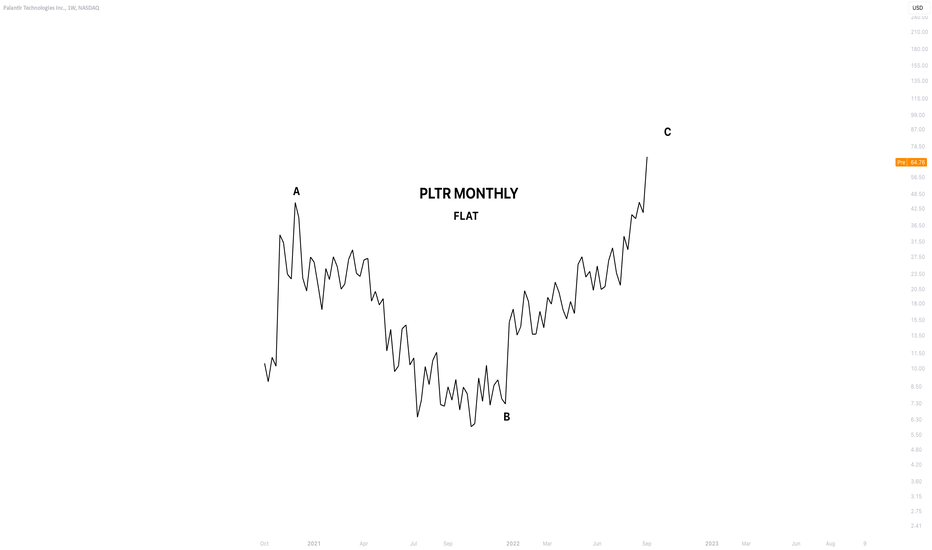

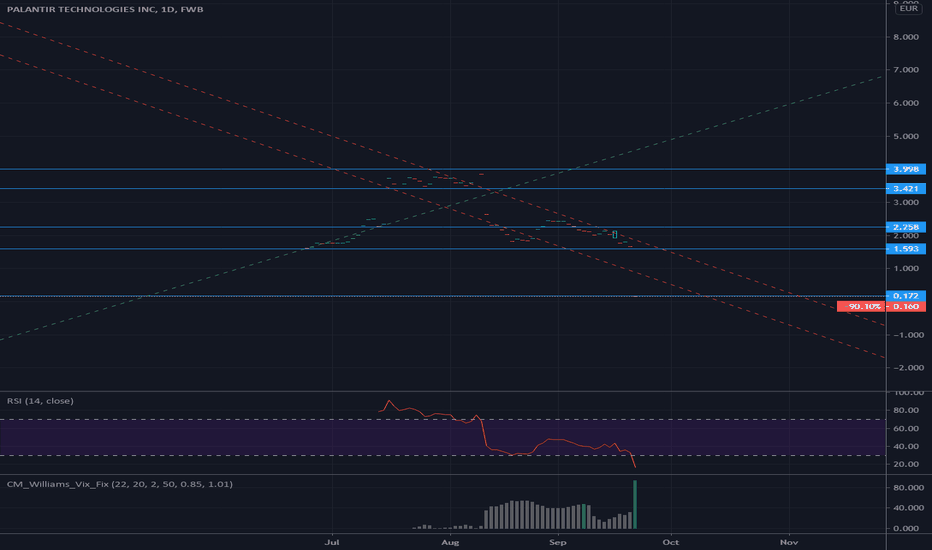

PLTR NEOWAVE ANALYSISExperimental analysis with the intention to follow back later on as I am still learning

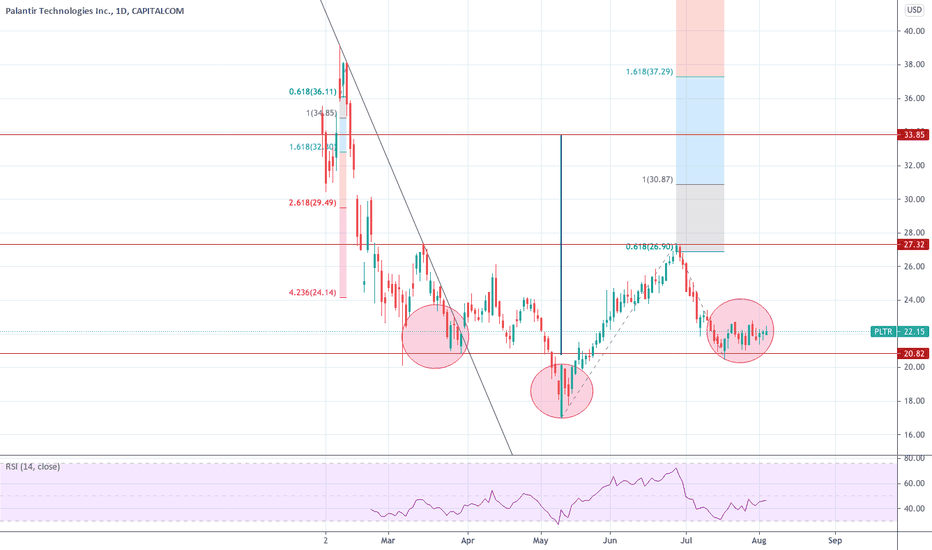

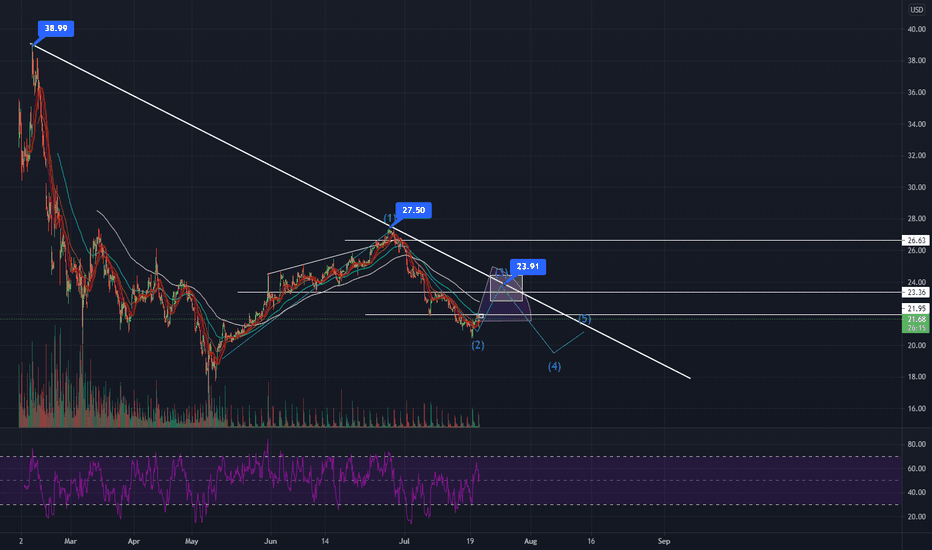

Looks like a clear flat pattern due to the very stretched out B wave, which also ended around the 1.38 extension of wave A retracement. This tells me one thing: the B wave was indeed strong. Normally, in such scenarios, there is a very small chance that wave C retraces wave A with such force.

This pattern will most likely be the first leg of a very complex correction. Although rest assured that the overall trend for PLTR is up, I do not know to what extent. But after this wave C completion, we will be headed down for quite some time.

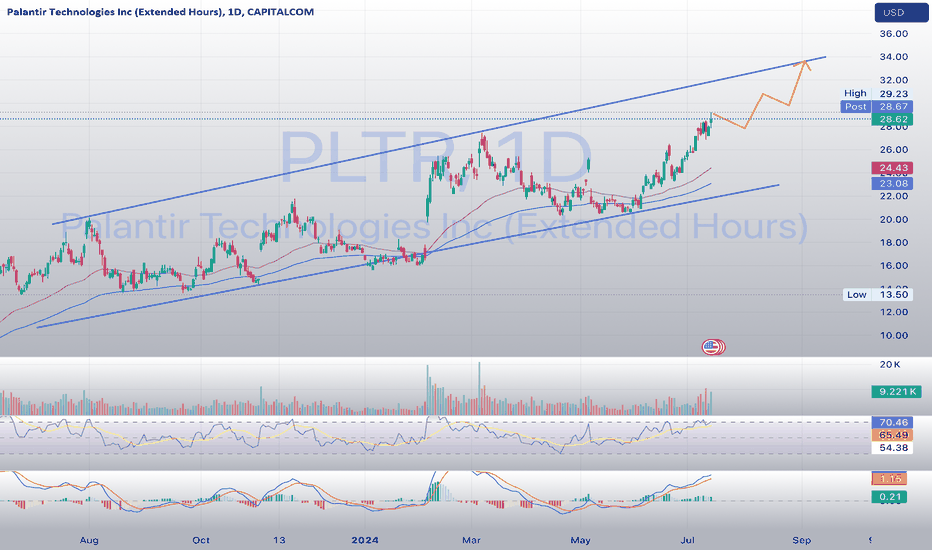

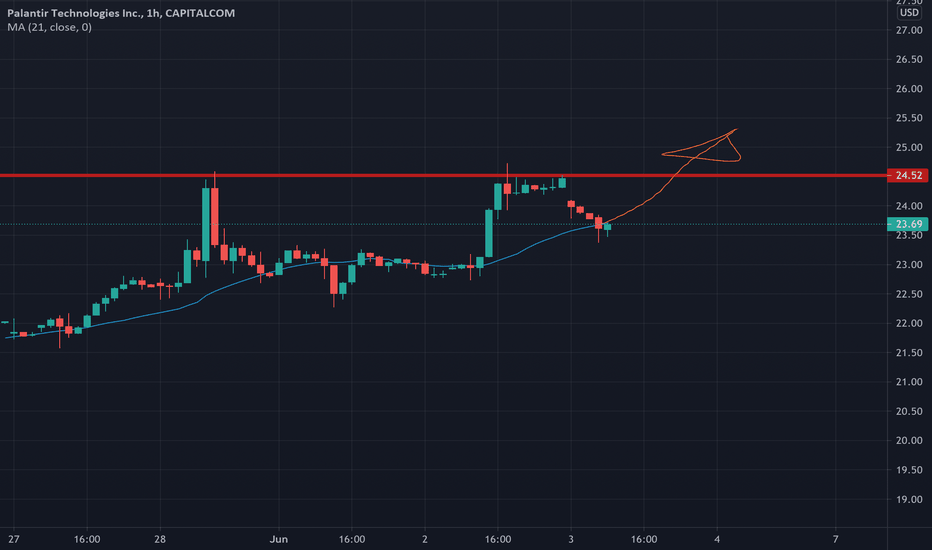

PTX trade ideas

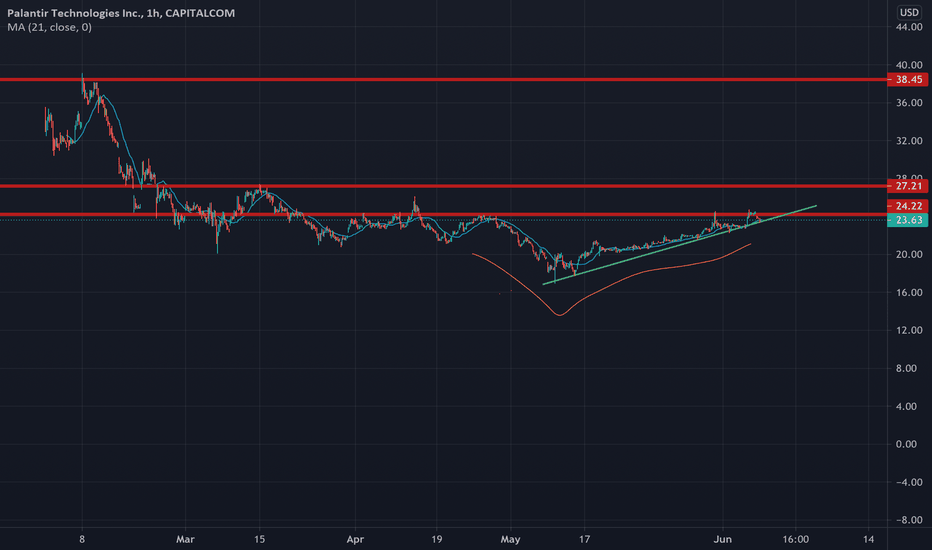

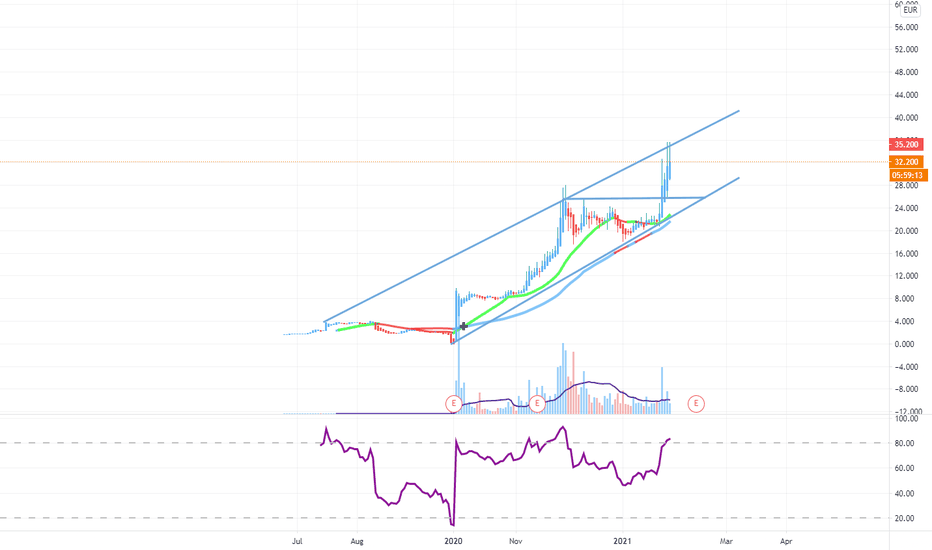

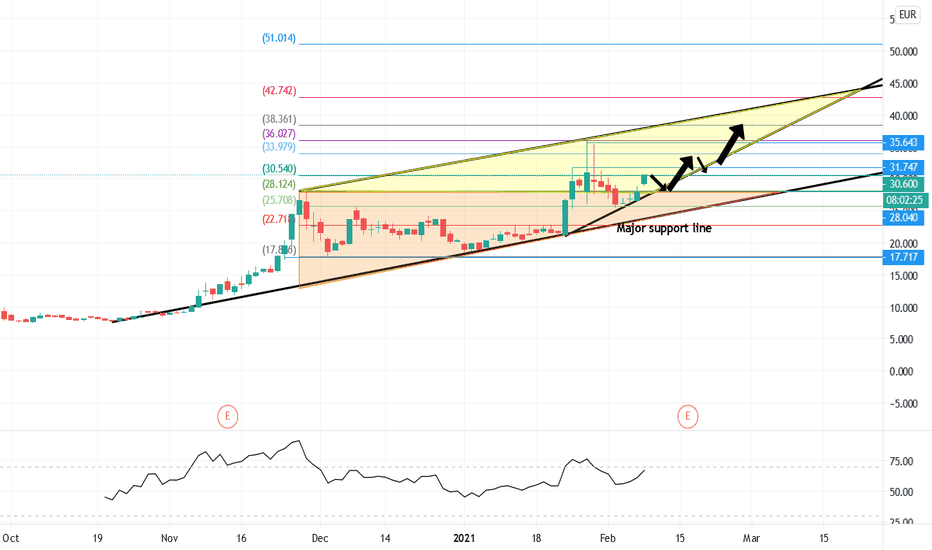

Gotham to the Moon, or will price be grounded by Foundry..?CAPITALCOM:PLTR has been n an uptrend the last 12 months, all though in a somewhat wide channel. For a company like CAPITALCOM:PLTR it is not unusual that there is some volatility in its journey, but the direction has been upwards with a gain of more than 100% in the period. The 50 EMA crossed above the 100 EMA back in February, but more noteworthy, it did not cross back below in June. The stock has since had a steep movement up, with RSI currently at 70 and MACD showing strength. They report earnings on Aug 5, and the last 4 quarters they have been batting a 0.5 average. Point to note is the last Q2 report (which is the quarter to be reported next) was on expectation, as was Q1 this year. Analysts are not over the moon about the stock, but investors are (78% bullish, only 9% bearish according to Yahoo! Finance). This could be a buy the “rumor” not the news, and I feel the stock could push up some more. If not to the Moon, I can see it approaching the upper hand of the channel, around $33-$34. (PS. Sorry for the terrible word play in the heading..).

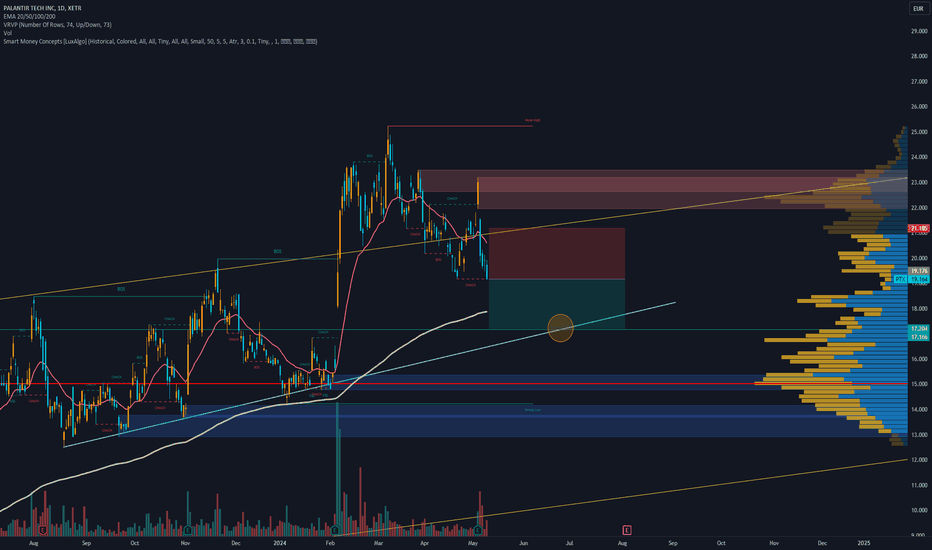

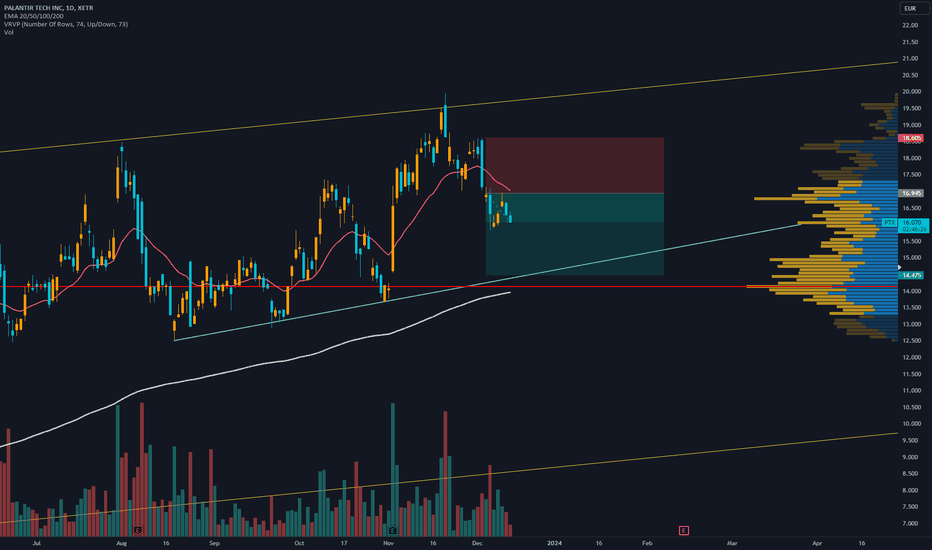

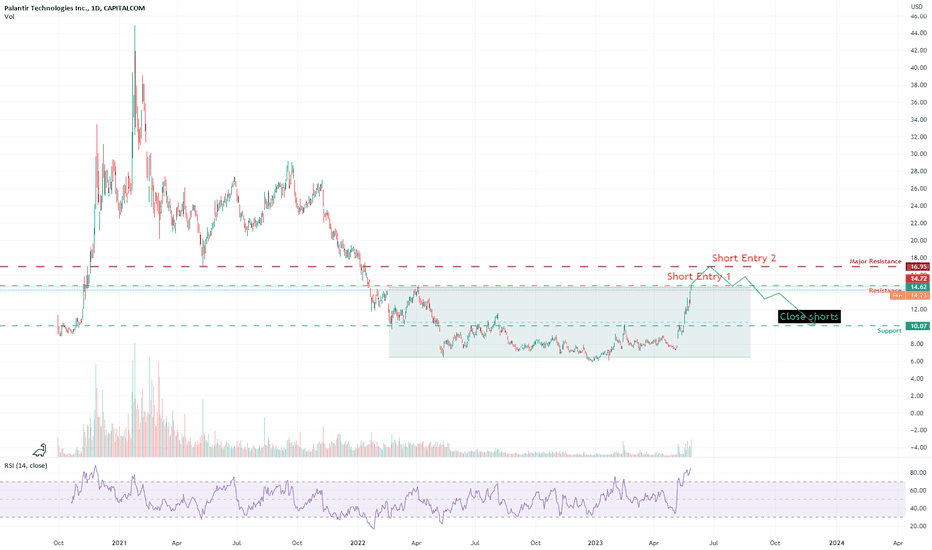

palantir on the downPalantir Technologies is a public American company that specializes in big data analytics. The company’s stock has been volatile in the past, and some investors believe that it is overvalued. Additionally, the company’s listing on the Nasdaq Global Select Market is currently in question due to the exchange’s disapproval of the company’s plan to consolidate the financial results of Canopy USA at one point. If Canopy chooses to continue with its plan and speed up its entry into the U.S. cannabis market, its listing on Nasdaq could be in jeopardy