GBPAUD trade ideas

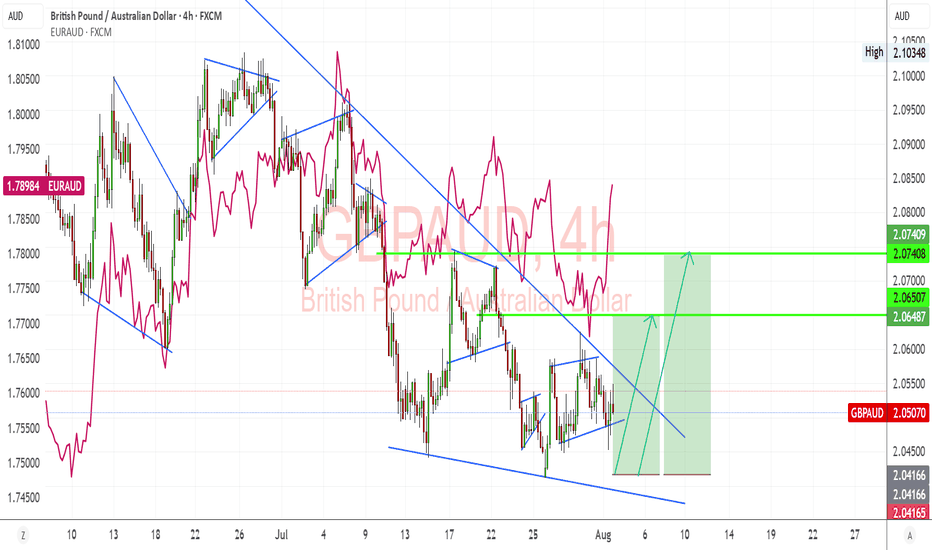

GBPAUD Potential Bullish Reversal Setup – Key Breakout Levels GBPAUD is showing signs of a potential bullish reversal after a prolonged downtrend, with price consolidating within a descending wedge pattern. The pair is testing a breakout point, and fundamentals favor a bullish recovery supported by GBP strength relative to AUD weakness.

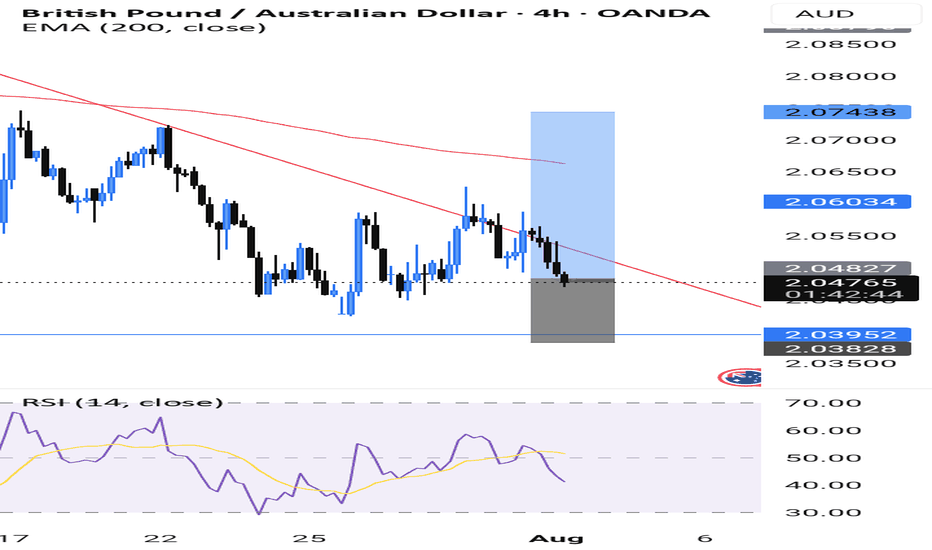

Technical Analysis (4H Chart)

Pattern: Descending wedge formation, often a bullish reversal structure.

Current Level: 2.0507, holding within the wedge and preparing for a potential breakout.

Key Support Levels:

2.0416 – immediate support and invalidation zone if broken.

2.0350 – extended support if bearish pressure resumes.

Resistance Levels:

2.0650 – near-term breakout level.

2.0740 – secondary bullish target if breakout confirms.

Projection: If the wedge breaks upward, price could rally toward 2.0650 initially, then 2.0740 for further confirmation of bullish momentum.

Fundamental Analysis

Bias: Bullish if breakout confirms.

Key Fundamentals:

GBP: BOE remains cautious but leans toward maintaining tight policy amid sticky inflation.

AUD: RBA is constrained by weaker growth and trade risks linked to global tariffs, limiting AUD upside.

Global Sentiment: Risk-off sentiment weighs on AUD, favoring GBP relative strength.

Risks:

Hawkish RBA surprise or strong China data could strengthen AUD.

BOE dovish signals may cap GBP upside.

Key Events:

BOE policy updates and UK inflation data.

RBA meeting and Chinese economic releases.

Leader/Lagger Dynamics

GBP/AUD is a lagger, often following EUR/AUD and GBP/USD movements, but it could gain momentum if GBP strength broadens against risk-sensitive currencies.

Summary: Bias and Watchpoints

GBP/AUD is setting up for a bullish reversal, with key breakout confirmation above 2.0650. A move toward 2.0740 would reinforce this scenario. The main watchpoints are BOE policy tone, RBA updates, and China’s economic signals.

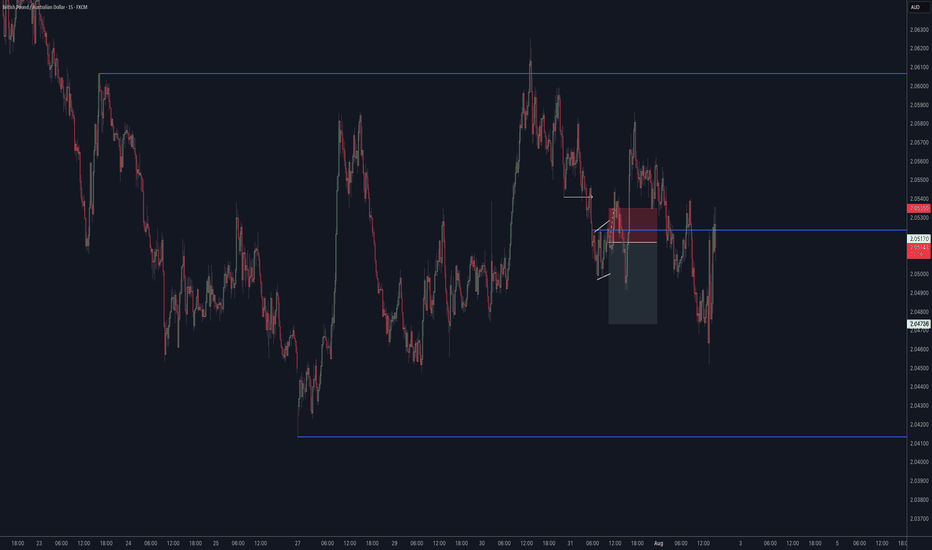

AUDCAD / GBPAUD Trade Recaps 01.08.25A tester trade on AUDCAD with the reasons explained as to why this was a test position, and a short position executed on GBPAUD. Solid setup that this time around just didn't commit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

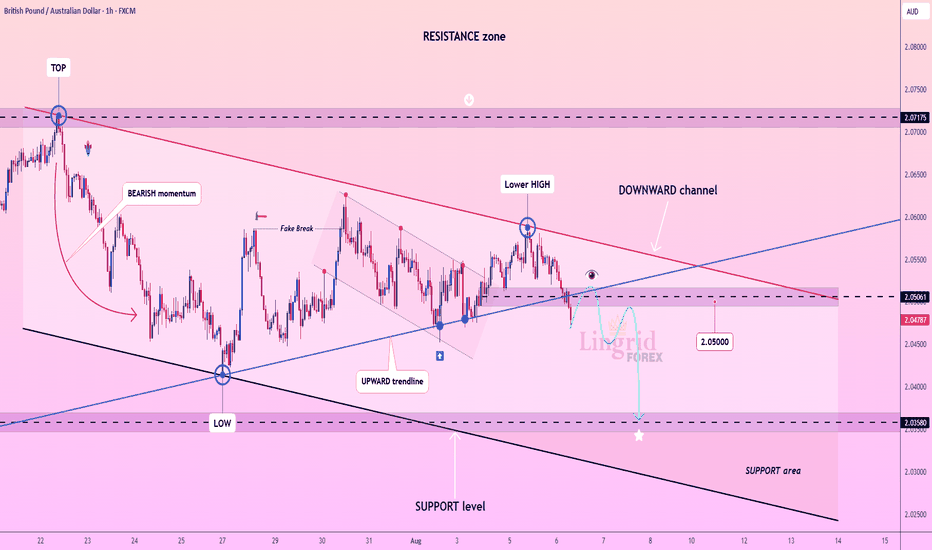

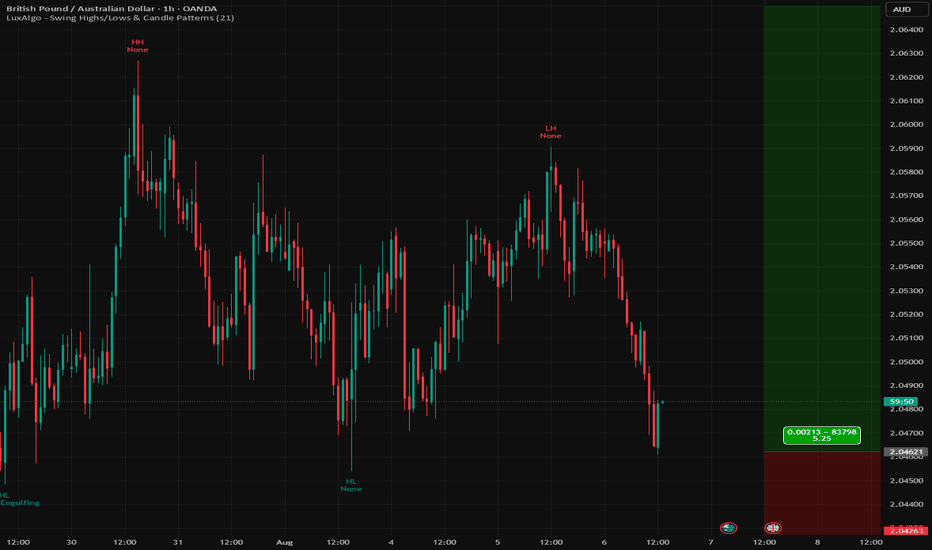

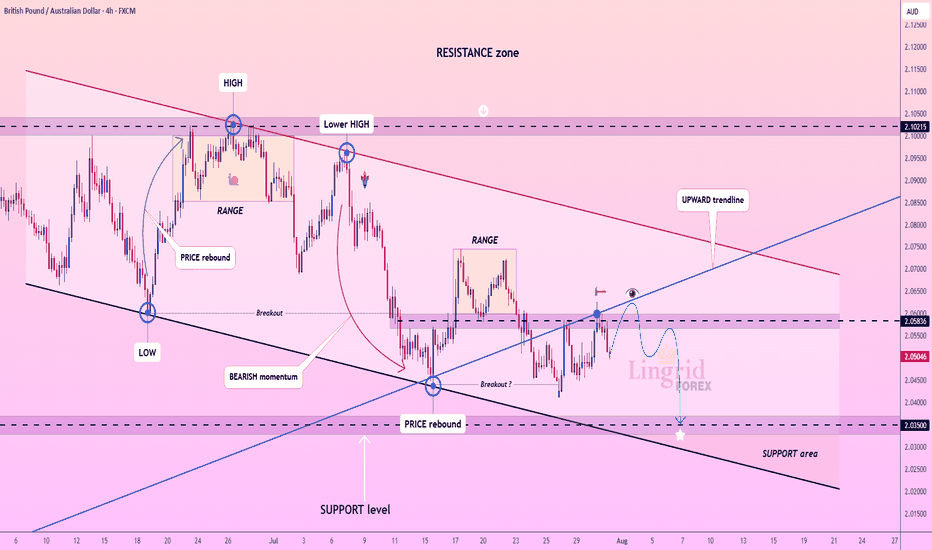

Lingrid | GBPAUD Consolidation - Continuation ScenarioFX:GBPAUD is breaking down from the upward trendline and testing key horizontal support near 2.0500 after rejecting from a lower high in the downward channel. This structure confirms a bearish continuation bias within the broader descending pattern. A clean break below 2.0500 opens the path toward the next support level around 2.0358. The failure to reclaim the lower high signals growing bearish pressure on the pair.

📉 Key Levels

Sell trigger: Break and hold below 2.0500

Sell zone: 2.0500–2.0480

Target: 2.0358

Invalidation: Return above 2.0506

💡 Risks

Bullish defense of 2.0500 could trigger a rebound

Re-entry into the broken trendline may trap sellers

Broader AUD weakness may delay downside move

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

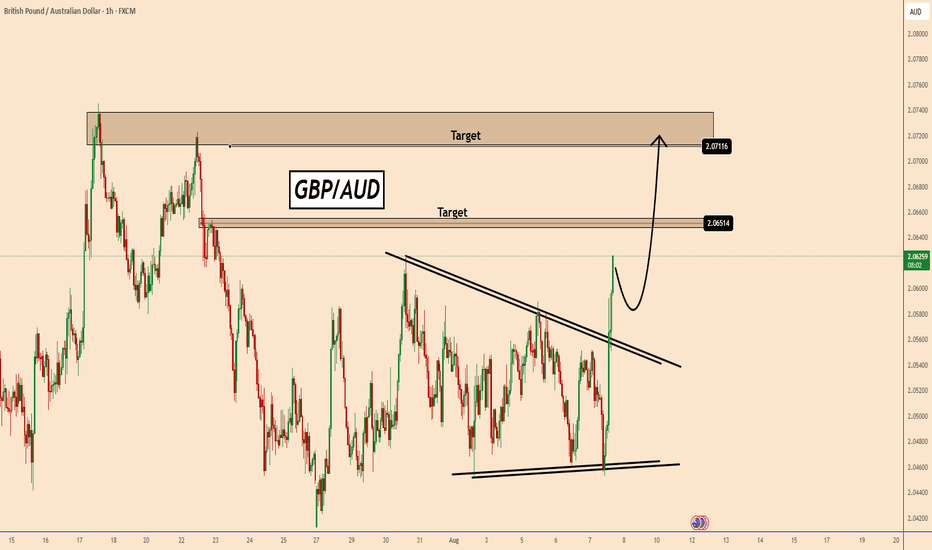

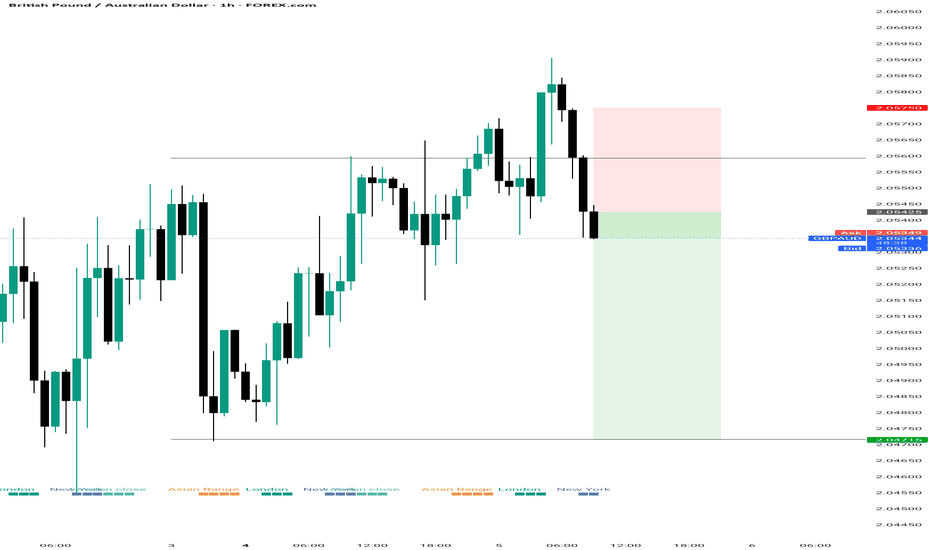

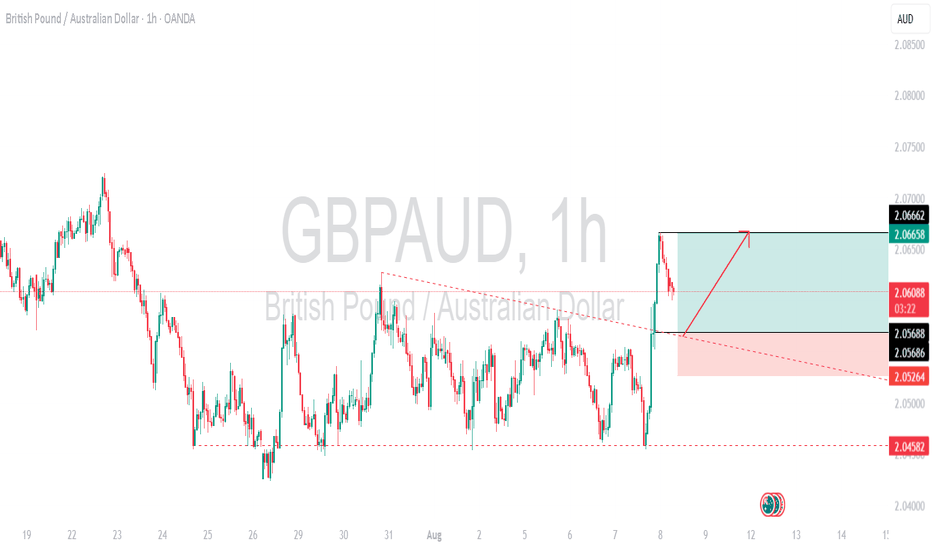

GBPAUD started an uptrend movement after BOE rate decisionGBPAUD started an uptrend movement after BOE rate decision

Today, the Bank of England cut interest rates by 25 basis points to 4% from 4.25%.

BoE Governor Bailey explained that he has not changed his view on the direction of the interest rate path, the question is the timeframe. The BoE is hinting at prolonged higher rates, weighing on growth, sending an aggressive signal to the market.

GBPAUD strengthened after the rate decision was released and has risen further since then.

GBPAUD broke out of this bullish triangle pattern. The breakout looks strong and the volume that the price has increased was high.

I expect a small pause before GBPAUD moves further to 2.0650 and possibly higher to 2.0700, where it was also rejected several times, but where it was also tested several times.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

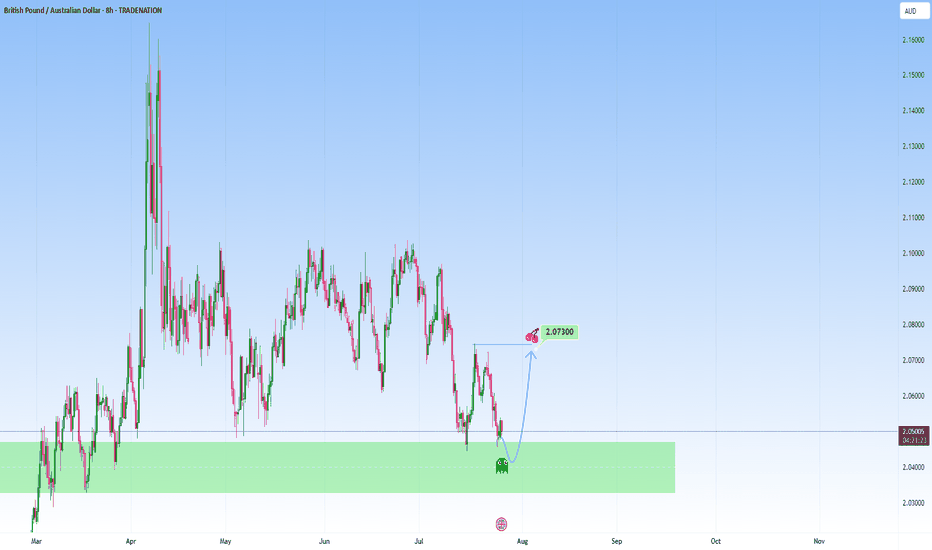

GBPAUD: Possible bounce at supportI am watching for a possible reversal GBPAUD, expecting a rejection with a upside target at around 2.073.

This area is where it can become a decision point, either price finds support and bounces, or it breaks below, and the move can start to extend lower.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

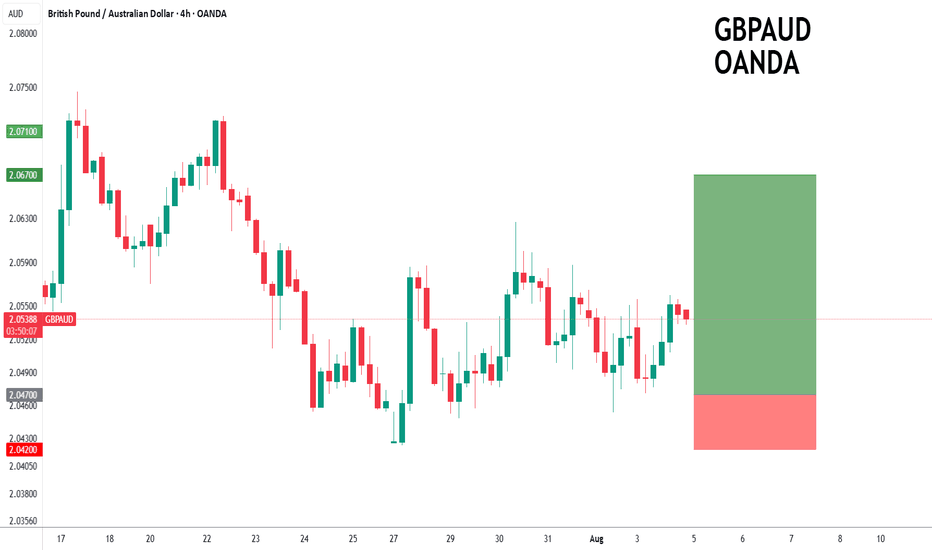

GBPAUD forming a bottom?GBPAUD - 24h expiry

The primary trend remains bullish.

Price action looks to be forming a bottom.

We look for a temporary move lower.

Preferred trade is to buy on dips.

Bespoke support is located at 2.0470.

We look to Buy at 2.0470 (stop at 2.0420)

Our profit targets will be 2.0670 and 2.0700

Resistance: 2.0600 / 2.0670 / 2.0700

Support: 2.0450 / 2.0420 / 2.0390

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

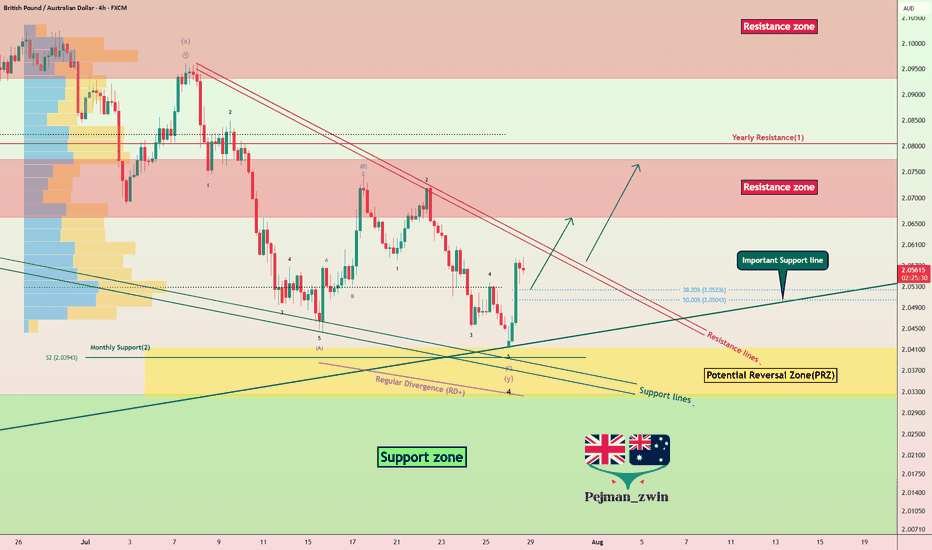

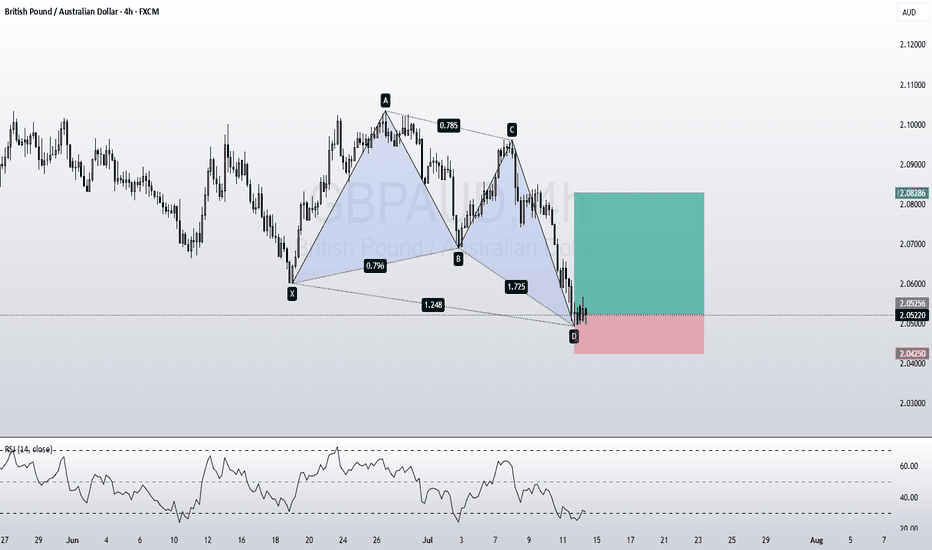

GBPAUD Reverses from Key Zone – Long Setup in Play!Today I want to share with you a Long position on GBPAUD ( OANDA:GBPAUD ).

GBPAUD started to rise well from the Important Support line , Support zone(2.032 AUD-1.987 AUD) , and Potential Reversal Zone(PRZ) and managed to close the 4-hour candle above 2.053 AUD (important) .

In terms of Elliott wave theory , GBPAUD seems to have completed the main wave 4 . The main wave 4 structure was a Double Three Correction(WXY) .

Also, along the way, we can see a Bullish Marubozu candle , which could indicate a continuation of the uptrend .

I expect GBPAUD to break the Resistance lines soon and attack the Resistance zone(2.078 AUD-2.066 AUD) .

First Target: 2.065 AUD

Second Target: 2.076 AUD

Note: Stop Loss(SL): 2.040 =Worst SL

Please respect each other's ideas and express them politely if you agree or disagree.

British Pound/ Australian Dollar Analyze (GBPAUD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

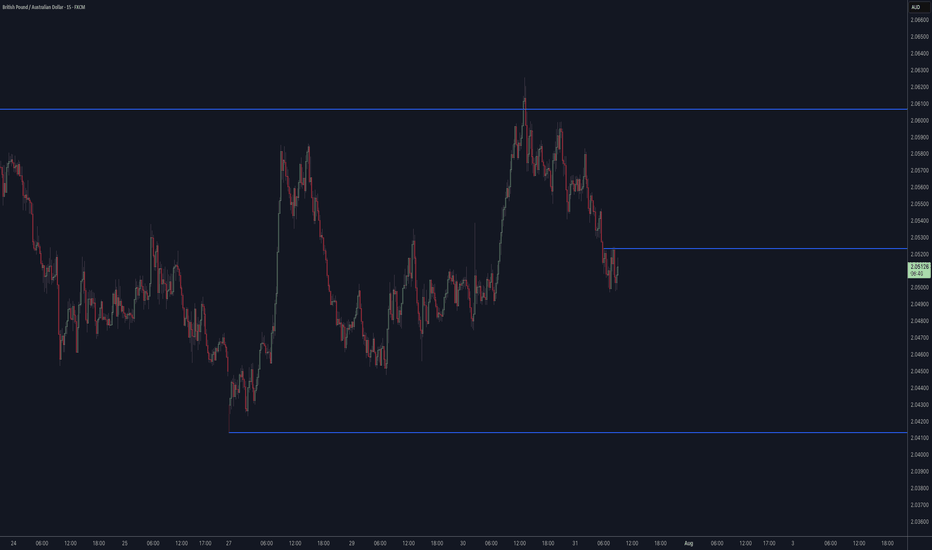

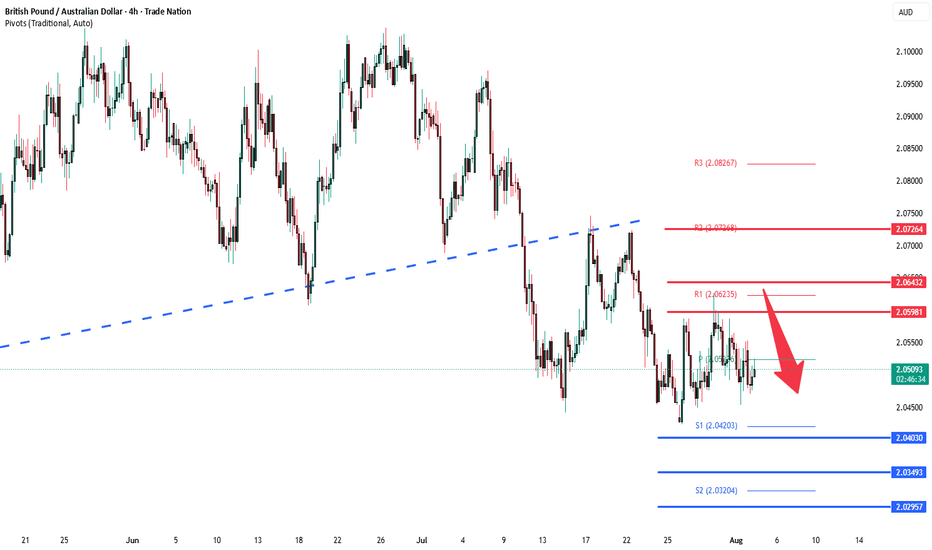

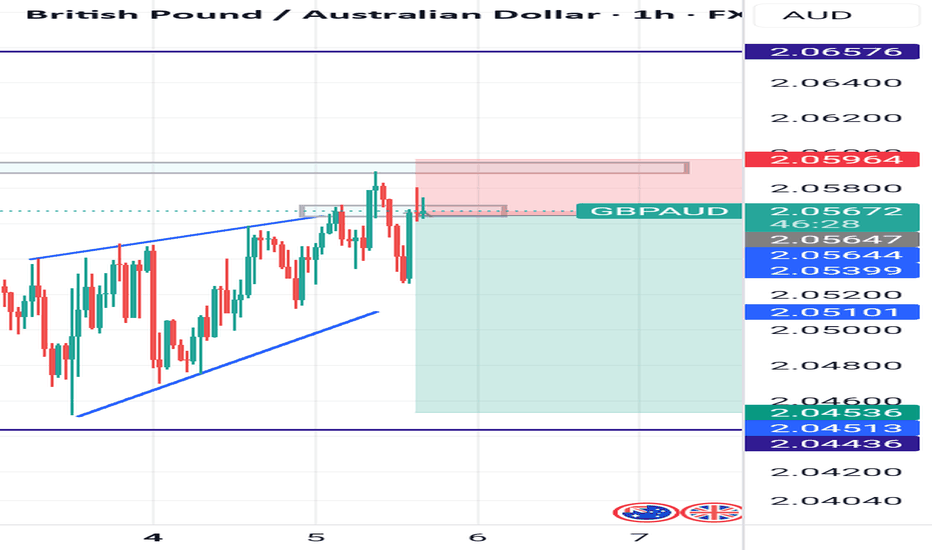

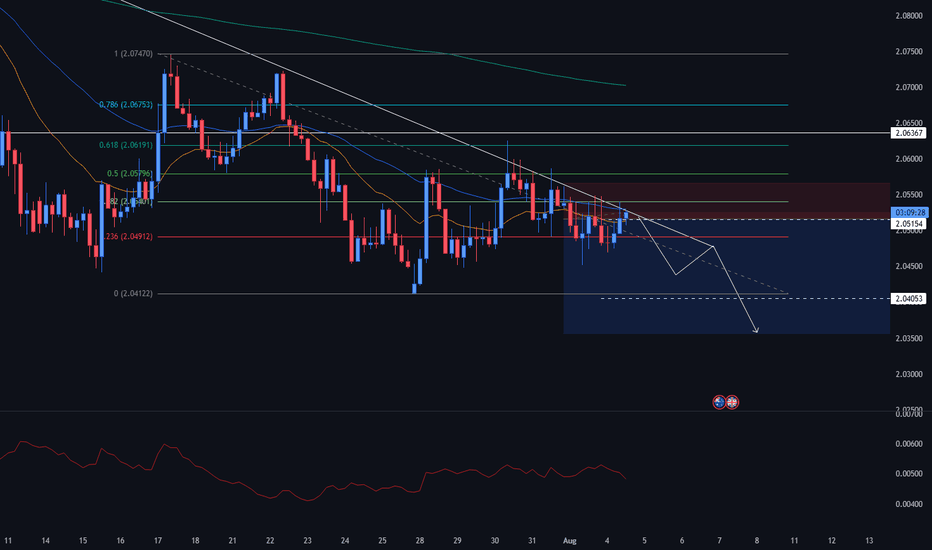

GBPAUD sideways consolidation capped at 2.0600The GBPAUD pair is currently trading with a bearish bias, aligned with the broader downward trend. Recent price action shows a retest of the resistance, suggesting a temporary relief rally within the downtrend.

Key resistance is located at 2.0600, a prior consolidation zone. This level will be critical in determining the next directional move.

A bearish rejection from 2.0600 could confirm the resumption of the downtrend, targeting the next support levels at 2.0400, followed by 2.0350 and 2.0290 over a longer timeframe.

Conversely, a decisive breakout and daily close above 2.0600 would invalidate the current bearish setup, shifting sentiment to bullish and potentially triggering a move towards 2.0645, then 2.0730.

Conclusion:

The short-term outlook remains bearish unless the pair breaks and holds above 2.0600. Traders should watch for price action signals around this key level to confirm direction. A rejection favours fresh downside continuation, while a breakout signals a potential trend reversal or deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

I’m bullish on GBPAUDGBPAUD – Catching the Lift from the Launchpad 🚀

Markets don’t move in straight lines — they coil, pull back, and then explode. GBPAUD looks ready to do just that. It’s pulling into a demand zone, flashing oversold signals, and now showing early signs of upward momentum. This may be the moment just before the next leg up.

📈 I’m bullish on GBPAUD — buying at support with price action confirmation.

Key drivers behind this setup:

GBPAUD in a strong uptrend ✅

Demand level + technical support zone 📍

Momentum shifting upward after retracement 🔄

AUD weakness expected due to RBA easing 📉

UK fundamentals holding firm despite mixed sentiment

The UK economy remains steady — Q1 growth hit 0.7%, driven by business investment. While May saw a small GDP dip, the bigger picture shows resilience. The BoE is likely to cut by 25bps on August 7, but the easing path is gradual. GBP sentiment is mixed, with positioning cooling off, but technicals still favor long setups like GBPAUD over time.

Australia’s situation looks softer. Inflation is moderating (2.18%), consumer spending is weak, and the Reserve Bank of Australia is widely expected to cut rates on August 12. Despite a recent trade surplus, the AUD dropped 1.4% last week as expectations shifted toward easing. Speculators are still net short on AUD, and if the RBA delivers another dovish message, the Aussie could slide further.

Technically and fundamentally, GBPAUD looks like it’s bottoming at a buyable level. This is a textbook “buy-the-dip” scenario with both sentiment and price structure aligning.

Are you long this one too? Or fading the strength? Let’s talk trades.

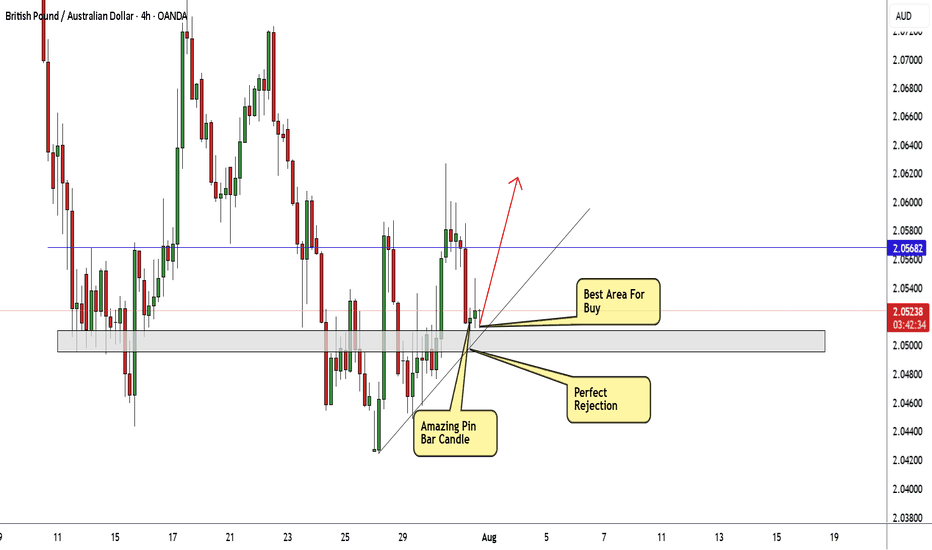

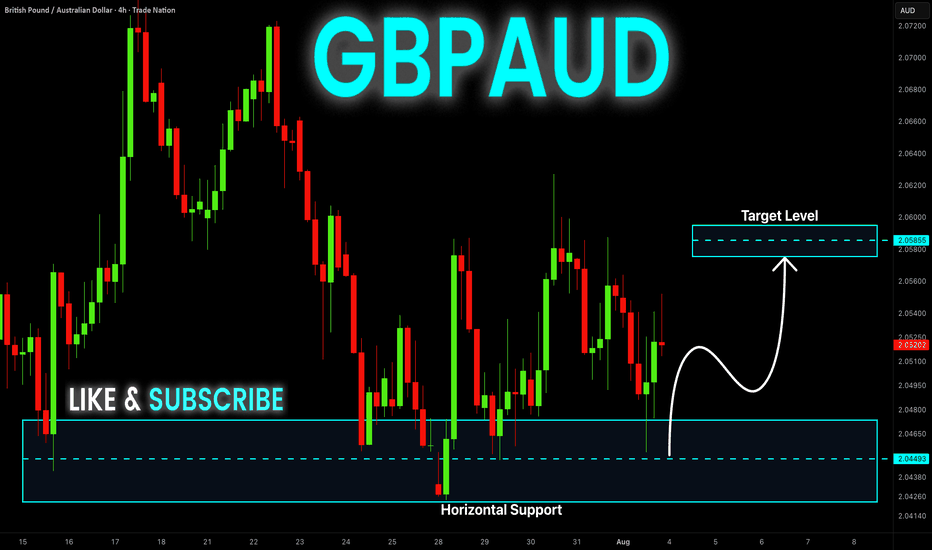

GBP/AUD At Very Interesting Buy Area , Don`t Miss 150 Pips !Here is my GBP/AUD 4H Chart and this is my opinion , the price moved very hard to downside And now creating new wave in the 4H Up Trendline and the price at strong support now 2.05000 which is forced the price many times to go up , so it`s my best place to enter a buy trade , and if you checked the chart you will see the price creating the new higher low to complete the new higher high . if we have a daily closure below my support area then this idea will not be valid anymore .

Lingrid | GBPAUD Bearish Pressure. Potential ShortThe price perfectly fulfilled my previous idea . FX:GBPAUD rebounded from support and has climbed into a tight resistance zone near 2.05836, but momentum remains weak near the downward trendline. The price structure shows a sequence of lower highs and a tight range below resistance, suggesting sellers are still in control. A rejection at this level would confirm another failed breakout attempt. If confirmed, the pair could revisit the 2.03500 support area with bearish continuation pressure.

📌 Key Levels

Sell trigger: Rejection at 2.05836 and break of 2.05000

Sell zone: 2.05800–2.06000

Target: 2.03500

Invalidation: Strong break and close above 2.06000

💡 Risks

Bullish breakout above trendline resistance

Fundamental surprise (UK/AU economic data)

Shift in broader risk sentiment or AUD weakness

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

GBPAUD - COULD BE A GOOD SELL TRADEHey Traders!

I believe GBPAUD could have a strong bearish push towards the downside, since the institutional data suggest that GBP is weakening, while AUD orders are slightly increasing, looking at the 4 hour trends it seems it stay on a bearish path, however just recently it broke out the weekly pivot point, which could signal a breakout so consider risking less, overall daily timeframe is also bearish, there are also a number of chart patterns on the daily timeframe suggesting sell bias as well.

Some issues with this trade is the major pairs gbpusd especially has broken upwards past the weekly pivot showing signs of bullish pressure, so we could see a push of gbp before a exhaustion back down.

I suggest taking partial profits along the way.

GBP-AUD Growth Ahead! Buy!

Hello,Traders!

GBP-AUD made a retest

Of the horizontal support

Of 2.0420 and we are

Already seeing a bullish

Rebound so we will be

Expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

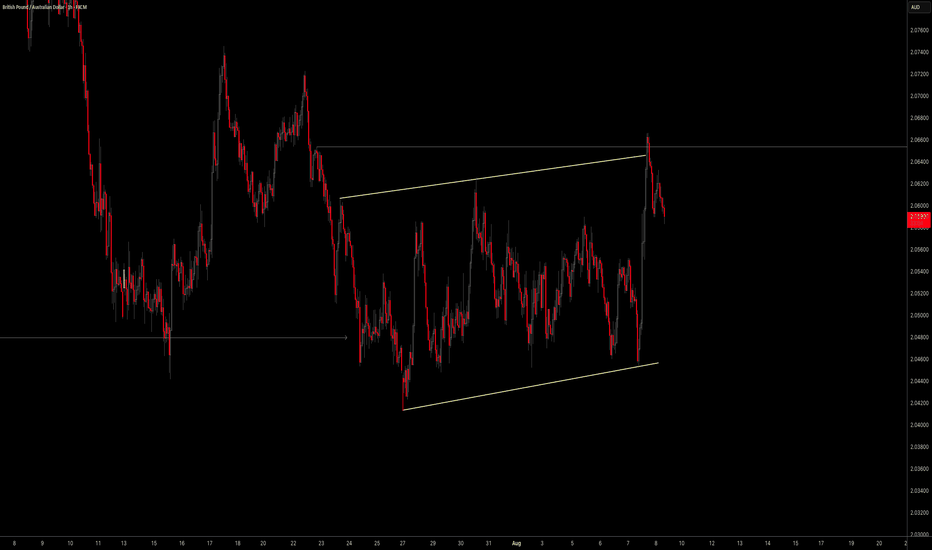

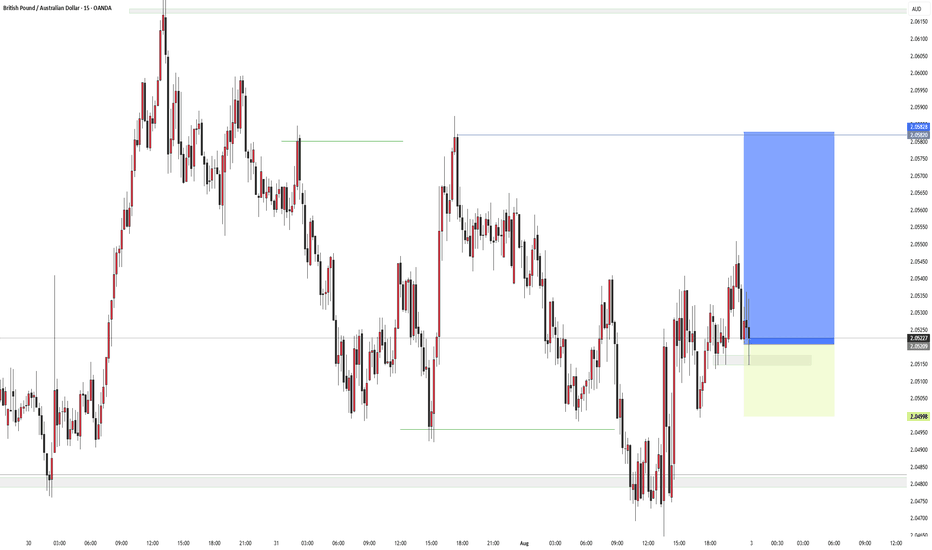

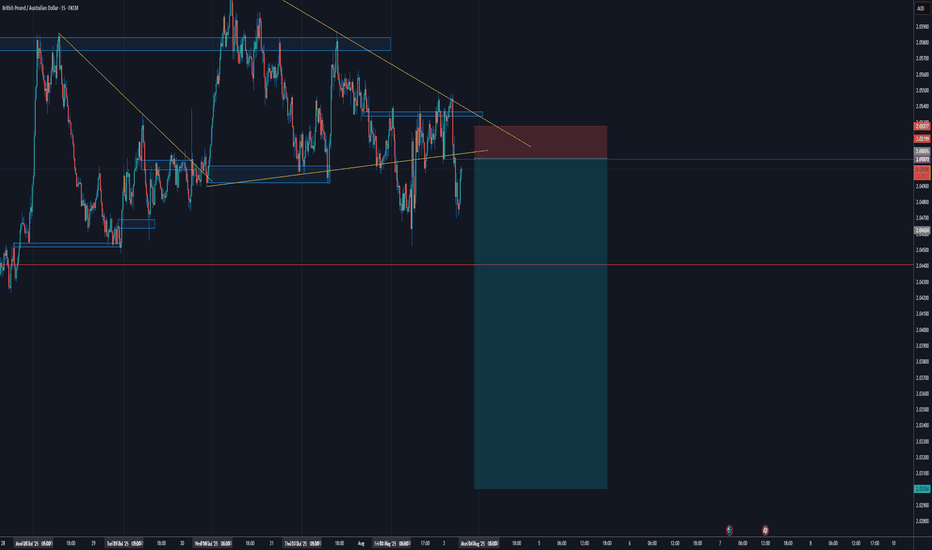

GBP/AUD SHORT 200 PIPS 1-10 RR🎯 1. Resistance at Trendline & Horizontal Zone

The price is touching a descending trendline (in yellow), coupled with a horizontal resistance zone (light-blue/boxed) just above.

This area acted as support earlier and now has flipped to resistance—classic supply–resistance confluence.

2. Structure Shift – Lower High Forming

The most recent swing high is lower than the previous peak, indicating weakening momentum and possible shift into a downtrend.

Market structure aligns in favor of sellers.

3. Trendline Rejection (Backtest)

The price attempted to breach the descending line but failed and pulled back below it.

Indicates lack of bullish conviction and a likely continuation downward.

4. Risk–Reward Zone

The red zone indicates your stop-loss placed just above the resistance zone/trendline confluence — a tight and logical level.

The large blue rectangle below represents your potential profit target — good R:R.

In essence, you're risking small for a larger reward.

5. Confirmation via Price Action

Notice the recent wick-up into resistance followed by bearish rejection (candles showing rejections).

This is a typical reversal signal at a strong confluence area.