GBPUSD trade ideas

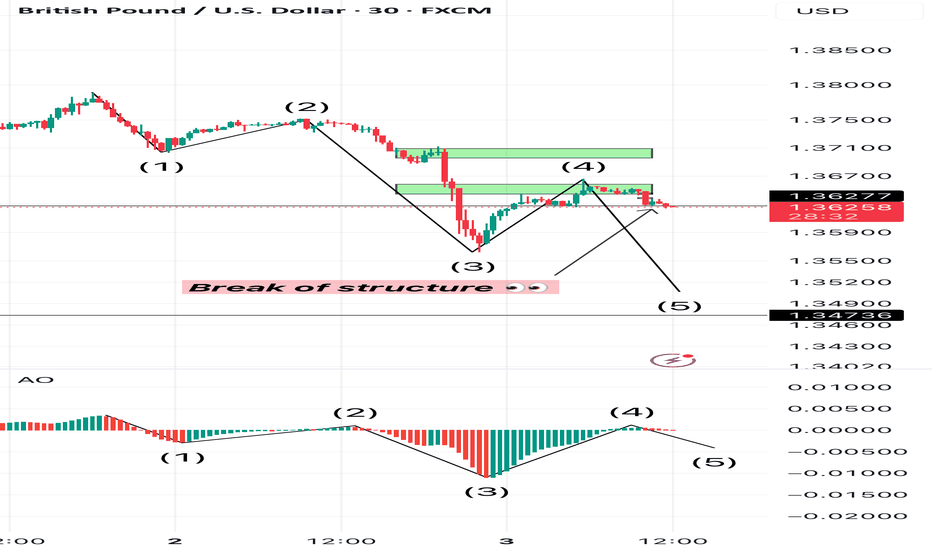

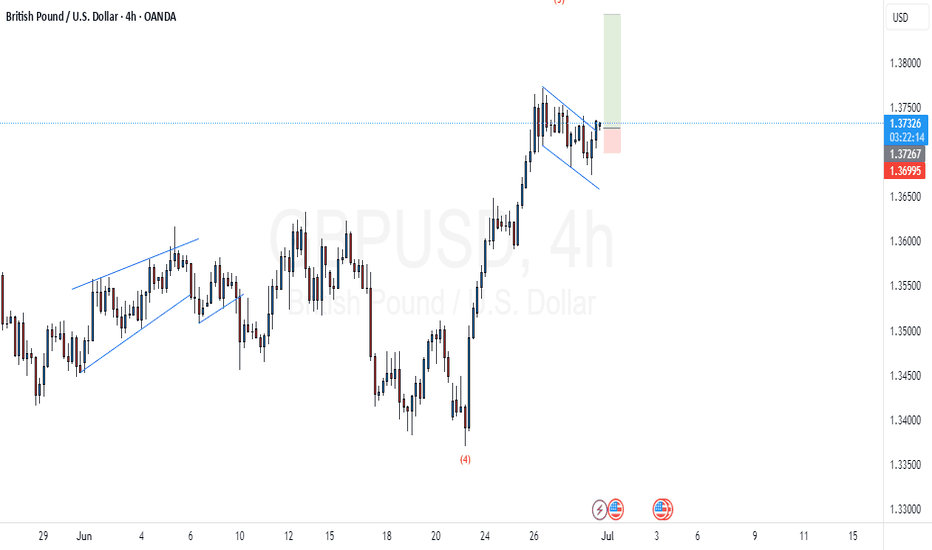

GBPUSD 30m – Elliott Wave + AO ConfirmationPrice is currently testing the 1.36277 zone. I’m closely monitoring for a break of structure below this level. If it breaks, I’ll be watching for a pullback setup to short, ideally aligning with BBMA/EMA confluence.

The wave structure looks clean:

• ✅ Wave (1), (2), (3), and (4) are completed.

• ✅ AO histogram also confirms momentum waves (1) to (4), with the current move likely to complete Wave (5) to the downside.

• 🔻 Wave (4) retraced into the previous imbalance zone and respected resistance, giving further confluence for bearish continuation.

Looking to target below 1.3500 for Wave (5) completion.

Key Levels to Watch:

• 🔑 Break below 1.36277 = Bearish confirmation

• 🎯 Potential TP Zone: 1.3450 – 1.3425

• 🚫 Invalidation if price closes above 1.3700 with momentum

Let’s see how price reacts at this key level 👀

#GBPUSD #ElliottWave #AO #PriceAction #BreakOfStructure #TradingView

GBPUSD InsightHello to all subscribers,

Please feel free to share your personal opinions in the comments. Don’t forget to hit the booster and subscribe!

Key Points

- According to the ADP National Employment Report, U.S. private employment in June decreased by 33,000 compared to the previous month — the first negative figure since March 2023. This has strengthened expectations for interest rate cuts.

- U.S. President Donald Trump announced that a trade agreement has been reached with Vietnam. Reportedly, Vietnam has agreed to significantly lower its tariffs to 20% in exchange for opening its market. This has raised hopes for progress in ongoing trade negotiations with other countries.

- The EU trade team is currently in Washington, D.C., negotiating with the U.S. side and is reportedly requesting preemptive tariff exemptions in certain sectors.

- In the U.K., the welfare reform plan proposed by the Labour government has been significantly scaled back. Prime Minister Keir Starmer has not confirmed his confidence in Chancellor Rachel Reeves, leading to growing speculation that she may be replaced. If Reeves — who has emphasized fiscal discipline — is replaced, there are concerns that fiscal control could loosen.

Key Economic Events This Week

+ July 3: U.S. Non-Farm Payrolls (June), U.S. Unemployment Rate (June)

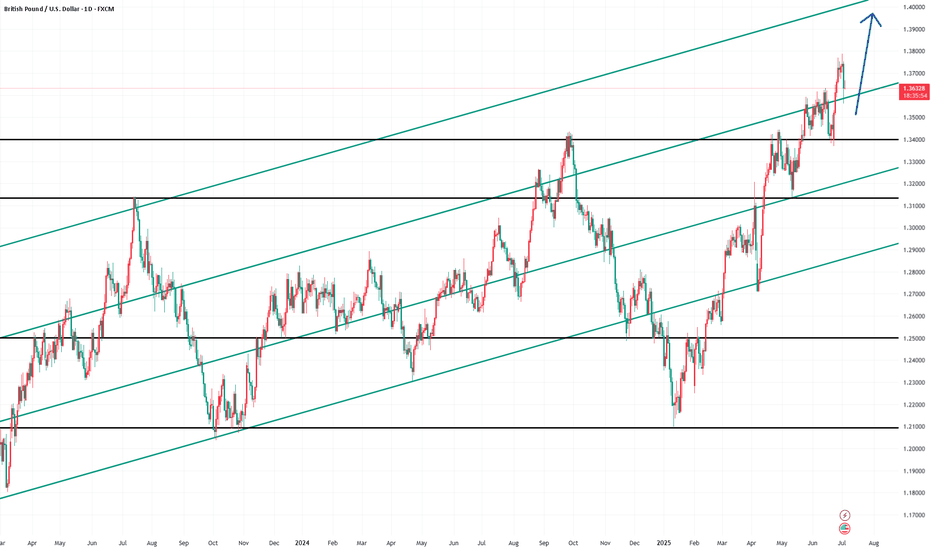

GBPUSD Chart Analysis

After maintaining an upward trend, GBPUSD experienced a sharp drop. However, the pair appears to have regained its bullish momentum with support from the trendline. The upward view will be maintained toward the resistance level of 1.40000, the trend’s previous high.

That said, caution is advised near the 1.38000 level, where the previous sharp decline occurred, as this zone could introduce volatility.

Political Uncertainty, Dollar Weakness & A Projected CorrectionDespite being a technical trader, there are some fundamental factors floating in the background of today's trading idea.

1) We saw weakness on the GBP today due to some political uncertainty & investors having concerns over the stability of the UK's leadership and economic direction.

2) We saw a drop in the ADP Non-Farm Employment Change for the US Dollar today which is starting to look like a trend rather than a one-off.

Why this is important is because, despite the very bearish day that the FX:GBPUSD had today, I don't think the GBP reaction is as relevant as it's shown and I do think the USD is weaker than it's shown on this particular chart, due to the reactions that we've seen on other crosses.

All in all, that this means is that I wouldn't be shocked to see today's move corrected and price is at the perfect technical level to do just that.

If you have any questions, comments or opinions, please don't hesitate to leave them below.

Akil

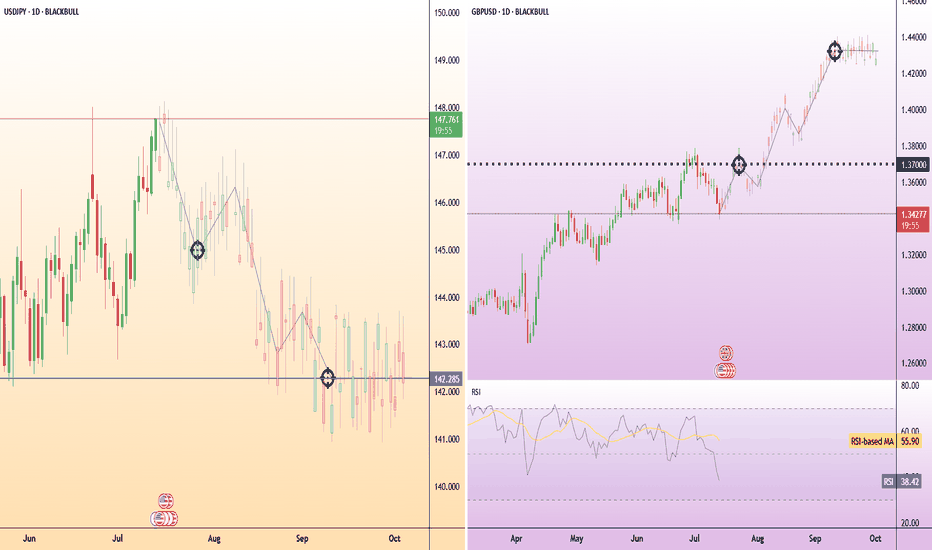

GBPUSD opportunity to go SHORTThe pair has been showing weakness for some time through RSI divergence.

On hourly chart it printed the indecision candle followed by two red candles. This gives us the cue for bearish momentum.

Since we need multiple reasons to short sell so we identify the recent low and if the price goes lower than this than we initiate a short trade.

For ready reference the TPs have been marked on chart.

wishing you a PROFIT-able trading.

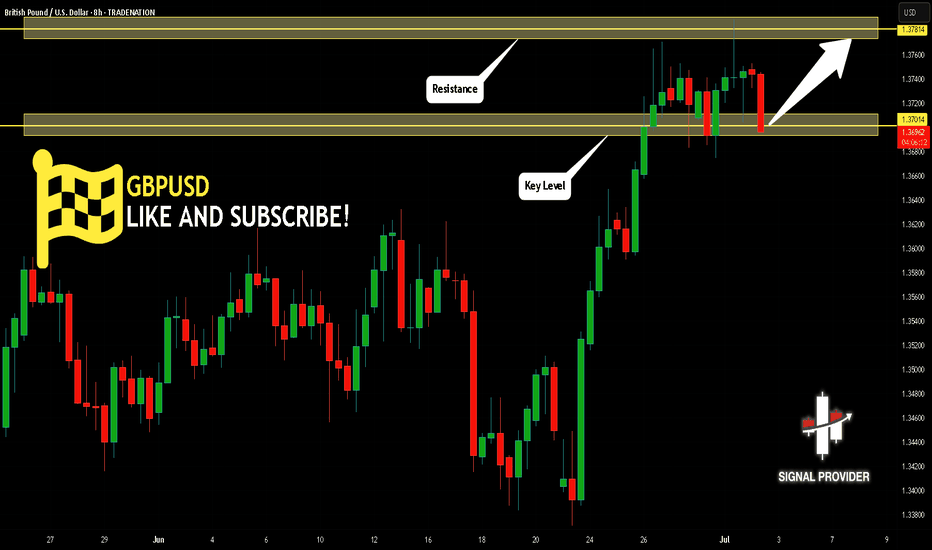

GBPUSD Will Go Up! Buy!

Take a look at our analysis for GBPUSD.

Time Frame: 8h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 1.370.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 1.378 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

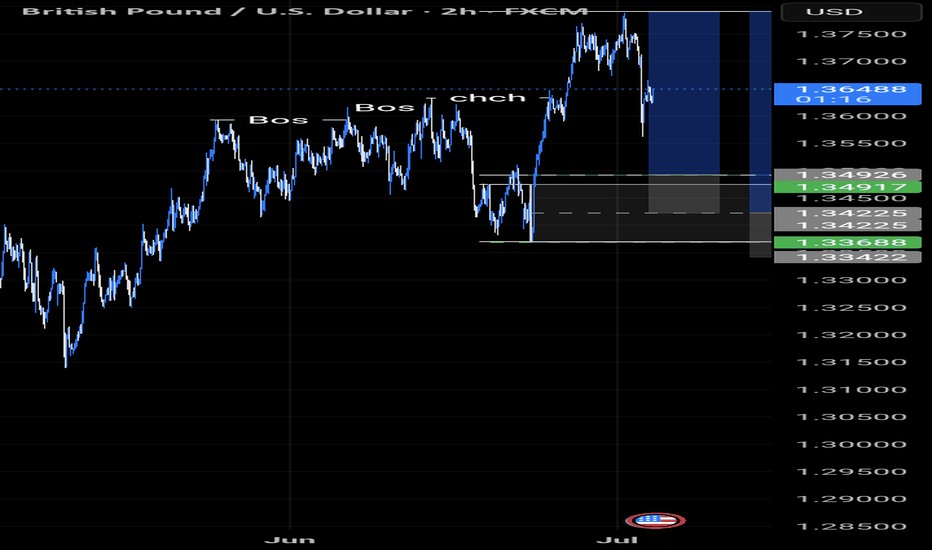

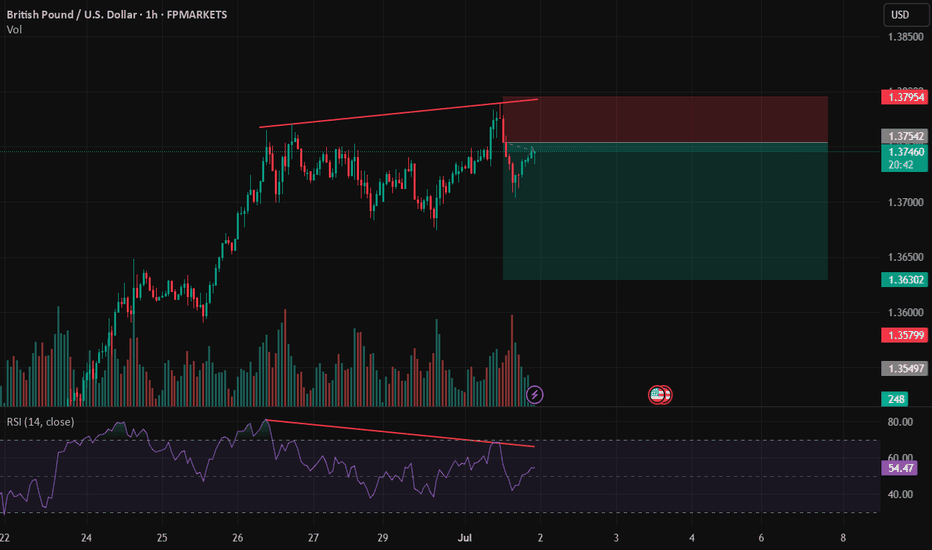

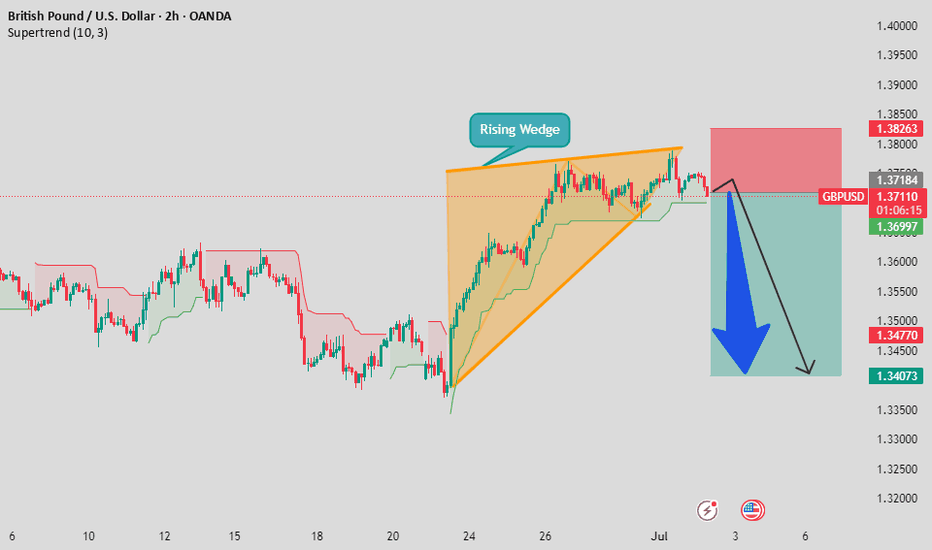

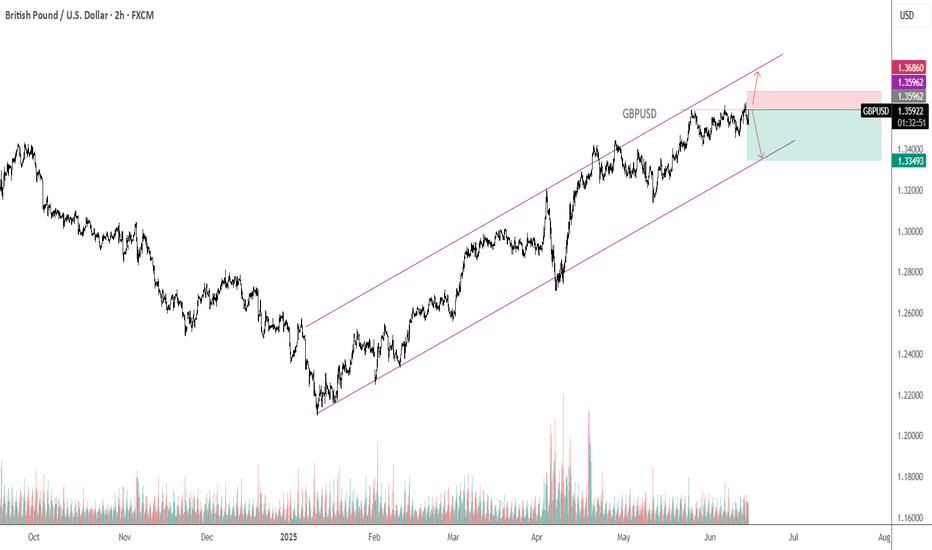

GBP/USD Short Setup – Rising Wedge BreakdownGBP/USD Short Setup – Rising Wedge Breakdown

Timeframe: 2H

The pair has formed a rising wedge pattern, typically a bearish reversal signal. Price has now broken below the lower trendline, suggesting a potential downside move.

Setup Details:

Entry: ~$1.3717 (post-breakout)

Stop Loss: ~$1.3826 (above recent highs)

Target Zone: $1.3477 to $1.3407

Technical Analysis:

Rising wedge pattern breakdown confirmed

Supertrend indicator has flipped bearish

Momentum divergence visible on lower timeframes (not shown)

Fundamental Context:

GBP remains under pressure due to weak UK economic data and ongoing BoE rate cut expectations

USD strength backed by persistent inflation concerns and hawkish Fed tone

Bias: Bearish (Short-Term Swing Trade)

Look for potential retests of broken support for confirmation. Manage risk accordingly as volatility may increase ahead of upcoming macro events

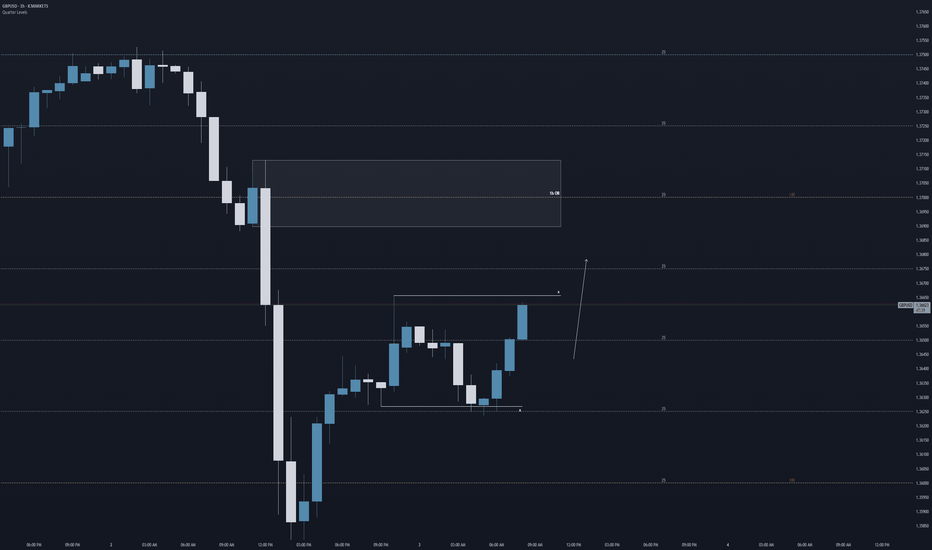

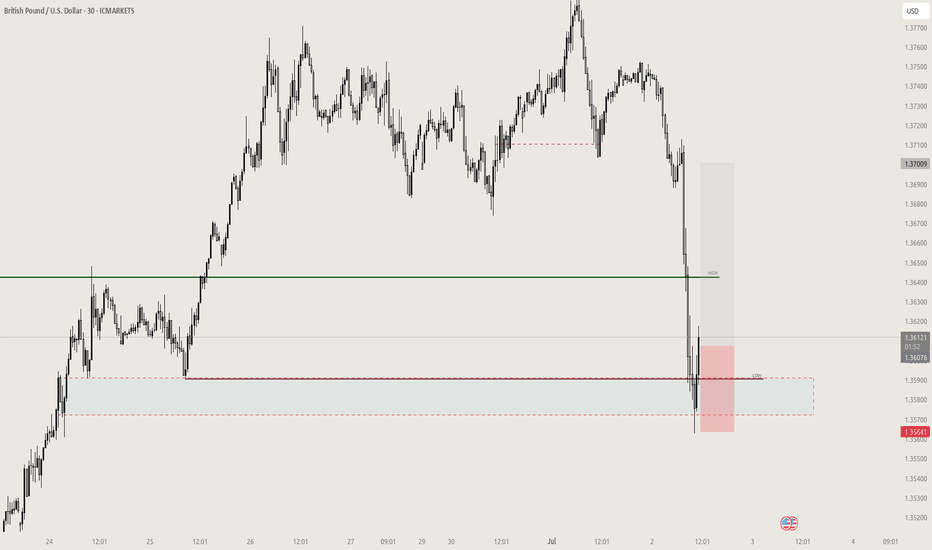

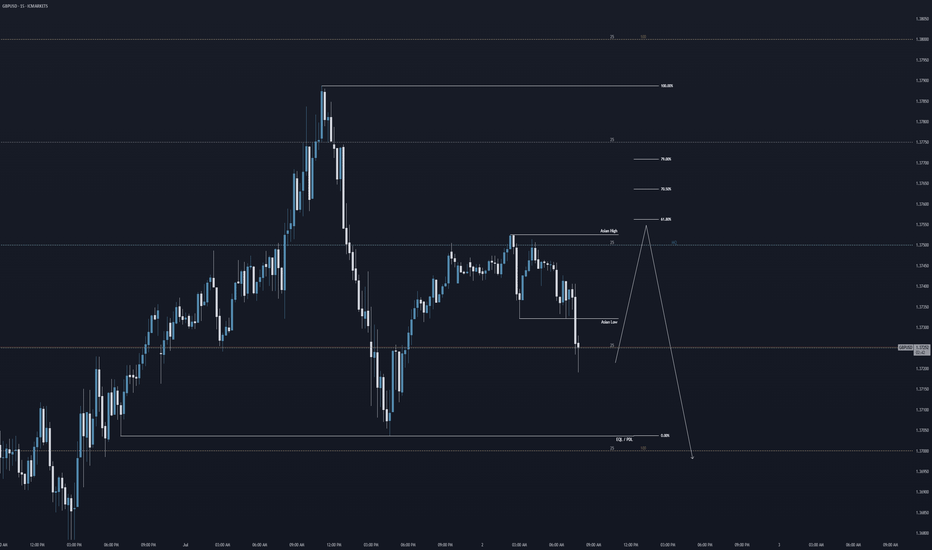

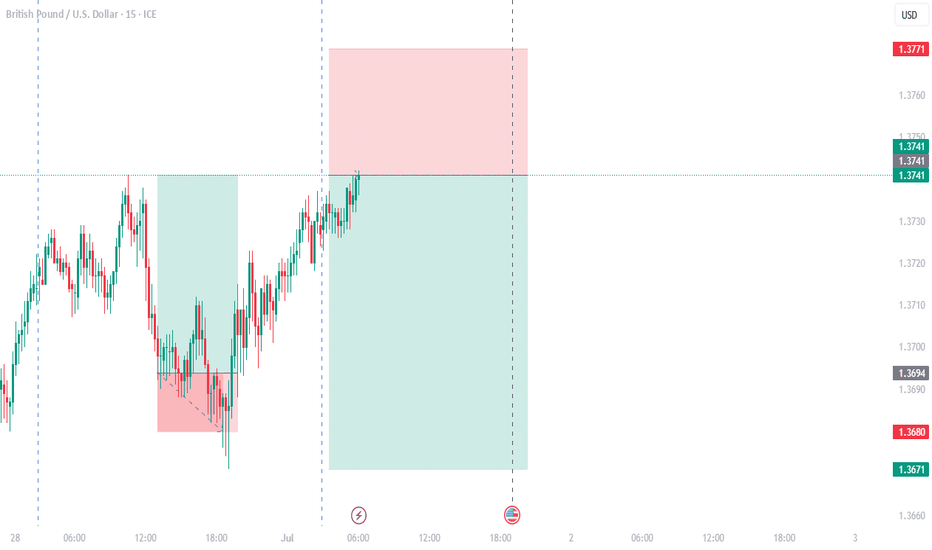

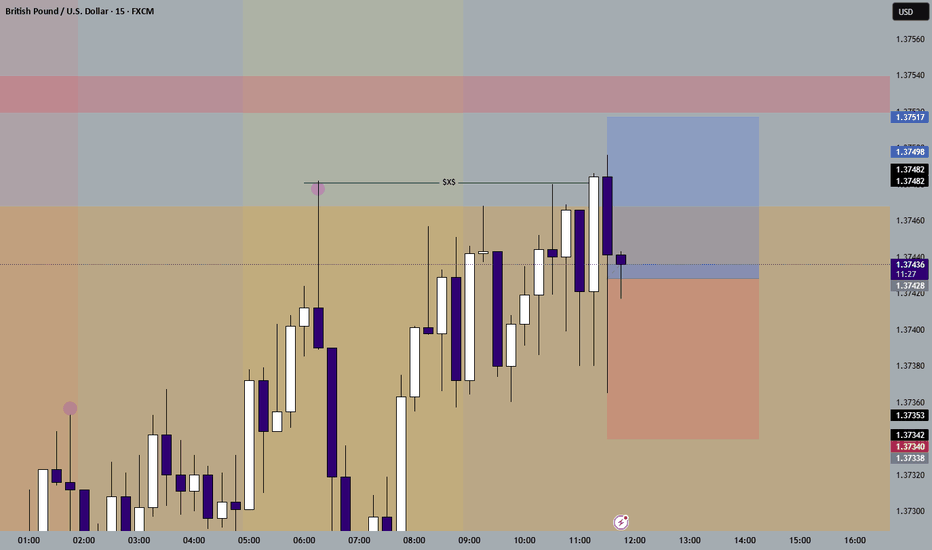

GU: Asian highs > Previous Day Low?Hi everyone,

Here is my forecast this morning for GBPUSD. Overall I'm thinking bearish, but I reckon that price could take out the Asian range highs first and then give us a bearish leg towards the previous day low.

Regards,

Aman | SMC Wolf FX

1-1 student onboarding is currently open (website in my signature & profile)

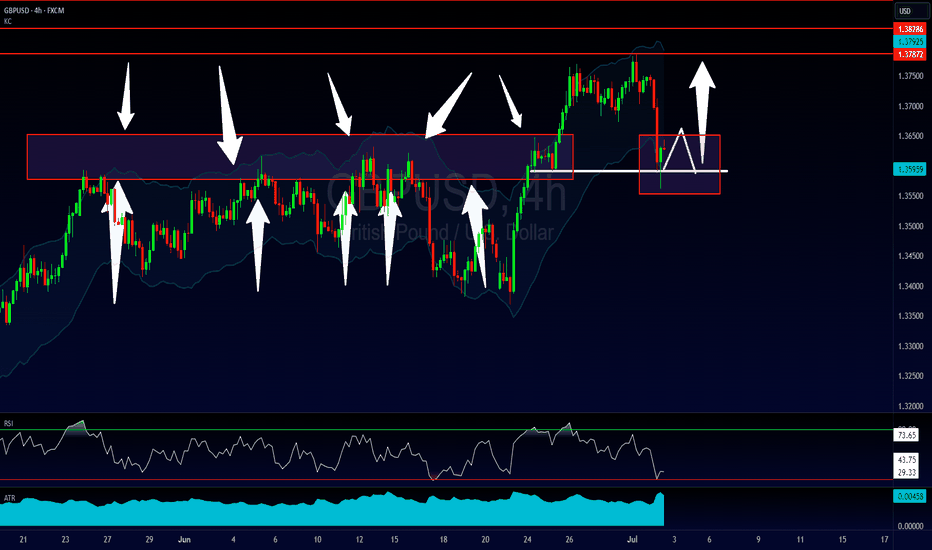

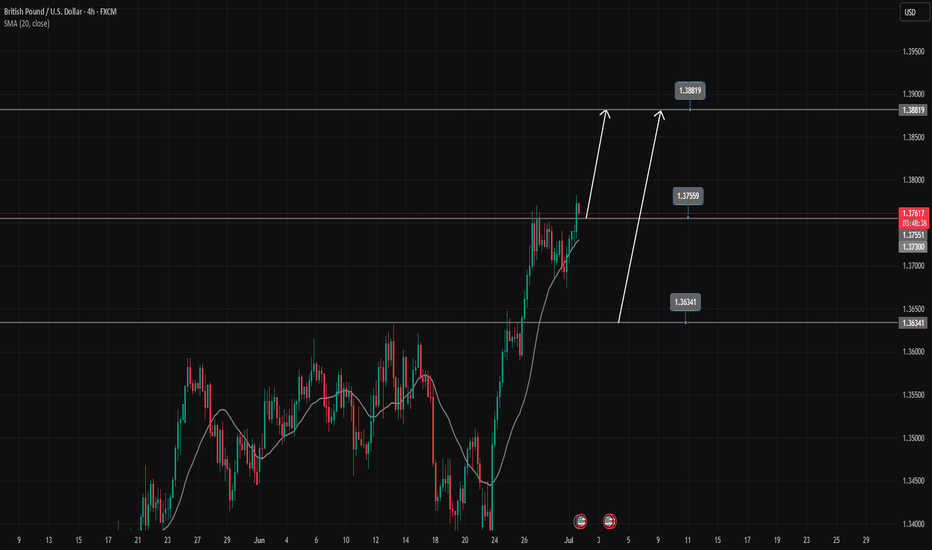

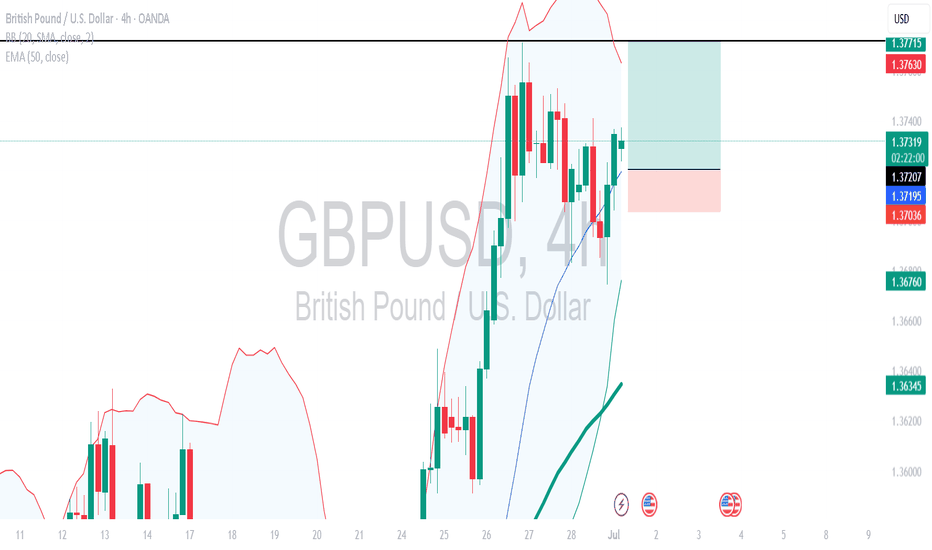

GBPUSD's strong uptrend continuesGBPUSD is in a strong uptrend, Price has just broken the resistance zone of 1.37500.

All the bullish momentum is heading towards the resistance zone of 1.388.

If there is a close of the h4 candle below the resistance zone of 1.375, there will likely be a Pullback to 1.363 to find more buying momentum towards the target at the resistance zone of 1.388

📈 Key Levels

Support: 1.375-1.363

Resistance: 1.388

📊 Recommended Trade Setups

BUY GBPUSD 1.375-1.373 Stoploss 1.37000

BUY GBPUSD 1.363-1.361 Stoploss 1.35800

SELL GBPUSD 1.388-1.390 Stoploss 1.39300

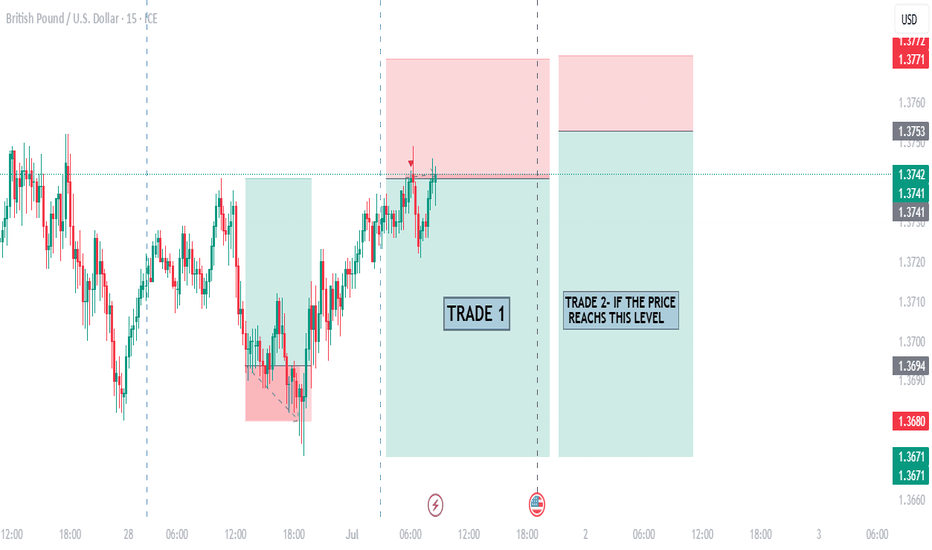

Updated GBP/USD Trade Idea: New Setup If Price Reaches Key LevelAfter successfully executing the previous trade, I’m now monitoring GBP/USD for a fresh opportunity. If the price reaches this point, it aligns with a high-probability zone where market structure suggests a potential reaction. This area has historically acted as a decision point, and I’ll be watching closely for confirmation before entering the next position.

This updated idea reflects a disciplined, price-action-based approach—focused on timing, structure, and market behavior. Whether you're a day trader or swing trader, this setup offers a clean risk-to-reward profile and fits well within an intraday strategy.

📈 Stay tuned for real-time updates, trade management insights, and detailed breakdowns. 💬 Follow for more GBP/USD strategies and actionable forex content.

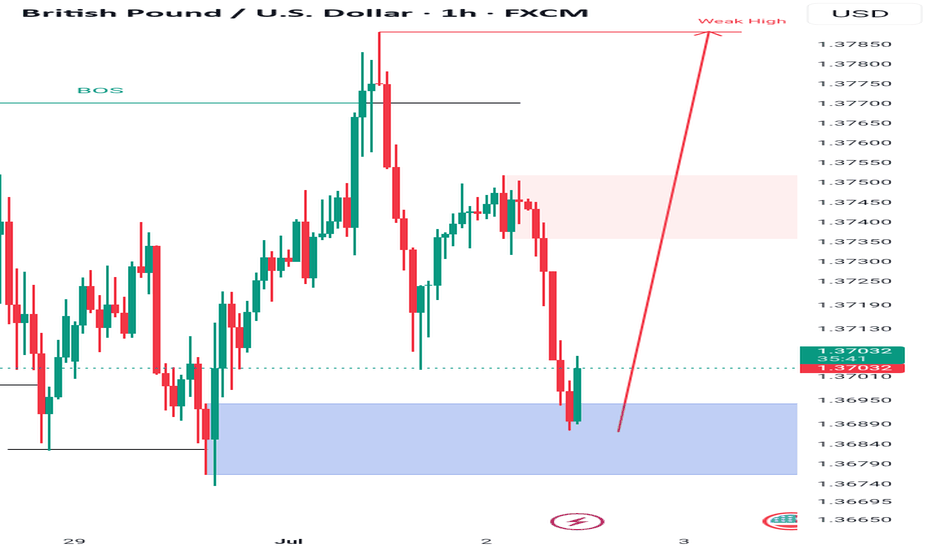

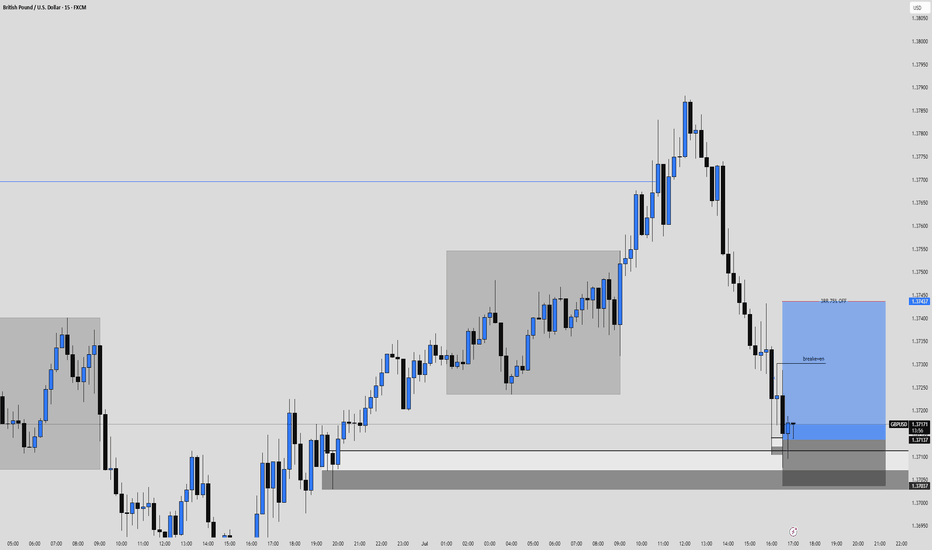

GBPUSD Long, 1 JulyPrice is reacting from a Daily bearish OB, but this setup aims to catch the pullback — making a long valid here despite HTF structure.

LTF gave a clean 15m BOS, followed by reaction from the extreme 15m OB.

Entry was taken after a confirmed 1m BOS + OB retrace, in alignment with structure and location.

🎯 Target: 30 pips (1:3 RR)

⚠️ No clear Asia target, but structure favors this move

📍Entry: 1m OB after BOS

📉 Risk: 0.5%

High-probability pullback play, executed with confirmation and clean structure.

GBP/USD Tactical Shift: Long Closed, Short Bias ActivatedAfter successfully capturing the upside move on GBP/USD, price has now reached a key resistance zone where bullish momentum appears to be fading. The recent price action shows signs of exhaustion, with lower highs forming near the top and a noticeable slowdown in buying pressure.

This shift in structure suggests a potential reversal opportunity. I'm now positioning for a short setup, anticipating a corrective move as sellers begin to step in. The risk is clearly defined above the recent highs, with downside targets aligned with previous reaction zones and intraday support levels.

This transition from long to short reflects a dynamic response to evolving market conditions—focused, disciplined, and opportunity-driven.

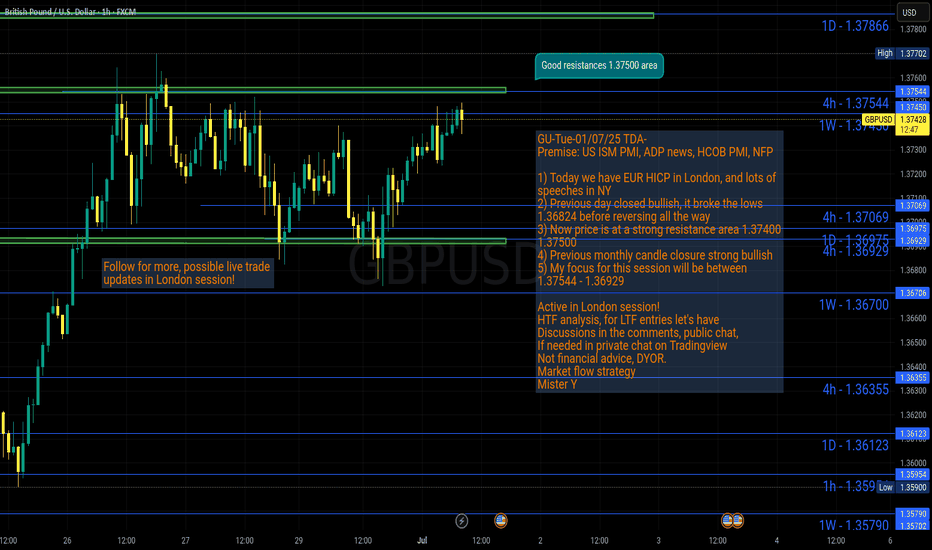

GU-Tue-01/07/25 TDA-Strong resistance area approaching 1.37500Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Timing!

You might ask yourself why sometimes your

trade idea was good but still ended up hitting your sl before it moves to your direction.

The reason is simple: Timing.

price is just not ready to push at that time

and needed extra liquidity and structure before it finally has the force to push.

Understanding when the market is ready is one of the most difficult thing for a trader to do but with experience you start to understand better and improve.

If you like the way I present and analyze, make sure to boost,

share and follow me for more future posts, ideas and useful informations.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

What Happens the Day Jerome Powell Is Fired or Quits?A sudden exit by Fed Chair Jerome Powell would create both a political and monetary shock.

While the Chair is technically protected from arbitrary removal. Recent reports confirm that President Trump and his allies are scrutinising the Fed’s $2.5 billion renovation project—potentially laying the groundwork for a “for cause” dismissal.

A surprise departure would undermine confidence in the Fed’s independence. The U.S. dollar could fall sharply across major pairs.

USD/JPY could fall toward ¥145, with safe-haven demand favouring the yen. However, the reaction may be less severe than in pairs like Swiss franc which we have noted in the past is the potentially preferred safe haven. A panic selloff could extend to 142.20—a prior consolidation floor.

GBP/USD could surge as traders anticipate a more dovish Fed stance under the new Trump-stooge Fed Chair. From a technical perspective, GBP/USD is maybe already oversold and potentially poised for a potential rebound anyway—Powell’s resignation or firing could potentially exacerbate this. The first level to watch being a return to 1.3700, assuming the likely expectation of Fed rate cuts rise.

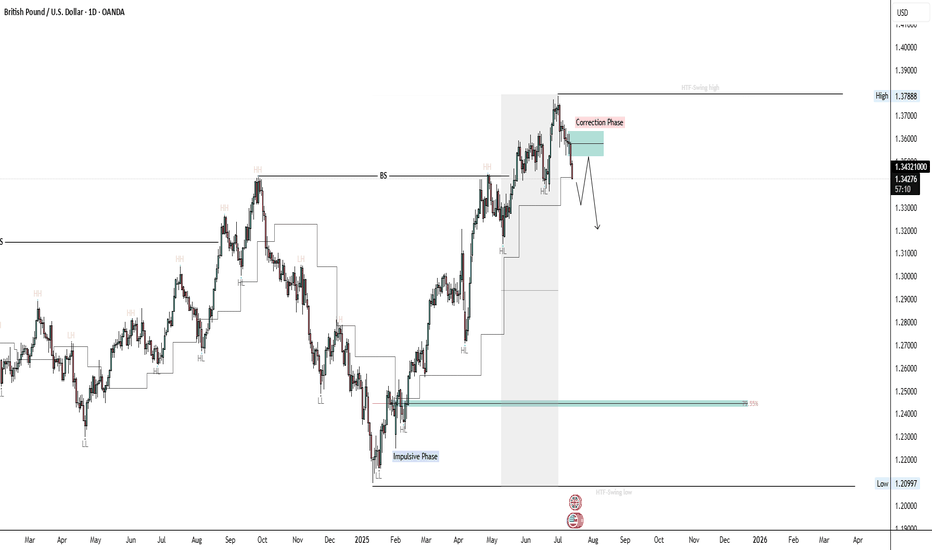

GBPUSD Swing Outlook 14-07-2025Hello Traders!

It's been a while since my last post on the market.

Here's a breakdown of GBPUSD.

Daily Timeframe:

1. We have been in a bullish trend, price forming HH and respecting HL. (impulsive phase)

2. By dragging our Fibonacci level from swing low to swing high, we can clearly see potential discounted levels where we can look for buying opportunities again.

3.(Corrective phase) Current price action indicates to us that price has a potential of closing below our last HL, which will indicate MMS/CHOCH and a start of a bearish trend.

4. What we know is that in a bearish trend price respects LH and breaks LL, and we should be looking for selling opportunities.

5. By using the H4 timeframe we can look for internal swing points where we can drag our Fibonacci to identify best-selling opportunities at a premium level. (This will be counter trend trading, and we can capitalize on it until we are in discounted levels again)