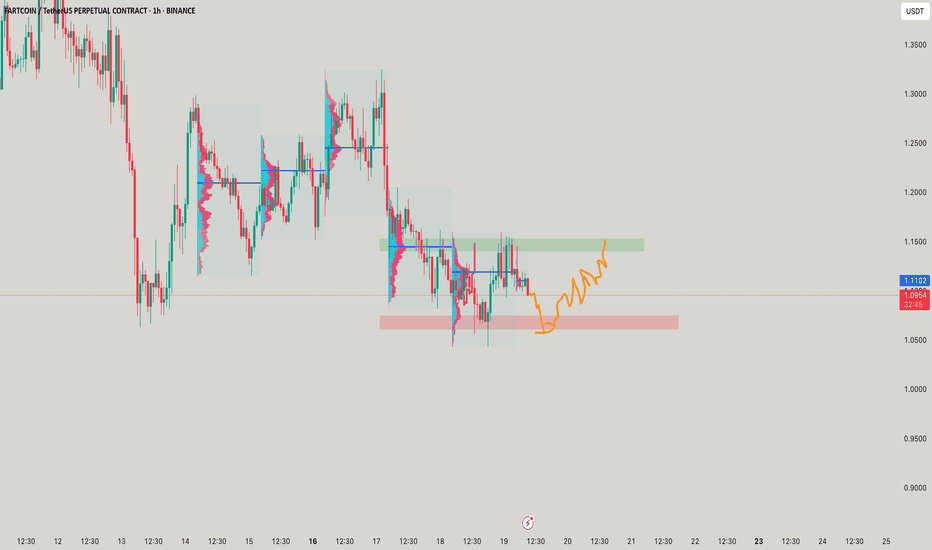

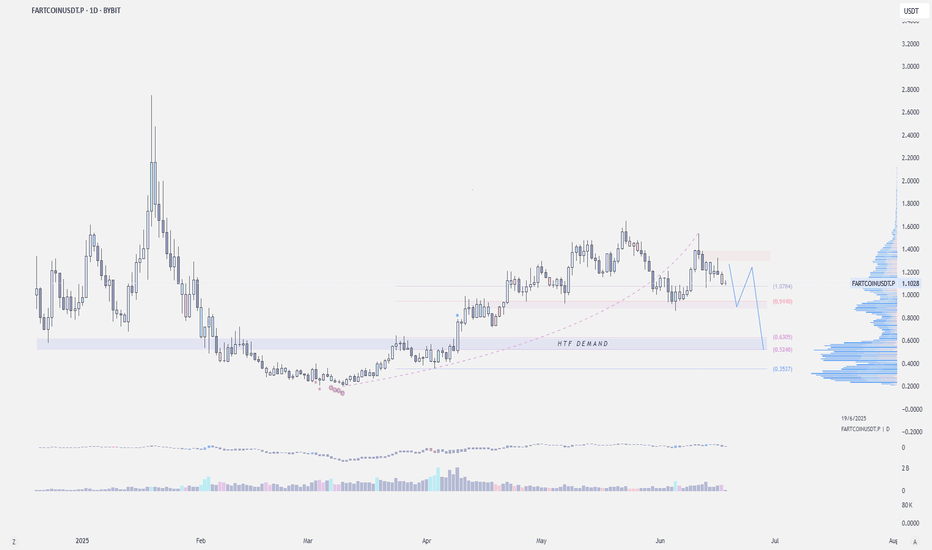

$FARTCOIN - HTF DemandMEXC:FARTCOINUSDT | 1D

If CRYPTOCAP:BTC makes another upthrust to sweep the highs, Fartcoin could test the 1.20–1.30 zone

If $1 is lost, the next support is around 0.94 to 0.87.

Failure to reclaim 1.20 on the upside increases the risk of revisiting the higher timeframe demand at 0.64–0.50.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.