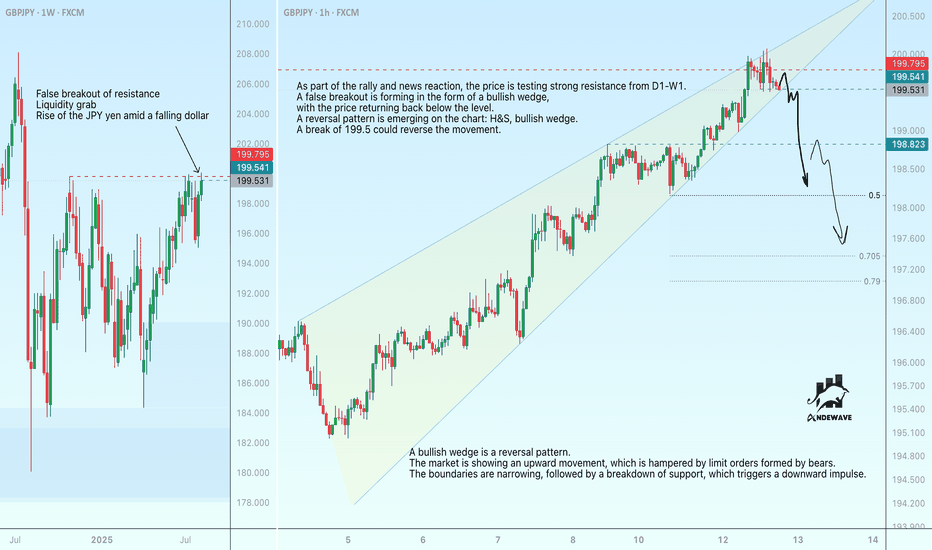

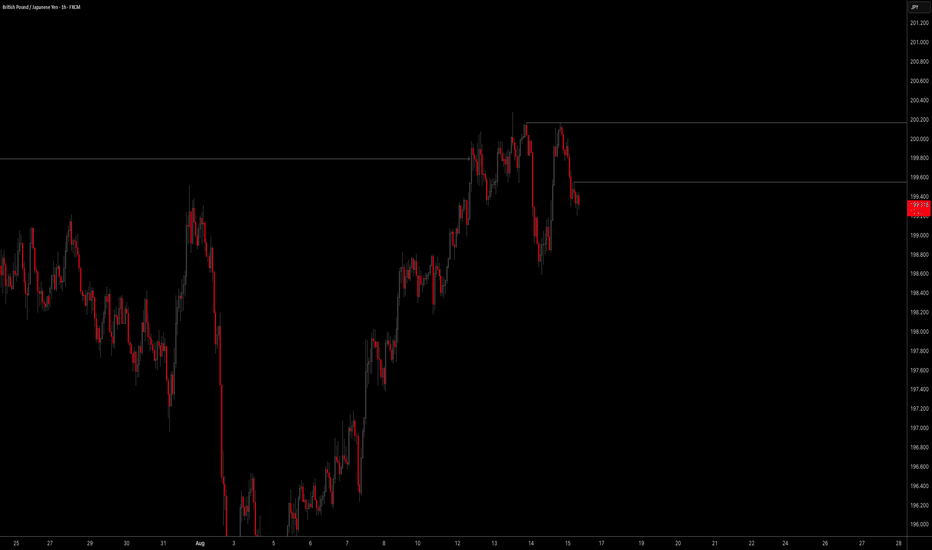

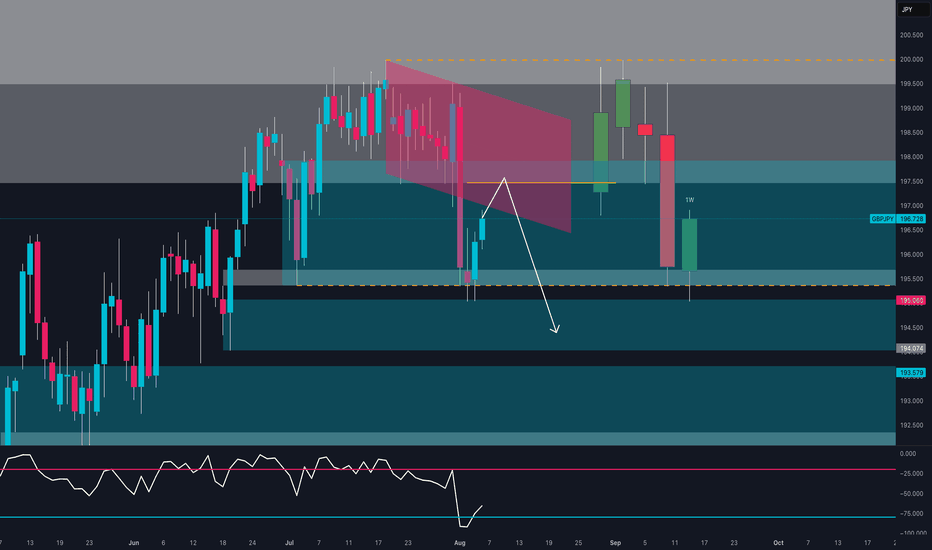

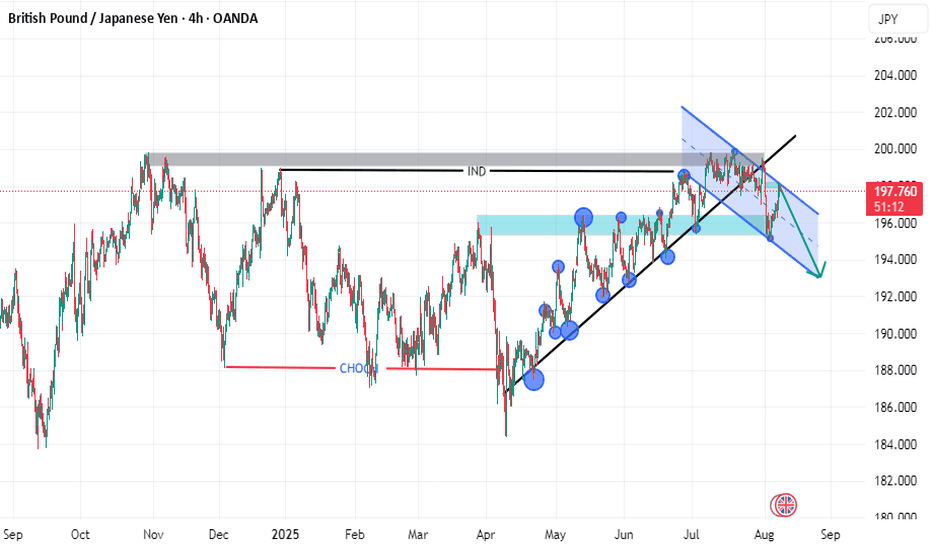

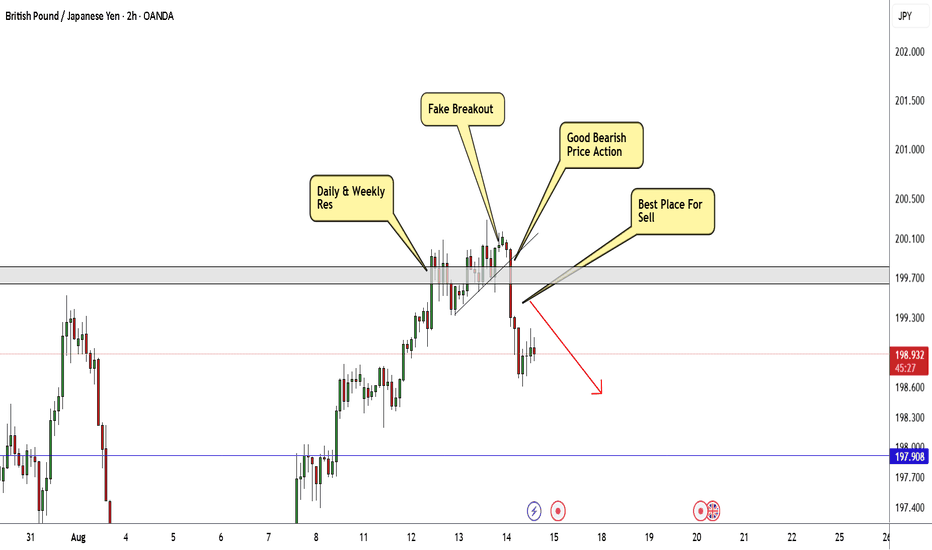

GBPJPY is forming a reversal pattern. Trend reversal...As part of the rally and news reaction, the price is testing strong resistance from D1-W1.

A false breakout is forming in the form of a bullish wedge, with the price returning back below the level. A reversal pattern is emerging on the chart: H&S, bullish wedge. A break of 199.5 could reverse the movement.

A bullish wedge is a reversal pattern. The market is showing an upward movement, which is hampered by limit orders formed by bears. The boundaries are narrowing, followed by a breakdown of support, which triggers a downward impulse.

GBPJPY trade ideas

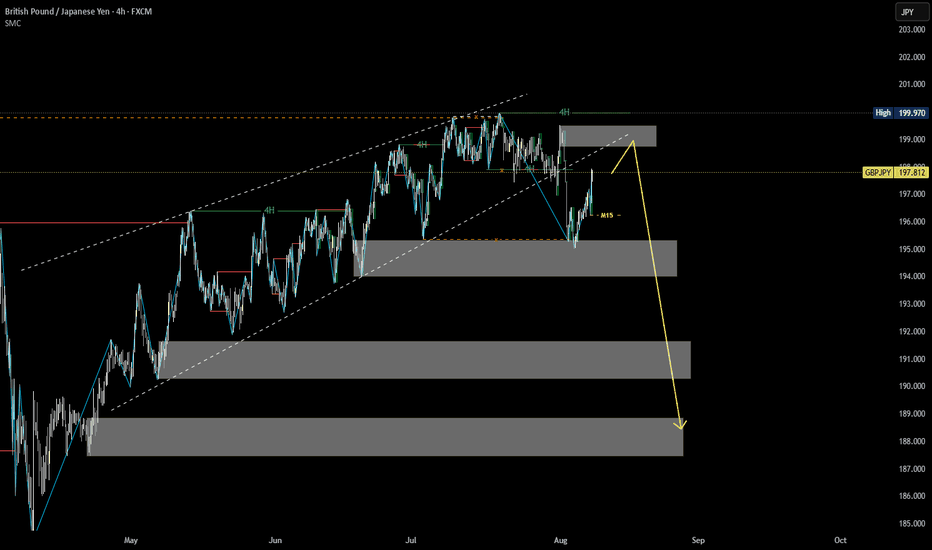

GBPJPY NEXT MOVE (expecting a bearish move)(mid term)Go through the analysis carefully, and do trade accordingly.

Anup Bias (Mid term)

Current price- 198.500

"if Price stay below 200.500 then next target is 196.500 and 191.500 and below that 189.000.

-POSSIBILITY-1

Wait (as geopolitical situation are worsening )

-POSSIBILITY-2

Wait (as geopolitical situation are worsening)

Best of luck

Never risk 2% of principal to follow any position.

Support us by liking and sharing the post.

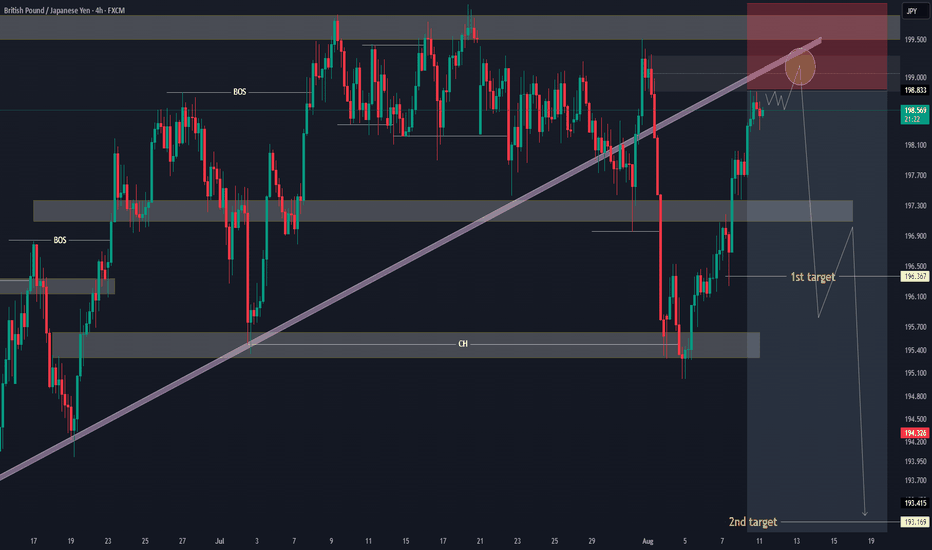

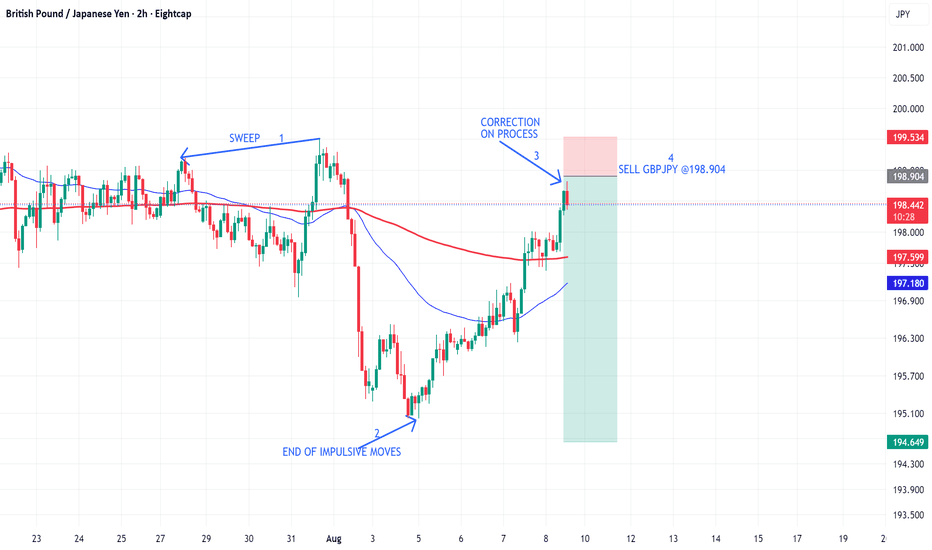

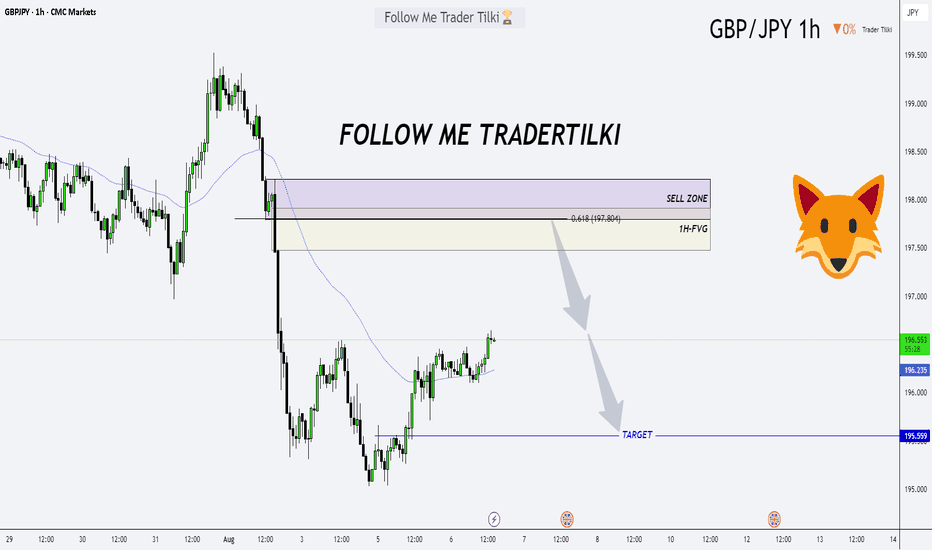

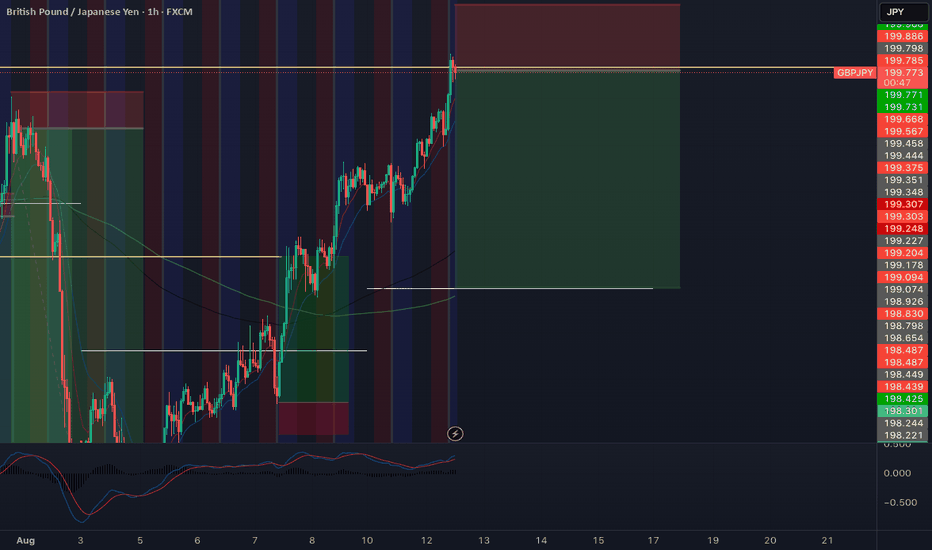

GBPJPY Short trade set up 4H📉 GBP Swing Trade Setup – Bearish Bias

Liquidity Sweep: On 31st July, price swept key liquidity before commencing its move lower.

FVG Structure: The drop left multiple Fair Value Gaps (FVGs). Price has now fully retraced into the first FVG of this leg down, presenting a potential continuation opportunity.

Discounted Price: Current price action has retraced into discounted territory (below equilibrium of the prior swing).

Orderflow Bias: Using the Orderflow Boxing method, bias remains bearish.

Fundamental Confluence:

The Bank of England has signalled a rate-cutting cycle ahead, with commentary suggesting the nominal rate should move towards the 2–4% range.

This is typically bearish for GBP unless already fully priced into the market.

Swing Trade Plan:

Direction: Short (bearish bias)

POI: First FVG from the leg down starting 31st July

Confluences:

Liquidity sweep

Retracement into discount

Within FVG

Bearish orderflow

Dovish BoE stance

📌 This is not financial advice. For educational purposes only.

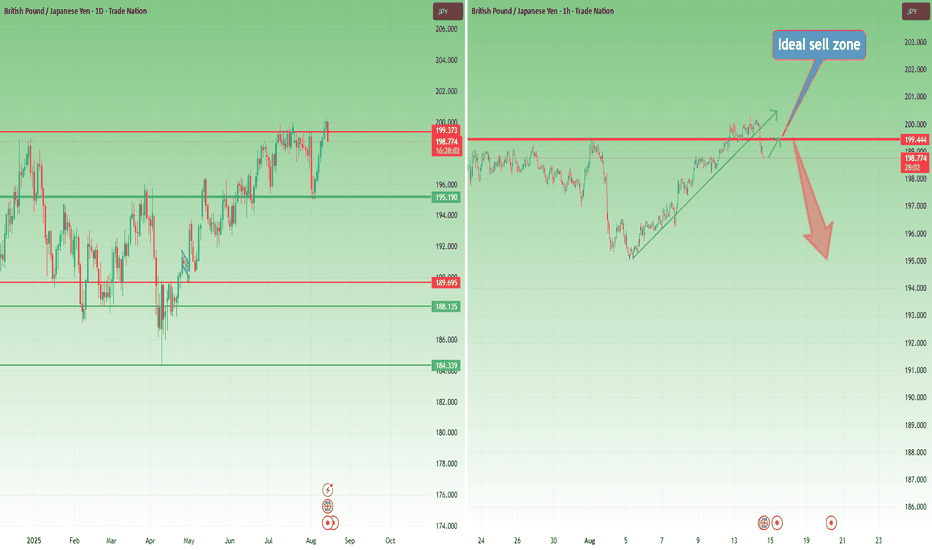

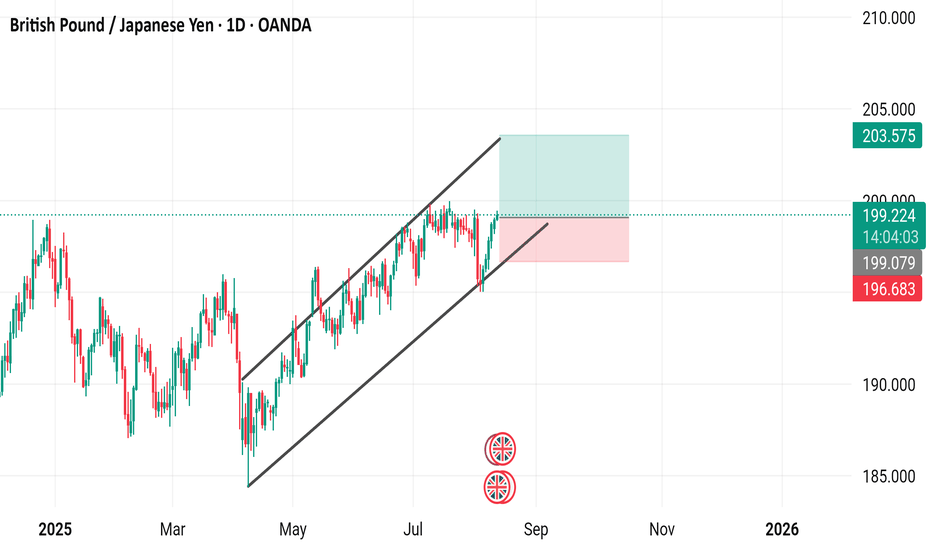

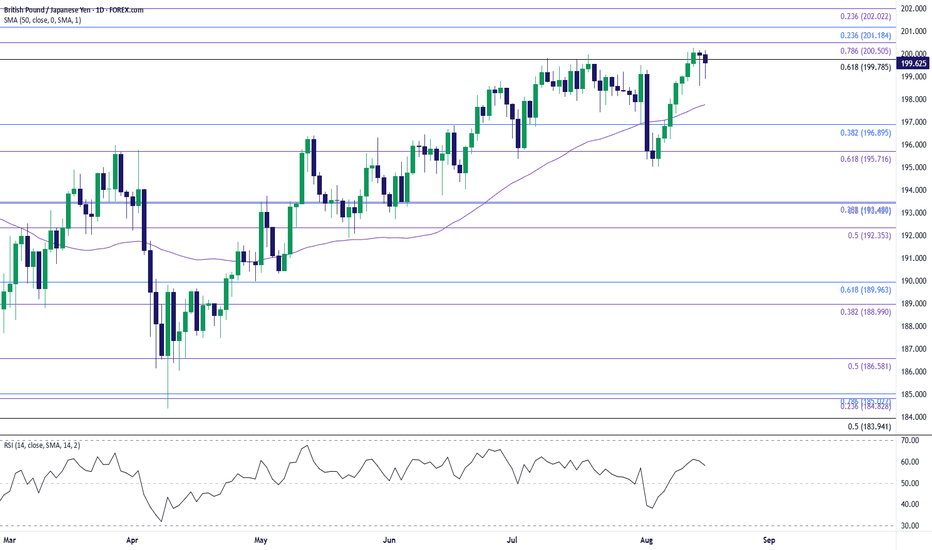

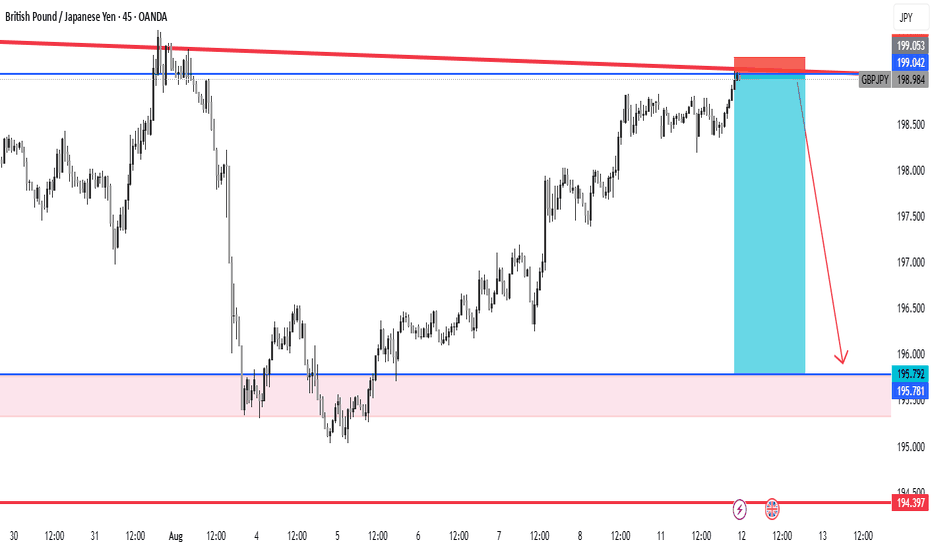

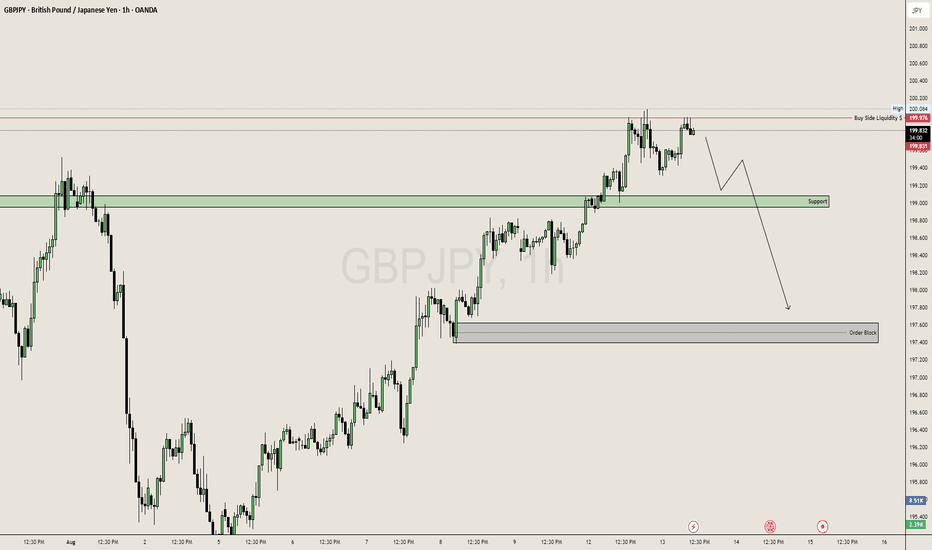

GBP/JPY – Possible False Break Above 200After confirming 195 support at the beginning of August, GBP/JPY posted 7 consecutive daily gains, bringing the pair back to resistance and even spiking above it — briefly crossing the important psychological level of 200.

Today started with a sharp drop, suggesting that the 200+ zone is a significant milestone and hinting at a potential false breakout.

Trading Plan:

I will work with the assumption that GBP/JPY bears will hold firm around 200. The ideal sell zone is near 199.50, with a swing target back to the 195 support area, offering a risk–reward ratio of 1:5.

A sustained move above 200 would invalidate this scenario. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

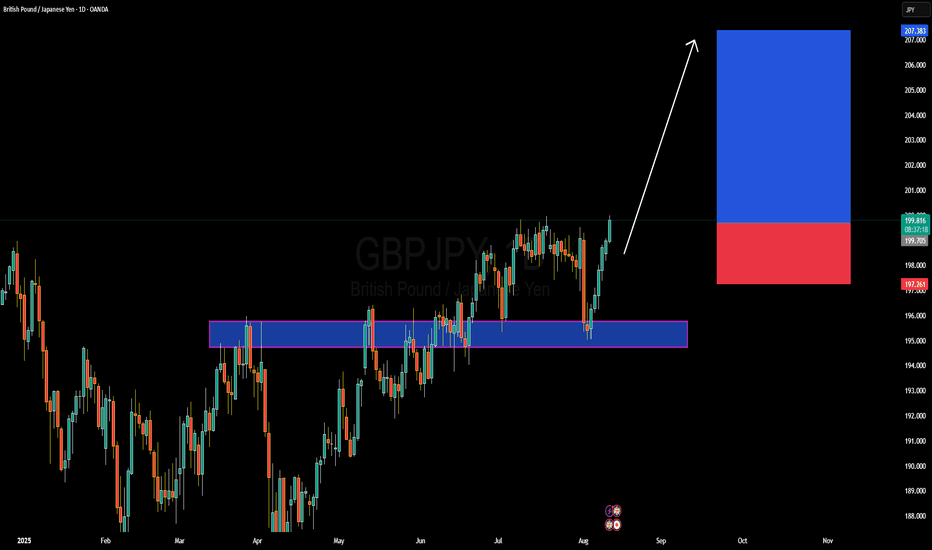

GBPJPY Forming Bullish ContinuationGBPJPY has broken upward from a multi-test demand zone near the 195.00–195.50 area on the daily chart, and buyers are now stepping in confidently. Price is holding above that support and pushing toward the upper resistance region. A clean move and close above 200.00 could set the stage for a further leg upward, targeting the 207.30 zone as indicated on the chart.

From a macro perspective, recent developments are in favor of the pound and against the yen. The Bank of England has started easing, cutting rates to 4% with a "gradual and careful" tone, but still remains relatively hawkish amid sticky inflation pressures. Meanwhile, the Bank of Japan remains cautious, keeping rates low, which continues to exert weakening pressure on the yen overall.

Technically, the bounce from that demand zone and clear upward momentum indicate a strong continuation pattern. As long as the pair stays above 195.50, the trend remains bullish. Traders may look to enter on dips with stops below that zone, aiming for the 207.30 level where resistance and liquidity converge.

Overall, GBPJPY is showing a compelling trend-following opportunity driven by both technical structure and fundamental divergence. Breaking above 200 would likely accelerate momentum toward the 207 area. It’s a high-probability setup with clearly defined risk levels and strong macro alignment—not to be missed.

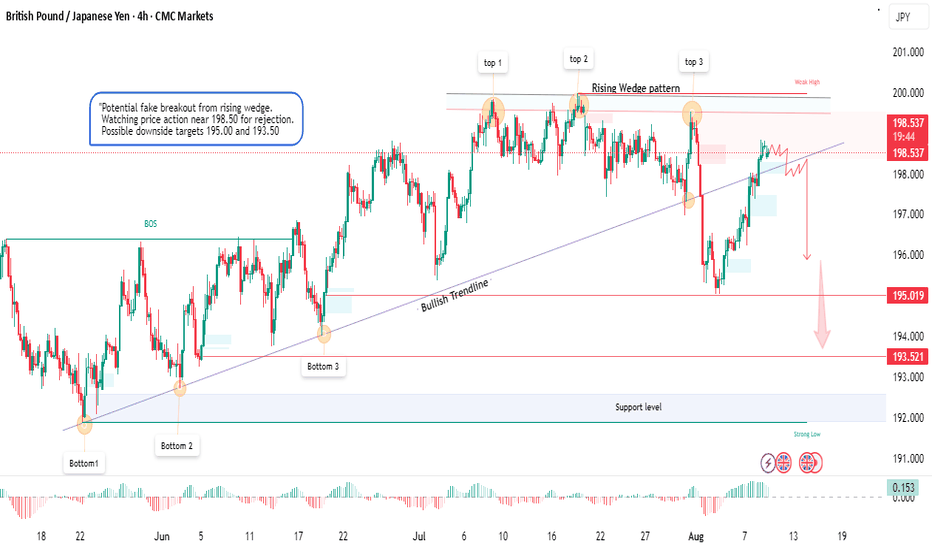

GBP/JPY–Potential Fake Breakout from Rising Wedge/KeyLevelsAheadGBP/JPY is currently testing the 198.50 resistance area after forming a Rising Wedge pattern on the 4H chart. This zone has historically acted as a strong rejection point (previous tops), and the current structure suggests a possible fake breakout scenario.

Key observations:

Pattern: Rising Wedge following a bullish trendline from June lows.

Resistance: 198.50–200.00 remains a critical supply zone.

Rejection Signals: Multiple failed attempts to hold above this level (Tops 1, 2, and 3).

Downside Targets: If price confirms rejection, potential short-term targets are 195.00 and 193.50.

Support: Major support zone near 191.50–192.00.

Trading Plan:

I am closely monitoring price action around 198.50. A clear bearish rejection with strong volume could trigger a sell-off toward the mentioned targets. If buyers push above 200.00 with strong momentum, the bearish scenario becomes invalid.

⚠️ Risk Management: Always wait for confirmation before entering trades. Use stop-loss orders and avoid over-leveraging. This is not financial advice — for educational purposes only

GBP/JPY WEEKThis week in the markets was nothing short of amazing. I stayed sharp, made calculated moves, and turned challenges into opportunities. Every trade taught me something new, and I kept my focus steady even when the charts got wild. It felt good to see my strategy pay off and my confidence grow with every win. Overall, it was a powerful reminder that persistence, patience, and smart decisions can really make the difference. Ready to keep this momentum going! OANDA:GBPJPY

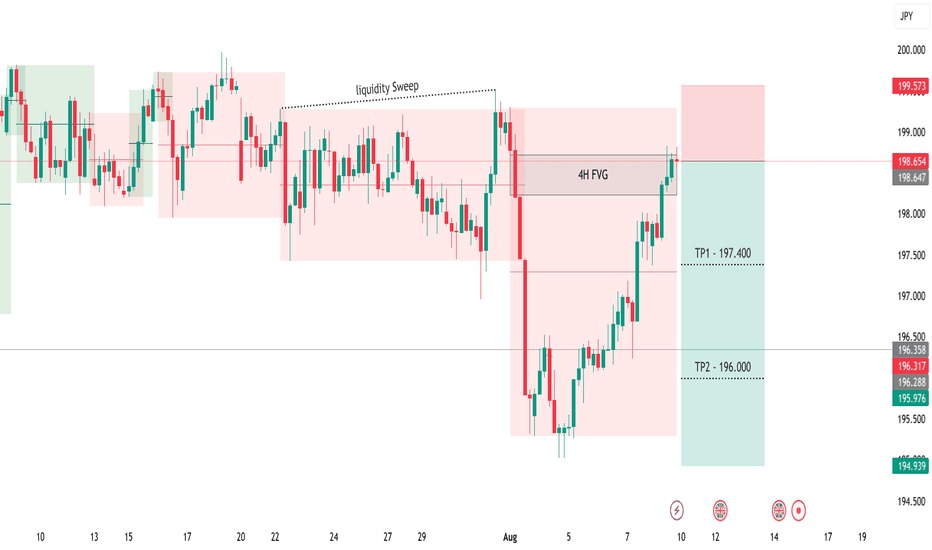

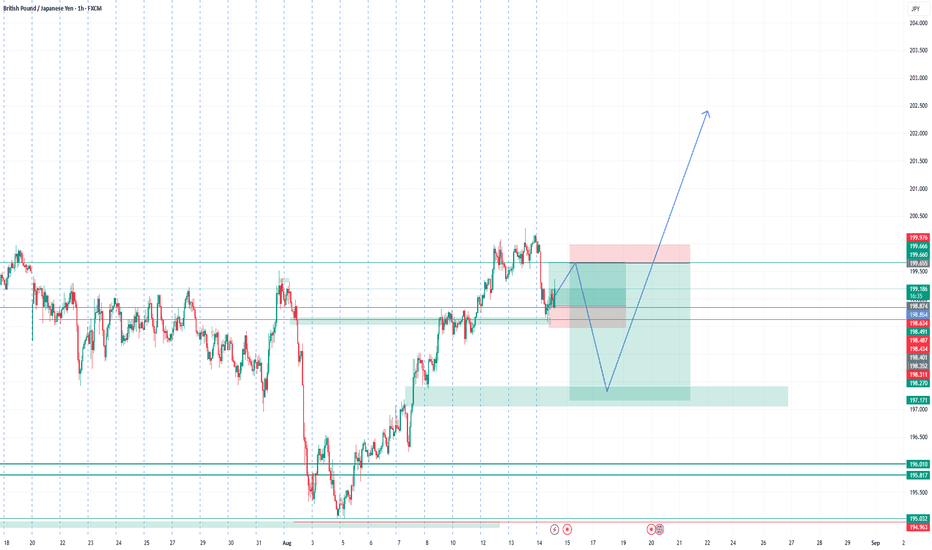

GBP/JPY Trap? Smart Money Might Be Setting Up the Next Drop📊 1. Technical Overview

Price broke the bullish structure decisively, closing below a key demand zone between 195.00–196.00, leaving a large unfilled imbalance.

Last week's recovery candle suggests a potential pullback toward 197.40–197.80, now acting as a resistance confluence.

The descending channel and weak RSI further support a continuation of the bearish trend.

Bearish targets: 193.50 and 192.20

📈 2. COT (Commitment of Traders) Report

GBP:

Non-commercials are cutting long positions (–5,961) and adding shorts (+6,637) → Bearish divergence developing on GBP.

JPY:

Non-commercials are heavily increasing short exposure (+15,113), but remain strongly net-long overall, indicating a potential exhaustion of bullish JPY positioning.

💭 3. Retail Sentiment

Positioning is neutral: 51% long / 49% short.

This balance suggests no excessive retail bias, leaving room for directional moves without immediate contrarian pressure.

📆 4. Seasonality

August is historically bearish for GBP/JPY:

• –2.82% (20Y average)

• –3.04% (15Y average)

• –1.44% (5Y average)

The data shows a consistent historical bias to the downside during this month.

🎯 5. Strategic Outlook

• Primary Bias: Bearish below 197.40–197.80

• Invalidation: Weekly close above 198.10

• Targets: 195.00 > 193.50 > 192.20

The confluence of technical rejection, bearish COT dynamics, neutral sentiment, and negative seasonality supports a corrective scenario for August.

GBP/JPY 1D Chart - OANDAdaily performance of the British Pound (GBP) against the Japanese Yen (JPY) as of August 12, 2025, with a current value of 199.248 (+0.264 or +0.13%). The chart includes a bullish trendline, a highlighted resistance zone around 203.575, and key support levels at 199.079 and 196.683. Buy and sell signals are marked at 199.259 and 199.236 respectively, with a projected upward movement indicated.

GBPJPY SELL SWEET SETUP SHOOOOOOOOOOOOORT HHHHHHHHHI think we should research selling opportunity

because we have uptrend line has broken and tested

and we have bearish channel and the price reflect from resistance on time frame 1W

SO SHORTLY i will sell Especially since we have a rebound from the imbalance as well.

Look at this picture as it makes it clearer to you

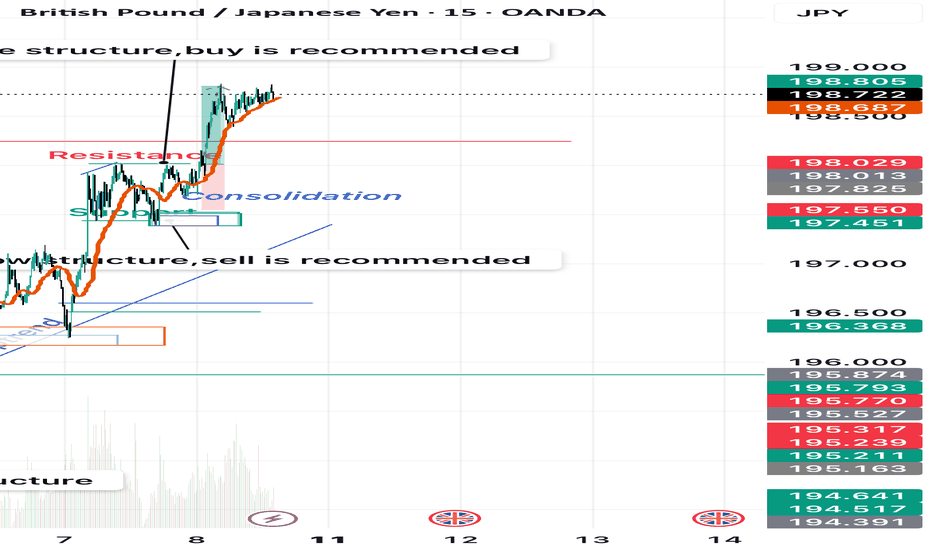

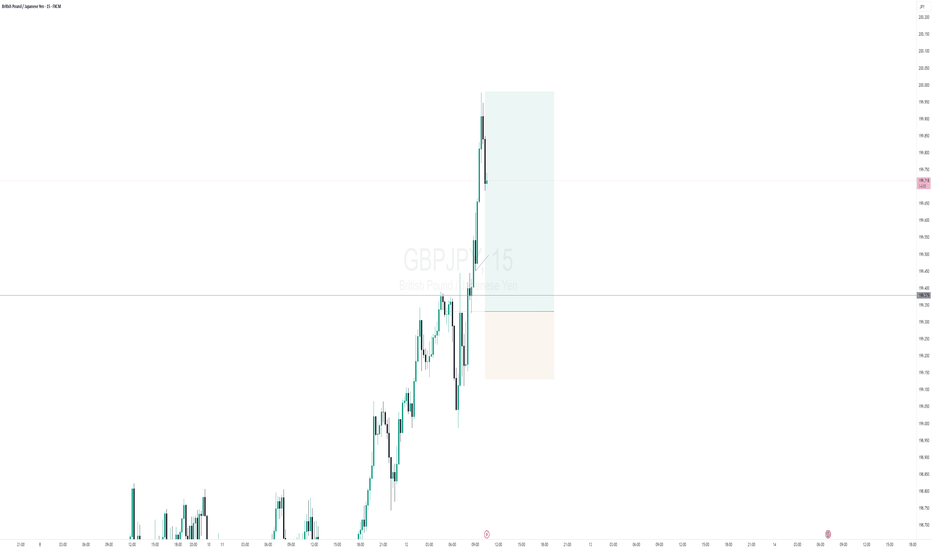

Market Structure Analysis of GBPJPY on the 4H TimeframeMulti-Timeframe Context (HTF: 4H, LTF: M15)

The main trend on the 4H chart is bearish.

Price is currently in a retracement phase (pullback).

On the M15, price is in a bullish short-term structure.

We monitor the M15 market structure closely to look for signs of weakness and identify high-probability short entries in alignment with the 4H downtrend.

GBP/JPY Rally UnravelsThe recent rally in GBP/JPY seems to be unraveling as the exchange rate struggles to push/close above the 199.80 (61.8% Fibonacci retracement) to 200.50 (78.6% Fibonacci extension) zone.

In turn, failure to defend the weekly low (198.18) may push GBP/JPY back toward the 195.70 (61.8% Fibonacci extension) to 196.60 (23.6% Fibonacci extension) region, with a breach of the monthly low (195.04) bringing the 192.40 (50% Fibonacci extension) to 193.50 (38.2% Fibonacci extension) area on the radar, which incorporates the June low (192.73).

At the same time, a move/close above the 199.80 (61.8% Fibonacci retracement) to 200.50 (78.6% Fibonacci extension) zone opens up 201.20 (23.6% Fibonacci retracement), with the next area of interest coming in around 202.00 (23.6% Fibonacci extension).

--- Written by David Song, Senior Strategist at FOREX.com

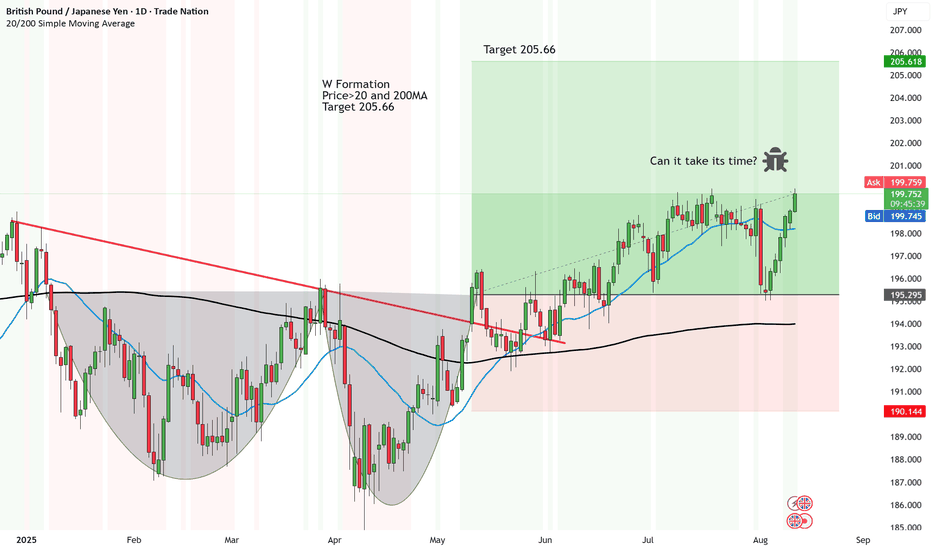

UPDATE: GBP/JPY heading to target but like a Dungbeetle!Another analysis done in May with a W Formation.

It broke above then below then tested the resistance (neckline) three times.

Before it turned back up.

So now we are getting good traction for upside (if the interest daily charges haven't eaten enough of the portfolio.

And now we will just wait for the price to head to the first target of 205.66

W Formation

Price>20 and 200MA

Target 205.66

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP/JPY Gave Fake Breakout , Short Setup Valid To Get 200 Pips !Here is my 2H Chart on GBP/JPY , We Have A Fake Breakout and then the price closed below my old res and we have a very good bearish Price Action on 1 And 2 Hours T.F Also the price trying to retest the area now and giving a good bearish price action on smaller time frames , , So i see it`s a good chance to sell this pair if it go up a little to retest the broken area and then we can sell it and targeting 100 to 150 pips . and if we have a daily closure again above my new res then this idea will not be valid anymore .

GBPJPY Sell Setup from Two Key Levels!Hey friends 👋

Here’s my carefully prepared GBPJPY analysis, just for you 📊

In this setup, I’ll be opening sell positions from two key levels:

1️⃣ 197.477

2️⃣ 198.100

My target level is: 🎯 195.560

Every single like you give truly fuels my motivation to keep sharing these insights.

Huge thanks to everyone who supports and encourages me with their likes 🙏

GBPJPY will fall or break up!?GBPJPY is at 200.00, this is a major resistance and on break or this zone can lead GJ to move more upside but before breaking we can expect a retest before breaking resistance.

On Higher Time Frame, We saw that GJ moved upside continuously due to JPY, It didn't hunted and liquidity so we can expect a liquidity hunt before moving up, this sell trade can be risky as trend is positive for upside but we can get a scalp trade and then plan a buy from support zones.