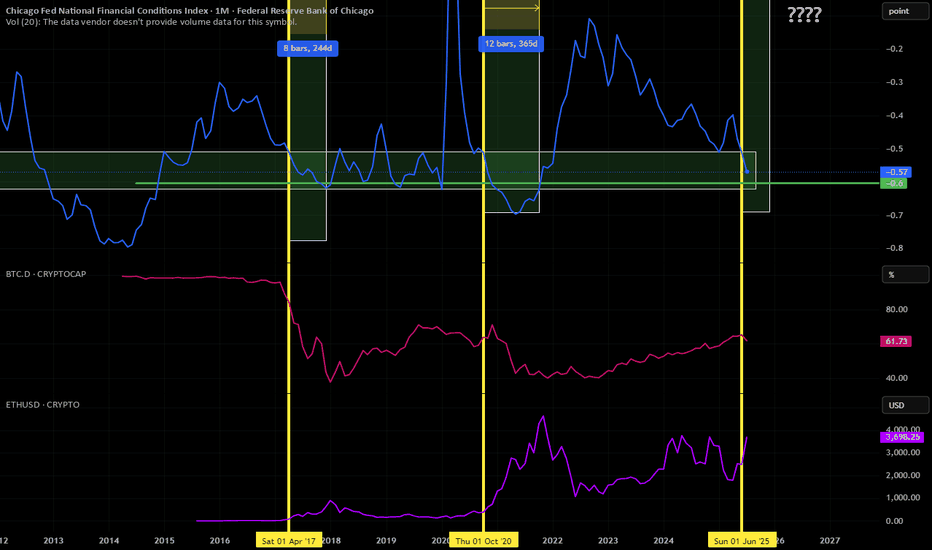

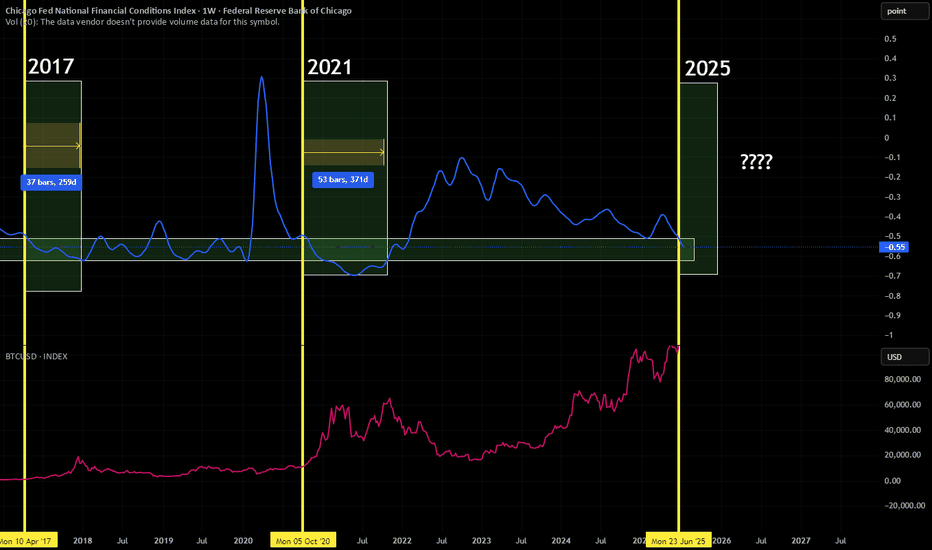

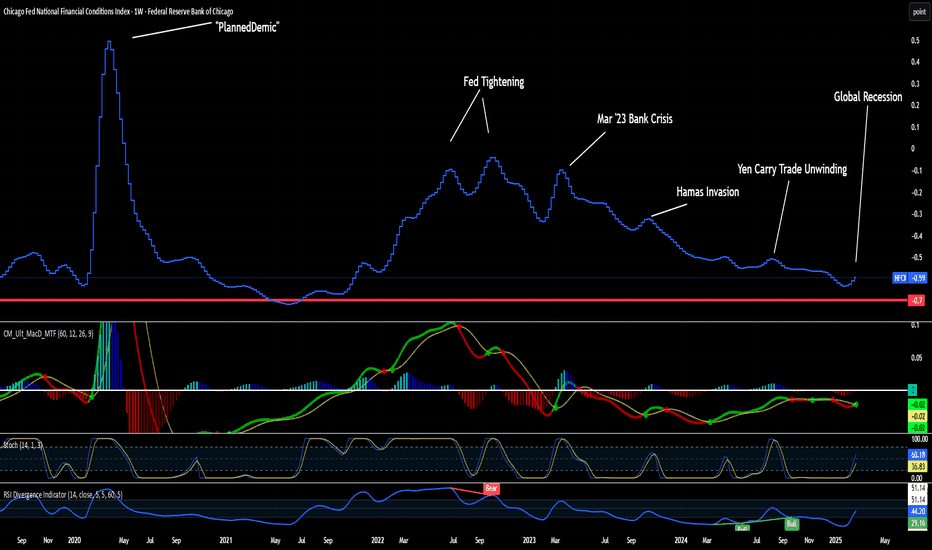

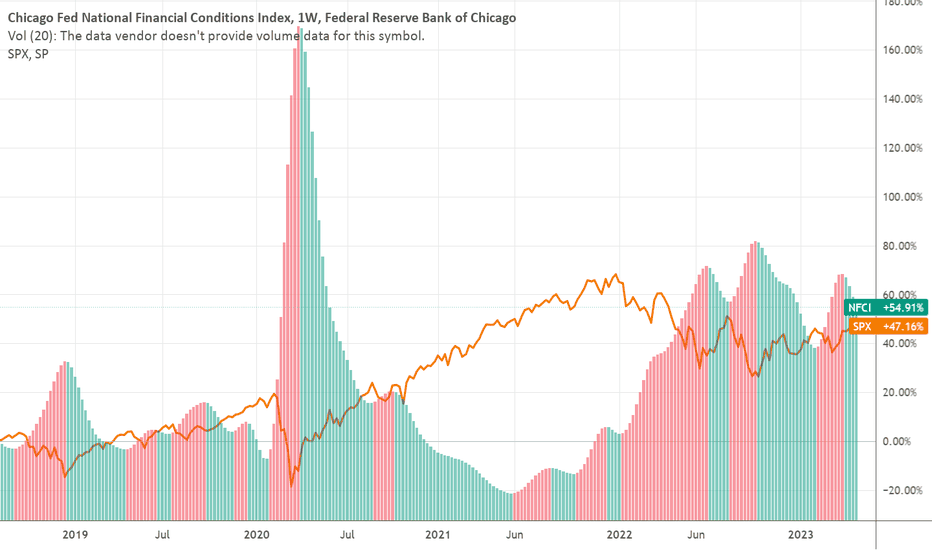

nfci corellation with Eth and altcoin Alt season is not a magic internet voodoo that happens every 4 years . It happens when the financial condition easy past a certain point , which the last two instance was -60.

Eth starts running when Nfci crosses' -50 and when that crosses -60 alt season

Data Point on when eth started its bull run or mini bull run

April 2017 (eth started Bull run)

Oct 2017 we crosses -60 result alt season

April 2019 ( eth started running defi season)

Jan 2020 one month below -60, Data is inconclusive due to covid crisis

Oct 2020 we all know what happens next

We are at -57 , waiting for -60

Inconclusion are we in alt season , NO

are we close , yes very very close

NFCI trade ideas

NFCI Turning Up AgainNFCI is Turning Up Again. This time, it is the onset of a Global Recession. China, India, the EU all are falling into deep recessions. The Japanese "Yen Carry Trade" is going to unwind again due to the weakening dollar, demand destruction with Oil, and inflation resurgence in the USA.

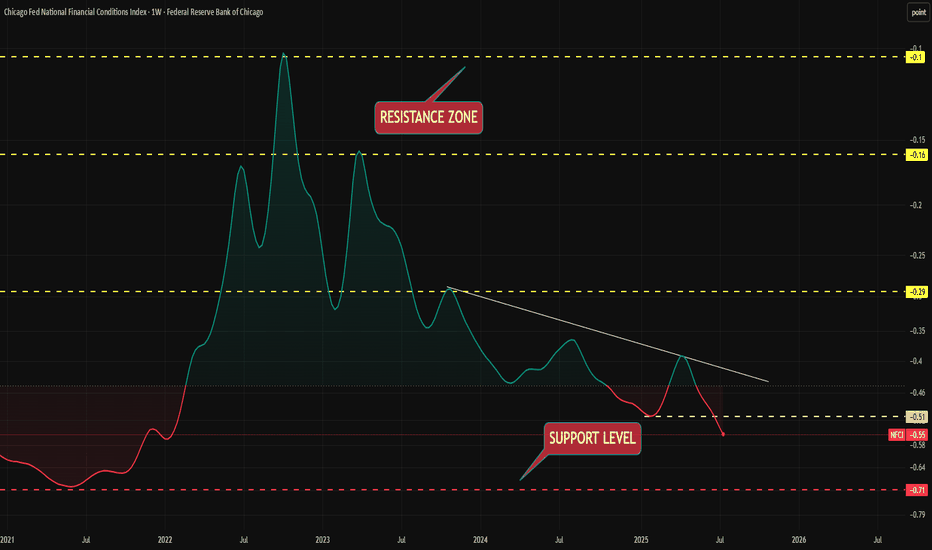

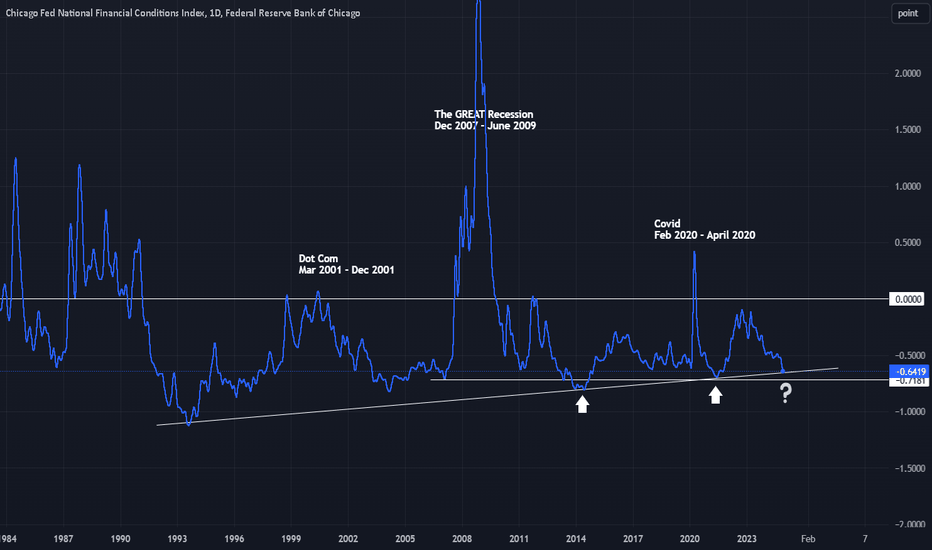

NFCI : From Greed to GriefTV is a very useful platform. It provides a lot of wonderful charts. But many are seldom used.

To look into the future, there are 3 critical charts. NFCI is one of them. US10Y and Oil are the other two.

What we see above is a lot of GREED currently going on - with financial conditions so loose. It is NOW at a quite critical level. In all probabilities, it can go UP. And if it does, it means shit hits the fan. ALL RISKY assets will DEFINITELY go BUST.

My opinion is that if GREED is the cause - just like in 2007/09 with subprime - the aftermath is going to be extremely BAD.

Take care and good luck.

DXY | JPY | CREDIT EVENT | DECRYPTERS Hi People Welcome to Team " DECRYPTERS"

SO we Have 3 Main events this Week Lets Get A DEEP DIVE IN TO THEM

1- FED :- FED RATE HIKES ( PRICED IN ) + PRESS CONFERENCE ( HAWKISH )

AS we predicted Last time what Ever Happen Rate hikes will be increased we still stand by our words . Lets go further Either we are Getting 50 BPS This time or We are Getting 25 BPS next time

WHY Is That So ... ??

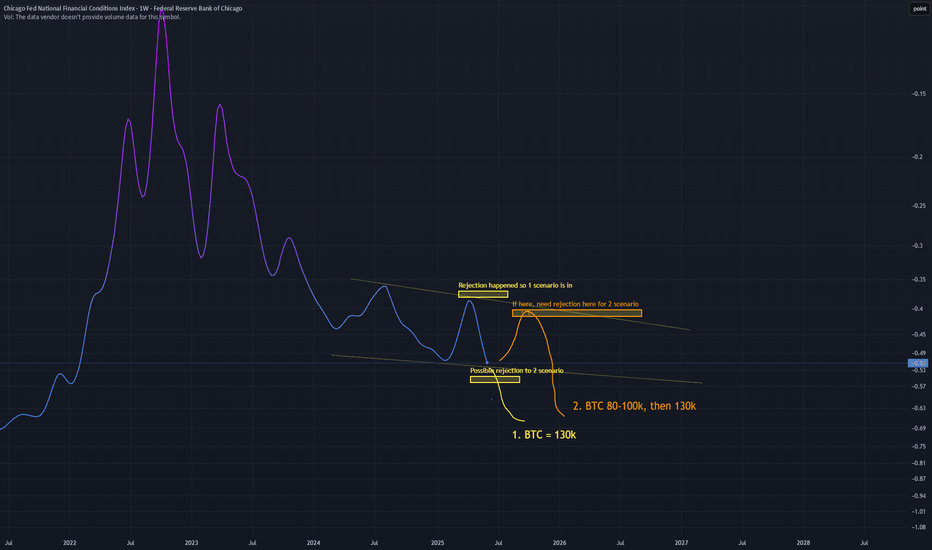

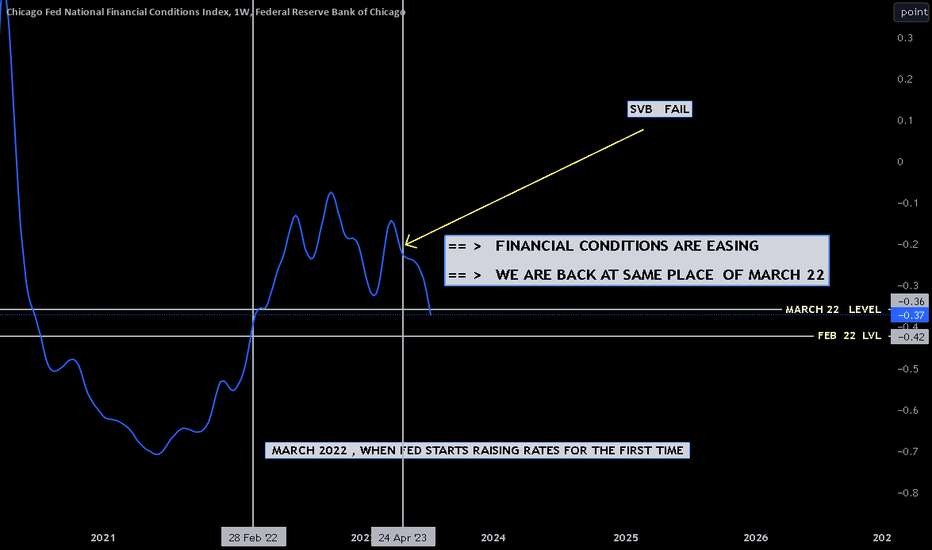

The Attached Charts shows the overall level of financial conditions in an economy The conditions are on Same levels When FED was ABOUT to hike Rates Meaning .

Further more —Dot plots , Fed curves ,GSUSCFI Index and Bloom Berg Index & Fall in Credit spread "ALL" Indicating ease in financial system Meaning this Data provide Evidence that FED Can increase More Interest Rates As Credit spread also falling to positive signal for economy

— Rise In commodity Prices Like (RBAB Gasoline) Indicates more higher Prices in Energy sectors.

— Lastly Good inflation trading above 20 years average & CPI Also printing higher on Y/Y Basis.

2- EURO RATE HIKES :-

THIS comes With same Expectations Rate hikes + Hawkish Stance with & Lagarde speech.

Lets Discuss JPY NEWS ON FRIDAY

3- BOJ REPORT :-

A surprise can be Expected From Other Side Like

They can Increase the range of "10 -years JGB" 50 BPS TO 75 /100 BPS

( BOND BUYING BACK PROGRAM) This will Cause bonds Prices to Rise / Yields to Fall &

"JPY TO GET WEAKEN"

—Other yield can React Negatively To IT ( LIKE US -10 YEAR)