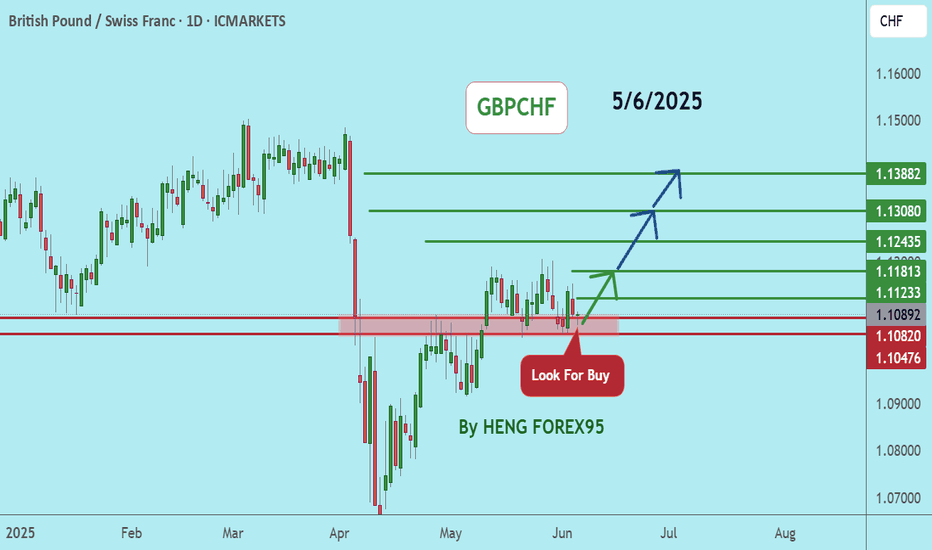

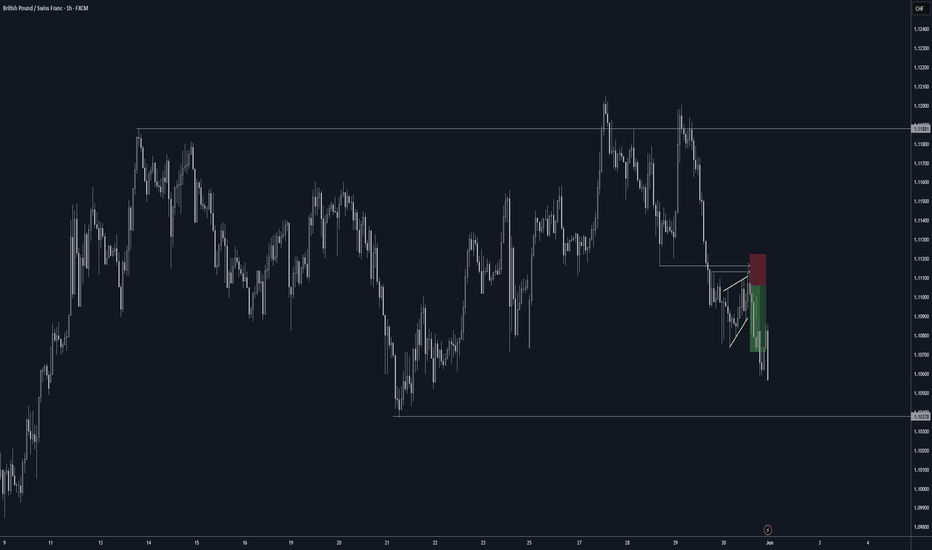

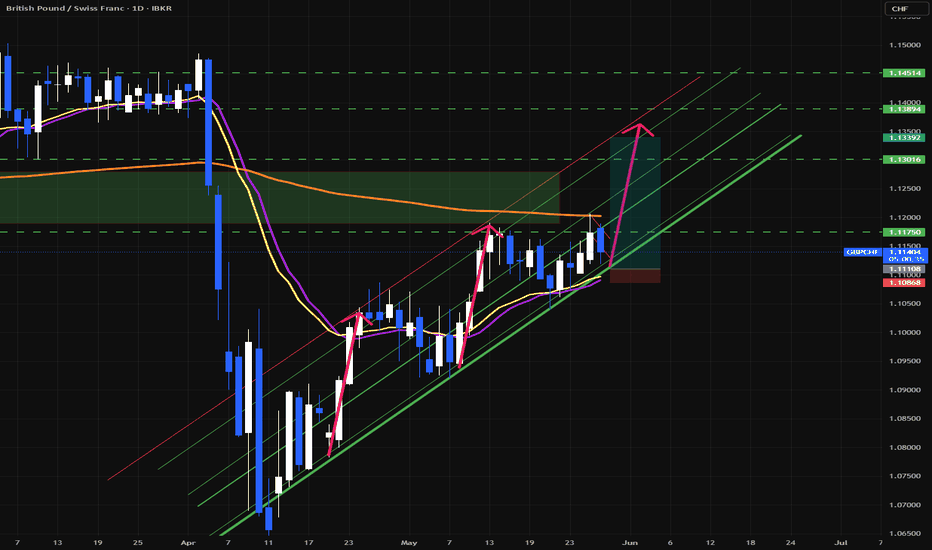

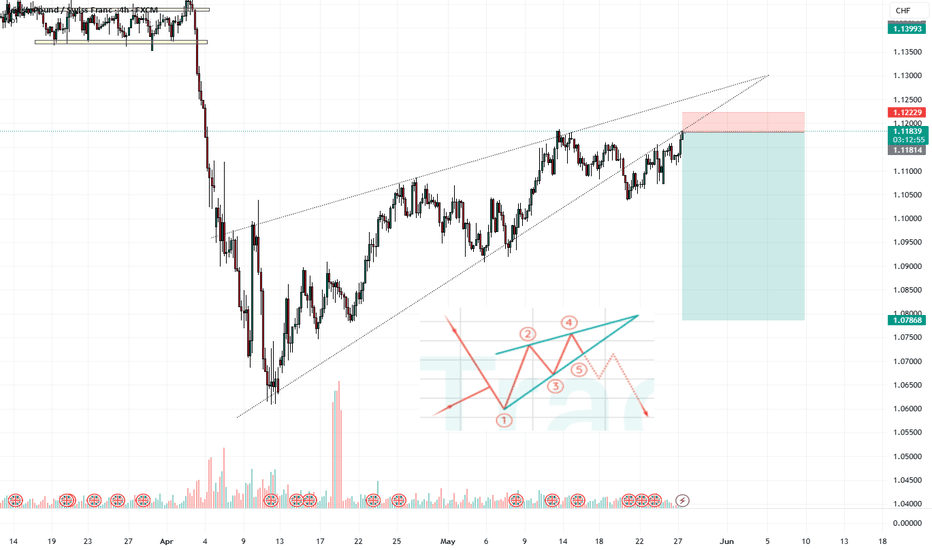

GBPCHFGBPCHF If the price can still stay above 1.10476, it is expected that the price will have a chance to adjust up. Consider buying the red zone

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

GBPCHF trade ideas

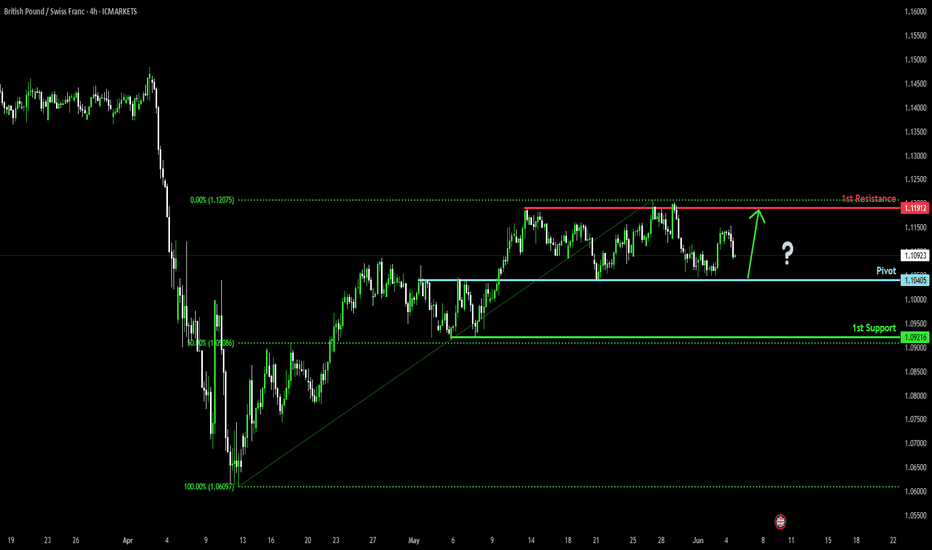

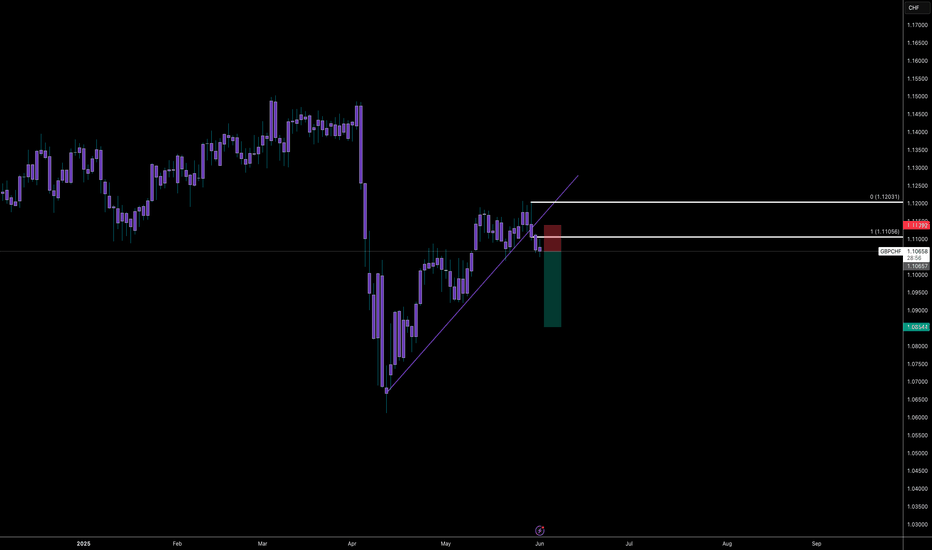

Falling towards overlap support?GBP/CHF is falling towards the pivot, which is an overlap support, and could bounce to the 1st resistance, which acts as a pullback resistance.

Pivot: 1.1045

1st Support: 1.0921

1st Resistance: 1.1191

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

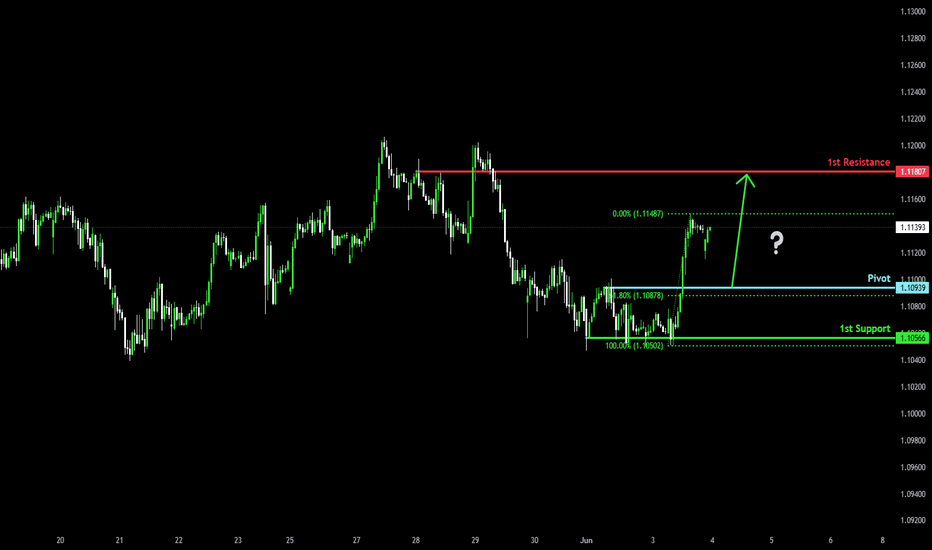

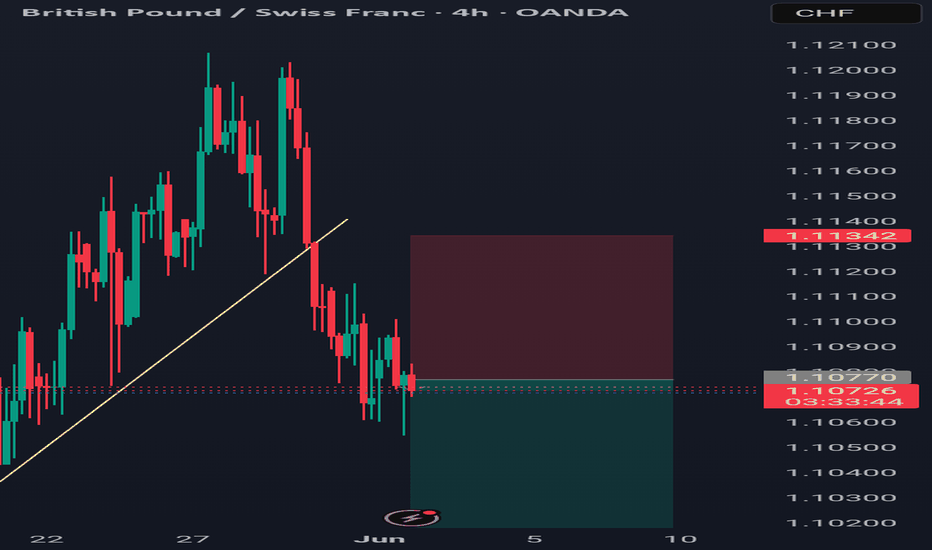

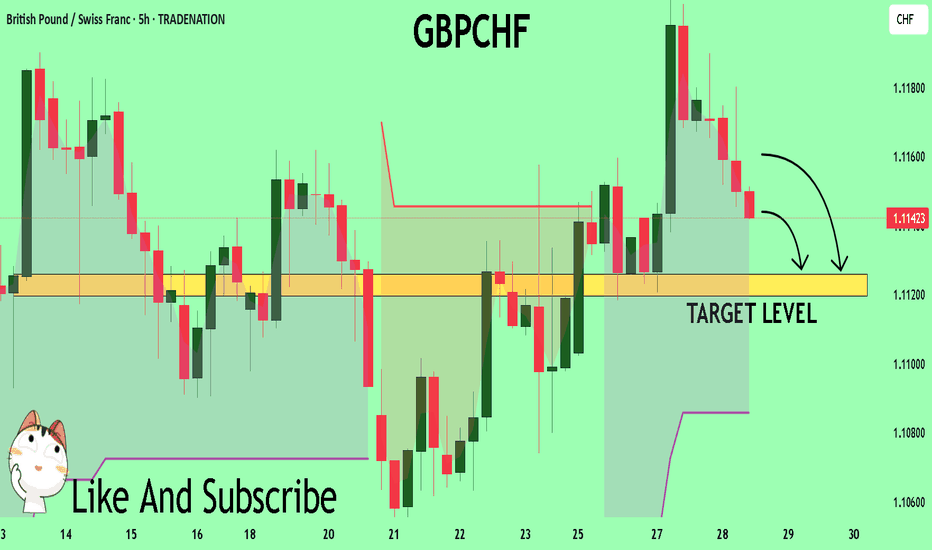

Bullish bounce off 61.8% Fibonacci support?GBP/CHF is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance, which acts as a pullback resistance.

Pivot: 1.1093

1st Support: 1.1056

1st Resistance: 1.1180

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

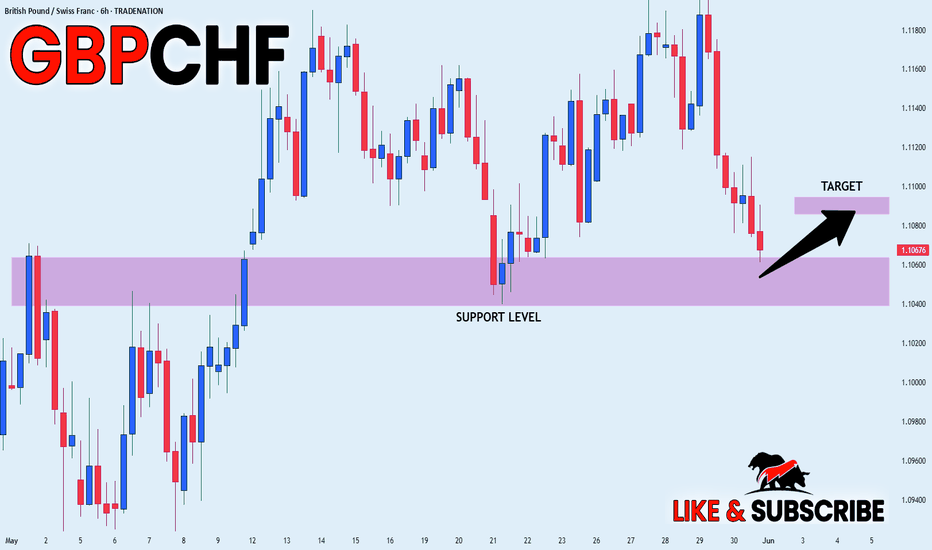

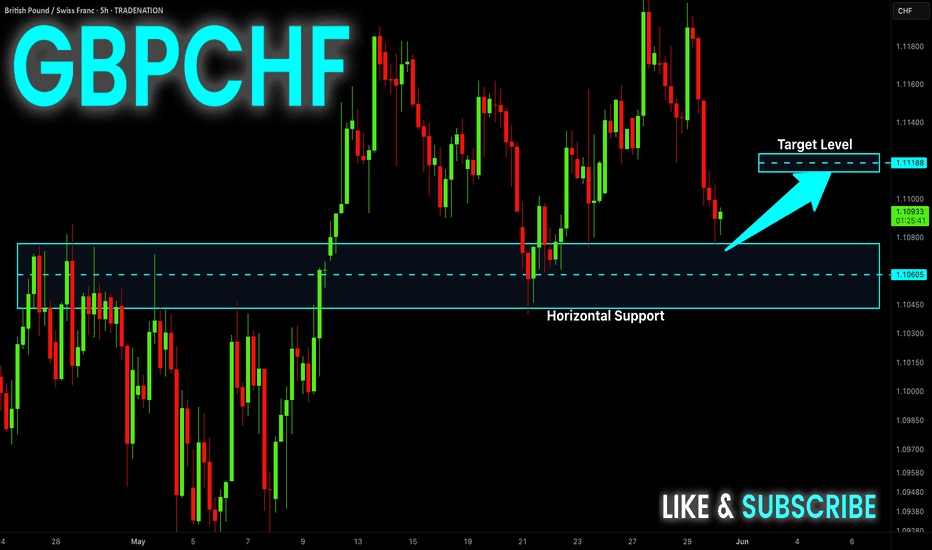

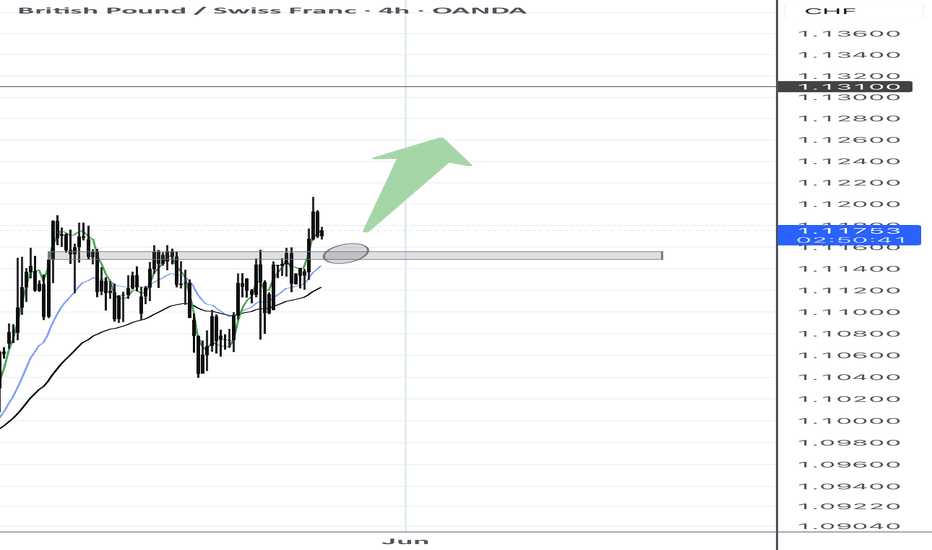

GBP_CHF POTENTIAL LONG|

✅GBP_CHF is going down now

But a strong support level is ahead at 1.1051

Thus I am expecting a rebound

And a move up towards the target of 1.1088

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

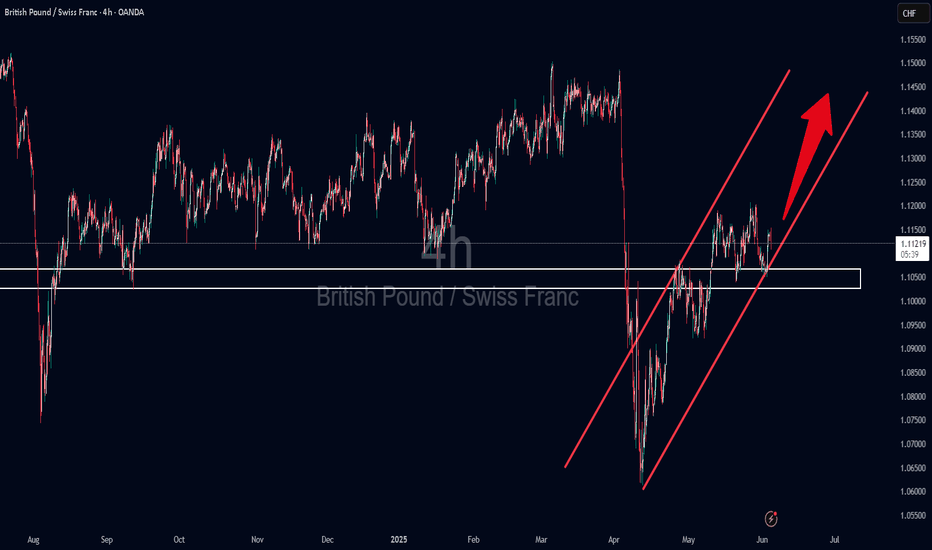

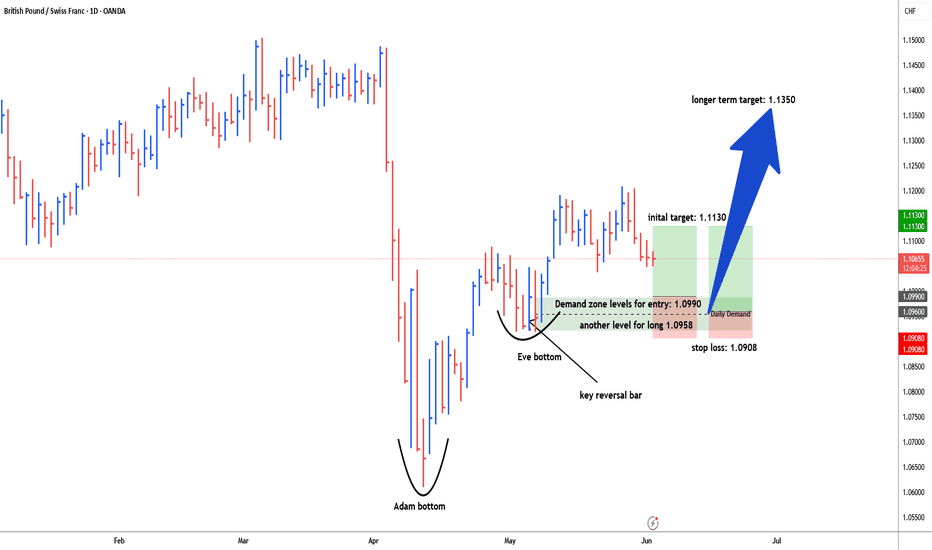

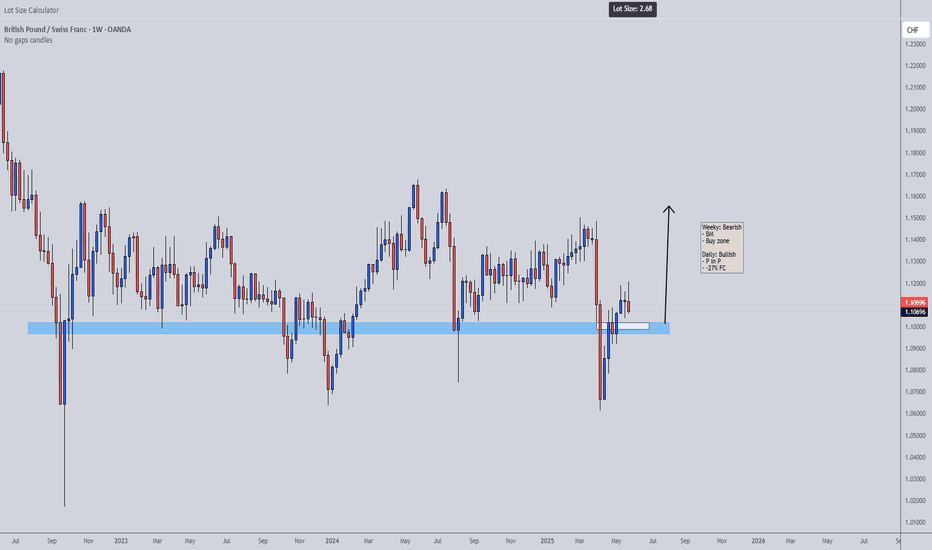

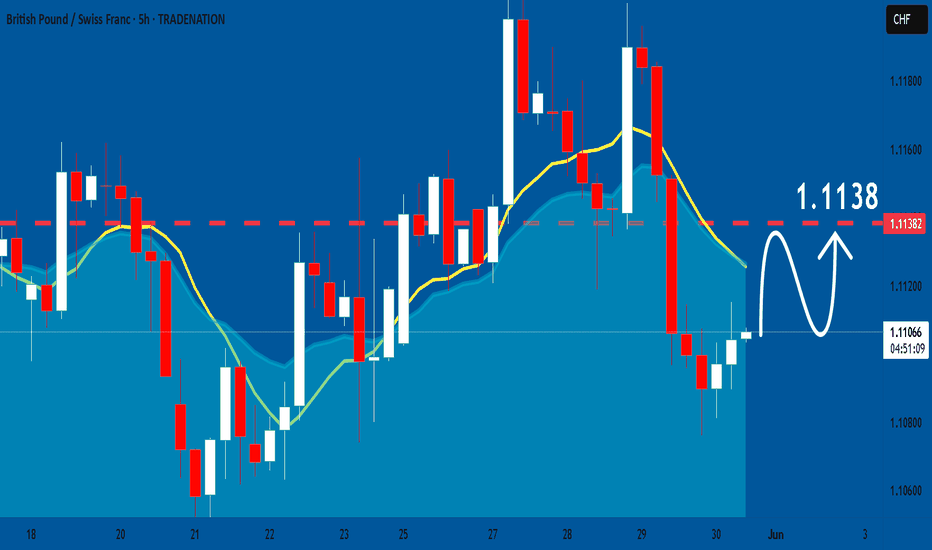

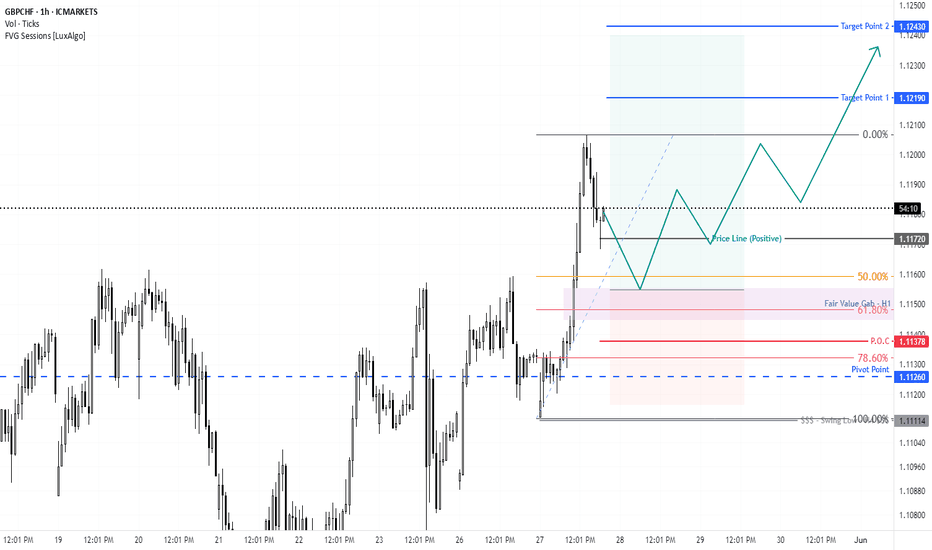

GBPCHF: Bullish Continuation is Expected! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPCHF chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP-CHF Risky Long! Buy!

Hello,Traders!

GBP-CHF will soon hit

A wide horizontal support

Level around 1.1048 and

After the retest a local

Bullish rebound and a move

Up are to be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

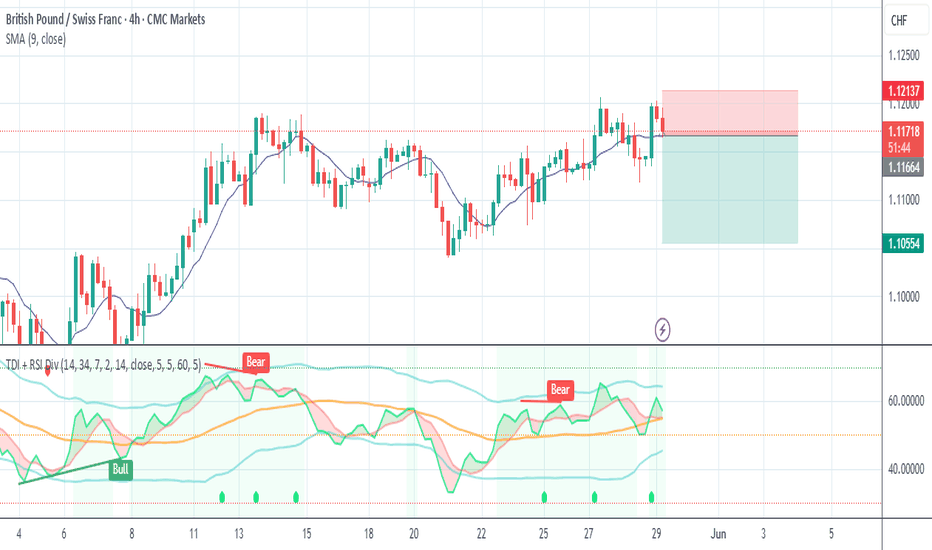

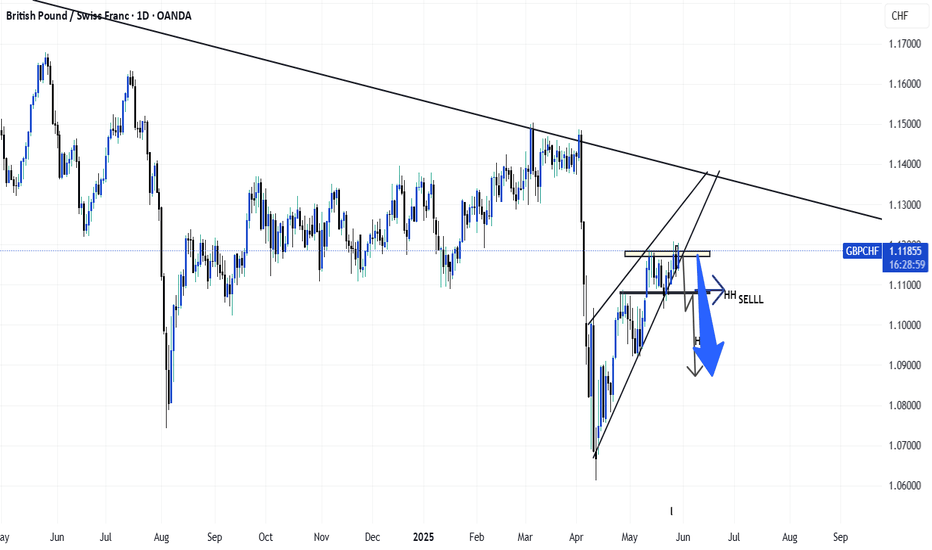

GBPCHF My Opinion! SELL!

My dear friends,

My technical analysis for GBPCHF is below:

The market is trading on 1.1144 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.1126

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPCHF INTRADAY bearish below 1.1230The GBP/CHF currency pair is currently exhibiting a bearish sentiment, aligned with the broader downtrend. Recent price action shows the market is in a sideways consolidation phase, indicating a potential pause before the next directional move.

Key Trading Level: 1.1230

This level marks a prior intraday consolidation zone and serves as a critical resistance area within the current trend context.

Bearish Scenario (on rejection from 1.1230):

A failed test of 1.1230 resistance would likely reinforce bearish momentum.

Downside support targets include:

1.1100 – Initial support

1.1050 – Next structural support

1.0980 – Long-term bearish target

Bullish Scenario (on breakout above 1.1230):

A confirmed breakout and daily close above 1.1230 would invalidate the bearish structure.

In that case, potential upside targets include:

1.1300 – Key resistance level

1.1370 – Higher resistance from previous reversal zones

Conclusion

The medium-term outlook for GBP/CHF remains bearish, with 1.1230 acting as a decisive pivot level. As long as price stays below this threshold, downside continuation toward 1.1100 and beyond remains favored. However, a clear breakout above 1.1230 on a daily closing basis would shift the sentiment and open the door for a bullish correction toward 1.1300–1.1370. Traders should monitor the 1.1230 level closely for directional confirmation.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

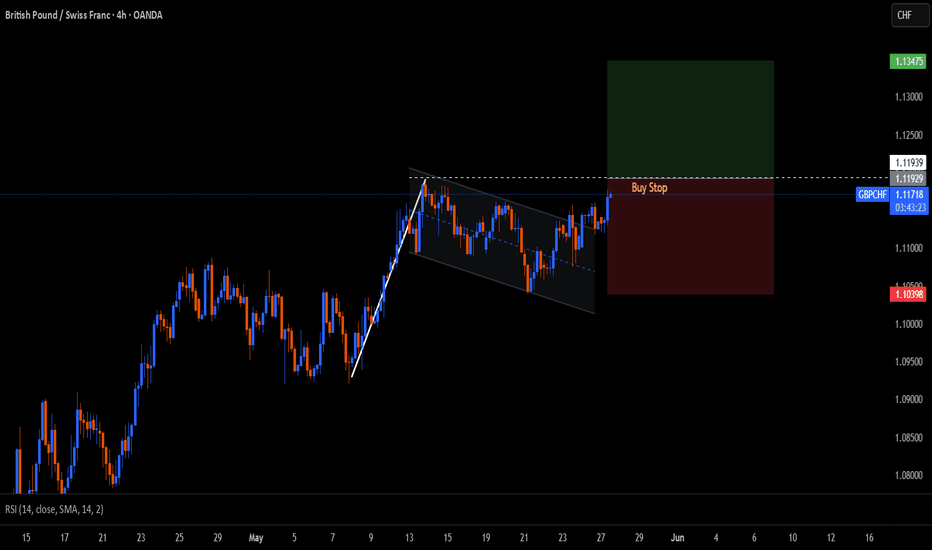

GBP/CHF Break & Retest – Bullish Continuation Setup (4H)Price has broken above a key structure level around 1.1155–1.1160, forming a higher high in line with the prevailing 4H uptrend. I’m watching for a clean retest of this zone with a rejection confirmation (preferably wick rejection or bullish engulfing) to take a long position.

Confluences:

• EMA 20/50 bullish alignment

• Break & retest of previous resistance turned support

• Bullish market structure (HHs, HLs)

Target: 1.13100

Invalidation: Break and close below the retest zone

Waiting for price to come to me — no early entries.

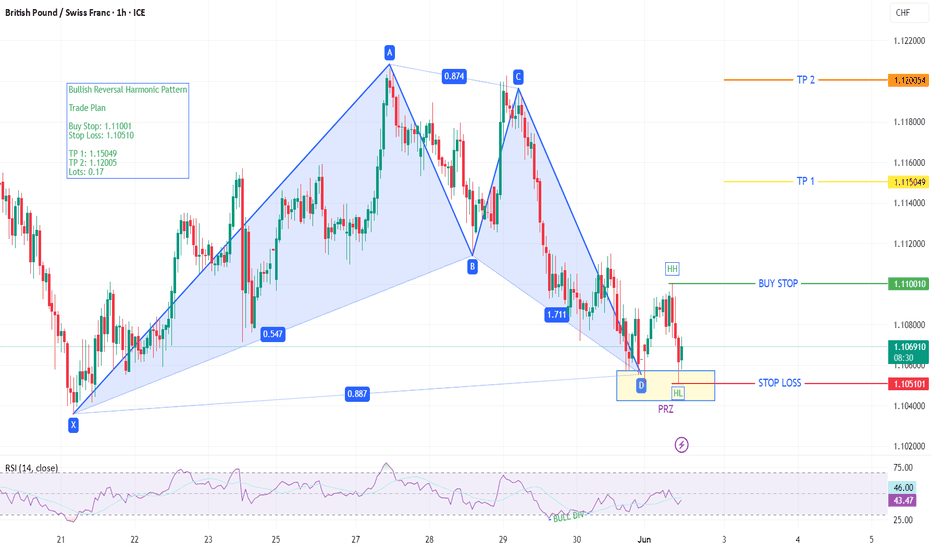

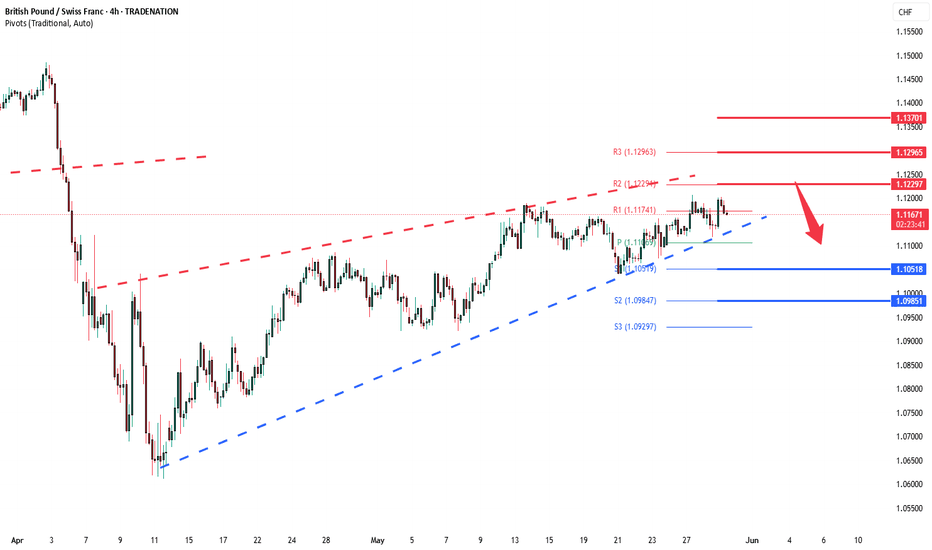

RISING WEDGE RETEST SHORT?Trading the Rising Wedge Pattern

Trading the rising wedge pattern involves strategically capitalizing on its bearish reversal signal.

Here's a common set of steps to go about it:

5

Identification: The first step is to identify the rising wedge pattern on the chart. A trader or investor would look for converging, upward-sloping trend lines with higher highs and higher lows. The pattern usually forms during an uptrend.

Confirmation: The trader will wait for confirmation before entering a trade. Confirmation typically comes in the form of a break below the lower trend line. Declining volume during the wedge formation can serve as additional confirmation.

Entry point: Traders often enter a short position once the pattern is confirmed. The breakout point below the lower trend line serves as the entry point.

Stop losses: A stop loss is generally set just above the last high within the pattern. This minimizes potential losses if the pattern fails and the price reverses into an uptrend.

Price target: The price target is usually determined by measuring the pattern's height at its widest point and subtracting that value from the breakout level. Some traders use Fibonacci retracement levels as added targets to fine-tune their exit strategy.

Risk management: Managing risk effectively when trading the rising wedge pattern is critical. This involves setting appropriate position sizes and using other technical analysis indicators to validate the pattern, such as the relative strength index (RSI) or moving average convergence divergence (MACD).

Exit strategy: Traders usually exit the position once the price reaches the preset target. However, monitoring other technical analysis indicators and market news that could influence price action is advisable.