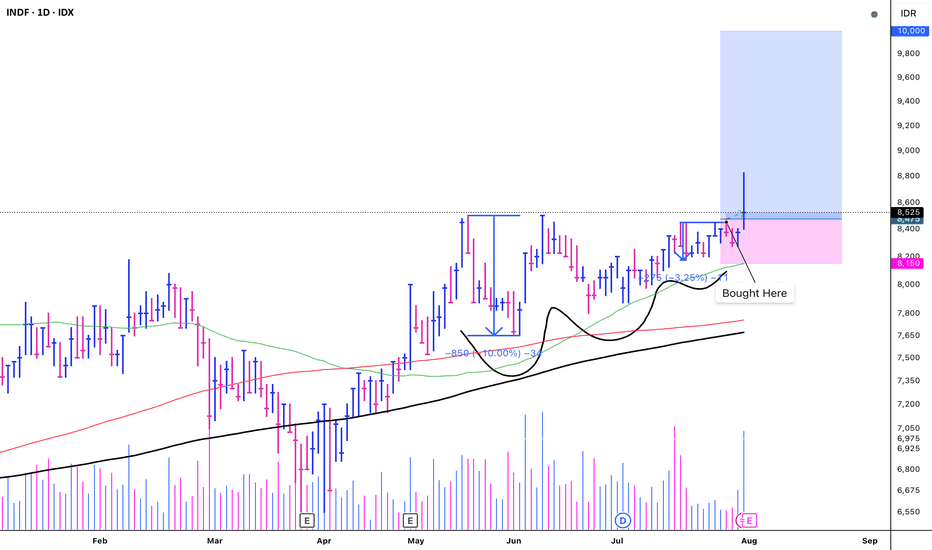

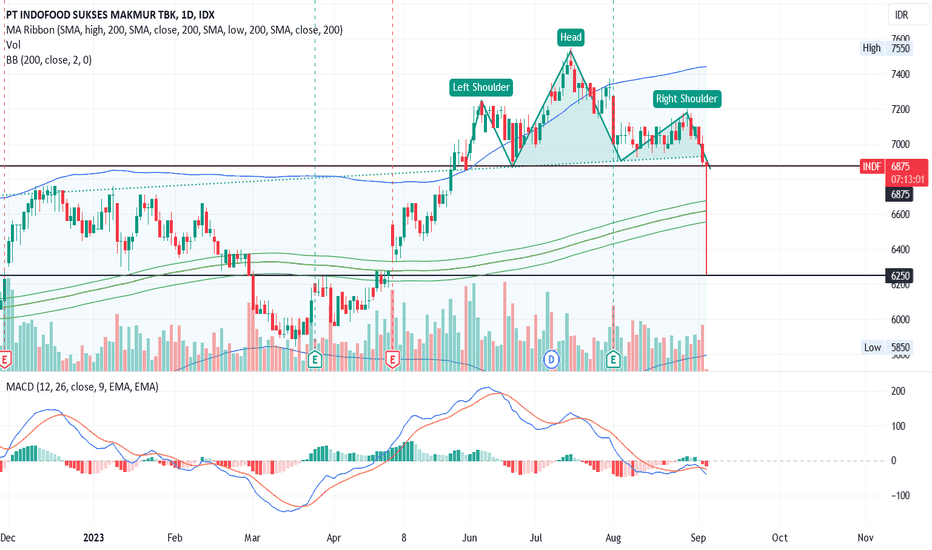

INDF - VCP (13W 10/3 3T)IDX:INDF - VCP

+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 > 150 > 200

4. Price is within 25% of its 52-week high.

5. Price is over 25% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.064 EUR

517.55 M EUR

6.93 B EUR

4.38 B

About PT INDOFOOD SUKSES MAKMUR TBK

Sector

Industry

CEO

Anthoni Salim

Website

Headquarters

Jakarta

Founded

1990

ISIN

ID1000057003

FIGI

BBG000J6GL74

PT Indofood Sukses Makmur Tbk engages in the food manufacturing and processing business. It operates through the following segments: Consumer Branded Product, Bogasari, Agribusiness, and Distribution. The Consumer Branded Products segment focuses on the production of consumer branded products, which include noodles, dairy, snack foods, food seasonings, nutrition and special foods, and beverages. The Bogasari segment is involved in the production of wheat flour and pasta. The Agribusiness segment covers the research and development, seed breeding, oil palm cultivation and milling and production and marketing of branded cooking oils, margarine, and shortening. The Distribution segment refers to the distribution of the company and third-party products. The company was founded on August 14, 1990 and is headquartered in Jakarta, Indonesia.

Related stocks

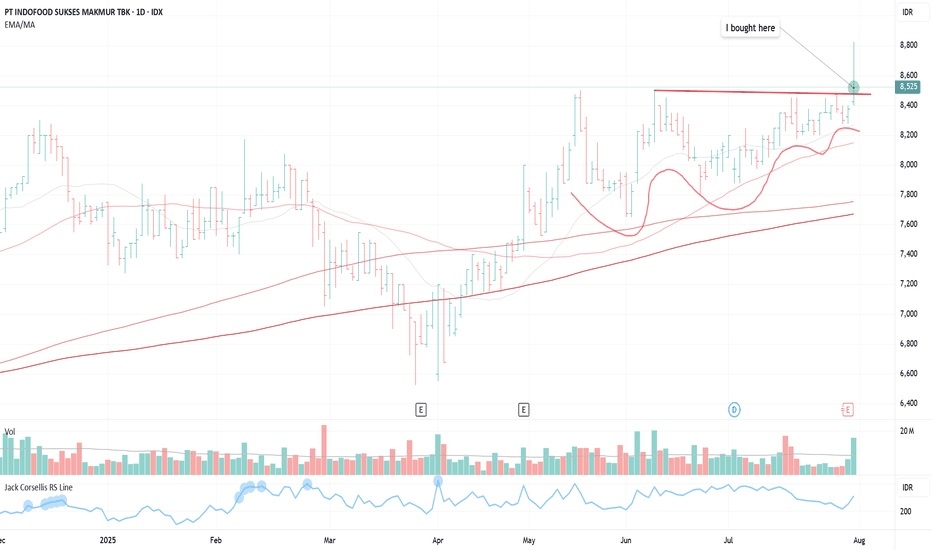

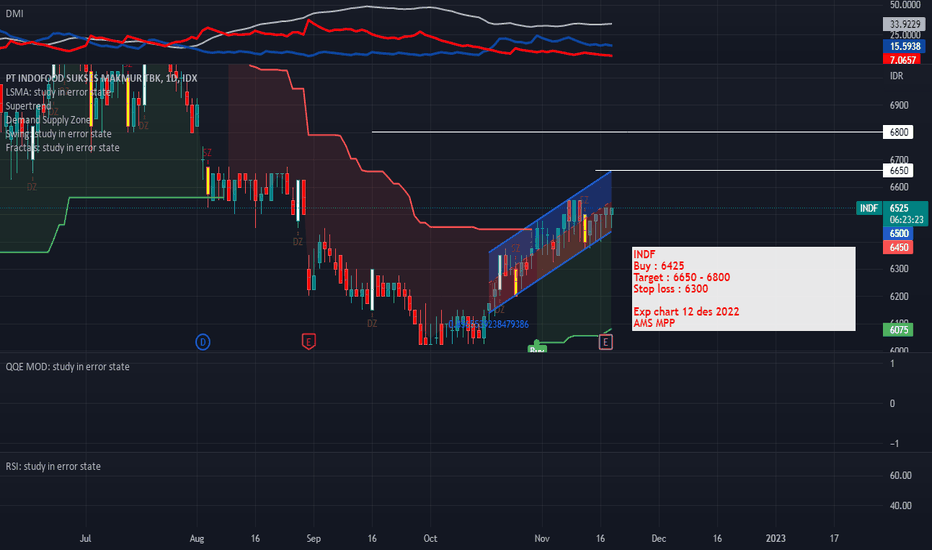

$INDF (VCP - 10W 10/3 4T)Position update: July 31, 2025.

Key factors:

1. Confirmed stage 2 uptrend.

2. A textbook Volatility Contraction Pattern (VCP) with a clearly defined, low-risk entry point.

3. Price action moves in the opposite direction of the declining general market.

4. The stock moves on its own drummer, rall

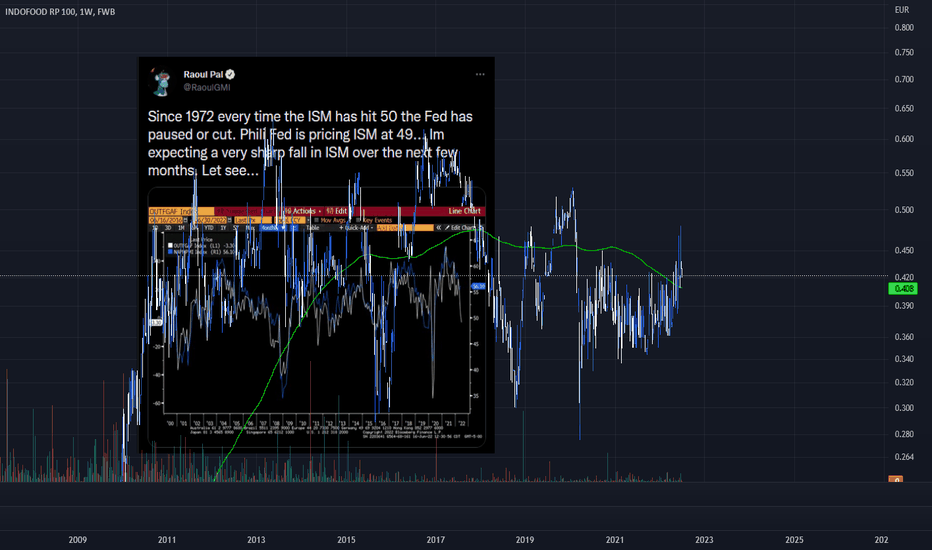

Raoul Pal say money printer will go BRR when the ISM hits 50I have set alerts for this

The ISM manufacturing index or purchasing managers' index is considered a key indicator of the state of the U.S. economy. It indicates the level of demand for products by measuring the amount of ordering activity at the nation's factories.

people are going to stop buying

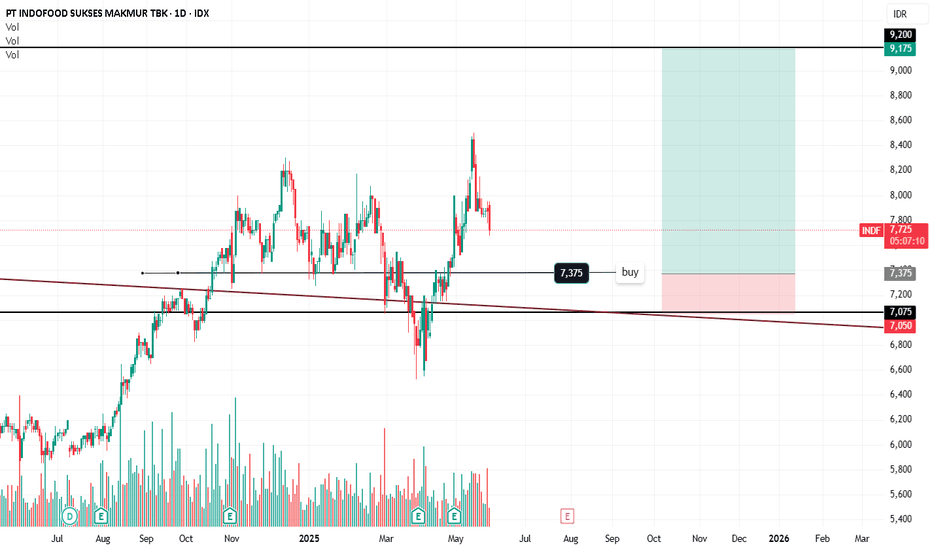

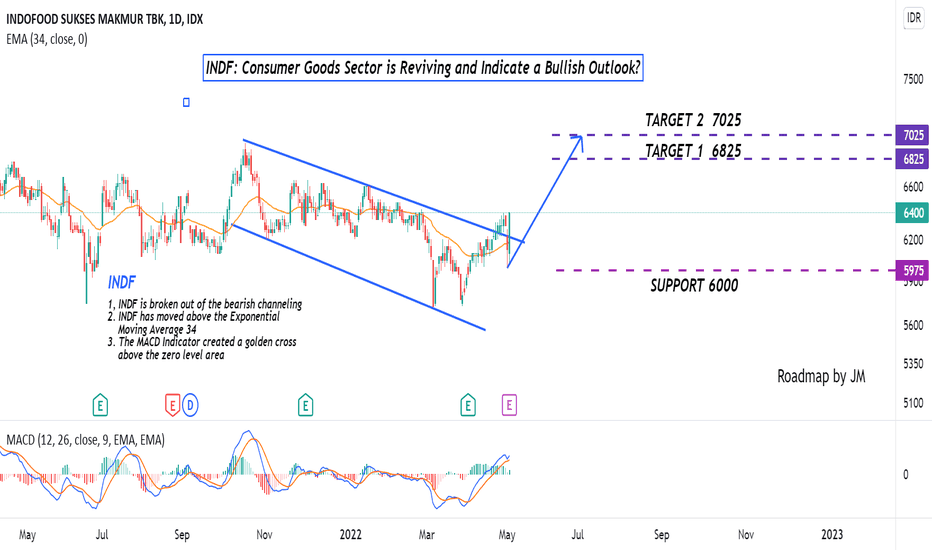

INDF: Consumer Good Sector is Reviving, a Bullish Outlook ahead?Hello Stock Market Enthusiast! Here's the Long-term outlook for INDF, Support the Channel by smashing the FOLLOW and LIKES Button, then Share your opinion in the Comment Section below :)

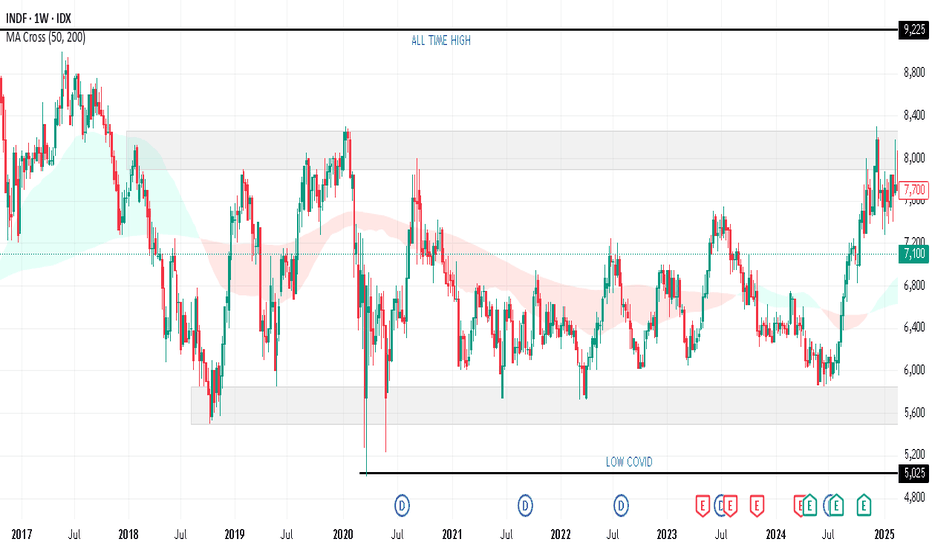

INDF is broken out of the descending broadening wedge pattern. The golden cross signifies a potential bullish mo

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange INDOFOOD RP 100 stocks are traded under the ticker ISM.

We've gathered analysts' opinions on INDOFOOD RP 100 future price: according to them, ISM price has a max estimate of 0.69 EUR and a min estimate of 0.44 EUR. Watch ISM chart and read a more detailed INDOFOOD RP 100 stock forecast: see what analysts think of INDOFOOD RP 100 and suggest that you do with its stocks.

Yes, you can track INDOFOOD RP 100 financials in yearly and quarterly reports right on TradingView.

INDOFOOD RP 100 is going to release the next earnings report on Nov 26, 2025. Keep track of upcoming events with our Earnings Calendar.

ISM net income for the last quarter is 163.91 M EUR, while the quarter before that showed 151.08 M EUR of net income which accounts for 8.49% change. Track more INDOFOOD RP 100 financial stats to get the full picture.

Yes, ISM dividends are paid annually. The last dividend per share was 0.01 EUR. As of today, Dividend Yield (TTM)% is 3.34%. Tracking INDOFOOD RP 100 dividends might help you take more informed decisions.

INDOFOOD RP 100 dividend yield was 3.64% in 2024, and payout ratio reached 28.45%. The year before the numbers were 4.14% and 28.78% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 5, 2025, the company has 95.61 K employees. See our rating of the largest employees — is INDOFOOD RP 100 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. INDOFOOD RP 100 EBITDA is 1.44 B EUR, and current EBITDA margin is 23.34%. See more stats in INDOFOOD RP 100 financial statements.

Like other stocks, ISM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade INDOFOOD RP 100 stock right from TradingView charts — choose your broker and connect to your account.