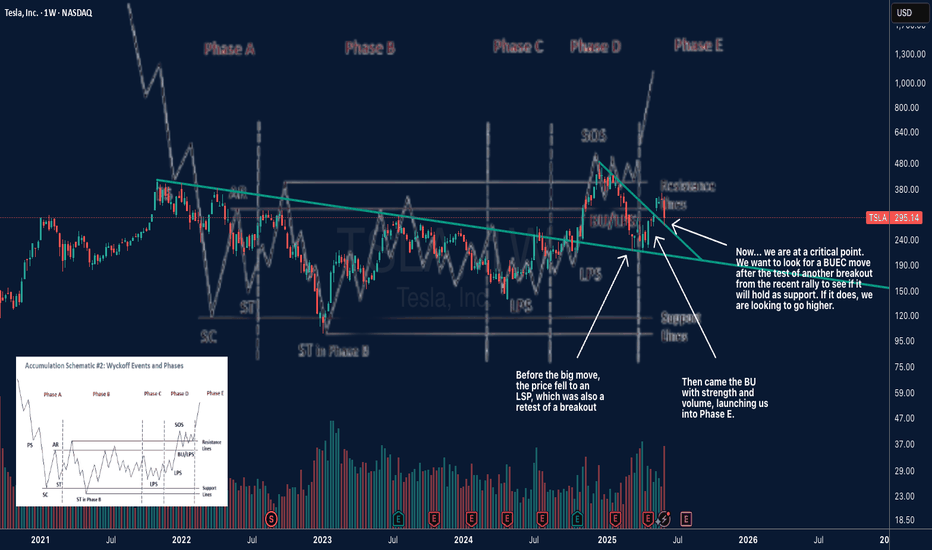

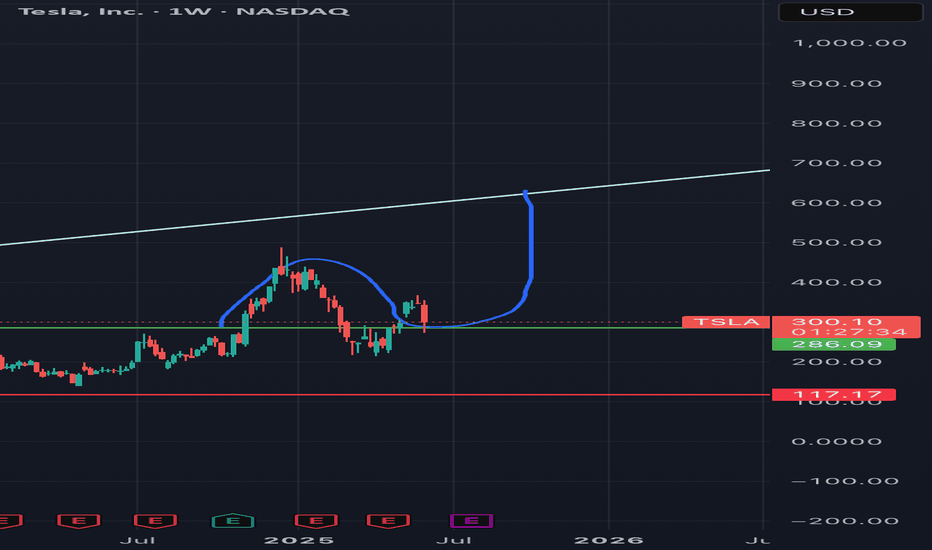

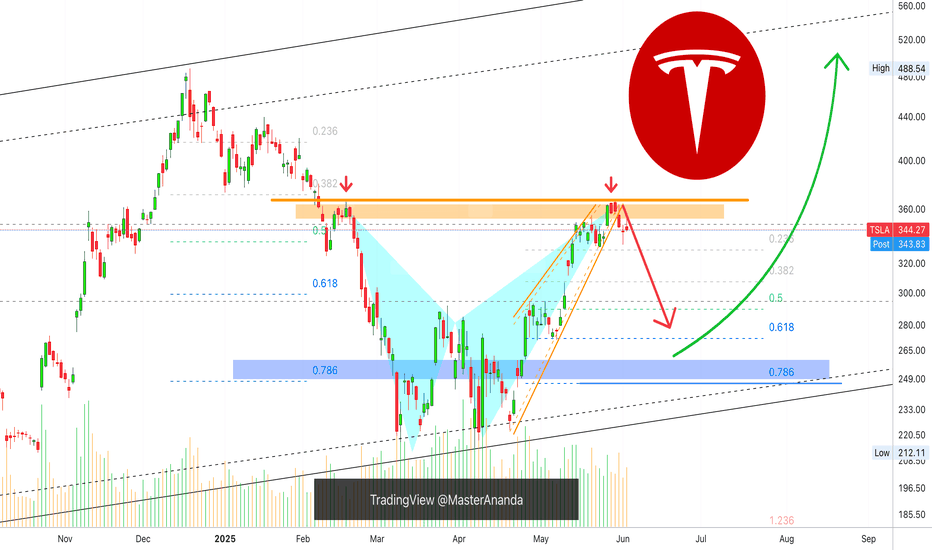

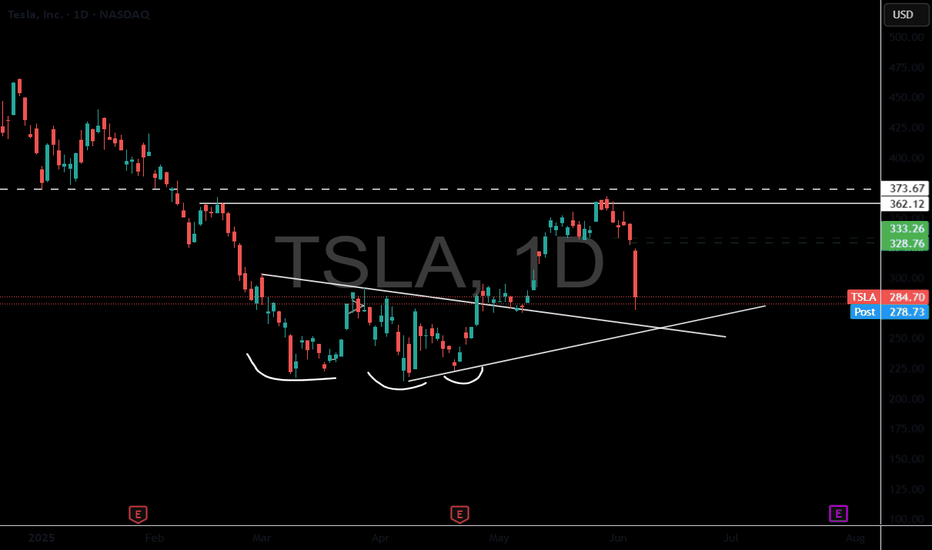

Is Tesla telling a classic story right on its chart?This looks like a textbook example of Richard Wyckoff's "Creek" analogy. For months, the stock faced a "creek" of selling pressure around the $280-$300 resistance line, turning back any attempt to move higher.

Before the big move, the price "backed up" to a Last Point of Support (LPS) to gather steam—that was the dip we saw back in Phase D. Then came the powerful "Jump Across the Creek," a breakout with strength and volume, launching us into what appears to be Phase E.

But the story isn't over. The sharp pullback we're seeing now isn't necessarily failure. It's the critical "Back-Up to the Edge of the Creek." The stock is testing if the old resistance (the far bank of the creek) will now hold as new support.

The question now is: Does the ground hold for the next launch higher, or does the price fall back into the water? This is the moment of truth.

TL0 trade ideas

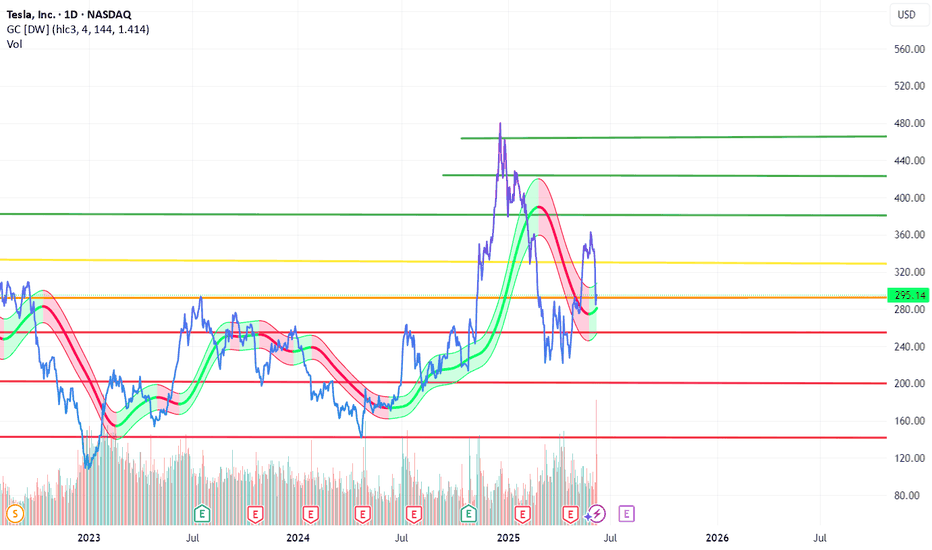

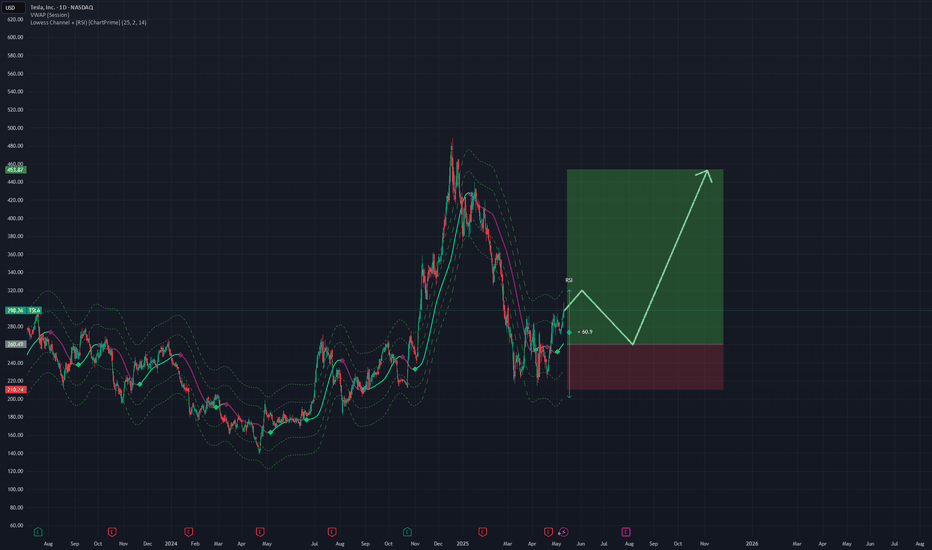

Bullish on TSLA if its stay above 290$ USD**INDICATOR SAY BULL🚀 TESLA (TSLA): The Ultimate Showdown – Bullish Surge or Bearish Collapse? 🚀

Tesla (TSLA) has all eyes locked on it , standing at a crossroads that could dictate its next explosive move. Hovering at $295.14 USD , it’s holding onto the crucial $290 USD support level , a make-or-break zone that could either ignite a spectacular rally or trigger a sharp decline.

🔥 Bulls Are Ready to Take Off: If Tesla defends $290 USD , it’s GAME ON. This level acts as a launchpad—a pressure point where accumulation fuels momentum, setting the stage for a surge toward $460 USD. Investors, traders, and market enthusiasts are all watching for this breakout moment, knowing that breaching higher resistance could spark an avalanche of buy orders. Tesla’s chart suggests a brewing storm of demand, one that could shatter expectations and push the stock into new highs.

⚡ Bears Are Lurking in the Shadows: But danger is never far away. A slip below $290 USD could signal the end of bullish dominance, dragging TSLA into a downward freefall toward $220 USD or even $200 USD . This break would suggest weakening momentum, market hesitation, and potential large-scale selling pressure. Bears will seize the opportunity, forcing Tesla into a recalibration phase—one that could reshape investor sentiment for weeks to come.

🔥 Tesla’s Next Move? A Market-Defining Moment! 🔥

This isn’t just another stock movement—it’s a battle between fear and ambition, bulls and bears, excitement and caution. Tesla is standing on the edge of innovation and volatility, making its current price action one of the most thrilling showdowns in the market today.

Will it skyrocket toward greatness , or will the bears drag it down?

Whatever happens next, one thing is certain— this ride will be unforgettable . Buckle up! 🚀⚡🔥

Let me know if you want even more refinements or additional angles! 😎🔥

Subscribe for more!

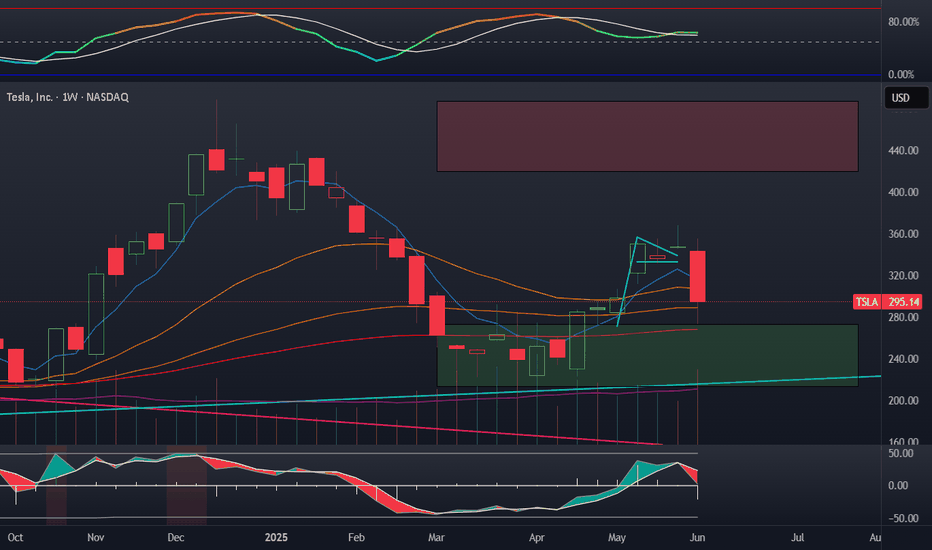

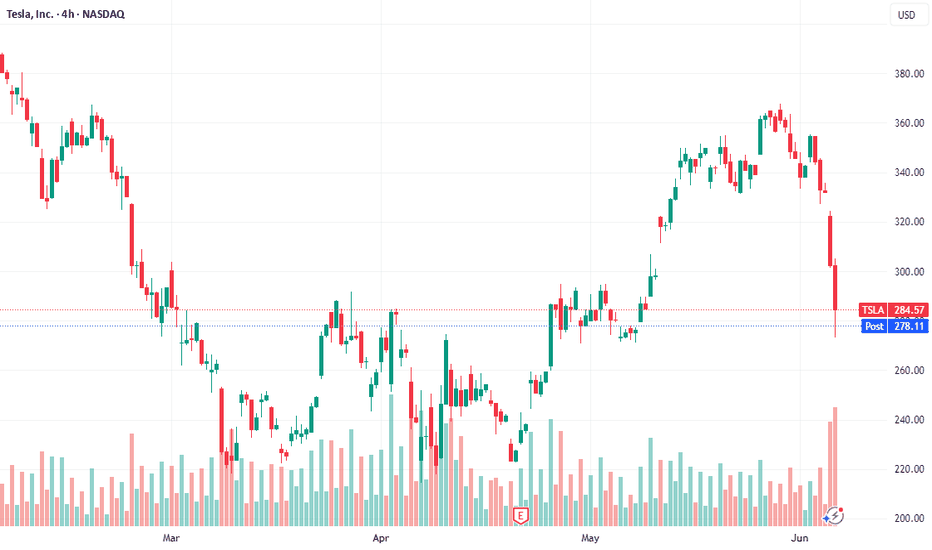

Tesla rejects bull flagTesla rejected the bull flag and immediately dropped back to the weekly demand zone. I am glad I only sold one TSLL put around the base of the flag rejection retest. I have taken this opportunity to buy 1000 shares for a big swing trade here. There was a very strong bounce on my rejection target of 275.

I believe we see 330 again in no time.

My plan: 1000 shares of TSLL

Old 13$ CSP sold

new 9$ CSP solds

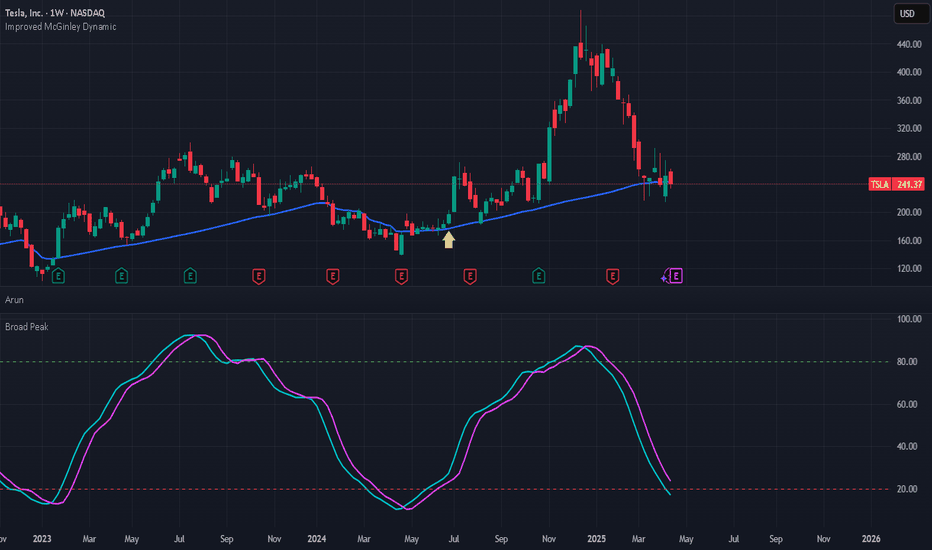

13$ Covered calls sold for next week x10

TSLA at an inflection pointNASDAQ:TSLA weekly chart shown wirh Mcginley indicator (a trend following indicator) and cycle oscillator. Whilst price currently shows a negative bias, I believe price has reached an inflection point as the market seeks direction. Those waiting to buy the dip should wait patiently for entry opportunities upon confirmation of momentum and volume.

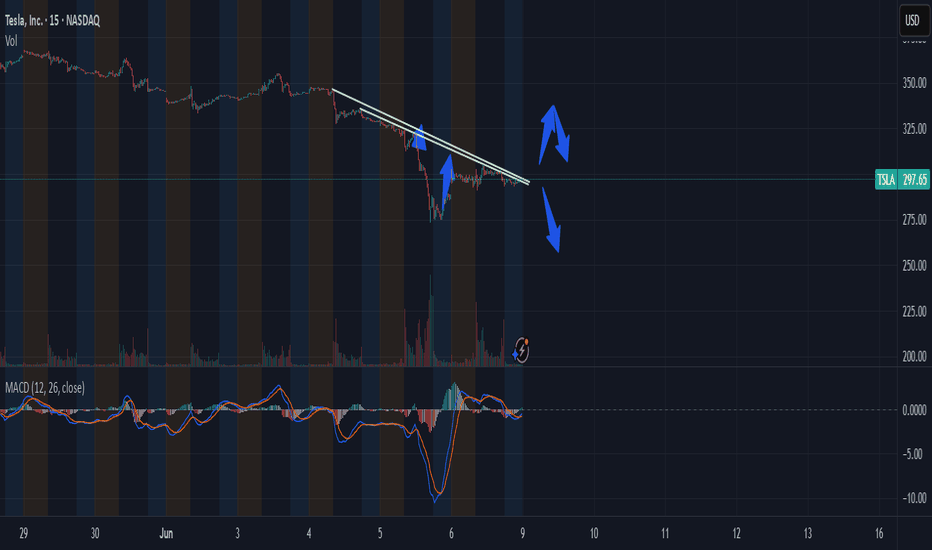

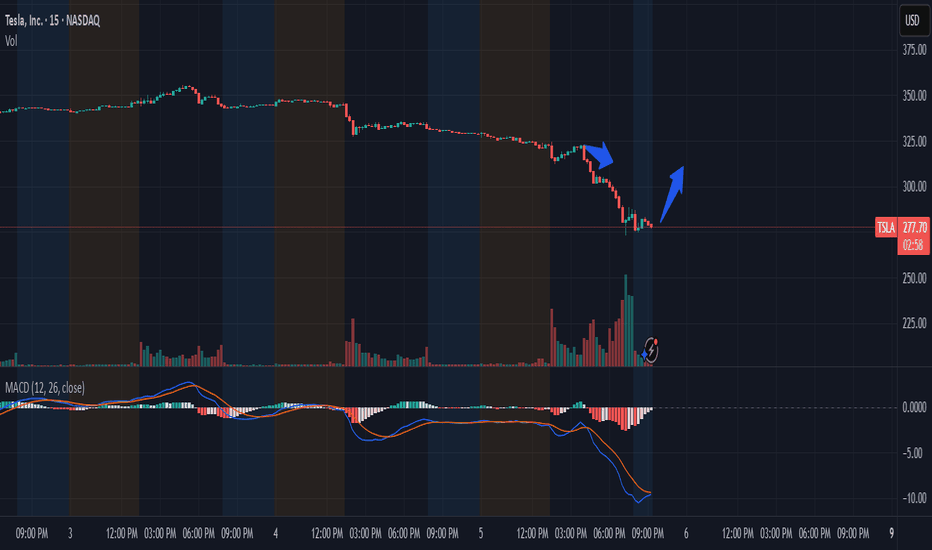

TSLA Oversold Bounce Setup – Targeting $300 Max Pain Zone🚗 TSLA Oversold Bounce Setup – Targeting $300 Max Pain Zone 🔥

📅 Signal Date: June 5, 2025 | ⏳ Duration: 5–10 Day Swing

🎯 Objective: Play oversold bounce into heavy open interest at $300

📊 Multi-Model Insight Summary

Model Bias Strategy Strike Entry Target Stop Confidence

Grok Mod. Bullish Buy Call 290 34.00 40.80 17.00 75%

Claude Mod. Bullish Buy Call 290 34.00 50.00–65.00 20.00 75%

DeepSeek Mod. Bullish Buy Call 300 26.65 32.00 20.00 75%

Gemini Neutral/Stand Aside No Trade — — — — 45%

Llama Mod. Bearish Buy Put 280 3.30 1.65 3.30 75%

🔎 Technical & Sentiment Snapshot

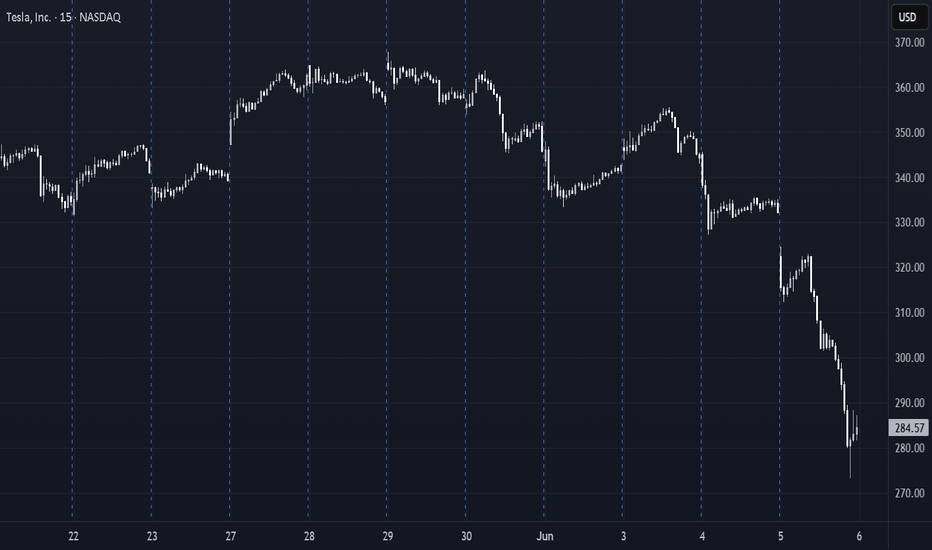

15-Min RSI: Extremely oversold → Mean-reversion potential

Daily/Weekly: Neutral, but nearing key support zones

Price Action: 5-day sharp drop into $280–$285 area

Max Pain: $300 → potential gravitational magnet for bounce

Sentiment: News uncertainty (Musk/Trump noise) but positioning supports upside

IV Rank: Elevated — options rich but supported by move potential

🎯 Trade Setup – Long TSLA Call

Instrument: TSLA

Direction: CALL (LONG)

Strike: $290.00

Expiry: 2025-06-20

Entry Price: $34.00

Profit Target: $40.80 (20% premium gain)

Stop Loss: $17.00 (50% premium loss)

Size: 1 contract

Entry Timing: Market open

Confidence Level: 70%

⚠️ Risk Management Notes

🔻 Premium decay: Watch theta decay closely, especially if no bounce by day 5

🚫 Technical breach: Close trade if $280–$285 breaks on strong volume

💣 Headline risk: Musk-related catalysts or macro shifts can swing direction rapidly

⏳ Time Exit Rule: Consider exiting by June 14 if trade hasn’t reached target

🧠 Trade Rationale

TSLA’s sharp pullback into oversold territory alongside strong call OI at $300 sets the stage for a short-term relief bounce. Multiple models support the call play, with a focus on a 5–10 day recovery swing.

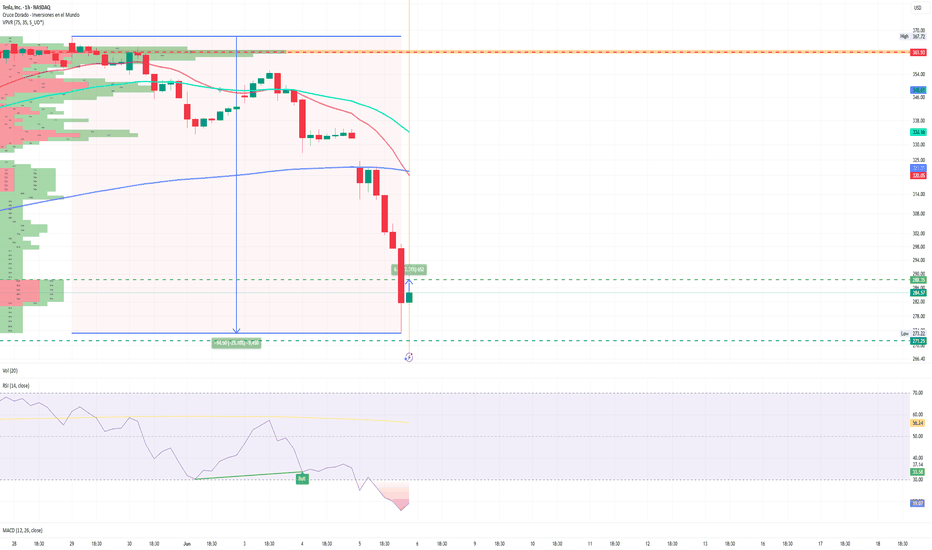

Tesla Recovers After Announcement of Trump–Musk DialogueBy Ion Jauregui – Analyst at ActivTrades

After a session marked by a sharp decline, Tesla shares rebounded strongly in after-hours trading. The catalyst: a *Politico* report revealing that President Donald Trump’s advisors have scheduled a phone call with Elon Musk for today, Friday, in an effort to ease tensions following a public dispute between the two figures. On Thursday, Tesla suffered one of its worst declines of the year, plunging 14.26% and wiping out more than \$150 billion in market value within hours. This brings the quarterly loss to 25.70%. However, news of a potential reconciliation pushed the stock back into positive territory, closing at \$288.35 with a 2.31% recovery, sparking speculative after-hours trading that could extend into the week’s final session.

The clash erupted after Musk criticized a new tax cut bill championed by the White House. Trump promptly responded by threatening to reassess federal contracts awarded to Musk's companies, such as SpaceX. Tensions escalated further when Musk, via social media, hinted at alleged ties between Trump and the late financier Jeffrey Epstein.

According to *Politico*, although Trump has publicly projected an air of indifference, his advisors have been working behind the scenes to de-escalate the feud and avoid broader political and economic fallout. The scheduled call on Friday may mark the beginning of a truce.

It’s worth recalling that during his tenure at the Department of Government Efficiency (DOGE) under Trump’s administration, Elon Musk faced accusations of conflicts of interest, particularly for pushing deregulatory policies that directly benefited Tesla and SpaceX. These actions triggered public protests, the "Tesla Takedown" boycott movement, and investor concerns over Musk's divided attention—ultimately harming Tesla’s reputation and market valuation.

Tesla Under the Microscope: Between Market Rebound and Financial Pressure

The technical rebound has offered investors some relief, but Tesla’s challenges extend beyond the political arena. As of 2025, the stock is down nearly 25% amid shrinking global EV demand, intensified competition, and margin pressure. In its Q1 2025 earnings report, Tesla posted \$21.3 billion in revenue, down 5% year-on-year. Net income also fell to \$1.04 billion, dragged by an aggressive discount strategy and rising operational costs. Gross margin declined to 17.2%, while free cash flow stood at \$620 million. Despite these headwinds, the company maintains a strong financial position, with \$22 billion in cash and \$7.8 billion in total debt. Tesla currently trades at a price-to-earnings ratio of 56, well above the industry average, reflecting high—though increasingly questioned—growth expectations.

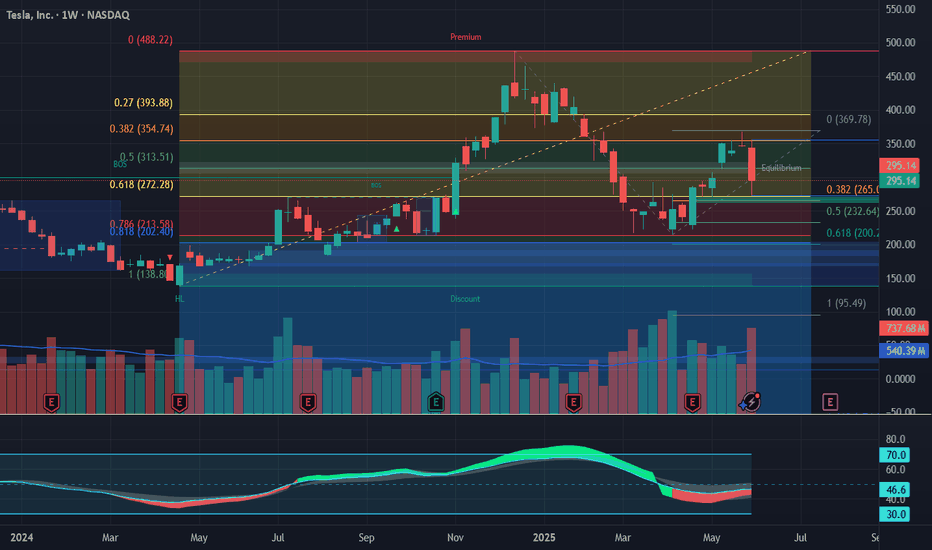

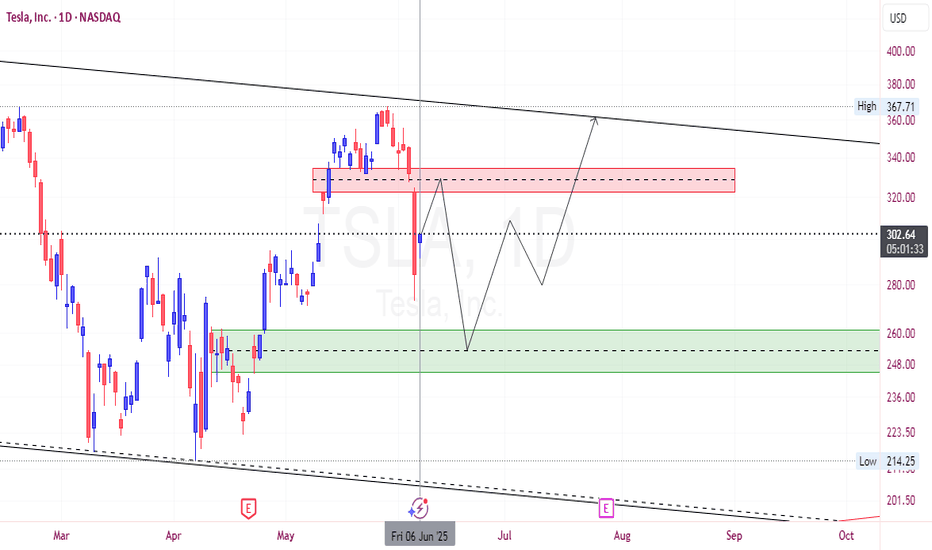

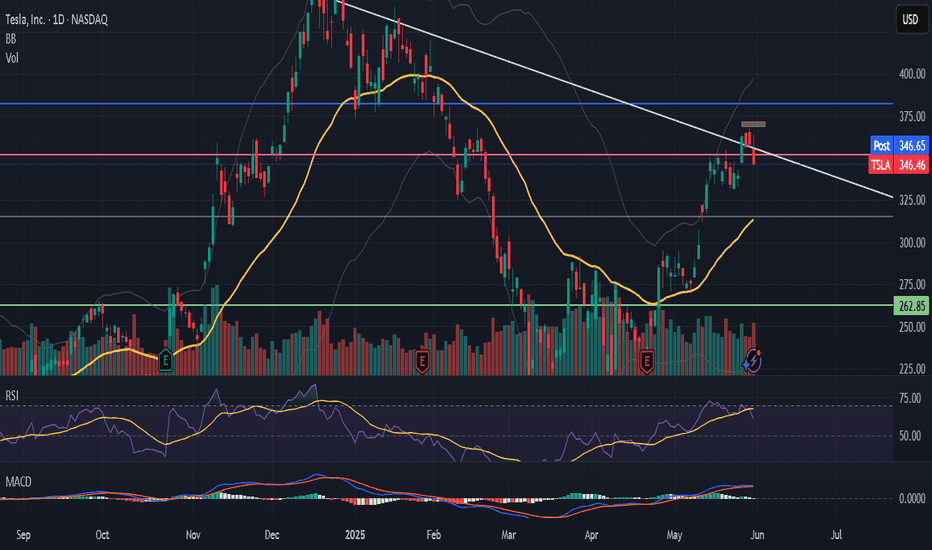

Technical Outlook: Key Support Level in Sight

From a technical perspective, Tesla has found crucial support around the \$271.22 level. This bounce aligns with the beginning of a bearish consolidation cross seen on Wednesday. If the 200-day moving average remains below the 100-day and the 50-day adjusts downward, further bearish momentum could ensue. A break below this level may lead to a decline toward \$250. Conversely, a sustained recovery could push the stock toward the previous control point at \$361.93, though not before consolidating around the \$320 resistance zone. The RSI shows clear signs of extreme overselling at 19%, potentially signaling the door to an upward move.

In the short term, everything hinges on the outcome of today’s Trump–Musk conversation, which markets will be watching very closely.

Conclusion

The clash between Musk and Trump has left visible scars on the market. While a possible rapprochement may open a window for stabilization, Tesla’s financial and technical fundamentals reveal ongoing challenges. Any recovery could prove as volatile as the leadership surrounding it.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

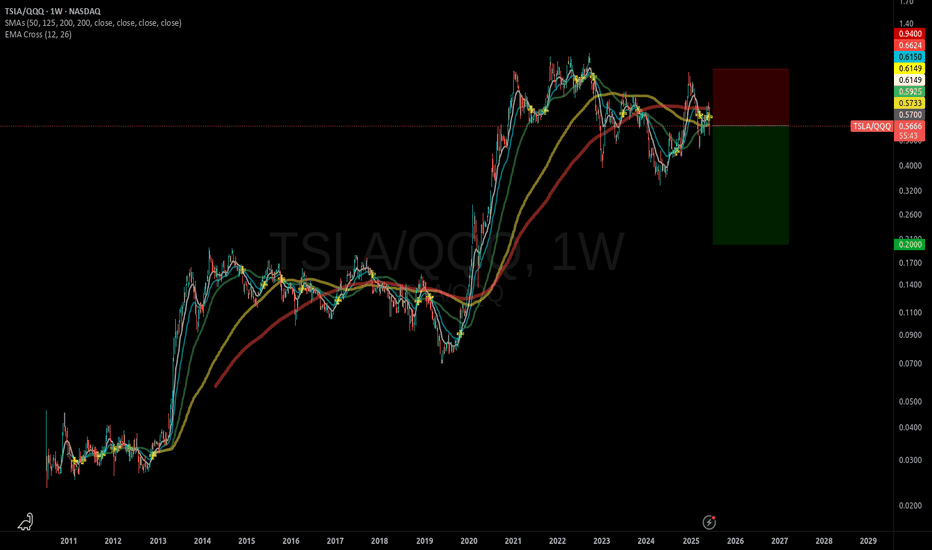

Tesla Still Slightly Bearish Until FED Cuts RatesOne of my followers asked, "how about now?"

The question comes because he is bullish and I am sharing bearish charts.

Here is the thing, the chart is still bearish of course because of the red candles and the double-top. This can't change unless the last high is broken with significant rising volume.

I'll make it easy. This stock is likely to continue bearish until after the Federal Reserve cuts interest rates. When they lower the stuff, they do their magic their numbers then the market will turn bullish. So bearish before, bullish after. And this is a classic dynamic.

The market goes through a retrace or correction preceding a major bullish development. Since the bullish development will definitely push prices up, the market must express its bearish tendencies before the event shows up.

So bearish now. When the Fed announces that they are reducing interest rates later this month, then 100% bullish I agree of course.

Thanks a lot for your continued support.

This same analysis applies to Bitcoin and all related markets.

The altcoins though are a different thing because these are smaller and already trading at bottom prices. They will recover sooner and will start moving ahead of the pack revealing what is coming to the bigger ones.

All is good.

Thank you for reading.

Namaste.

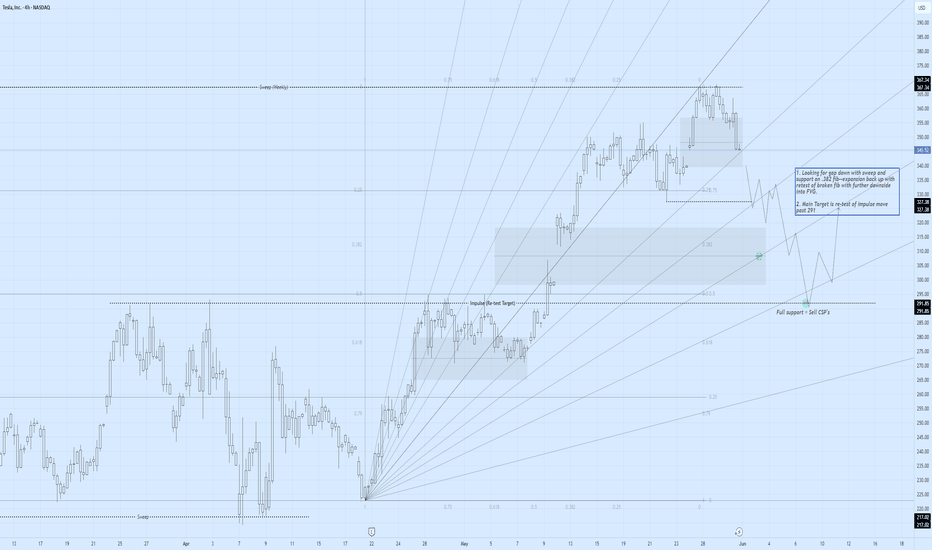

TSLA Descent 4-hr OutlookTSLA Descent!

1. Looking for gap down with sweep and support on .382 fib--expansion back up with retest of broken fib with further downside into FVG.

2. Main Target is re-test of impulse move (291 level).

-- take into consideration TSLA moves 29 points weekly (avg).

3. Full support = selling CSP's 14+ days out.

Tesla's Perfect Storm: A $152 Billion MeltdownTesla's Perfect Storm: A $152 Billion Meltdown, Chinese Rivals on the Attack, and a Faltering Shanghai Fortress

A tempest has engulfed Tesla, the electric vehicle behemoth, wiping a staggering $152 billion from its market capitalization in a single day. This monumental loss, the largest in the company's history, was triggered by a dramatic and public feud between CEO Elon Musk and former U.S. President Donald Trump. The confrontation, however, is but the most visible squall in a much larger storm. Lurking just beneath the surface are the relentless waves of competition from Chinese automakers, who are rapidly eroding Tesla's dominance, and the ominous sign of eight consecutive months of declining shipments from its once-impenetrable Shanghai Gigafactory.

The confluence of these events has plunged Tesla into a precarious position, raising fundamental questions about its future trajectory and its ability to navigate the turbulent waters of a rapidly evolving automotive landscape. The narrative of Tesla as an unstoppable force is being rewritten in real-time, replaced by a more complex and challenging reality.

The Trump-Musk Spat: A Bromance Turned Billion-Dollar Blow-Up

The relationship between Elon Musk and Donald Trump, once a seemingly symbiotic alliance of power and influence, has spectacularly imploded, leaving a trail of financial and political wreckage in its wake. The public falling out, which played out in a series of scathing social media posts and public statements, sent shockwaves through Wall Street and Washington, culminating in a historic sell-off of Tesla stock.

The genesis of the feud lies in Musk's vocal criticism of a sweeping tax and spending bill, a cornerstone of the Trump administration's second-term agenda. Musk, who had previously been a vocal supporter and even an advisor to the President, lambasted the legislation as a "disgusting abomination" filled with "pork." This public rebuke from a figure of Musk's stature was a direct challenge to Trump's authority and legislative priorities.

The President's response was swift and sharp. In an Oval Office meeting, Trump expressed his "disappointment" in Musk, questioning the future of their "great relationship." The war of words then escalated dramatically on their respective social media platforms. Trump, on his social media platform, threatened to terminate Tesla's lucrative government subsidies and contracts, a move that would have significant financial implications for Musk's business empire. He also claimed to have asked Musk to leave his advisory role, a statement Musk labeled as an "obvious lie."

Musk, in turn, did not hold back. On X (formerly Twitter), he claimed that without his substantial financial support in the 2024 election, Trump would have lost the presidency. This assertion of his political influence was a direct jab at the President's ego and a stark reminder of the financial power Musk wields. The spat took an even more personal and inflammatory turn when Musk alluded to Trump's name appearing in the unreleased records of the Jeffrey Epstein investigation.

The market's reaction to this public spectacle was brutal. Tesla's stock plummeted by over 14% in a single day, erasing more than $152 billion in market capitalization and pushing the company's valuation below the coveted $1 trillion mark. The sell-off was a clear indication of investor anxiety over the political instability and the potential for tangible financial repercussions from the feud. The incident underscored how intertwined Musk's personal and political activities have become with Tesla's financial performance, a vulnerability that has been a recurring theme for the company.

The Chinese Dragon Breathes Fire: Tesla's EV Dominance Under Siege

While the political drama in Washington captured headlines, a more fundamental and perhaps more enduring threat to Tesla's long-term prosperity is brewing in the East. The Chinese electric vehicle market, once a key engine of Tesla's growth, has become a fiercely competitive battleground where a host of domestic rivals are not just challenging Tesla, but in some aspects, surpassing it.

Companies like BYD, Nio, XPeng, and now even the tech giant Xiaomi, are relentlessly innovating and offering a diverse range of electric vehicles that are often more affordable and technologically advanced than Tesla's offerings. This intense competition has led to a significant erosion of Tesla's market share in China. From a dominant position just a few years ago, Tesla's share of the battery electric vehicle market has fallen significantly.

One of the key advantages for Chinese automakers is their control over the entire EV supply chain, particularly in battery production. This allows them to produce vehicles at a lower cost, a crucial factor in a price-sensitive market. The result is a growing disparity in pricing, with many Chinese EVs offering comparable or even superior features at a fraction of the cost of a Tesla.

Furthermore, Chinese consumers are increasingly viewing electric vehicles as "rolling smartphones," prioritizing advanced digital features, connectivity, and a sophisticated user experience. In this regard, many domestic brands are seen as more innovative and in tune with local preferences than Tesla. This shift in consumer sentiment has been a significant factor in the declining interest in the Tesla brand in China.

The numbers paint a stark picture of Tesla's predicament. While the overall new-energy vehicle market in China continues to grow at a remarkable pace, Tesla's sales have been on a downward trend. This is a worrying sign for a company that has invested heavily in its Chinese operations and has historically relied on the country for a substantial portion of its global sales.

The pressure on Tesla's sales in China is so intense that its sales staff are working grueling 13-hour shifts, seven days a week, in a desperate attempt to meet demanding sales targets. The high-pressure environment has reportedly led to high turnover rates among sales staff, a clear indication of the immense strain the company is under in this critical market.

The Shanghai Gigafactory: A Fortress with a Faltering Gate

The struggles in the Chinese market are reflected in the declining output from Tesla's Shanghai Gigafactory. For eight consecutive months, shipments from the factory, which serves both the domestic Chinese market and is a key export hub, have seen a year-on-year decline. In May 2025, the factory delivered 61,662 vehicles, a 15% drop compared to the same period the previous year.

This sustained decline in shipments is a significant red flag for several reasons. Firstly, the Shanghai factory is Tesla's largest and most efficient production facility, accounting for a substantial portion of its global output. A slowdown in production at this key facility has a direct impact on the company's overall delivery numbers and financial performance.

Secondly, the declining shipments are a direct consequence of the weakening demand for Tesla's vehicles in China. Despite being a production powerhouse, the factory's output is ultimately dictated by the number of cars it can sell. The falling shipment numbers are a clear indication that the company is struggling to maintain its sales momentum in the face of fierce competition.

The situation in China is a microcosm of the broader challenges facing Tesla. The company's product lineup, which has not seen a major new addition in the affordable segment for some time, is starting to look dated compared to the rapid product cycles of its Chinese competitors. The refreshed Model 3 and Model Y, while still popular, are no longer the novelties they once were, and are facing a growing number of compelling alternatives.

A Confluence of Crises: What Lies Ahead for Tesla?

The convergence of a high-profile political feud, intensifying competition, and production headwinds has created a perfect storm for Tesla. The company that once seemed invincible is now facing a multi-front battle for its future.

The spat with Trump, while seemingly a short-term crisis, has exposed the risks associated with a CEO whose public persona is so closely tied to the company's brand. The incident has also highlighted the potential for political winds to shift, and for government policies that have benefited Tesla in the past to be reversed.

The challenge from Chinese automakers is a more fundamental and long-term threat. The rise of these nimble and innovative competitors is not a fleeting trend, but a structural shift in the global automotive industry. Tesla can no longer rely on its brand cachet and technological lead to maintain its dominance. It must now compete on price, features, and innovation in a market that is becoming increasingly crowded and sophisticated.

The declining shipments from the Shanghai factory are a tangible manifestation of these challenges. The factory, once a symbol of Tesla's global manufacturing prowess, is now a barometer of its struggles in its most important market.

To navigate this storm, Tesla will need to demonstrate a level of agility and adaptability that it has not been required to show in the past. This will likely involve a renewed focus on product development, particularly in the affordable EV segment, to better compete with the value propositions offered by its Chinese rivals. It will also require a more nuanced and strategic approach to the Chinese market, one that acknowledges the unique preferences and demands of Chinese consumers.

The coming months will be a critical test for Tesla and its leadership. The company's ability to weather this storm and emerge stronger will depend on its capacity to innovate, to compete, and to navigate the complex and often unpredictable currents of the global automotive market. The era of unchallenged dominance is over. The battle for the future of electric mobility has truly begun.

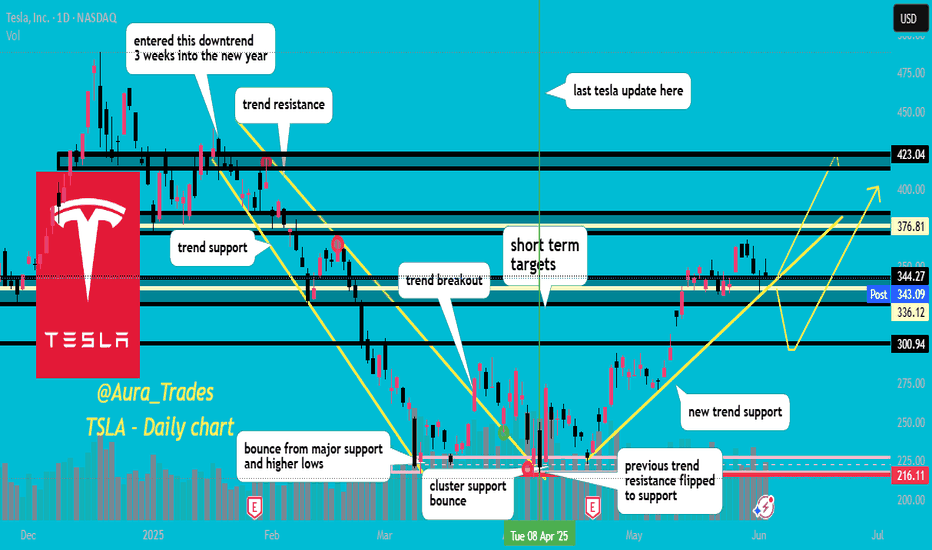

congrats to tesla longs! boost and follow for more ❤️🔥 in my last tesla update in early april I mentioned the break of trend resistance, and how that resistance acted as support.. how this meant the bottom was likely in. lots of people doubted this, but here we are a few months later at my short term targets 🎯

now we are sitting at a important trend support that has held since april, a break below can send us to 290-300 before the next push higher.. if we hold here and start to rally it might go straight to my next target around 430..

whether it breaks or holds, I think 430 will get hit soon enough.. I am wearing a tesla shirt as a write this analysis hehe.. 🤣 I will see you soon with more updates, I am done for today! felt good to post some stuff after being gone for over a month.

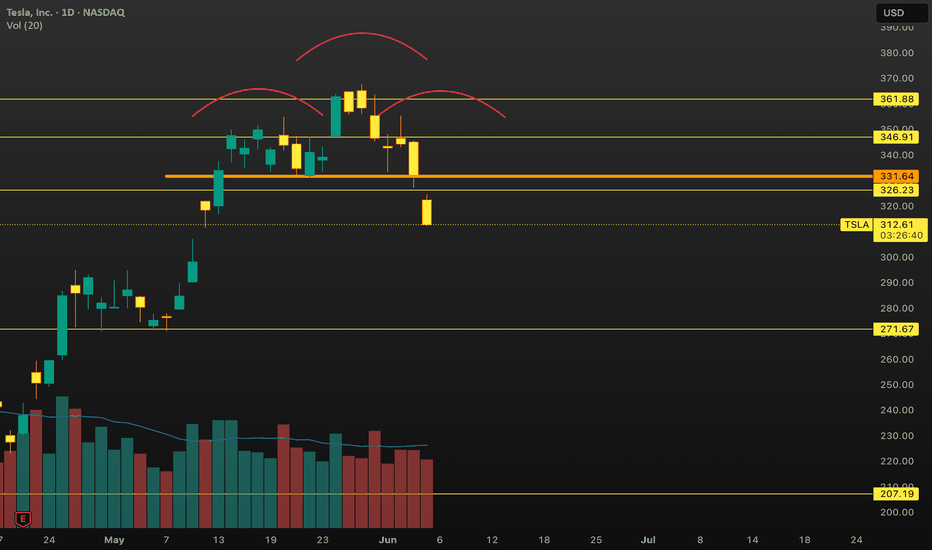

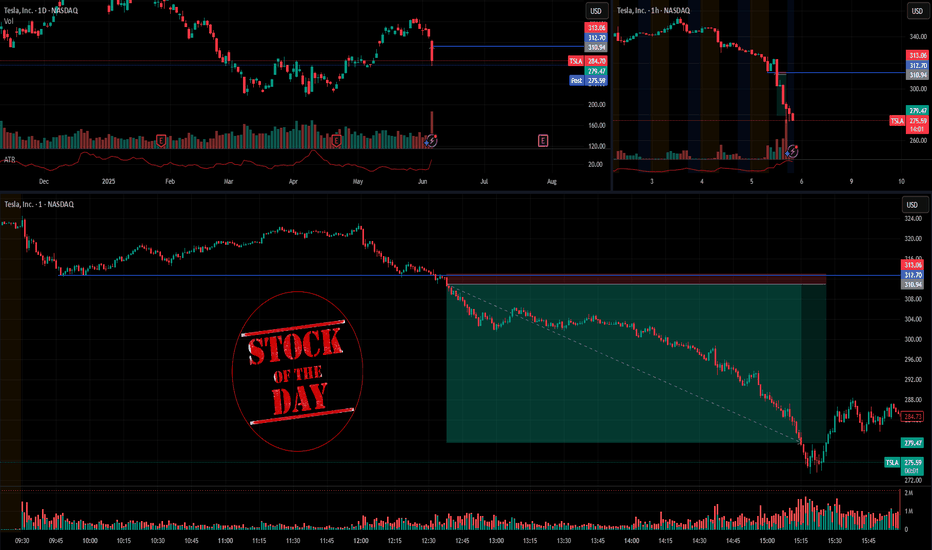

Stock Of The Day / 06.06.25 / TSLA06.06.2025 / NASDAQ:TSLA

Fundamentals. Negative background due to the conflict between Musk and Trump.

Technical analysis.

Daily chart: Pullback on an uptrend

Premarket: Gap Down on increased volume.

Trading session: The primary impulse from the opening of the session was stopped at 312.70, after which a smooth, long pullback followed. At 12:00 p.m., volumes appeared and the price sharply returned and tested the level of 312.70, and the next pullback was significantly smaller than the previous one. We are considering a short trade to continue the downward movement in case of breakdown and holding the price below the level.

Trading scenario: #breakdown with retest of level 312.70

Entry: 310.94 after the breakout, retest and holding below the level.

Stop: 313.06 we hide it above the tail of the retest.

Exit: Cover the position at 279.47 when the structure of the downward trend is broken amid price acceleration and volume growth.

Risk Rewards: 1/14

P.S. In order to understand the idea of the Stock Of The Day analysis, please read the following information .

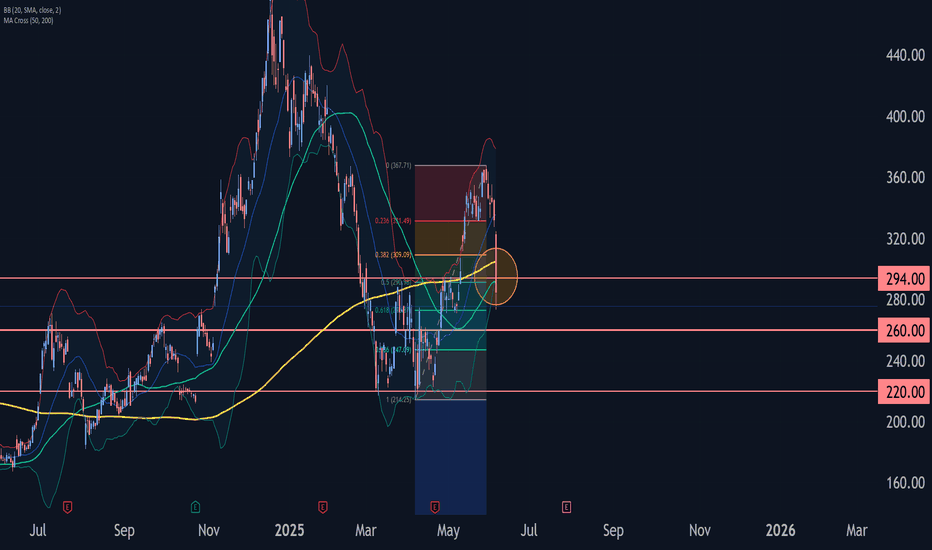

Tesla Wave Analysis – 5 June 2025

- Tesla broke the support zone

- Likely to fall to support level 260.00

Tesla recently broke the support zone located between the support level 294.00 (former resistance from April and March) and the 50% Fibonacci correction of the upward impulse from April.

The breakout of this support zone accelerated the active minor ABC correction 2 from the end of May.

Tesla can be expected to fall to the next support level 260.00, which is the former resistance from the start of April.

TESLA: Patience Is KeyAdmittedly: The news surrounding Tesla is not particularly exciting at the moment. Nevertheless, it is unlikely that the share price of the e-mobility pioneer will plummet. Rather, it is now important to wait for an ideal entry point.

The share has currently recovered significantly from its recent lows and a long entry would offer a suboptimal RRR. Instead, we assume that the price will move sideways to negative in the coming weeks and months, in line with the rather bearish annual seasonality, which usually lasts until September or October. The entry point shown at around USD 260 would then provide an ideal RRR for a long trade that would take us to the ATH area and possibly beyond.

Elon Musk vs Trump: Who you betting on?Elon Musk and Donald Trump have recently had a public falling-out, with their feud playing out on social media and in political circles.

The dispute seems to have started over Trump's new budget bill, which Musk has criticized for increasing the national debt. Trump, in turn, accused Musk of being upset because the bill removes electric vehicle subsidies that benefit Tesla.

The tension escalated when Trump suggested that Musk had known about the bill beforehand and had no issue with it until after leaving his government role. Musk denied this, claiming he was never shown the bill and that it was passed too quickly for proper review. Trump then took things further by threatening to cut Musk’s government contracts and subsidies, which amount to billions of dollars. Musk responded defiantly on social media, calling Trump "ungrateful" and claiming that without his financial support, Trump would have lost the election.

TSLA violated key levels and will be looking for a sharp technical bounce off the $260-$257 zone

Everything we know about the Trump - Musk divorce (so far)

Elon Musk publicly criticised Trump’s “One Big Beautiful Bill” as a “disgusting abomination” that would explode the U.S. deficit and “bankrupt America.” The bill is projected to add $2.5 trillion to the U.S. deficit over 10 years.

Musk claimed Trump wouldn’t have won the 2024 election without his support, calling the backlash “such ingratitude.”

Musk then alleged on X that Trump appears in the Epstein files. This marks a serious escalation (but we all thought this before Musk confirmed it right?)

Trump followed up on Truth Social by calling Musk “crazy” and hinting at cancelling federal contracts with his companies. Trump wrote that cancelling subsidies for Musk’s companies “could save billions,”.

Tesla has wiped out ~$100 billion in market value. Tesla now politically exposed?

Musk floated the idea of creating a new centrist political party, criticising both Democrats and MAGA Republicans. “We need a party that actually represents the interests of the people. Not lobbyists. Not legacy donors. Not extremists.”

TSLA cooling offI know Tesla lovers hate to see a short post on the stock. Okay... it's cooling off... lol.

*another news report states he's leaving gov't; trump holding on tight... we shall see

*alleged new growth story incoming... check news and see what you see

*TA (technical analysis) look like a pullback in order... 330-325

Do you see what I see? Or you are feeling like it's a straight moon shot?

Have a great weekend.