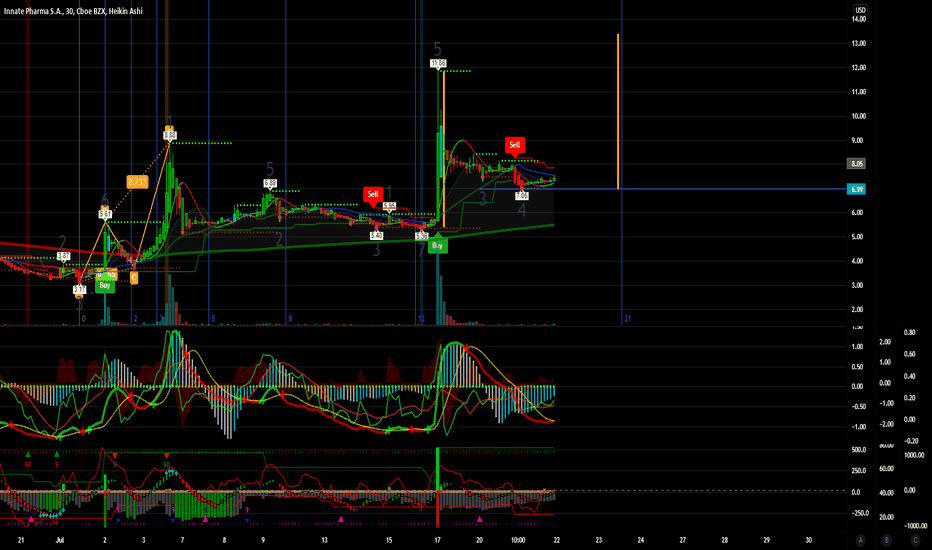

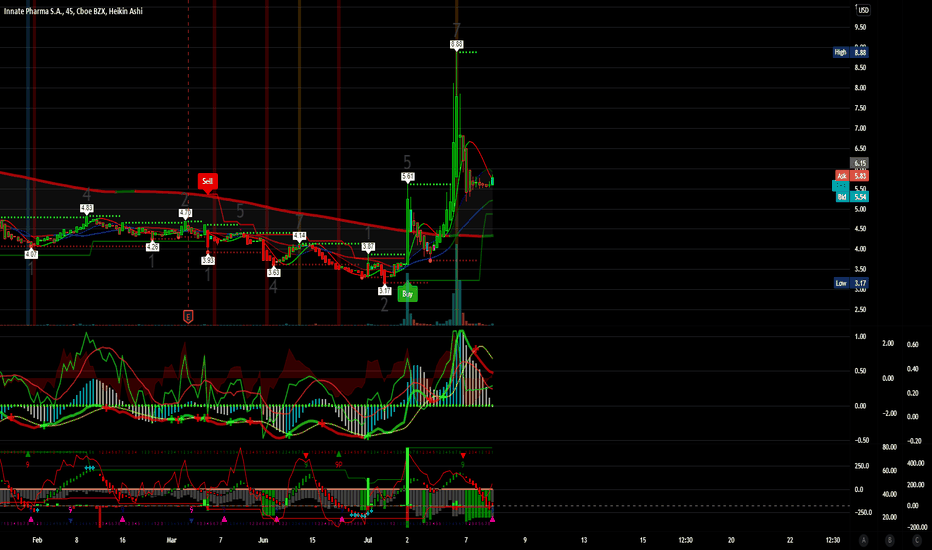

$IPHAKey Words: Innate Pharma S.A. (NASDAQ: IPHA) shares gained 40.9% to close at $8.10 as its partner AstraZeneca Plc (NASDAQ: AZN) presented results from the COAST Phase 2 trial during the European Society for Medical Oncology (ESMO21) Congress 2021. SVB Leerink maintained Innate Pharma with an Outperf

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.610 EUR

−49.47 M EUR

12.62 M EUR

56.75 M

About Innate Pharma SA Class A

Sector

Industry

CEO

Jonathan Dickinson

Website

Headquarters

Marseille

Founded

1999

ISIN

FR0010331421

FIGI

BBG000Q71CT6

Innate Pharma SA is a global, clinical-stage biotechnology company, which engages in developing immunotherapies for cancer patients. Its product pipeline includes Lacutamab, Monalizumab, Avdoralimab, and IPH62. The company was founded by Hervé Eloi Dominique Brailly, Eric Vivier, Marc Bonneville, Alessandro Moretta, Jean-Jacques Fournié, and François Romagné on September 23, 1999 and is headquartered in Marseille, France.

Related stocks

$IPHAInnate Pharma S.A., a biotechnology company, discovers, develops, and commercializes therapeutic antibodies for the treatment of oncology indications in France and internationally. The company's products include Lacutamab (IPH4102), an anti-KIR3DL2 antibody, which is in Phase II clinical trials for

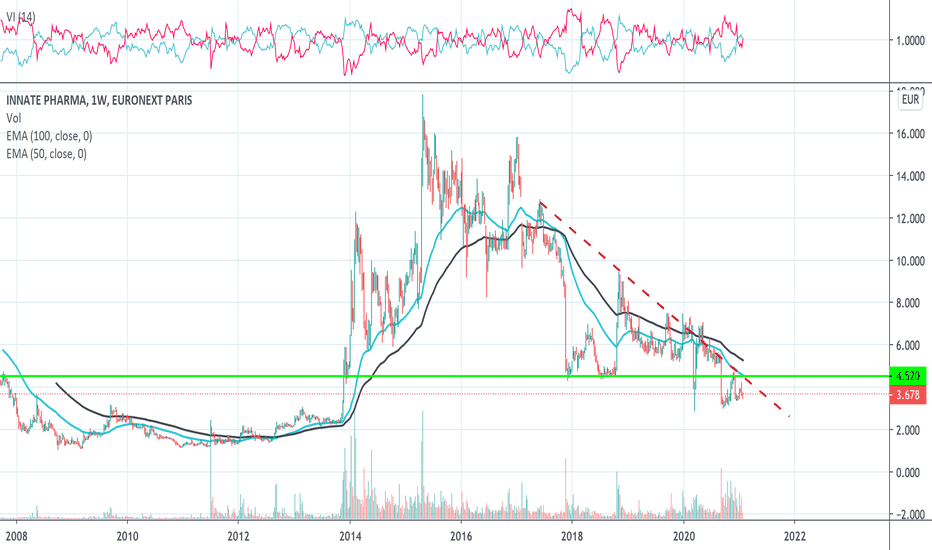

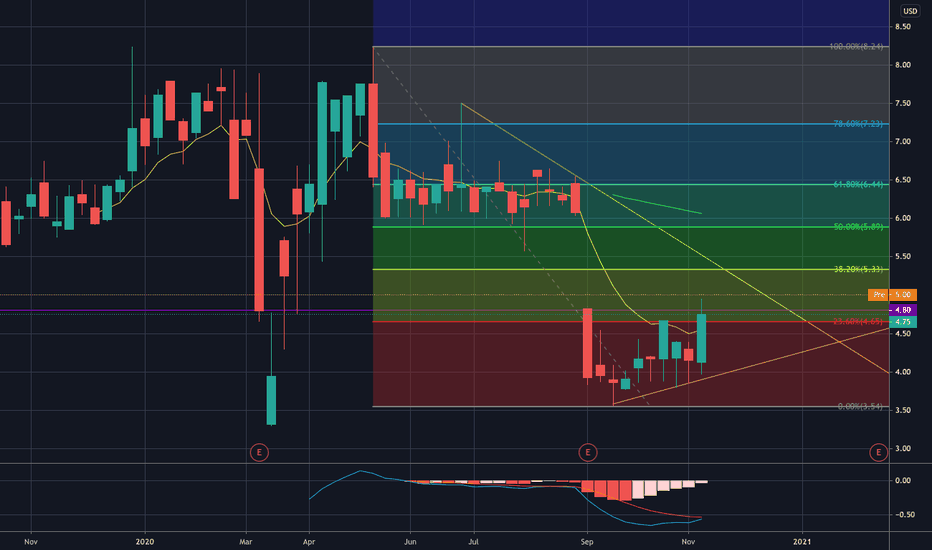

IPH big news today -the news published may help to break the down trend, and the oblic resistance caping the price since years !

weekly resistance at 3.42 - tonight, closure at 3.22,

Target is to reach at least 3.9 so another 20% same as today,intraday or in swing for a few days;

- what's your view guys ?

bewar

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

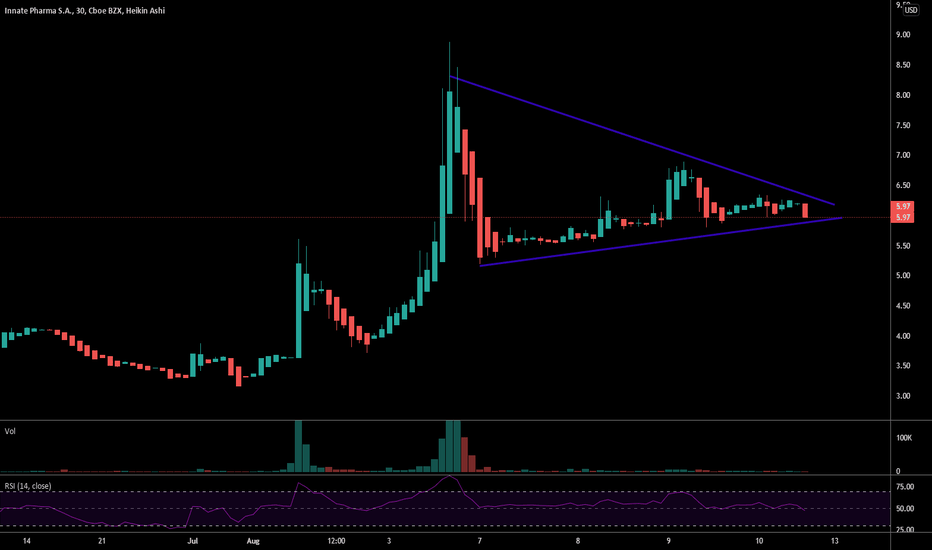

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of IDD is 1.746 EUR — it has increased by 2.11% in the past 24 hours. Watch Innate Pharma SA Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Innate Pharma SA Class A stocks are traded under the ticker IDD.

IDD stock has fallen by −5.42% compared to the previous week, the month change is a −5.21% fall, over the last year Innate Pharma SA Class A has showed a −18.03% decrease.

We've gathered analysts' opinions on Innate Pharma SA Class A future price: according to them, IDD price has a max estimate of 6.92 EUR and a min estimate of 5.70 EUR. Watch IDD chart and read a more detailed Innate Pharma SA Class A stock forecast: see what analysts think of Innate Pharma SA Class A and suggest that you do with its stocks.

IDD stock is 2.06% volatile and has beta coefficient of 0.68. Track Innate Pharma SA Class A stock price on the chart and check out the list of the most volatile stocks — is Innate Pharma SA Class A there?

Today Innate Pharma SA Class A has the market capitalization of 163.32 M, it has decreased by −0.22% over the last week.

Yes, you can track Innate Pharma SA Class A financials in yearly and quarterly reports right on TradingView.

Innate Pharma SA Class A is going to release the next earnings report on Sep 17, 2025. Keep track of upcoming events with our Earnings Calendar.

IDD earnings for the last half-year are −0.31 EUR per share, whereas the estimation was −0.26 EUR, resulting in a −21.57% surprise. The estimated earnings for the next half-year are −0.28 EUR per share. See more details about Innate Pharma SA Class A earnings.

Innate Pharma SA Class A revenue for the last half-year amounts to 7.78 M EUR, despite the estimated figure of 17.32 M EUR. In the next half-year revenue is expected to reach 12.00 M EUR.

IDD net income for the last half-year is −24.71 M EUR, while the previous report showed −24.76 M EUR of net income which accounts for 0.23% change. Track more Innate Pharma SA Class A financial stats to get the full picture.

No, IDD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 10, 2025, the company has 181 employees. See our rating of the largest employees — is Innate Pharma SA Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Innate Pharma SA Class A EBITDA is −57.09 M EUR, and current EBITDA margin is −452.47%. See more stats in Innate Pharma SA Class A financial statements.

Like other stocks, IDD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Innate Pharma SA Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Innate Pharma SA Class A technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Innate Pharma SA Class A stock shows the sell signal. See more of Innate Pharma SA Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.