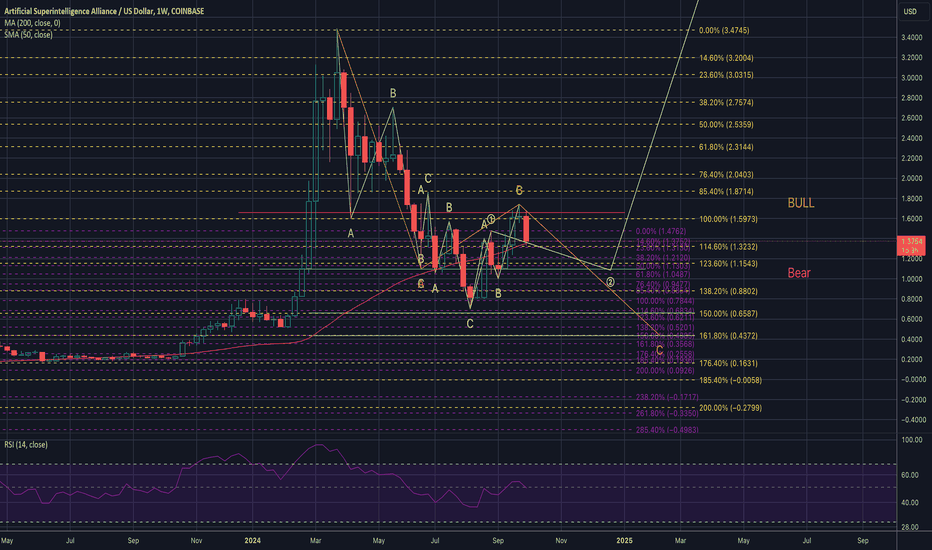

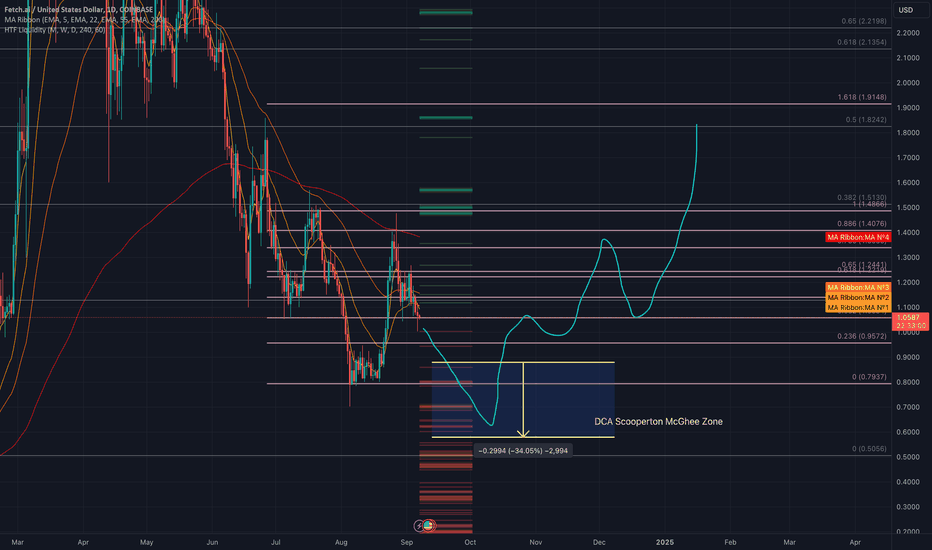

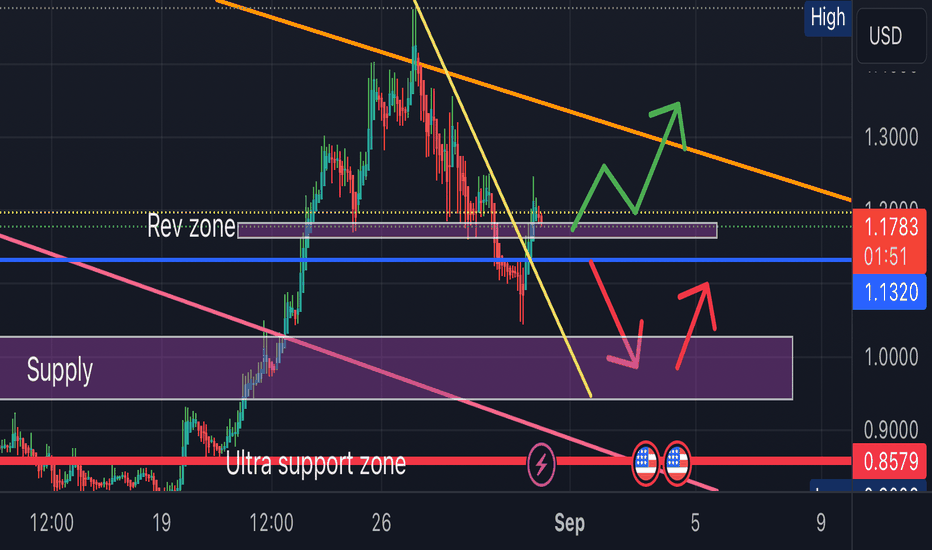

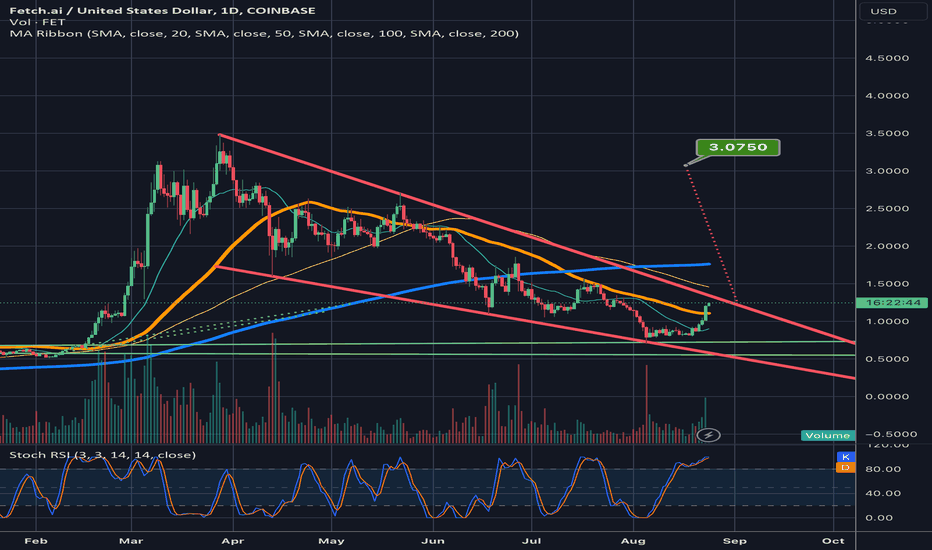

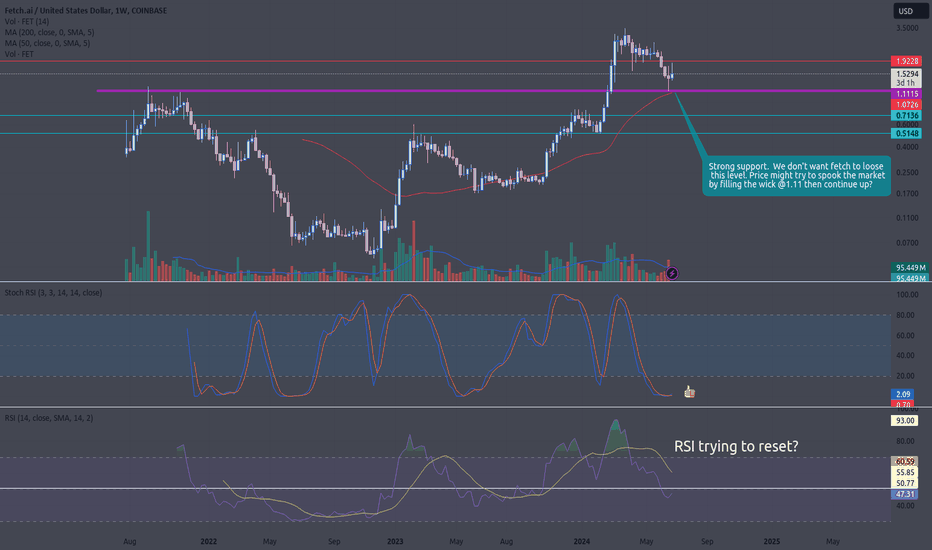

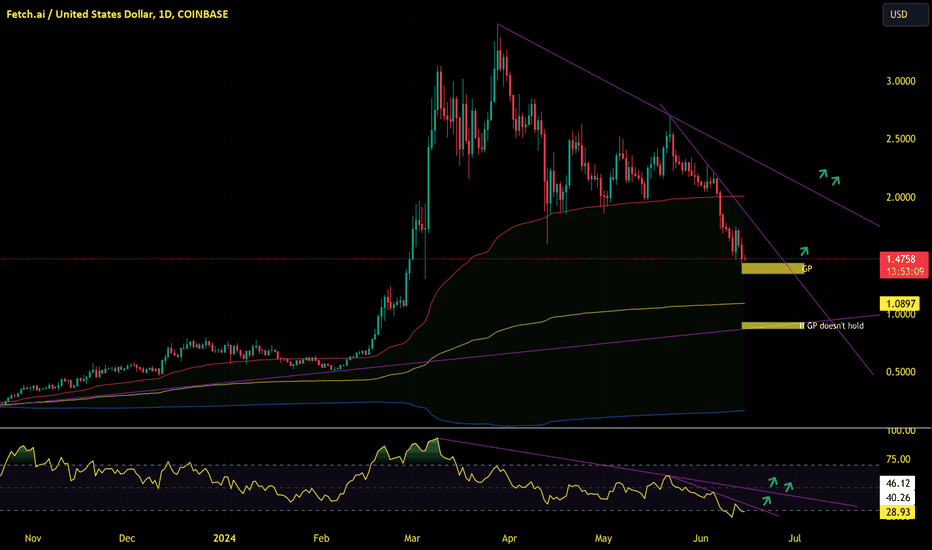

FETUSD BULL / Bear If weekly closes around $1.33 or lower, could be a sign of a new low. closing pattern would be Evening Star www.investopedia.com . But there is also a head and shoulders pattern if support $1.10 holds. stop loss at $1.00. under a dollar, the next support could be as low as .54$ or around .88$ for a high end support. These next few weeks could be crazy in the US market. Gonna be watching a few markets closely

FETUSD trade ideas

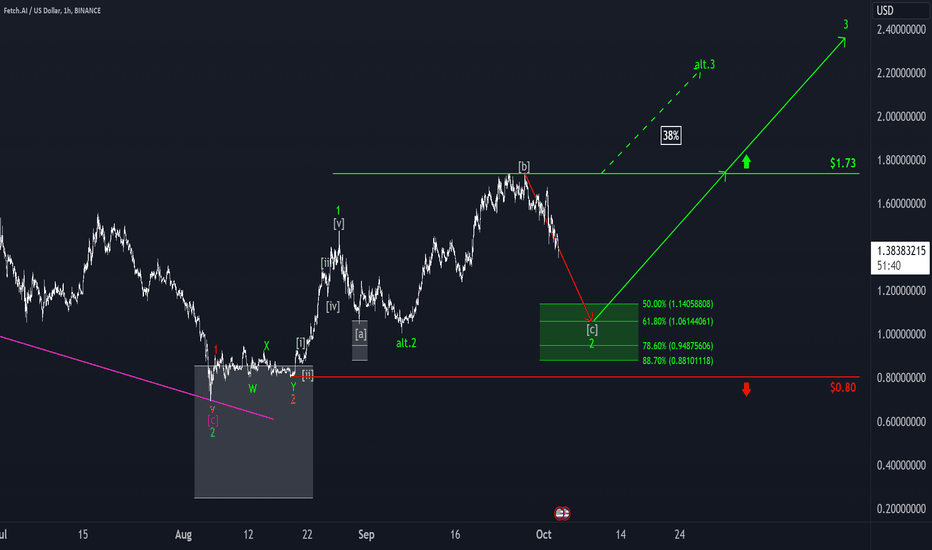

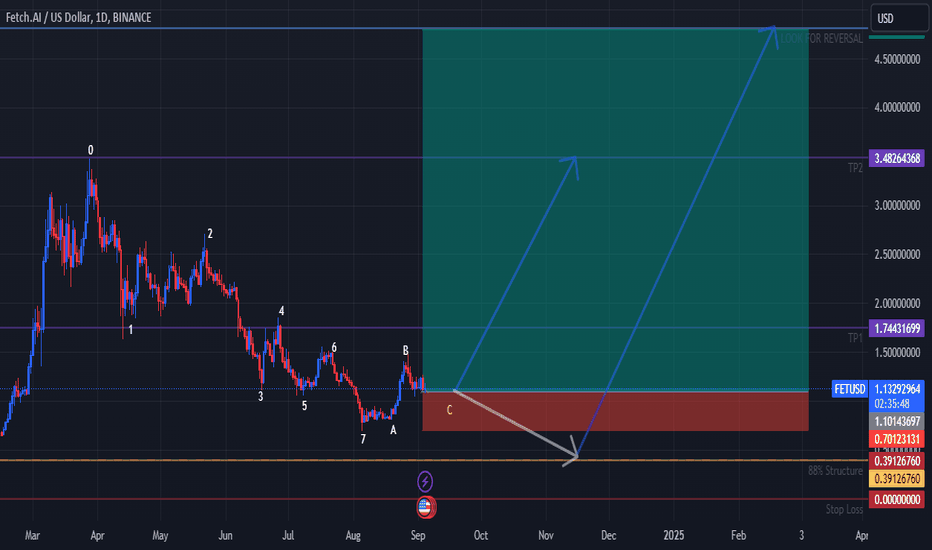

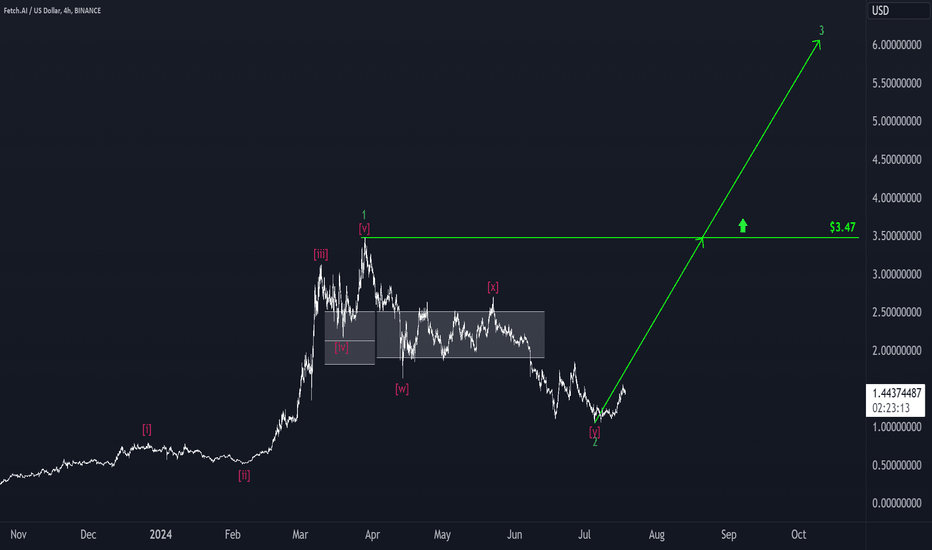

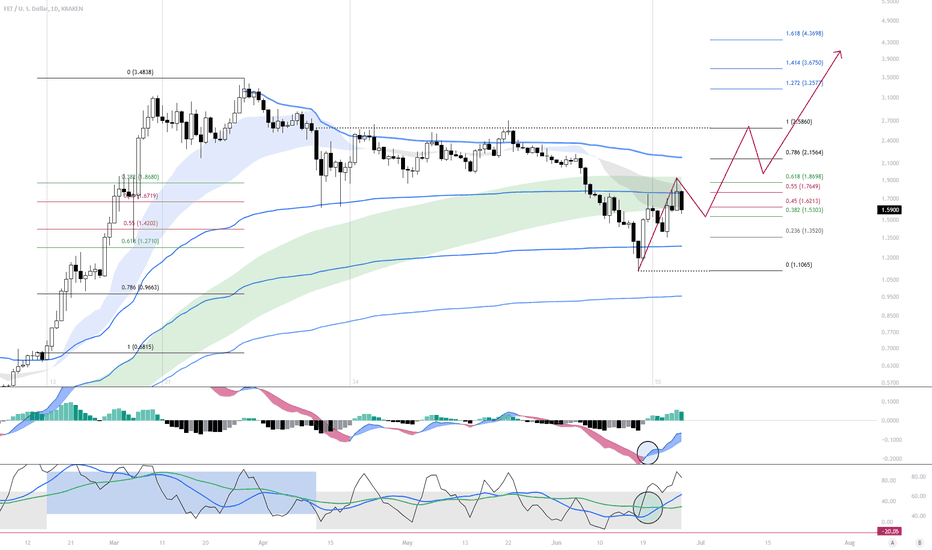

Fetch: Home StretchFET has sold off as planned over the last seven days, reinforcing our primary assumption that the final subwave of wave 2 in green is currently unfolding. To catch the low of this movement, we’ve added a green Target Zone onto the chart; it ranges from $1.14 to $0.8810. Investors could enter long positions there, with stops placed about 1% below the lower edge or at the support level of $0.80. Once the low is confirmed, we anticipate a rise above the resistance at $1.73. However, if this level is breached earlier (38% probability), we will already place the coin in the green wave alt. 3.

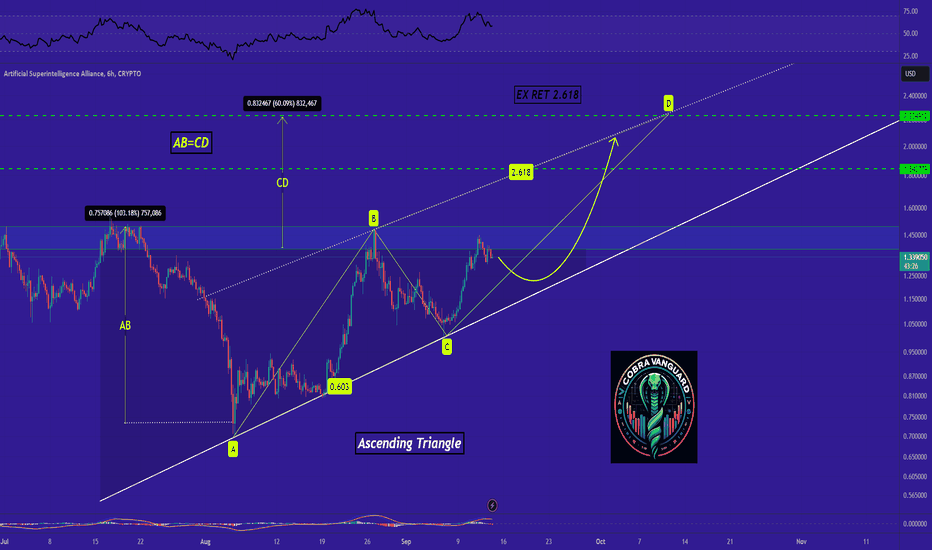

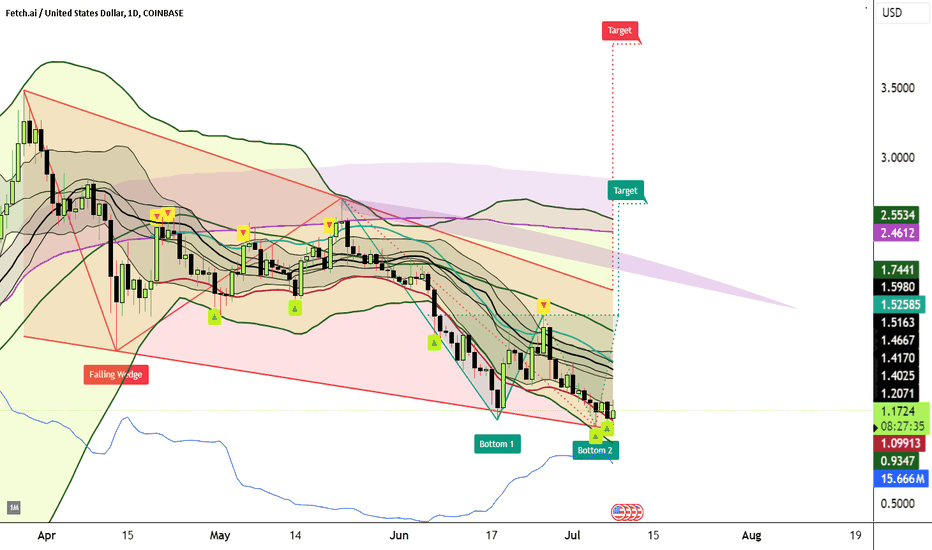

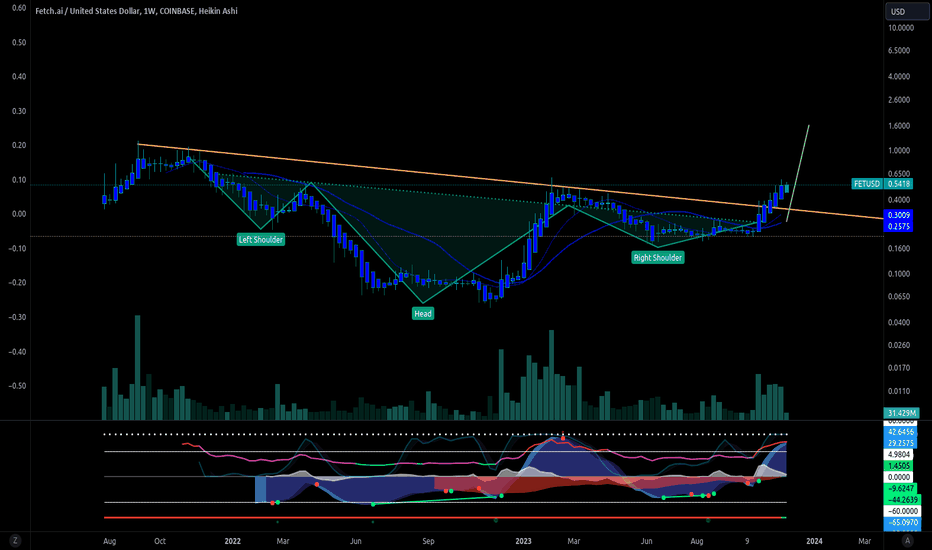

Honestly, I don't feel like explaining, the chart says it all !!The FET is in a ascending triangle now which means the price will increase and also It is expected that the price would at least grow as good as the measured price movement(AB=CD)

Note: we should wait for the breaking of the triangle and than make a move!

✨Traders, if you liked this idea or have your opinion on it, write in the comments, We will be glad.

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

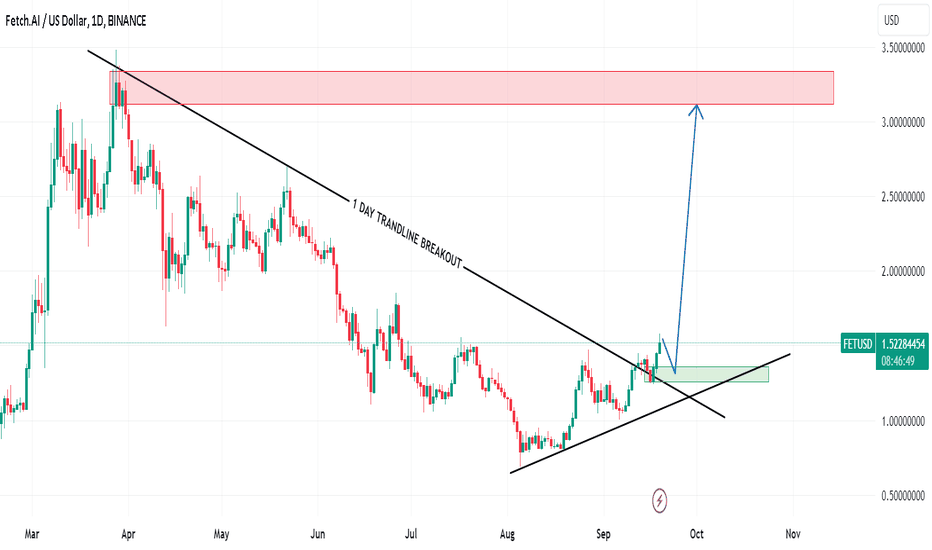

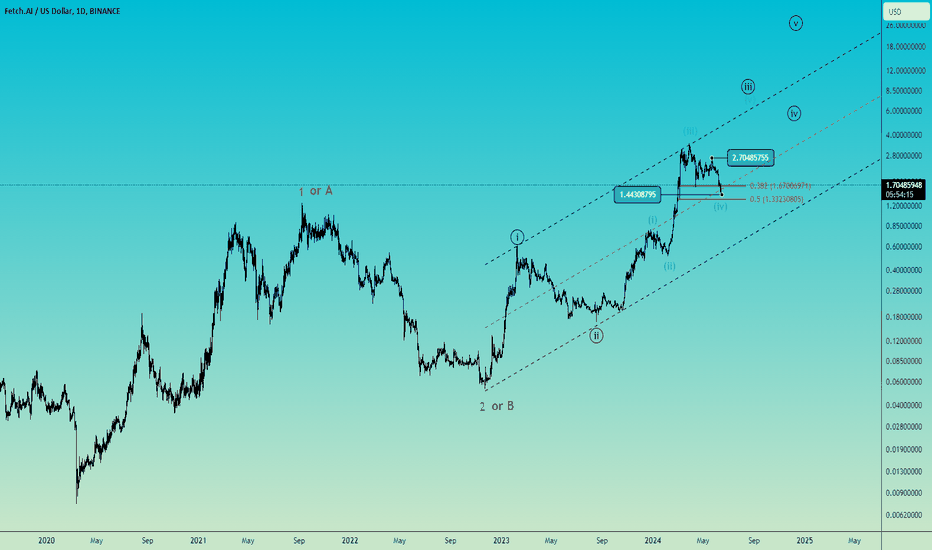

#FETUSD 1 DAYFETUSD 1-Day Chart Analysis: Buy Opportunity on Downtrend Breakout

Overview:

The FETUSD pair is currently showing signs of a potential bullish reversal after breaking out of a significant downtrend. This presents an attractive buy opportunity for traders looking to capitalize on the upcoming price movement.

Technical Analysis:

Downtrend Breakout: The recent price action indicates a clear breakout above the resistance level that defined the downtrend. This breakout suggests a shift in market sentiment, potentially leading to upward momentum.

Volume Confirmation: Accompanying the breakout, we observe an increase in trading volume, which adds validity to the move and indicates strong buying interest.

Support Levels: Key support levels have formed below the current price, providing a safety net for buyers. A pullback to these levels could offer an even better entry point.

Market Sentiment:

The overall market sentiment appears to be turning bullish, driven by positive developments and increased interest in FET. As traders reassess their positions, this could lead to further upward pressure on the price.

Action Plan:

Entry Point: Consider entering on the breakout confirmation or on a pullback to support.

Target Price: Set profit targets based on recent resistance levels, and monitor for any potential price rejections.

Stop Loss: Implement a stop-loss order below the breakout level to manage risk effectively.

Conclusion:

The FETUSD pair presents a promising buy opportunity following a downtrend breakout. Traders should stay vigilant and ready to act as momentum builds in the coming sessions.

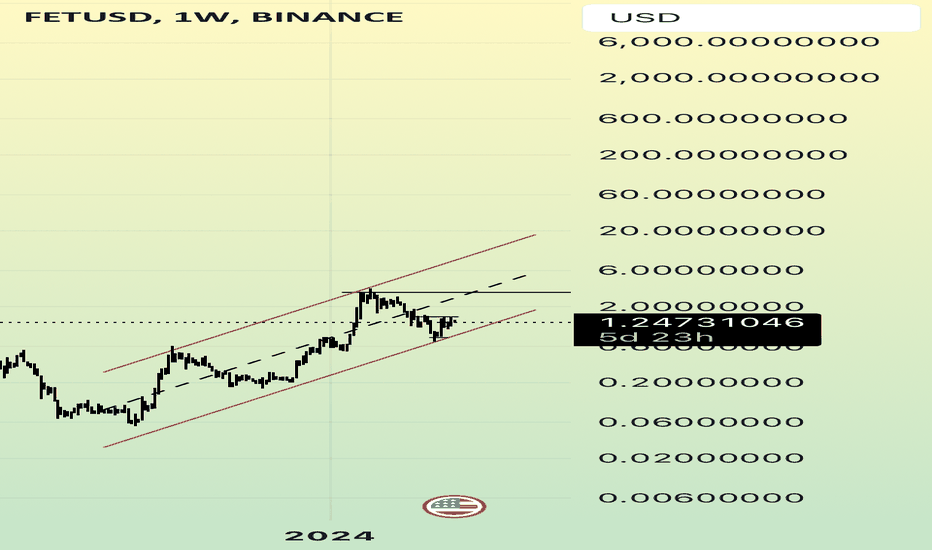

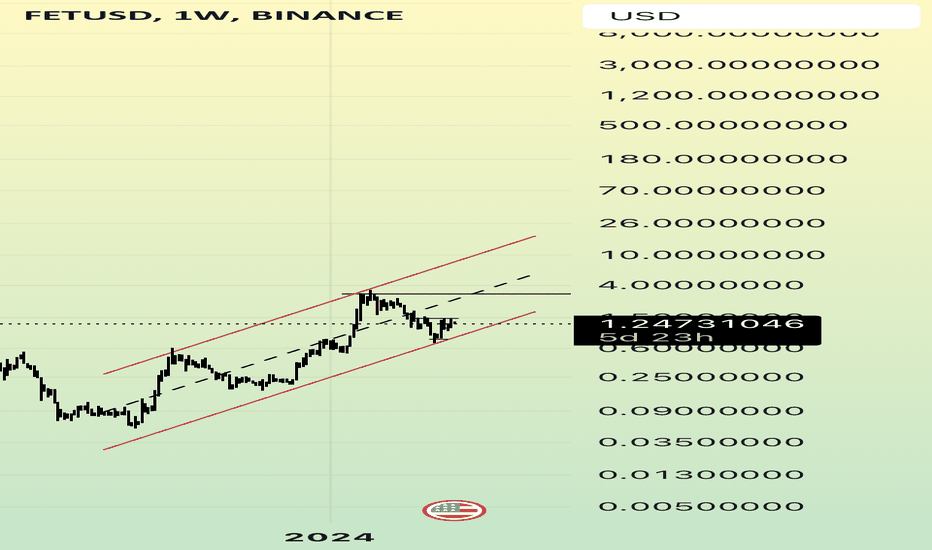

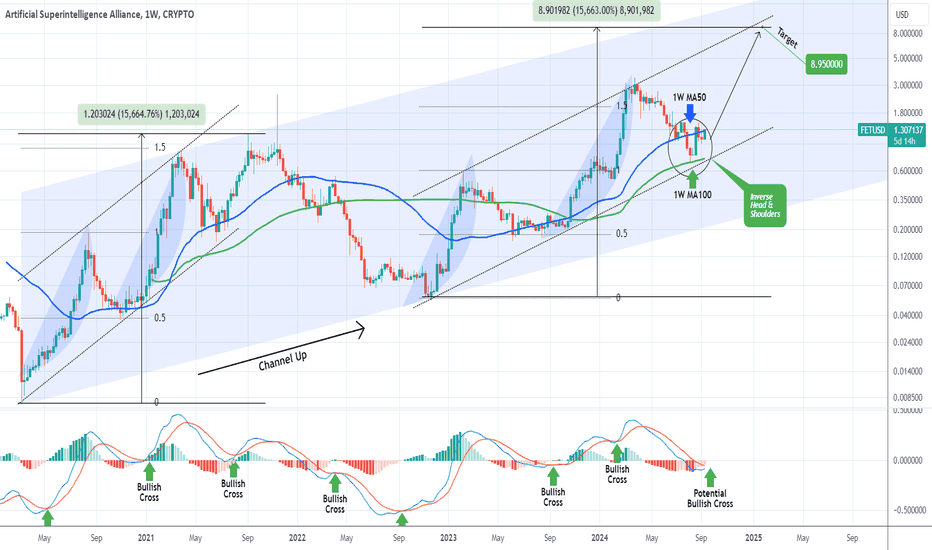

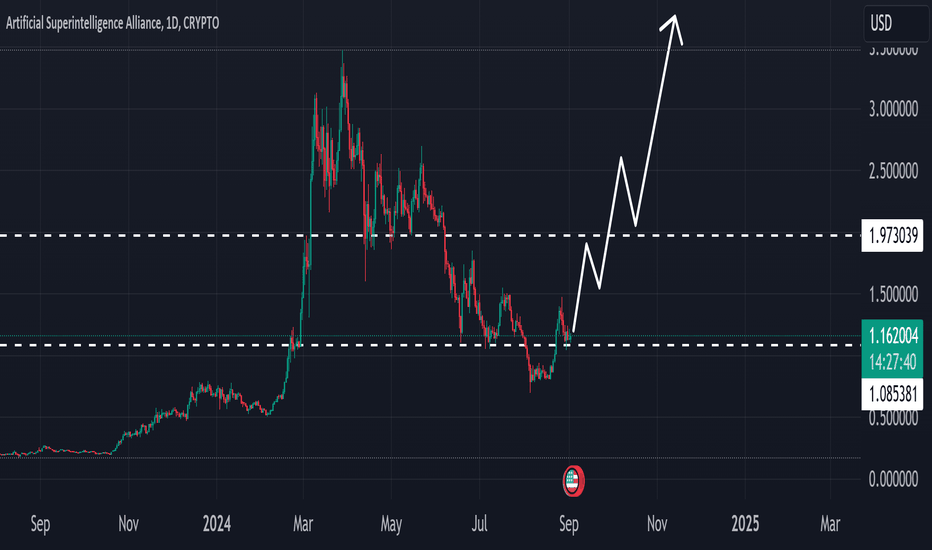

FETUSD signaling to +600% gains in early 2025.Fetch.AI (FETUSD) has been trading within a (dotted) Channel Up since the November 21 2022 bottom of the Inflation Crisis and the recent August 05 Low touched and rebounded exactly on the 1W MA100 (green trend-line).

Technically, that was the Head of an Inverse Head and Shoulders (IH&S) pattern, which is typically a formation seen on market bottom reversals. Given the fact that it was also on the bottom (Higher Lows trend-line) of the 2-year Channel Up, there are high chances of a new Bullish Leg. A 1W MACD Bullish Cross (which is very close to emerge) will confirm that signal.

Since 2019 and the start of FET's trading, a 1W MACD Bullish Cross has delivered strong rallies in 6 out of 8 times. Considering also the fact that since the March 09 2020 bottom, the multi-year pattern is a (blue) Channel Up, there are currently much higher chances for a new rally than not.

The first Bullish Leg of the blue Channel Up (2020/21) peaked at more than +15660% and above the 1.5 Fibonacci extension. Assuming that the pattern is to print another such rise (+15660%) from the November 2022 bottom, then we should be expecting a Q1 2025 Target at around 8.9500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Fetch A.I. nearing the top trendline of its falling wedgeNot sure how long it will take it to break upward from this wedge so the measured move line and breakout target is currently placed in an arbitrary location that will obviously need adjusted to wherever it legitimately breaks up from. Not exactly sure how this chart will be effected by the merger of fetch, singularity nd the other ai chain merge. Wil have to wait and see. Will update this chart whenever we get a legitimate breakout. *not financial advice*

FET - Risky play, probably fine for long-term holdersFET is one of the more riskier plays here, it could pump but we had a recent death cross on the daily on July 11th. We are close to peak greed, so I'd like to see the fast line hook up to confirm we have room to run. Personally, I'm not setting a SL here because I'm waiting until after the merge to ASI to see how things go but it's never wrong to TP if you made money or have a lighter risk profile.

Fetch.Ai, I love the action on this chart.Definitely one of my favorite altcoin charts. Clean price action, very readable. Actually had to stop myself from drawing too much on the chart. I personally have been leaning neutral/bearish on the whole market until liquidity conditions improve. Nothing changes for me in the long term. Different conditions create different opportunities.

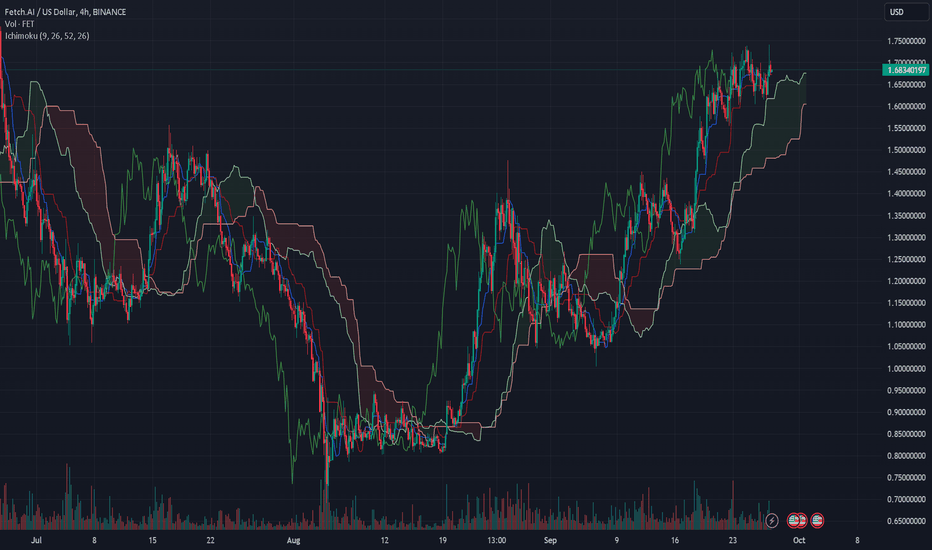

FET - Consolidation nearly over?CRYPTO:FETUSD The volume-weighted moving average (VWMA) anchored to the October 2023 momentum breakout has acted as support. FET is now testing the Anchored VWAP (AVWAP) from the beginning of the December 2023 consolidation. When it cleared this AVWAP in February, it went on to make a 400% move to the March high. FET has also reclaimed its 21 VWMA and 200 SMA. The 200WMA:200SMA cloud is positive, and it is testing the 50 EMA and 200 WMA. We also have a positive signal crossover on the LMACD and the composite index.

These are all favorable signs, but I will look for additional confirmation before making a move. I'd like to see it clear the AVWAP from the March high and clear and retest the 0.618-0.786 Fibonacci retracement levels. This suggests a potential for gains in the $3.00-$3.50 range at the lower end, with the possibility of reaching a new high in the $4-$5 range. This scenario would be invalidated and require new analysis if we see a move below ~$1.25.

Don't forget that we also have the coin merger with OCEAN and AGIX into FET in July, followed by a conversion to ASI. Depending on how the merger goes and other market conditions, this news event could be a short-term catalyst for either a move higher or a panic selloff. I remain very optimistic about the long-term opportunity.

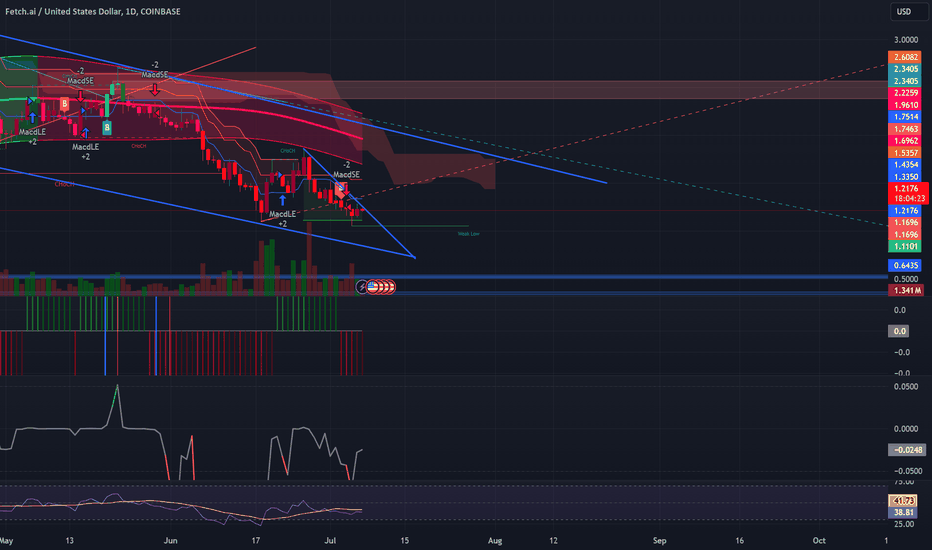

FET - Daily Shortterm Trend & Support/Resistence Trade SignalFET - Daily Shortterm Trend & Support/Resistence Trade Signal

-------------------------

FET now completed a correction and are ready to return to gain higher.

The new opportunity at the current price

🟢 Trend: Bullish 🚀

🟢 Support: $1.47

🟢 Target: $ 8.8

------

Current: $1.58