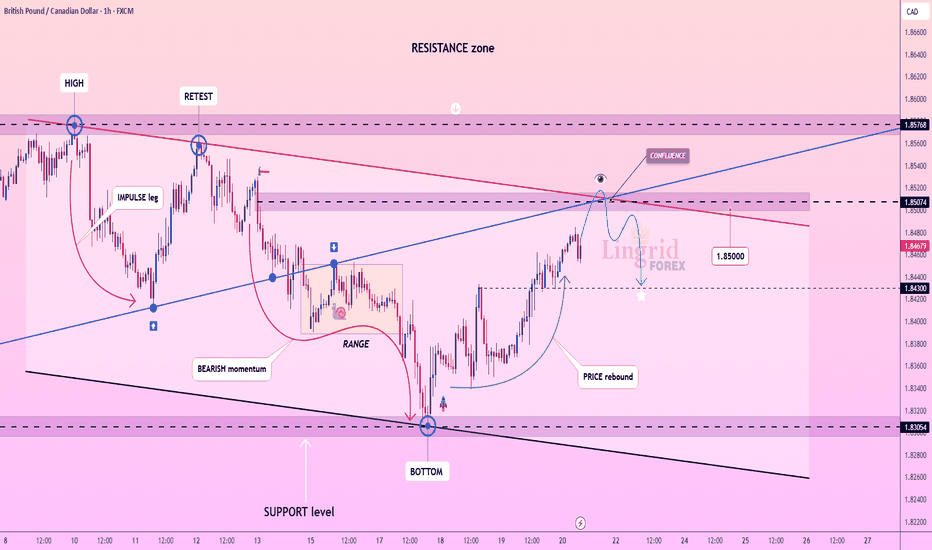

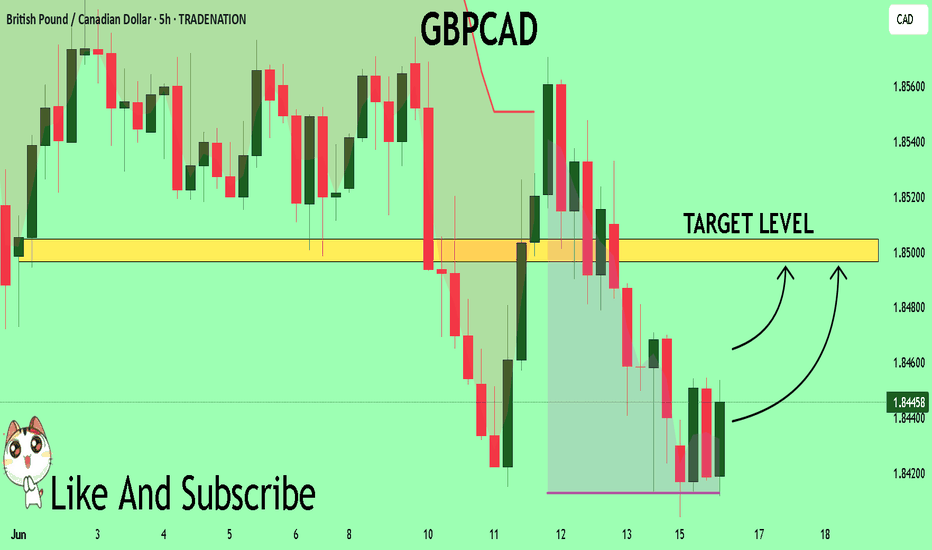

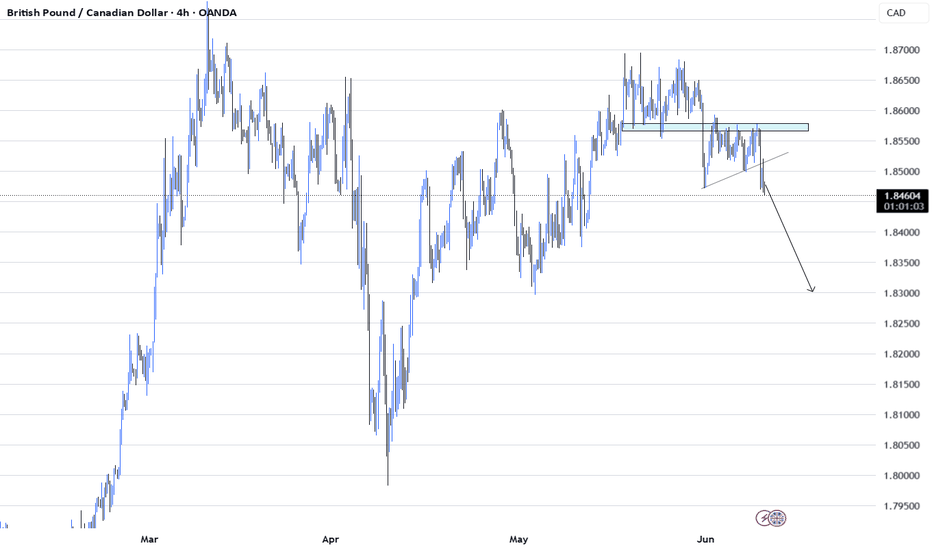

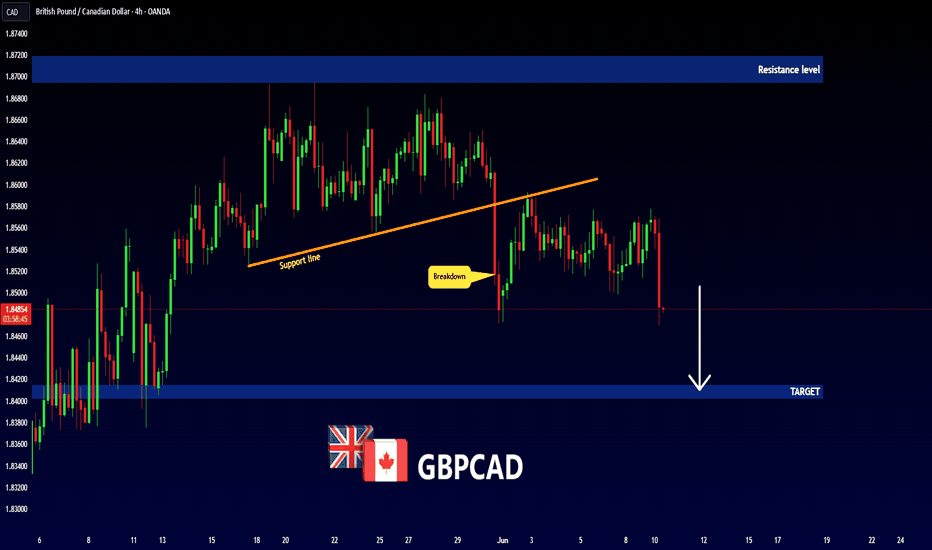

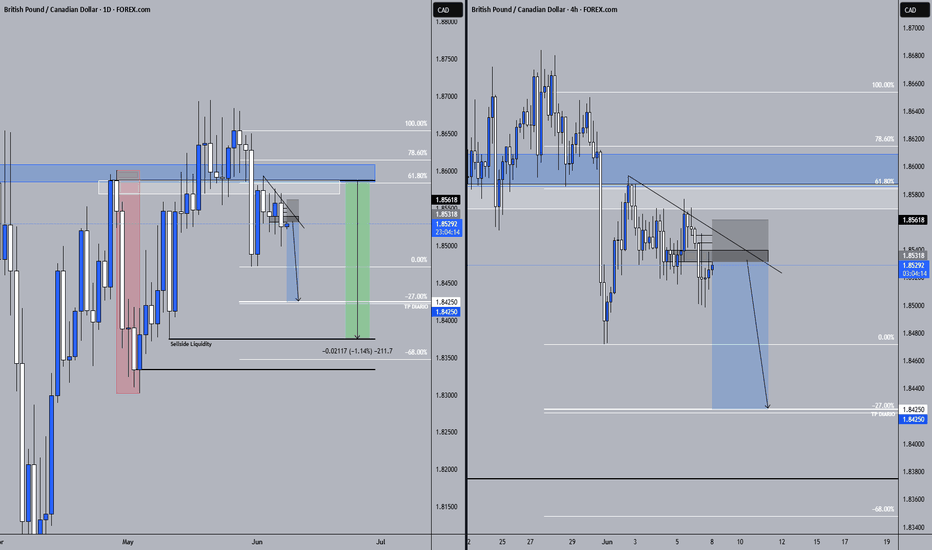

Lingrid | GBPCAD Bearish Opportunity at Confluence ZoneFX:GBPCAD is rebounding from the bottom of its support zone, forming a rounded recovery toward a confluence of resistance levels near 1.8507. Price is nearing the intersection of a downtrend line and a horizontal key level, creating a high-risk rejection zone. A failure to break above this confluence could initiate a bearish swing toward 1.8430 or lower.

📈 Key Levels

Buy zone: 1.8430–1.8460

Sell trigger: bearish rejection at 1.8507

Target: 1.8305

Buy trigger: strong close above 1.8576

💡 Risks

Breaking 1.8507 could lead to extended upside

Economic news or CAD volatility may disrupt pattern

Price may stall in the resistance cluster before choosing direction

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

GBPCAD trade ideas

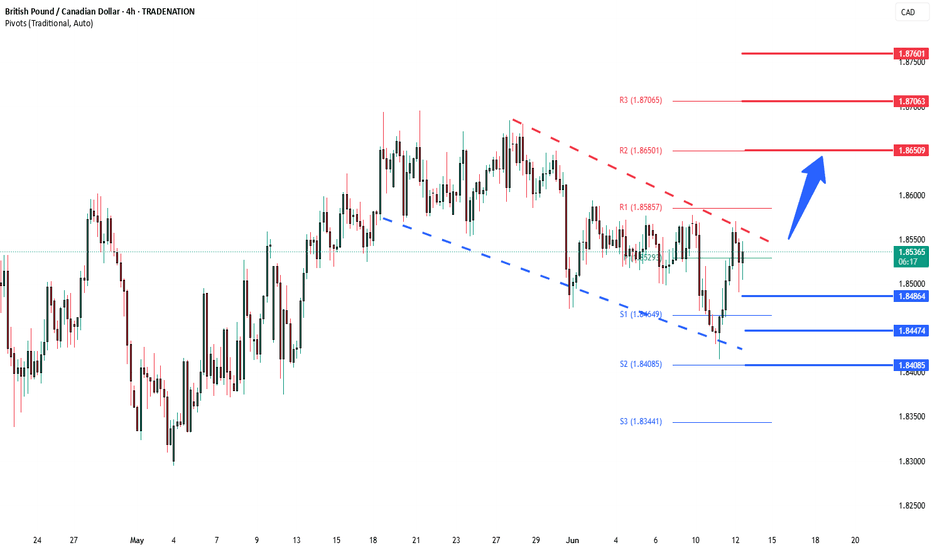

GBPCAD What Next? BUY!

My dear subscribers,

GBPCAD looks like it will make a good move, and here are the details:

The market is trading on 1.8440 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.8496

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

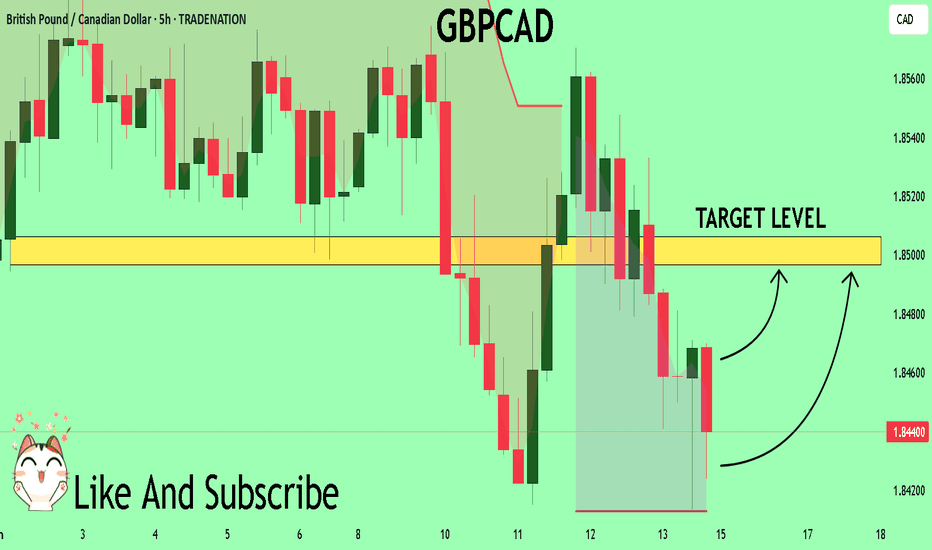

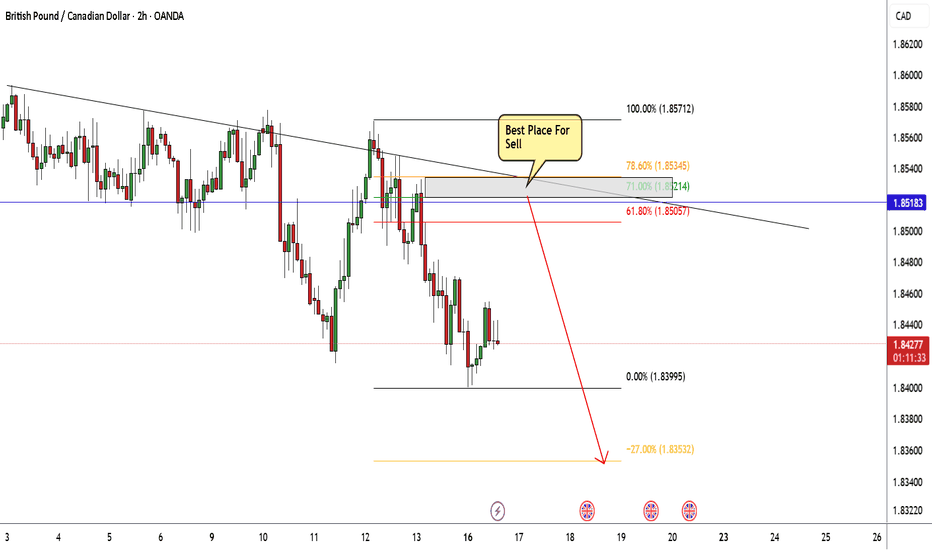

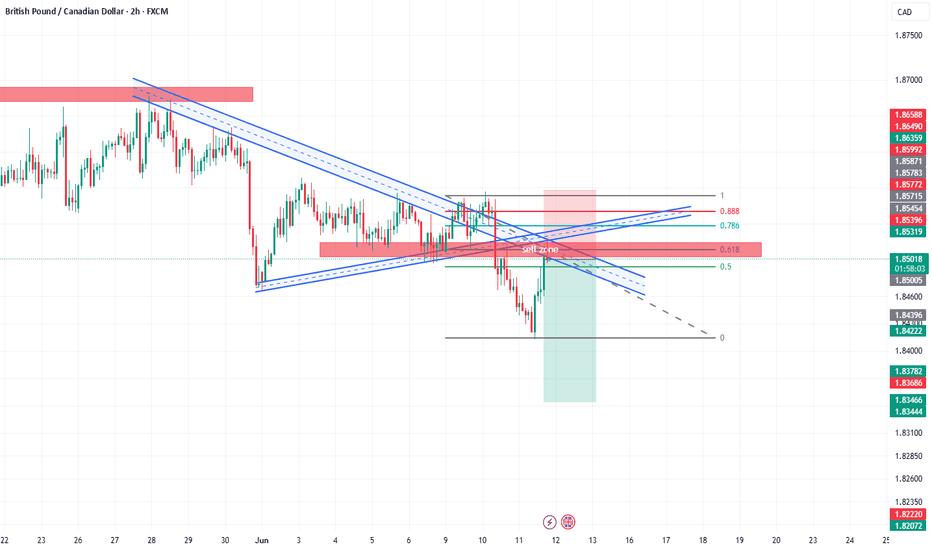

GBP/CAD Made A New Wave , Golden Place To Sell Very Clear !Here is my opinion on GBP/CAD 2H Chart . we have finally a good wave and the price made a new down trendline and moving very good , now i put my fibo indicator and i`m waiting the price to retest a broken support and also 71% fib level and give me any bearish price action and then we can enter a sell trade to create new lower low .

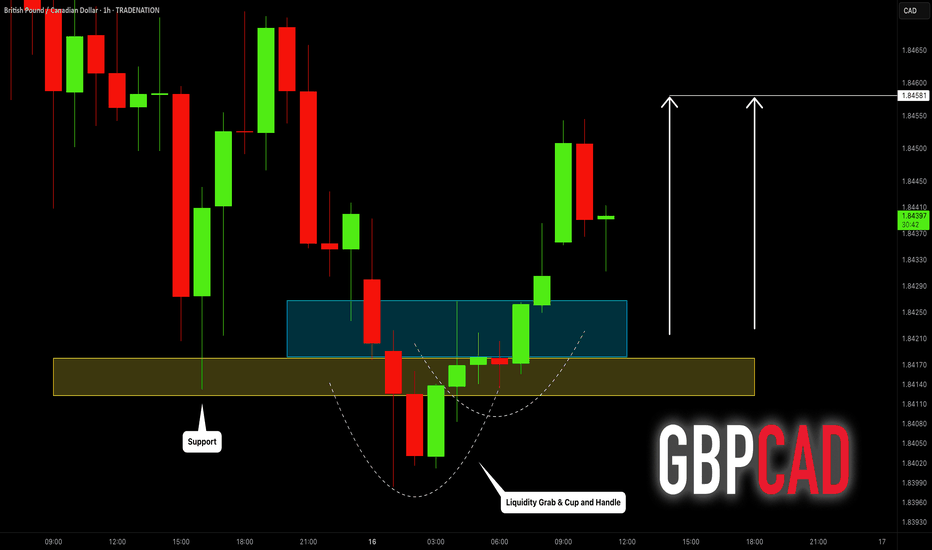

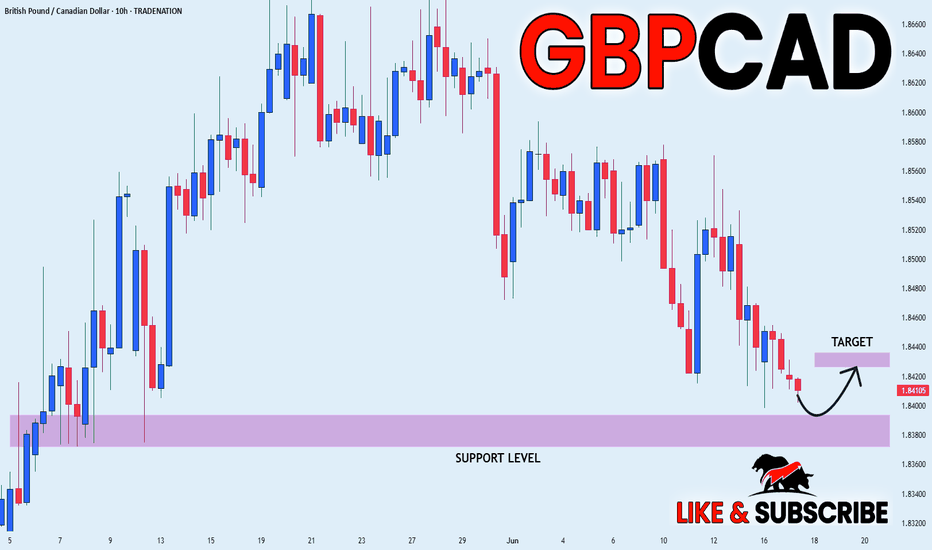

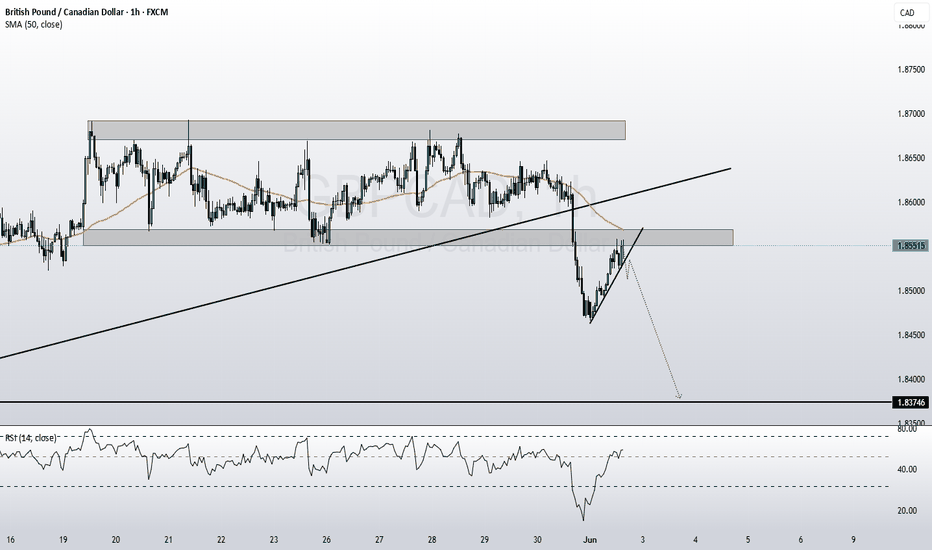

GBPCAD: Pullback After a Trap 🇬🇧🇨🇦

There is a high chance that GBPCAD will pull back

from the underlined support.

The price started to grow after a false violation of that and a confirmed bearish trap.

Goal - 1.8458

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

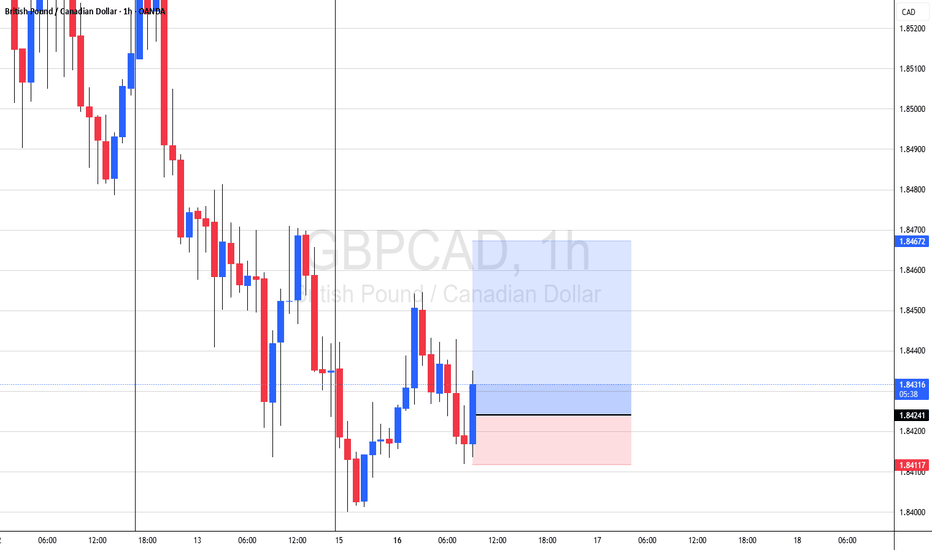

GBP_CAD RISKY LONG|

✅GBP_CAD is set to retest a

Strong support level below at 1.8380

After trading in a local downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 1.8426

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCAD Technical Analysis! BUY!

My dear friends,

GBPCAD looks like it will make a good move, and here are the details:

The market is trading on 1.8449 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.8496

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

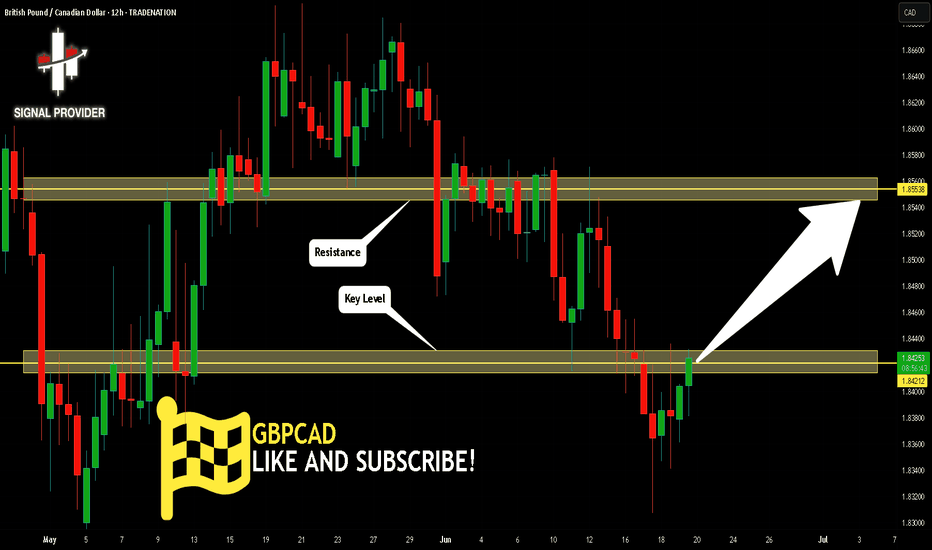

GBPCAD Will Move Higher! Long!

Please, check our technical outlook for GBPCAD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1.842.

Considering the today's price action, probabilities will be high to see a movement to 1.855.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

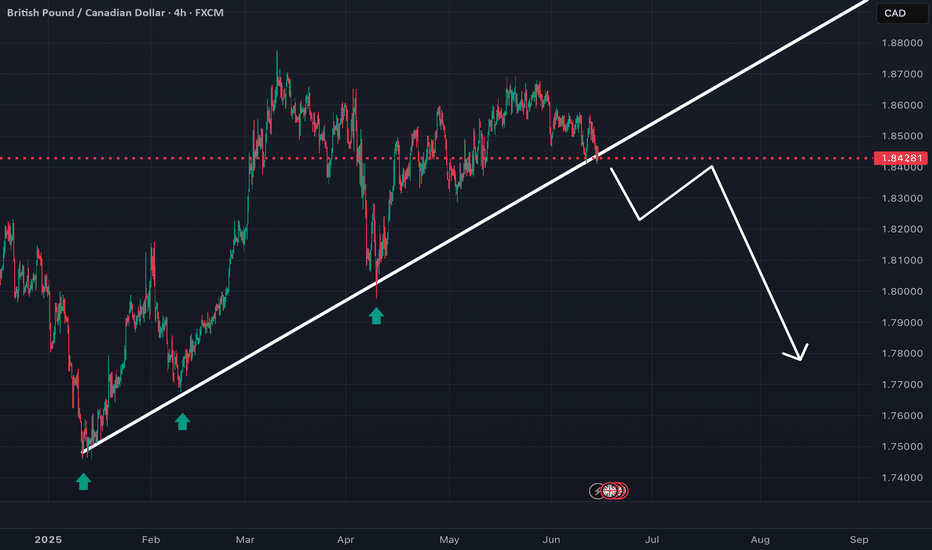

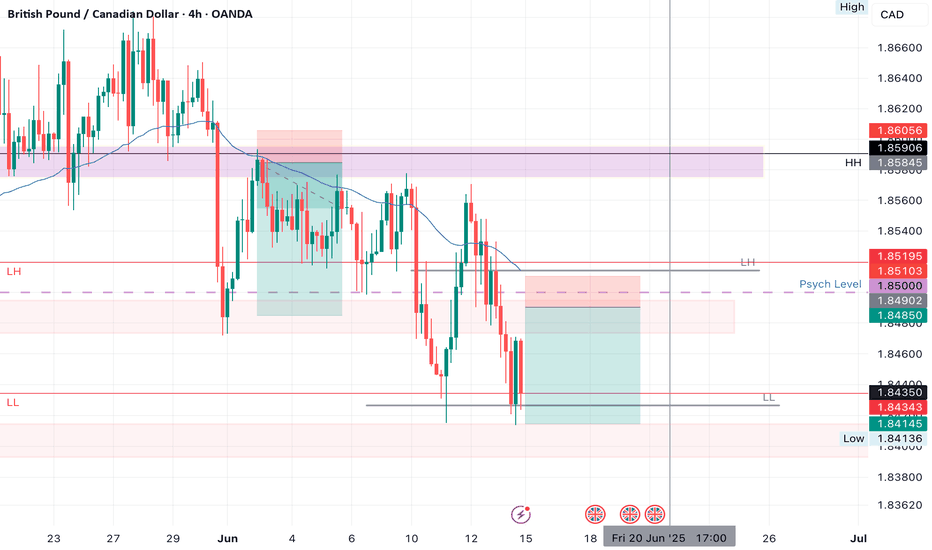

GBPCAD SHORTMarket structure bearish on HTFS DH

entry at Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 1.85000

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 3.77

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

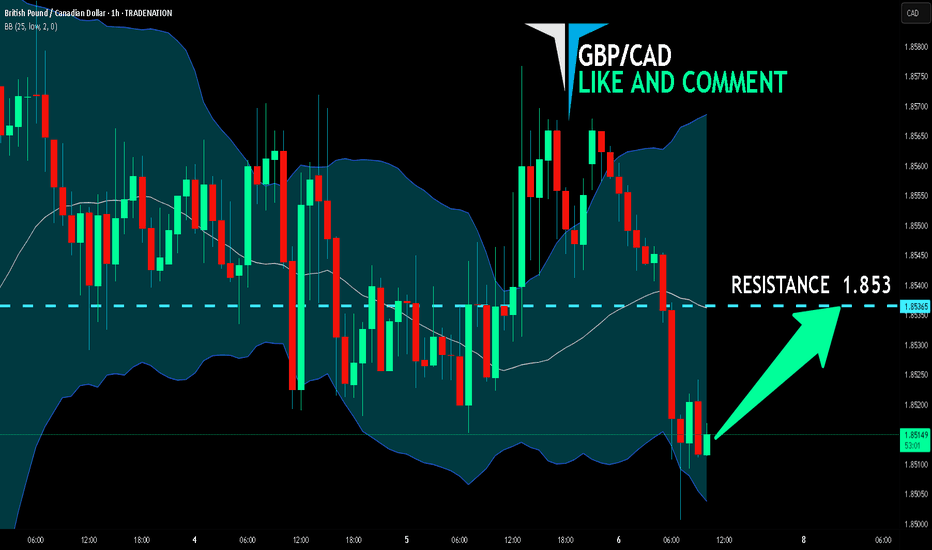

GBP/CAD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

GBP/CAD pair is trading in a local uptrend which know by looking at the previous 1W candle which is green. On the 1H timeframe the pair is going down. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 1.853 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

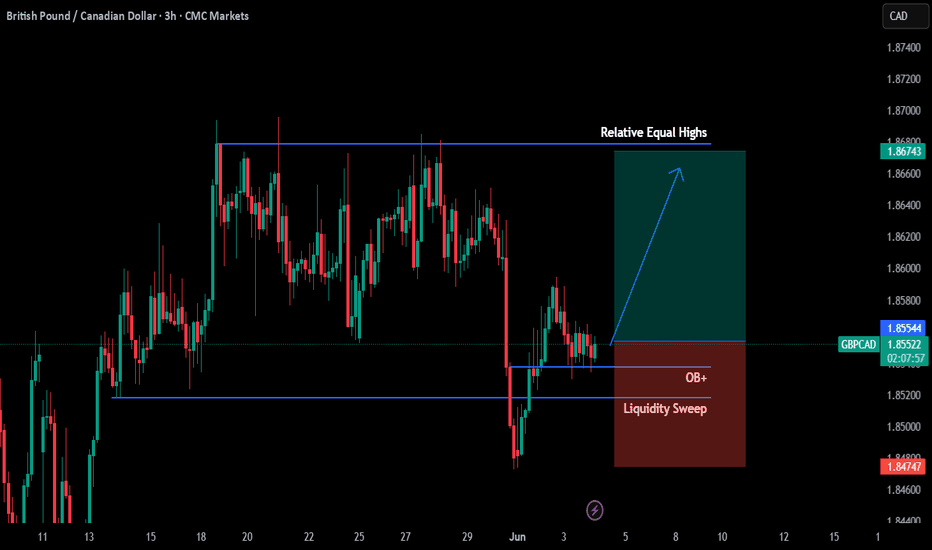

GBP/CAD Potential Upward Movement💡 Buy Market Order @ 1.85544

🎯 Target Profit 1.86743

🛑 Stop Loss 1.84747

❌ Do not risk more than 1% of your account on each trade

Description:

The price has swept liquidity under the swing lows and bounced back quickly. GBP/CAD is in a consolidation mode before a new move upward all the way up toward 1.86 mark.

-------------------------------------------------------------------------------------

Please press “Like” if you appreciate the trading idea 👍

“Follow” for more trading ideas in the future 👀

“Comment” below to share your thoughts with us and other traders 👥

-------------------------------------------------------------------------------------

Risk Disclaimer: All trading ideas published by “PriceActionDesk” are for educational purposes only. These posts can help you to enhance your trading skills, but please do your own research before opening any trading position. ⚠️

-------------------------------------------------------------------------------------

🙂 Good Luck!

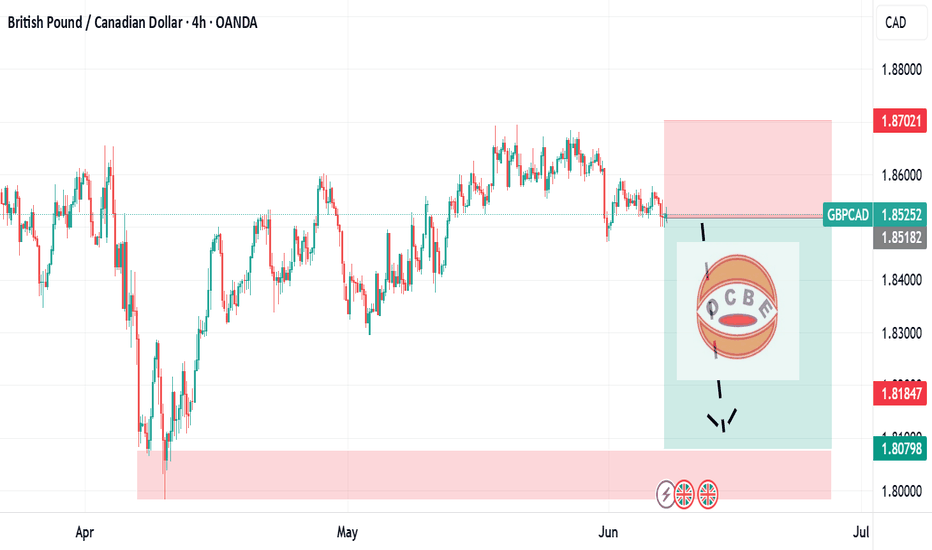

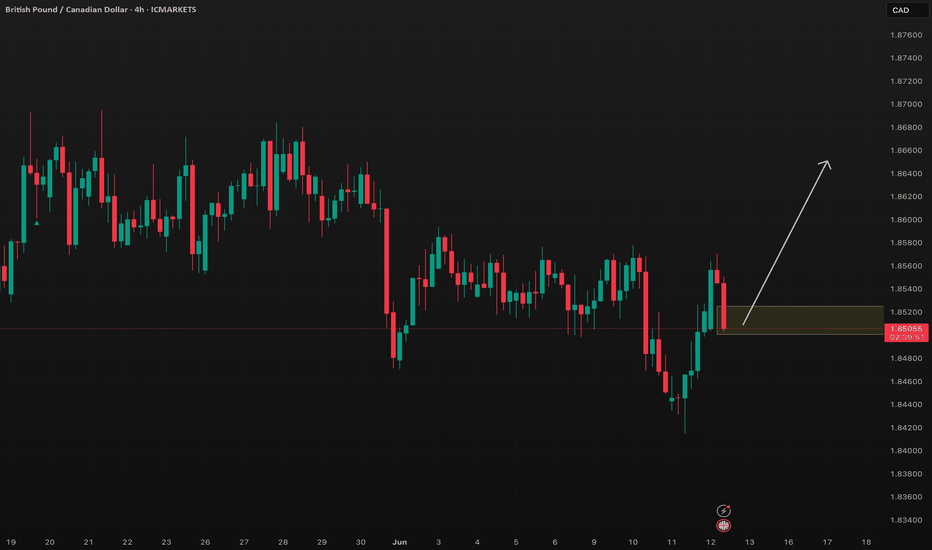

GBPCAD Bullish Flag continuation pattern developing GBP/CAD maintains a bullish bias, supported by a well-established rising trend. Recent intraday movement suggests sideways consolidation, which may serve as a base for the next upward leg if key support holds.

Key Level: 1.8530

This zone marks the previous consolidation range and serves as a critical support level.

Bullish Scenario (bounce from 1.8530):

A successful retest and rebound from 1.8530 would reinforce the bullish outlook.

Upside targets include:

1.8720 – Near-term resistance

1.8760 – Previous swing high

1.8830 – Long-term resistance zone

Bearish Scenario (break below 1.8530):

A confirmed daily close below 1.8530 would weaken the bullish structure.

Potential downside support levels:

1.8490 – Initial support

1.8460 – Deeper retracement level

Conclusion

The outlook for GBP/CAD remains constructive as long as 1.8530 holds. A bullish bounce from this level could pave the way for continuation toward 1.8720 and higher. However, a daily close below 1.8530 would shift the bias to neutral-to-bearish, exposing the pair to further downside toward the 1.8460 region. Traders should closely monitor price action at 1.8530 for directional confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPCAD BUY TRADE PLAN

## 📘 ForexGPT Elite Trade Plan – GBP/CAD

🔹 *Last Updated: June 12, 2025 –

🔹 *Market Type: Swing-to-Intraday Breakout with Optional Pullback Re-entry*

---

### 🧠 Multi-Timeframe Technical Summary:

🔍 **1H Chart**

* Price broke above key structure resistance (1.8525) with momentum.

* Minor rejection wicks at 1.8550 zone → could lead to shallow pullback (buy-the-dip opportunity).

* Short-term support now forms at 1.8520–1.8500.

🔍 **4H Chart**

* Clean breakout above recent double-bottom neckline (1.8525).

* Bullish structure, likely to attempt 1.8590–1.8650 range retest.

* Ideal to buy near support with confirmation OR on fresh breakout continuation.

🔍 **Daily Chart**

* Bullish bounce off 1.8420–1.8440 demand zone confirmed.

* Room to move toward 1.8650–1.8730 range highs.

* Trend bias is recovering from corrective phase.

🔍 **Weekly Chart**

* Holding mid-range compression, bullish structure intact.

* Higher lows since March support upside continuation bias.

---

🎯 Primary Trade Plan – Breakout Continuation Buy

Parameter Value

Trade Type Swing-to-Intraday

Order Type ✅ Buy Limit at 1.8525/05 (pullback entry)

SL Below 1.8440 (safe zone under structure)

TP1 1.8590

TP2 1.8650

TP3 (extended) 1.8730 (only if strong daily momentum)---

### 🔁 Alternate Entry Plan – *Manual Buy on Confirmation*

* Wait for price to **retest 1.8525-05** and show **bullish rejection candle** on H1 or M30.

* Entry: **Market Buy** on bullish engulfing / pin bar confirmation

* Same SL and TP as above.

---

### ⚠️ Bearish Scenario (Low Probability)

* If price shows strong **bearish engulfing from 1.8550–1.8560**, invalidating the breakout:

* **Sell Entry**: 1.8500

* **SL**: Above 1.8565

* **TP1**: 1.8445

* **TP2**: 1.8390 (if downside accelerates)

---

### 🧠 ForexGPT Forecast Summary:

> “If 1.8525/05 holds as new support, GBP/CAD is primed for a rally toward 1.8650. If it breaks back below 1.8510 and forms bearish engulfing, then bears may regain control. At this moment, I favor the upside with 70% probability.”

---

### ✅ What I’d Personally Do:

> Place a **Buy Limit at 1.8505**, **SL below 1.8440**, target **1.8650**.

> If price revisits 1.8505 but shows indecision, I’d wait for a bullish confirmation candle before manually buying.

---

⚠️ **Risk Note:**

Trading forex involves substantial risk. Never risk more than you can afford to lose. Use proper lot sizing, especially during key news (BOE/CAD data nearby).

---

🧠 **Pro Tip:**

"Watch for clean retests and candle confirmation. Always let the market come to you. Patience = Profits."

---

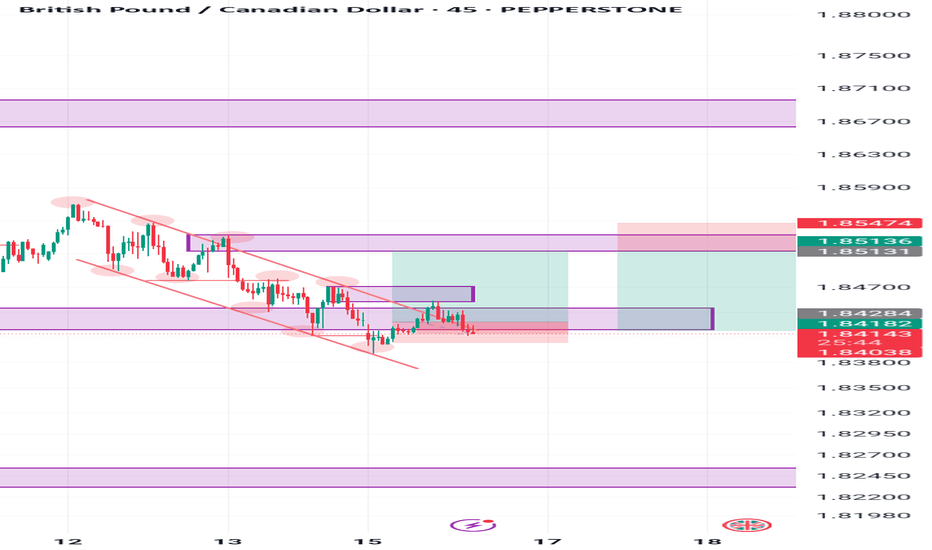

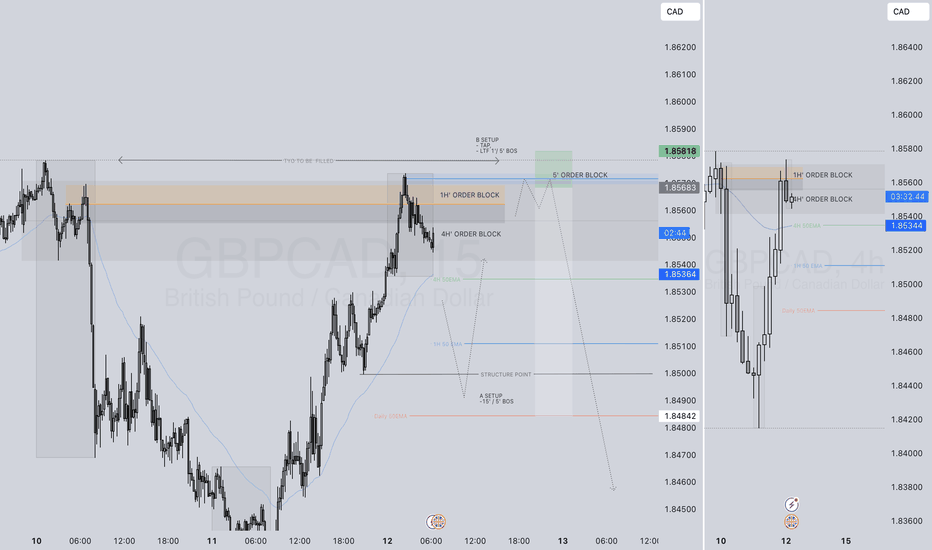

GBPCAD SHORT FORECAST Q2 W24 D12 Y25GBPCAD SHORT FORECAST Q2 W24 D12 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly highs POI

✅1H order block rejection

✅4H order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X