GBPNZD trade ideas

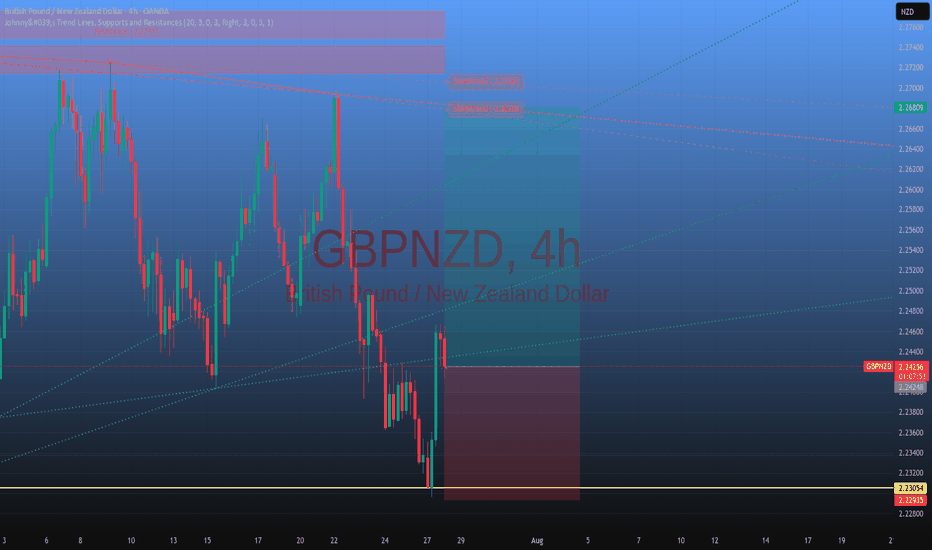

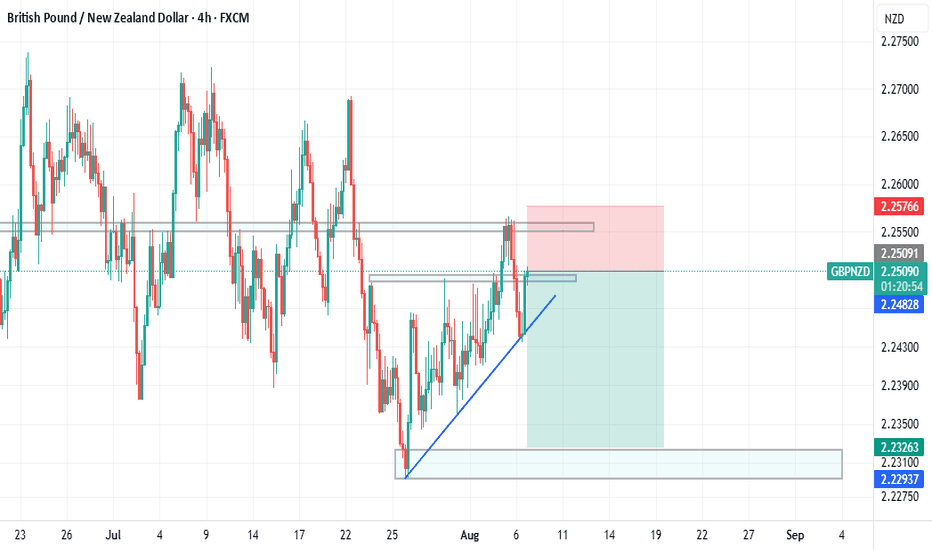

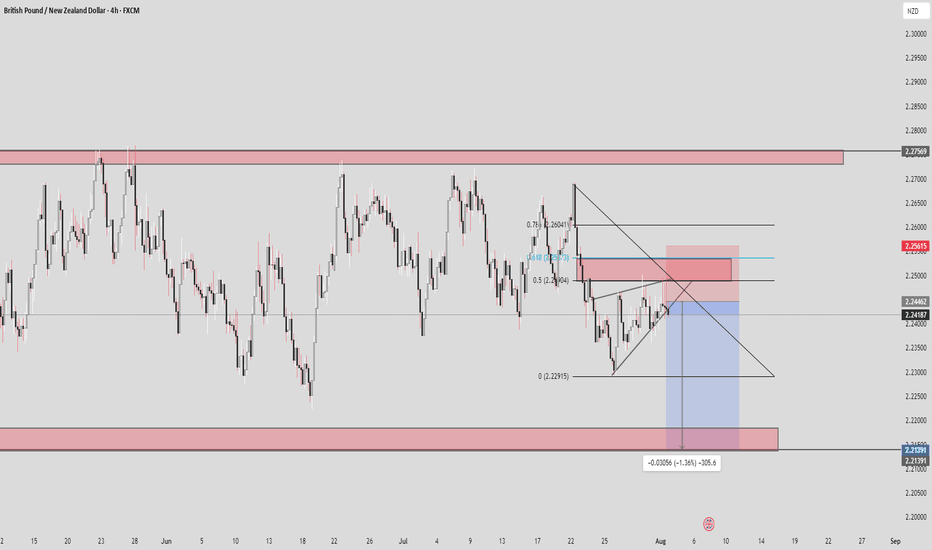

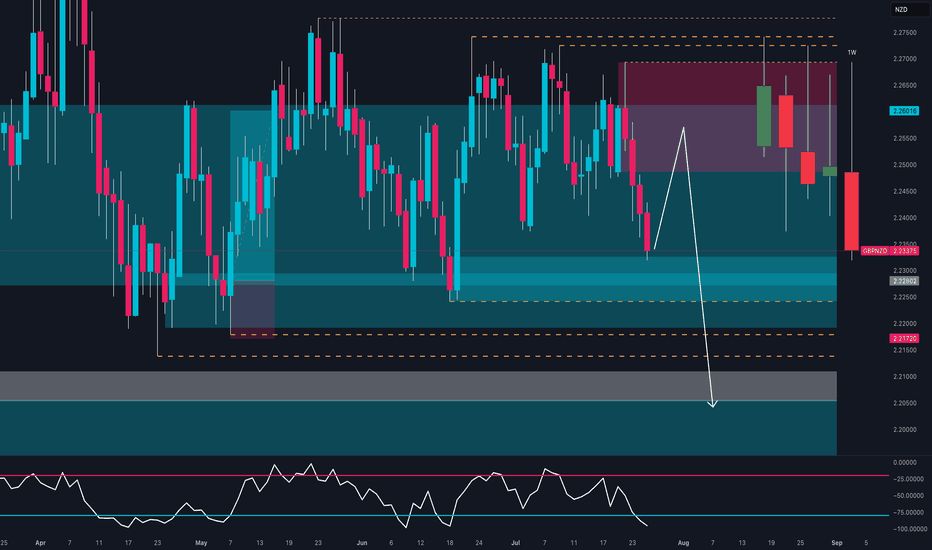

GBPNZD – Range High Meets Weekly Trend PressureGBPNZD – Range High Meets Weekly Trend Pressure 📉

When an uptrend runs into a wall, it doesn’t always crash — sometimes it just stalls. GBPNZD is now pressing against daily range resistance while the broader weekly uptrend still looms in the background. This is where short-term traders can find opportunity in fading a push that’s lost fuel.

📉 I’m bearish on GBPNZD — looking to short at the top of its daily range.

Why this setup stands out:

Price at a well-defined daily resistance zone 📍

Weekly uptrend slowing, momentum flattening 🔄

GBP under pressure after a 25 bps Bank of England rate cut 📉

NZD not strong, but less exposed to immediate policy easing ✅

Clear technical invalidation if resistance breaks 🎯

The British Pound’s rally has been losing steam, and the latest BoE move — cutting its benchmark rate by 25 basis points — confirms the dovish turn. This rate cut, aimed at supporting a slowing economy, signals reduced yield appeal for GBP in the near term.

The New Zealand Dollar still faces mixed fundamentals, with cautious central bank policy and consumer sentiment lagging. Yet in this matchup, NZD’s relative stability against GBP’s policy-driven weakness tilts the scales toward sellers, especially at stretched technical levels.

This is a tactical play — shorting into daily resistance within a broader range, with tight risk control. If price rejects here, a rotation back toward mid-range levels is on the table.

Would you fade this range high now that the BoE has already pulled the trigger?

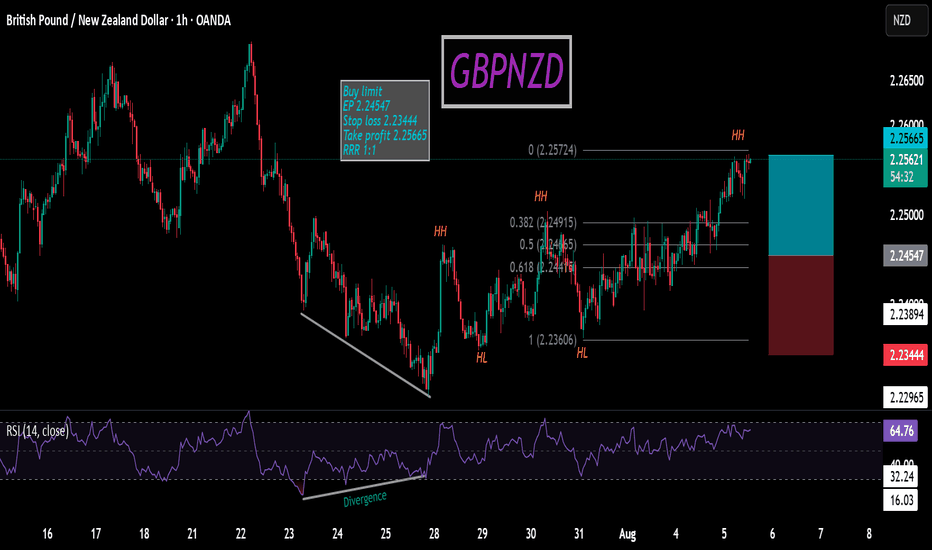

3 Powerful Buy Signals on GBP/NZD – Rocket Booster Strategy 🚀 3 Powerful Buy Signals on GBP/NZD – Rocket Booster Strategy Ignites!

Pair: GBP/NZD

Timeframe:

Bias: Bullish Reversal Setup

Strategy: Rocket Booster Strategy

Signal Strength: ✅✅✅

🔍 Breakdown of the 3 Signals:

1️⃣ Volume Oscillator – Reversal Underway

Buy-side volume is increasing after a dry spell, suggesting a potential trend reversal and accumulation phase.

2️⃣ MACD – Bullish Cross Below Zero Line

Early momentum shift detected — this is where smart entries begin before full confirmation.

3️⃣ ADX + DI+ – Buyers Taking Control

ADX rising above 20 → Strengthening trend

DI+ crossing up → Buyers are clearly stepping in

🔧 Rocket Booster Strategy Criteria Met:

✅ Price is above EMA 50 and EMA 200

✅ Momentum, volume, and trend all aligned

✅ Ideal launch conditions for a bullish continuation

💡 Trade Idea (Example Only):

Entry: Market or pullback

Stop-Loss: Below swing low / EMA 50

TP1: Previous high

TP2: 2R+ extension

Optional: Use a trailing stop for scaling out

⚠️ Disclaimer:

This is not financial advice. Use a simulation account to test this strategy first.

Always apply risk management and have a clear profit-taking plan.

Never risk more than you can afford to lose.

🔚 Final Thought:

When volume, momentum, and trend align — it’s time to pay attention.

This is a textbook Rocket Booster setup: clean, powerful, and primed for upside.

Rocket Boost This Content To Learn More

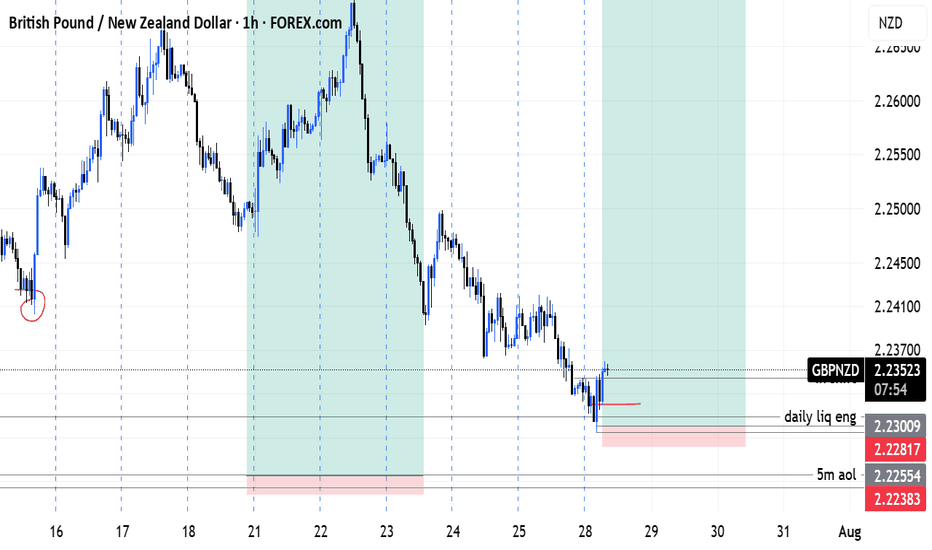

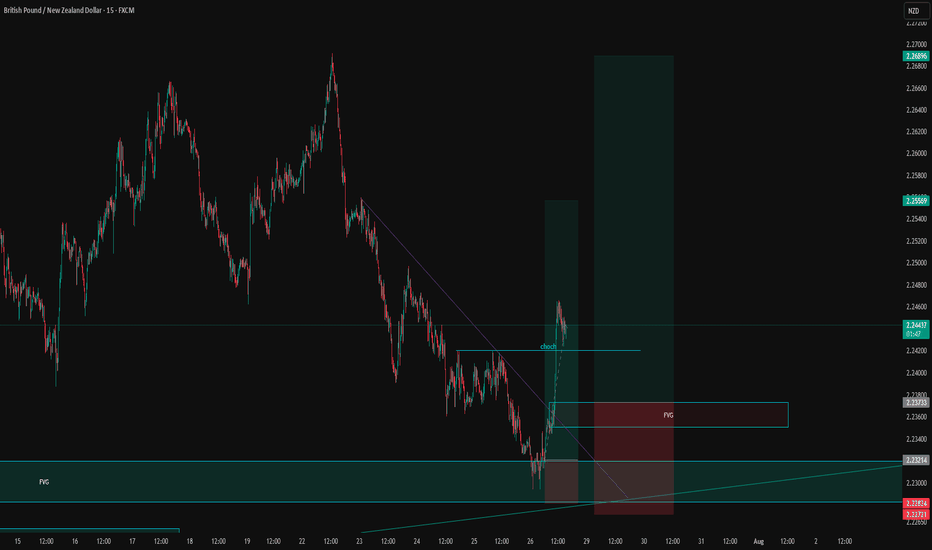

GBPNZD 15m buyHello friends. The price of the GBPNZD symbol in the 15-minute time frame after hitting the FVG high time frame is now bullish. You can see that it also happened in the choch direction. If it returns to the FVG 15m area, it can be entered for buy. Friends, please note that this is just a theory.

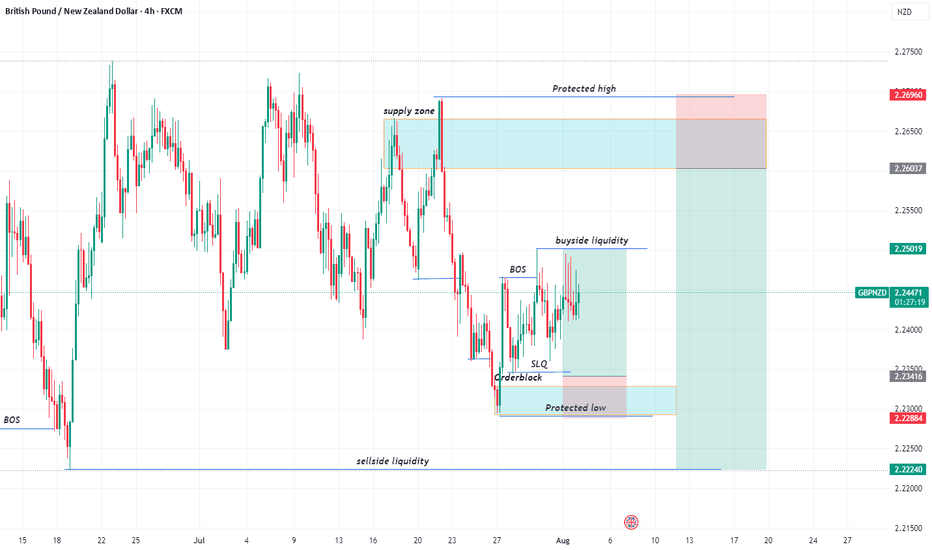

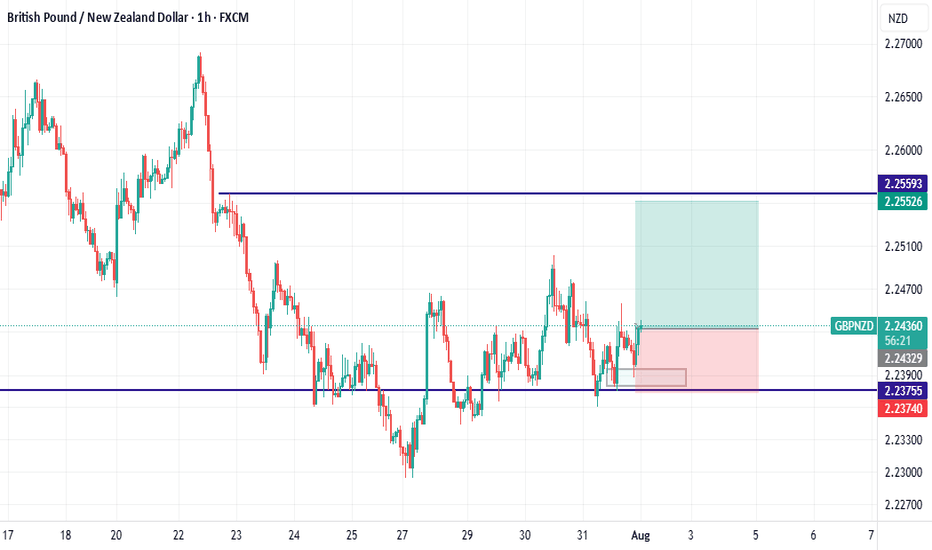

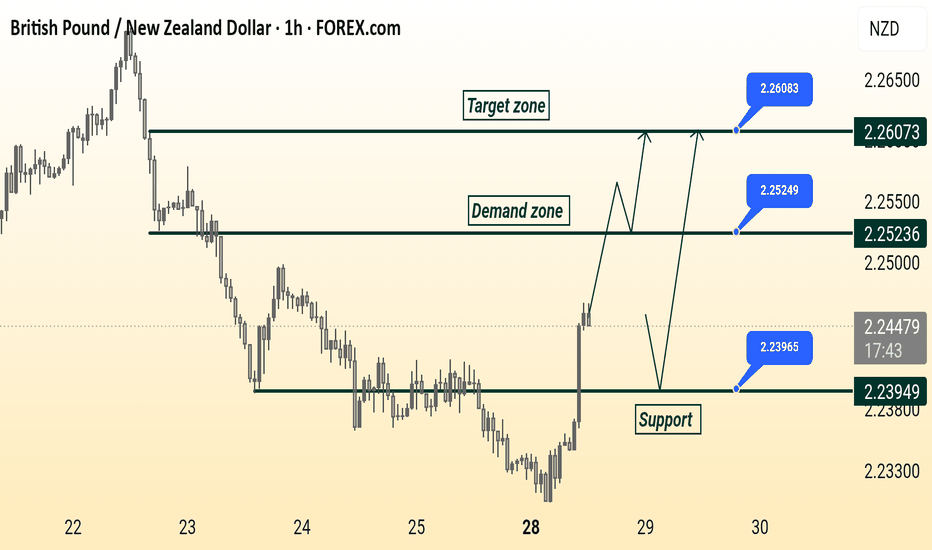

GBP/ NZD Ready Read The Captions This 1-hour chart analysis of GBP/NZD highlights key trading zones:

Support level: 2.23949

Demand zone: 2.25236

Target zone: 2.26073

The price is currently rising from support and approaching the demand zone. Two possible scenarios are shown: a breakout toward the target zone or a pullback to the support before a new upward attempt.

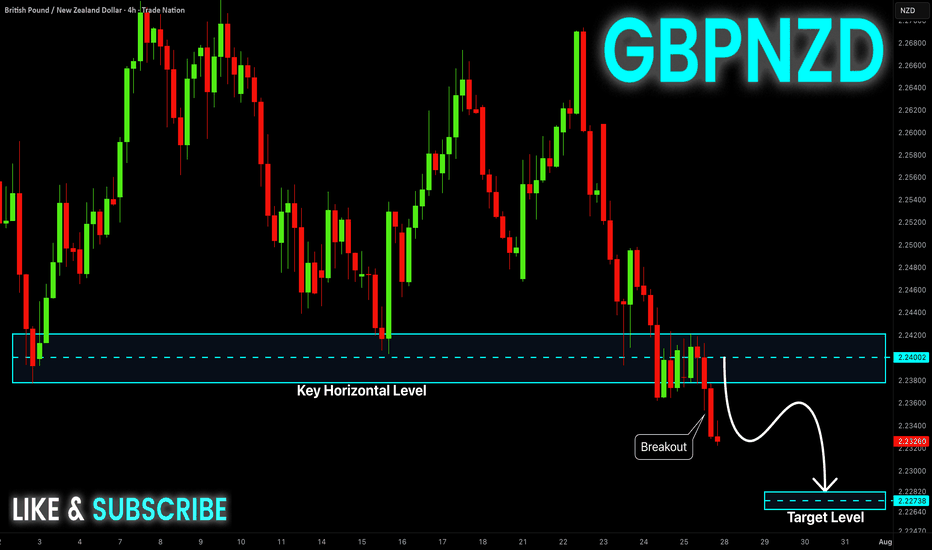

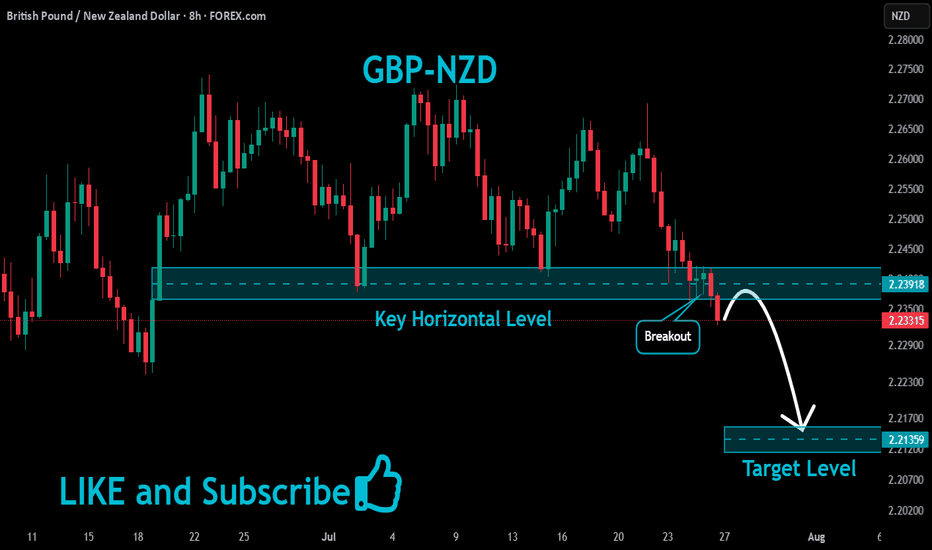

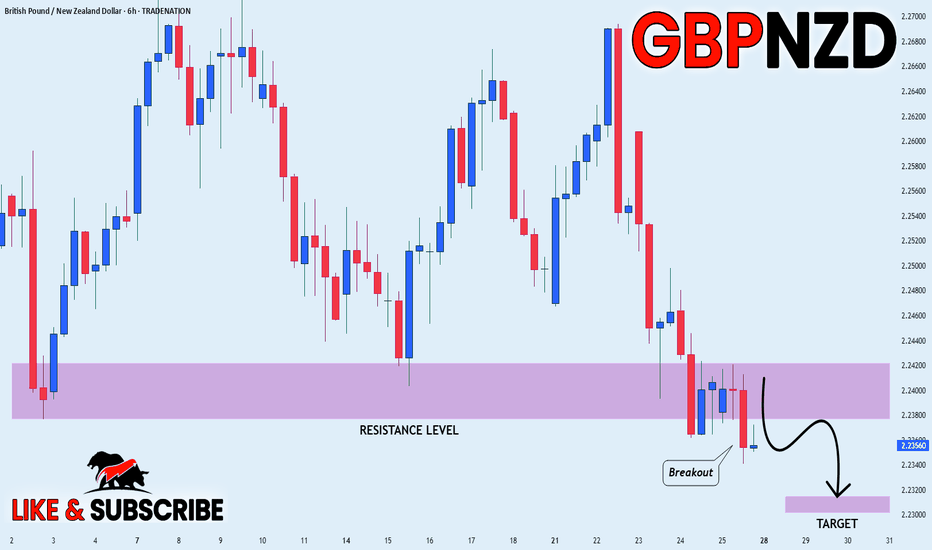

GBP-NZD Will Keep Falling! Sell!

Hello,Traders!

GBP-NZD keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 2.2400

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

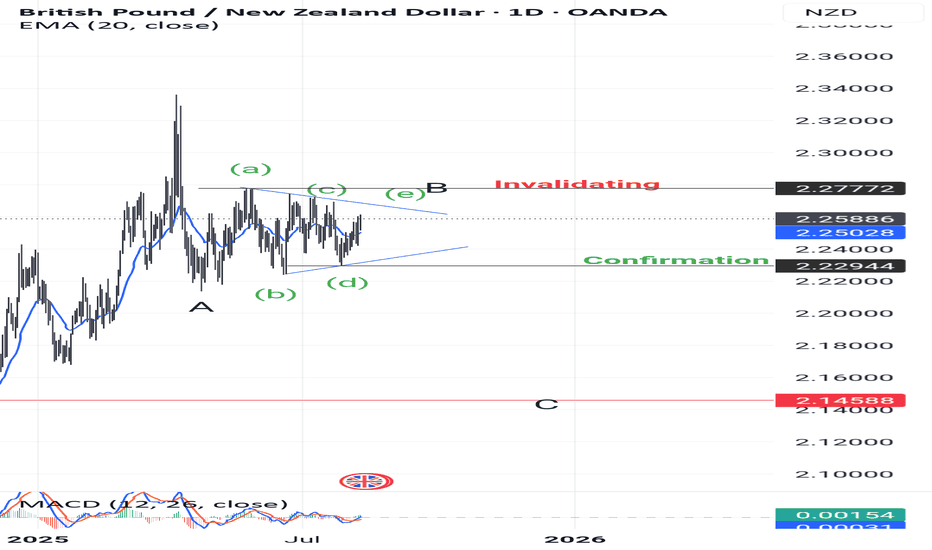

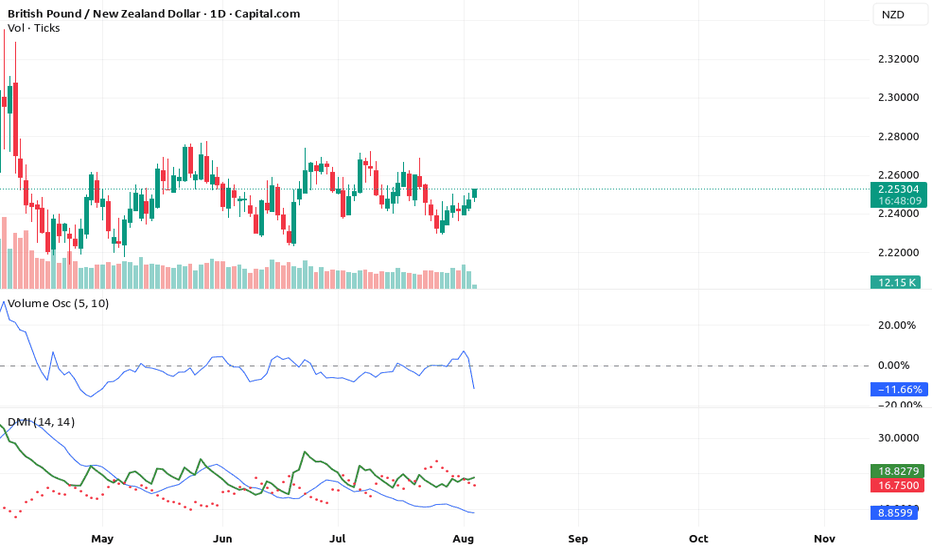

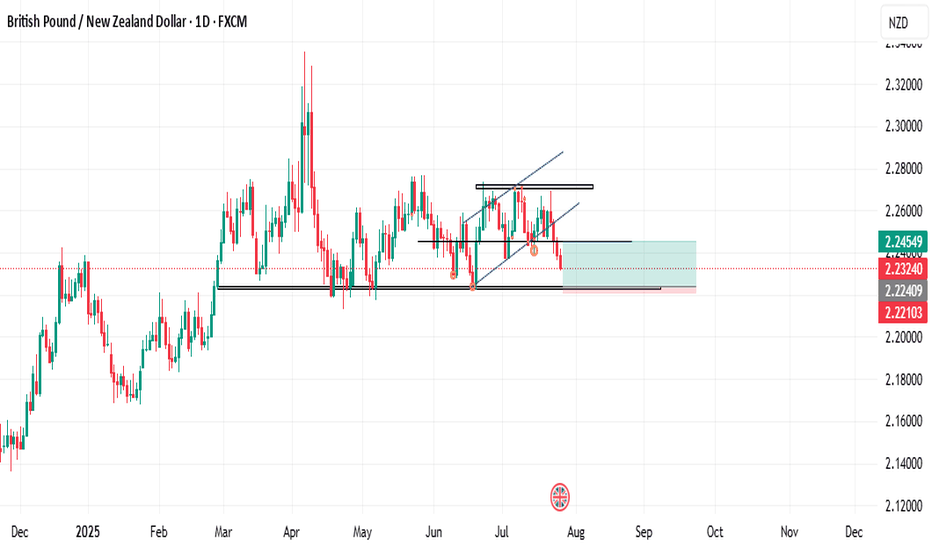

GBPNZD Breakdown – Smart Money Turns Fully Bearish🧠 Macro + COT + Sentiment Context

Commitment of Traders (COT) – Asset Managers

Institutional asset managers are significantly net short on GBPNZD, with positioning at its lowest level of the year and declining sharply since May. This reflects a clear bearish stance from smart money and reinforces the current downward pressure.

Sentiment & Momentum Indicators

DPO: -54.9 → Indicates a moderately bearish momentum phase.

Wyckoff: -20.3 → Price is in a distribution phase, suggesting weakness.

Speed: 3.2 → Low acceleration, but directional bias remains bearish.

Market Mood: Neutral, but leaning into oversold territory.

Seasonality (July 1st – Sept 30th)

Historically, GBPNZD performs positively in this period:

3Y: +1.7%, 5Y: +1.6%, 10Y: +2.3%, 15Y: +2.8%

However, in 2025, price is diverging sharply from seasonal norms. The pair is trading against historical patterns, suggesting a seasonal anomaly where institutional flow is dominating historical behavior.

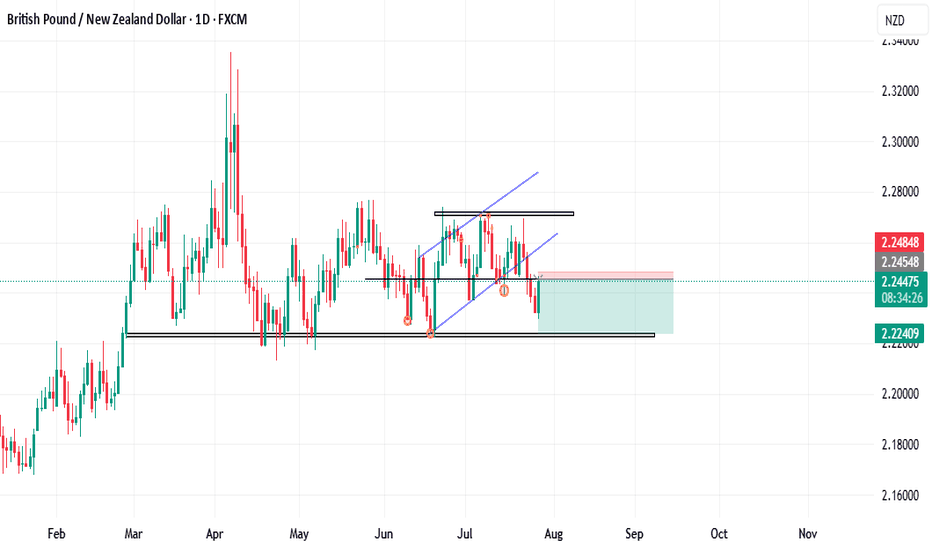

🧱 Technical Outlook (Daily Chart)

GBPNZD had been consolidating in a clear range between 2.2170 support and 2.2750 resistance since May. The pair has now broken down with a strong, full-bodied weekly candle, closing below the 2.2320 demand zone.

Key Technical Zones:

Supply zone (2.2494–2.2659) → A clear rejection zone that initiated the current selloff.

Demand zone (2.2170–2.2300) → Has been tested twice already, increasing the probability of a clean breakdown.

RSI (Daily) → Currently neutral, with a sequence of lower highs and no bullish divergence in sight — indicating weak momentum.

✅ Conclusion & Trade Plan

Directional Bias: Bearish (Short)

Although seasonality typically supports bullish price action for GBPNZD in Q3, the current context is decisively bearish. Institutional positioning, price structure, and sentiment all confirm a potential shift in direction, reinforced by a confirmed weekly breakdown.

Bearish Targets:

📍 First: 2.2170 (recent support test)

📍 Second: 2.2000–2.1900 (April swing low)

📍 Extension: 2.1750 (base of previous accumulation zone)

Invalidation Criteria:

A weekly close above 2.2490 (supply zone breached)

Bullish RSI divergence + weekly recovery candle

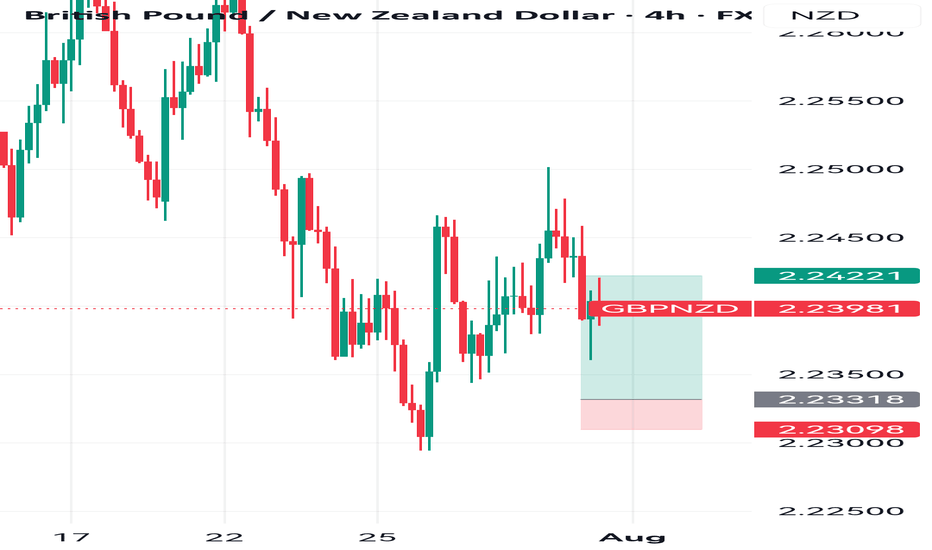

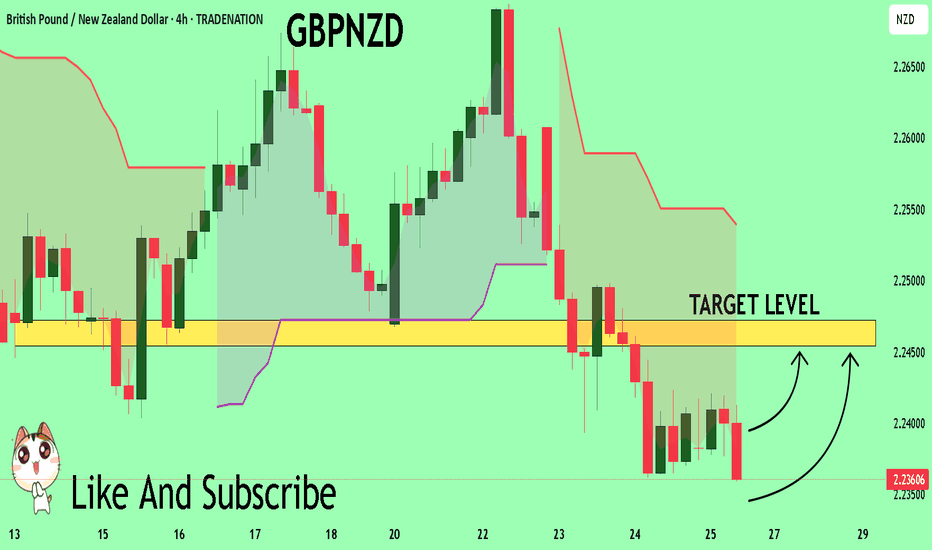

GBP_NZD BEARISH BREAKOUT|SHORT|

✅GBP_NZD is going down currently

As the pair broke the key structure level of 2.2400

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPNZD Will Explode! BUY!

My dear friends,

My technical analysis for GBPNZD is below:

The market is trading on 2.2361 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.2454

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

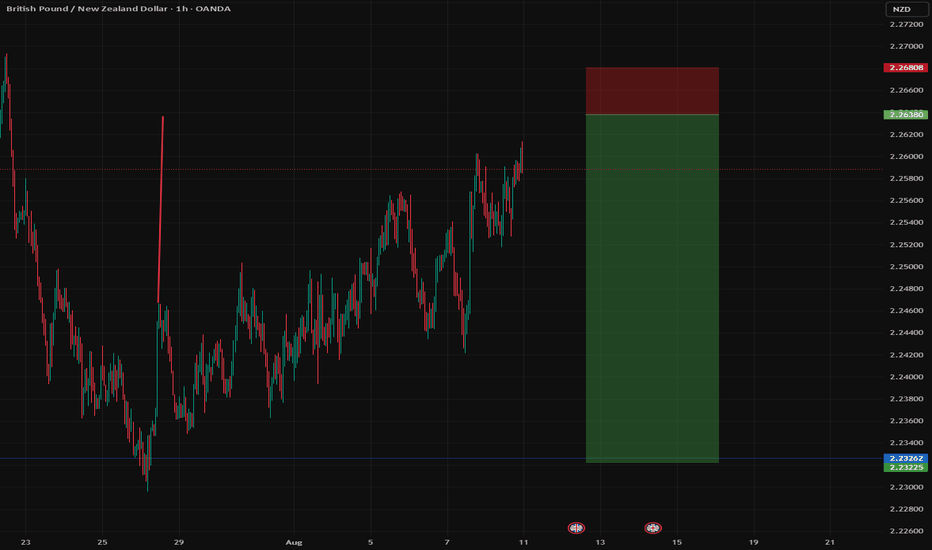

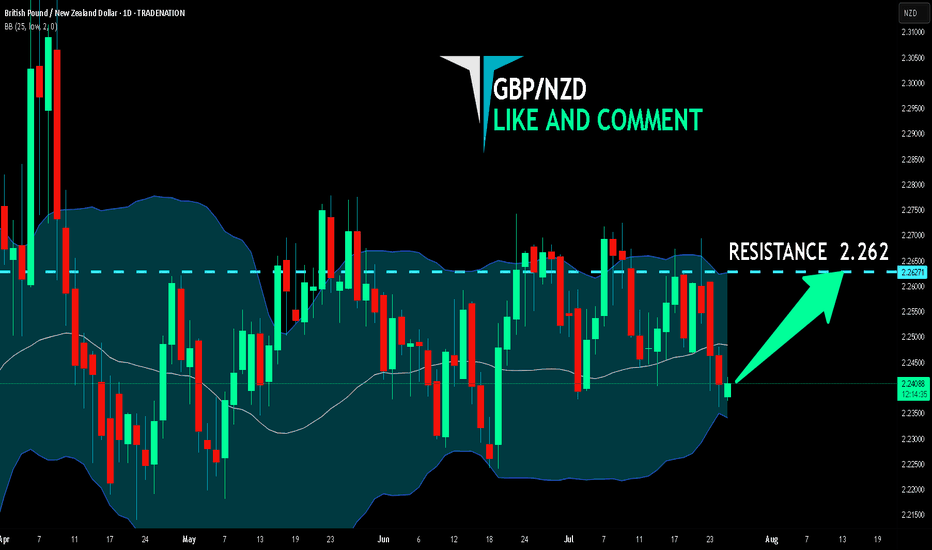

GBP/NZD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

We are going long on the GBP/NZD with the target of 2.262 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅