Key stats

About NEW GOLD ISSUER LTD.

Home page

Inception date

Nov 1, 2004

Replication method

Physical

Dividend treatment

Capitalizes

Primary advisor

NewGold Managers Pty Ltd.

ISIN

ZAE000060067

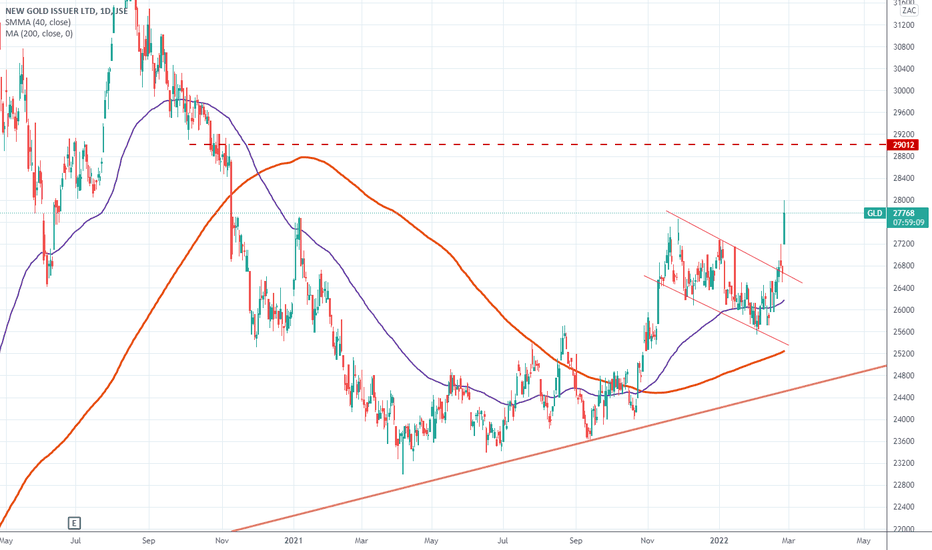

NewGold continuously tracks the gold spot price and enables investors to invest in a listed instrument (structured as a debenture) in which each security is equivalent to approximately 1/100th ounce of gold and is fully backed by holdings of gold bullion with the NewGold Custodian, ICBC Standard Bank.

Related funds

Classification

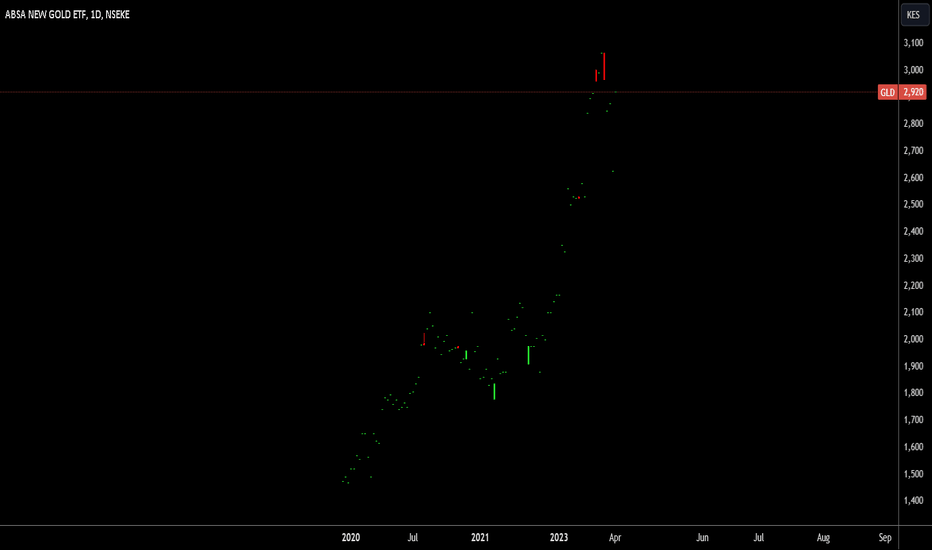

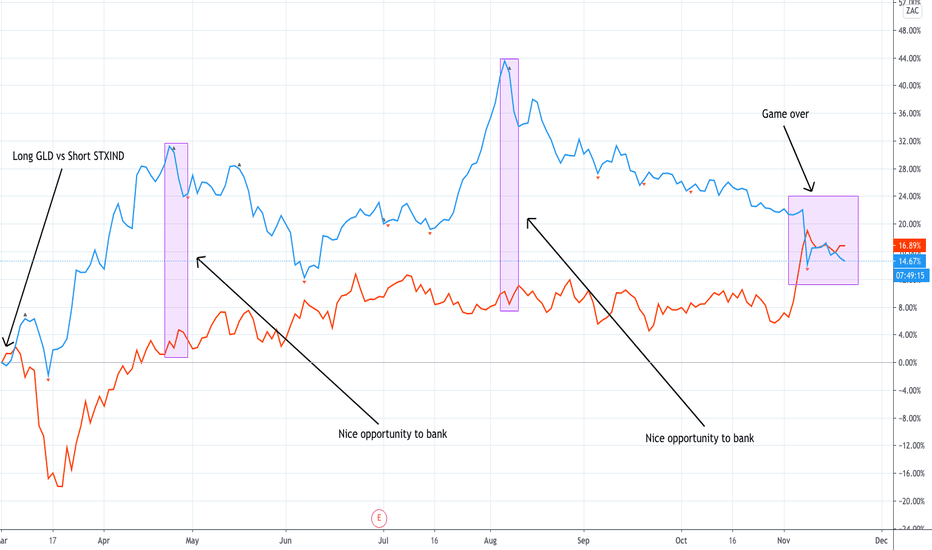

Investing in the Absa Gold ETF listed on the NSEHello,

Investors in Kenya and the wider East African region have long had the opportunity to trade in Exchange Traded Funds (ETFs) following the launch of the Absa NewGold ETF on the Nairobi Securities Exchange (NSE). This groundbreaking ETF, also listed on the Johannesburg Stock Exchange (JSE), ha

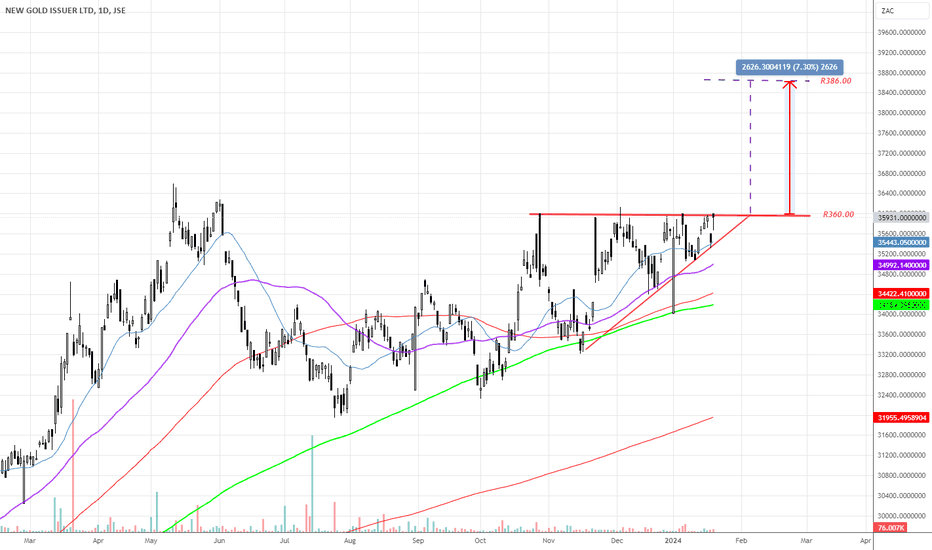

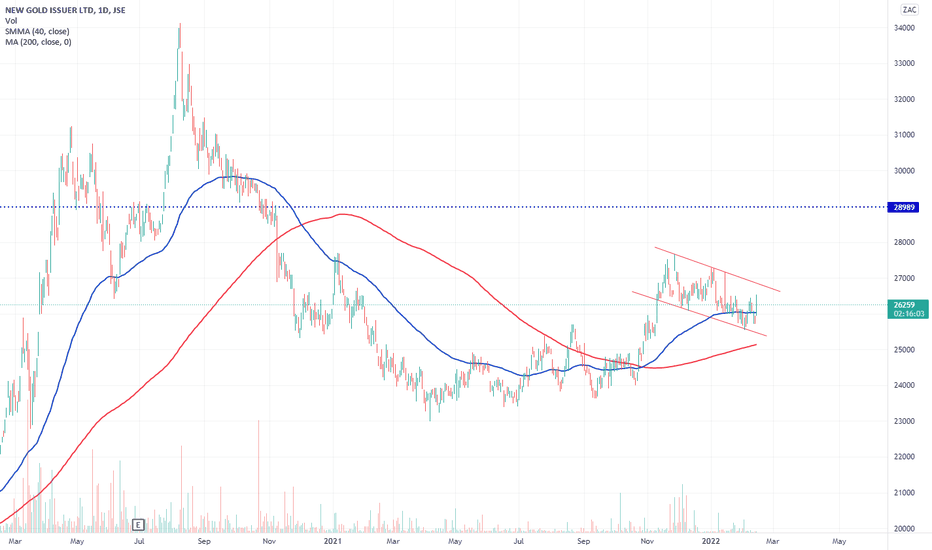

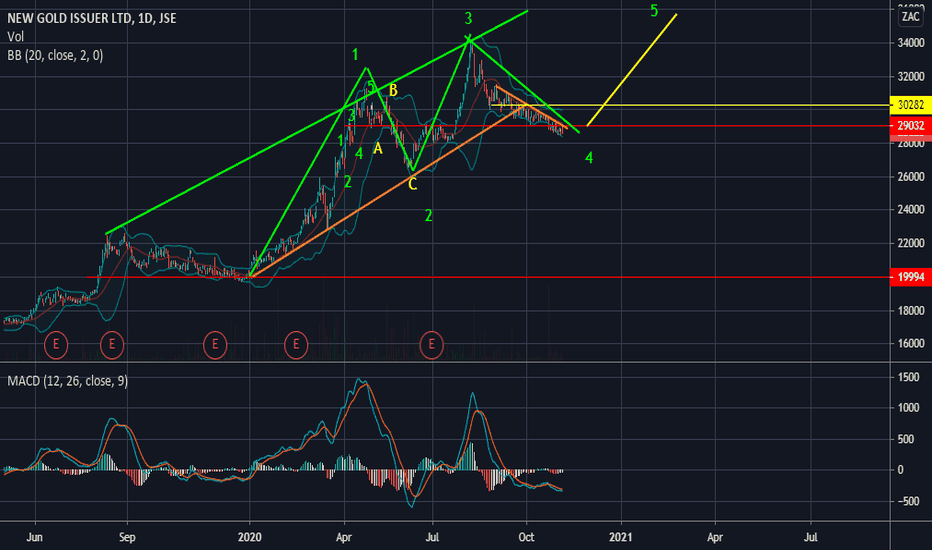

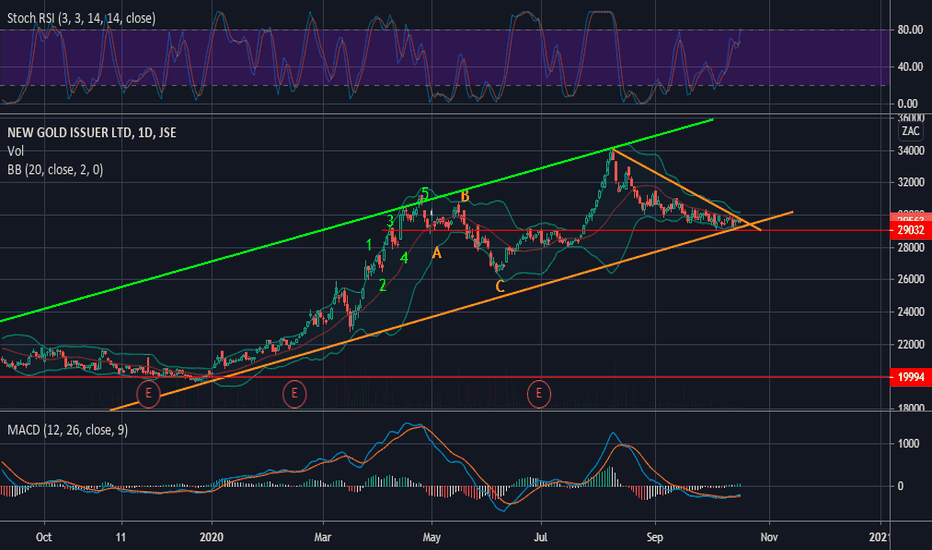

#GLD Newgold etf on the cusp of a massive breakoutNewGold ETF which tracks the rand price of Gold has been knocking hard on the R360.00 level. A breakout of this level should see an explosive move upwards which possibly supports the longs i am seeing in DRD and AngloGold. The break of the flat top triangle targets R386 which is an approximate move

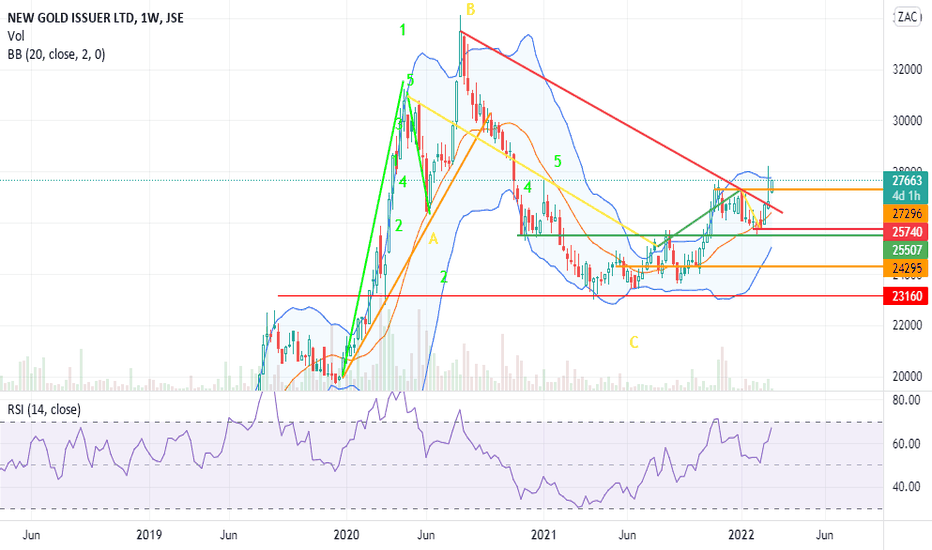

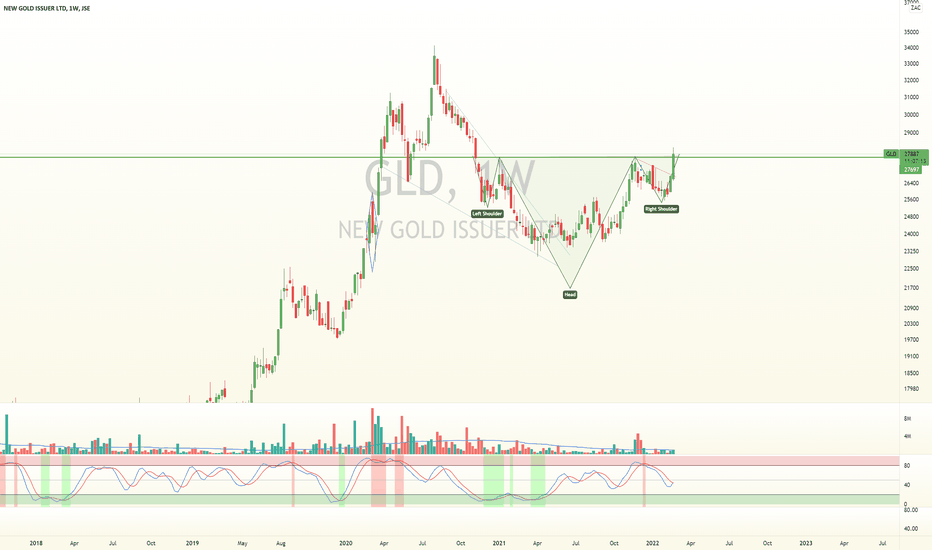

NEWGLD - ObservationAn inverted head and shoulders has developed on the NEWGOLD etf

The instrument does well on a weaker rand / stronger gold price..

NB: This can be quite a volatile instrument to trade.

-- MANAGE YOUR RISK - -

Disclaimer: All ideas are my opinion and should not be taken as financial advice.

See all ideas

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

ONG assets under management is 1.64 B EUR. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

No, ONG isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

No, ONG doesn't pay dividends to its holders.

ONG shares are issued by Newgold Owner Trust

ONG follows the LBMA Gold Price AM ($/ozt). ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Nov 1, 2004.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.