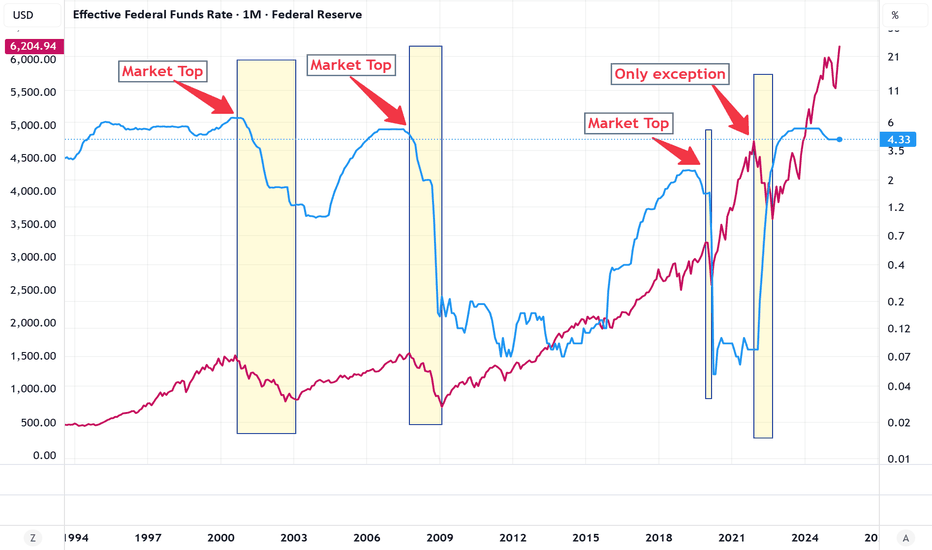

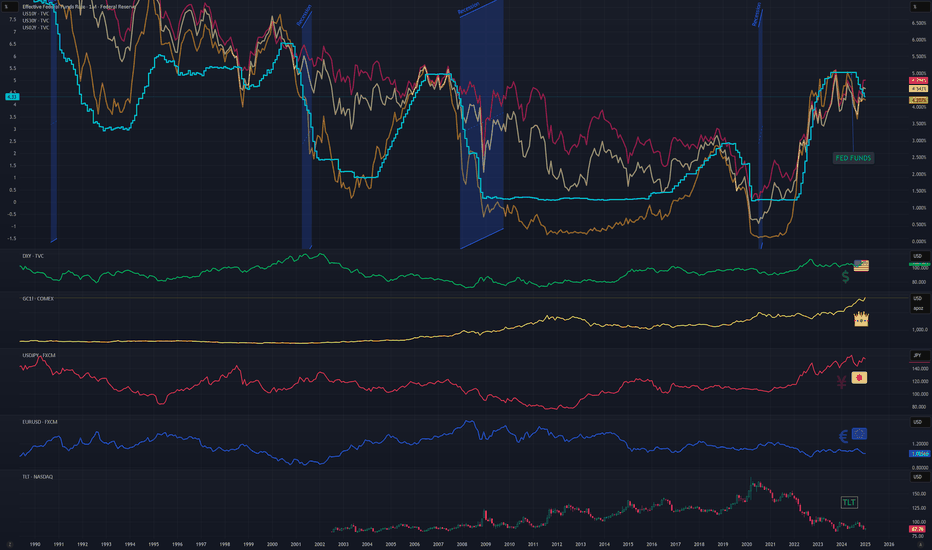

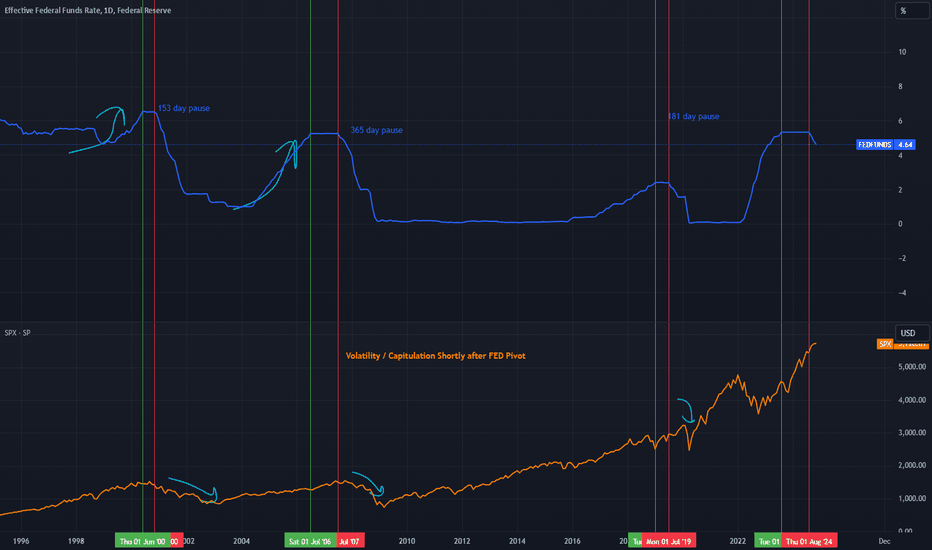

FED: An unlikely rate cut in September, unless…The United States Federal Reserve (FED) unveiled this week a new monetary policy decision, maintaining the status quo on interest rates—hence no change in the federal funds rate since December 2024. This did not prevent the S&P 500 from hitting new all-time highs, driven by GAFAM financial results a

About Effective Federal Funds Rate

Related indicators

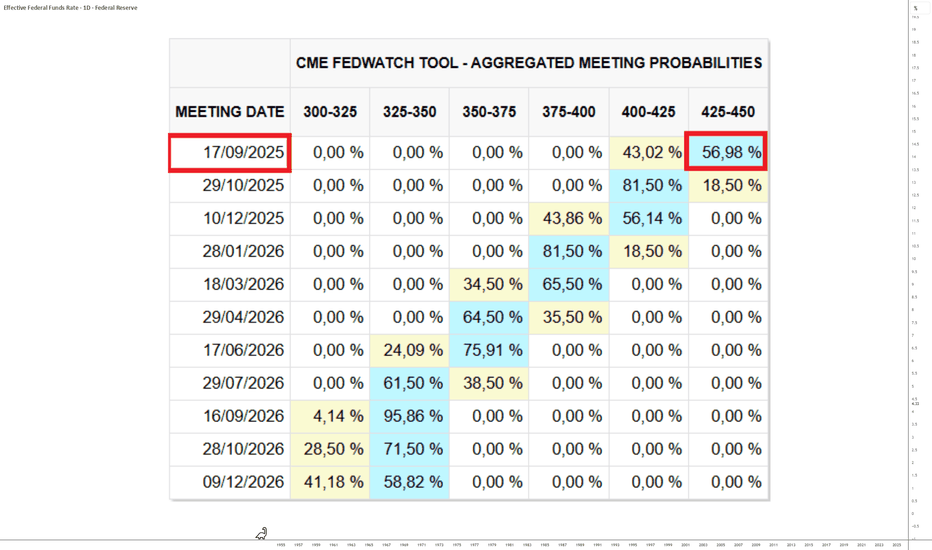

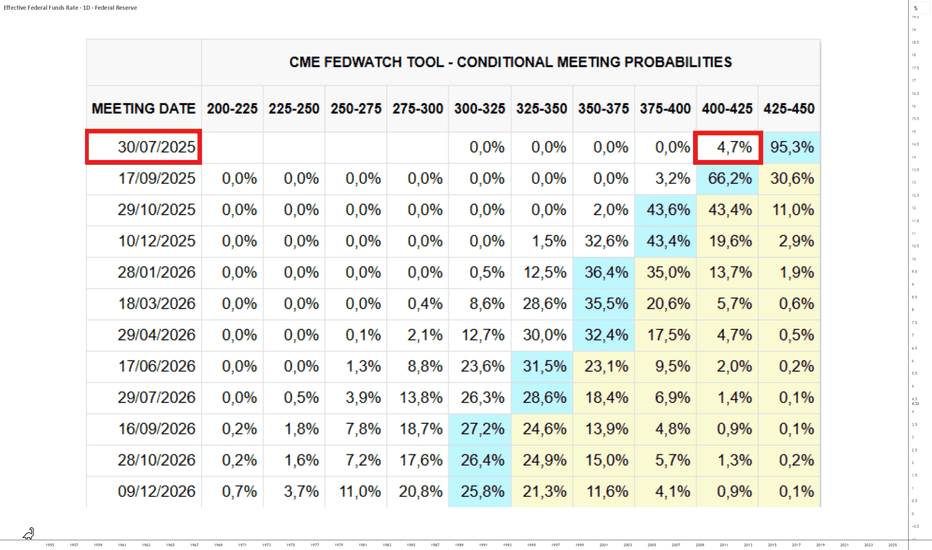

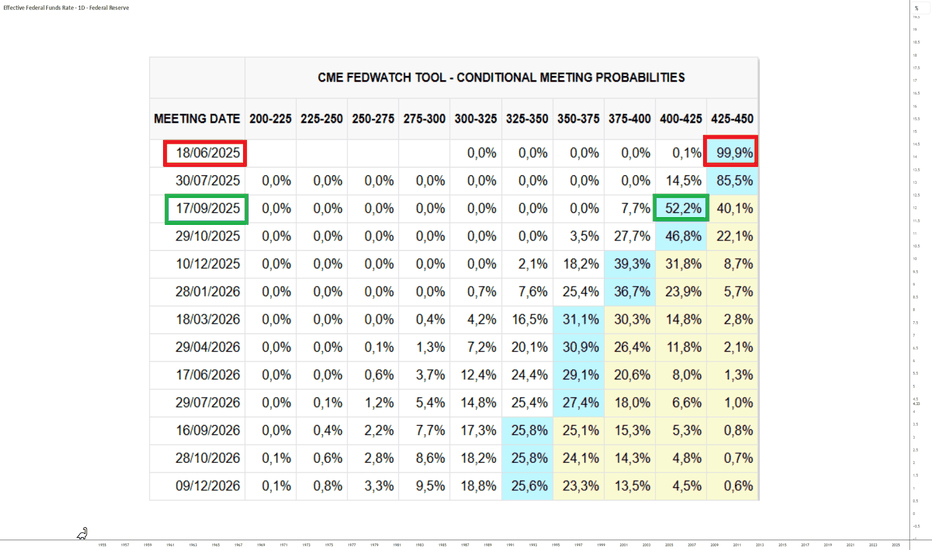

FED: less than 5% probability of a rate cut on July 301) The US labor market remains resilient according to the latest NFP report, which is good news for the macro-economic situation

The US labor market demonstrated its resilience last week, making a rate cut by the FED on Wednesday July 30 unlikely: the unemployment rate fell to 4.1% of the labor fo

FED, rate cut possible on July 30? With the US Federal Reserve (FED) meeting on July 30 fast approaching, the markets are scrutinizing the slightest signals likely to indicate an inflexion in monetary policy. While a rate cut seems unlikely in the short term, it cannot be ruled out altogether. Despite Chairman Jerome Powell's firm st

The FED on June 18 will be decisive for the stock market!Several fundamental factors will have a strong influence on the stock market this week, including trade diplomacy, geopolitical tensions and the FED's monetary policy decision on Wednesday June 18.

1) The FED on June 18, the fundamental highlight of the week

The stock market week will be dominat

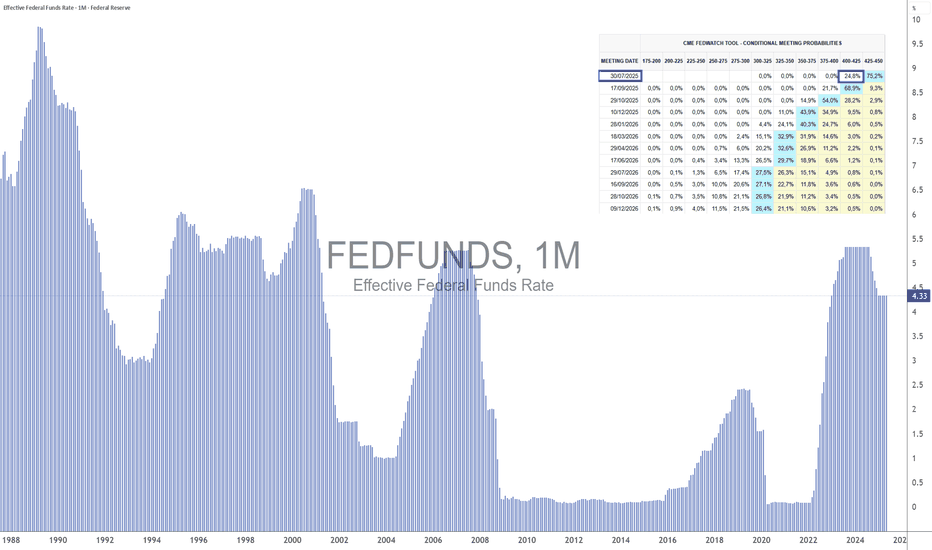

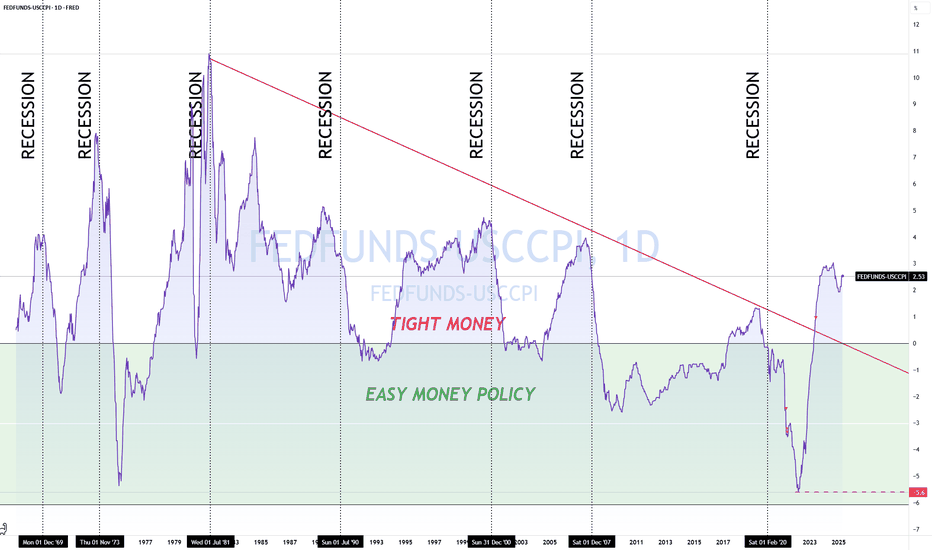

FED FUNDS Rate Inflation Adjusted Remains TightFED FUNDS Rate Inflation Adjusted for core inflation remains in the tightening area. As inflation rises over the next few months, thanks to Trump's liberating all Americans with higher taxes and less discretionary income to spend.

I expect this chart to drop as inflation rises and Fed holds rates s

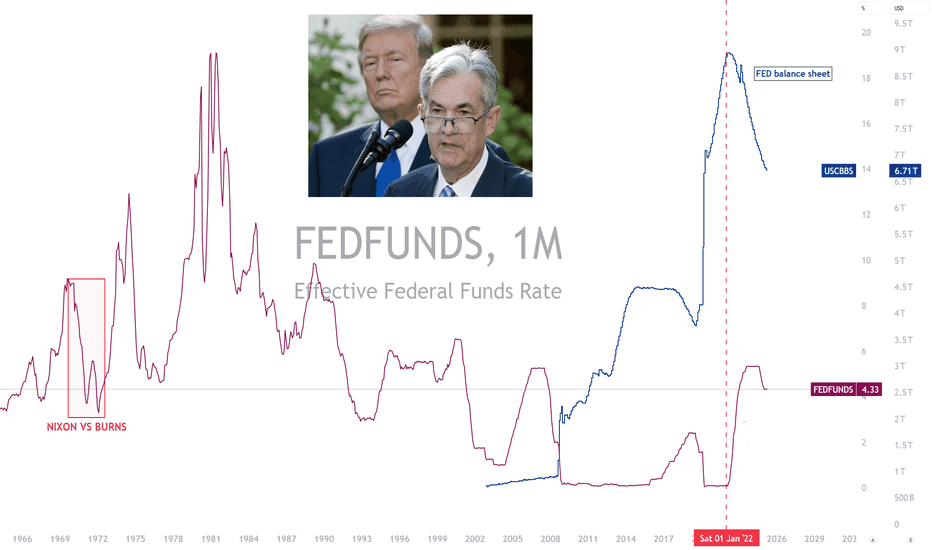

Will Jerome Powell give in on Wednesday May 7 by cutting rates?Introduction: As the US Federal Reserve (FED) approaches a new monetary policy decision, the central question is: Will Jerome Powell bow to political pressure and initiate a rate cut on May 7? To answer this question, it is essential to look back at the institutional framework of the FED and the hi

See all ideas