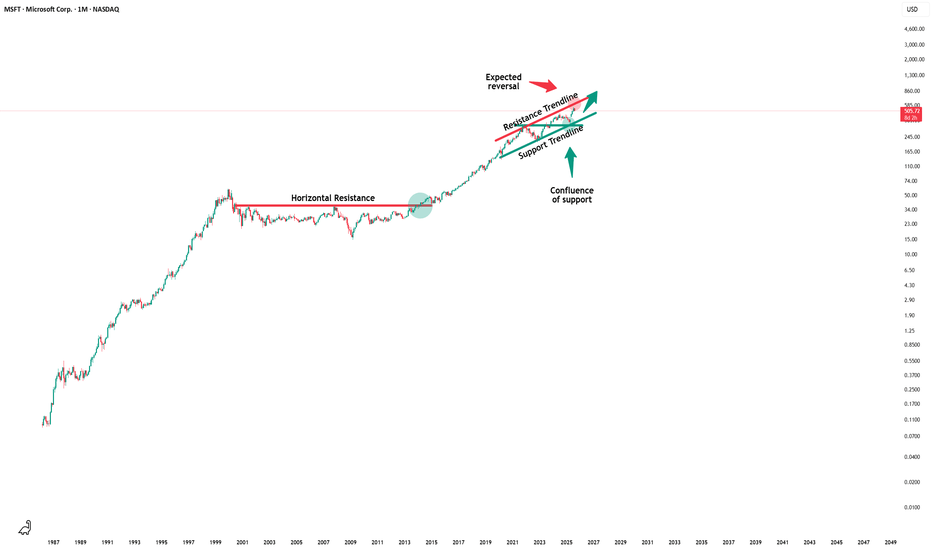

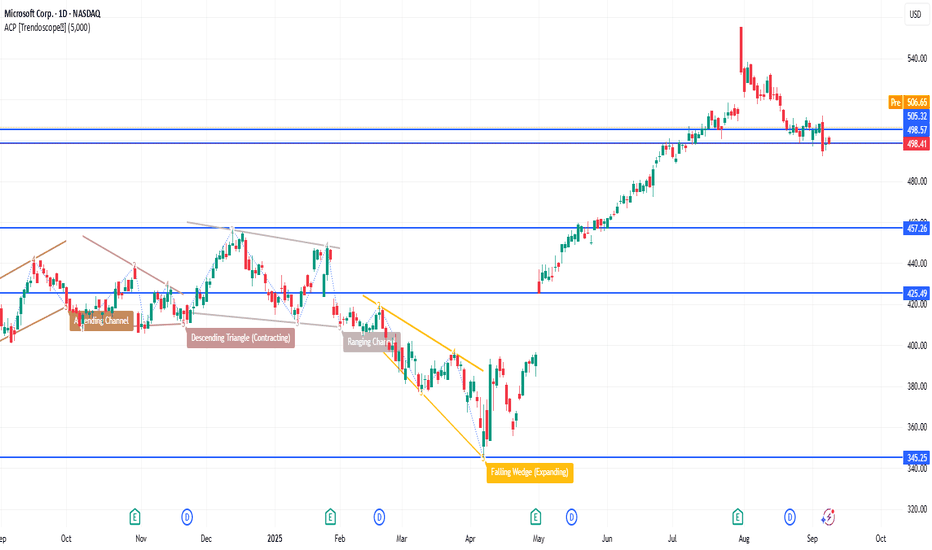

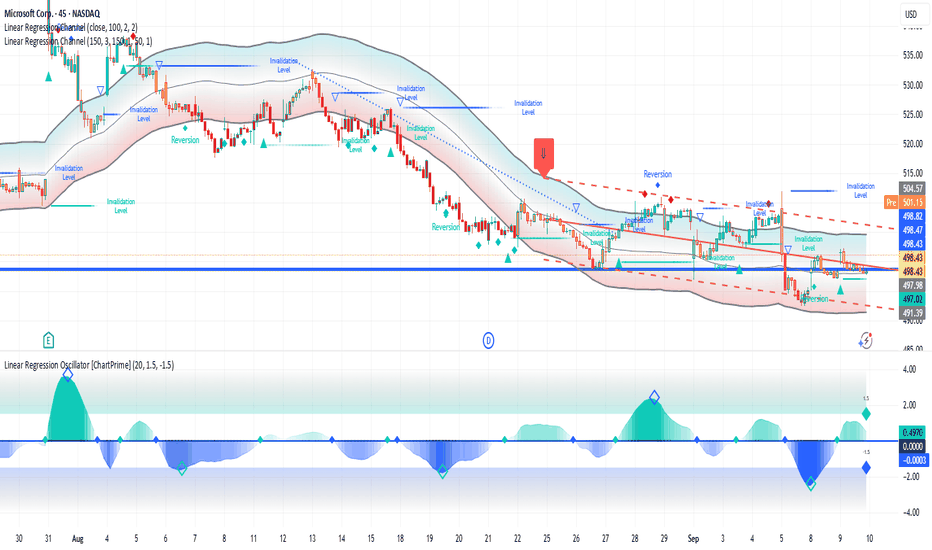

Microsoft - A very profitable repetition!💰Microsoft ( NASDAQ:MSFT ) just repeats the cycle:

🔎Analysis summary:

At this exact moment, Microsoft is once again retesting the upper channel resistance trendline. Following all previous cycles, there is a 100% chance that we will see a short term retracement. Since the trend remains bullis

Key facts today

On September 8, 2025, Microsoft signed a five-year, $17.4 billion contract with Nebius for GPU infrastructure, enhancing Azure cloud services and AI efforts while reducing capital costs.

Microsoft will acquire AI tech from Anthropic, moving away from OpenAI, enabling the integration of Anthropic's AI features into Office 365 applications.

Microsoft holds a strong position in cloud computing, sharing a significant market share with Amazon and Google, which together control 65% of the total market.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

11.65 EUR

86.45 B EUR

239.16 B EUR

7.32 B

About Microsoft Corp.

Sector

Industry

CEO

Satya Nadella

Website

Headquarters

Redmond

Founded

1975

ISIN

US5949181045

FIGI

BBG000DMWMD8

Microsoft Corp. engages in the development and support of software, services, devices, and solutions. It operates through the following segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. The Productivity and Business Processes segment is composed of products and services relating to productivity, communication, and information services such as Office Commercial, Office Consumer, LinkedIn, and Dynamics business solutions. The Intelligent Cloud segment consists of public, private, and hybrid server products and cloud services for businesses and developers, as well as enterprise and partner services. The More Personal Computing segment refers to products and services including Windows operating system, Windows cloud services, Surface, HoloLens, personal computer accessories, Xbox hardware, Xbox Cloud Gaming, Microsoft News, and Microsoft Edge. The company was founded by Paul Gardner Allen and William Henry Gates, III in 1975 and is headquartered in Redmond, WA.

Related stocks

The report is good, but there is no stock dynamicsMSFT gapped up at around $555 on the report and reached a market cap of $4.1 trillion

This happened because the report significantly exceeded expectations on key metrics

The latest quarterly report showed record results.

Revenue for the quarter was $76.4 billion (up 18% y/y)

Net income was $27.2 b

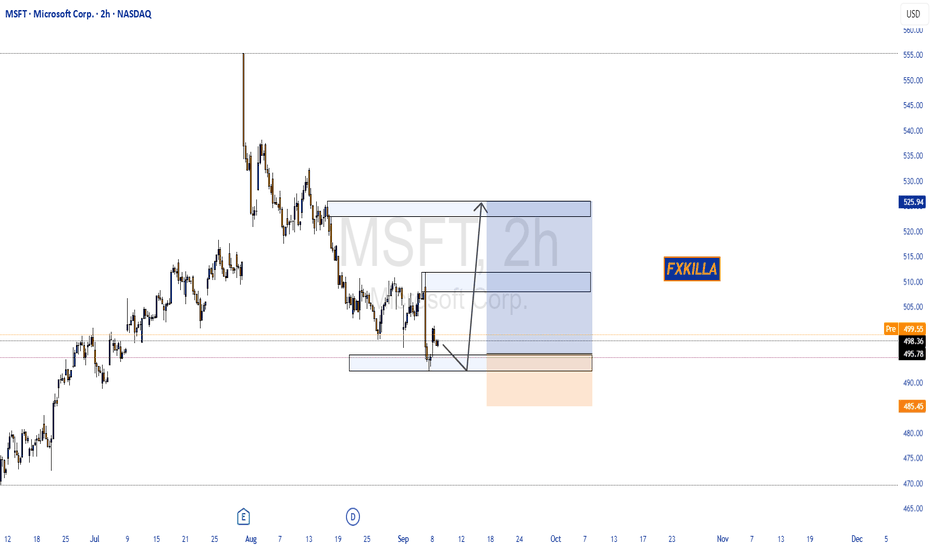

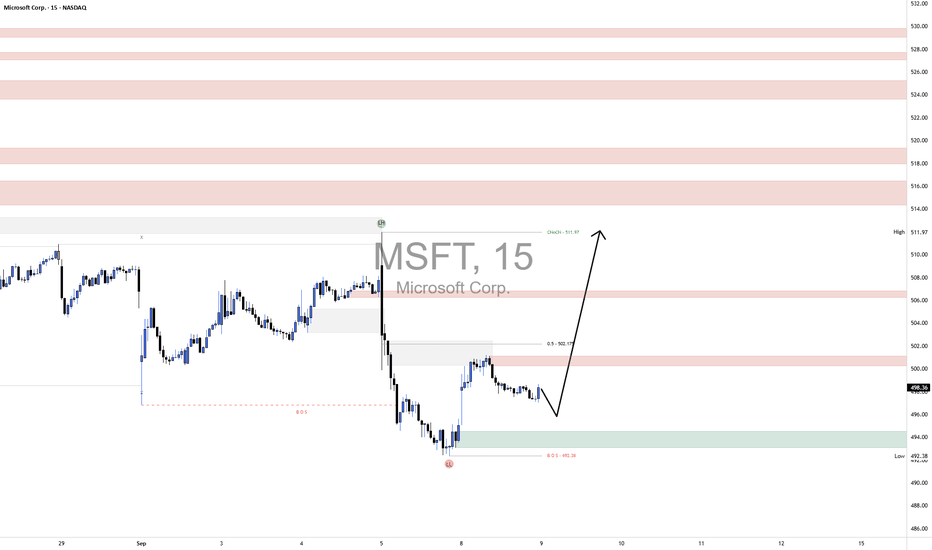

MSFT LongBroader Market Structure (MSFT 15M):

Microsoft’s short-term structure shows a clear bearish shift. After printing a high at 511.97, price rolled over, creating a Change of Character (CHoCH) and following through with a Break of Structure (BOS) to the downside at 492.38. This confirmed a shift from b

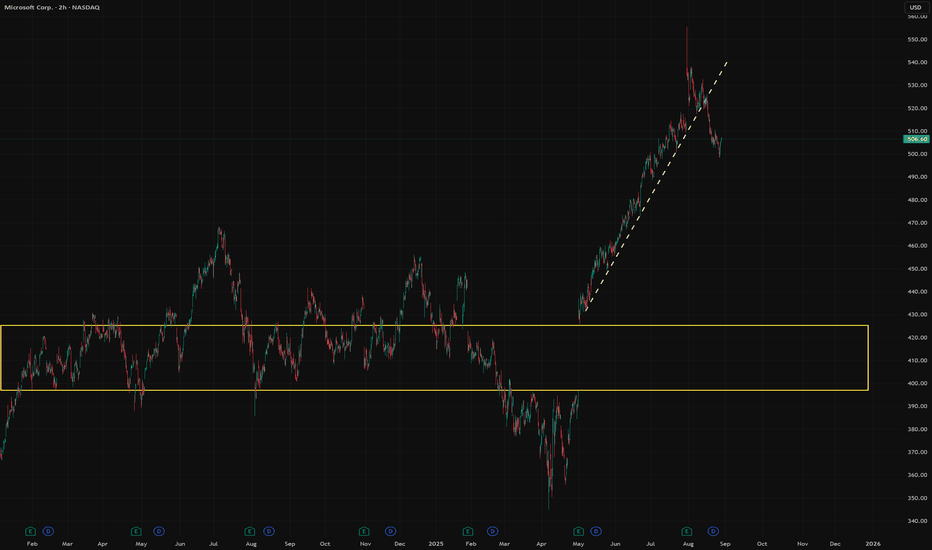

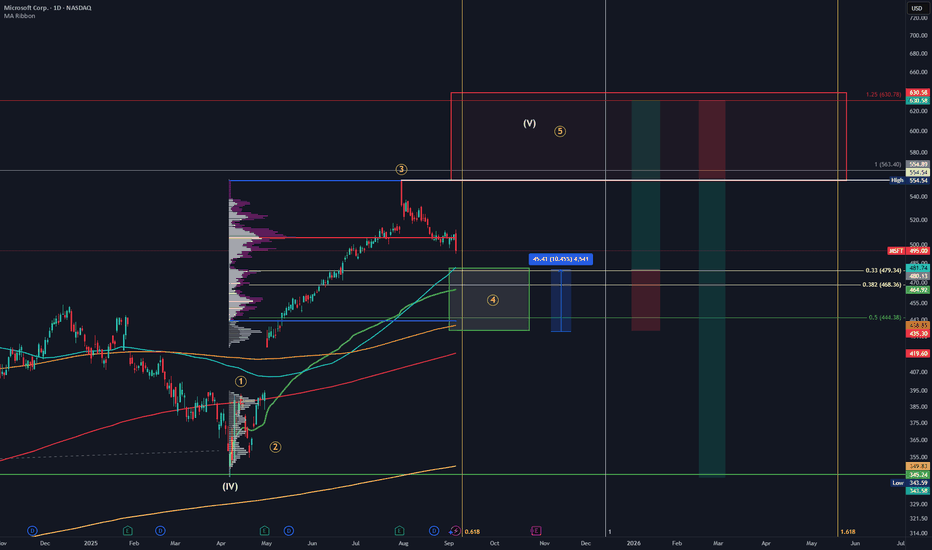

Microsoft Swing Long into Swing Short. Elliot Wave countLook for long setups between 440-480 with current ATH being the initial target. After that look for swing short setups above current ATH. Difficult to determine where exactly the low will be put in. So look for setups and reaction in that 10% zone. A lot of daily and weekly sma's stacking. Anchored

Market Correlations between US, Europe, and AsiaIntroduction

Global financial markets are more connected today than at any other time in history. Advances in technology, international trade, cross-border investments, and geopolitical events have created a web of interdependence between major financial hubs. Among them, the United States, Europe,

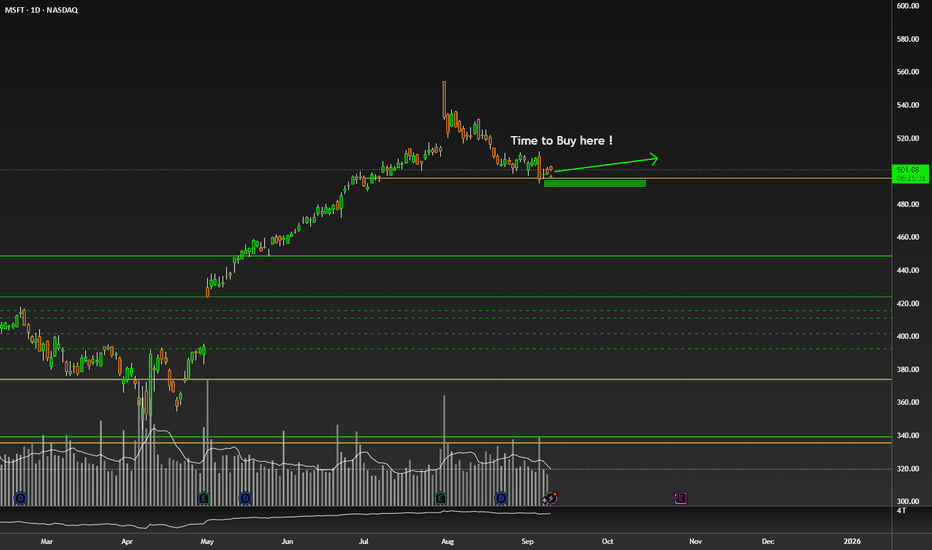

MSFT 1D Time frameMarket Snapshot

Current Price: ~$498.41

Daily Change: +0.23 (≈0.05%)

Market Cap: ~$2.79 Trillion

P/E Ratio: ~28.9

EPS: ~12.93

🔎 Technical Indicators

RSI (14-day): ~41 → Neutral, leaning slightly bearish.

MACD: –2.7 → Negative but giving a weak buy crossover signal.

Williams %R (14-day): ~–7

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where MSF is featured.

Frequently Asked Questions

The current price of MSF is 431.50 EUR — it has increased by 0.64% in the past 24 hours. Watch Microsoft Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Microsoft Corporation stocks are traded under the ticker MSF.

MSF stock has fallen by −1.62% compared to the previous week, the month change is a −5.14% fall, over the last year Microsoft Corporation has showed a 18.04% increase.

We've gathered analysts' opinions on Microsoft Corporation future price: according to them, MSF price has a max estimate of 599.18 EUR and a min estimate of 415.15 EUR. Watch MSF chart and read a more detailed Microsoft Corporation stock forecast: see what analysts think of Microsoft Corporation and suggest that you do with its stocks.

MSF stock is 1.92% volatile and has beta coefficient of 0.92. Track Microsoft Corporation stock price on the chart and check out the list of the most volatile stocks — is Microsoft Corporation there?

Today Microsoft Corporation has the market capitalization of 3.16 T, it has increased by 0.37% over the last week.

Yes, you can track Microsoft Corporation financials in yearly and quarterly reports right on TradingView.

Microsoft Corporation is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

MSF earnings for the last quarter are 3.10 EUR per share, whereas the estimation was 2.86 EUR resulting in a 8.16% surprise. The estimated earnings for the next quarter are 3.12 EUR per share. See more details about Microsoft Corporation earnings.

Microsoft Corporation revenue for the last quarter amounts to 64.89 B EUR, despite the estimated figure of 62.76 B EUR. In the next quarter, revenue is expected to reach 64.38 B EUR.

MSF net income for the last quarter is 23.12 B EUR, while the quarter before that showed 23.87 B EUR of net income which accounts for −3.15% change. Track more Microsoft Corporation financial stats to get the full picture.

Yes, MSF dividends are paid quarterly. The last dividend per share was 0.72 EUR. As of today, Dividend Yield (TTM)% is 0.67%. Tracking Microsoft Corporation dividends might help you take more informed decisions.

Microsoft Corporation dividend yield was 0.67% in 2025, and payout ratio reached 24.34%. The year before the numbers were 0.67% and 25.42% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 10, 2025, the company has 228 K employees. See our rating of the largest employees — is Microsoft Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Microsoft Corporation EBITDA is 138.10 B EUR, and current EBITDA margin is 57.74%. See more stats in Microsoft Corporation financial statements.

Like other stocks, MSF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Microsoft Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Microsoft Corporation technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Microsoft Corporation stock shows the buy signal. See more of Microsoft Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.