US Missiles Flyin'! Buy USD vs EUR GBP AUD NZD CAD CHF JPY!This is the FOREX futures outlook for the week of Jun 22-28th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

The USD is the world's reserve currency. When there are geo-political hot spots in the world, the USD sees inflows from investors. In light of US strikes against Iranians nuke sites last night, buying the USD versus other currencies is prudent and wise.

The USD should see more gains as long as the current tensions are high. If Iran comes back to the negotiations table, then the environment switches back to a risk on scenario, where the outflows from the USD go back into riskier assets like the stock market.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

USDX trade ideas

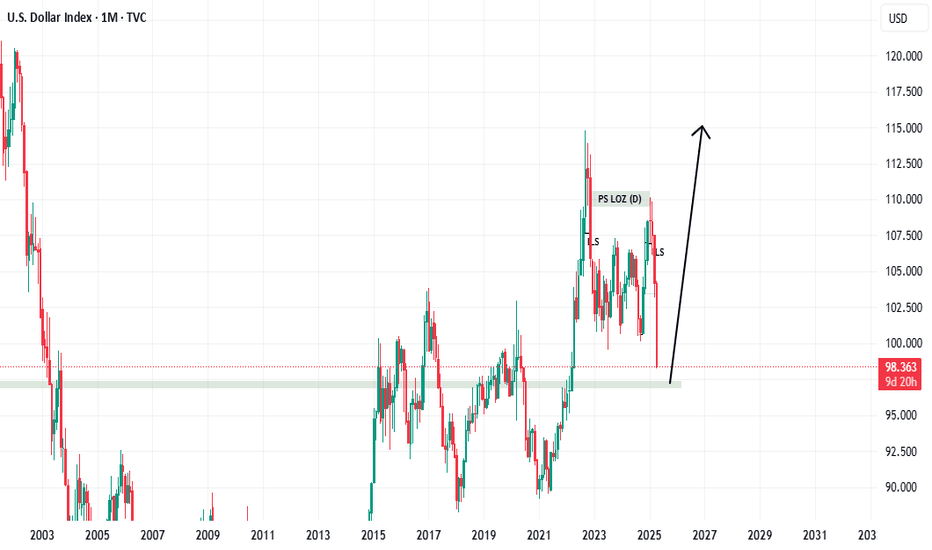

Dollar Monthly CLS I Model 1 I Reversal I DOBHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS Footprint, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behavior of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

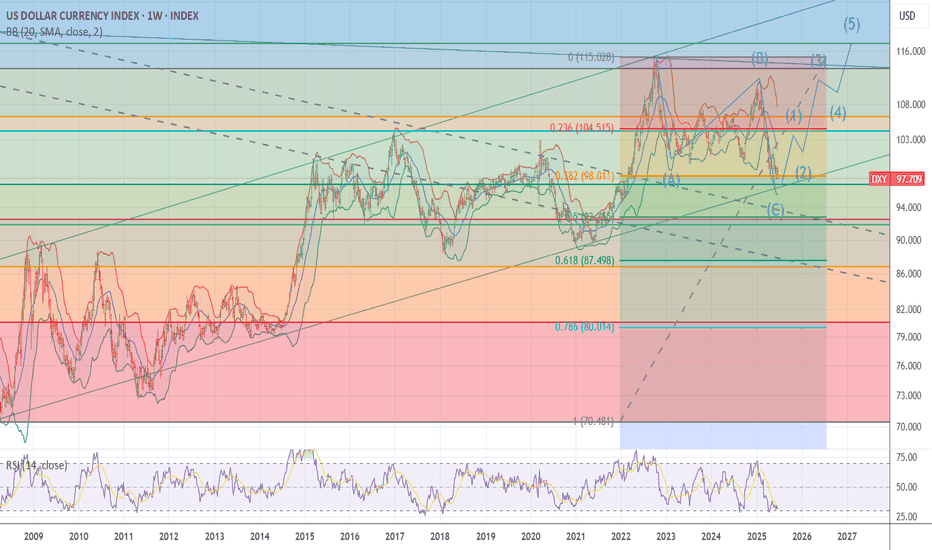

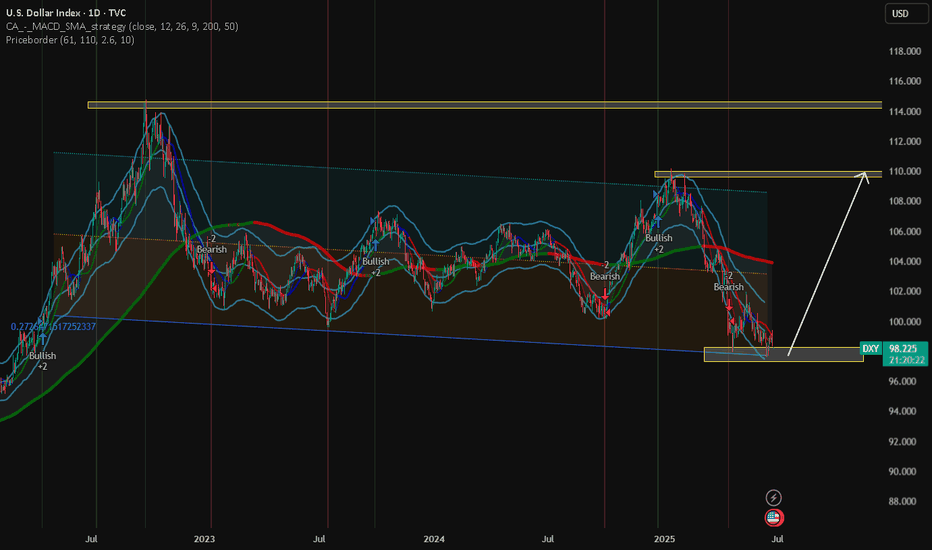

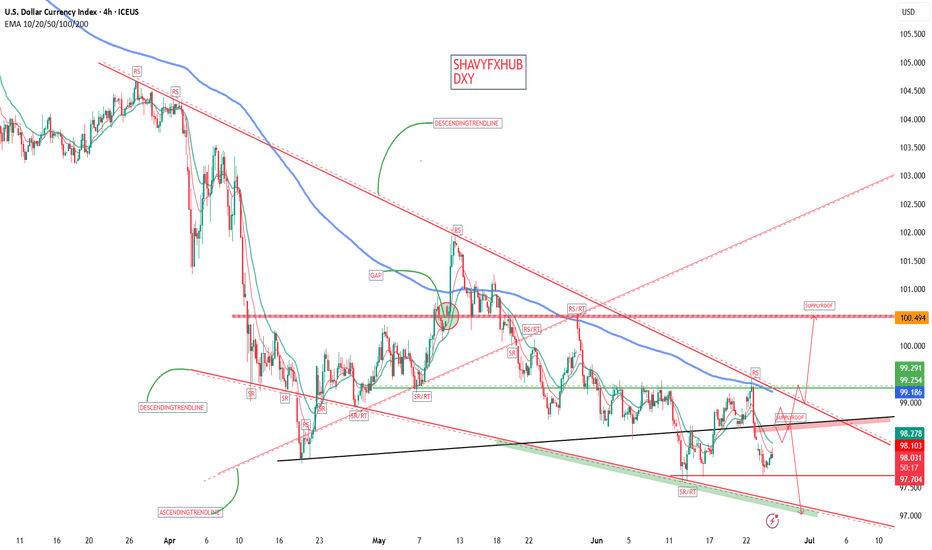

DXY CRACK! BAD JUJU!After Trump unilaterally imposed Tariffs (Taxes) on its citizens to buy imported goods from the rest of the world, promising 90 deals in 90 days, "in two weeks", the demand for the dollar payment system has collapsed by -12% reducing purchasing power for all $ holders'.

Imports of goods mean exporting $s to the rest of the world. As a world reserve currency (WRC), the US gets the benefit of seeing those $s invested back into the US. That creates demand for the $ payment system, and raises $ holders' purchasing power, reducing inflation.

What else happens? A bit complicated but I will try to explain. High demand for $ means the US indirectly exports inflation. Meaning, more $ for the same amount of goods and services. However, as a WRC, the US is not really exporting inflation. That is a bit inaccurate bc the US payment system as a WRC is actually includes a lot more goods and services from the entire planet. This makes sense if you think about it. However only going one way, meaning as long as the demand from the world for our payment system, more $ required by the world reflect more goods and services. As such not inflationary.

Now let's reverse it so you can see why it is not entirely accurate. Should the Global Economy (which is worth today about $100 trillion,) demand ever drop off. The $ value will collapse as people sell their $ holdings in exchange for other currencies. What you are seeing right now in this chart with a CRACK in it.

The US GDP is currently about $30 trillion. There is no way! A $ payment system designed for a $100T economy can suddenly absorb all those $ in a $30T economy. Inflation would skyrocket as more and more $ chase the same amount of goods and services ($30T). This is not rocket science. This is basic 3rd-grade arithmetic!

This CRACK! could be very bad JUJU!

CAUTION is in order. Don't let normality bias fool you. No matter how you feel about Trump. It is irrelevant to basic arithmetic.

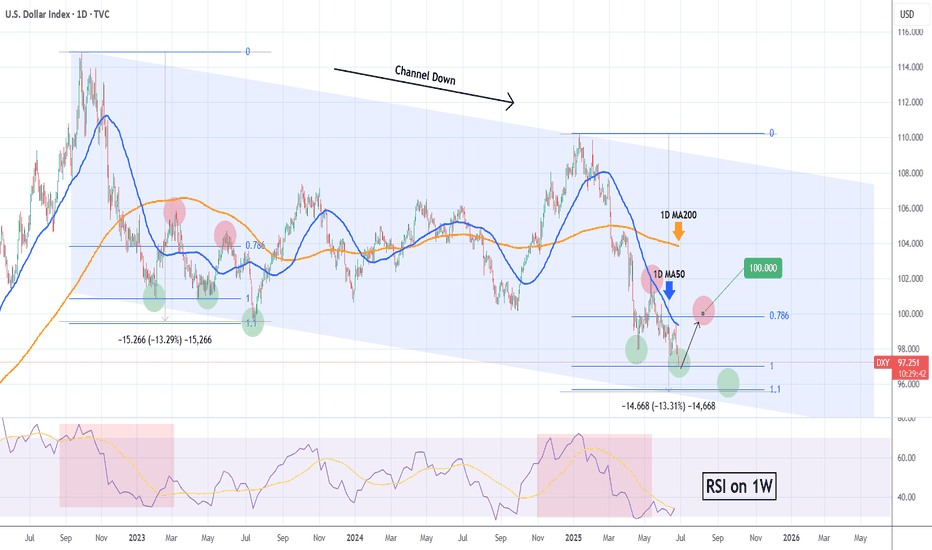

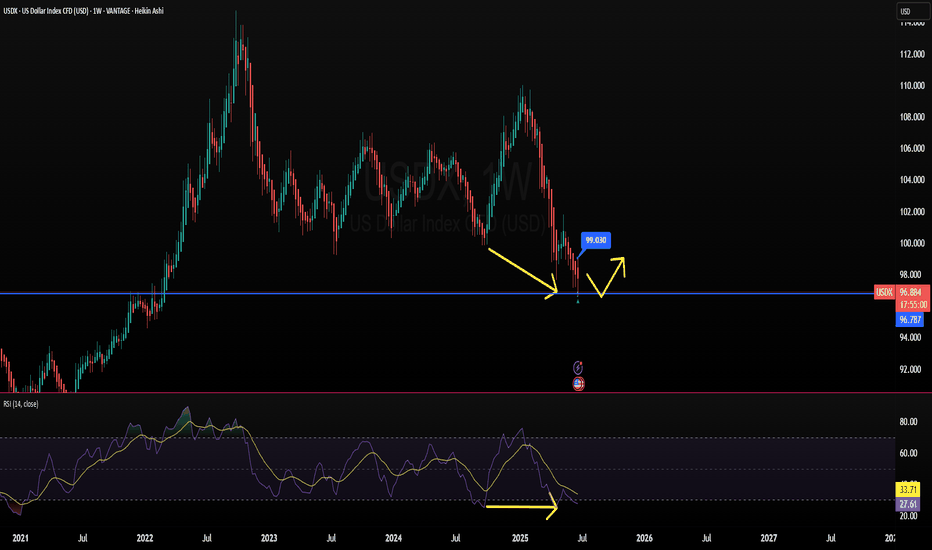

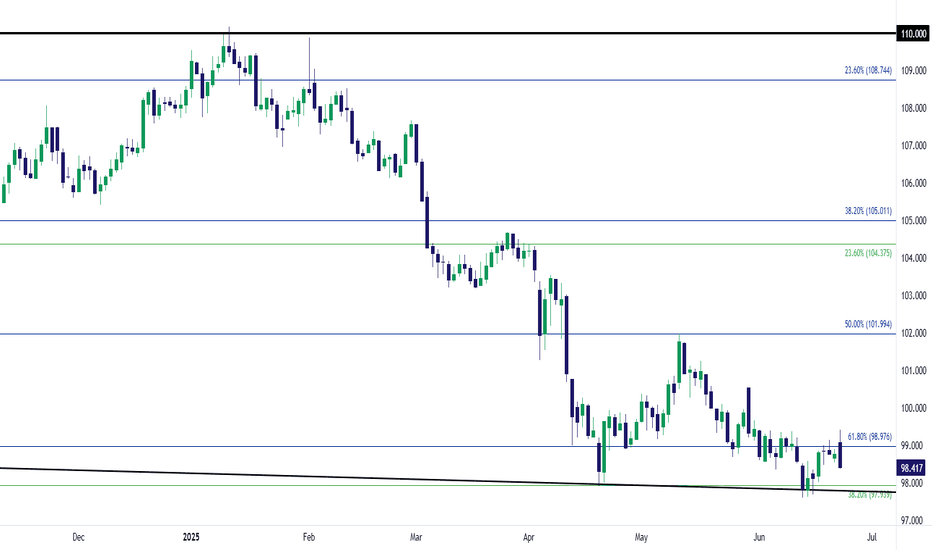

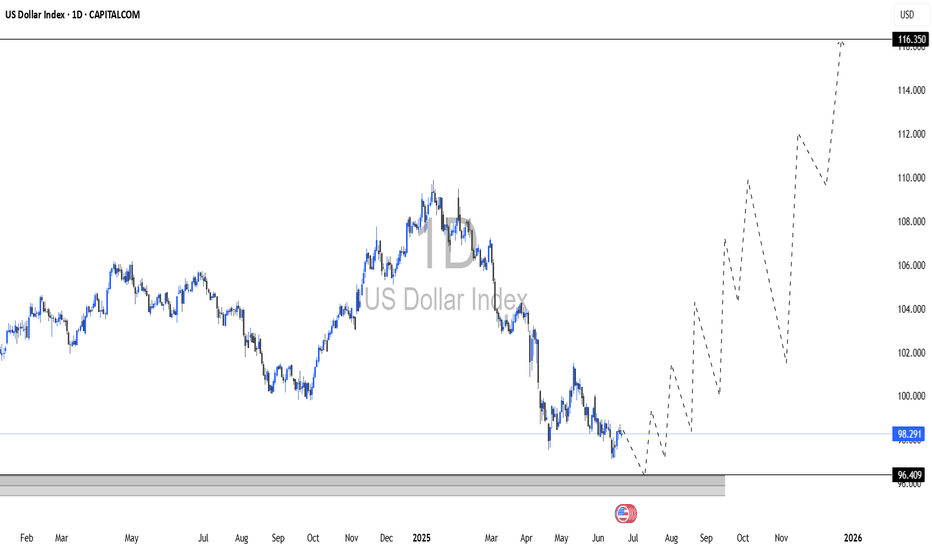

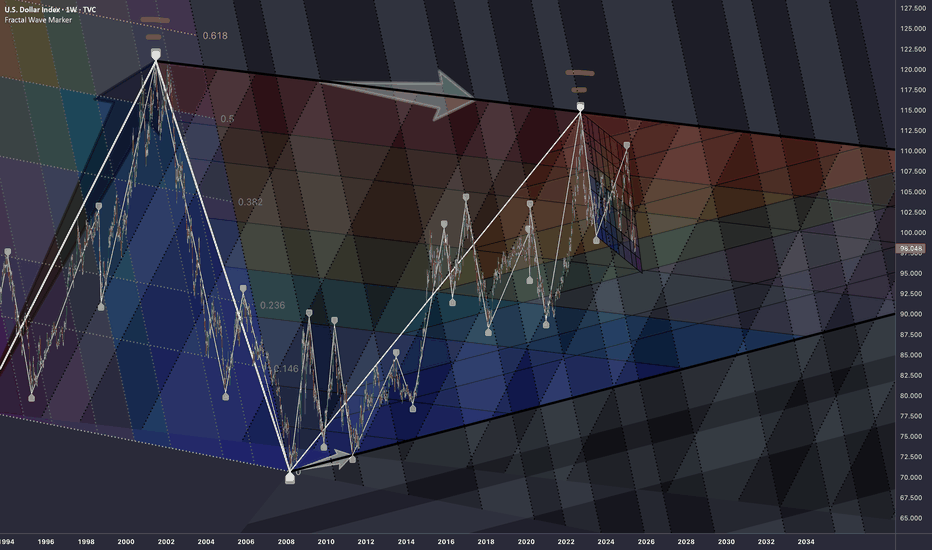

DXY Short-term rebound quite likely.The U.S. Dollar index (DXY) has been trading within almost a 3-year Channel Down, which has assisted us in choosing the right levels to sell high and buy low.

Despite being now on its 2nd major Bearish Leg, we see a short-term bounce possibly up to August quite likely based on the previous major Bearish Leg. As you see, the current setup resembles the April 13 023 Low after which the price rebounded short-term just above the 0.786 Fibonacci level, only to get rejected later and complete the bottom on the 1.1 Fib extension.

Even the 1W RSI sequences between the two fractals are identical. Therefore, before diving below 96.000, we believe a 100.000 test is quite likely.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DXY Technicals Add Pressure on FED Data〽️Weekly RSI Divergence Spotted in the US Dollar Index (DXY)

A bearish divergence has emerged on the weekly RSI chart of the US Dollar Index (DXY), signaling a potential loss of upward momentum. Historically, such divergences often precede price corrections or reversals.

✅Market Implications:

USD pairs, gold, and crypto assets may see retracement as dollar strength wanes in response to technical exhaustion.

Traders should watch for signs of consolidation or reversal in assets inversely correlated with the dollar, such as gold (XAU/USD) and Bitcoin (BTC/USD).

📈Macro Outlook:

All eyes on the Federal Reserve: The divergence adds weight to market speculation that the Fed might pivot toward a rate cut at its July 15 meeting.

If confirmed, rate cuts could further pressure the dollar, accelerating moves in risk-on assets and emerging market currencies.

#XAUUSD

#DXY

#BTCUSD

#tgifx

DXY: Strong Bullish Sentiment! Long!

My dear friends,

Today we will analyse DXY together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 96.899 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 97.077.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

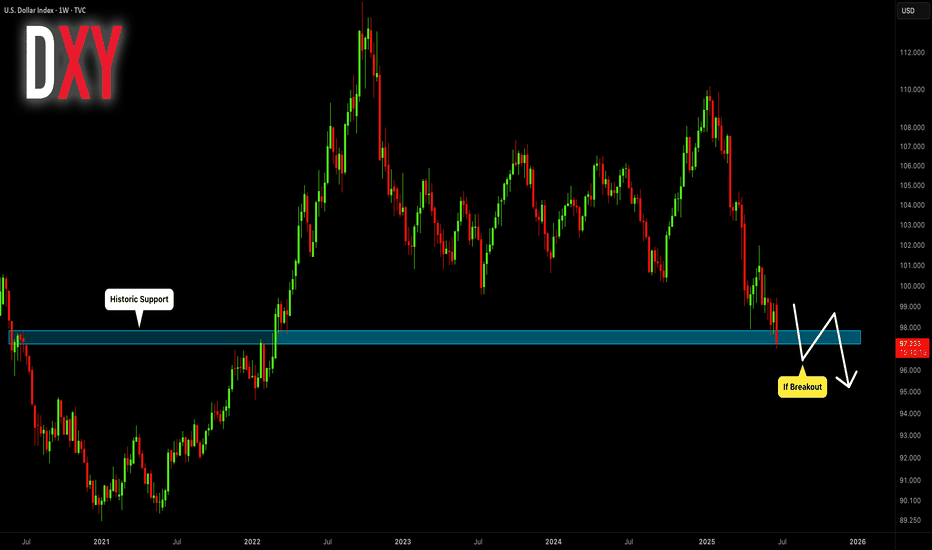

DOLLAR INDEX (DXY): Critical Moment

With an unprecedented pace of weakness of US Dollar,

DXY Index is now testing a historic weekly support cluster.

If the market breaks it today and closes below that, it will

open a potential for much more depreciation.

Next historic support will be 95.5 and a downtrend will continue.

Today's US fundamentals can be a trigger.

Please, support my work with like, thank you!

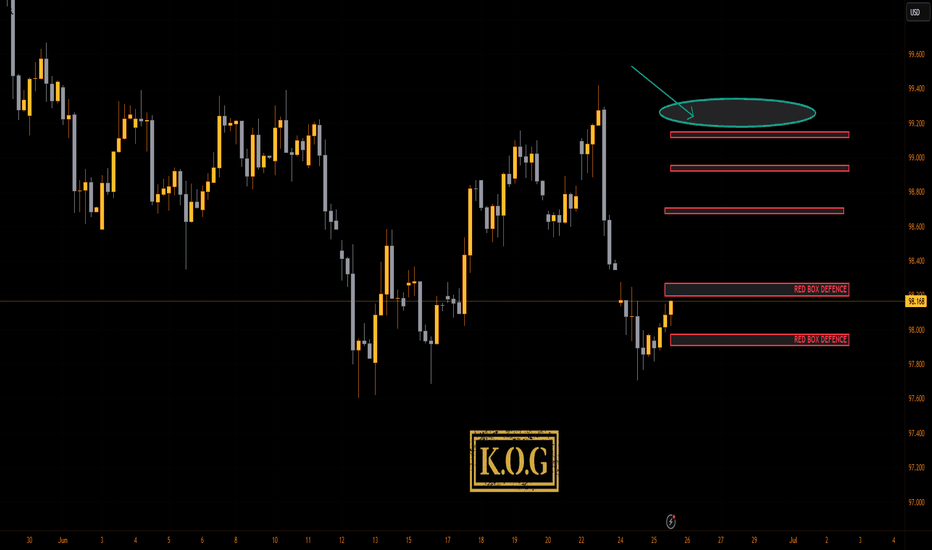

DXY hello trader, the price of DXY has reached major support level, price will likely reverse after fully liquid sweep on bearish side in daily tf... price could test the 97.7 in 1hr tf, so look for proper reversal in lower tf also, however weekly handle already did liquidity sweep of previous weekly candle. overall the target is 110 for now or could breakout.. price above 200ma will be a good sign of bullish momentum..

good luck to all

Short Term USD Strength This Week! Sell The Majors?This is the FOREX futures outlook for the week of Jun 8 - 12th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

USD gained some strength on Friday's job data. Talks with China this week may add to it. But I believe the bullishness will be short term.

Look for valid sells in EUR and GBP. Be cautious with AUD and NZD. CAD and CHF will also offer opportunities to sells.

CPI Data due Wed, making that day and the days that follow potentially the best trading days this week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

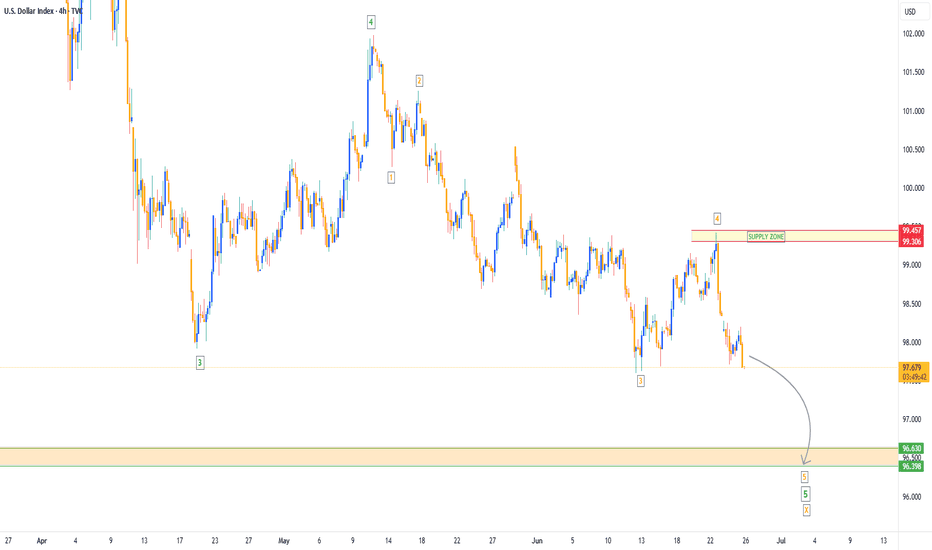

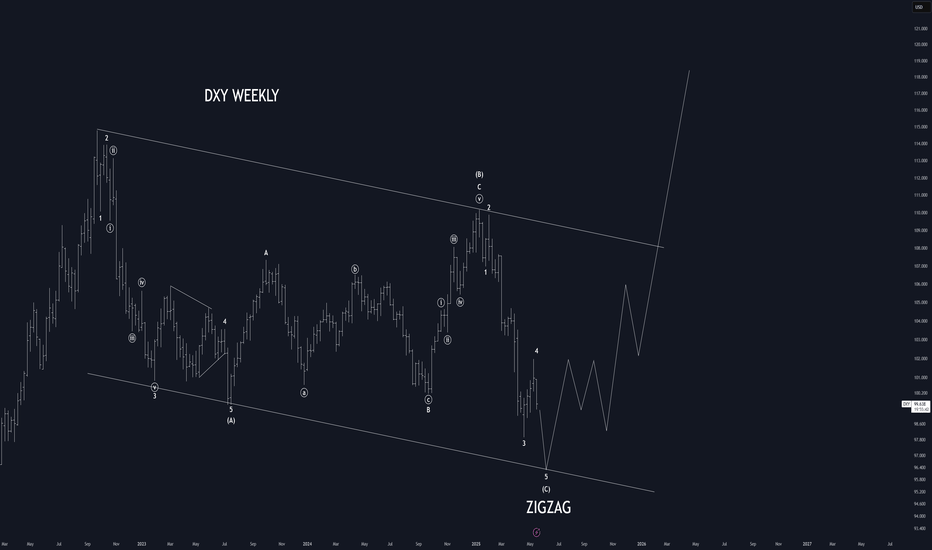

Dollar Index Bearish to $96The DXY has been in a downtrend for a while & that bearish pressure is not over yet. I expect more bearish downside towards the $96 zone, before we can re-analyse the market for any signs of bullish takeover.

⭕️Major Wave 3 Impulse Move Complete.

⭕️Major Wave 4 Corrective Move Complete.

⭕️Minor 4 Waves of Major Wave 5 Complete, With Minor Wave 5 Yet Pending.

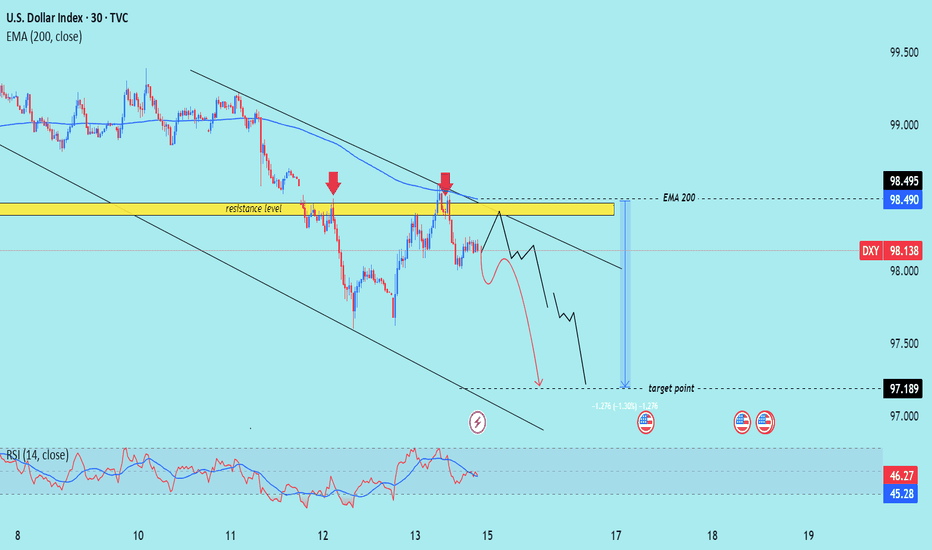

Index/US) Bearish trend analysis Read The caption)SMC trading point update

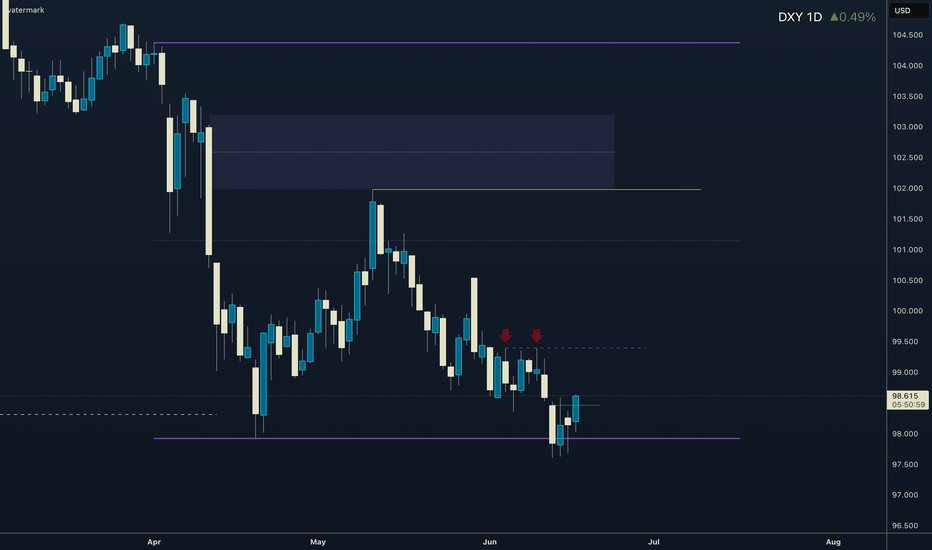

Technical analysis of U.S. Dollar Index (DXY) on the 30-minute timeframe, with the price respecting a clear downtrend and repeatedly rejecting a resistance zone near the 200 EMA.

---

Analysis Breakdown

Key Technical Elements:

1. Downtrend Structure:

The price remains within a descending channel.

Multiple lower highs and lower lows signal sustained bearish pressure.

2. Resistance Zone:

Highlighted near 98.490–98.495, aligned with the EMA 200.

Multiple rejections from this level (indicated by red arrows), confirming strong supply.

3. EMA 200 (98.490):

Acts as dynamic resistance.

Price is below it, reinforcing the bearish bias.

4. Projected Move:

Bearish price path targets the 97.189 level (target point).

A measured move of approximately -1.30% is illustrated.

5. RSI (14):

RSI currently at 46.27, below the neutral 50 mark.

This confirms bearish momentum without being oversold, leaving room for further downside.

---

Bearish Thesis:

Repeated failure to break above key resistance + downward channel + RSI weakness suggests a continuation to the downside.

Short-term consolidation expected before breakdown continuation.

---

Trade Idea Concept:

Entry: Sell on a minor pullback near resistance (~98.300–98.490), or breakdown below the recent minor support.

Target: 97.189 zone.

Stop Loss: Above 98.500 or EMA 200 to invalidate the bearish setup.

Mr SMC Trading point

Risks to Watch:

A break and strong close above 98.500 would invalidate the bearish structure and could initiate a trend reversal.

Economic events (noted by calendar icons) may trigger volatility – ideal to monitor closely around those times.

plesse support boost 🚀 this analysis)

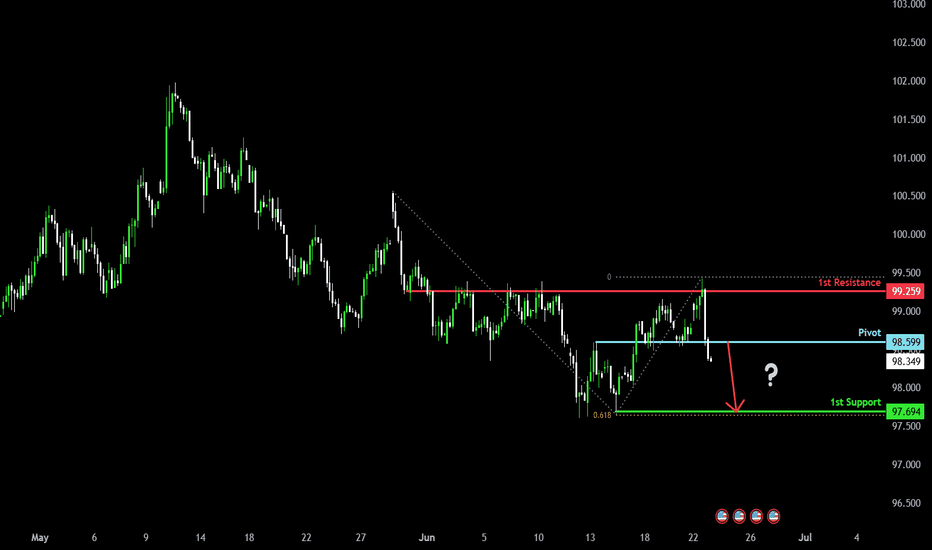

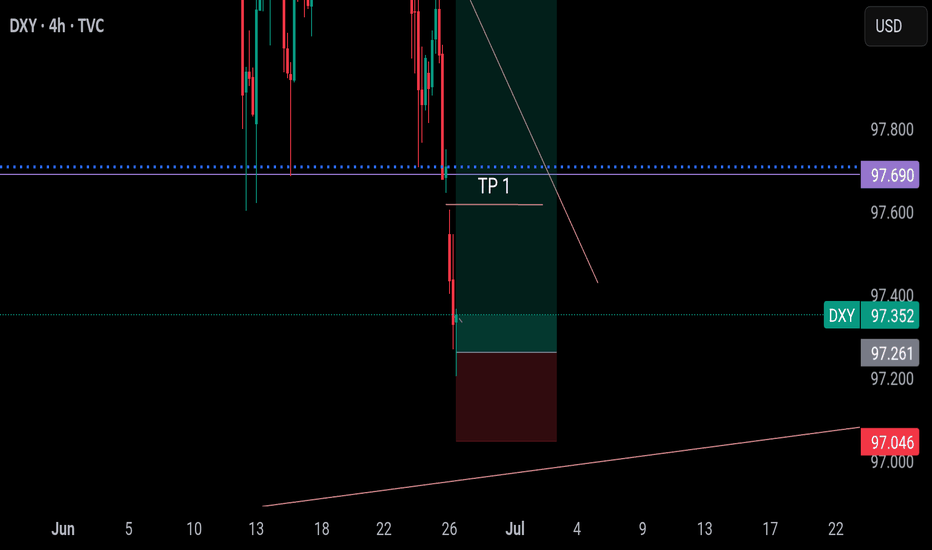

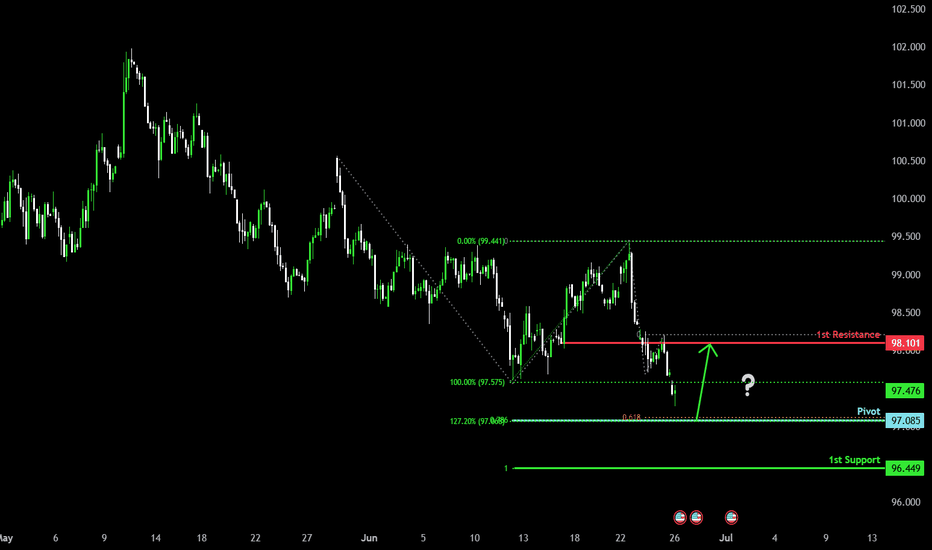

Bearish drop?US Dollar Index (DXY) has reacted off the pivot and could drop to the 1st support.

Pivot: 98.59

1st Support: 97.69

1st Resistance: 99.25

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

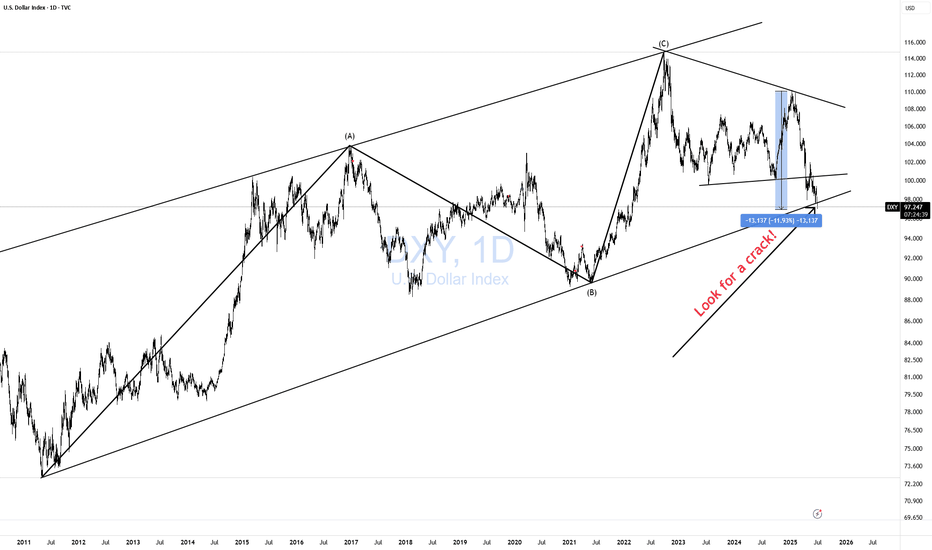

USD Bears Show Big Response to Rate Cut TalkThe bearish trend in USD has run for most of this year so far, and this has happened even as many members of the Fed refrain from talking up possible rate cuts. Last week, Jerome Powell once again reiterated that he thought tariffs would produce inflation, and he seemed to dismiss the forecasts that indicated two possible rate cuts in 2025.

Another inflationary factor showed with geopolitical risk, as tensions between the U.S. and Iran threatened to impact oil prices. And given how most consumer products in the U.S. transport via trucks, that could produce vulnerability to inflation from higher oil prices.

But, so far, we've seen a 'buy the rumor, sell the news' phenomenon around that, as Iran's retaliation hasn't seemed to excite markets, with oil prices heading lower after the attack. We've also seen the bid that drove the USD after the weekly open evaporate, and the daily bar is currently showing as a bearish engulfing candlestick.

There's quite a bit of U.S. drive from the calendar for this week including speeches from Jerome Powell along with numerous other Fed members. Friday brings the Fed's preferred inflation gauge, and sellers, at this point, seem to have an open door to make a run at the lows in USD. - js

DXY BULLISH MOMENTUM ABOUT TO BEGIN !The recent price action shows lower highs and lower lows, indicating a bearish market structure. The latest move bounced slightly off the 98 level, suggesting it is being respected as support, further US attacked Iran called successful operation which in my opinion could give a boost to DXY . watch tightly !

TA BY MIRZA

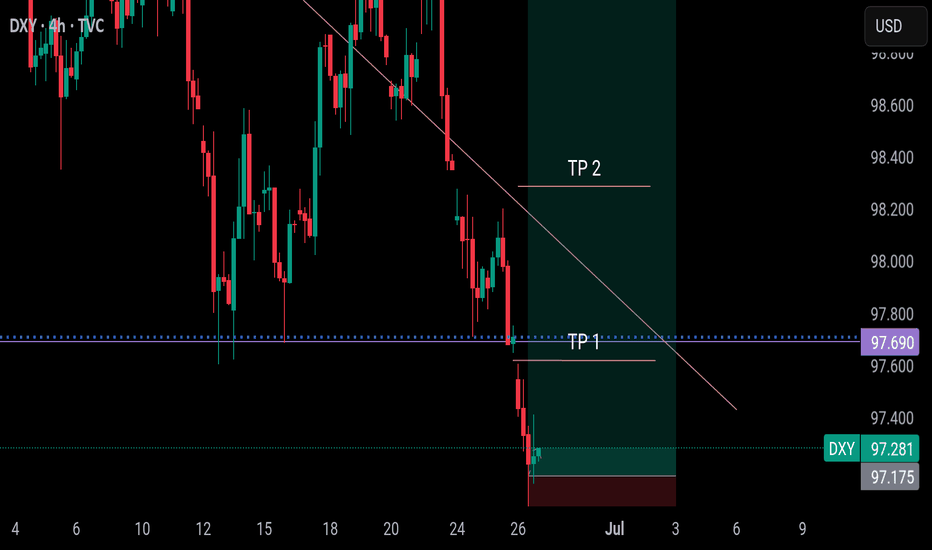

I dare say, DXY has bottomed, only higher from now on!This is the low on DXY. It can range from here or glide up slowly.

DXY is predictable this year because Trump is unpredictable. Causing the market to just repeat history. Check DXY on 2017

Conservative traders can wait for 4hrs close before entering.

The SL and TP are outlined on the chart.

Enjoy

DOLLAR INDEX the US Dollar Index (DXY) is trading around 97.704 -98.572,0.34% . The index has been under pressure due to easing geopolitical tensions ,Particularly optimism about a ceasefire between Israel and Iran and expectations of Federal Reserve rate cuts later in the year. The DXY remains below its 100-day,200 day exponential moving average (EMA), 100day, 200 day simple moving average with bearish momentum supported by interest rate hold and expected rate cut before the end of the year.

the 10 year united states bond yield is trading around 4.279%-4.324%,we have seen gold sell off at 3336-3334 on dollar rally.

Market Outlook:

The DXY is attempting to stabilize but remains in a bearish phase until it decisively breaks above 100 resistance.

the future of the dollar index is depending on Fed policy and global economic conditions.

Summary:

The DXY is currently weak around 97.88 -98.00 due to easing geopolitical risks and Fed rate cut expectations.

Bearish momentum dominates below the 100-day EMA, 200-day EMA, 100-day SMA AND 200 day SMA

A break above 100 would be needed to signal a bullish reversal, if the retest to broken supply at 100 could become demand floor .

#dxy

Potential bulllish reveresal?The US Dollar Index (DXY) is falling towards the pivot, which aligns with the Fibonacci confluence and could reverse to the 1st resistance.

Pivot: 97.08

1st Support: 96.44

1st Resistance: 98.10

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.