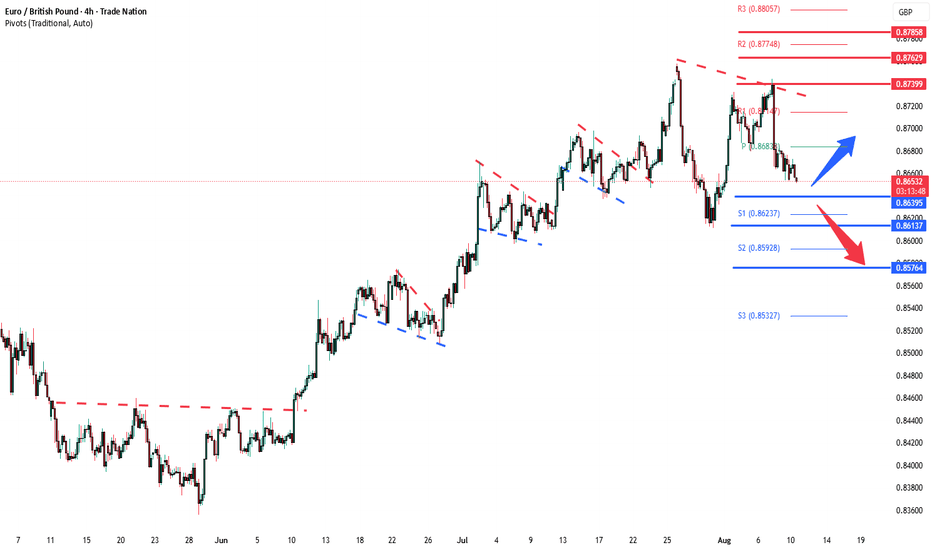

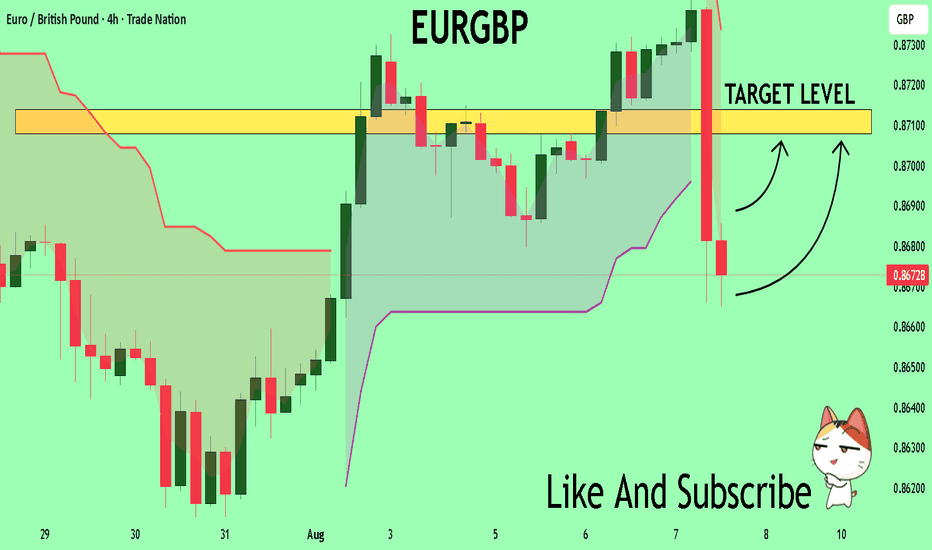

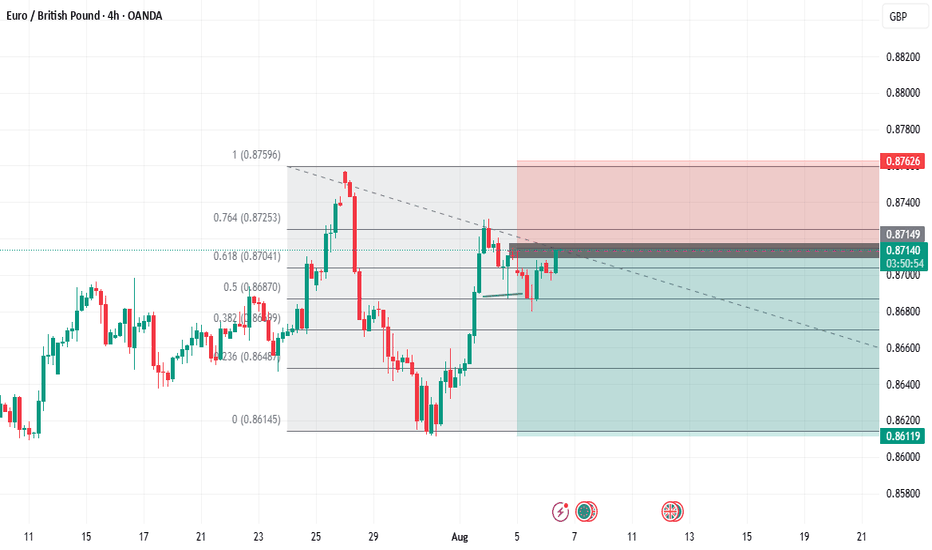

EURGBP at the pivotal zoneThe EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8640 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8640 would confirm ongoing upside momentum, with potential targets at:

0.8740 – initial resistance

0.8760 – psychological and structural level

0.8785 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8640 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8613 – minor support

0.8576 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8640 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GBPEUR trade ideas

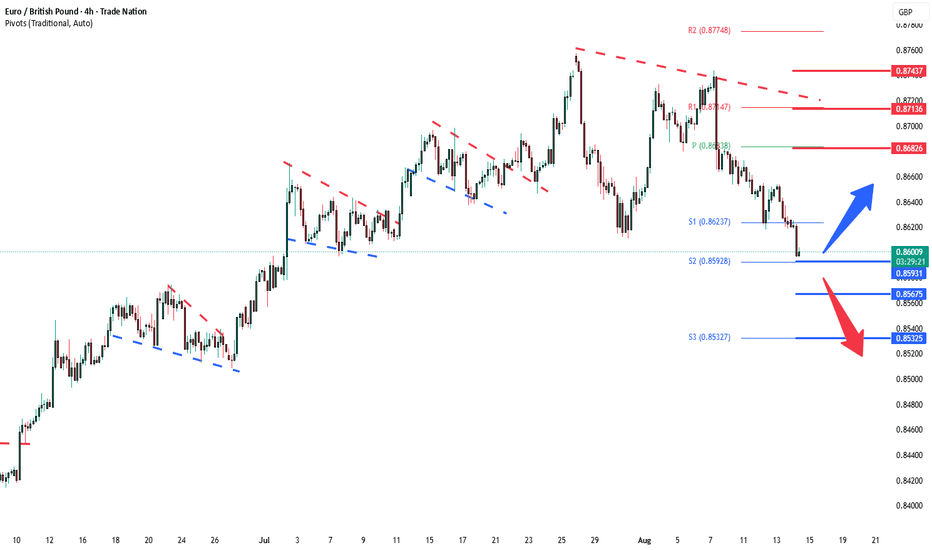

EURGBP support retest after upbeat UK GDP dataThe EURGBP remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 0.8590 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.8590 would confirm ongoing upside momentum, with potential targets at:

0.8680 – initial resistance

0.8713 – psychological and structural level

0.8745 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.8590 would weaken the bullish outlook and suggest deeper downside risk toward:

0.8567 – minor support

0.8532 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the EURGBP holds above 0.8590 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

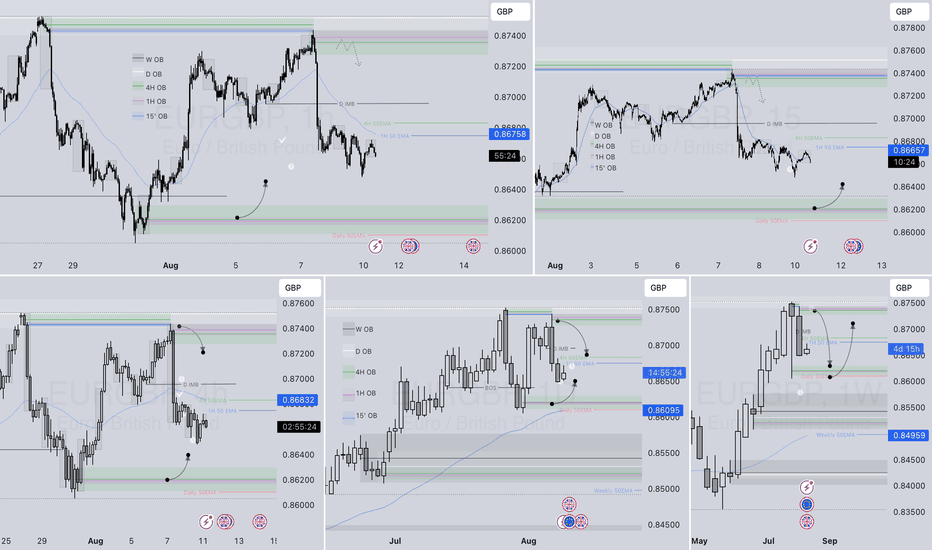

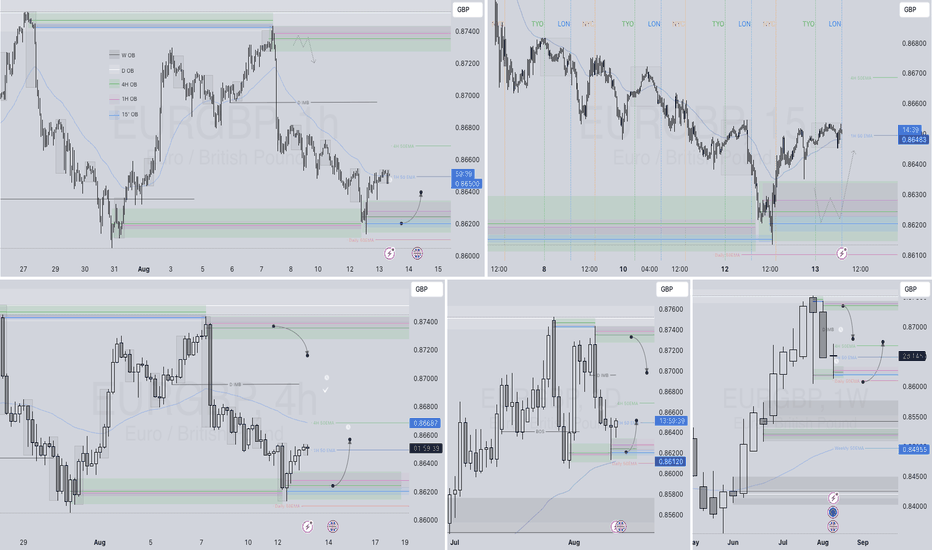

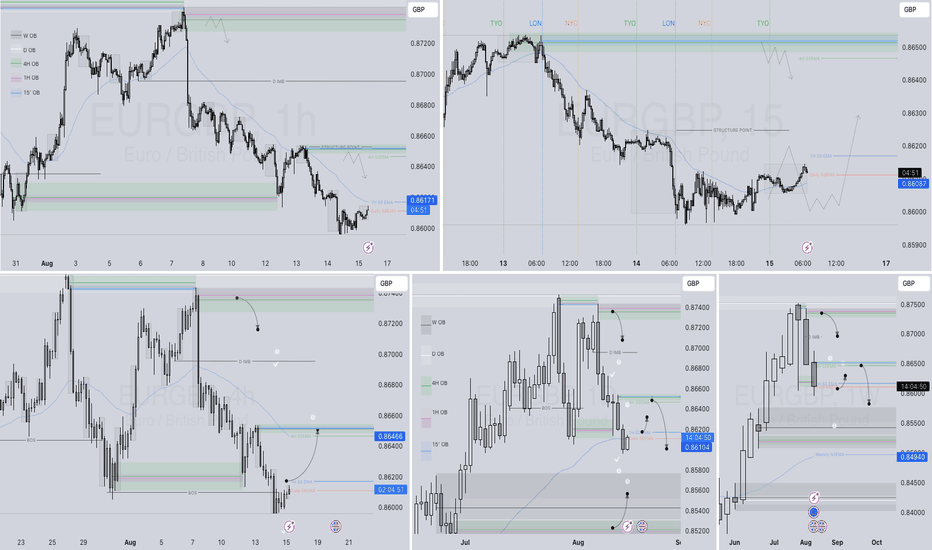

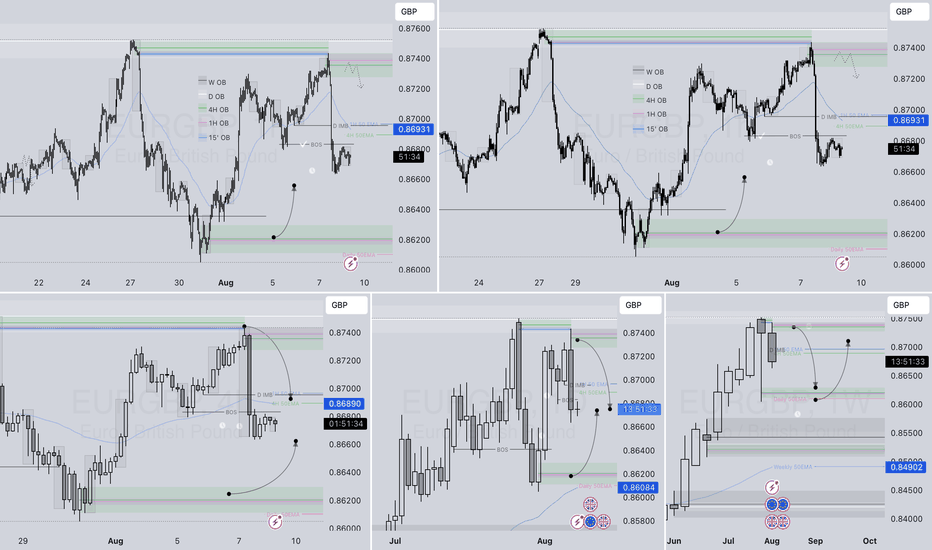

EURGBP – DAILY FORECAST Q3 | W33 | D11 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W33 | D11 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

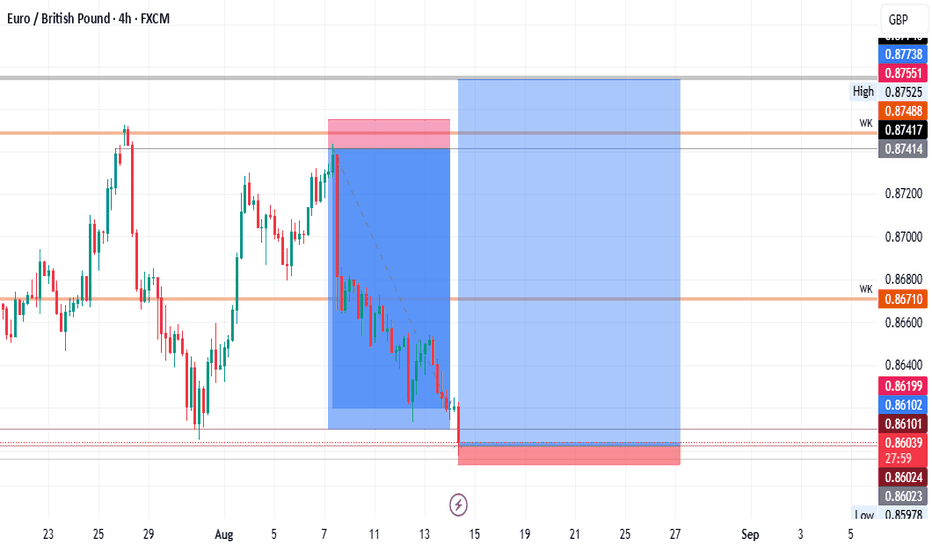

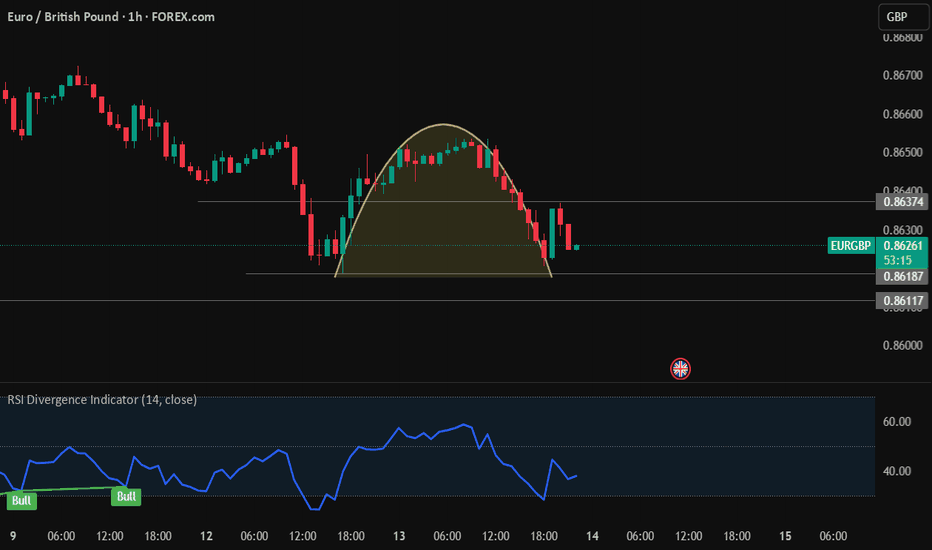

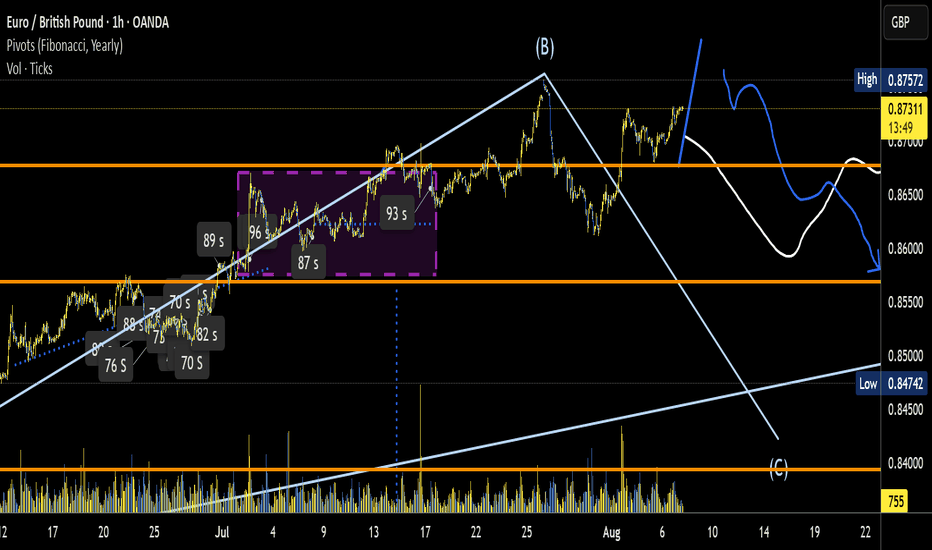

Bearish Bias on 1H 🟡 EUR/GBP – Rounded Top Formation | Bearish Bias on 1H 📉

The EUR/GBP pair is showing a Rounded Top formation on the 1H chart — a classic distribution pattern indicating a potential bearish reversal. Price action has completed the arc, and it's currently testing support .

🔍 Key Technical Observations:

Rounded Top structure, signaling loss of bullish momentum.

RSI near 37, with no bullish divergence yet — bearish momentum still active.

Price failed to hold above 0.8637 resistance, confirming sellers’ control.

📉 Bearish Scenario (Primary Idea):

Entry: 0.86180 (short)

SL: 0.86370

TP (1:1): 0.85990

Also Seems Bearish in Days May Create Double Top trend can be streached.

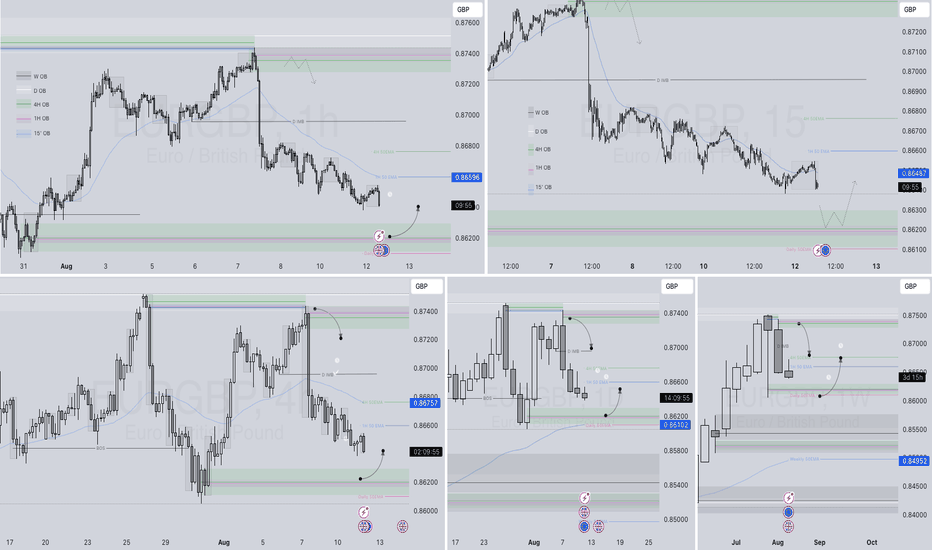

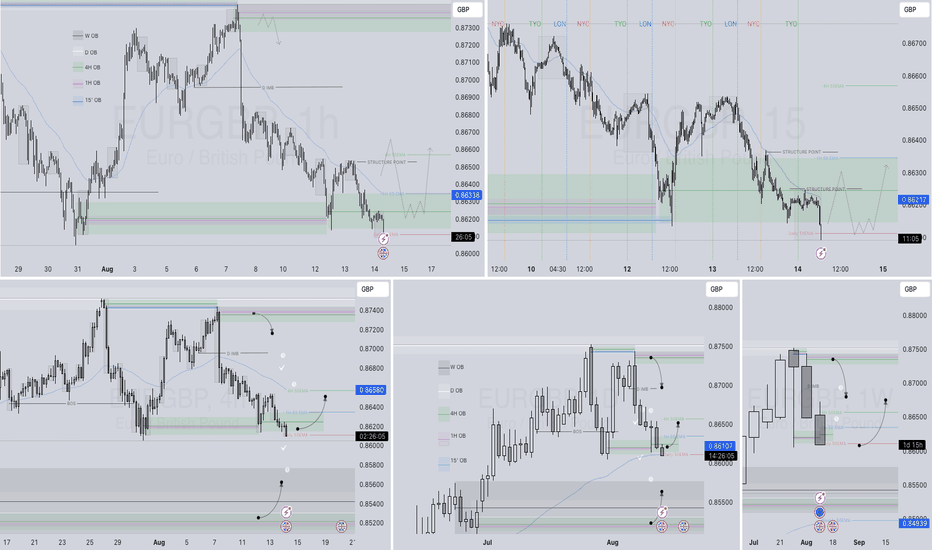

EURGBP – DAILY FORECAST Q3 | W33 | D13 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W33 | D13 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

EURGBP – DAILY FORECAST Q3 | W33 | D12 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W33 | D12 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

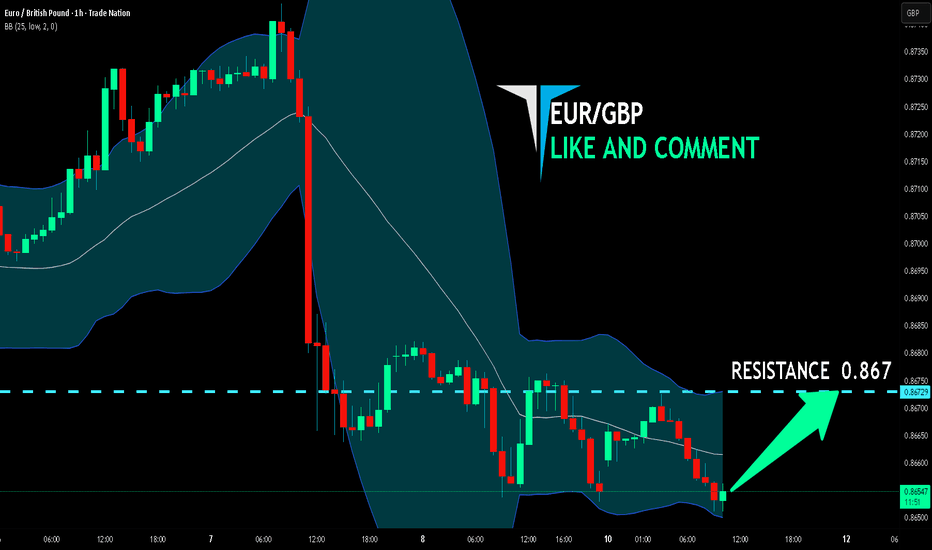

EUR/GBP SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

EUR-GBP downtrend evident from the last 1W red candle makes longs trades more risky, but the current set-up targeting 0.867 area still presents a good opportunity for us to buy the pair because the support line is nearby and the BB lower band is close which indicates the oversold state of the EUR/GBP pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURGBP – DAILY FORECAST Q3 | W33 | D15 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W33 | D15 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

EURGBP – DAILY FORECAST Q3 | W33 | D14 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W33 | D14 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

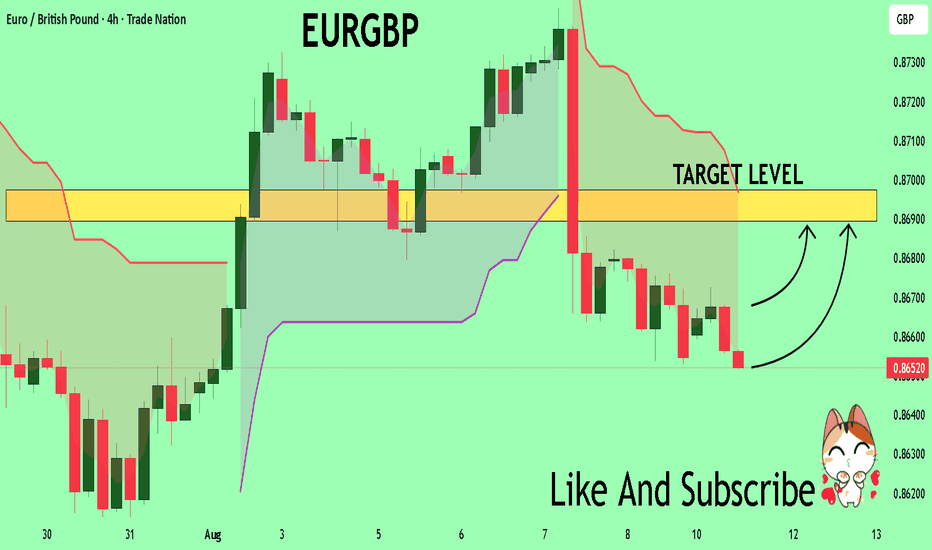

EURGBP Set To Grow! BUY!

My dear followers,

I analysed this chart on EURGBP and concluded the following:

The market is trading on 0.8653 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.8689

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

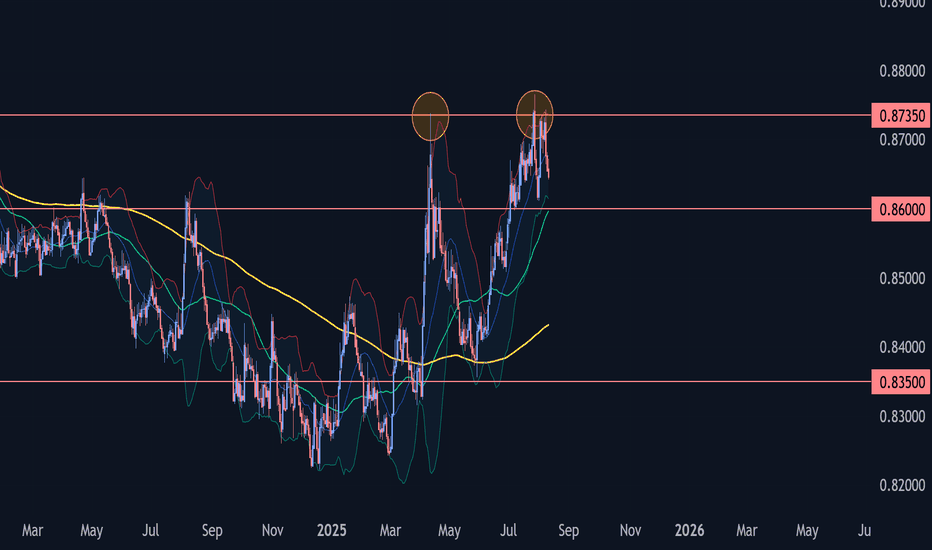

EURGBP Wave Analysis – 11 August 2025- EURGBP reversed from a strong resistance level 0.8735

- Likely to fall to support level 0.8600

EURGBP currency pair recently reversed down from the strong resistance level 0.8735 (which stopped all earlier sharp impulse waves from April), coinciding with the upper daily Bollinger Band.

The downward reversal from the resistance level 0.8735 created the daily Japanese candlesticks reversal pattern, Bearish Engulfing.

EURGBP currency pair can be expected to fall further to the next support level 0.8600, which stopped the earlier downward correction 2.

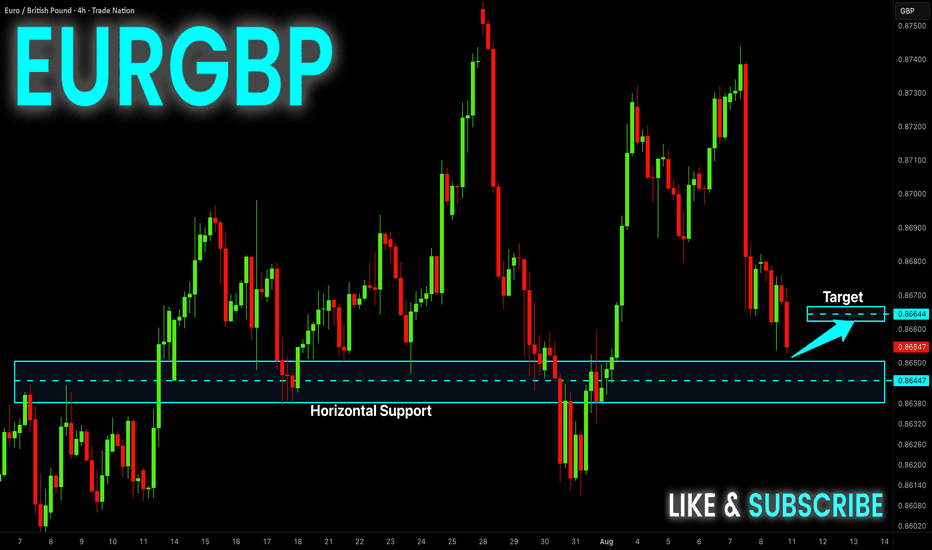

EUR-GBP Potential Long! Buy!

Hello,Traders!

EUR-GBP keeps falling down

Towards the horizontal support

Level of 0.8650 and after the

Retest we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP – DAILY FORECAST Q3 | W32 | D8 | Y25📊 EURGBP – DAILY FORECAST

Q3 | W32 | D8 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:EURGBP

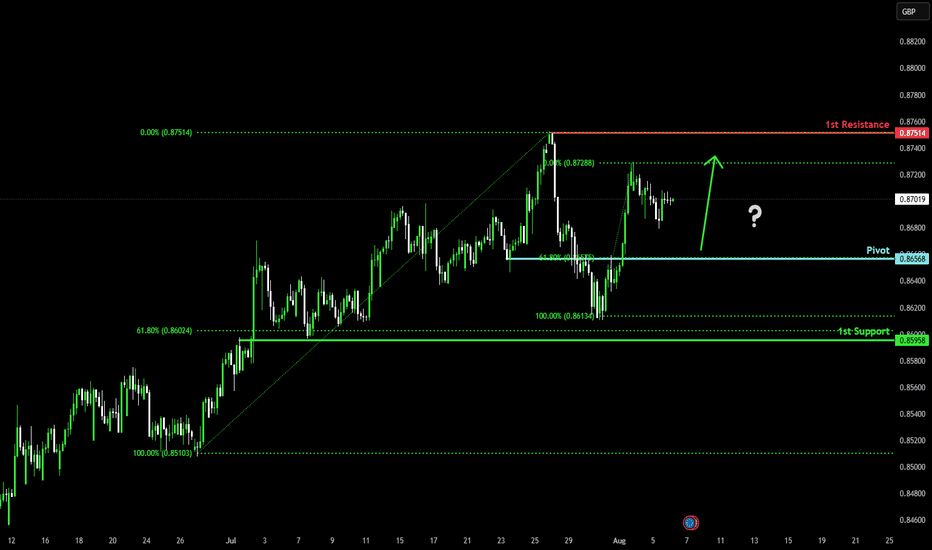

Falling towards 61.8% Fibonacci support?EUR/GBP is falling towards the pivot and could bounce to the 1st resistance which is a swing high resistance.

Pivot: 0.8656

1st Support: 0.8595

1st Resistance: 0.8751

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

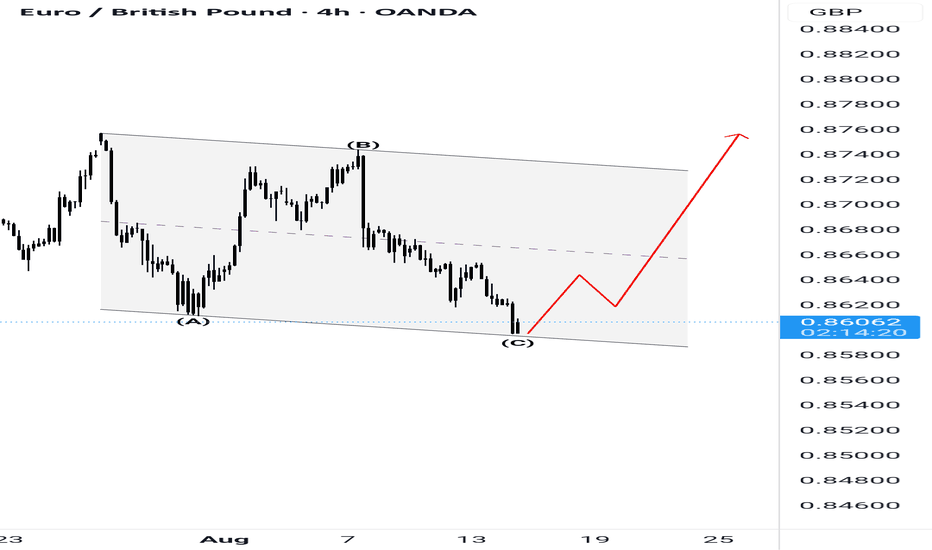

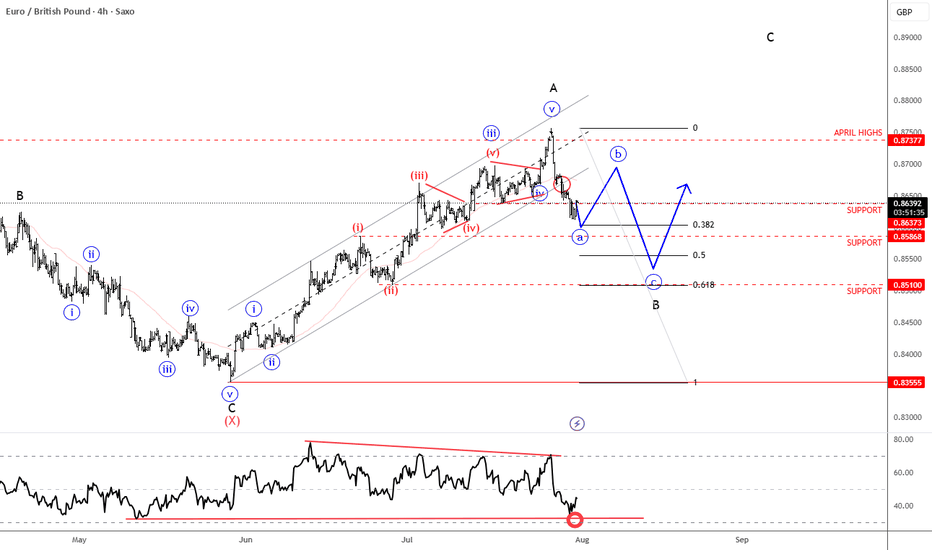

EURGBP Steps Into A Correction Within Ongoing RecoveryEURGBP is sharply down after reaching April highs for wave »v« of an impulse into wave A. As expected, the pair is now unfolding a three-wave abc corrective setback within higher-degree wave B. Currently, EURGBP is breaking below the channel support line in a sharp and impulsive projected wave »a«. A corrective recovery in wave »b« may follow, considering that RSI is already at the lower side of its range. Overall, we are still tracking this correction toward the 0.85x support area, which could act as a base before a potential bullish continuation higher into wave C.

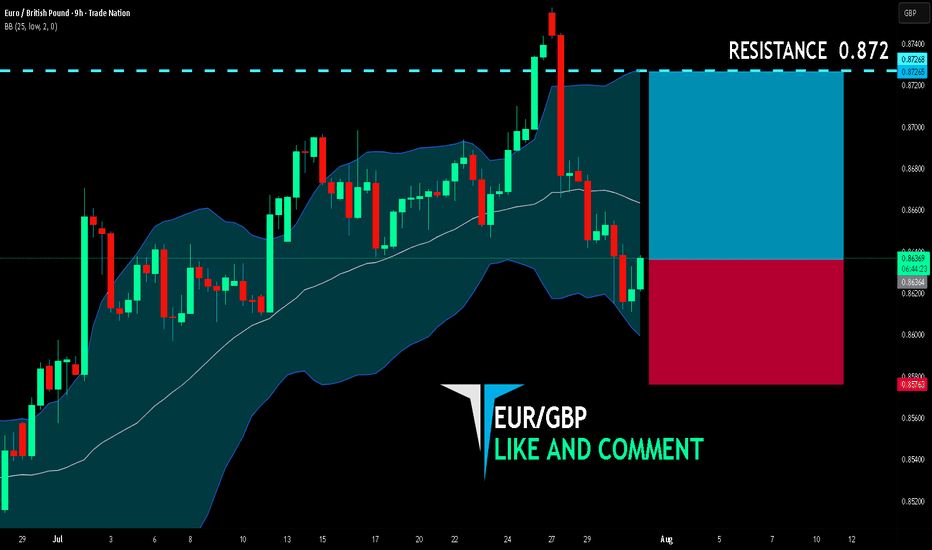

EUR/GBP BULLS ARE STRONG HERE|LONG

EUR/GBP SIGNAL

Trade Direction: long

Entry Level: 0.863

Target Level: 0.872

Stop Loss: 0.857

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Market Analysis: EUR/GBP Loses MomentumMarket Analysis: EUR/GBP Loses Momentum

EUR/GBP is consolidating and might aim for a fresh increase above 0.8700.

Important Takeaways for EUR/GBP Analysis Today

- EUR/GBP is trading in a positive zone above the 0.8665 pivot level.

- There is a short-term declining channel forming with resistance near 0.8705 on the hourly chart.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP, the pair started a consolidation phase after it failed to surpass 0.8730. The Euro traded below the 0.8710 and 0.8700 support levels against the British Pound.

The EUR/GBP chart suggests that the pair even declined below the 23.6% Fib retracement level of the upward move from the 0.8605 swing low to the 0.8729 high. It is now consolidating losses and trading below the 50-hour simple moving average.

The pair is now facing resistance near the 0.8705 level. There is also a short-term declining channel forming with resistance near 0.8705.

The next major resistance could be 0.8730. The main resistance is near the 0.8750 zone. A close above the 0.8750 level might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8780. Any more gains might send the pair toward the 0.8800 level.

Immediate support sits near 0.8680. The next major support is near 0.8665 or the 50% Fib retracement level of the upward move from the 0.8605 swing low to the 0.8729 high.

A downside break below 0.8665 might call for more downsides. In the stated case, the pair could drop toward 0.8635.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURGBP Expected Growth! BUY!

My dear friends,

Please, find my technical outlook for EURGBP below:

The instrument tests an important psychological level 0.8673

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.8707

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK