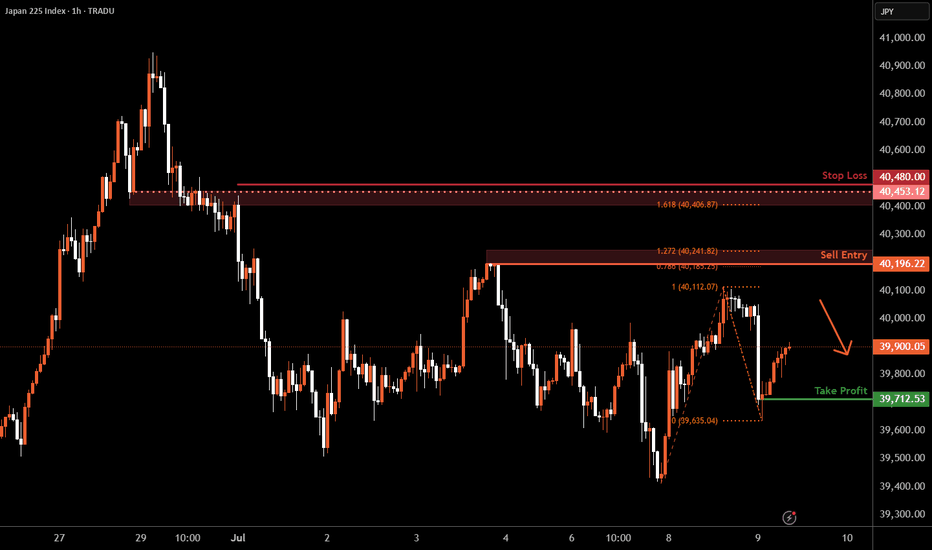

Nikkei 225 H1 | Swing-high resistance at a Fibo confluence zoneThe Nikkei 225 (JPN225) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 40,196.22 which is a swing-high resistance that aligns with a confluence of Fibonacci levels i.e. the 78.6% projection and the 127.2% extension.

Stop loss

About Nikkei Stock Average, Nikkei 225

Related indicators

JP225 Long Trap or Bull Escape? Heist in Motion.🦹♂️🎯 JP225 Ninja Heist: Breakout Loot Plan 💥💰 (Long Game Playbook)

🌟Hi! Hola! Ola! Bonjour! Hallo! Assallamu Allaikum!🌟

Dear Money Makers, Market Raiders & Silent Robbers, 🤑💰💸✈️

It’s time to gear up for the ultimate breakout heist on the JP225 / NIKKEI Index CFD Market. Based on my 🔥Thief Trading

Bit of a delay - New Falling Wedge ready to break upJapan like Hong Kong is showing strong signs of growth.

We first had the breakout above the Cup and Handle and now we are awaiting the breakout above the Falling Wedge...

There are some strong signs of upside fundamentally...

💼 1. Solid GDP & corporate profits

Japan’s economy grew about 2.7% a

NI225: Will Go Up! Long!

My dear friends,

Today we will analyse NI225 together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 39,581.12 will confirm the new direction upwards with the target being the next key level of 39,719.48 and a reconvened placement o

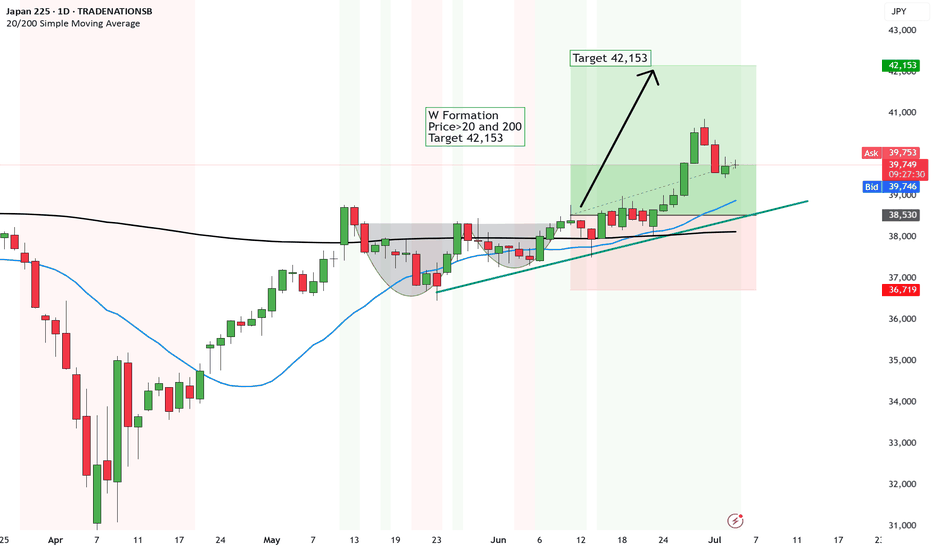

UPDATE Japan cruising to 42,153 thanks to the Tech War btw E & WIf you read my previous post about China you'll note, there are MAJOR developments in the East compared to the west.

It's always been a battle between the two. But this time it's based on research, developments and upgrades.

Loving the war on technology, because it is helping us normal folk with

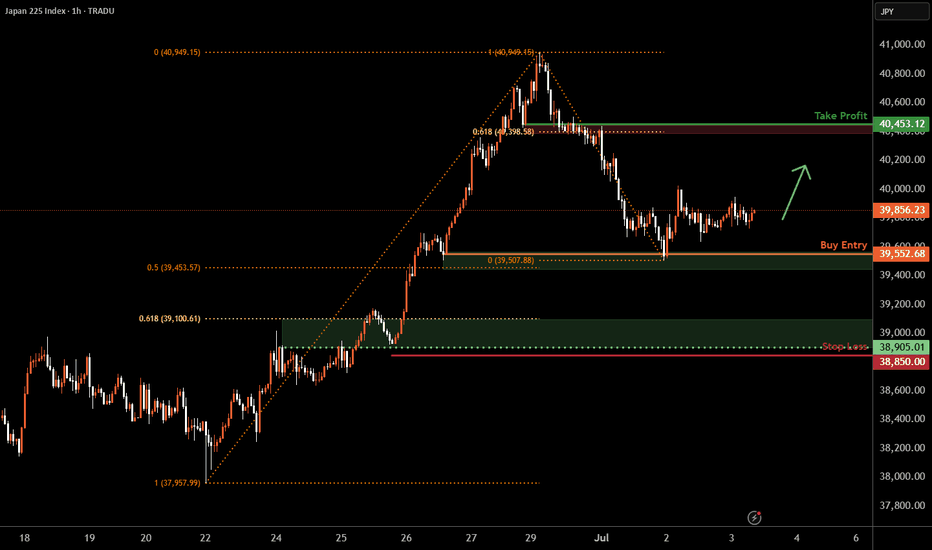

Nikkei 225 H1 | Potential bullish bounceThe Nikkei 225 (JPN225) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 39,552.68 which is an overlap support that aligns with the 50% Fibonacci retracement.

Stop loss is at 38,850.00 which is a level that lies underneath an overla

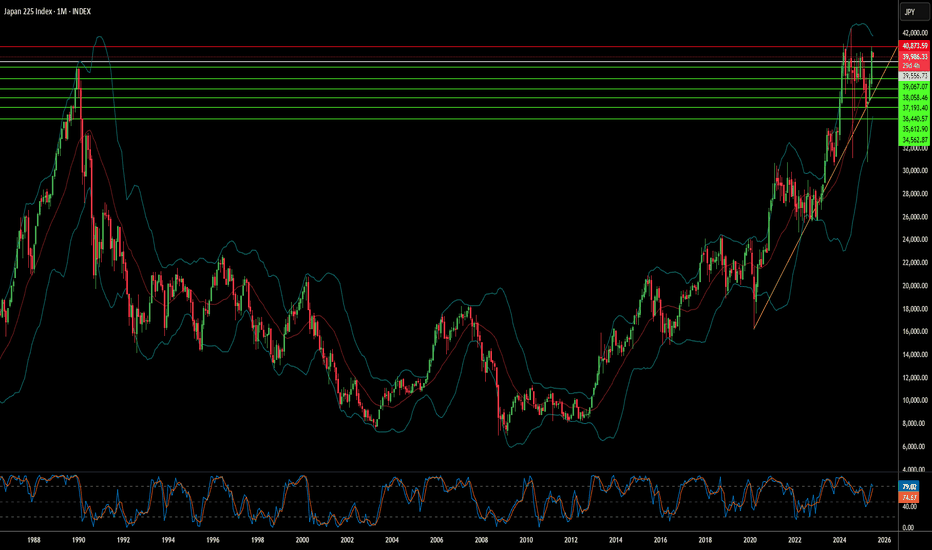

Is Japan's Economic Future at a Tariff Crossroads?The Nikkei 225, Japan's benchmark stock index, stands at a critical juncture, facing significant pressure from potential US tariffs of up to 35% on Japanese imports. This assertive stance by US President Donald Trump has already triggered a notable decline in Japanese equities, with the Nikkei 225 e

NI225 NIKKEI 225 25-7-11Japan stocks remind me the most of this time in 1975, which marked a bottom. It’s not identical at all. Just the closest I could compare it to. It’s at all time highs and after a year or so of consolidation. The thing is now looks even better for a textbook W reversal up now. It’s a striking pattern

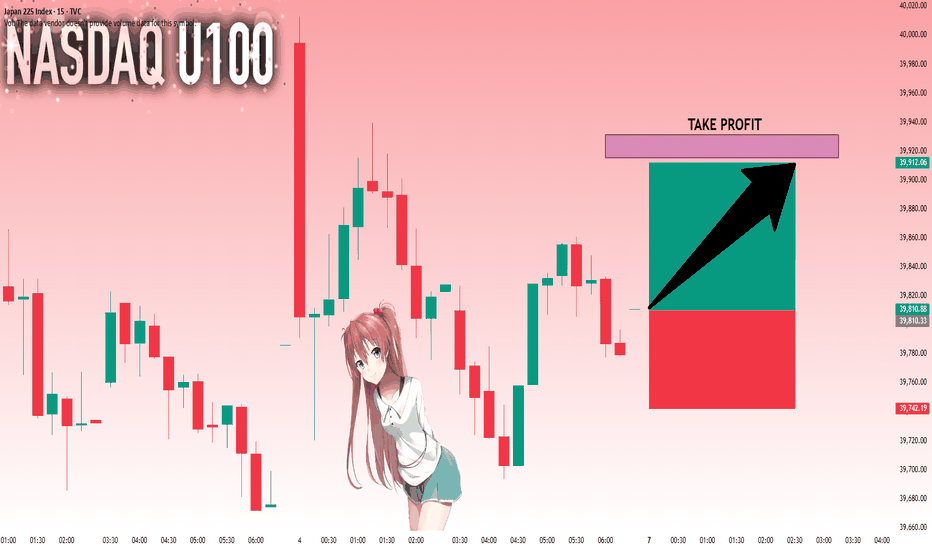

NI225: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse NI225 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 39,810.33 So a bullish continuation seems plausible, targeting the next high. We should enter on confirm

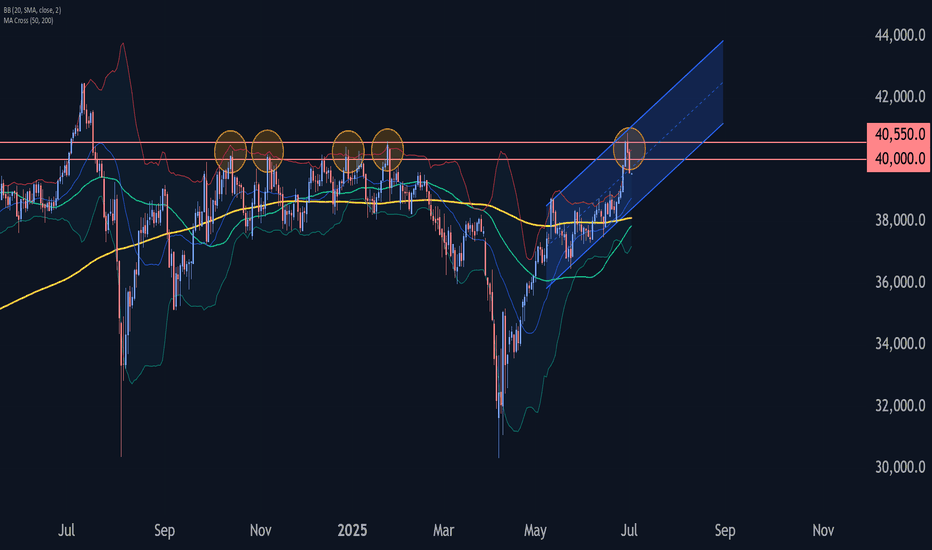

Nikkei 225 Wave Analysis – 1 July 2025

- Nikkei 225 reversed from resistance zone

- Likely to fall to support level 39000.00

Nikkei 225 index recently reversed down with the Evening Star from the resistance zone between the resistance levels 40000.00 and 40550.00 (former multi month high from January).

This resistance zone was streng

See all ideas