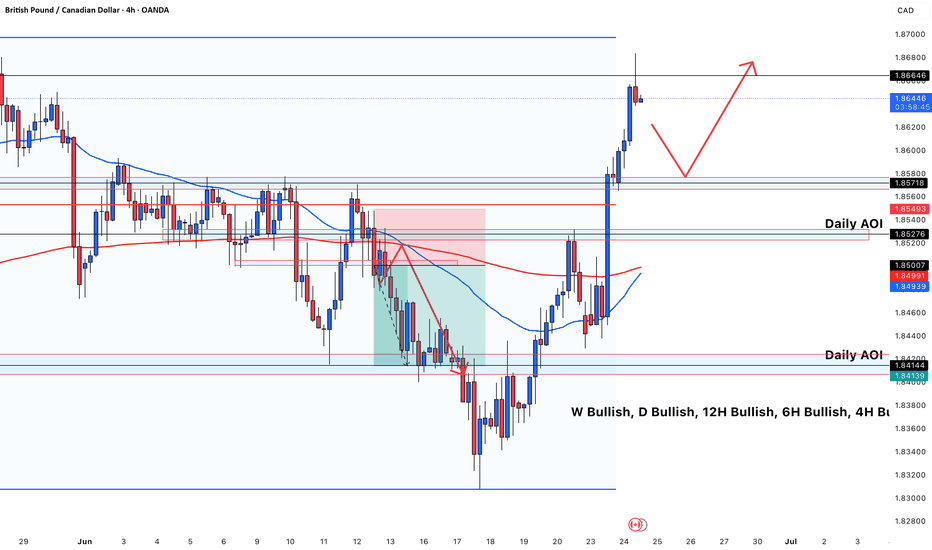

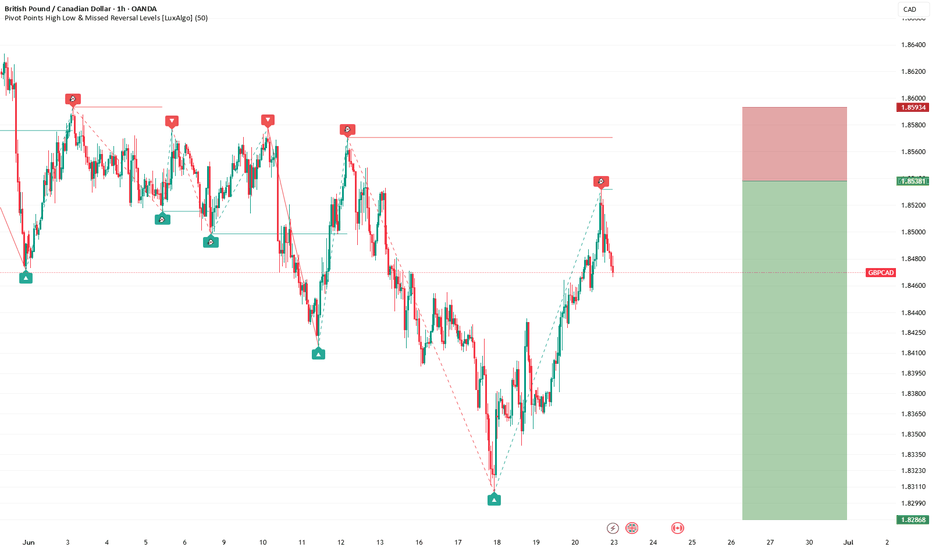

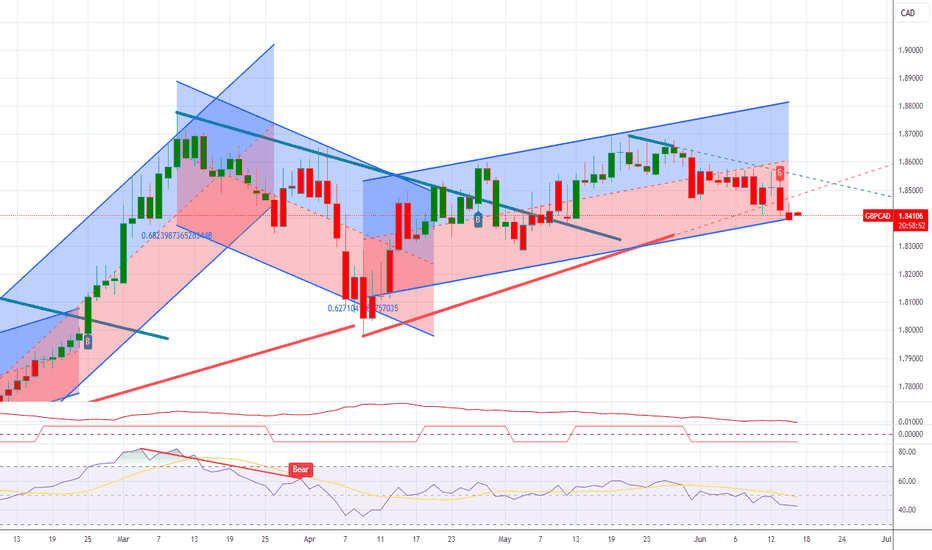

Ready for the Long?This is a **GBP/CAD 4H chart** with a clear **bullish bias** across multiple timeframes (W, D, 12H, 6H, 4H).

### Key Points:

* **Market Structure**: Strong bullish breakout above previous resistance zones, confirming a shift in momentum.

* **Current Price**: 1.8641, just below a key resistance level at **1.8664**.

* **Projection**: Expecting a **pullback** towards the **1.8571–1.8549 Daily AOI** zone, followed by a **bullish continuation** to the upside.

* **EMAs**:

* Price is above both the **50 EMA (blue)** and **200 EMA (red)**, confirming upward momentum.

* **Volume & Liquidity Zones**:

* The breakout cleared previous liquidity, indicating strength.

* The next major resistance is untested, suggesting more room for upside after a healthy retracement.

### Summary:

GBP/CAD is in a **strong uptrend**. After a short-term correction into the Daily AOI (support), a **continuation toward new highs** is anticipated if bullish order flow continues.

GBPCAD trade ideas

GBP/CADPrice action trading is a methodology in financial markets where traders make decisions based on the actual price movements of an asset over time, rather than relying heavily on technical indicators or fundamental analysis. It involves observing and interpreting patterns and trends in price charts to predict future price movements.

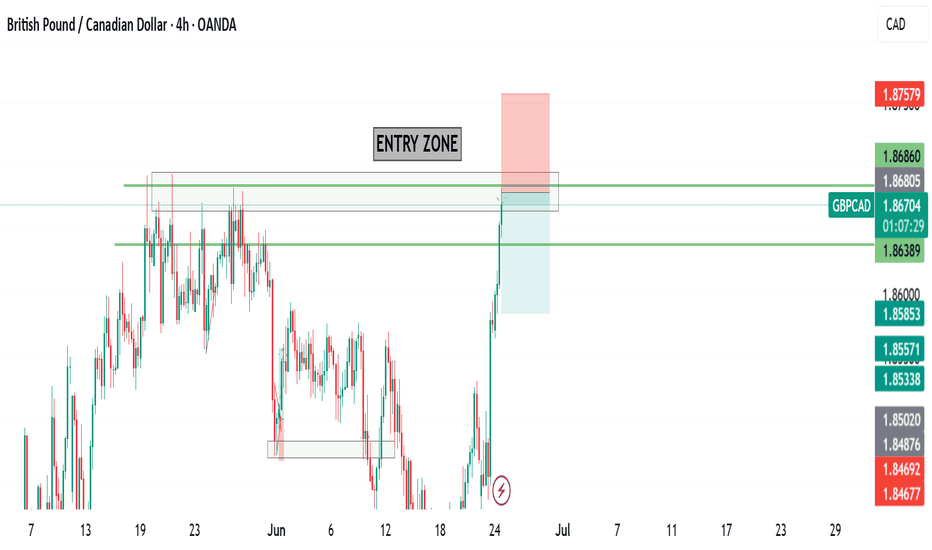

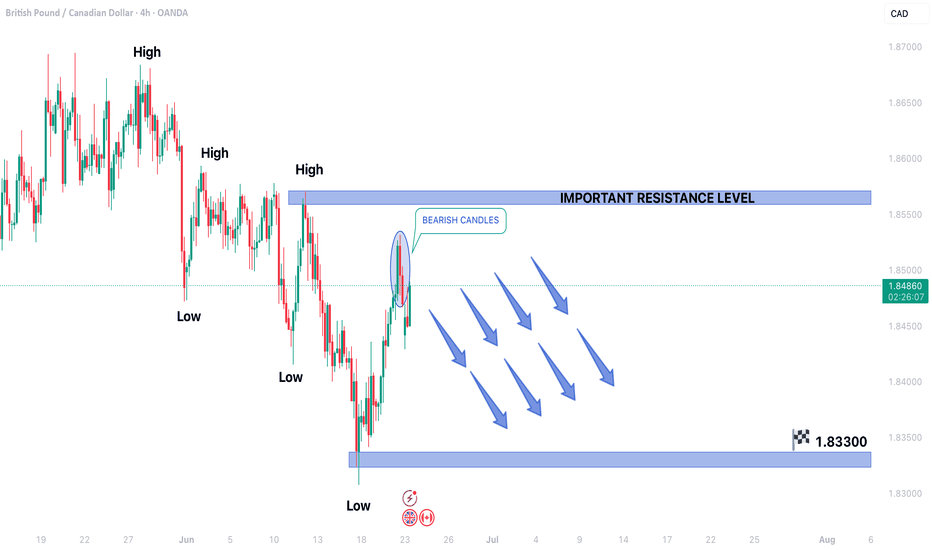

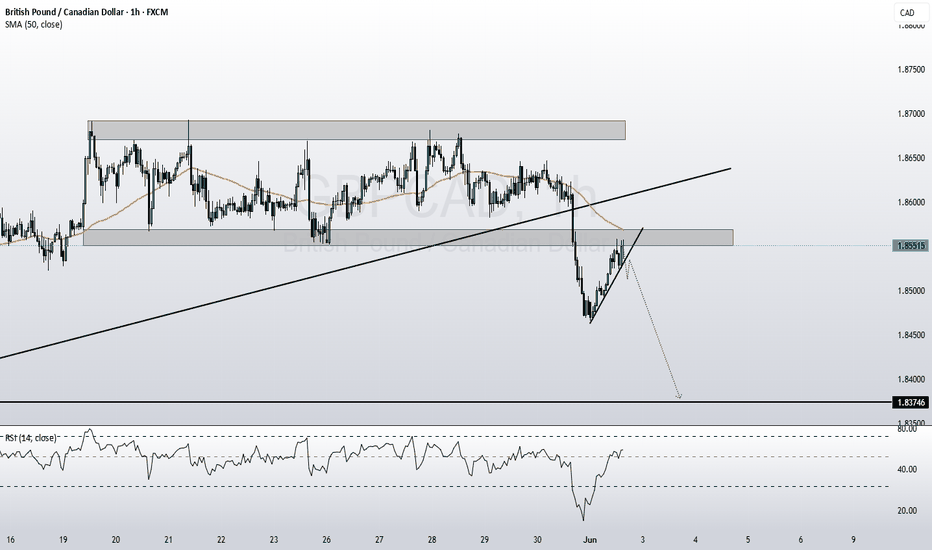

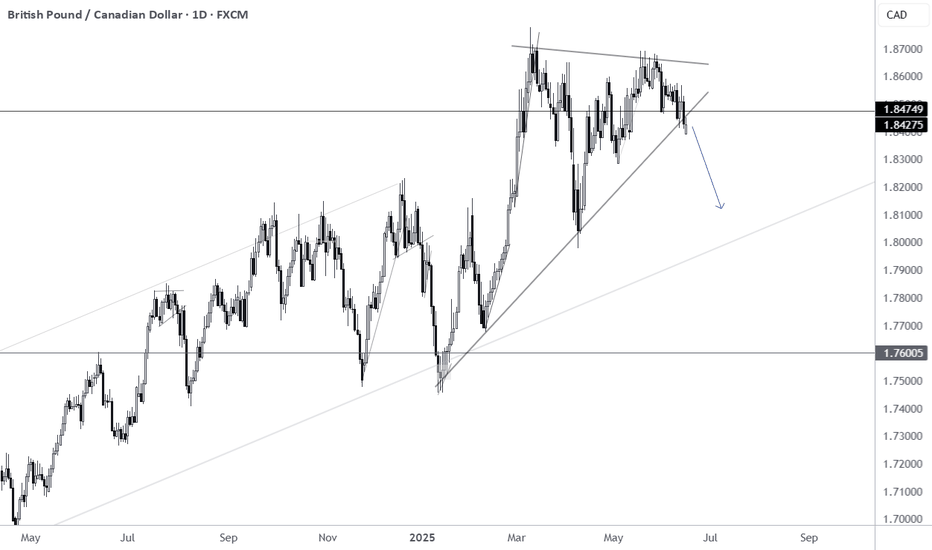

Technical Zones & StructureTechnical Zones & Structure

🔹 Bearish Rejection Zone (Supply Area)

Price tapped into a strong supply zone at the top blue box, aligning with trendline resistance.

Immediate reaction followed by sharp bearish candle shows potential liquidity grab and smart money sell-off.

🔹 Demand Zone

Mid-chart gray/blue zone is a key reaction area that price may retest before confirming further downside.

Market Structure

I’ve drawn a rising wedge, which price has already broken down from = bearish reversal signal.

Pullback anticipated into the broken structure zone (gray) → potential entry zone for short.

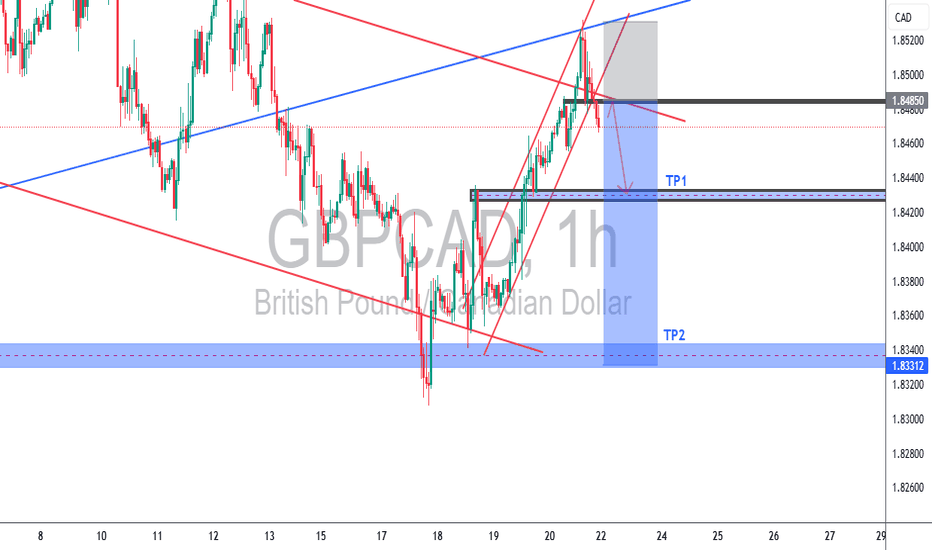

Trade Idea (as visualized)

Sell Setup Plan:

✅ Ideal Entry: Retest of broken wedge / demand-turned-supply (~1.84750–1.84900)

🎯 Target 1: 1.84300 zone

🎯 Target 2: 1.83500 (bottom demand zone)

🛑 SL: Above previous high / upper blue supply (~1.85300+)

SET and FORGET

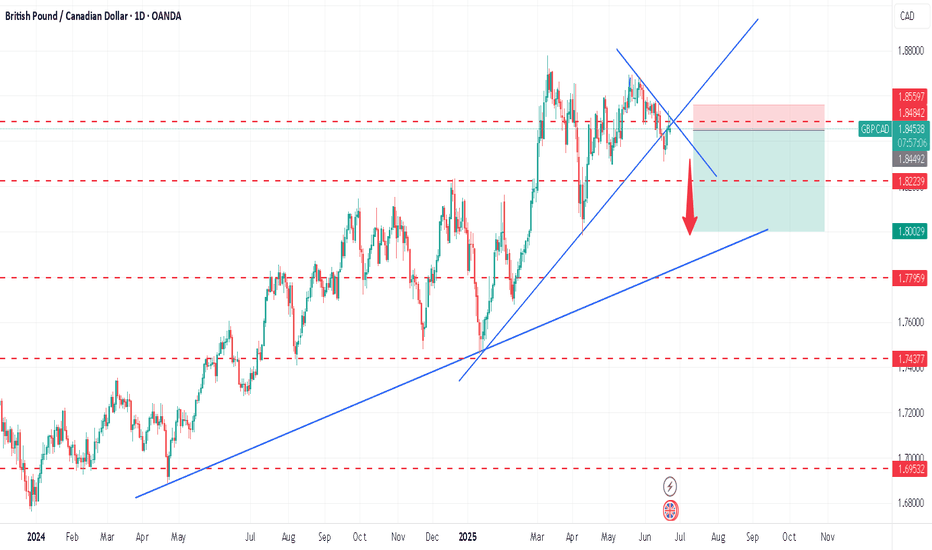

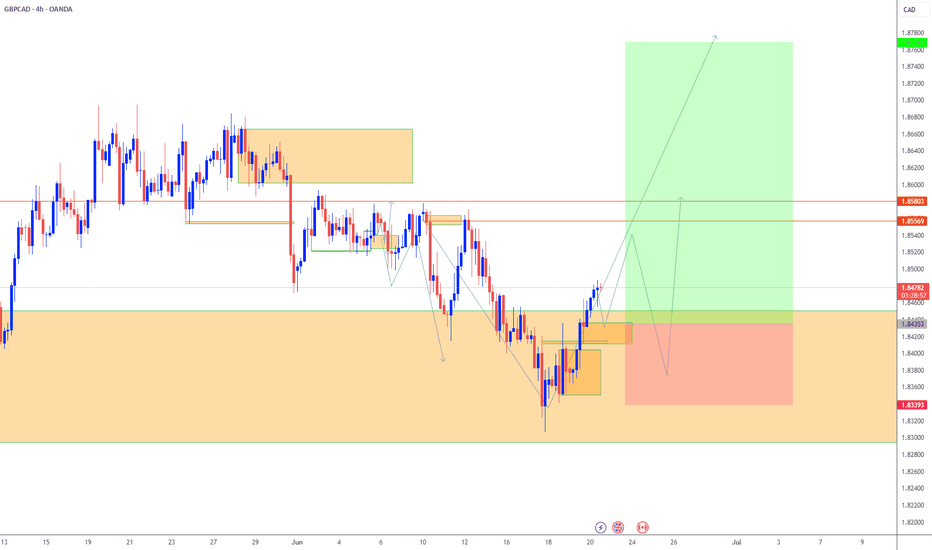

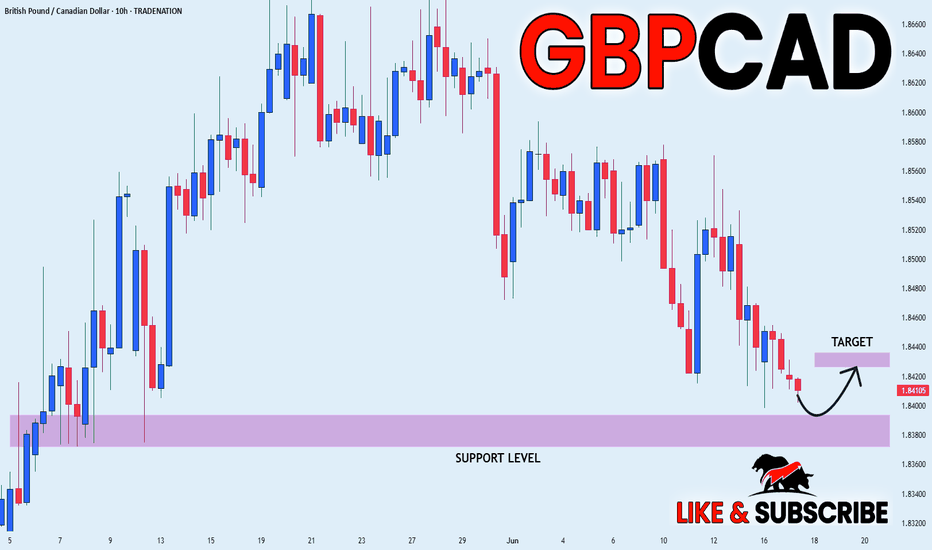

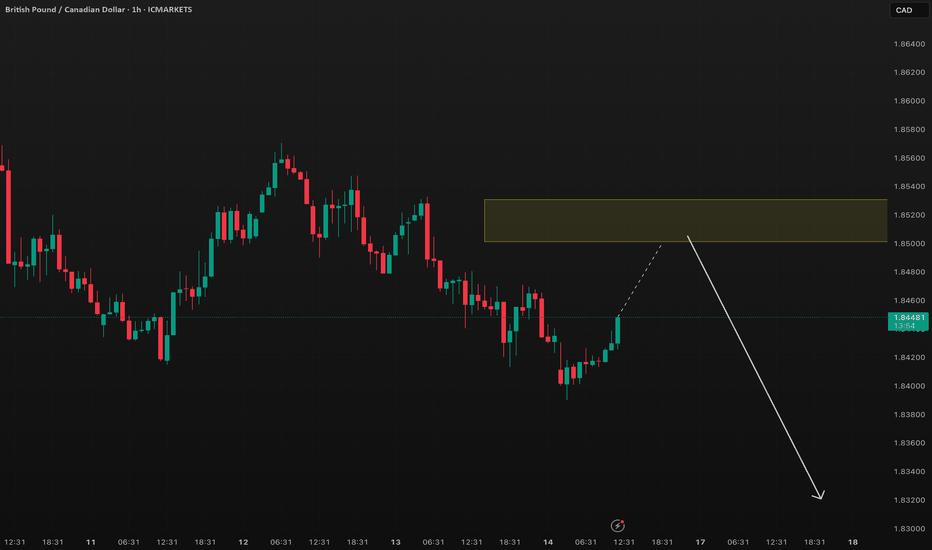

GBPCAD CONTINUING DOWNTREND STRUCTUREGBPCAD CONTINUING DOWNTREND STRUCTURE IN 4H TIME FRAME.

Price forming Lower Lows & Lower Highs.

After secondary trend market started forming bearish candles.

Showing signal of seller's entry in the market.

Market may remain bearish in upcoming trading sessions.

On lower side market may hit the target of 1.83300.

On higher side 1.85750 may act as a important resistance level for the market.

Trade Idea: Sell GBPCAD (Short-Term Exhaustion Setup)### **📉 Trade Idea: Sell GBPCAD (Short-Term Exhaustion Setup)**

**Bias:** 🔻 Short-Term Bearish | 🧭 Medium-Term Neutral

**Goal:** Catch the dip before trend resumes or price flattens

---

### **💡 Why Sell?**

**🇬🇧 GBP:**

* Sluggish data 😴

* BoE expected to cut 🔻

* Traders losing interest in the pound

**🇨🇦 CAD:**

* Oil holding strong = CAD backed 🛢️

* Inflation still sticky = no rush to ease 🧨

* CAD showing quiet strength vs peers

---

### **📊 Technical Feel (Not Exact):**

* **Momentum looks tired:** Price has pushed up a few times but keeps slowing down 🐌

* **Structure stretched:** Feels like it's gone too far too fast — a breather makes sense 🧘

* **Buyers losing steam:** Recent pushes feel weaker — candles getting smaller, follow-through fading 🔍

* **Volume thinning:** Less excitement at these highs — fewer traders chasing 🚶♂️

* **Indicators turning soft:** Momentum tools like RSI/MACD feel heavy — not reversing, just sagging 🧯

* **Drift from moving averages:** Price looks disconnected from its base — likely to snap back 👣

---

### **⚠️ Invalidation:**

> If the move gathers fresh energy and breaks recent highs with speed — bulls still in charge ⚡

---

### **🎯 Summary:**

GBP feels overextended, CAD quietly strong.

Charts aren’t screaming sell — but whispering “this move’s tired.”

Short-term dip likely before the next decision point.

---

Let me know if you'd like a one-liner caption or want this fitted into a trading journal style!

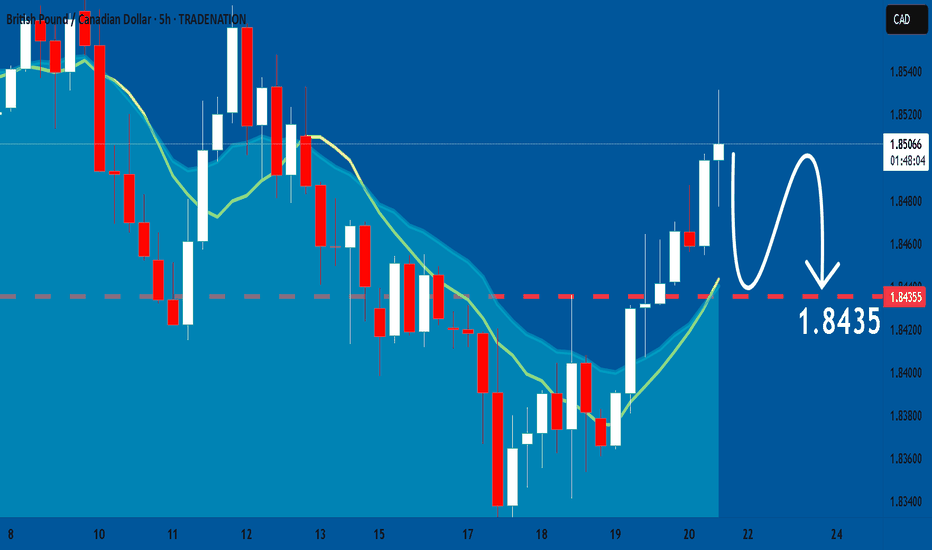

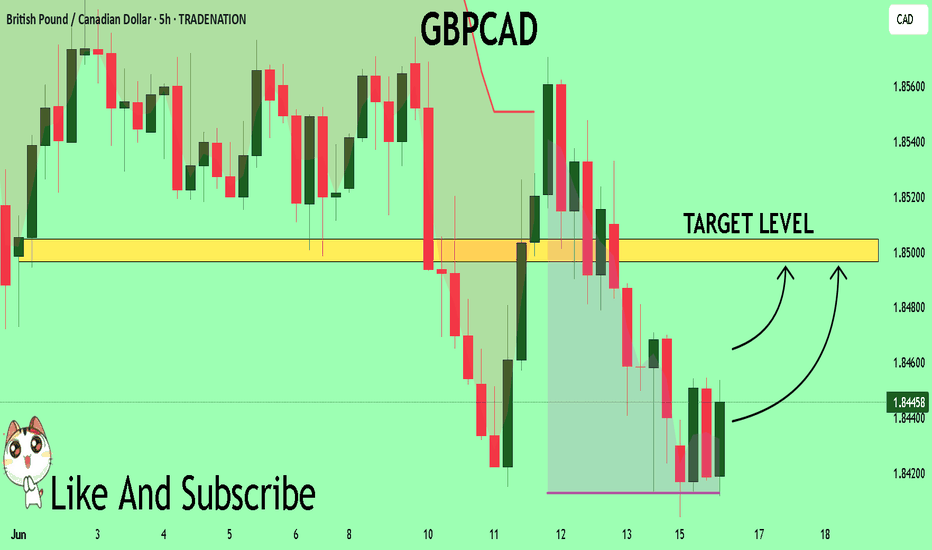

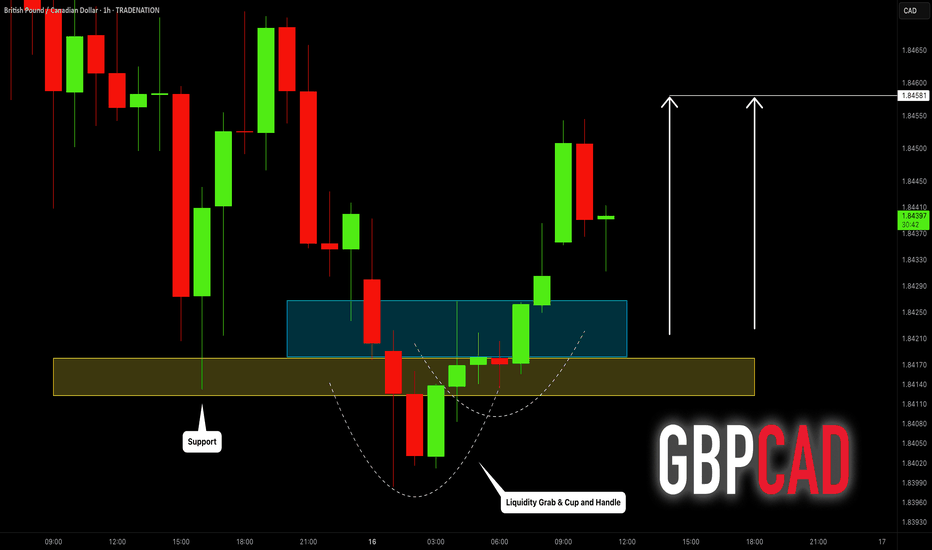

GBPCAD: Expecting Bearish Movement! Here is Why:

Balance of buyers and sellers on the GBPCAD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

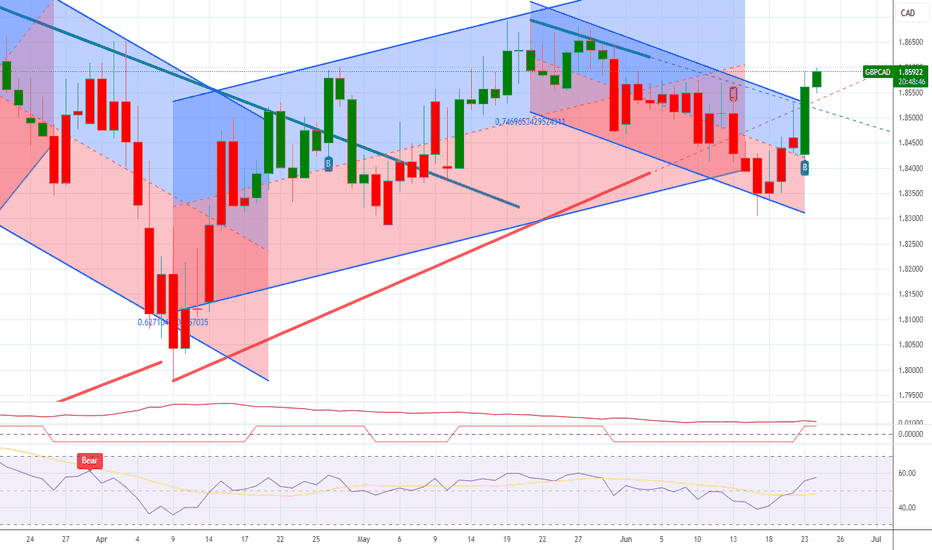

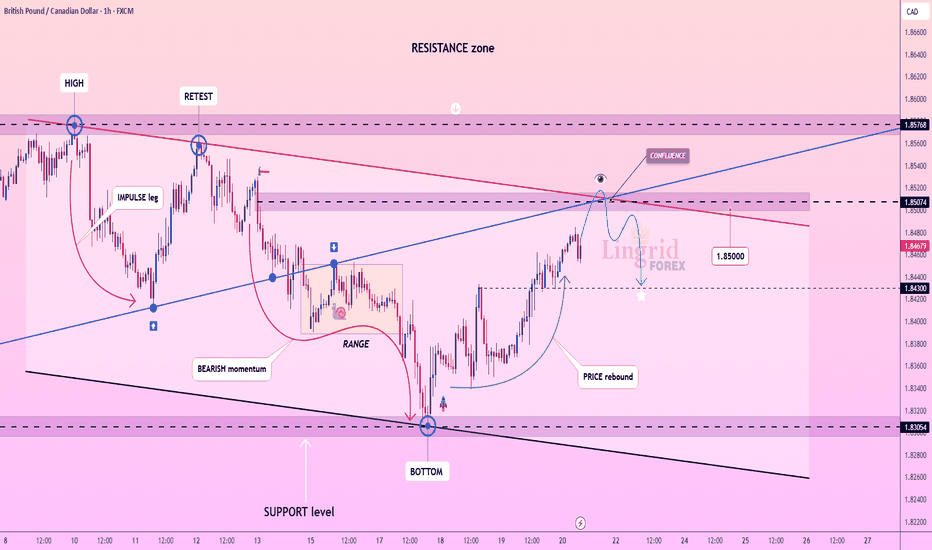

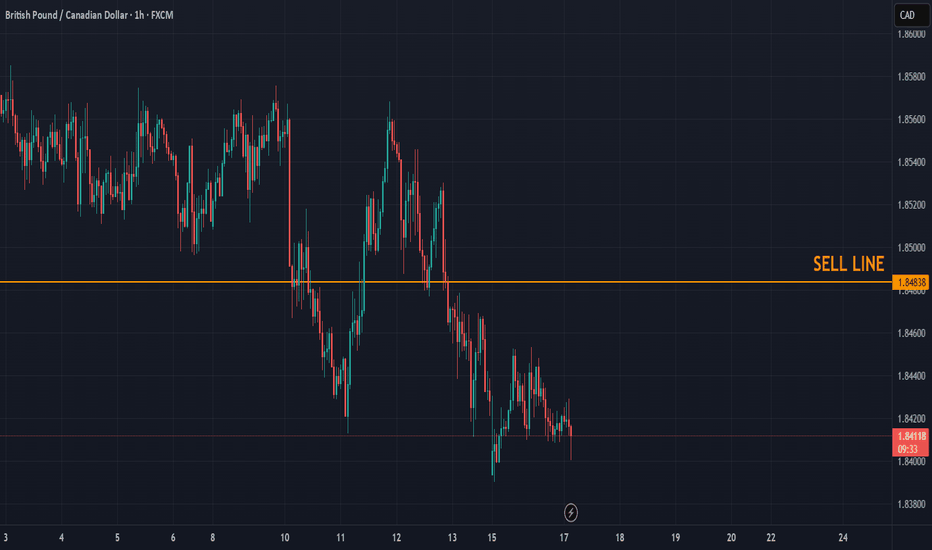

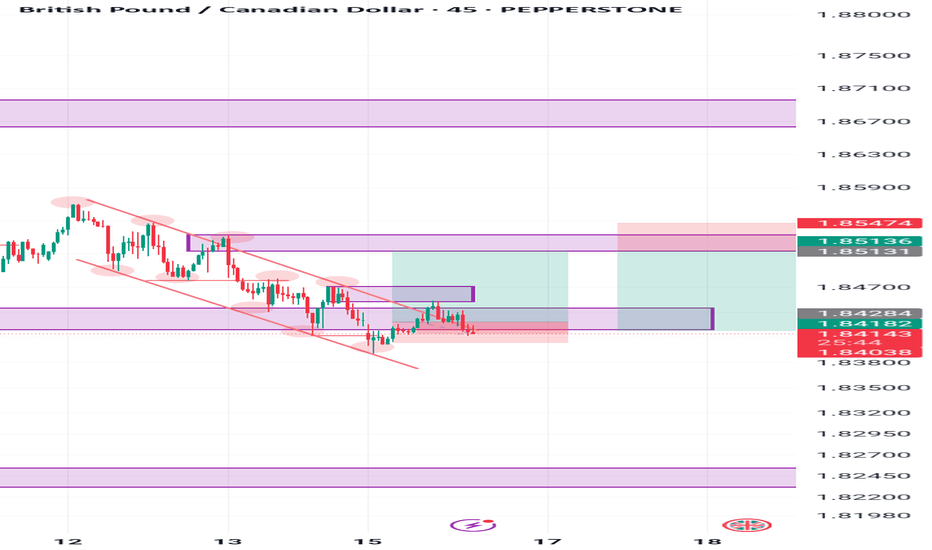

Lingrid | GBPCAD Bearish Opportunity at Confluence ZoneFX:GBPCAD is rebounding from the bottom of its support zone, forming a rounded recovery toward a confluence of resistance levels near 1.8507. Price is nearing the intersection of a downtrend line and a horizontal key level, creating a high-risk rejection zone. A failure to break above this confluence could initiate a bearish swing toward 1.8430 or lower.

📈 Key Levels

Buy zone: 1.8430–1.8460

Sell trigger: bearish rejection at 1.8507

Target: 1.8305

Buy trigger: strong close above 1.8576

💡 Risks

Breaking 1.8507 could lead to extended upside

Economic news or CAD volatility may disrupt pattern

Price may stall in the resistance cluster before choosing direction

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

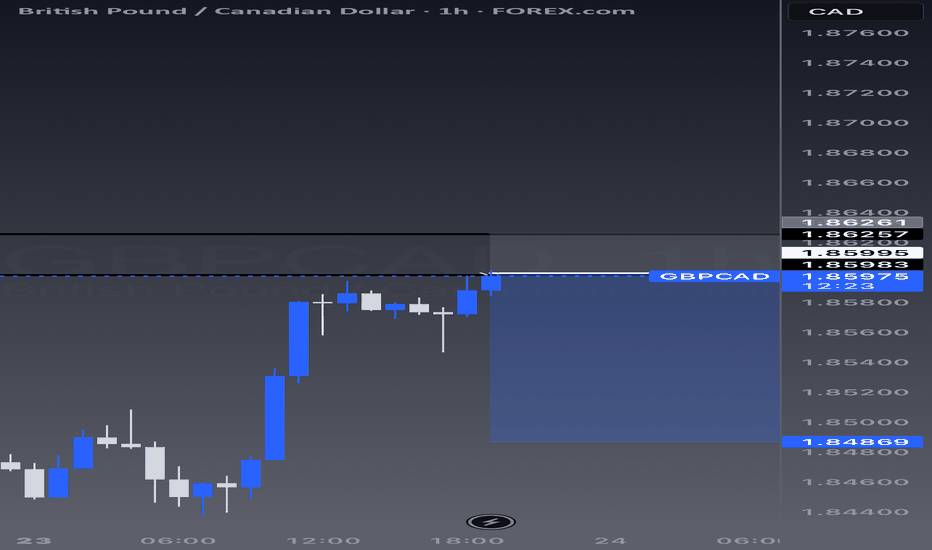

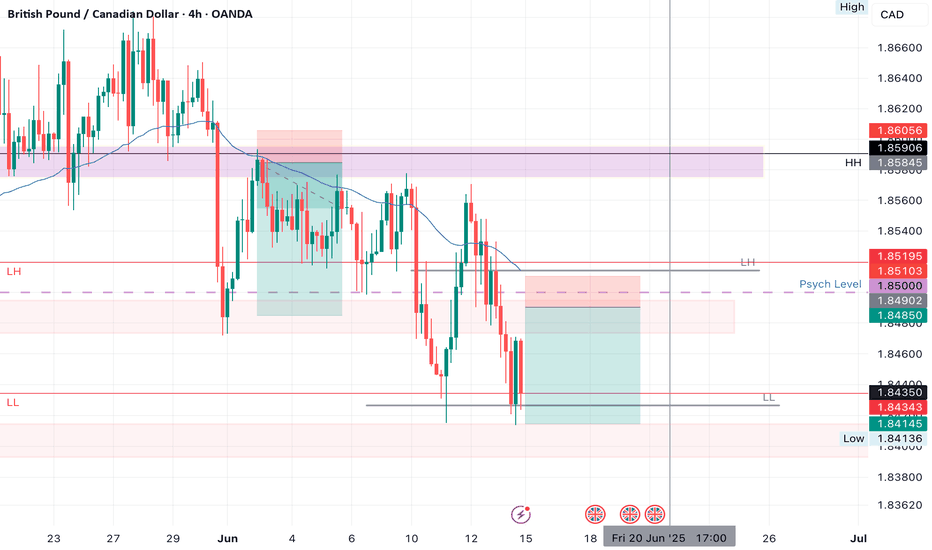

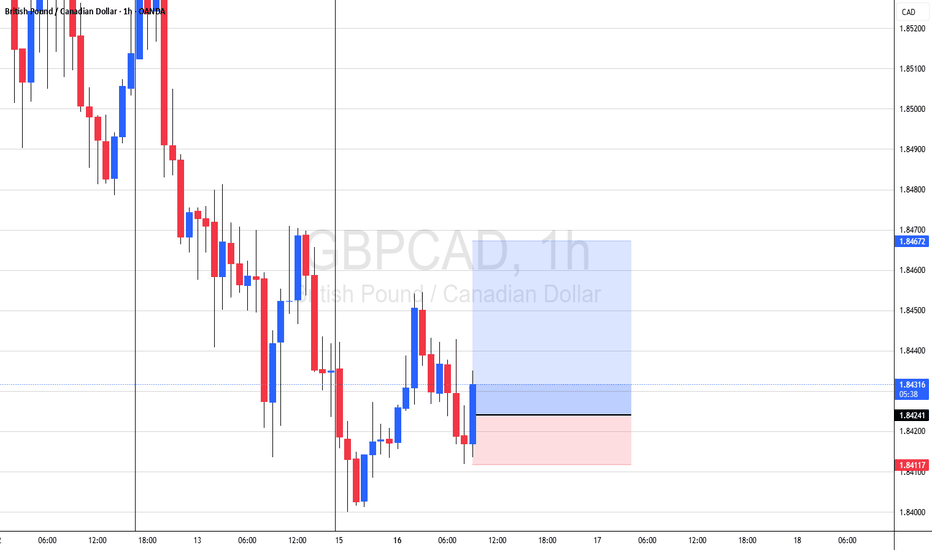

GBPCAD SHORTMarket structure bearish on HTFS DH

entry at Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 1.85000

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 3.77

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

GBP_CAD RISKY LONG|

✅GBP_CAD is set to retest a

Strong support level below at 1.8380

After trading in a local downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 1.8426

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCAD Technical Analysis! BUY!

My dear friends,

GBPCAD looks like it will make a good move, and here are the details:

The market is trading on 1.8449 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.8496

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

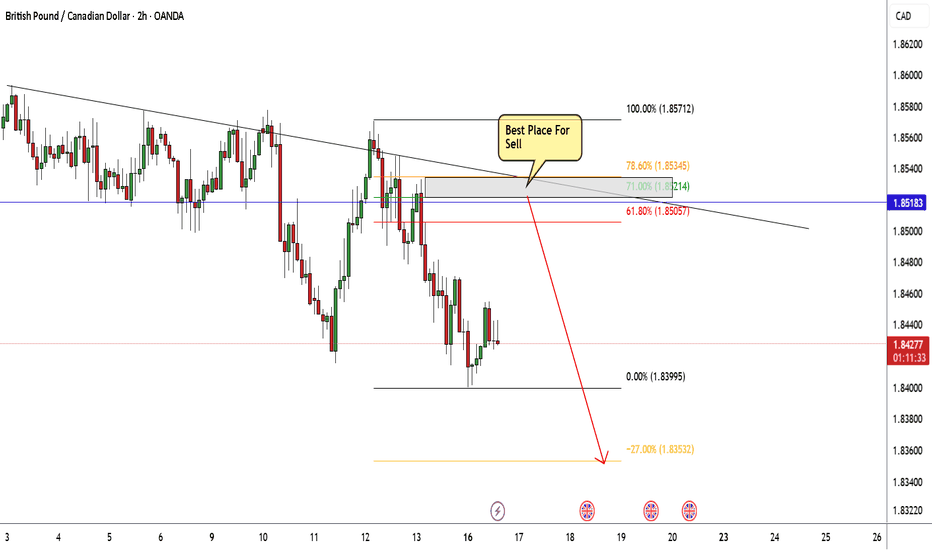

GBP/CAD Made A New Wave , Golden Place To Sell Very Clear !Here is my opinion on GBP/CAD 2H Chart . we have finally a good wave and the price made a new down trendline and moving very good , now i put my fibo indicator and i`m waiting the price to retest a broken support and also 71% fib level and give me any bearish price action and then we can enter a sell trade to create new lower low .

GBPCAD: Pullback After a Trap 🇬🇧🇨🇦

There is a high chance that GBPCAD will pull back

from the underlined support.

The price started to grow after a false violation of that and a confirmed bearish trap.

Goal - 1.8458

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCAD SELL TRADE PLAN🔥 GBP/CAD CONDITIONAL SELL PLAN 🔥

📅 Date: June 16, 2025

📋 TRADE PLAN OVERVIEW

Item Value

Type Swing

Direction 📉 Sell

Confidence ⭐⭐⭐⭐ 88%

R:R 3.8:1

Status ⚠️ Conditional – Awaiting Entry Tap & Confirmation

🧠 Guidance: Primary swing setup. Risk 1.00% max. If tapped, only enter with confirmation (engulfing / iBOS / volume spike).

📈 MARKET BIAS & TRADE TYPE

Section Details

Bias Bearish 📉

Type Breaker Block Reversal / CHoCH Swing Sell

🔰 CONFIDENCE LEVEL

Total: 88% (⭐⭐⭐⭐)

Confluence Element Weight

D1 CHoCH + Liquidity Below 25%

H4 Supply + FVG Zone 20%

H1 Weakness + Internal BOS 18%

Session Trap Potential 10%

No Macro Conflict (CAD strength) 15%

📍 ENTRY ZONES

Type Range Description

🟥 Primary Sell 1.8500–1.8530 H4 OB + FVG + Session Trap

🟧 Secondary Sell 1.8560–1.8585 Liquidity Inducement Zone (High RR)

❗ STOP LOSS

SL: 1.8588 (Above OB wick + 1H ATR)

Dynamic ATR Logic Applied (Normal VIX → 1x H1 ATR)

🎯 TAKE PROFITS

TP Level Target Details

TP1 1.8420 Internal liquidity zone

TP2 1.8320 Breaker flip + H4 OB break

TP3 1.8210 Full liquidity cleanout

📏 RISK:REWARD

TP1: 2.3:1

TP2: 3.8:1 ✅

TP3: 5.6:1 🚀

🧠 MANAGEMENT STRATEGY

🔹 Risk: 1% of account (swing)

🔹 TP1: 50% off + BE (+10pips)

🔹 TP2: 30% off

🔹 TP3: Trail final 20%

🔹 Adjust SL if macro shift only (BOC, CPI)

⚠️ CONFIRMATION CRITERIA

✅ Only Enter If:

H1/H4 Bearish Engulfing or OB Flip

Volume Spike or Sweep @ 1.8500

iBOS or SMT Divergence

🛑 No confirmation = no entry.

⏳ VALIDITY WINDOW

Valid until: June 18, 2025 – 22:00 UTC

Auto-expire if zone untapped or invalidation

❌ INVALIDATION

❌ H4 BOS above 1.8600

❌ CAD macro sentiment flips

❌ No rejection / liquidity sweep at OB

🌐 FUNDAMENTAL SNAPSHOT

Element Value

Retail Sentiment GBP Longs → High %

DXY Neutral

CAD Strength Rising oil → CAD support

COT (GBP) Bearish bias continuing

Sentiment Score ✅ +7/10

📋 FINAL TRADE SUMMARY

We are targeting a retest of bearish supply at 1.8500–1.8530

If price rejects w/ confirmation, sell toward liquidity below 1.8300

Avoid early entry — structure + timing + volume needed

Blueprint-compliant swing play, clean OB, and FVG overlap

🧠 Tactical Summary:

"Wait for price to enter 1.8500–1.8530 and trigger confirmation. Do not preempt. This is a sniper reversal off OB + liquidity sweep."

Patience = Power.