NASDAQ 100 Index (NDX) forum

If your trading strategy revolves around Trump and his nonsense, then you are as volatile as lower timeframes on the NAS100...

You will be forever chasing price instead of waiting for structure to be complete and executing your next move.

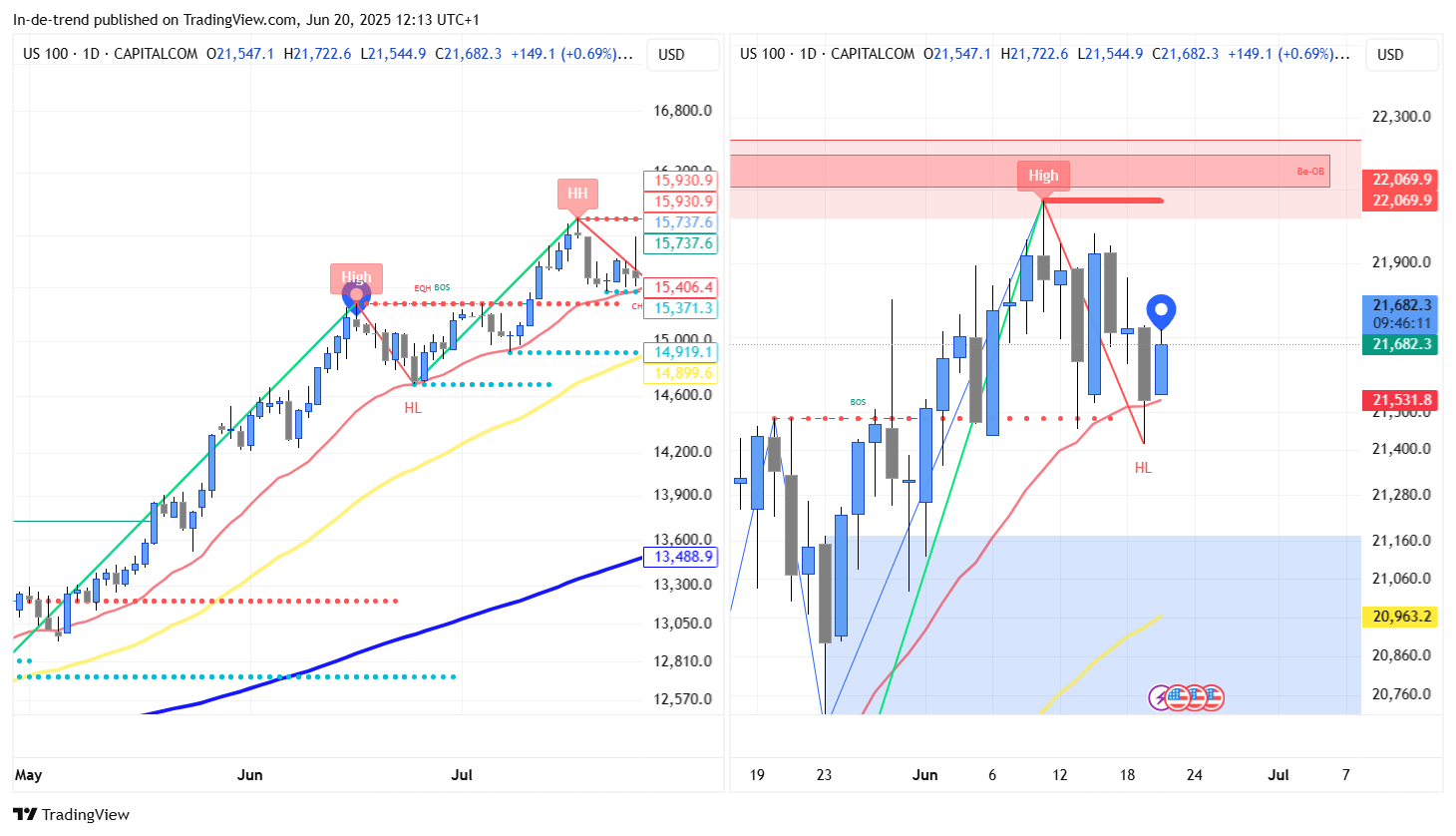

Any volatility the market creates never creates a new structure on your largest timeframe...the price only reacts withing the boundaries of the set highs and lows...prove me wrong! (Remember the largest Timeframe with the HIgh and low)

HL's to HH's guaranteed

#oneauberstrategy

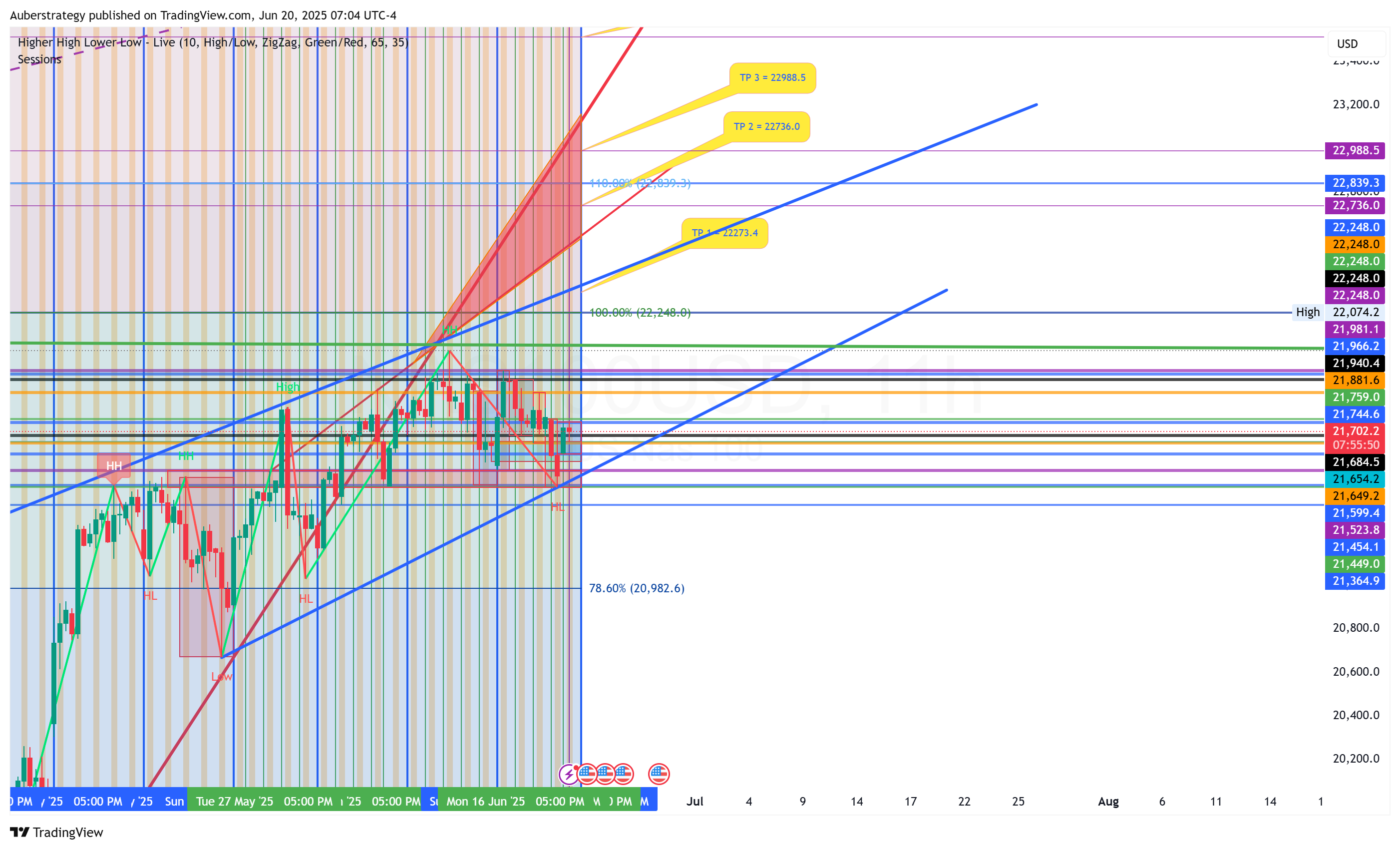

🧠 Market Compression Isn’t Breakout — It’s Setup

📅 June 20, 2025 — Post-OPEX Flow Update

This week has been a case study in how structure holds even when signals feel noisy. Both NAS100USD and

NAS100USD and  SPX500USD are flashing macro-aligned BUY signals on the daily, yet execution remains tight under the surface.

SPX500USD are flashing macro-aligned BUY signals on the daily, yet execution remains tight under the surface.

________________________________________

🔍 Multi-Timeframe View (Excerpt)

🟢 Daily Bias: Accumulation & Long

🔴 Intraday Bias: Still Bearish / Fading

⚠️ Signal Strength: Weak-to-Neutral

💧 Volume: Thin

🎯 Range Heat: Extreme (Expansion → Compression)

“This is not a breakout — this is a re-test.”

While many are chasing moves on noise, the structure is telling a slower, more informed story.

________________________________________

🎛️ Tactical Wisdom

• “Bias ≠ Timing — wait for volume and structure to align.”

• “Don’t confuse expiry distortion with trend break.”

• “If you need confirmation, you’re already doing better than most.”

________________________________________

🔓 Hint: Some traders already mapped this compression last week — they’re not reacting today, they’re observing.

🛡️ Take Profits, Not Chances. Manage Risk to Accumulate.

Titan Protect | Market Structure. Flow Intelligence. No Noise.

📅 June 20, 2025 — Post-OPEX Flow Update

This week has been a case study in how structure holds even when signals feel noisy. Both

________________________________________

🔍 Multi-Timeframe View (Excerpt)

🟢 Daily Bias: Accumulation & Long

🔴 Intraday Bias: Still Bearish / Fading

⚠️ Signal Strength: Weak-to-Neutral

💧 Volume: Thin

🎯 Range Heat: Extreme (Expansion → Compression)

“This is not a breakout — this is a re-test.”

While many are chasing moves on noise, the structure is telling a slower, more informed story.

________________________________________

🎛️ Tactical Wisdom

• “Bias ≠ Timing — wait for volume and structure to align.”

• “Don’t confuse expiry distortion with trend break.”

• “If you need confirmation, you’re already doing better than most.”

________________________________________

🔓 Hint: Some traders already mapped this compression last week — they’re not reacting today, they’re observing.

🛡️ Take Profits, Not Chances. Manage Risk to Accumulate.

Titan Protect | Market Structure. Flow Intelligence. No Noise.

Let’s see where we go with this pseudo push weekly pivot acted a resistance this morning and daily R1 as support..will see if we stay in this range by market open ..for now for me is wit and see

Also Potus Schedule..

Friday, June 20 2025

11:00 AM

The President attends a National Security Meeting

Oval Office Closed Press

2:00 PM

The President departs The White House en route Bedminster, NJ

South Lawn Open Press

Expect turbulence around 2pm NY..

OPEX Gravity & Institutional Silence – The Market Holds Its Breath -

(OPEX Friday Pre-Market)

📆 Friday, June 20, 2025 | ⏰ Pre-Market NY | 🎯 Post-FOMC + OPEX Positioning

NDX

NDX  SPX

SPX

🔍 Market Structure

SPX500USD is hovering just below 6000.

NAS100USD is holding near 21,700 — both sitting right on their gamma flip zones.

➡️ Expect dealer pinning and tight flow until data hits or OPEX positioning breaks.

🟢 Flow & Sentiment

Volatility is falling fast. VIX is down ~7% and VVIX is crushed.

DXY is slightly red — USD flatlining with no conviction pre-data.

Gold and Silver are fading. Crude is holding but not breaking out.

➡️ This is classic OPEX calm: positioning masks conviction.

⚙️ Futures & Sector Rotation

Natural Gas showing strength

Gold, Silver, and Copper are weak — no inflation fear bid

Defensive sectors (utilities, energy, REITs) are slightly green

Growth sectors (tech, discretionary, healthcare) are flat to red

➡️ Passive rotation continues, but it’s not aggressive. It’s preservation mode.

💡 Key Equities Flow

META saw a $263M dark pool block pre-market → institutional repositioning

META saw a $263M dark pool block pre-market → institutional repositioning

Tech leaders (MSFT, TSLA, AAPL) showing minor weakness

INTC and SMCI leading tech bounce — risk is being reframed, not chased

🔻 Short Volume

SPY, QQQ, and high-beta names still see elevated short interest.

But some short covering is creeping into leveraged ETFs.

➡️ Risk-off remains the baseline posture, not full reversal.

🛡️ Titan Insight

OPEX isn’t a trend — it’s a trap.

Watch for deceptive strength into expiry. Real moves wait for data or Monday.

🛡️ Take Profits, Not Chances. Manage Risk to Accumulate.

Best wish and Success.

#TitanProtect #TitanMinds #SPX500USD #NAS100USD #OPEX #GammaPin #GoldFade #META #DarkPool #VolatilityTrap

(OPEX Friday Pre-Market)

📆 Friday, June 20, 2025 | ⏰ Pre-Market NY | 🎯 Post-FOMC + OPEX Positioning

🔍 Market Structure

SPX500USD is hovering just below 6000.

NAS100USD is holding near 21,700 — both sitting right on their gamma flip zones.

➡️ Expect dealer pinning and tight flow until data hits or OPEX positioning breaks.

🟢 Flow & Sentiment

Volatility is falling fast. VIX is down ~7% and VVIX is crushed.

DXY is slightly red — USD flatlining with no conviction pre-data.

Gold and Silver are fading. Crude is holding but not breaking out.

➡️ This is classic OPEX calm: positioning masks conviction.

⚙️ Futures & Sector Rotation

Natural Gas showing strength

Gold, Silver, and Copper are weak — no inflation fear bid

Defensive sectors (utilities, energy, REITs) are slightly green

Growth sectors (tech, discretionary, healthcare) are flat to red

➡️ Passive rotation continues, but it’s not aggressive. It’s preservation mode.

💡 Key Equities Flow

Tech leaders (MSFT, TSLA, AAPL) showing minor weakness

INTC and SMCI leading tech bounce — risk is being reframed, not chased

🔻 Short Volume

SPY, QQQ, and high-beta names still see elevated short interest.

But some short covering is creeping into leveraged ETFs.

➡️ Risk-off remains the baseline posture, not full reversal.

🛡️ Titan Insight

OPEX isn’t a trend — it’s a trap.

Watch for deceptive strength into expiry. Real moves wait for data or Monday.

🛡️ Take Profits, Not Chances. Manage Risk to Accumulate.

Best wish and Success.

#TitanProtect #TitanMinds #SPX500USD #NAS100USD #OPEX #GammaPin #GoldFade #META #DarkPool #VolatilityTrap

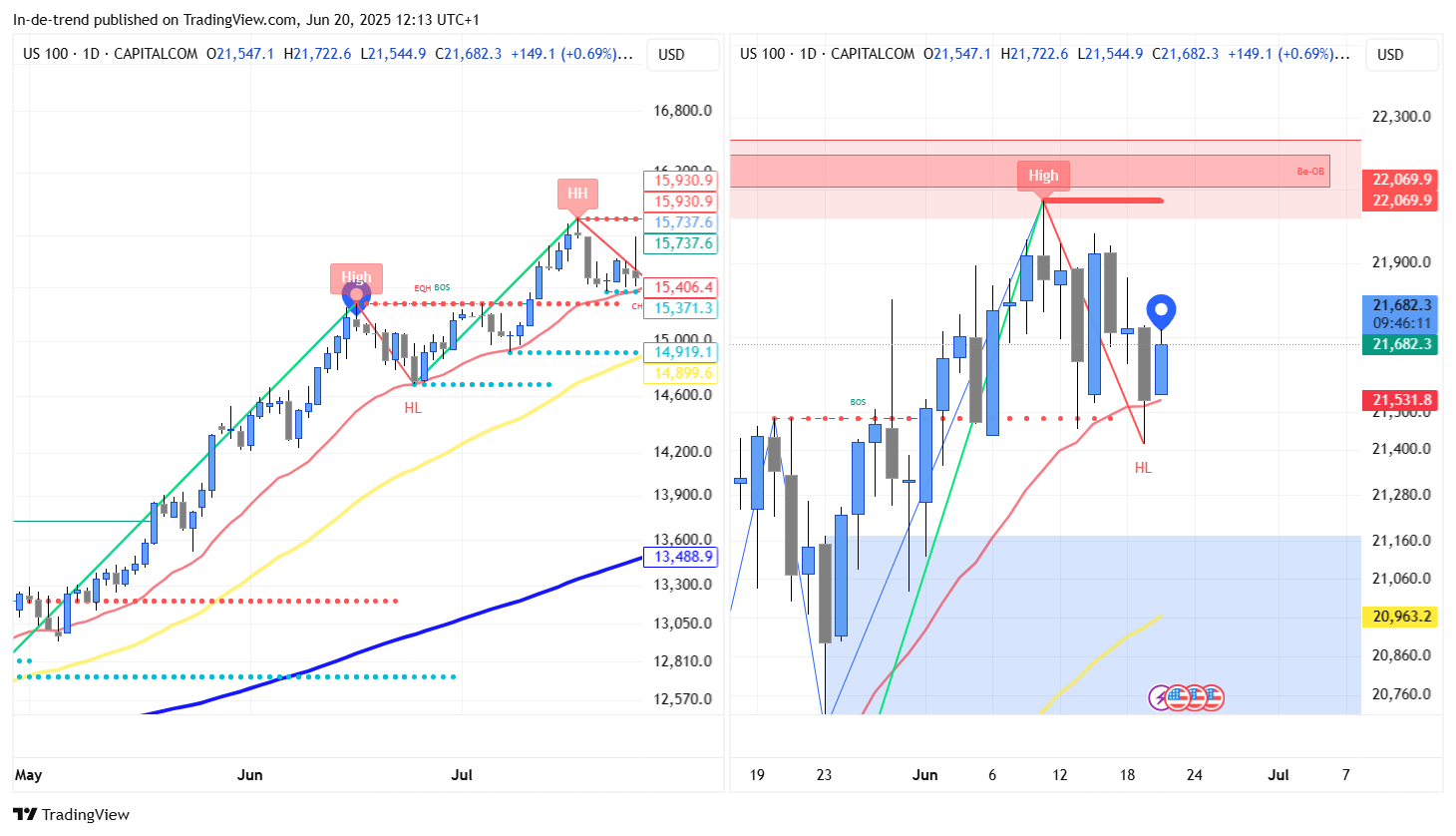

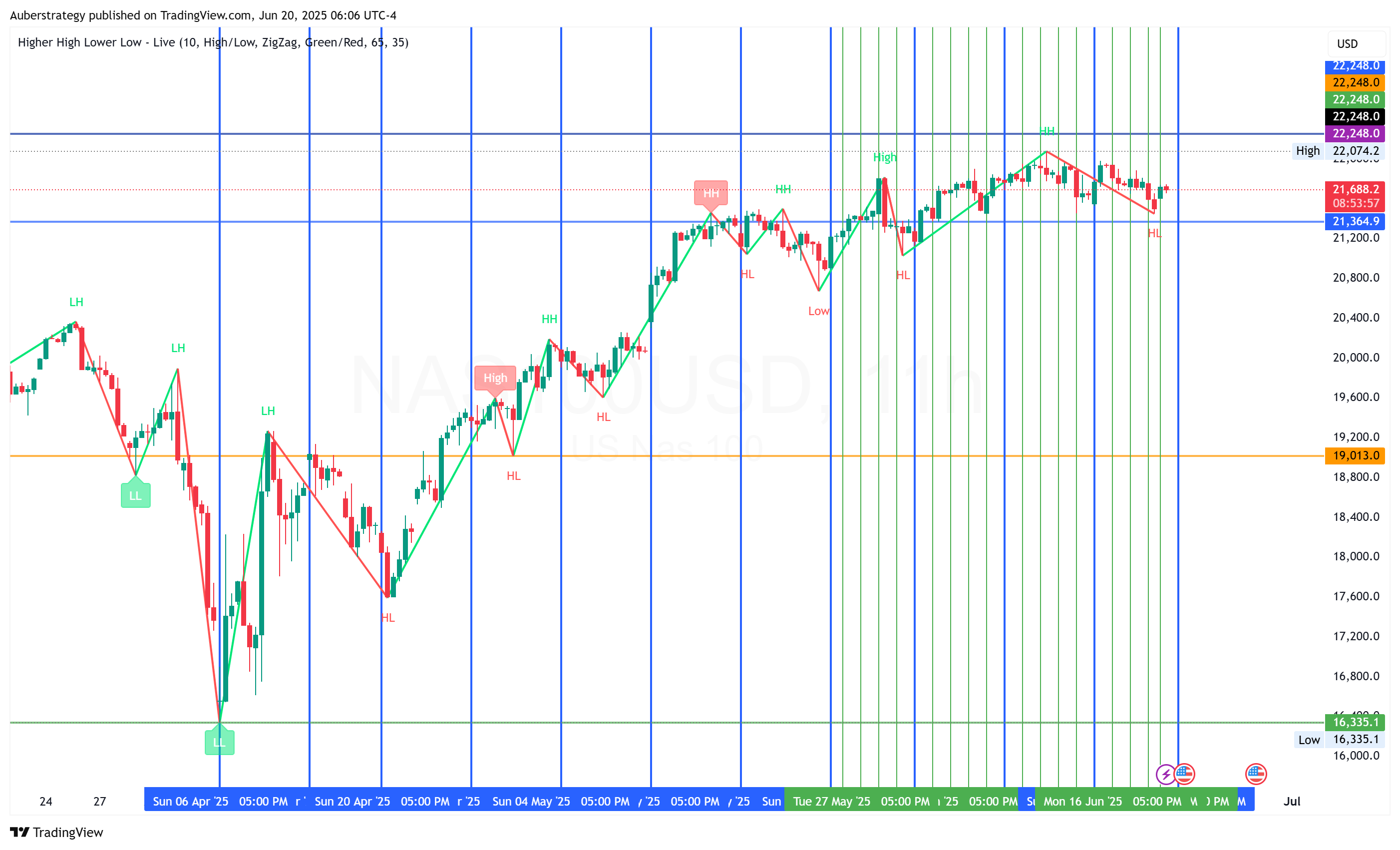

In a market that is loaded with upper level consolidation...sometimes you just have to zoom out and look at the larger picture...

Do you see LH's to LL's?

Do you see HL's to HH's?

(H11 used to show detail)

Then trade what you see

#oneauberstrategy

So while 95 - 99% of you are waiting for the huge bearish wave...here is what you have missed:

1. My 3 "crayon" circles indicate the last 3 HL points for the past three weeks

2. A new support was form yesterday with a new low on the H4 (Equivalent to a HL on H8)

3. Another day below the shaded area on the triangle above confirms more strength for the ultimate buy move.

4. Multiple additional locks added to an ever growing bear trap that started from the Lowest point of 2025 4/6/2025 7:10 pm

So to my bulls I remind you:

1. It is a marathon and not a sprint

2. The HL's to HH's are always guaranteed

3. Keep analyzing on your largest timeframes down to your smaller timeframes

4. Use proper risk management

5. Sometimes just let the market and your trades speak for you.

6. Learn and exercise patience

7. Remember it is not the quantity of your trades...just the quality of that one.

Every single buy for me is now in profit...

Just be still and let NAS100 do it's thing...

Remember this is a masterclass put on by NAS100...if you are interested...pay attention to what the market gives...not what you think.

HL's to HH's Guaranteed

#oneauberstrategy

He is farming followers.

Cc TradingView