GBP/CHF POSSIBLE SETUPWatching for Pullback + V/M Alignment

We’re watching this market to see if price will break above current resistance then pull back into the key support/resistance zone.

What we want to see:

✅ Volume increasing in the direction of the trend

✅ Momentum aligning — ideally rising and then hooking back in trade direction

✅ A clean engulfing candle at or near the 50EMA

✅ Pullback must reach the recent broken high/low (structure matters)

This is classic VMS strategy setup behavior — no need to predict, just prepare.

📌 Discipline is waiting. The setup either shows up or it doesn’t.

We’ll keep watching.

GBPCHF trade ideas

GBPCHF is Ready for a breakthroughHello Traders

In This Chart GBPCHF HOURLY Forex Forecast By FOREX PLANET

today GBPCHF analysis 👆

🟢This Chart includes_ (GBPCHF market update)

🟢What is The Next Opportunity on GBPCHF Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

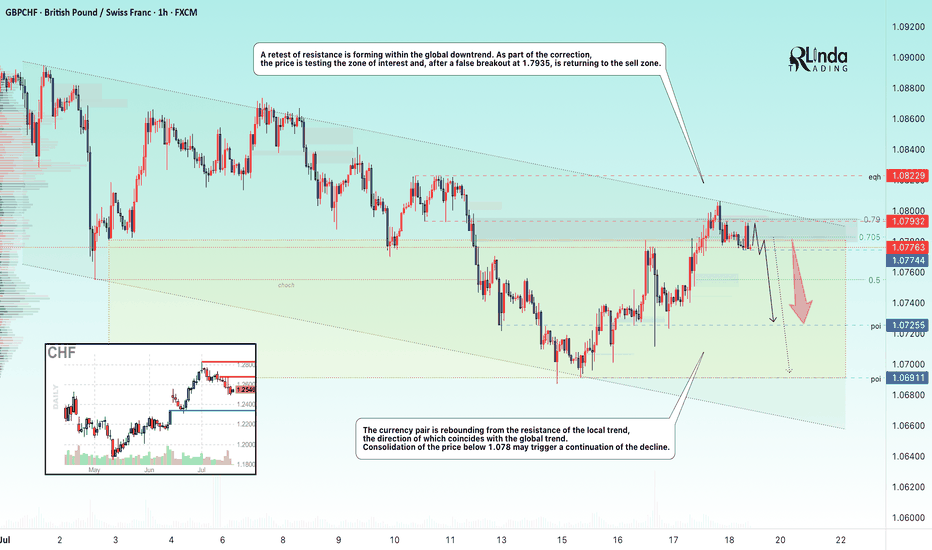

GBPCHF → Retest of resistance to the global downtrendFX:GBPCHF is facing resistance from the local trend, which is aligned with the global bearish trend. The trend may continue...

A retest of resistance is forming within the global downtrend. As part of the correction, the price is testing the zone of interest and, after a false breakout of 1.7935, is returning to the selling zone.

The currency pair is rebounding from the resistance of the local trend, which coincides with the global trend. Consolidation of the price below 1.078 may trigger a continuation of the decline

Resistance levels: 1.07932, 1.0823

Support levels: 1.07744, 1.07255

Price consolidation in the selling zone followed by a break of the local structure could strengthen the bearish sentiment, which could trigger a further decline overall.

Best regards, R. Linda!

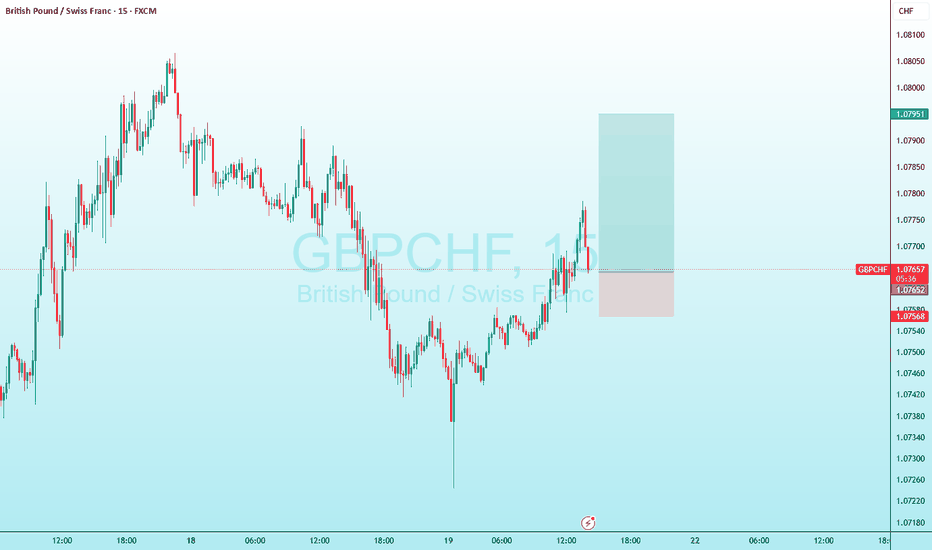

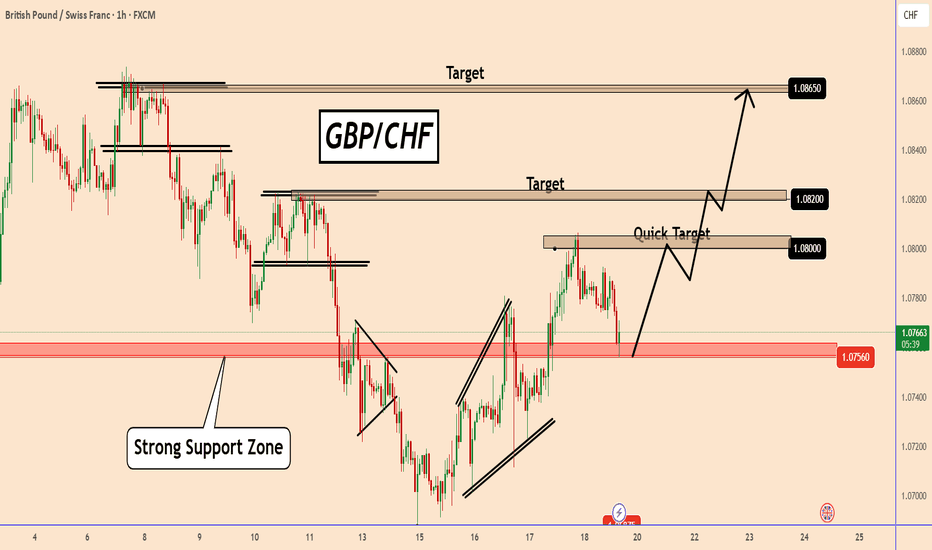

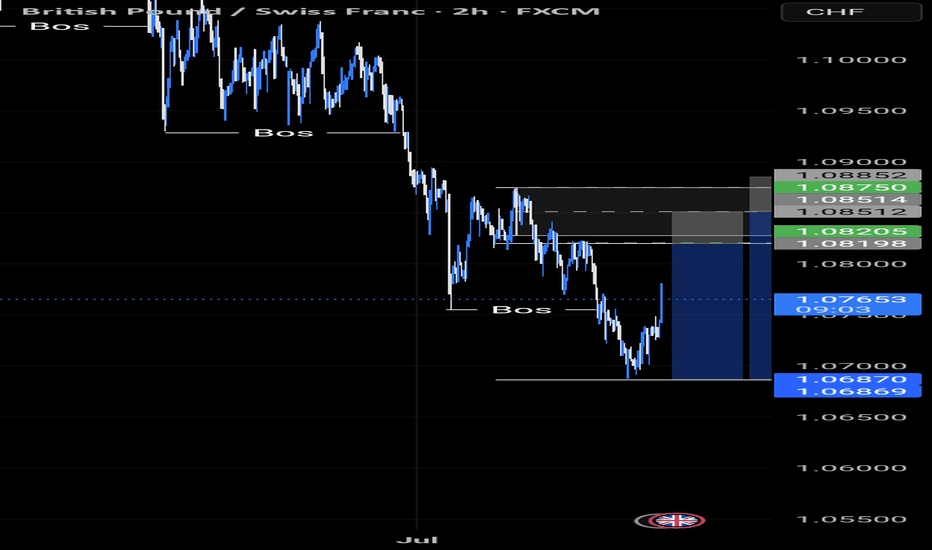

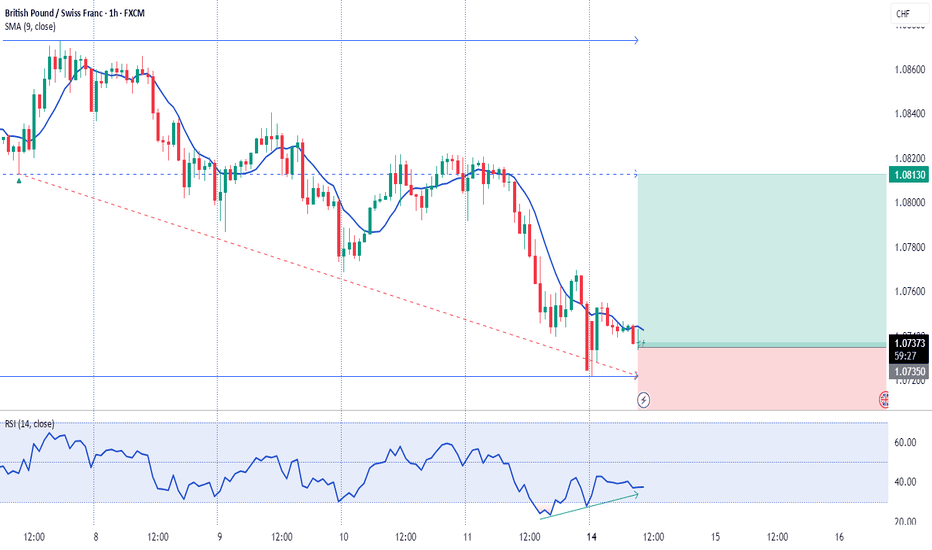

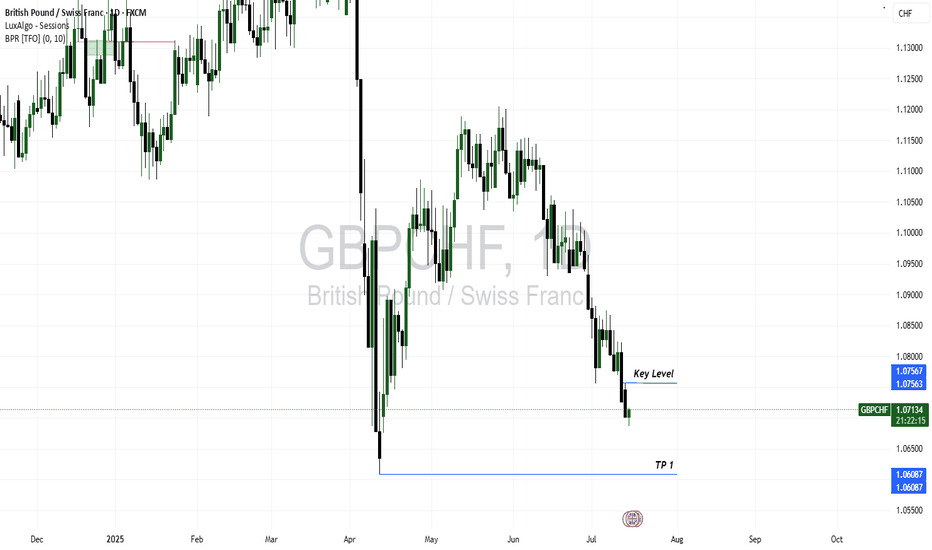

GBPCHF may bounce back from 1.0750 support areaGBPCHF may bounce back from 1.0750 support area

GBPCHF reached a low of 1.0687 for the time being and resumed an upward move.

The price rose above a strong support area, indicating increasing momentum. If GBPCHF manages to hold around this area, the chances of further growth will increase.

Key target areas: 1.0800; 1.0820 and 1.0865

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

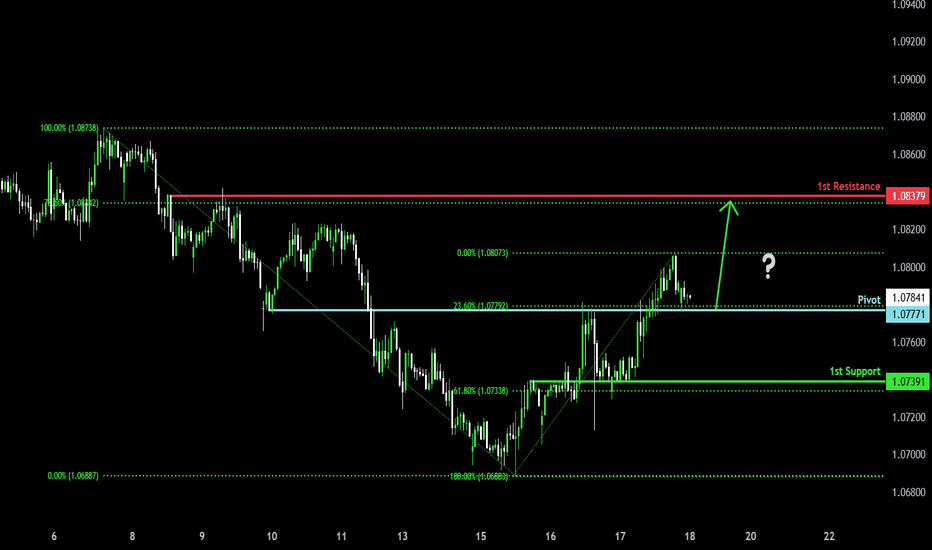

Could the price bounce from here?The GBP/CHF is falling towards the pivot and could bounce to the 1st resistance, which serves as a pullback resistance.

Pivot: 1.0777

1st Support: 1.0739

1st Resistance: 1.0837

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

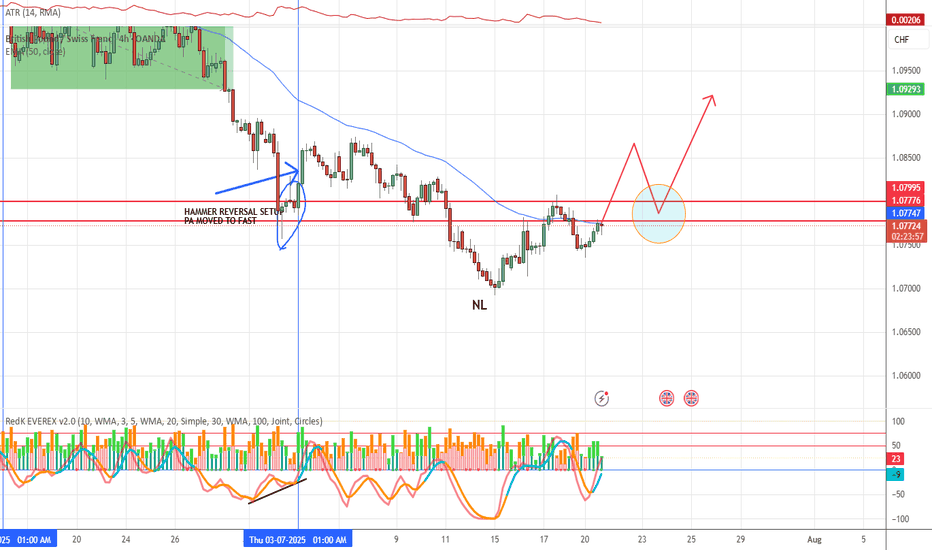

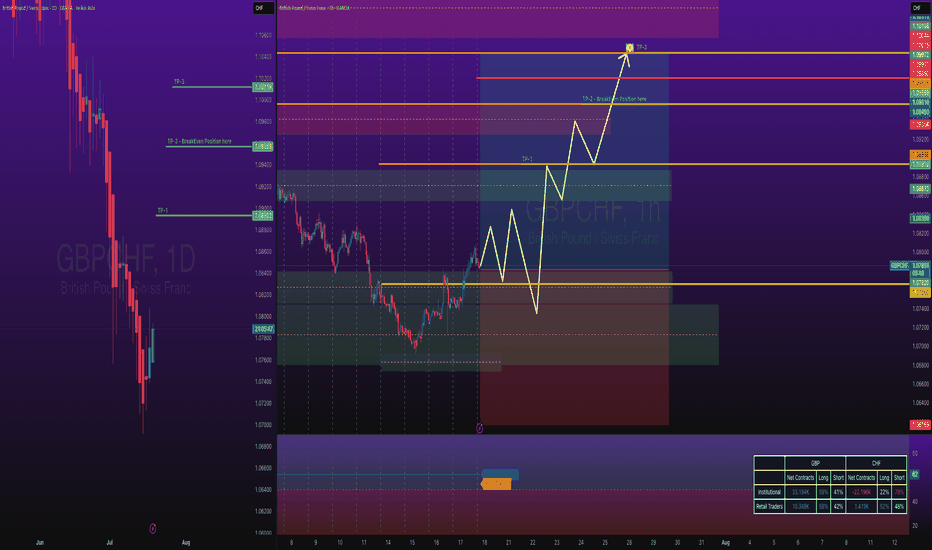

GBPCHF Long Swing Trade - Time to go Long with HedgeFundsOANDA:GBPCHF Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

This is second time I getting into Long of GBPCHF, hedgefunds, banks have already started buying, lets see how much buying pressure we have.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

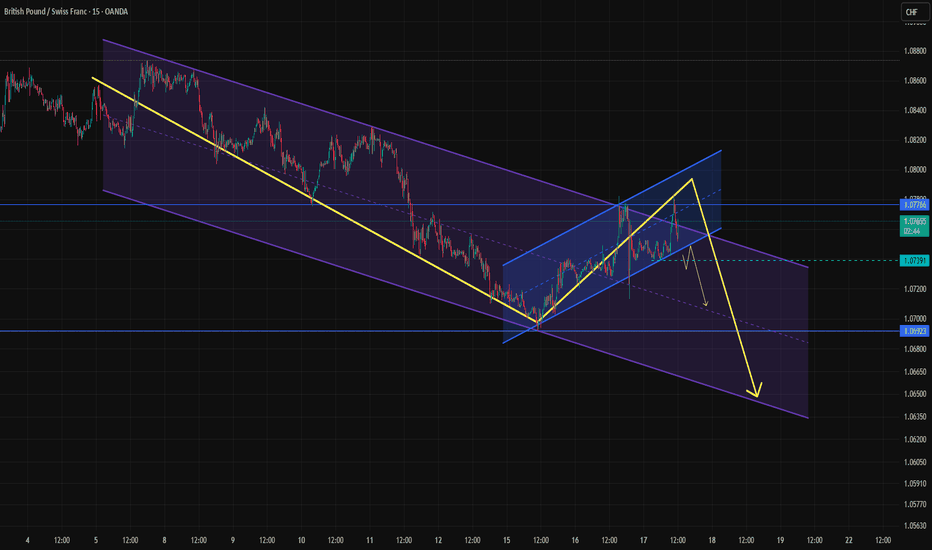

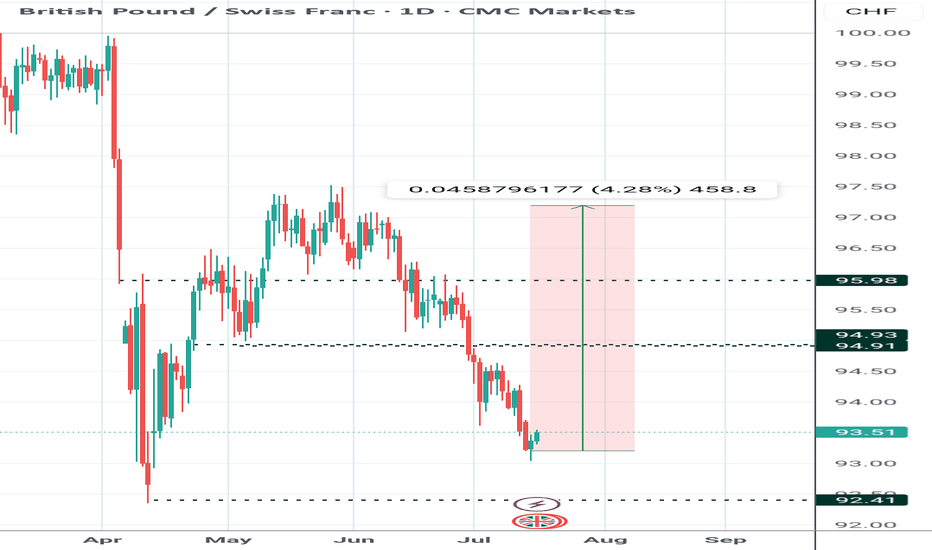

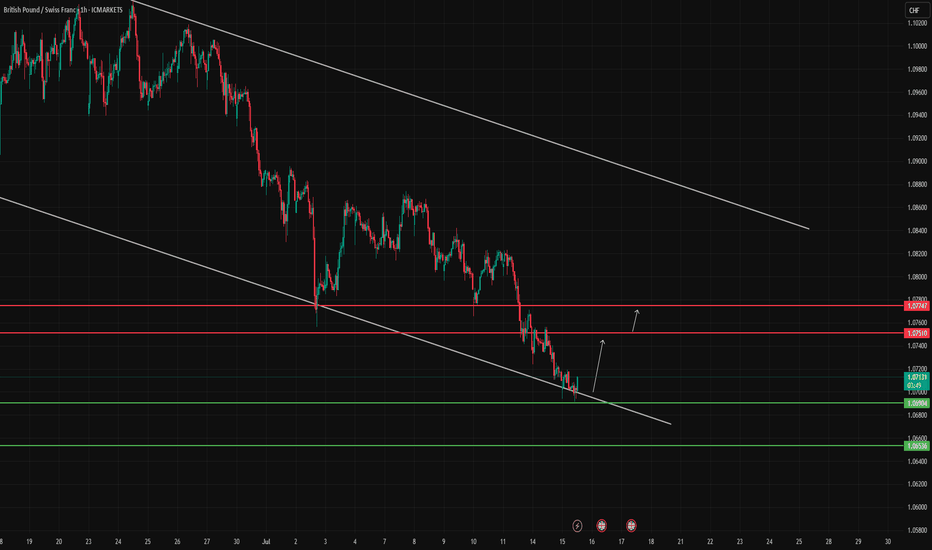

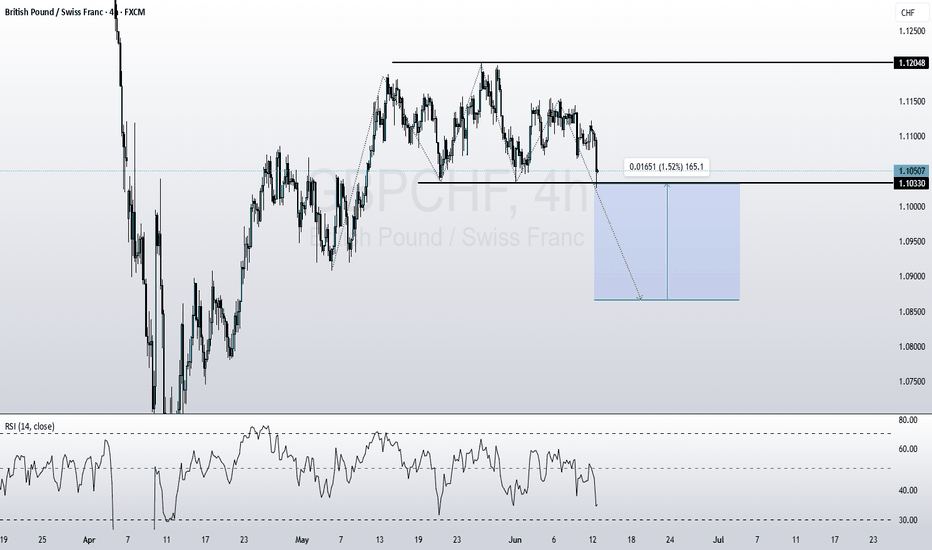

Analysis based on a channel within two cyclesWe have a large descending channel, which appears to be forming a smaller ascending channel as part of a correction.

Once the correction is confirmed and completed, it could provide a good opportunity for a short position.

However, if the lower boundary isn't broken and the price moves higher, we’ll hold off and wait for a new structure to form.

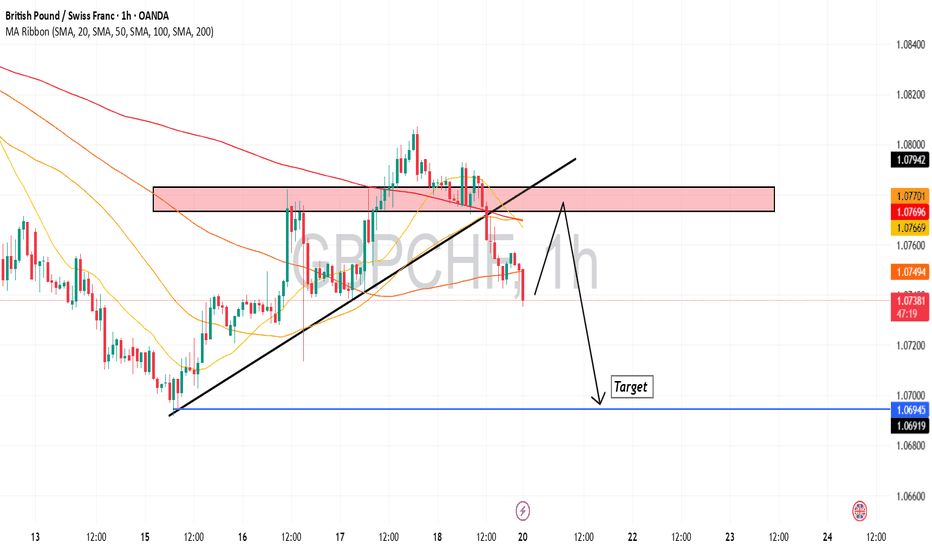

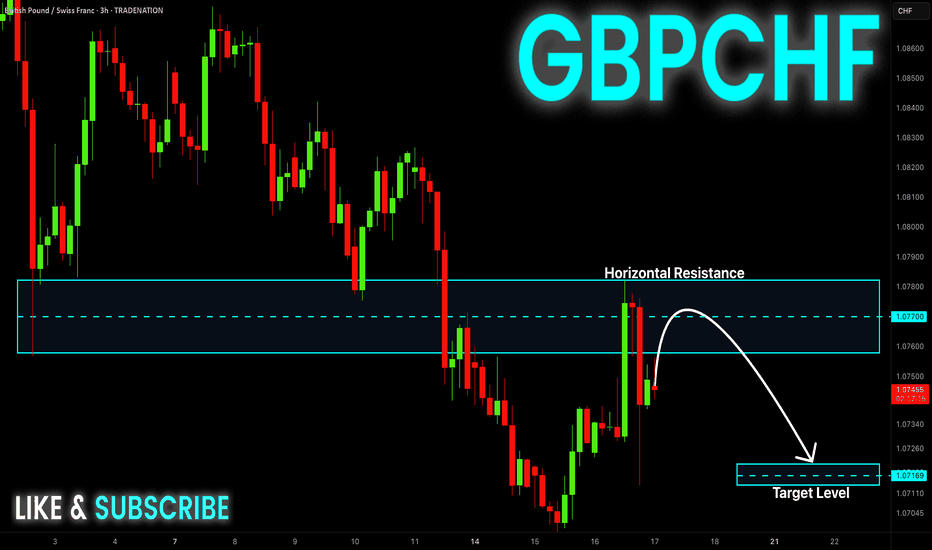

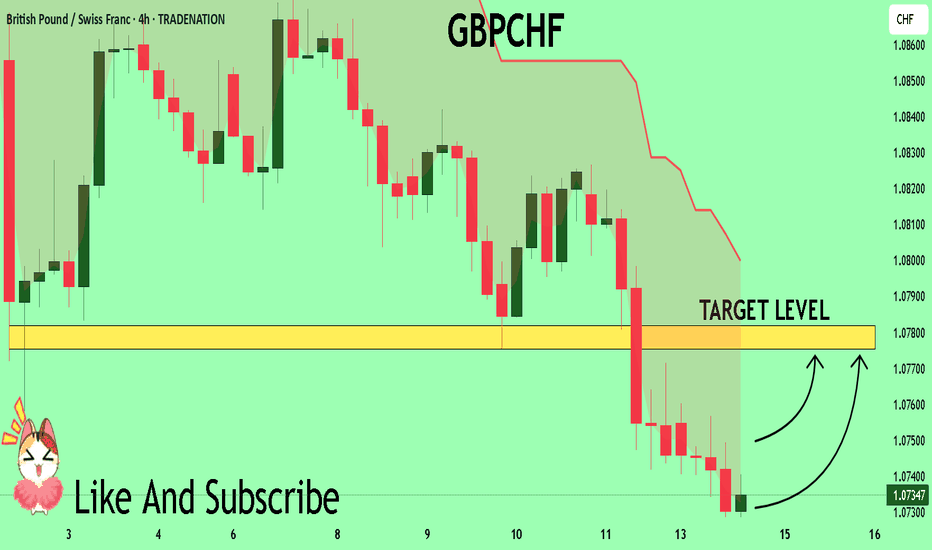

GBP-CHF Local Short! Sell!

Hello,Traders!

GBP-CHF made a retest of

The wide horizontal resistance

Of 1.0780 and we are already

Seeing a bearish pullback

So as the pair is trading in a

Downtrend we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

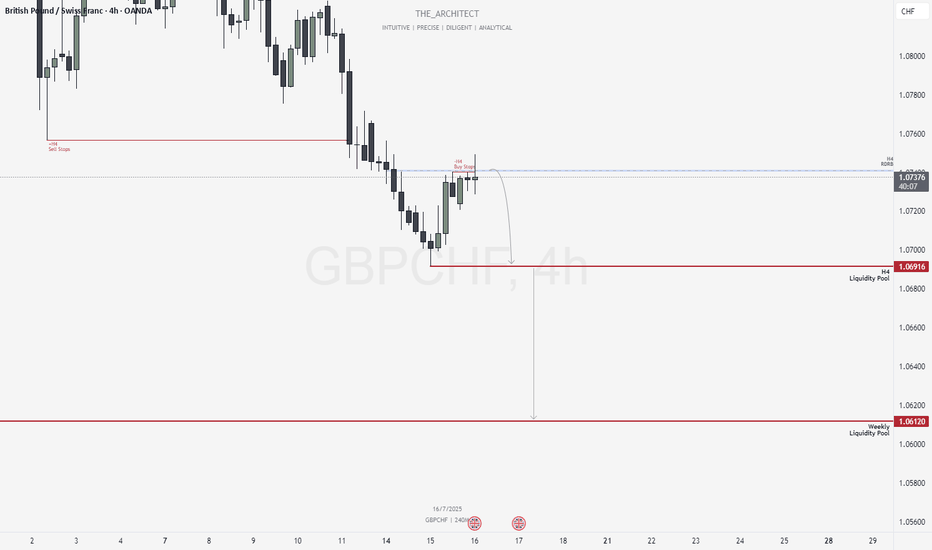

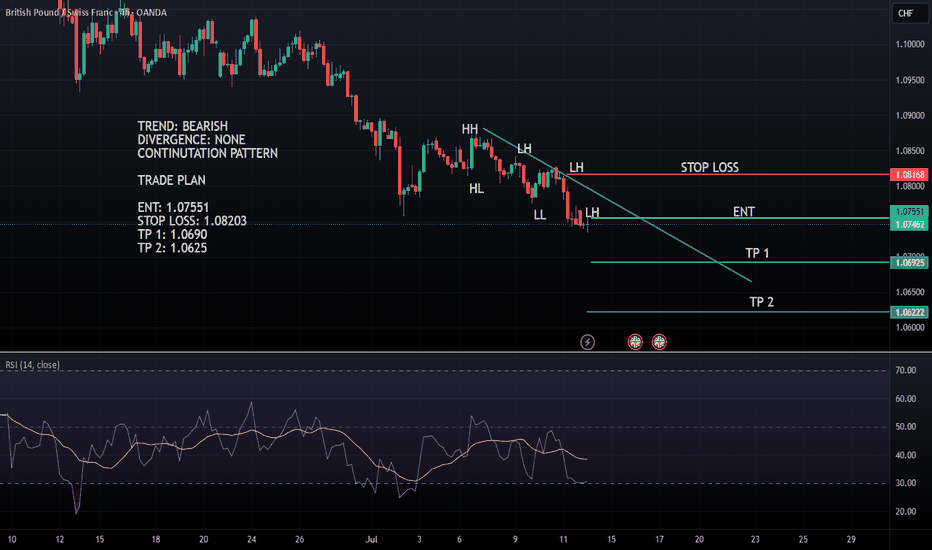

GBPCHF: Bearish Structure Aligns for Potential Sell Setups!Greetings Traders,

In today’s analysis of GBPCHF, we observe that the institutional order flow is currently bearish, and as such, we aim to align with this bias by identifying selling opportunities from key institutional resistance zones.

Higher Timeframe Context:

Weekly TF:

The weekly timeframe, which serves as our macro bias, is firmly bearish. This sentiment is reinforced on the H4 timeframe—our intermediate structure—which is also delivering consistent lower highs and lower lows. The alignment between these two timeframes strengthens our conviction to trade in the direction of institutional bearish order flow.

Key Observations on H4:

Re-delivered & Re-balanced Price Zone: Price has retraced into a previously balanced area that has now been re-delivered into, signaling institutional interest. Rejection from this zone adds to our bearish bias.

Buy Stop Raid: Price action has swept H4 buy stops in this area, providing confirmation that smart money may have used this liquidity for order pairing into short positions.

Entry Zone: The current rejection suggests a high-probability shorting opportunity from this region, provided confirmation on the lower timeframes.

Trading Plan:

Entry Strategy: Await confirmation at the current H4 resistance for short entries.

Targets: First target is the H4 liquidity pool located at discount prices. The longer-term objective is the weekly liquidity pool, which represents the primary draw on liquidity.

Continue to monitor price action closely, maintain patience for confirmation, and manage risk according to your trading plan.

Kind Regards,

The Architect 🏛️📉

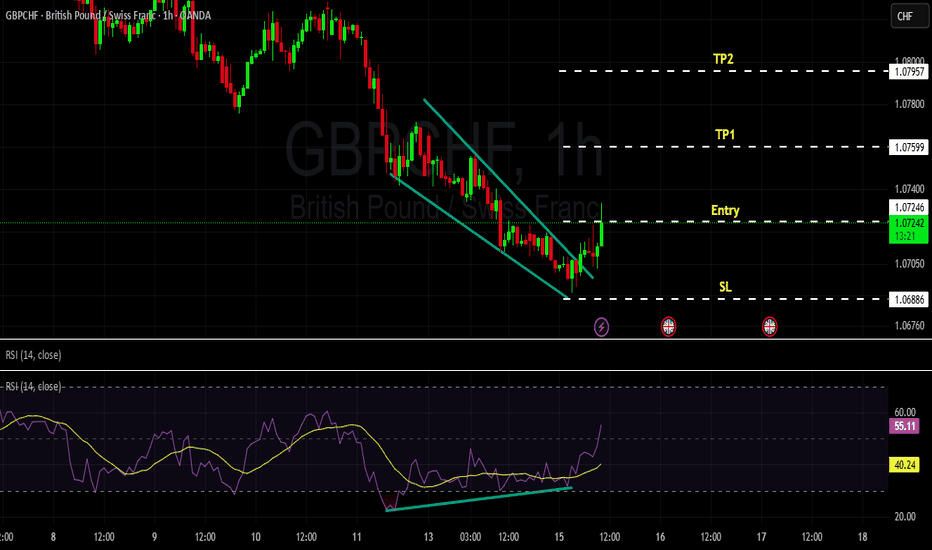

GBPCHF - Bullish BUY Market has formed a strong divergence in the bearish trend on 1H time frame- market has also formed as wedge patter which is a good sign of reversal.

market has currently broken the last LH.

we take instant entry and place SL as defined on the charts with R:R of 1:1 and 1:2 we put our TPs.

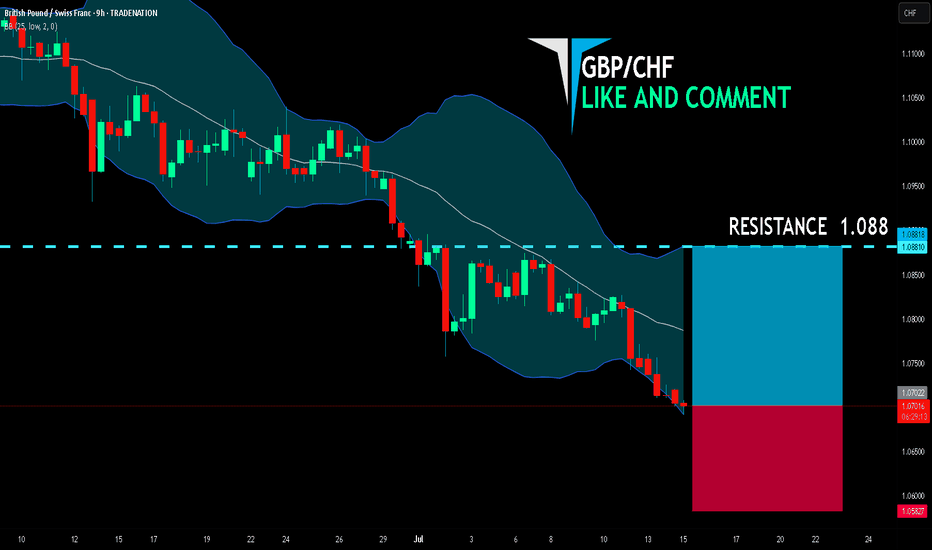

GBP/CHF BULLS WILL DOMINATE THE MARKET|LONG

GBP/CHF SIGNAL

Trade Direction: long

Entry Level: 1.070

Target Level: 1.088

Stop Loss: 1.058

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCHF - BuyMarket is making series of LH and LL. Market is forming a wedge pattern followed by divergence which is a good sign of reversal soon.

we anticipate market to break the last LH as marked in the charts, we place our SL below the Last LL & plan our TPs 1 and Tp2 with R:R of 1:1 and 1:2

sentiments of this instrument is also bullish around 94% which adds more weight to the reversal (bulls in control soon)

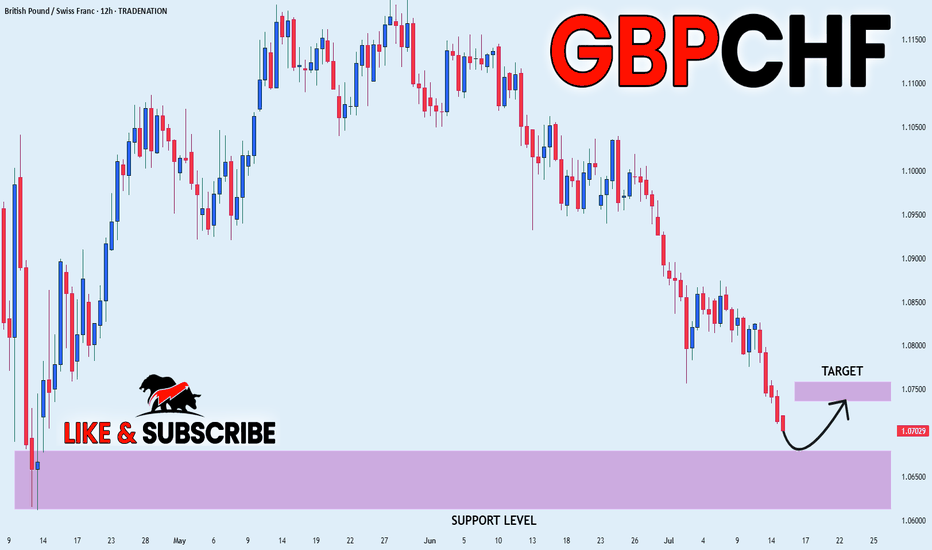

GBP_CHF SWING LONG|

✅GBP_CHF is set to retest a

Strong support level below at 1.0650

After trading in a strong downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 1.0750

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF Technical Analysis! BUY!

My dear followers,

I analysed this chart on GBPCHF and concluded the following:

The market is trading on 1.0733 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.0775

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF – Setting Up for a ShortWe’ve clearly marked our key resistance zone,

and now we’re patiently waiting for price to reach that level.

⚠️ Once we get a valid bearish signal,

I’ll open a short position according to plan.

🔁 If the level breaks cleanly and pulls back,

I’ll flip my bias and go long from the retest —

because I don’t marry levels,

I follow what price tells me.

We’re not here to predict.

We’re here to react, adapt, and manage risk.

The market does what it wants — and I’m ready for every scenario.