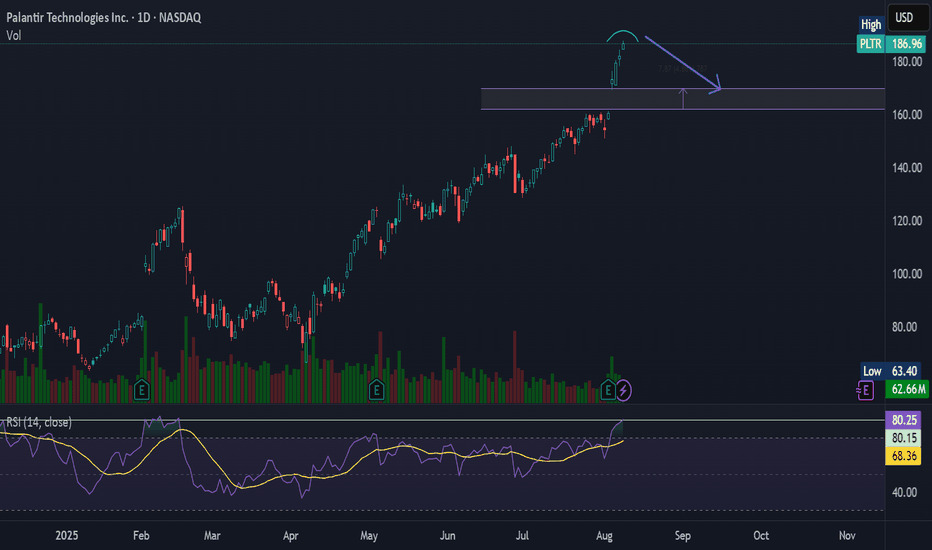

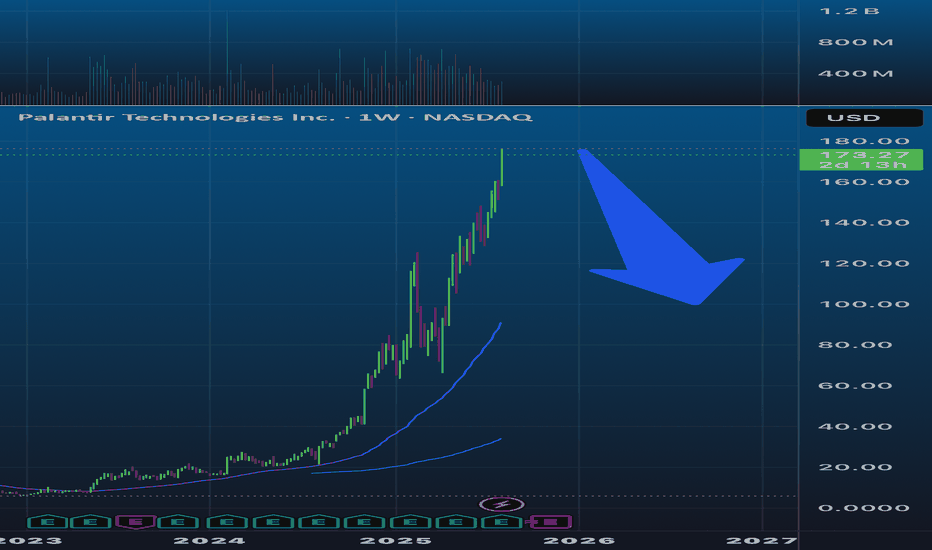

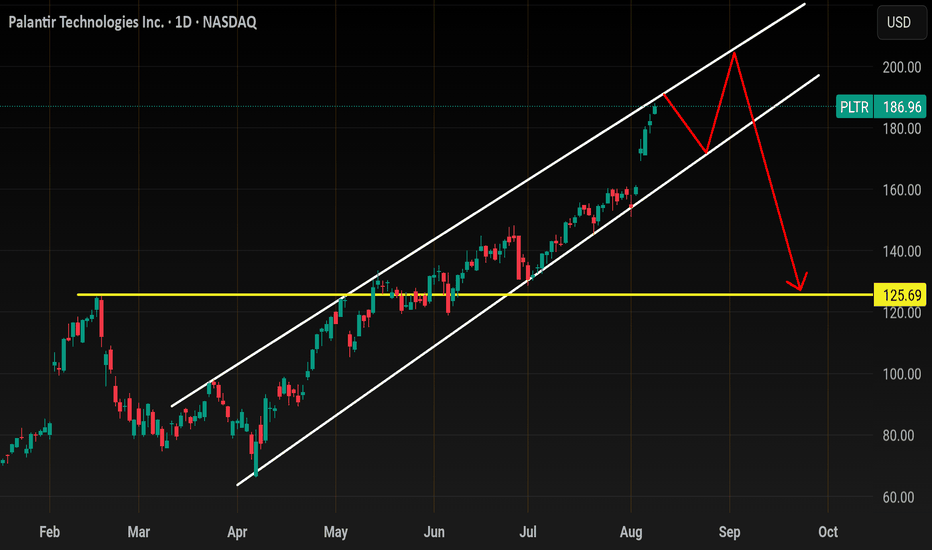

Short PLTR as it's time for a pullbackExtremely High Valuation: Palantir's stock has soared, and it's now trading at over 200 times its forward earnings. Such a high valuation can be hard to sustain, making the stock vulnerable to a correction.

The stock is up 28% in the last month. It is up close to 600% in the last year.

Even though Palantir has good profit margins that may grow even more in the coming years, there is only so much margin expansion you can achieve.

PTX trade ideas

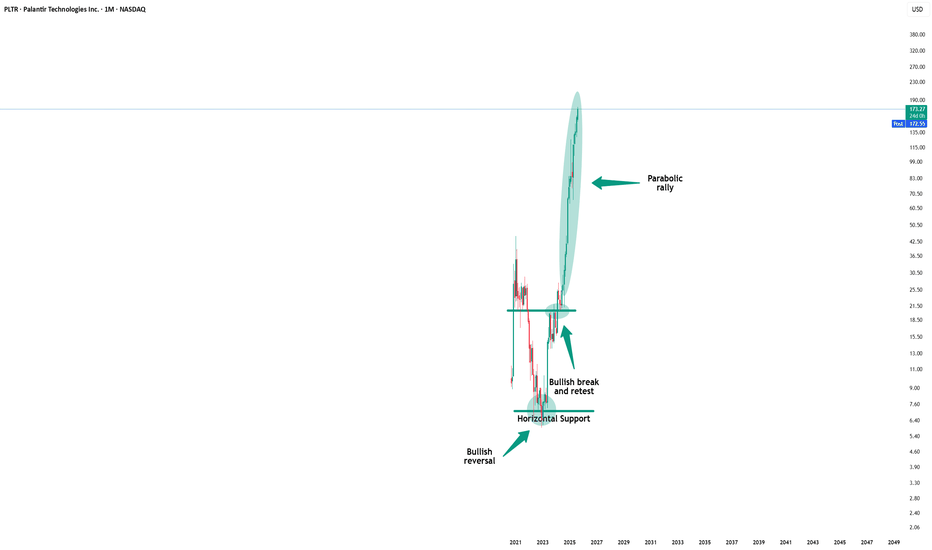

Palantir - The unstoppable company!💣Palantir ( NASDAQ:PLTR ) is just too strong:

🔎Analysis summary:

Since mid 2022, Palantir managed to rally more than 2.500%, creating new all time highs every single month. Eventually this rally will slow down, but before this happens, Palantir could rally another +100%. This is a classic example of stock market behaviour and you should take advantage.

📝Levels to watch:

$200

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

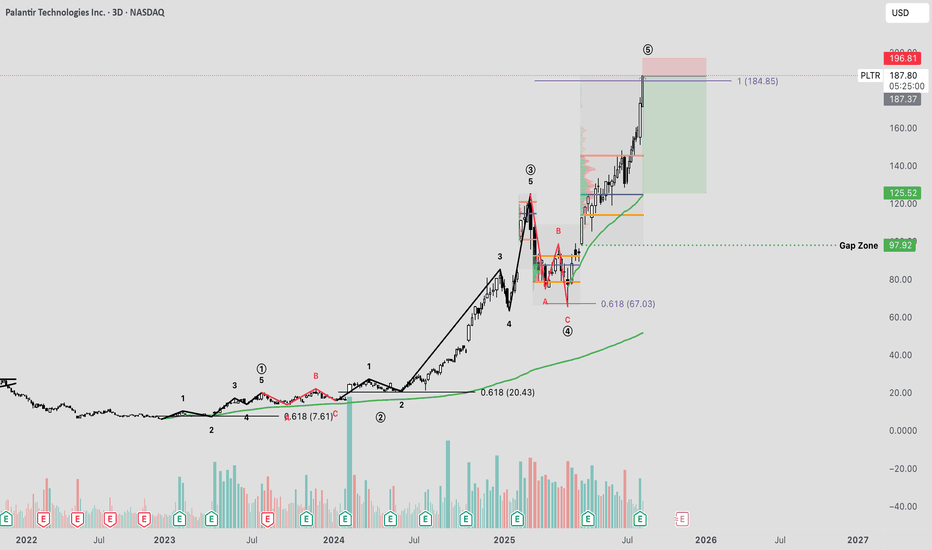

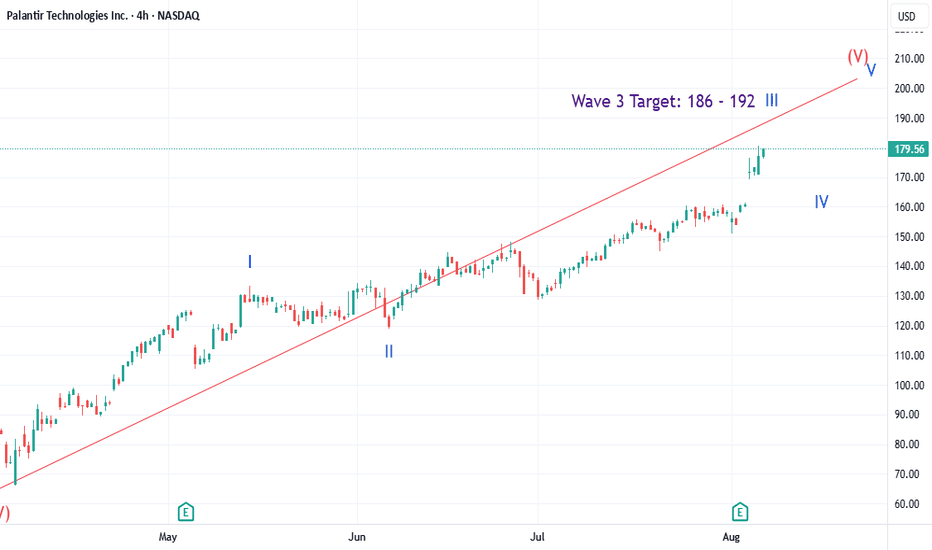

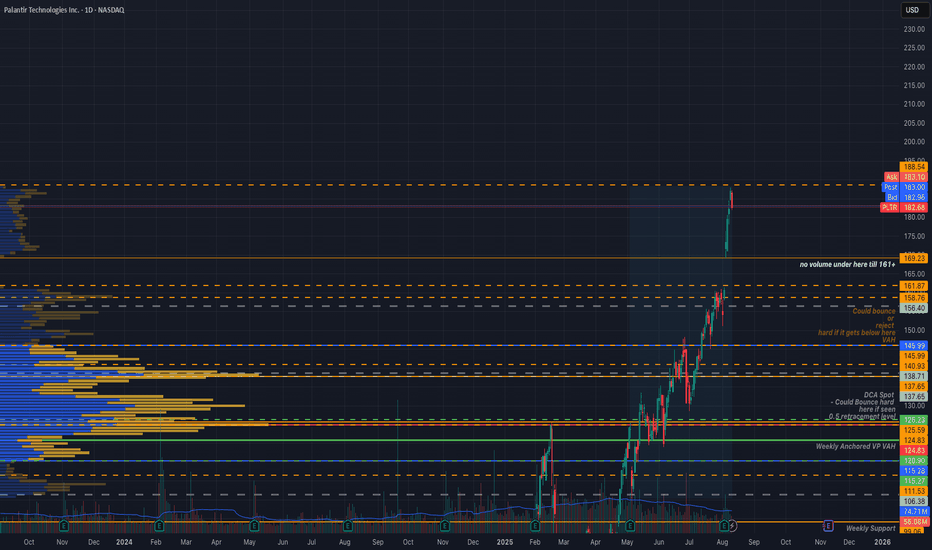

PLTR Elliot Wave Short Trade IdeaPalantir has experienced a remarkable rally since its April lows, surging to its current price levels. Throughout this uptrend, I’ve been analyzing the movement through the lens of Elliott Wave Theory. Given the stock’s relatively limited price history, the wave structure has been notably straightforward and discernible.

We’ve decisively broken through several key price zones as the stock appears to be approaching the culmination of a fifth wave, with a projected target around the $185–$186 range. Based on my analysis, this level may act as a potential area for profit-taking, potentially triggering a retracement toward the Point of Control (POC)—the price range that has seen the highest volume during this ascent.

If such a pullback does occur, it could serve as an effective hedge for those who have realized significant gains during this impressive rally.

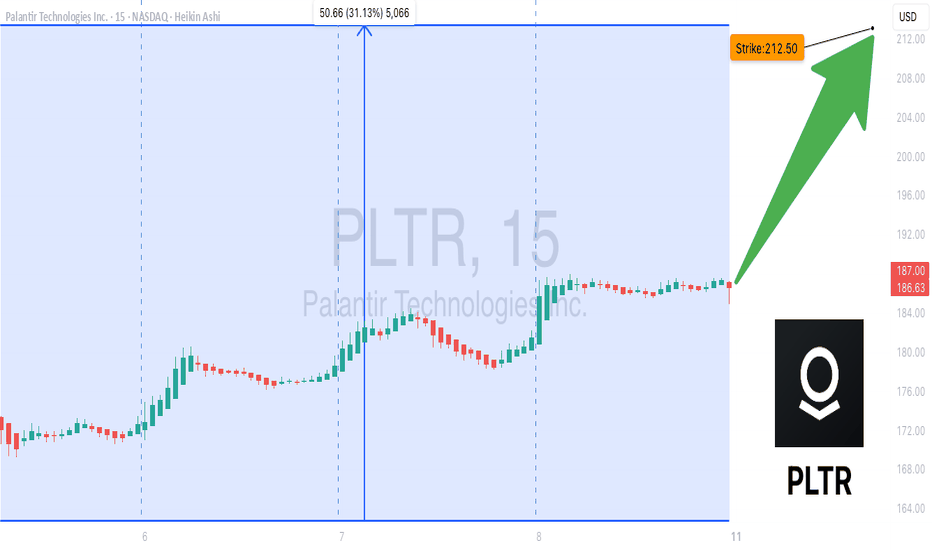

PLTR Bulls Unstoppable? Key Levels You Can’t Ignore! 🚀 PLTR Swing Trade Setup (2025-08-09) 🚀

**Bias:** 📈 **Cautious Bullish** — momentum strong, RSI hot, but volume light = high risk at highs.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:PLTR

* **Type:** CALL (LONG)

* **Strike:** \$212.50 (slightly OTM)

* **Entry:** \$0.85 (open)

* **Profit Target:** \$1.27 (+49%)

* **Stop Loss:** \$0.59 (-30%)

* **Expiry:** 2025-08-22 (2W)

* **Size:** 1 contract

* **Confidence:** 70%

**📊 Key Notes**

* RSI 84.2 → extreme overbought 🚨

* Multi-timeframe momentum ✅

* Weak volume = low institutional conviction ❌

* Resistance ahead — watch \$175-\$180 pullback zone for safer reload

* Mixed analyst models: some say “wait,” others say “small bullish”

Palantir is a cult? Ticker: NYSE:PLTR

Current Price: $173

Market Cap: $380B+

P/S: 116x

P/E: 500x+ trailing, 234x forward

Bear Thesis:

Palantir is now trading at a level that makes even Nvidia look cheap. This is a classic parabolic AI play driven by retail FOMO, not by fundamentals. The company needs to maintain 30%+ annual growth for years just to justify today’s valuation. One miss, and the whole tower comes down.

Problems:

1. Valuation is insane, far above anything justified by cashflow or realistic comps. DCF and sum-of-parts models put fair value between $20 and $30. That’s up to 85% downside from here.

2. Analyst average price target sits at $108. Plenty call for $40–$75 if growth stalls or the hype fades.

3. Heavy reliance on US government deals. Any cut to defense budgets, a change in admin, or a headline scandal and half their contracts can disappear.

4. Competition is coming hard. Google, Amazon, Microsoft all pushing enterprise AI. Palantir’s moat is shrinking.

5. Stock acts like a meme: options-fueled squeezes, no connection to cashflow. If market sentiment turns risk-off, these multiples get crushed.

What could trigger the unwind:

• Any earnings miss, weak guidance, or margin compression

• Defense budget cuts or bad headlines

• AI trade rotation or a macro correction targeting high-flyers

• Commercial growth disappoints

Bear Targets:

• $108: analyst average (still aggressive)

• $40–$75: if narrative breaks, AI hype dies, or execution slips

• $20–$30: where most bear DCFs cluster, fair value based on realistic growth

Bottom Line:

PLTR is pricing in perfection in a market that rarely delivers it. If you’re long here, you’re paying tomorrow’s prices for today’s story. This is one of the most crowded trades in AI right now, and history says these always end the same way. Protect your capital.

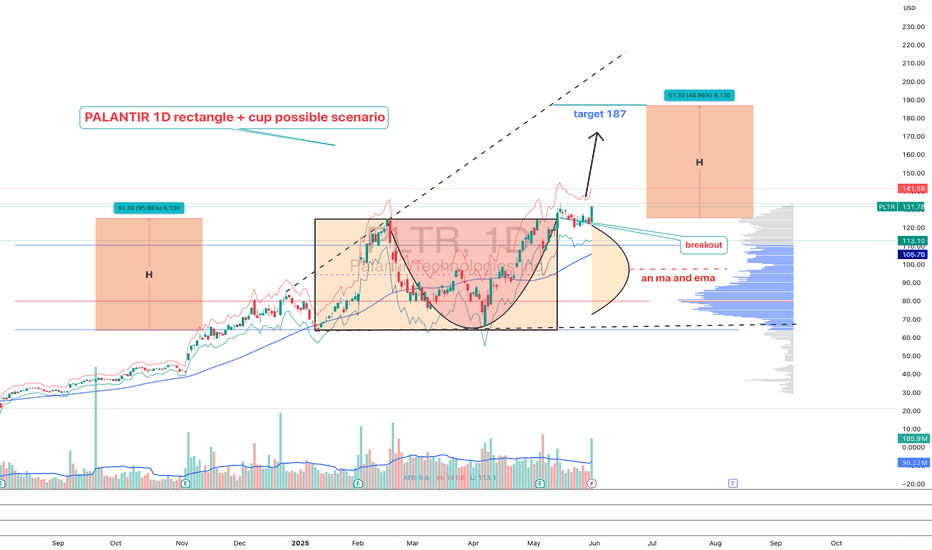

PLTR 1D — When the tea is brewed and the handle’s in placePalantir’s daily chart is shaping up a textbook cup with handle pattern — one of the most reliable continuation setups in technical analysis. The cup base was formed over several months and transitioned into a consolidation phase, building a rectangle structure where smart money likely accumulated positions before a breakout.

Now here’s the key: price has not only broken out — it’s settled above all major moving averages, including EMA 20/50/100/200 and MA 50/200. The breakout candle was supported by surging volume, signaling strong participation from institutional buyers. When all the averages start bending upwards, it's usually not by accident.

The breakout above the $121 resistance zone unlocked a pathway toward a target at $187 , derived by projecting the height of the cup upward from the breakout level. This kind of structure, once confirmed, often fuels aggressive continuation — and this one’s got the setup locked in.

From a fundamental perspective, Palantir is holding solid ground: strong earnings reports, expanding government and commercial contracts, and aggressive development in AI services. Institutional interest is rising steadily, and that momentum is visibly reflected in price action.

To sum it up: price has launched cleanly out of the consolidation zone, pierced all critical MAs and EMAs, and continues to gain momentum. While the market sips its tea, this cup is boiling hot. Just don’t forget your stop loss — this is a trading desk, not a tea party.

If you enjoy posts like this, drop a like, share it around, and let’s hear your thoughts below. It keeps ideas moving and the content flowing — free, sharp, and relevant.

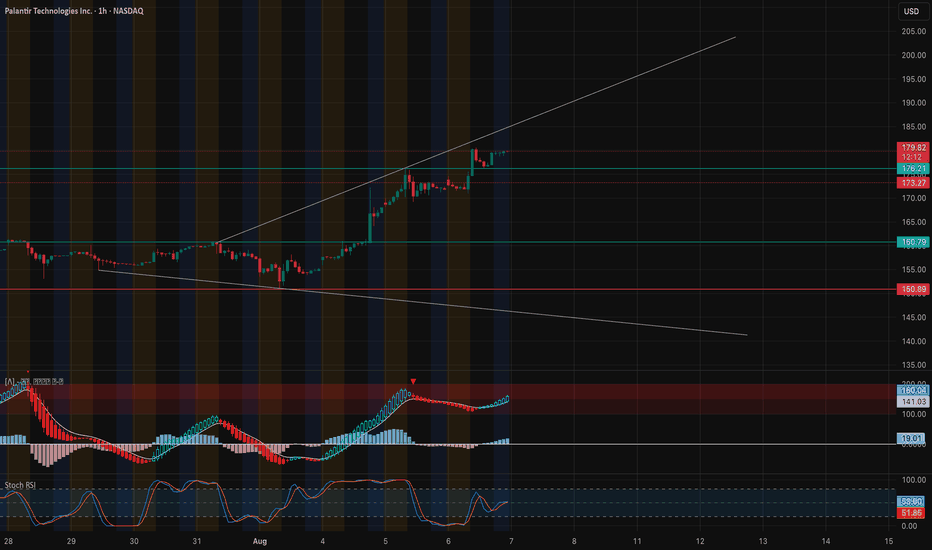

PLTR Approaching Critical Levels. Can the Breakout Sustain?Aug 7PLTR Approaching Critical Levels – Can the Breakout Sustain? 🔥

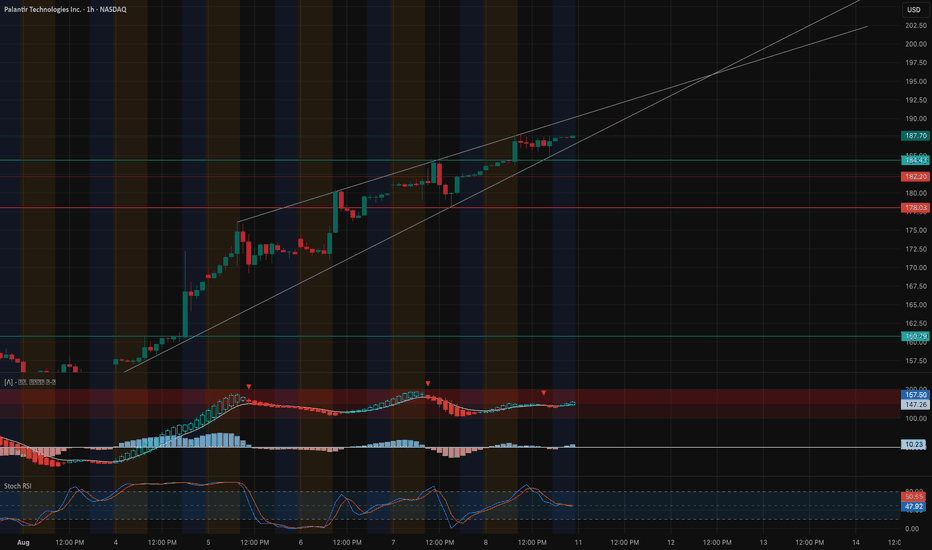

🔍 Technical Analysis (1H & 15M View)

PLTR has been in a strong uptrend, respecting the upper trendline of the rising channel on the 1H timeframe. Price is consolidating below $180 after a clean breakout from the $172.5–$176 range. Bullish momentum remains intact as MACD crosses upward again with histogram flipping light blue. Stoch RSI is mid-range, allowing room for another push.

* Key support: $176.21 and $172.27

* Resistance ahead: $183.00–$185.00 zone, aligned with projected trendline

* Trend structure: Higher highs and higher lows — buyers remain in control

* Volume is consistent on green candles, showing strength behind moves

15-Minute Chart Insight:

Price is flagging just under the $180 resistance after a measured move. A breakout above $180 could trigger a squeeze toward $183–$185. A clean 15-min close below $176 would weaken this structure and invite a pullback to $172.27.

Bias: Bullish while price holds above $176.21

🧠 Options & GEX Sentiment (Based on Tanuki GEX Map)

* GEX Resistance Zones:

* $182.5 → $185.0 (GEX9 + GEX7): This is the strongest gamma resistance cluster — a breakout here would be explosive.

* $179.5–$180 also marks a wall with high net positive GEX.

* Support Zones:

* $172.5–$176.21: Shallow demand zone, supported by options flow.

* $162.5–$160.0: Stronger GEX and HVL support, likely defended by dealers.

* Options Sentiment:

* IVR: 12.6 → Low implied volatility

* IVx Avg: 53.9 → Currently below average IV

* CALL$: 20.6% dominance → Mild bullish tilt

* GEX sentiment: All green (📗📗📗📗) — supports upside continuation

✅ Game Plan

* Bullish Setup:

* Entry: Above $180.2

* Target: $183.3 → $185

* Stop: $176.2

* Bearish Setup (only if rejected hard):

* Entry: Break below $175.5

* Target: $172.27 → $170

* Stop: $178

Scalpers can look for breakout retests on 15M or use VWAP bounce entries if price pulls into $176.2–$177.0 zone.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

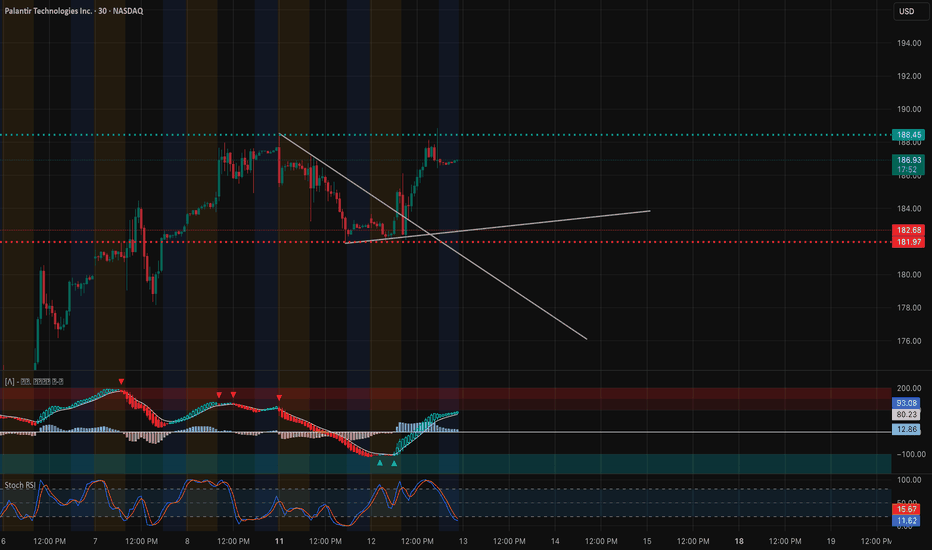

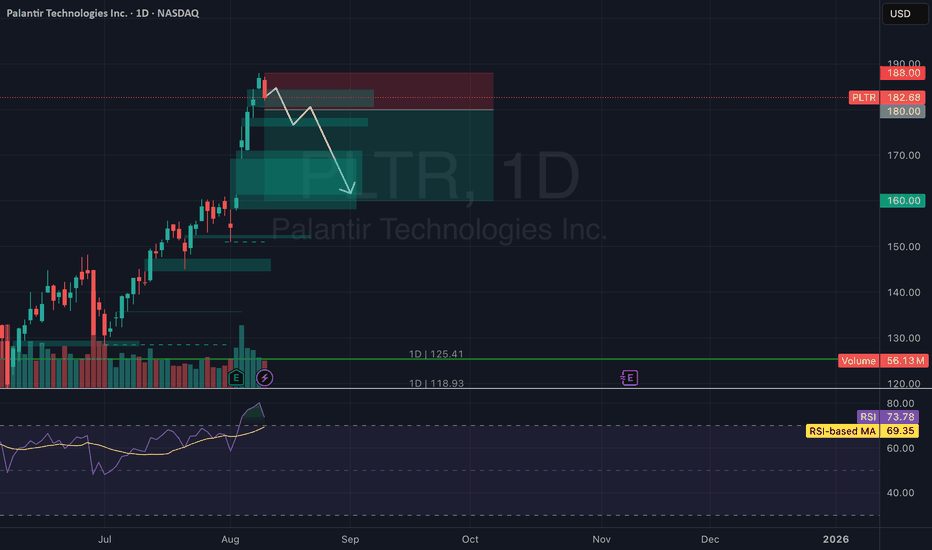

PLTR – TA + GEX Confluence for August 13, 202530-Minute Price Action

PLTR broke out of a short-term downtrend channel and is now testing the $188.45 resistance zone.

* Resistance: $188.45 – key breakout level; aligns with recent highs before pullbacks.

* Support: $182.68 – breakout retest level; $181.97 – secondary support.

* Indicators:

* MACD shows strong bullish momentum after crossover, though starting to flatten.

* Stoch RSI cooling off from overbought, indicating possible consolidation before next leg.

1-Hour GEX Insights

* Highest Positive NET GEX / Gamma Wall: $188.66 – major upside resistance.

* Next Call Walls Above: $190 (strong GEX concentration) and $192.5–$195 (layered gamma resistance).

* Put Support: $180 (GEX support floor), $172.5 (secondary defense), $170 (major downside floor).

* IVR: 9.3 – relatively low implied volatility rank, making long options affordable.

TA + GEX Combined Read

The 30m breakout toward $188.45 lines up with the largest GEX wall at $188.66 on the 1h chart.

* A break above $188.66 could quickly fuel momentum toward $190 and $192.5 on gamma hedging flows.

* Failure to hold above $188 could see a retest of $182.68 and possibly $180, where GEX provides strong support.

Trading Scenarios for August 13

* Bullish Breakout: Long calls or debit spreads above $189 targeting $190–$192.5.

* Bearish Rejection: Puts or put spreads if $188.66 rejects and $182.68 breaks, targeting $180.

* Neutral Play: If price stays between $182–$189, short premium strategies could work given low IVR, but manage risk for breakout moves.

Reasoning

The 30m breakout and retest structure aligns with the 1h GEX’s largest resistance level. Tomorrow’s trading will likely hinge on $188.66 — a confirmed break could trigger gamma-fueled upside, while rejection keeps PLTR in consolidation or sends it back to key GEX support zones.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk appropriately before trading.

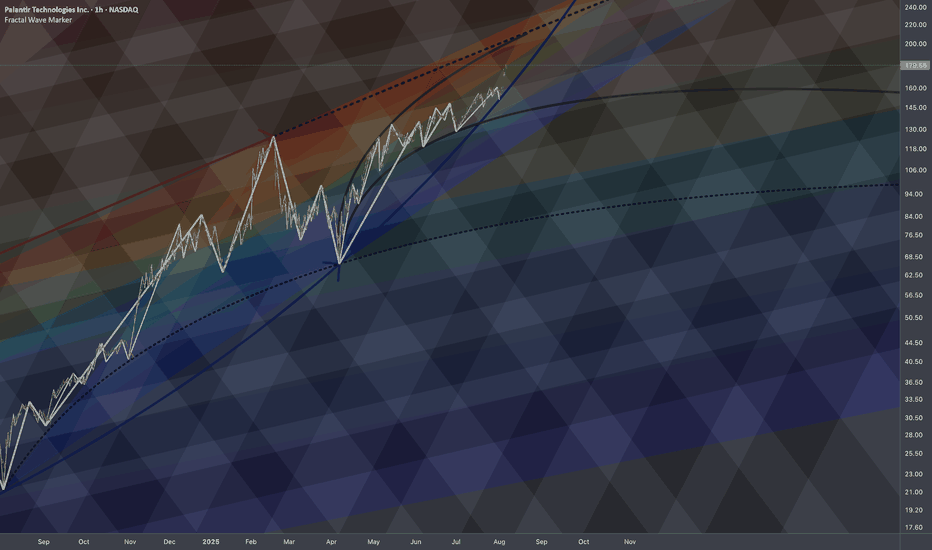

PLTR: Temporal Patterns🏛️ Research Notes

The fact that price touched and reflected up from the curve that mimics exponential growth, forced me to focus on the precursors that could explain the geometry of such decisive move.

Let's strip the chart and document how exactly chronological chain of human emotions were progressing across vast cycles.

Essentially, the composite sub-cycles patterns are the same but stretched towards denser probability point. It's not just percentages that matter, but how it was structured on the way down. Evidently that was enough to trigger exponential growth. (BTW, since that super-bottom price is up 2950%)

So, that force made the time tick differently in the following bigger cycle. Manifests in frequency of reversals of sub-waves and changing scaling laws.

Particular parts of large curves with gradient of last reaction move can be connected to further express how two forces push the price toward some mutual angle.

Publishing interactive chart as low as 1h TF to observe in details.

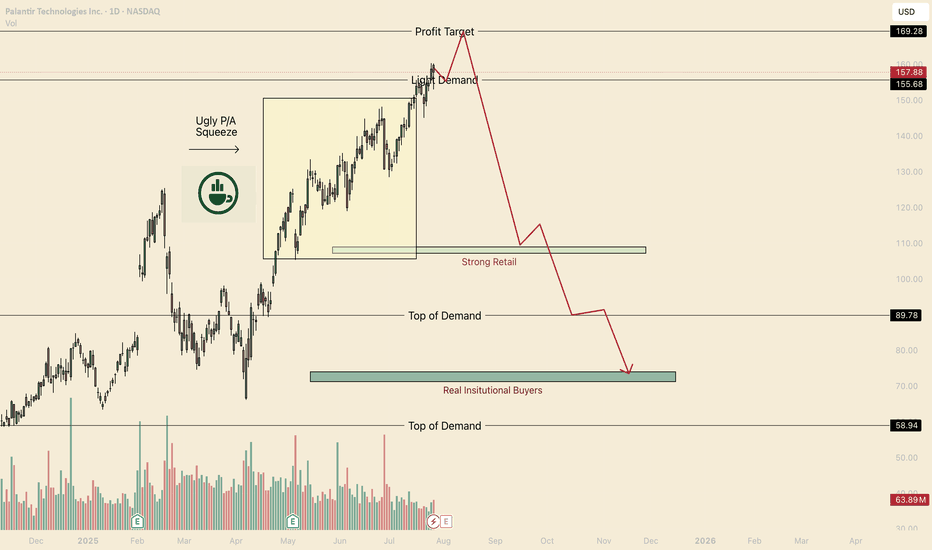

Hot Take, PLTR is a BubbleHello I am the Cafe Trader.

Price Action suggest we haven't had a proper buyer since $90.

Now I know that this can sound a bit off putting (especially if you bought above $90).

Even if this crashed, I am not suggesting you sell your long term position. I would instead look into hedging your position, giving yourself some exposure to the downside.

Consider these 2 non-biased reasons before writing me off.

Point 1

Price action suggests we have been in a short squeeze since April. Although in the short term I do see current retail buyers taking this to 169.

Point 2

If we do not land new Strong Buyer (someone that can support the price) all of this squeeze will come crashing back down to where they can support the price.

Conclusion

If we close below 152.50 on the day, this would suggest that bears have or are in control. This would expose many to tons of risk.

Here are my long Term prices for PLTR

Aggressive = 120

Fair = 107.50 - 108.50

Good = 89

Steal = 71-74.50

That's all for PLTR take a look at my other articles if you are interested in more!

Happy Trading!

@thecafetrader

PLTR AI hype cooling off? PLTR dipped to $182.68 (-2.29%), still up ~22% 1M, with RSI(14) at 80.25 and all-time high of 187.99 hit Aug 8. Stochastic >85, ADX >30, but fading volume post-Q2 (mixed AI outlook) and CPI-driven yield pressure suggest reversal below 190 resistance. Forecasts point to supports at 175/160 if 180 breaks.

Chart Analysis:

Uptrend from $150, but RSI at extremes with potential divergence. Price above EMA(50) ~$170, upper BB tested.

Key levels: Resistance at $188 (recent high), supports at $175 (near-term), $172.5 (HVL), deeper $160 (major pivot/Fib 61.8%).

Trade Idea: Short

Entry: Below $180 (break of key level).

Target: $160 (deeper support on earnings fade).

Stop Loss: $185 (tighter above resistance for lower risk).

Risk: ~$5 (180 to 185), Reward: ~$20 (180 to 160), R/R: 1:4. Watch for confirmation if loses 172.5.

#PLTR #Overbought #Tech #Pullback

PLTR — Testing Key Resistance, Eyes on 190 Breakout. Aug. 11PLTR — Testing Key Resistance, Eyes on 190 Breakout 🚀

GEX & Options Sentiment (1H)

PLTR’s options board is showing concentrated call positioning between 185–190, with 96% call wall pressure at 187.5. This is the highest positive NetGEX zone, meaning market makers are more likely to hedge by buying if price breaks and holds above 187.7 — which could trigger a gamma squeeze toward 192.5–195.

Downside protection sits at 180–182 with heavy put walls at 170 and 160. Losing 180 could pull the stock quickly toward 172.5 HVL support. IVR is at 11.9, relatively low, suggesting calls remain cheap for momentum plays.

1H Technical Analysis

Price has been respecting a rising channel with multiple touches on the trendline, currently consolidating just under 187.7 resistance. Momentum (MACD) is flat but still in positive territory, and Stoch RSI is mid-range — suggesting more room to run before overbought conditions kick in.

If bulls break 187.7 with volume, 190–192.5 is the next target. Failure to clear could trigger a pullback to retest 184.5 and possibly 182 before another leg higher.

Trade Plan

* Bullish Scenario:

Break & hold above 187.7 → target 190, then 192.5.

Options: Short-dated 190C for momentum or swing 192.5C if targeting the squeeze.

Stop-loss: Below 184.5.

* Bearish Scenario:

Rejection at 187.7 with heavy selling → target 184.5, then 182.

Options: Short-dated 182P or 180P if momentum shifts down.

Stop-loss: Above 188.5.

Thoughts

PLTR is sitting at a key inflection point — break 187.7 and bulls control short term; reject here and bears can force a healthy pullback. The low IVR makes directional options attractive, but this is a “breakout or fade” setup — so patience until confirmation is key.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always do your own research and manage risk accordingly.

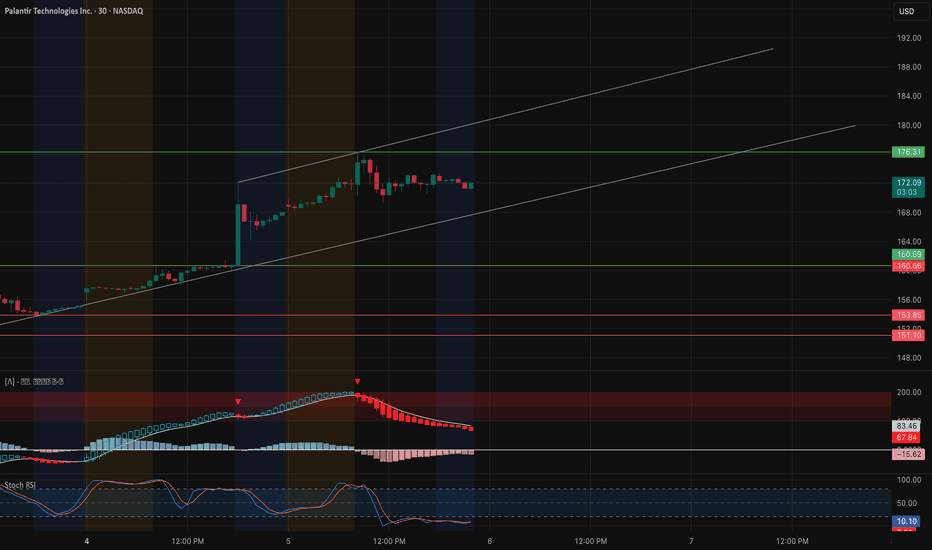

PLTR Holding Strong. TA for Aug. 6PLTR Holding Strong – Can the Momentum Continue? 🚀

Technical Overview (30-Min Chart)

PLTR has been in a strong uptrend, riding a steep ascending channel from the $151 support region. After hitting a high of $176.33, price has slightly cooled off but remains above $171, indicating healthy consolidation rather than a breakdown. MACD is showing a gradual loss in bullish momentum, while Stoch RSI is oversold—suggesting potential for another leg higher if buying pressure resumes.

Key support lies at $167.50–$165 (previous breakout area), while resistance remains at $176–$180 (channel top).

GEX / Options Sentiment

* Major Call Walls: $177.5, $180 – heavy gamma resistance where market makers could slow price movement if breached.

* Highest Positive NETGEX: $176.3 – aligns with the channel resistance, making it a critical breakout level.

* Strong Call Positioning: 72% concentration at $165–$177.5 range keeps the bias bullish above $167.

* Put Support: $155 – heavy protection level where downside could stall if selling pressure picks up.

Trading Plan

Bullish Scenario (Higher Probability if Above $167)

* Entry: On reclaim of $173 with strong volume or breakout above $176.5.

* Target 1: $177.5 (Call Wall test)

* Target 2: $180 (next gamma wall)

* Stop Loss: $166 close basis.

* Options Idea: Short-term weekly calls targeting $177.5+ strikes if breakout confirmed, keeping expirations tight (1–2 weeks).

Bearish Scenario (Only If Breakdown Below $165)

* Entry: On break & close below $165.

* Target 1: $160.7 (minor support)

* Target 2: $155 (Put wall)

* Stop Loss: Above $167.

* Options Idea: Short-term puts targeting $160–$155 zone, tight expiration to capture momentum drop.

Summary

PLTR remains bullish as long as $167 support holds. Watch for breakout above $176.3 for a gamma-driven push to $180. Options flow shows strong call dominance, but failure to hold $165 could flip sentiment quickly.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always manage risk according to your trading plan.

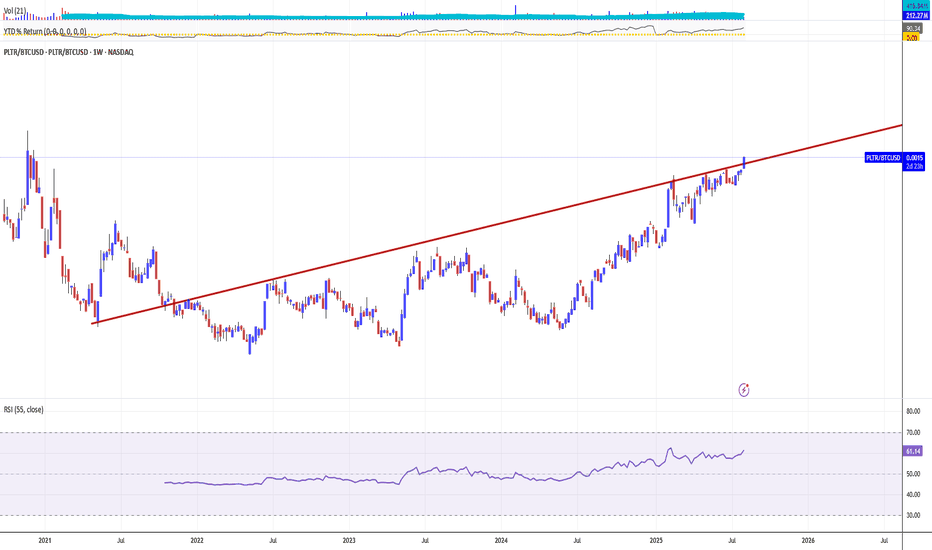

PALANTIR GOES 'BOMBASTIC', DETHRONES JUGGER BITCOIN SUPERIORITYIt's gone less than a year or so since Palantir stock has joined on Friday, September 20, 2024 Stock Top Club, also known as S&P 500 stock index SPX .

Palantir was one of the strongest contenders for inclusion in the broad market S&P500 Index.

This inclusion, as well as Dell (DELL), came after tech companies Super Micro (SMCI) and Crowdstrike (CRWD) also joined the index earlier in the year 2024.

Since that, Palantir stock became the best (i.e. #1) S&P500 index performer the year 2024 and even in nowadays this Jugger remains 'The Best of The Best' over the whole S&P 500 index, with current +127% YTD return in 2025 (and +697% over the past 12 months), being highlighted at 173.29 USD per share - the new all the history peak reached last Wednesday, August 05, 2025 at regular session close.

What is most important also, nor Federal Reserve (The US Central Bank) hawkish projections on monetary policy in 2025, nor bearish were not able to stop the only game in the city, or even make a pause on Palantir leadership.

Since Palantir stock is rallying, the stalkers remain decently far away, swallowing the galactic dust of Palantir shares.

Judge for yourself.

All the nearest pursuers in 2025 are still under 100% YTD return while Bitcoin BITSTAMP:BTCUSD is traded with modest +21% YTD return in 2025.

What is most important also, Palantir stock was able to outperform S&P500 index within 12 (twelve) straight month in a row.

In human words that means, Palantir stock monthly returns (every single month from June 2024 to May 2025) were better against broad market index.

What is Behind this?

On August 4, 2025 Palantir Technologies has announced financial results for the second quarter ended June 30, 2025.

Palantir reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 48% year on year to $1.00 billion. On top of that, next quarter’s revenue guidance ($1.09 billion at the midpoint) was surprisingly good and 10.5% above what analysts were expecting. Its non-GAAP profit of $0.16 per share was 15.6% above analysts’ consensus estimates.

“The growth rate of our business has accelerated radically, after years of investment on our part and derision by some. The skeptics are admittedly fewer now, having been defanged and bent into a kind of submission. Yet we see no reason to pause, to relent, here.

It has been a steep and upward climb—an ascent that is a reflection of the remarkable confluence of the arrival of language models, the chips necessary to power them, and our software infrastructure, one that allows organizations to tether the power of artificial intelligence to objects and relationships in the real world,” said Alexander C. Karp, Co-Founder and Chief Executive Officer of Palantir Technologies Inc.

Palantir stock Alpha

What is Alpha?

Alpha (a) is a term used in investing to describe an investment's ability to beat (outperform) the market, or its “edge.” Alpha is thus also often referred to as excess return or the abnormal rate of return in relation to a benchmark, or any other asset (even against simple sitting in a cash) when adjusted for risk.

The main graph represents a comparison across Bitcoin and Palantir stocks. Since Palantir outperforms BTC and accelerate right now, so why isn't to continue the play, by staying in a long with Palantir, and finally dethrone "the new oranges" respectively.

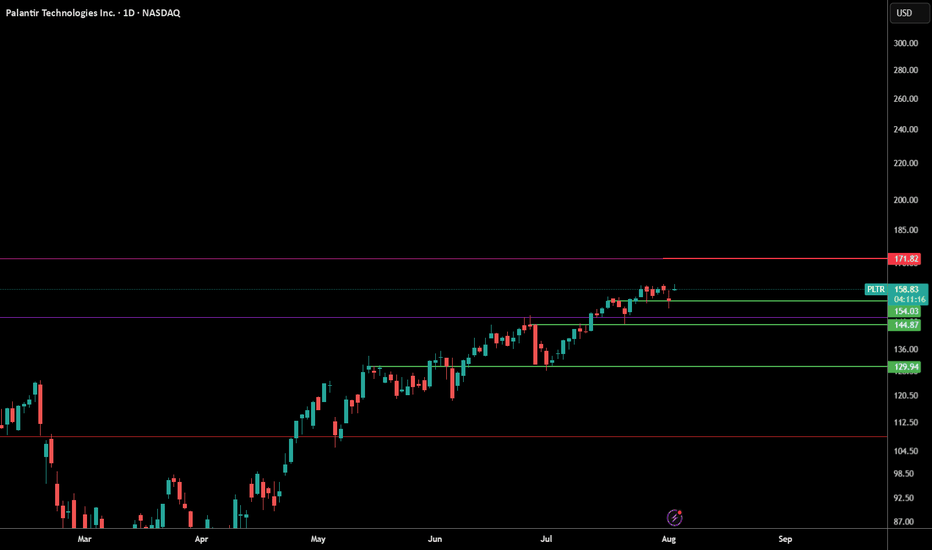

Huntin Wabbits - PalantirWill be using this chart to guide re-entries into palantir.

Immediately watching the $161 - $169 area.

Then $145-$126 if seen.

If S&P gets a good fuckening down the road, then I would like to begin DCAing into $126.

None of this is financial advice.

I'm just a guy with an interest and a celcius addiction.

~The Villain

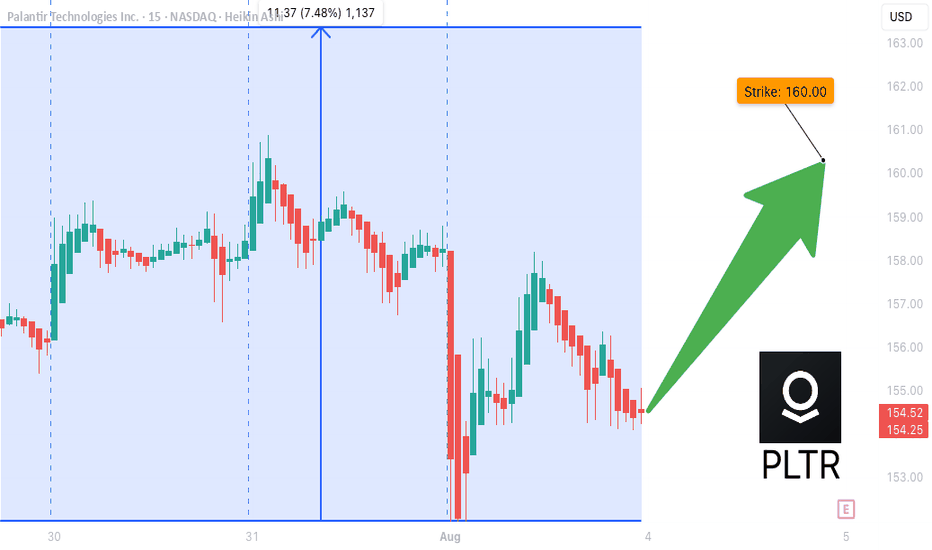

PLTR WEEKLY TRADE IDEA – AUG 2, 2025

📈 **\ NASDAQ:PLTR WEEKLY TRADE IDEA – AUG 2, 2025** 📈

⚡️ *Earnings Week Setup – Mixed Signals, But Bullish Flow*

---

🧠 **SENTIMENT SNAPSHOT**

• Call/Put Ratio: **2.29** = Bullish

• Volume Ratio: **1.1x** = Weak breakout support

• VIX: **20.38** = Normal vol, clean setups possible

📉 **RSI DIVERGENCE WARNING**

• Daily RSI: **56.3 (falling)** – losing steam

• Weekly RSI: **71.2 (overbought + falling)** – 🔻Bearish divergence

➡️ *Momentum fading, caution advised*

📊 **INSTITUTIONAL FLOW**

• Strong call buying ahead of earnings

• But... price not confirming = possible **profit-taking**

⚠️ **EARNINGS RISK ALERT**

• Earnings = this week

• Could inject volatility or invalidate setup – size small & use stop

---

🔥 **TRADE IDEA** 🔥

🟢 Direction: **CALL (LONG)**

🎯 Strike: **\$160**

💰 Entry: **\$6.80**

🏁 Target: **\$12.25** (80%+ gain)

🛑 Stop Loss: **\$3.40** (50% risk)

📆 Expiry: **08/08/2025**

⚖️ Confidence: **65%** (moderate risk, macro-backed)

⏰ Timing: **Buy Monday Open**

---

🔎 **STRATEGY TAGS**:

\#PLTR #WeeklyOptions #EarningsPlay #MomentumTrade #SmartMoneyFlow

---

📌 Final Thoughts:

Mixed momentum + strong call volume = **potential breakout**, but **momentum cracks** say **don’t chase blindly**. Small size, tight stop, defined risk = smart approach here.

🚀 *Save + Follow for more option setups each week!*

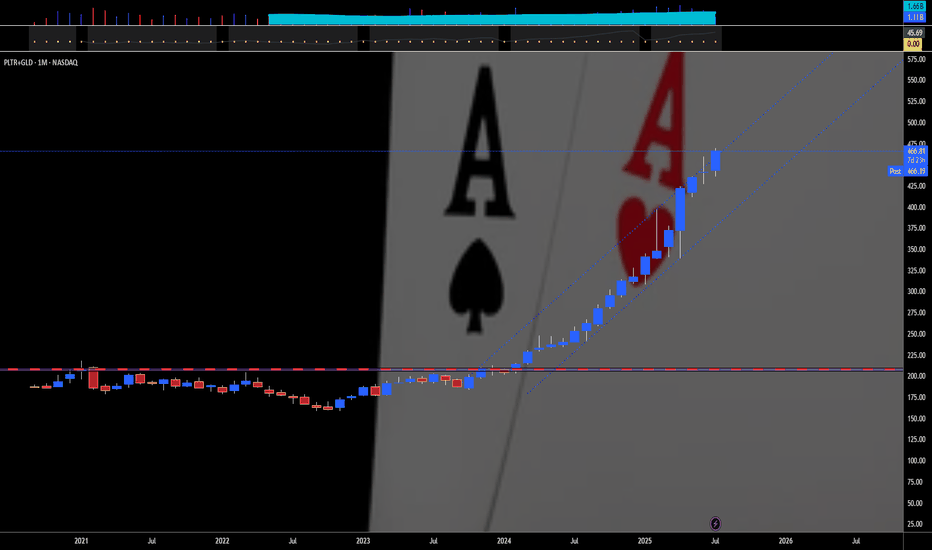

PALANTIR PLUS GOLD — TWO IS A PAIR"Two is a pair" means that the number two represents a set of two identical or closely related items that are used together or considered a unit. For example, a pair of socks, a pair of shoes, or a pair of gloves. It can also refer to two people, animals, or things that are grouped together.

Here's a more detailed breakdown:

Definition:

A pair is a set of two things that are alike, matched, or intended to be used together.

Examples:

"A pair of socks" - two socks designed to be worn on the feet.

"A pair of scissors" - two blades joined together.

"A pair of lovers" - two people romantically involved.

Singular/Plural:

The word "pair" can be singular or plural, depending on how it's used. For example: "This pair is comfortable" (singular) and "These two pairs are comfortable" (plural).

Relationship:

While "pair" often implies a strong connection or matching nature, it can also be used for things that are simply grouped together.

For example, like Palantir NASDAQ:PLTR & Gold AMEX:GLD that match each other, for 18 straight months in a row. 💖

--

Best wishes,

@PandorraResearch Team

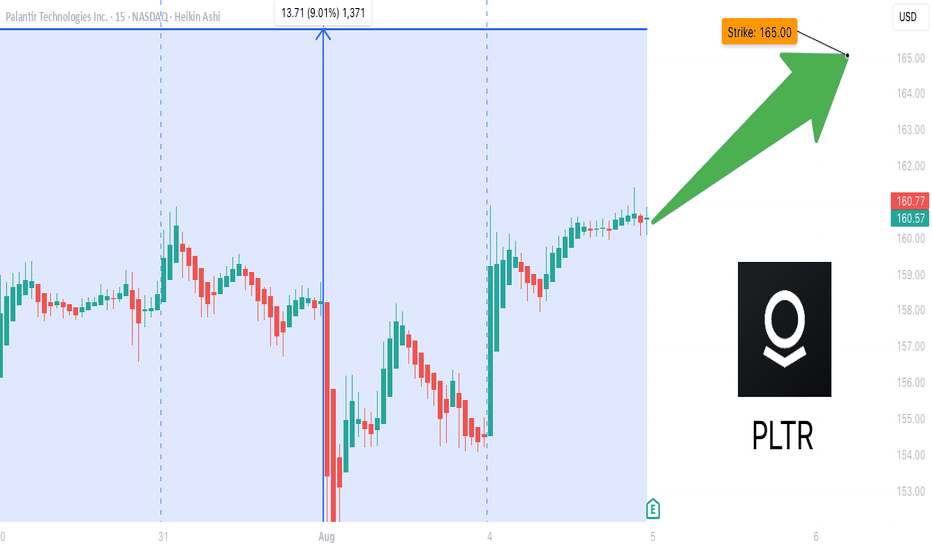

PLTR Earnings About To Print

## 🚨 PLTR Earnings Incoming: +80% Confidence Call Setup into AI Boom 🚀

**🧠 Palantir Technologies (PLTR) Earnings Analysis – August 8, 2025 (AMC)**

**📈 Position:** \$165 Call | 🎯 Entry: \$6.45 | 💰 Target: \$22.58 | 🛑 Stop: \$3.23

**🕒 Entry Timing:** Pre-Earnings Close | Expiry: Aug 8, 2025

---

### 🔍 Quick Breakdown:

* 📊 **Revenue Growth:** +39.3% TTM – AI sector leadership

* 💰 **Margins:** 80% Gross | 19.9% Operating | 18.3% Net

* 🧾 **EPS Beat Rate:** 88% | Avg Surprise: +10.7%

* 📉 **Debt-to-Equity:** 4.43 – watch rates & debt risk

* 📈 **RSI:** 66.88 – strong momentum, near breakout

* 📊 **Volume:** Above average – institutional accumulation

* 🧠 **Options Flow:** Heavy \$165/\$170 call OI = bullish gamma exposure

* 🛡️ **Support:** \$151.94 | 📌 Resistance: \$161.24

* 🔭 **Macro Tailwinds:** AI + defense demand + sector rotation into tech

---

### 🧠 Trade Thesis:

Strong fundamentals + bullish options flow + tech sector tailwinds = **High-probability breakout**

🧨 **IV Rank: 0.75** – Big move priced in

💡 Likely to squeeze if results exceed expectations

---

### 💼 Trade Setup (Recap):

```

💎 Ticker: NASDAQ:PLTR

🔔 Direction: Long Call

🎯 Strike: $165

💵 Entry: $6.45

🎯 Profit Target: $22.58 (250%+)

🛑 Stop Loss: $3.23

📅 Expiry: 2025-08-08

📆 Earnings: August 8 (AMC)

🧠 Confidence: 80%

```

---

### 📌 Hashtags for TradingView:

```

#PLTR #EarningsPlay #AIStocks #TechMomentum

#OptionsTrading #GammaSqueeze #CallOptions

#UnusualOptionsActivity #Palantir #EarningsSetup

#TradingViewIdeas #VolatilityPlay #RiskReward

#AI #DefenseStocks #SwingTrade

```

---

💬 **TL;DR:** PLTR earnings are set to rip. Revenue surging, margins healthy, call options stacked, and momentum rising. Are you in before the AI-driven explosion?

Pltr continues to defy logic600 p/e and 275 p/s, it has to go down right? The consensus seems to be we see a sell off after earnings. I'm not so sure, the trend seems very consistent so far. I think a test of $170 is more likely. We've never seen a AI platform before, the potential growth acceleration here could continue to defy logic, especially when analyst estimates seem far too pesimistic.

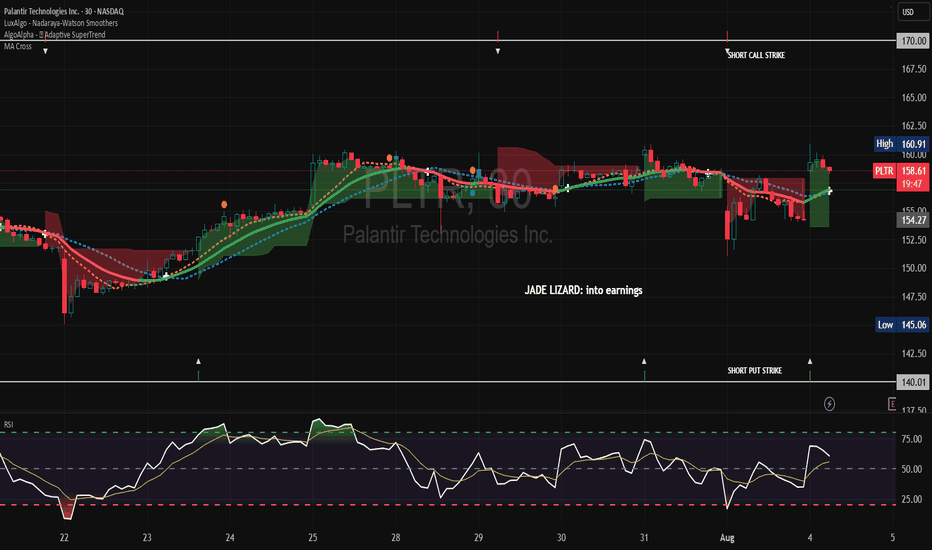

A Jade Lizard Play for Earnings (4-dte) on PLTR.

This is 4-DTE with a wide $140 short Put and $170 Short Call spread.

A slightly bullish strategy combining an out-of-the-money short put and out-of-the-money bear call spread. When created properly, this strategy has no upside risk. It is best suited for oversold stocks with high implied volatility.

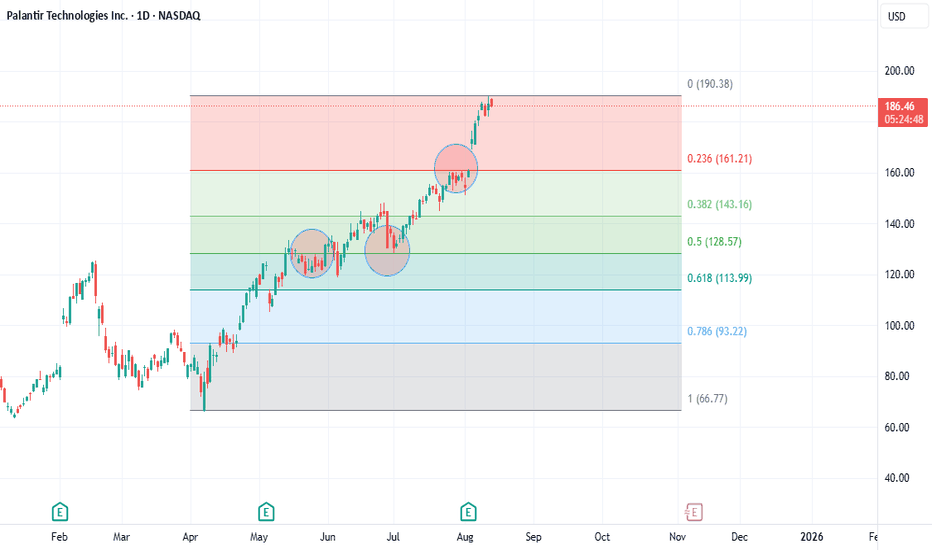

PLTR: The Top Is INPLTR has reached my top as stated in a previous post. This post is simply to show fib retracement levels to show how I came to this conclusion. As seen in the circles labeled, PLTR has given clues along the way by hitting these fib retracement, either as resistance or support. The next target for PLTR is $161 in the next week or two.