Idea link above ^^^

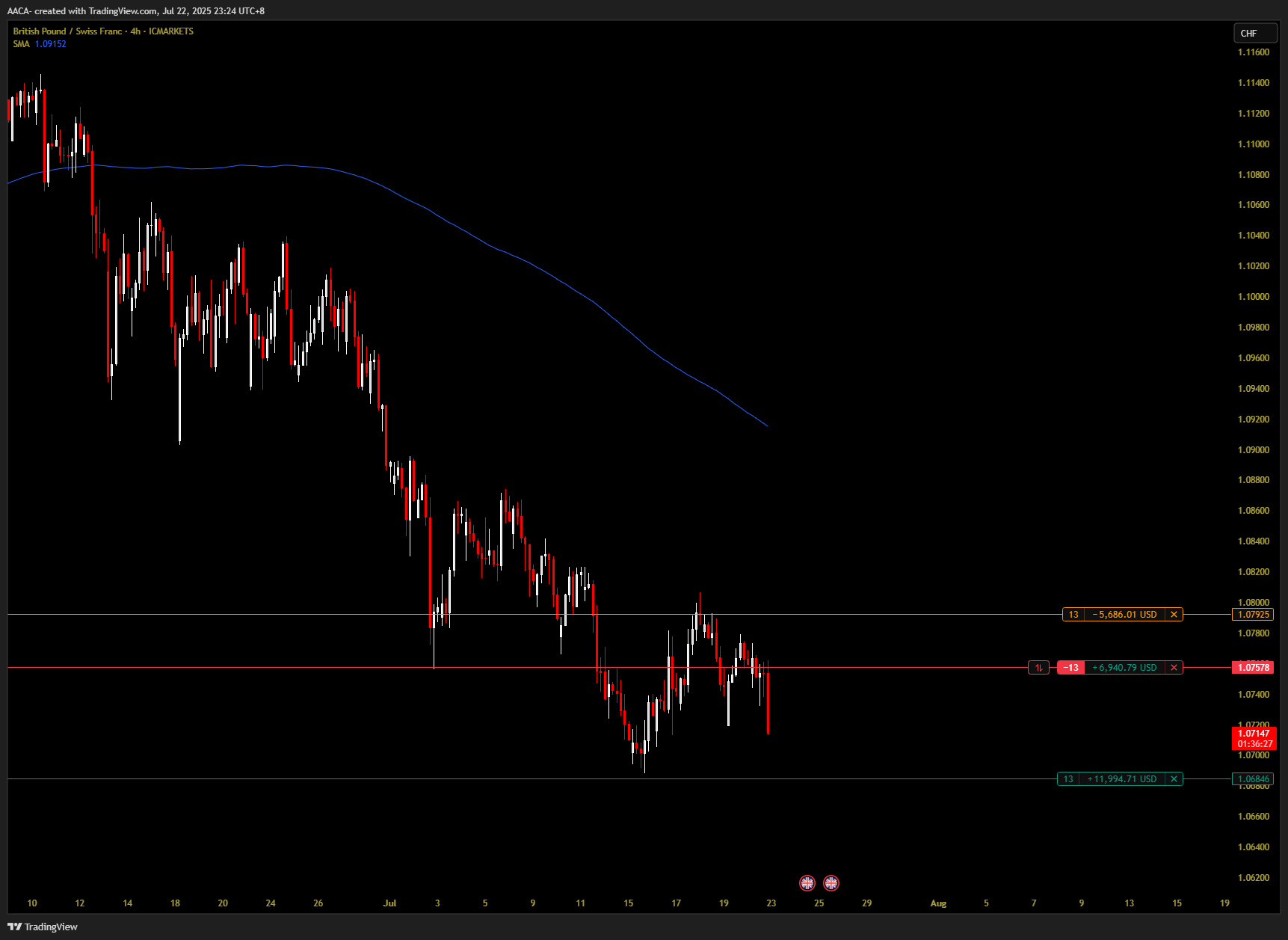

GBPCHF currently has the strongest bearish bias, reflecting widespread weakness across economic, sentiment, and trend-based indicators.

From a sentiment standpoint, institutional traders are reducing exposure to the British pound, while retail traders are predominantly long — which often precedes downside moves. Seasonality doesn’t favor GBP in August either, adding weight to the bearish pressure.

The UK's fundamental backdrop is deteriorating: recent data points to slowing GDP, weak retail sales, and significant declines in both manufacturing and services PMI readings. Labor market strength is fading, and inflation is easing, which could force the Bank of England to pivot toward rate cuts or, at the very least, a pause in hikes.

In contrast, the Swiss economy remains relatively stable. Inflation is under control, and the Swiss Franc continues to attract capital due to its safe-haven reputation, especially during periods of global uncertainty. With the SNB showing no urgency to adjust rates and the UK outlook worsening, policy divergence is increasingly favoring CHF strength over GBP.