GBPAUD – Swing Trade OpportunityGBPAUD has confirmed another bounce from long-term trendline support, combining technical signals with a supportive macro backdrop to set up a bullish swing opportunity.

Technical Highlights:

🔹Trendline support holding with multiple rejections, reinforcing bullish structure.

🔹Stochastic RSI has crossed up from oversold, signaling bullish momentum building.

🔹RSI recovering above 45, showing improving sentiment.

📰 Fundamental Backdrop:

The Bank of England remains hawkish on inflation, keeping GBP supported.

Australian Dollar under pressure as China growth concerns weigh on commodity demand.

Broader risk-on environment limits AUD’s safe-haven appeal compared to GBP.

🎯 Bullish Targets:

✔️ TP1: 2.0727 – First key resistance zone for partial take profit.

✔️ TP2: 2.0874 – Major resistance and next swing target.

✔️ TP3: 2.1000+ – Full potential if momentum extends.

🔒 Stop-Loss: Below 2.0461 – Clear invalidation if support fails.

📝 This setup provides a healthy Risk/Reward ratio with defined invalidation and multi-target upside. Manage actively as the trade develops.

GBPAUD trade ideas

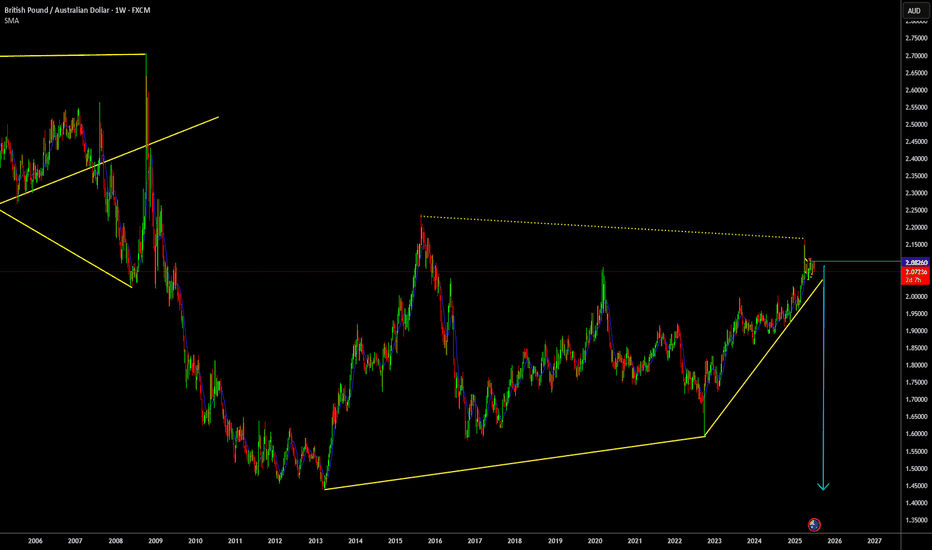

GBPAUD: Growth & Bullish Continuation

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPAUD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

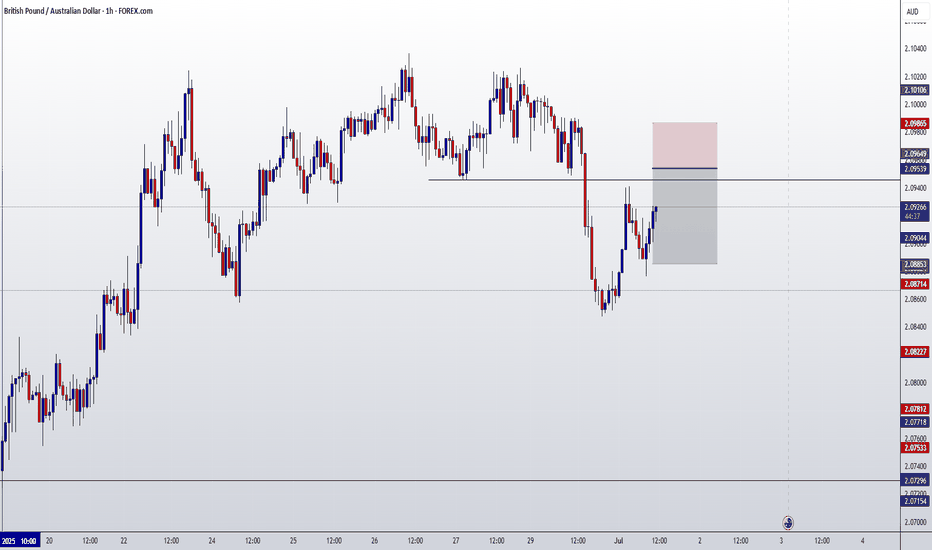

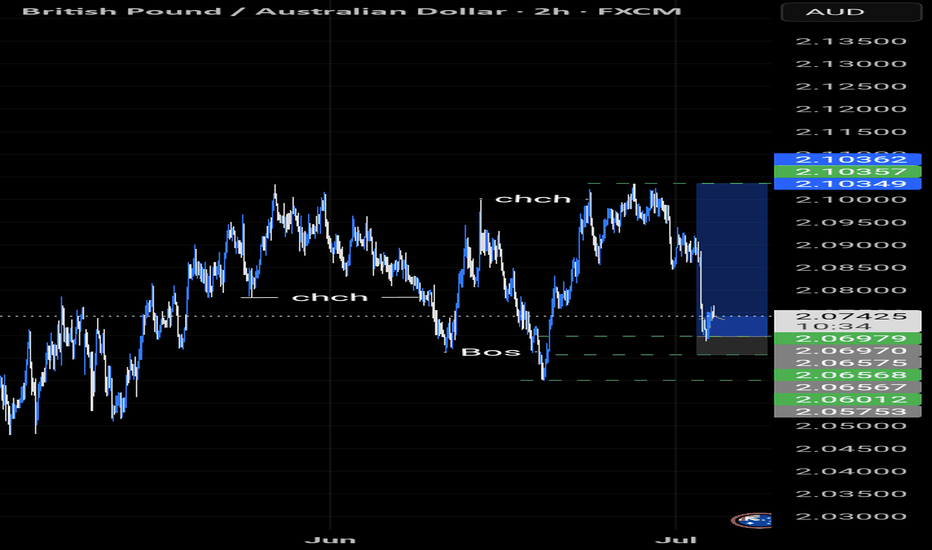

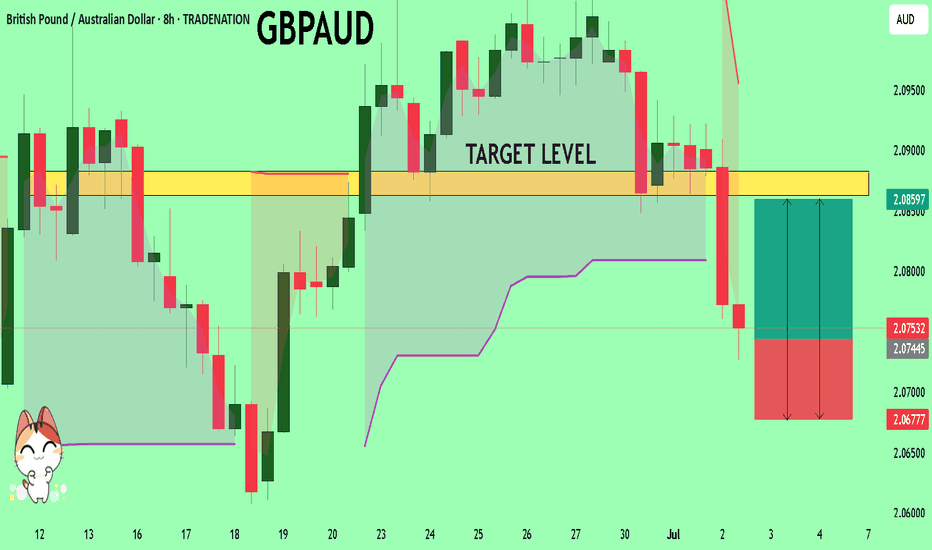

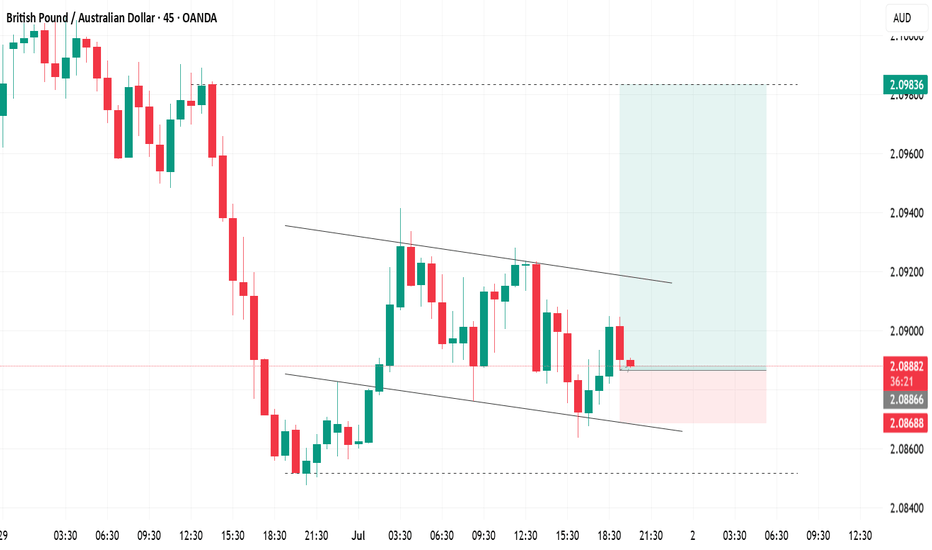

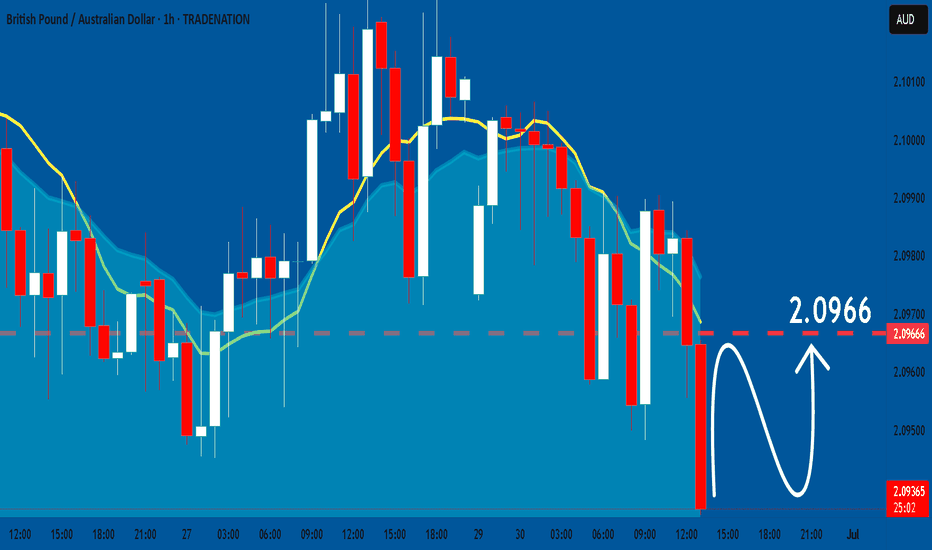

GBPAUD ENTRY CHARTOn this pair, we are anticipating for a SELL CONTINUATION, the intra-day time is BEARISH, but also we have strong BEARISH ENGULFING CANDLE on the daily close, the H1 is bearish, with a BB that is in confluence with the H4 SUPPLY, also we have additional confluence on this pair, So if this matches with your Idea, You can do well to join us with a Good Risk. THANK YOU and HAPPY NEW MONTH.

Possible GBPAUD Bearish setupBreaking down GBPAUD price action from yesterday, Price slipped below 2.08477, with bears pushing toward 2.06885 maintaining the pressure and still closing below 2.08477 If GBPAUD stays below our resistance zone, Expect a pullback towards:

Sell Levels: 2.08561 - 2.08484

with the sell setup targets being

Target Levels: 2.07112 - 2.06885

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

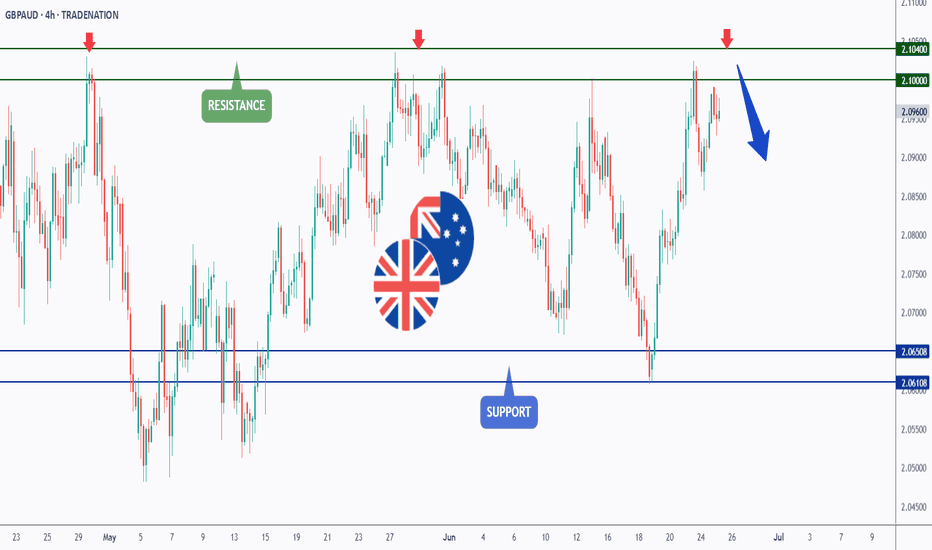

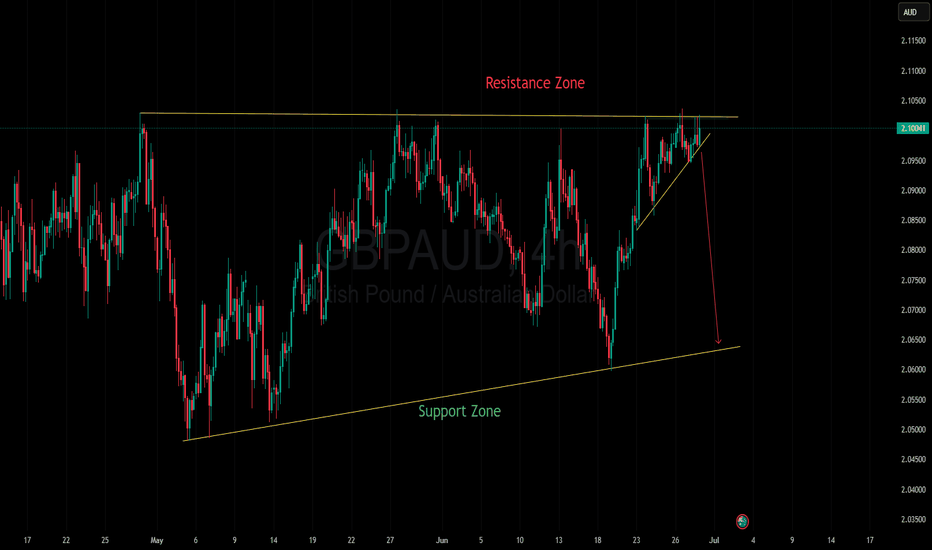

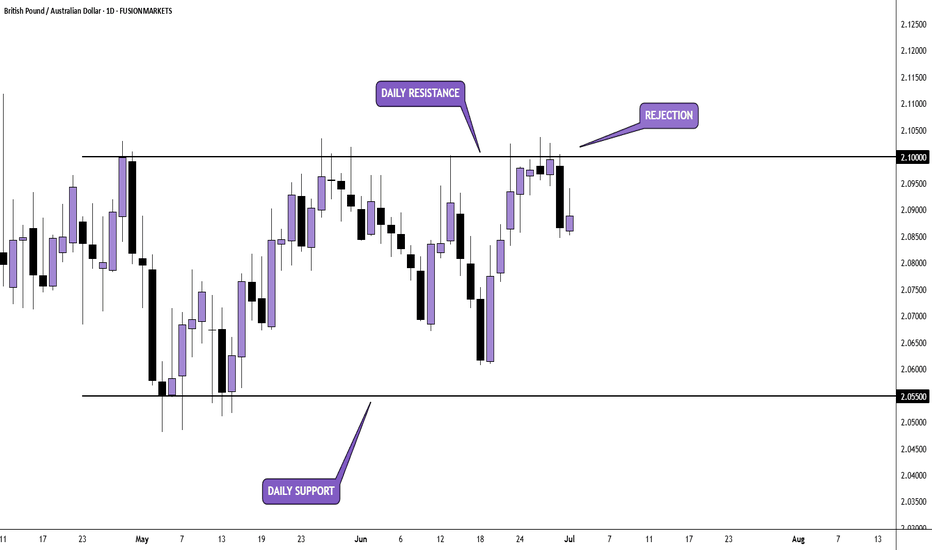

GBPAUD - Trading The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GA has been hovering within a big range.

This week, GA is retesting the upper bound of the range acting as a resistance.

As long as the resistance holds, we will be looking for shorts on lower timeframes, targeting the lower bound of the range.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

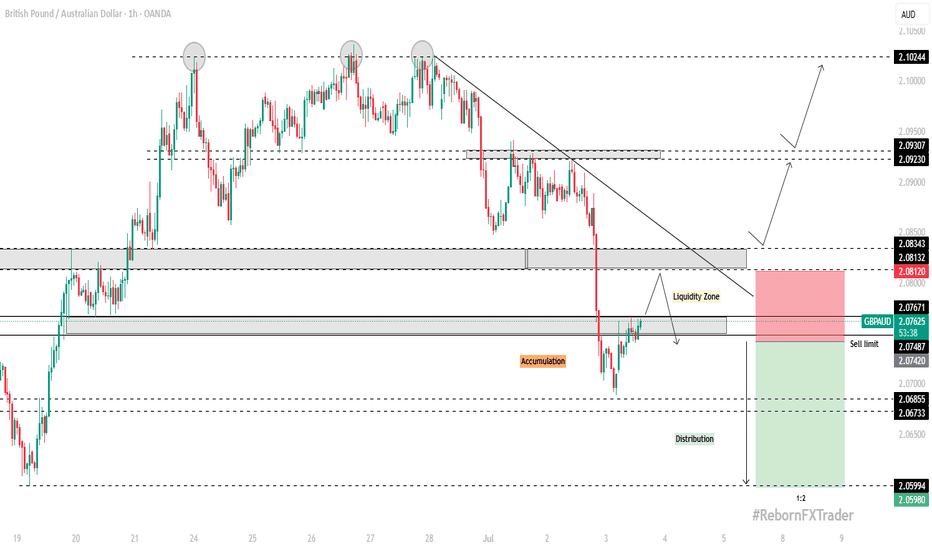

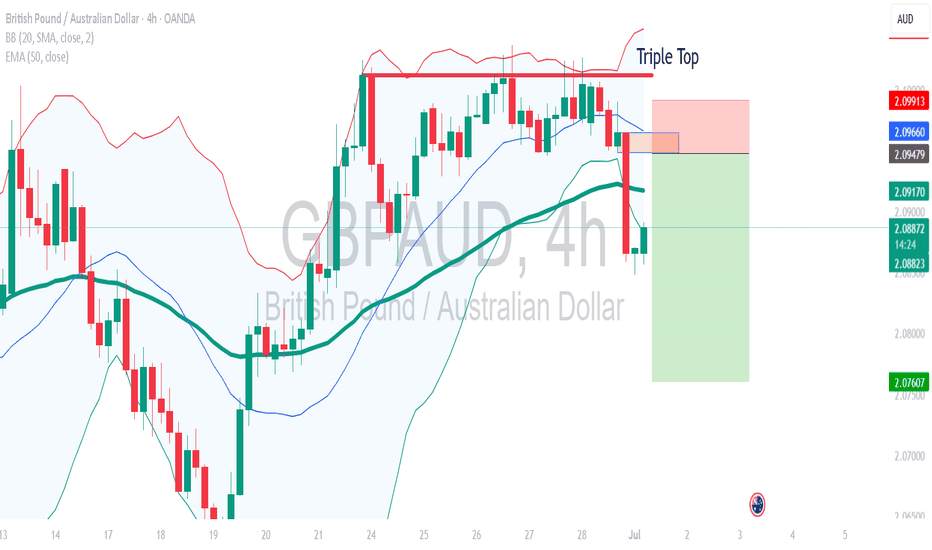

GBP/AUD 1H technical and fundamental analysisGBP/AUD 1H technical and fundamental analysis

GBP/AUD has drifted slightly lower over the past week (≈ –0.47%) and month (≈ –0.18%), despite being up roughly +9% YTD. The pair remains under bearish pressure in the short term, primarily due to weaker-than-expected UK GDP data and dovish signals from the Bank of England, which have raised concerns over a potential economic slowdown and future rate cuts.

These fundamentals are weighing on the British Pound, while the Australian Dollar remains relatively stable due to commodity support and neutral RBA guidance.

Technical Outlook (1-Hour Timeframe):

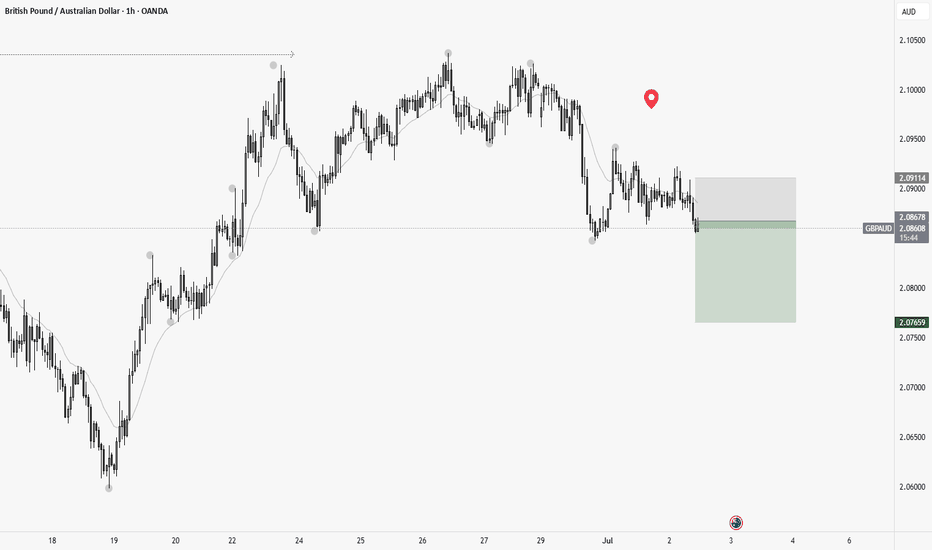

GBP/AUD recently formed a triple top pattern at the upper range, signaling strong seller dominance. Price has since rejected and is heading lower, currently testing the 2.0850–2.0760 minor support zone.

After this zone was broken, price began accumulating sell positions, suggesting institutional interest in driving the pair toward a liquidity zone. We are now seeing a potential stop-loss hunt near 2.0740, which aligns with a smart money sell setup.

Once the market breaks below and closes a bearish candle under key support, it will confirm further downside continuation.

📊 Trade Setup

📍 Area of Interest (AOI): 2.07420 (Sell Limit after candle close below key level)

🛡 Stop-Loss: 2.08120 (Just above the liquidity zone, if clear manipulation is confirmed)

🎯 Take Profit: 2.05980 (Next minor key support / ~1:2 RR)

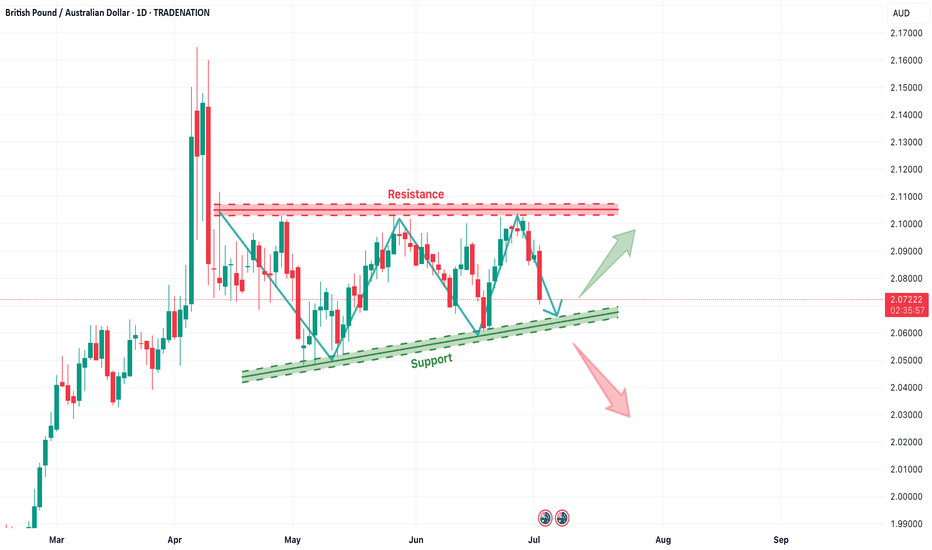

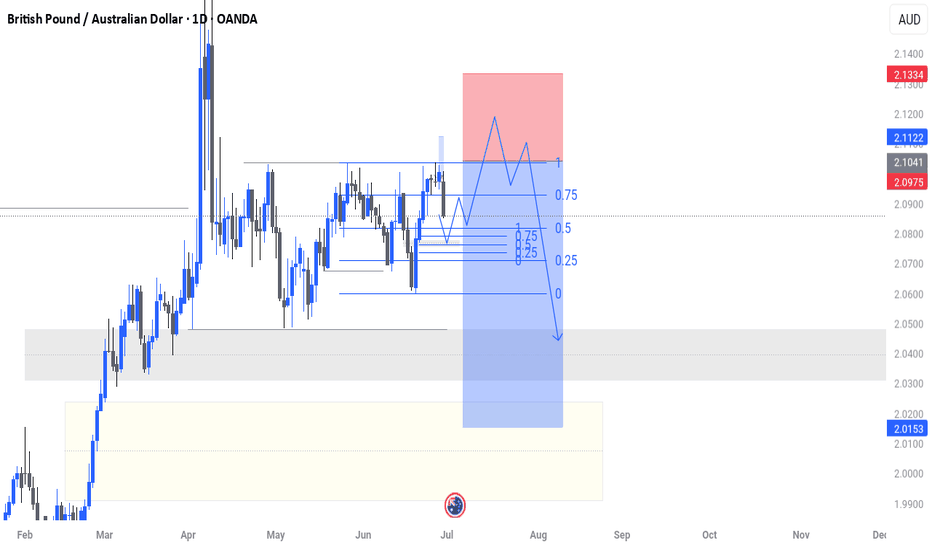

GBP/AUD Range-Bound Structure – Support Retest in ProgressThe GBP/AUD pair is currently trading inside a well-defined horizontal range channel, bounded by resistance around 2.1050–2.1100 and support near 2.0600–2.0650. Price has been moving in a sideways rhythm since late April, oscillating between the two levels with several clean swings.

As of now, the market is heading toward the ascending support trendline, indicating a possible short-term bounce or a larger directional move depending on how price reacts there.

🔄 Scenario 1: Bullish Rebound from Support

If the price finds buying interest near the 2.0650–2.0700 zone and bounces with strong bullish candles, it may signal the beginning of another swing toward the resistance zone at 2.1100. This would maintain the current range-trading behavior, offering traders a buy-low, sell-high opportunity.

Buy Entry: Near 2.0650–2.0700 (after confirmation)

SL: Below 2.0580

TP: 2.0950 / 2.1100

⛔ Scenario 2: Bearish Breakdown from Support

However, if price decisively breaks below the support zone with momentum, it would invalidate the current range and may trigger a larger corrective leg to the downside. This could lead to levels around 2.0400 or even 2.0200, aligned with previous demand zones.

Sell Entry: On breakdown below 2.0600 with retest

SL: Above 2.0700

TP: 2.0400 / 2.0200

🧭 Technical Outlook Summary

Pattern: Horizontal range with slight ascending base

Bias: Neutral – Watch for bounce or breakdown

Support to watch: 2.0650–2.0600

Resistance to watch: 2.1050–2.1100

Next Action: Wait for reaction at support before taking directionally biased trades

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

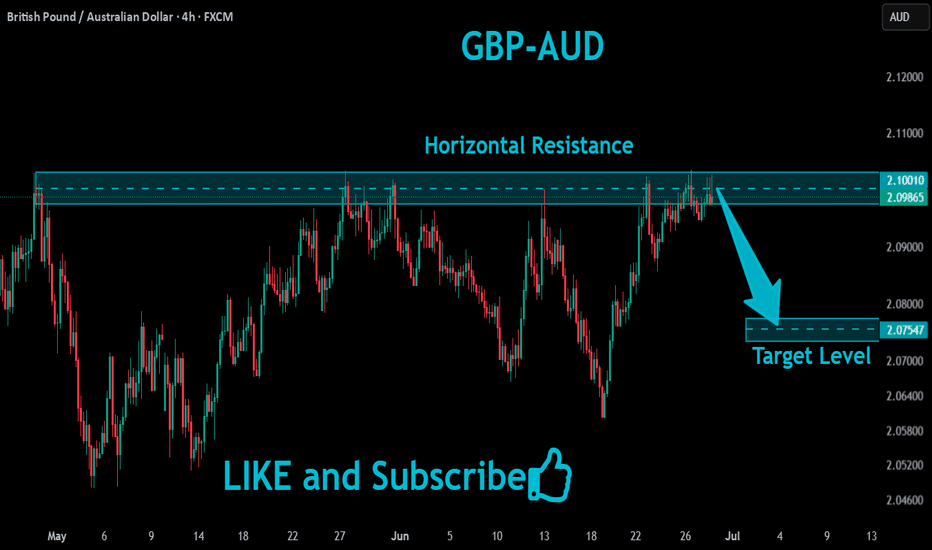

GBPAUD Short From Resistance!

HI,Traders !

#GBPAUD went up sharply

Made a retest of the

Horizontal resistance level

Of 2.10010 from where we

Are already seeing a local

Bearish reaction so we

Are locally bearish biased

And we will be expecting

A local bearish correction !

Comment and subscribe to help us grow !

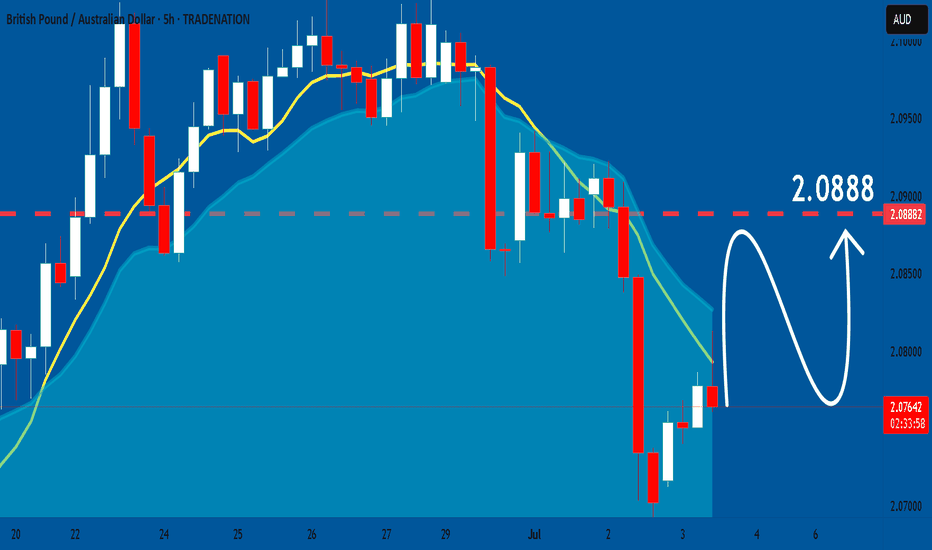

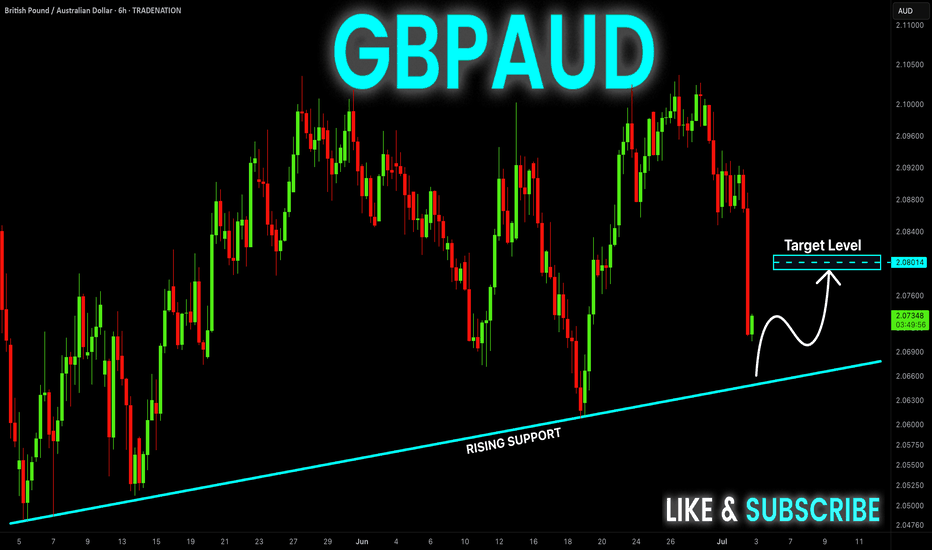

GBP-AUD Rising Support Ahead! Buy!

Hello,Traders!

GBP-AUD made a sharp

And sudden move down

And the pair is oversold

So after it retest the rising

Support line we will be

Expecting a local bullish

Correction and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPAUD Technical Analysis! BUY!

My dear friends,

My technical analysis for GBPAUD is below:

The market is trading on 2.0742 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.0862

Recommended Stop Loss - 2.0677

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

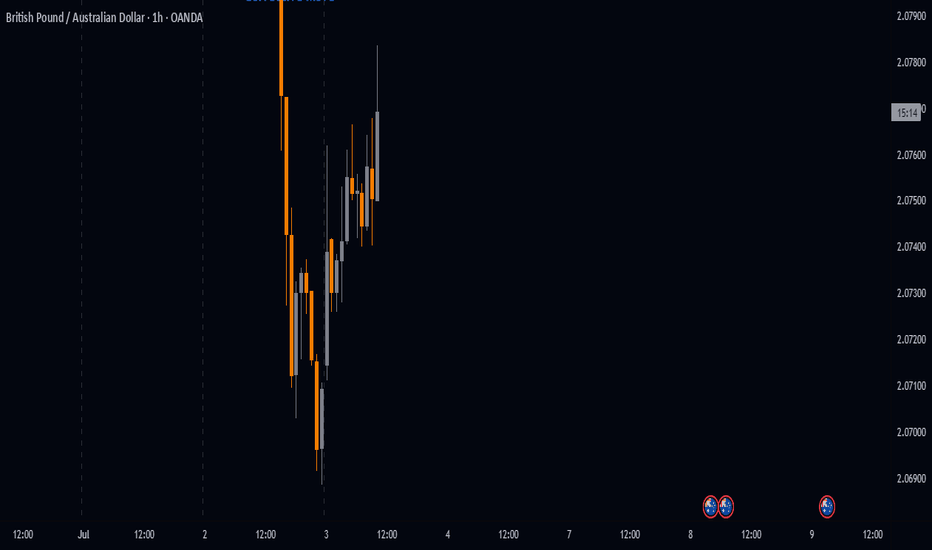

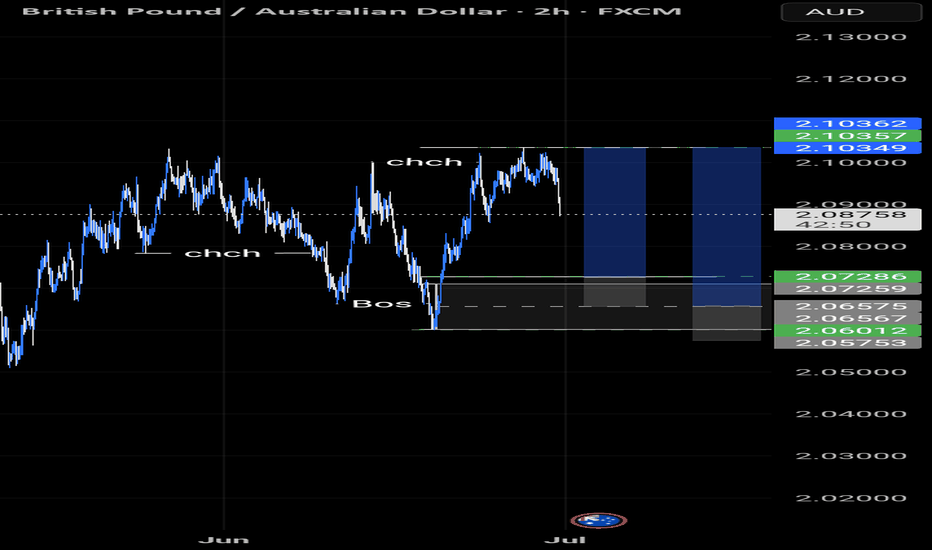

GbpAud - Sell IdeaAccording to last week's traders' report, retail traders changed the number of positions, being bullish on GA.

In this way, institutions tend to move the price in the opposite direction

In technical terms, there has been a sweep of Equal Highs on the higher-timeframes and the price, after catching all this liquidity, has changed structures. In addition, it is trading below the 4H and 1H EMA, respecting consecutive imbalances.

Let's see how this trade goes.

You vs You

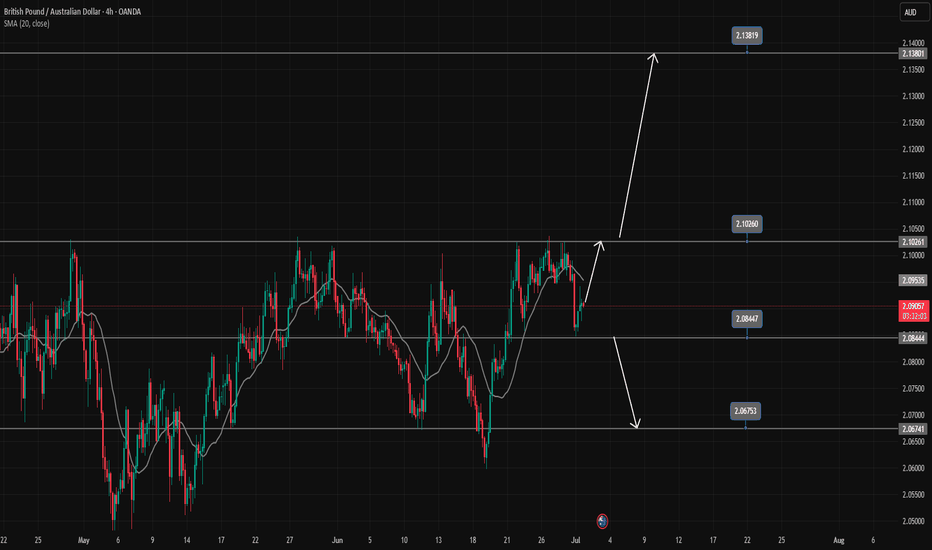

GBPAUD waiting for conditions to break out of the wide rangeGBPAUD found some buying momentum at the 2.085 support in today's trading session. In the long term, the pair's trading range is wide, extending from 2.102 to 2.067. A breakout of this range will form a new trend.

A BUY trading signal is confirmed when the pair breaks the resistance at 2.10200.

A SELL signal is confirmed when the pair breaks the support at 2.085.

📈 Key Levels

Support: 2.085 - 2.067

Resistance: 2.102 - 2.138

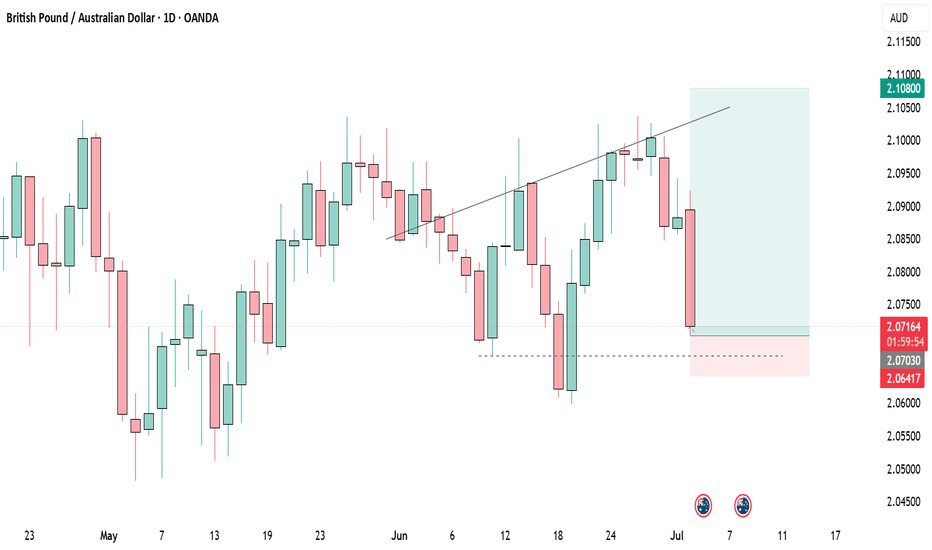

GBP/AUD Daily AnalysisPrice has found resistance at a price of 2.1000 for a number of days.

Mondays large bearish candle suggests that the price is still finding a ceiling at that price point.

This means that we could see some further selling.

If you agree with this analysis, look for a trading opportunity that meets your strategy rules.

GBPAUD FORMING A DOWNTREND STRUCTUREGBPAUD FORMING A DOWNTREND STRUCTURE IN 4H TIMEFRAME.

Market recently enter into new downtrend by forming a lower low.

Market is rejecting the price near the previous high which in important resistance level.

Price may start forming another primary trend and may remain bearish in upcoming sessions.

on lower side market may hit the targets of 2.06800 & 2.05500.

On higher side market may test the resistance level of 2.10330.

GBPAUD TRADE IDEA We're also looking at another trade idea on gbpaud.

The market is pulling back and we anticipate a pullback to our fib level before continuing on a buy trade

Let's see how the market unfolds and if we're gonna make profits or not.

TRADE IDEA UPDATE on this particular trade may not be dropped.

GBPAUD: Growth & Bullish Continuation

Balance of buyers and sellers on the GBPAUD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️