GBPJPY trade ideas

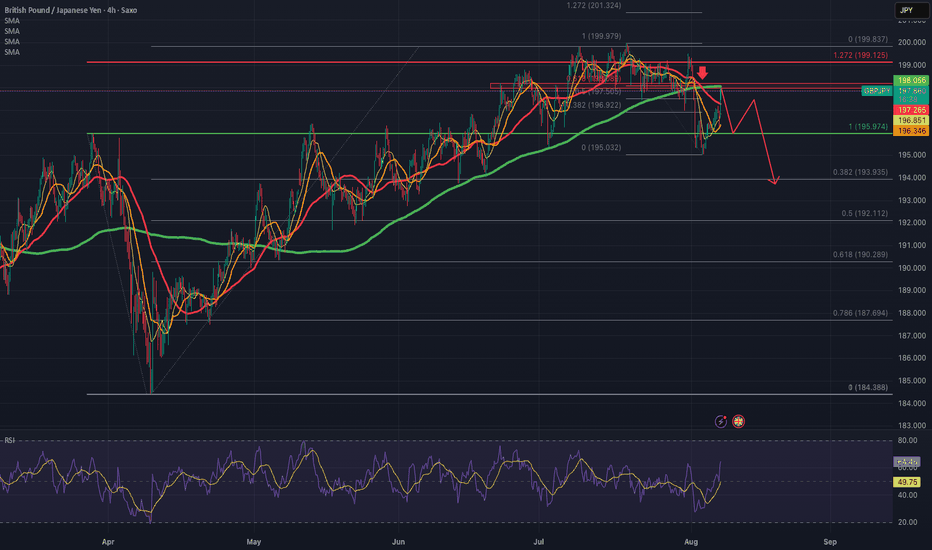

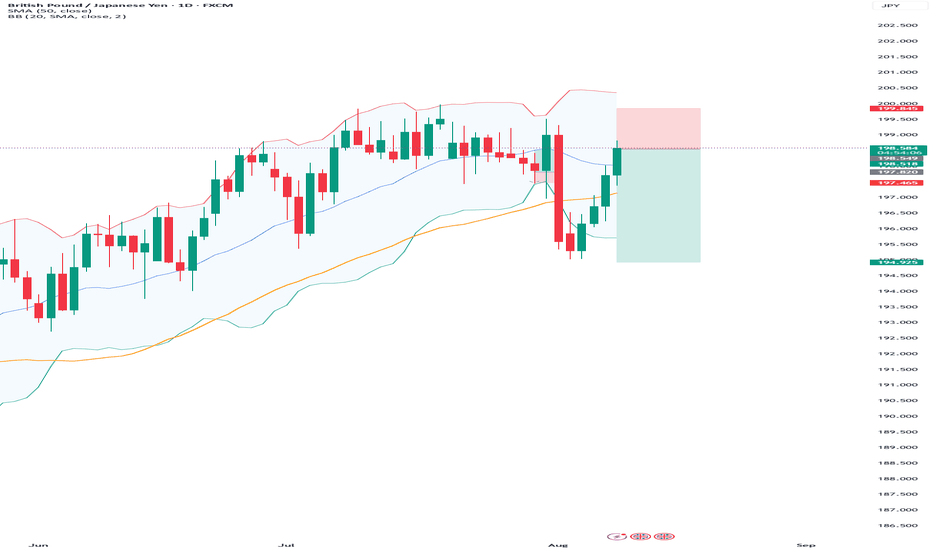

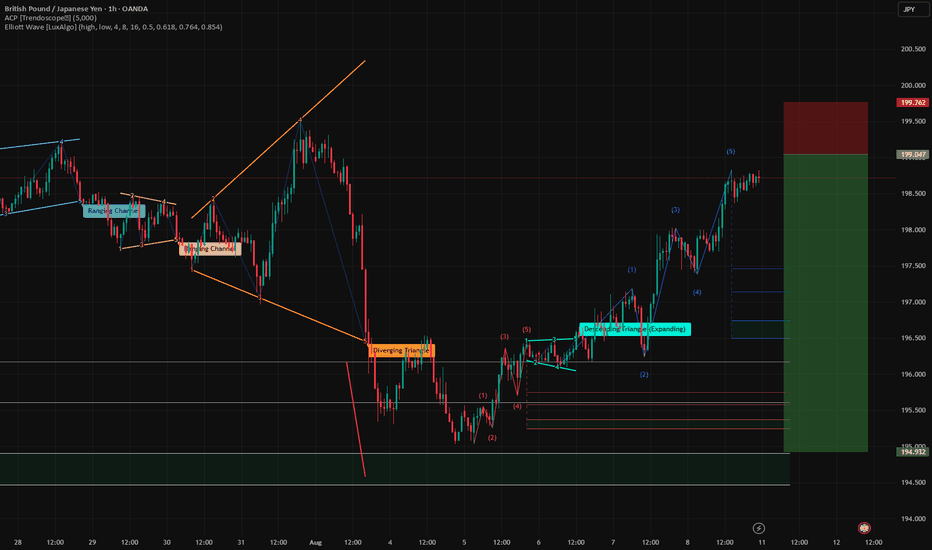

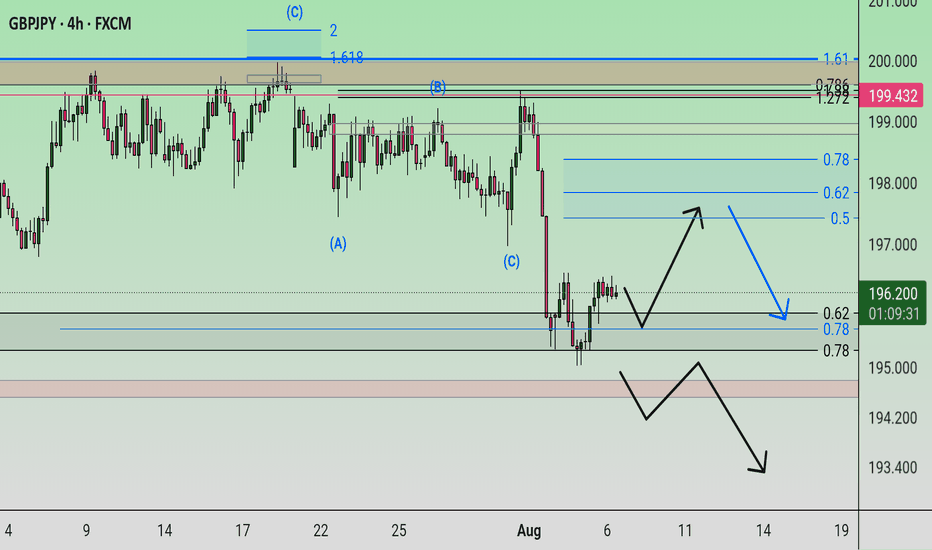

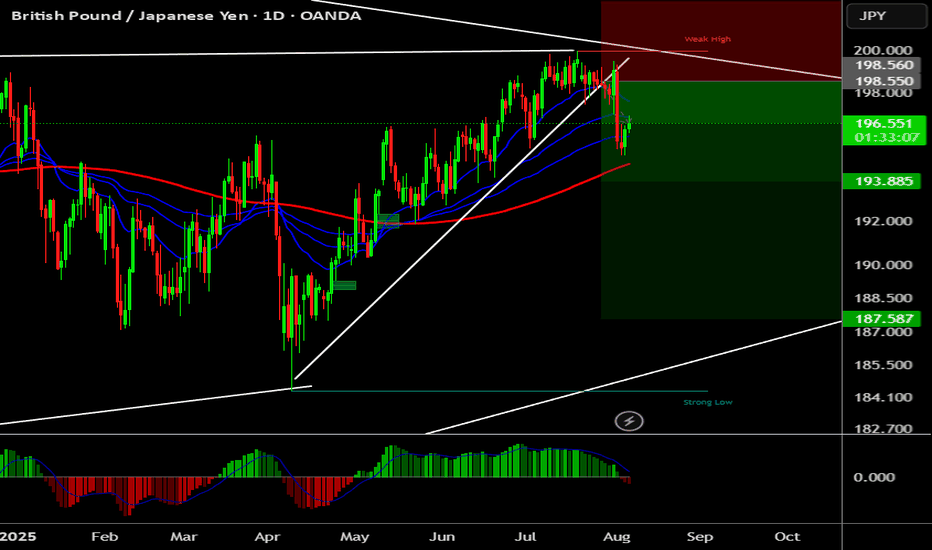

GBPJPY - at ResistanceSterling Yen long term was consolidating since Aug 24.

Now the price reached the FR 127.2 and respected it as Resistance.

On Aug 1st the support at FR 100 was broken. Yet, price crossed down SMA200 (4H)

Now price is testing the SMA200 from below, which is aligned with FR 61.8 of the latest impulse down.

If the Resistance at 198 holds, price may commence a longer correction, potentially down to 194 or even to 190.

Just my humble opinion.

GBP/JPY Could Be Rising Into a Bear ZoneGBP/JPY is trying to notch its third bullish day heading into today's Bank of England (BOE) meeting. But with a cut expected and the potential for a dovish tone, I suspect its upside could be limited. Besides, the technical clues on the daily and weekly chart suggest we may have seen a major top in July.

Matt Simpson, Market Analyst at City Index and Forex.com

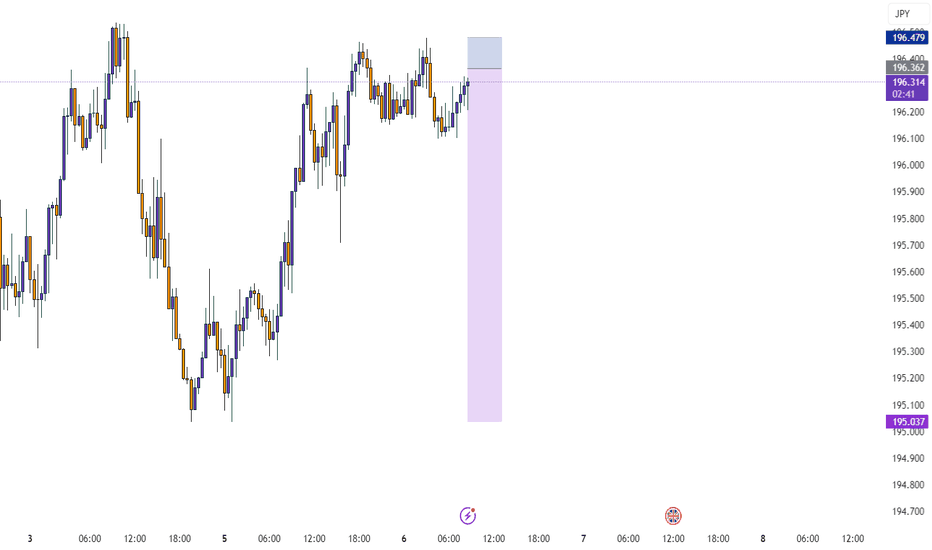

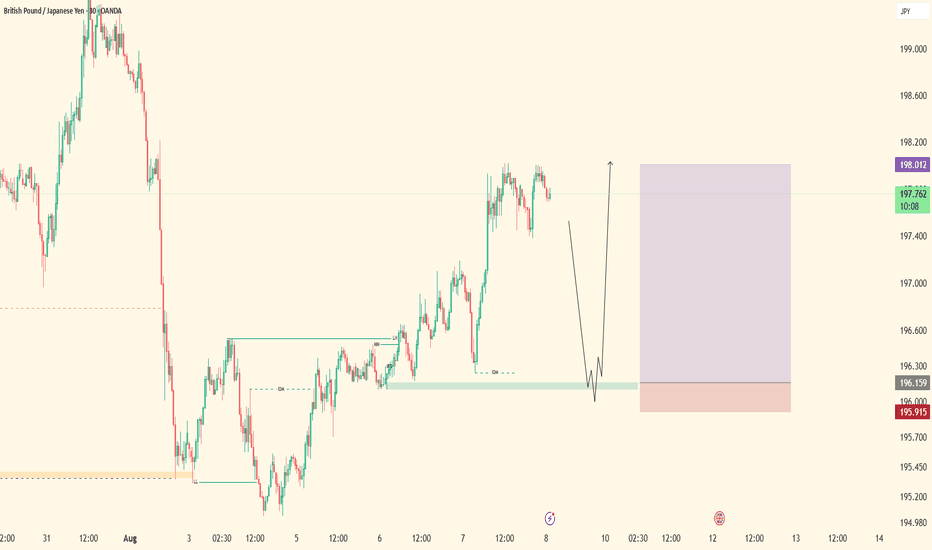

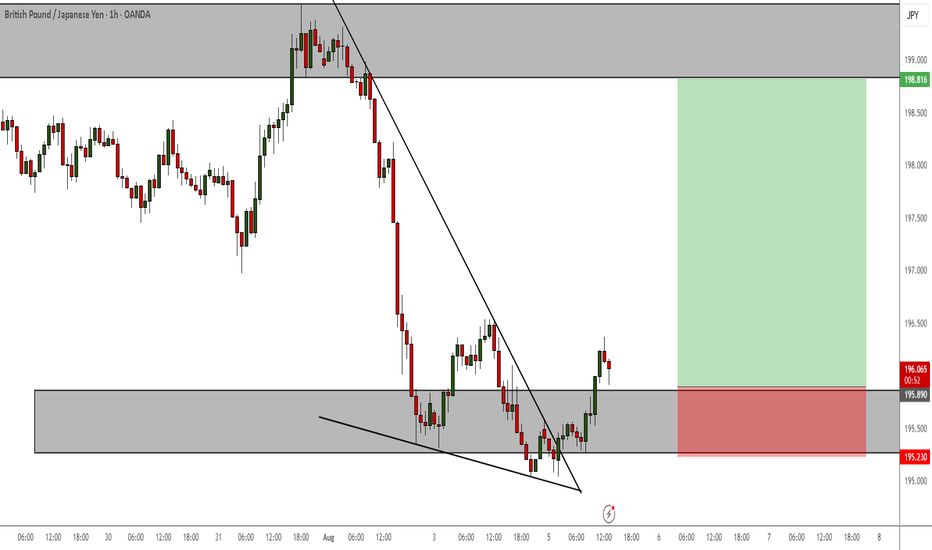

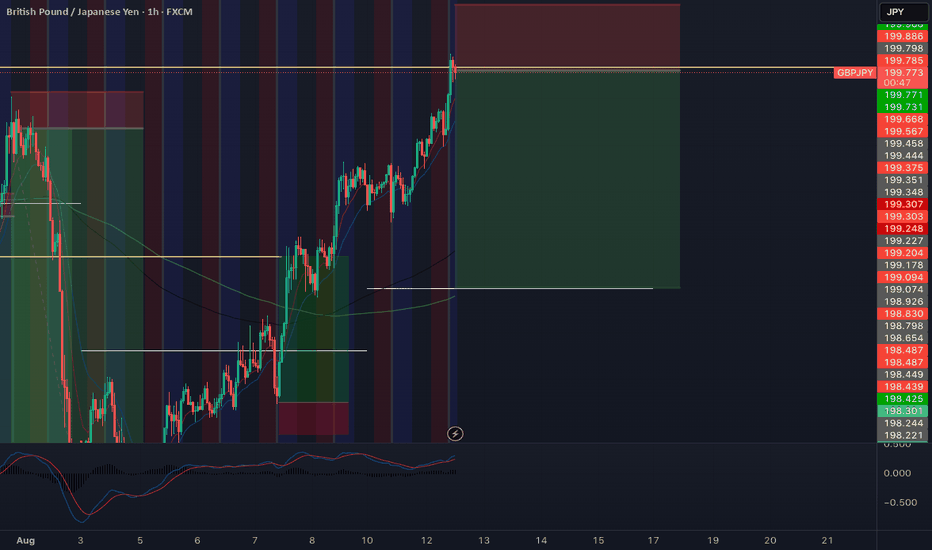

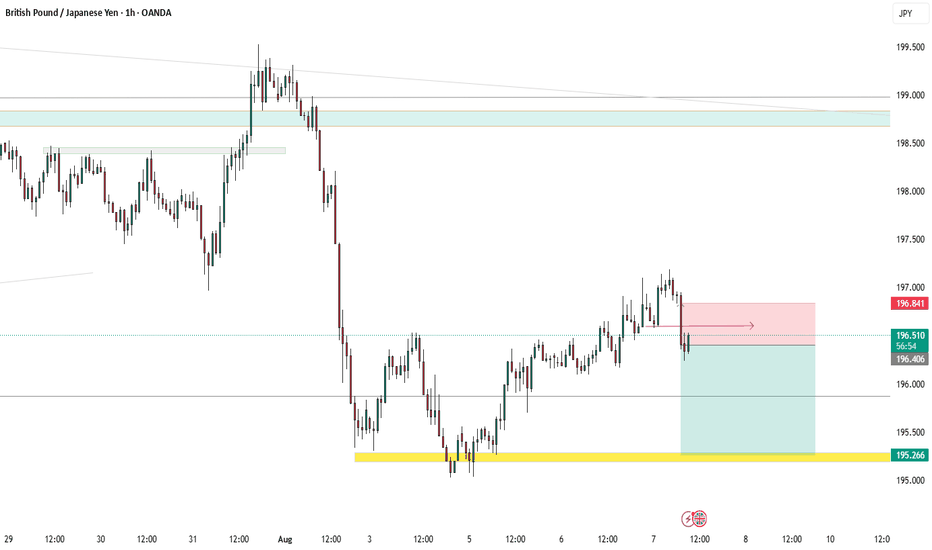

GJ|- Bullish Momentum Setup for Next Week4H – From the top-down, price has been respecting structure and just broke major highs with strong momentum to the upside.

30M – Price pulled back into structure, refined to the cleanest level. Before that, we had the professional sweep I mentioned in my last GJ post.

5M – I’m watching for a sweep of SSL into my refined zone before taking an entry. Once that happens, I’ll look for bullish follow-through.

Buy Zone: 196.264

SL: 195.925

Bias: Bullish continuation into next week — pending liquidity sweep confirmation.

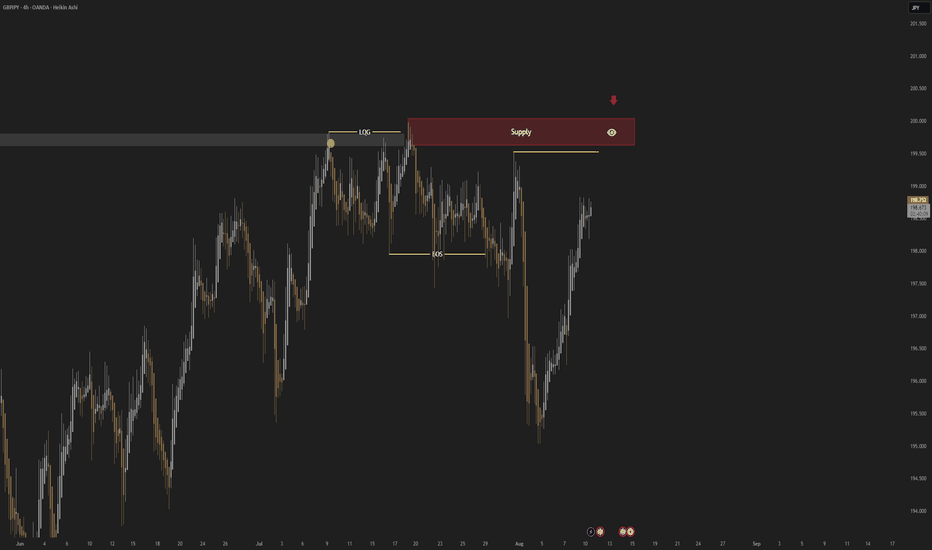

GBPJPY; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing market structure or imbalances.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

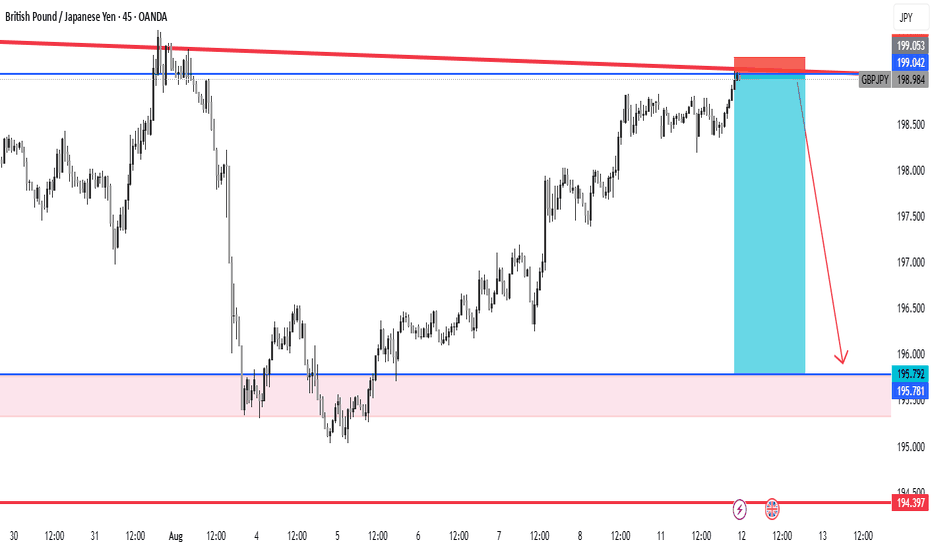

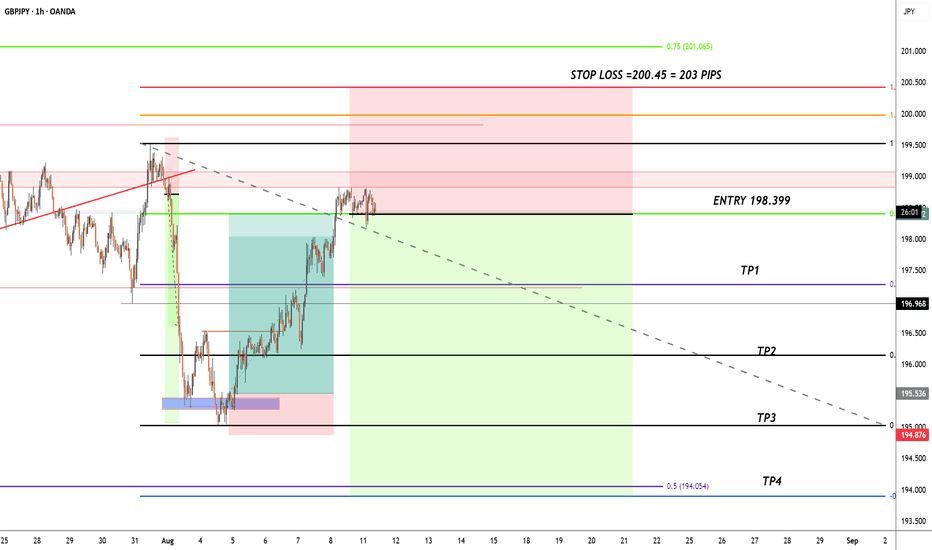

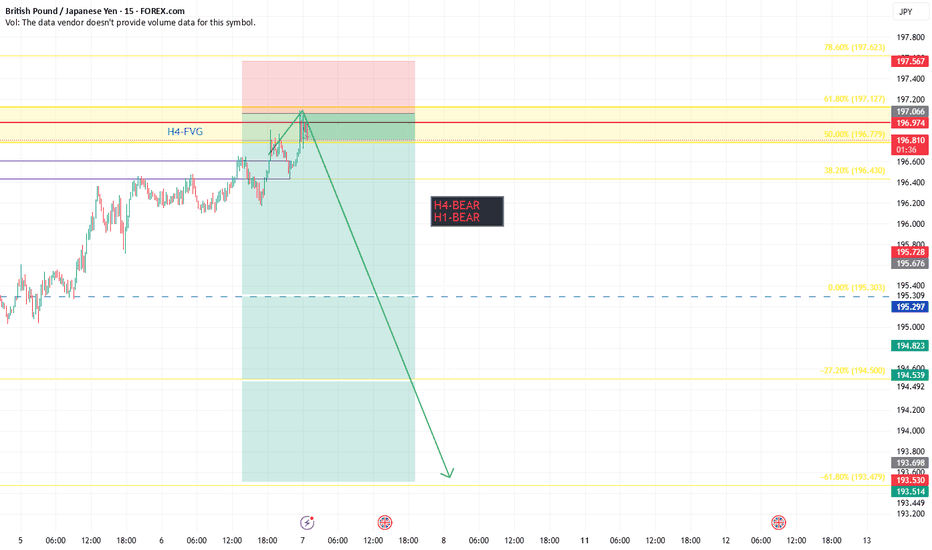

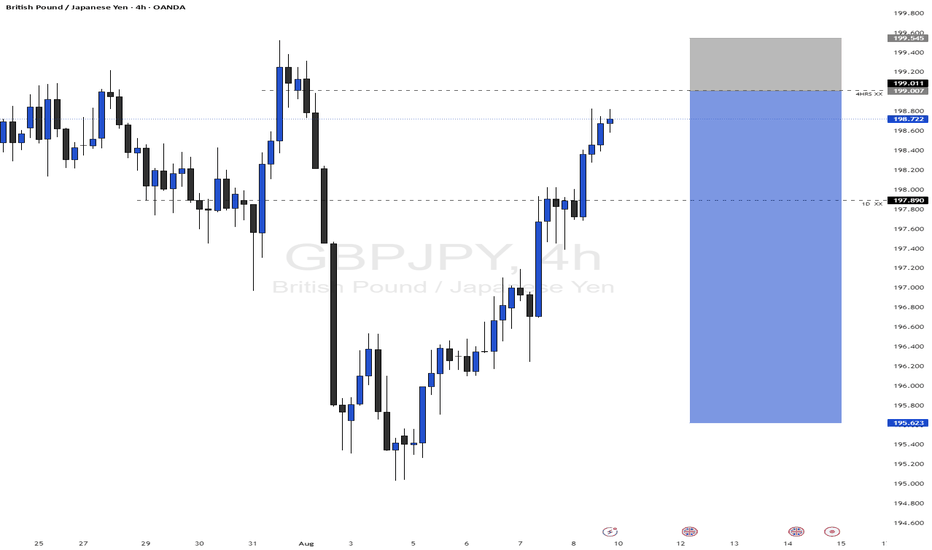

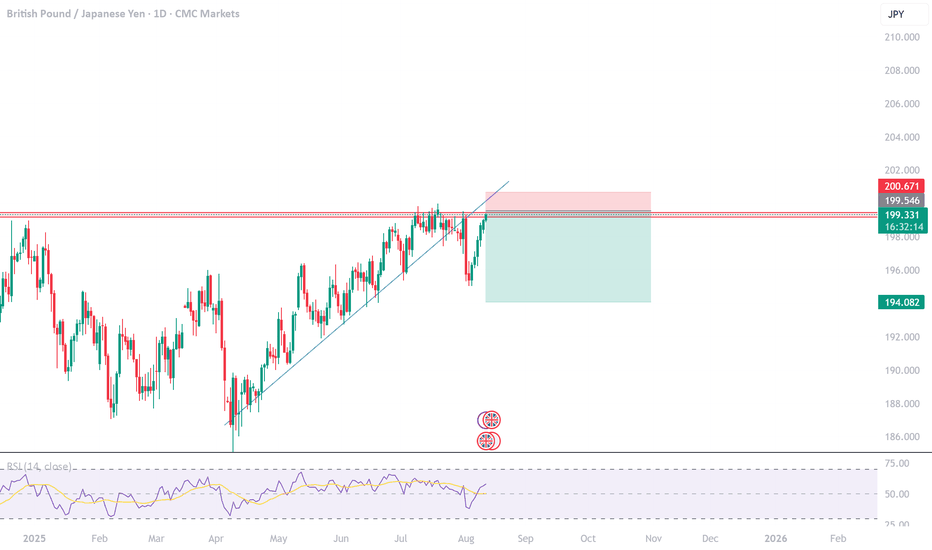

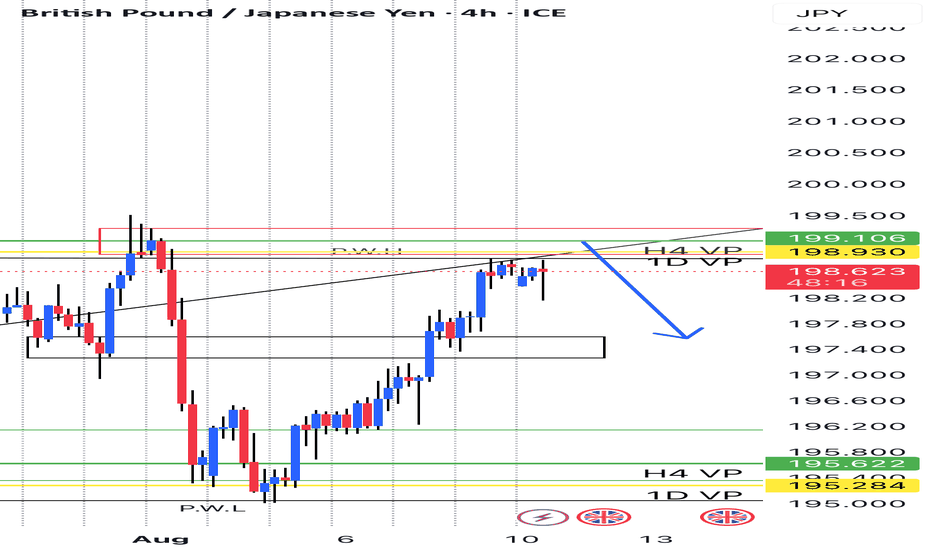

GBPJPY Sell IdeaGBPJPY – Daily Chart Sell Setup

Entry Zone: 198.850 – 199.300

Stop Loss: 199.845

Take Profits:

1️⃣ 197.880

2️⃣ 196.900

3️⃣ 195.450

Rationale:

Price is testing a key resistance zone. I'm watching for rejection signals to ride the move down. Ideal for swing entries.

Stick to your plan & manage risk accordingly.

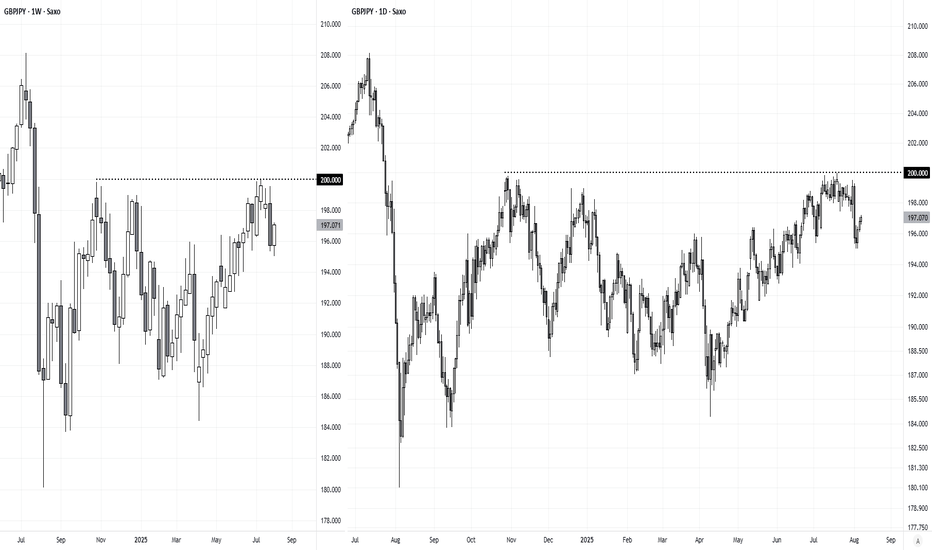

I’m bearish on GBPJPY — a countertrend short from resistance.GBPJPY – Resistance Holds as Momentum Shifts 📉

Trends don’t last forever — sometimes the turn starts quietly, deep inside the lower timeframes. GBPJPY’s daily uptrend is losing its edge, with 4H momentum already rolling over. Price is now pressing against a heavy resistance zone, flashing early sell signals.

📉 I’m bearish on GBPJPY — a countertrend short from resistance.

Key Drivers:

GBP hit by a 25 bps Bank of England rate cut 📉

Daily uptrend losing momentum, 4H showing reversal patterns 🔄

JPY still fundamentally weak, but sentiment extremely bearish (ripe for short-covering) ✅

Clear invalidation if price breaks above resistance 🎯

The British Pound’s bullish streak took a hit after the BoE confirmed a 25 basis point rate cut, marking a dovish shift to support the UK’s slowing economy. This move reduces GBP’s yield advantage and puts pressure on its recent strength, especially against currencies that could benefit from even a small sentiment reversal.

The Japanese Yen remains structurally weak — slow policy tightening, weak GDP growth, and heavy debt keep it under pressure. But with market positioning heavily skewed against the Yen, even modest safe-haven flows or profit-taking could spark upside moves in JPY pairs.

In this setup, I’m looking to fade GBPJPY’s test of resistance, leaning on the loss of short-term momentum as the first sign that the broader uptrend may be tiring. A rejection here could open a retracement toward recent 4H support zones, while risk remains clearly defined above resistance.

Would you take this countertrend shot, or wait for daily structure to fully break?

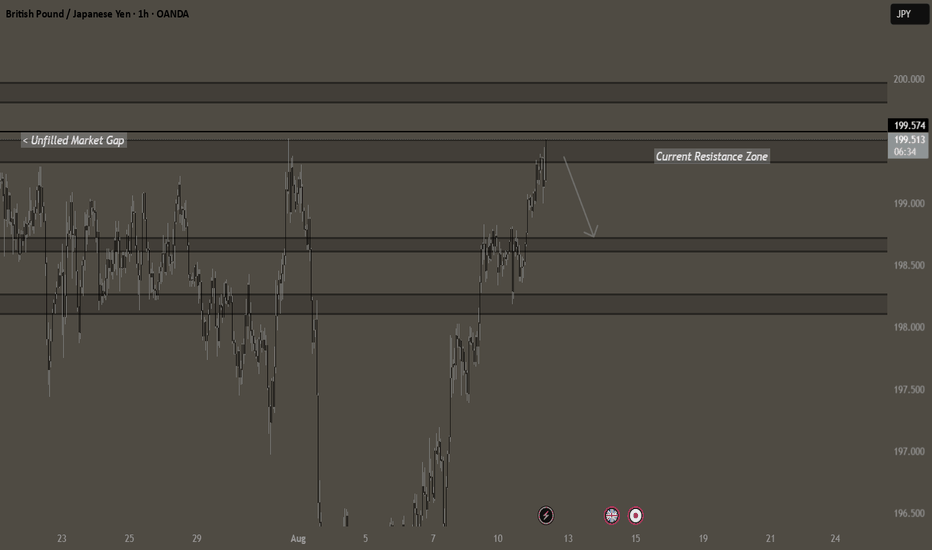

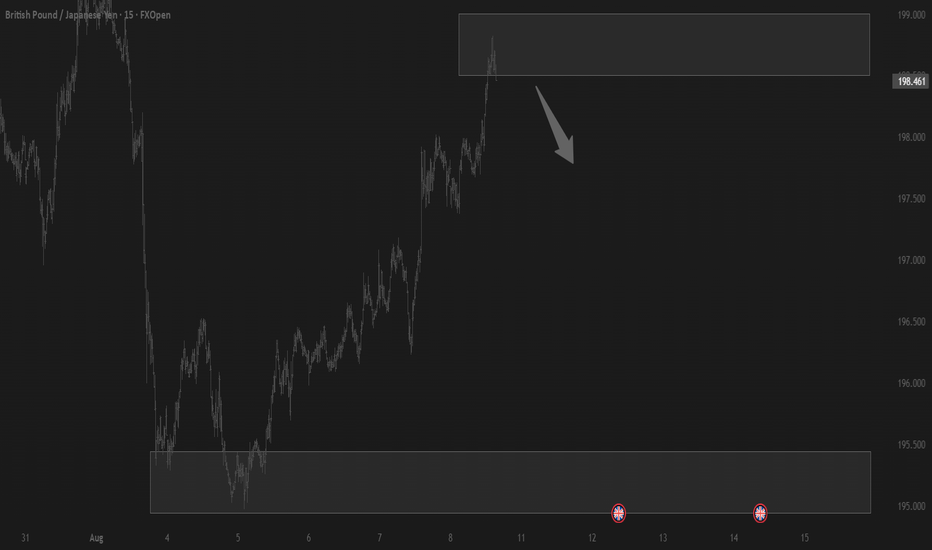

GJ SHORTS 199.540 AREACurrently looking at GJ shorts, could potentially look towards targeting the 198.650 broken resistance.

I personally wait for a confirmation, will not take any entry until I see so.

There is still a MARKET GAP at 199.540, so will also anticipate for that to be filled first before knowing where price can go to.

The also is a hidden 15min supply inside the market gap which could be respected.

GBP JPY SELL SETUPSee the chart for GBP JPY. came at the zone and expecting a sell continuation ..see the targets (tp-1 & tp2) trade this as swing.. do comment Ur feedback if u like my charting and analysis.

if you are interested to join my personal mentorship group which is i planning to expand ..then please join . i will assist you with more trade setups and real trade information.

message me to @thanz_123

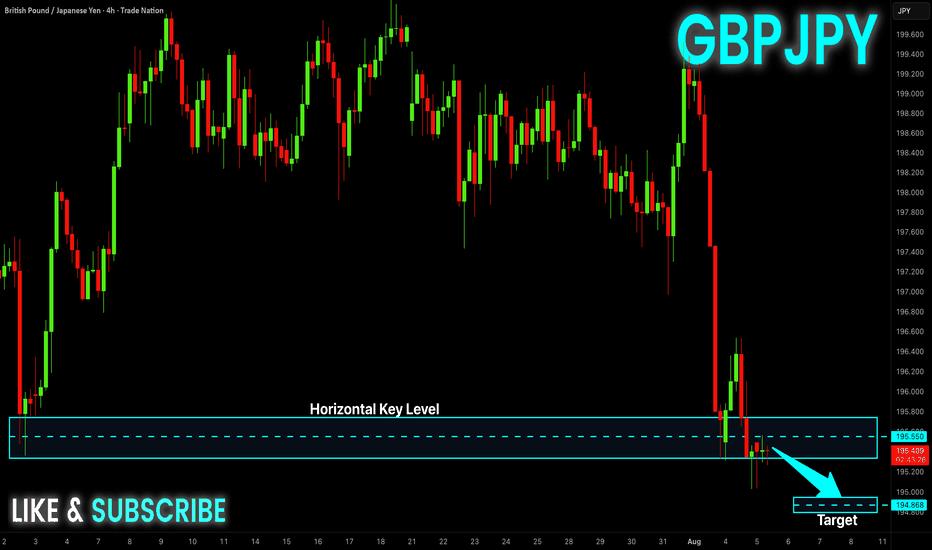

GBP-JPY Bearish Bias! Sell!

Hello,Traders!

GBP-JPY is going down

And the pair made a breakout

Of the key horizontal level

Of 195.500 so we are

Bearish biased and we

Will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

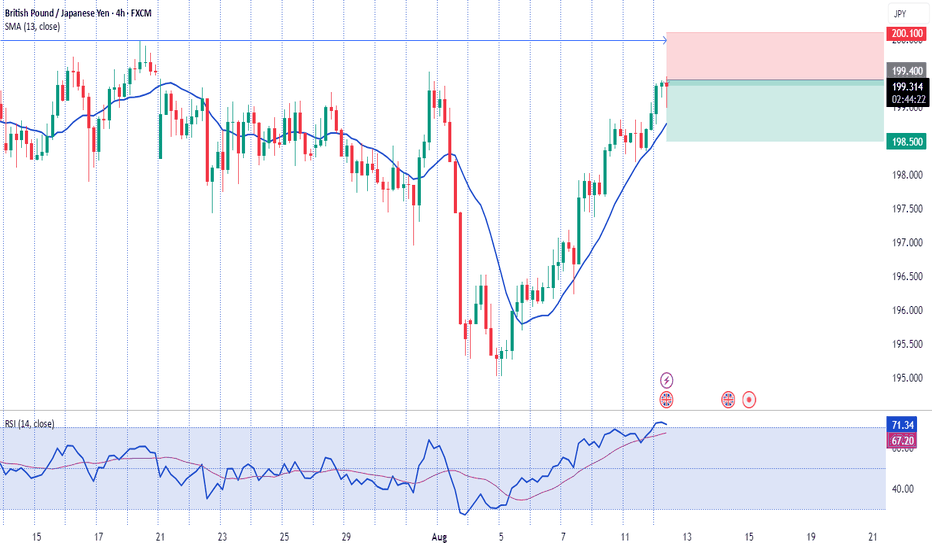

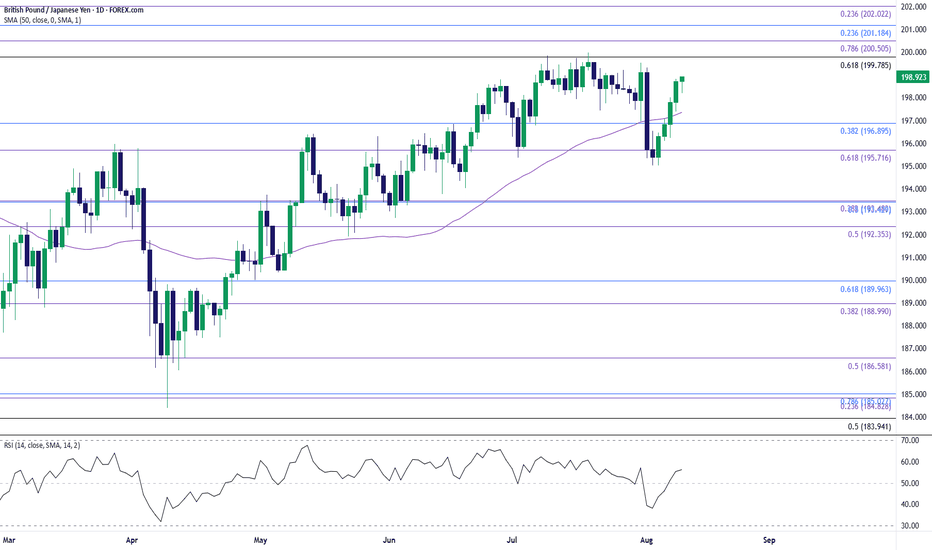

GBP/JPY Approaches Monthly HighGBP/JPY extends the recent series of higher highs and lows to approach the monthly high (199.31), with a move/close above the 199.80 (61.8% Fibonacci retracement) to 200.50 (78.6% Fibonacci extension) zone opening up 201.20 (23.6% Fibonacci retracement).

Next area of interest comes in around 202.00 (23.6% Fibonacci extension), but the bullish price series may turn out to be temporary should GBP/JPY fail to test the July high (199.98).

A move/close below the 195.70 (61.8% Fibonacci extension) to 196.60 (23.6% Fibonacci extension) region brings the monthly low (195.04) on the radar, with the next area of interest coming in around 192.40 (50% Fibonacci extension) to 193.50 (38.2% Fibonacci extension), which incorporates the June low (192.73).

--- Written by David Song, Senior Strategist at FOREX.com

Management options for GBPJPY trade.If anyone took this setup I posted last week, you can move sl to break even and protect the trade. We had a chance at 1:1 earlier in the week, which would have been a good time to get out if you were trading intraday. All else is normal; we are experiencing a correction on smaller timeframes, and I expect this trend to continue downward. We are stress-free in the trade, and that is the goal, friends. Stress-free and profitable.