Wester Union Stock Qoute | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

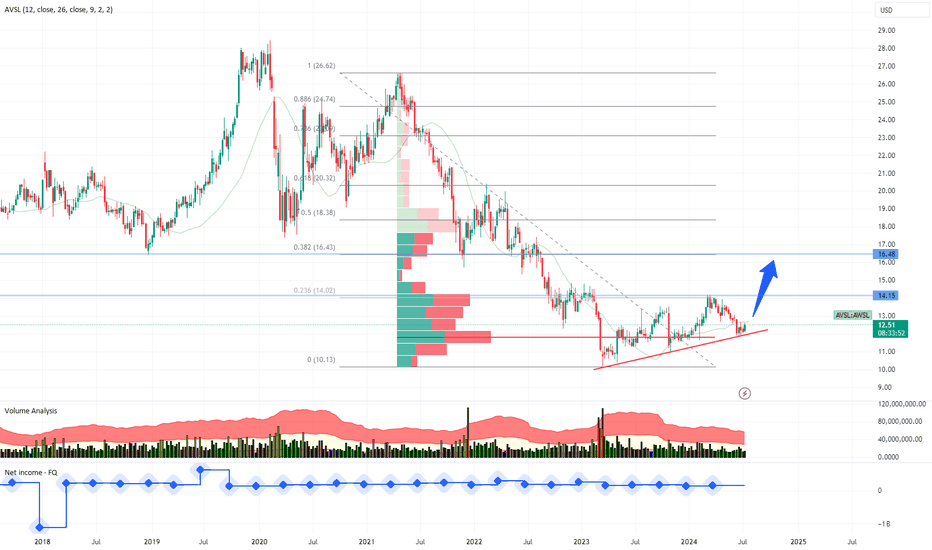

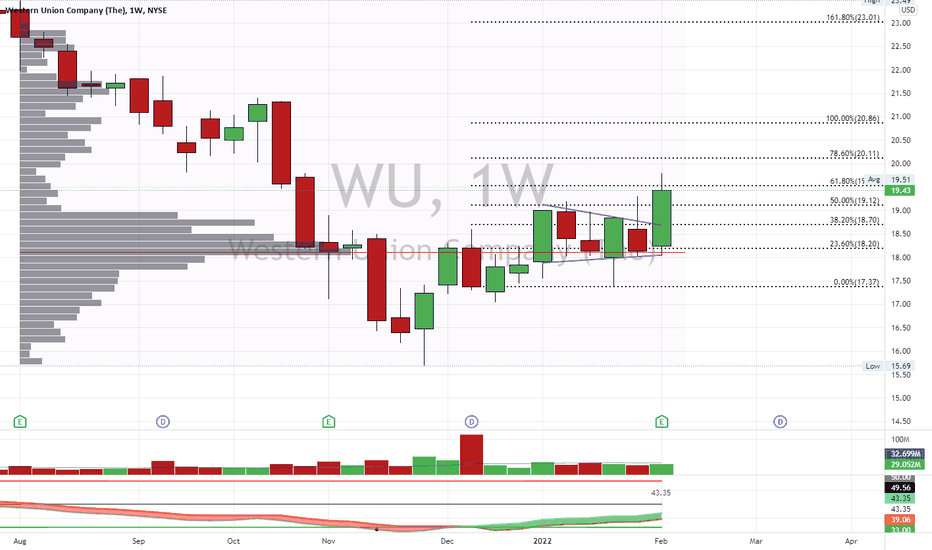

# Wester Union

- Double Formation

* A+ Set Up At 13.00 USD

* 012345 | Wave (1) & (2) | Downtrend Principle | Subdivision 1

- Triple Formation

* Neckline At 11.25 USD

* Flag structure |

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.258 EUR

902.42 M EUR

4.06 B EUR

320.32 M

About Western Union Company (The)

Sector

Industry

CEO

Devin B. McGranahan

Website

Headquarters

Denver

Founded

1851

ISIN

US9598021098

FIGI

BBG000BB4WR8

The Western Union Co. is a holding company, which engages in the provision of money transfer and payment services. It operates through the following segments: Consumer Money Transfer, Business Solutions, and Consumer Services. The Consumer Money Transfer segment facilitates money transfers, which are primarily sent from retail agent locations worldwide or through websites and mobile devices. The Business Solutions segment focuses on the payment and foreign exchange solutions, primarily cross-border, cross-currency transactions, for small and medium size enterprises and other organizations and individuals. The Consumer Services segment includes the company’s bill payment services which facilitate payments for consumers, businesses, and other organizations, as well as the company’s money order services, retail foreign exchange services, prepaid cards, lending partnerships, and digital wallets. The company was founded in 1851 and is headquartered in Denver, CO.

Related stocks

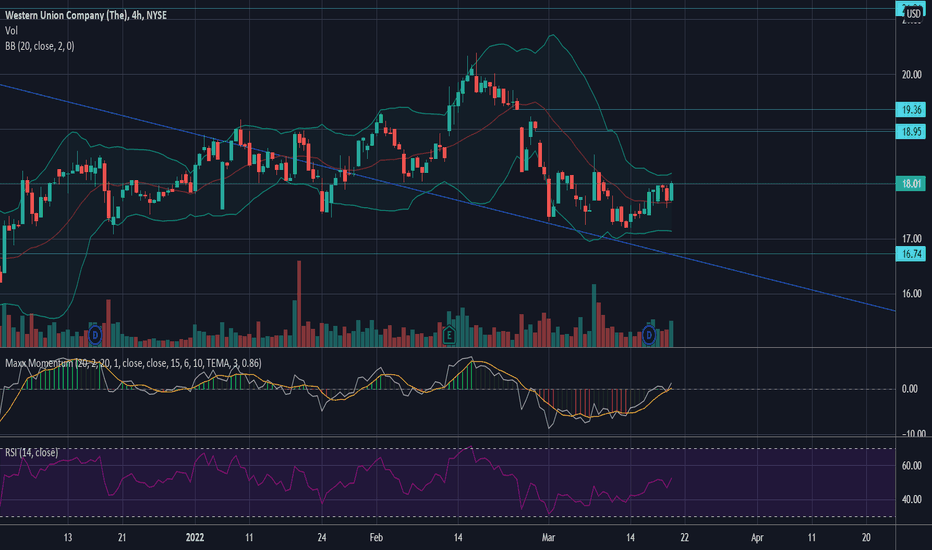

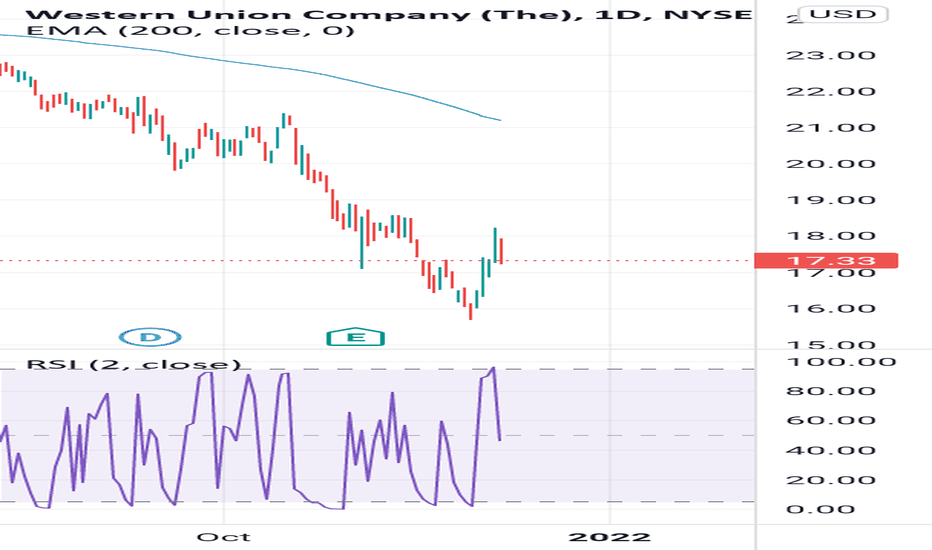

This Stock is Down But Its Up By +0.08%Short selling is a different style of trading

and doing it gives you a different mindset

--

As you watch online gurus most of them

will be short sellers

--

Because when you start trading your view

will be most likely of that of a short seller

--

This stock is up but when you pull back

to a weekly c

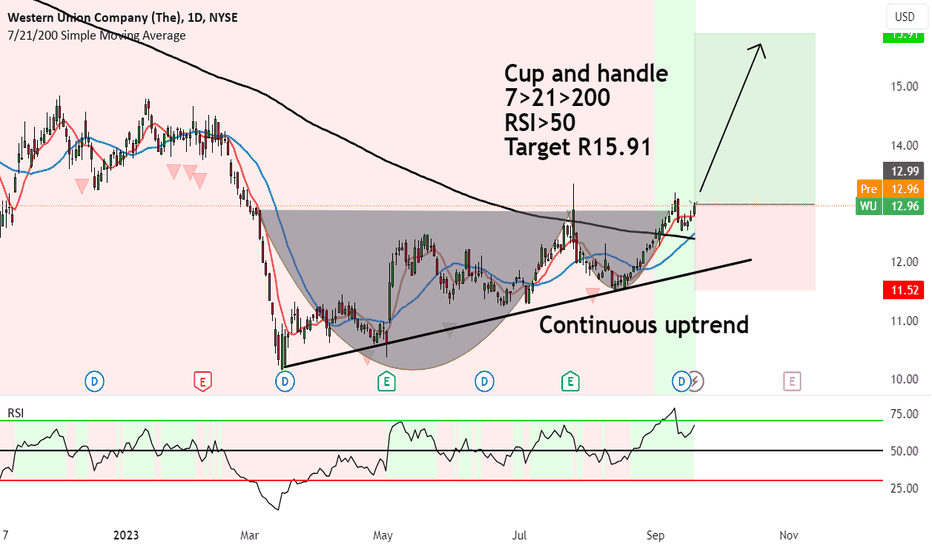

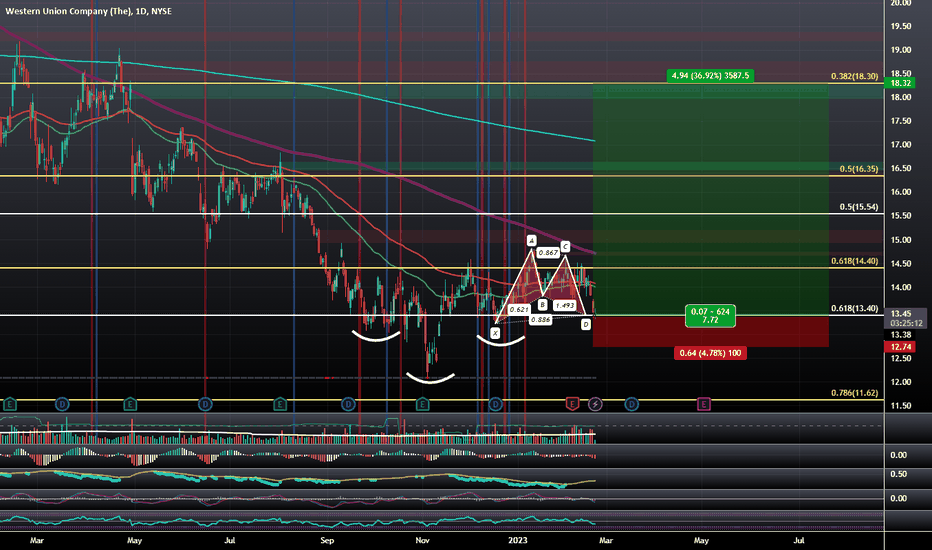

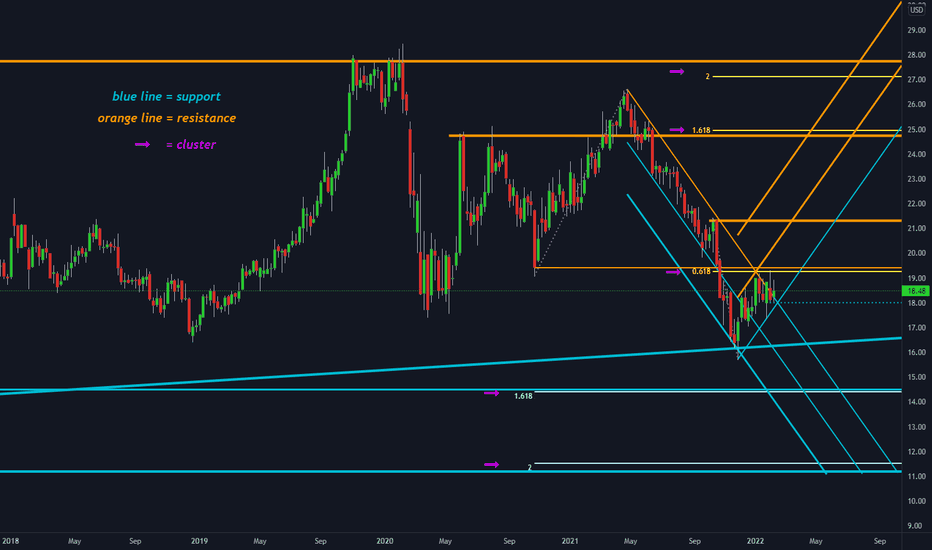

WESTERN UNION Stock Chart Fibonacci Analysis 071123 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 12/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

WU5138272

Western Union Company 1.35% 15-MAR-2026Yield to maturity

—

Maturity date

Mar 15, 2026

WU.GK

Western Union Company 6.2% 21-JUN-2040Yield to maturity

—

Maturity date

Jun 21, 2040

US959802AH2

Western Union Company 6.2% 17-NOV-2036Yield to maturity

—

Maturity date

Nov 17, 2036

US959802BA6

Western Union Company 2.75% 15-MAR-2031Yield to maturity

—

Maturity date

Mar 15, 2031

See all W3U bonds

Curated watchlists where W3U is featured.

Frequently Asked Questions

The current price of W3U is 7.340 EUR — it has decreased by −1.47% in the past 24 hours. Watch Western Union Company stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Western Union Company stocks are traded under the ticker W3U.

W3U stock has fallen by −1.11% compared to the previous week, the month change is a 5.80% rise, over the last year Western Union Company has showed a −32.60% decrease.

We've gathered analysts' opinions on Western Union Company future price: according to them, W3U price has a max estimate of 8.57 EUR and a min estimate of 6.00 EUR. Watch W3U chart and read a more detailed Western Union Company stock forecast: see what analysts think of Western Union Company and suggest that you do with its stocks.

W3U stock is 2.08% volatile and has beta coefficient of 0.27. Track Western Union Company stock price on the chart and check out the list of the most volatile stocks — is Western Union Company there?

Today Western Union Company has the market capitalization of 2.38 B, it has increased by 0.49% over the last week.

Yes, you can track Western Union Company financials in yearly and quarterly reports right on TradingView.

Western Union Company is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

W3U earnings for the last quarter are 0.36 EUR per share, whereas the estimation was 0.37 EUR resulting in a −4.33% surprise. The estimated earnings for the next quarter are 0.37 EUR per share. See more details about Western Union Company earnings.

Western Union Company revenue for the last quarter amounts to 871.06 M EUR, despite the estimated figure of 883.45 M EUR. In the next quarter, revenue is expected to reach 875.47 M EUR.

W3U net income for the last quarter is 103.65 M EUR, while the quarter before that showed 114.16 M EUR of net income which accounts for −9.20% change. Track more Western Union Company financial stats to get the full picture.

Yes, W3U dividends are paid quarterly. The last dividend per share was 0.20 EUR. As of today, Dividend Yield (TTM)% is 10.88%. Tracking Western Union Company dividends might help you take more informed decisions.

Western Union Company dividend yield was 8.87% in 2024, and payout ratio reached 34.32%. The year before the numbers were 7.89% and 55.83% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 10, 2025, the company has 9.1 K employees. See our rating of the largest employees — is Western Union Company on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Western Union Company EBITDA is 748.48 M EUR, and current EBITDA margin is 21.53%. See more stats in Western Union Company financial statements.

Like other stocks, W3U shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Western Union Company stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Western Union Company technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Western Union Company stock shows the sell signal. See more of Western Union Company technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.