GBPUSD trade ideas

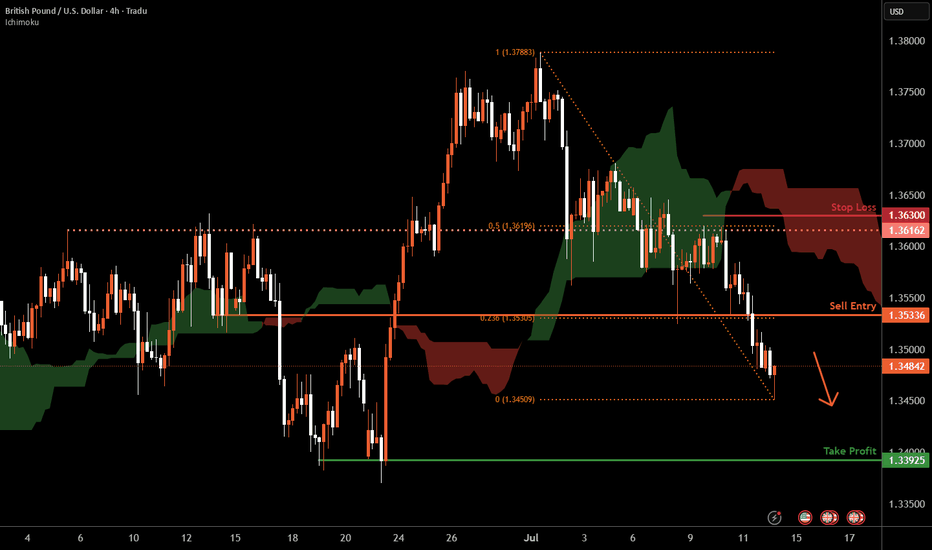

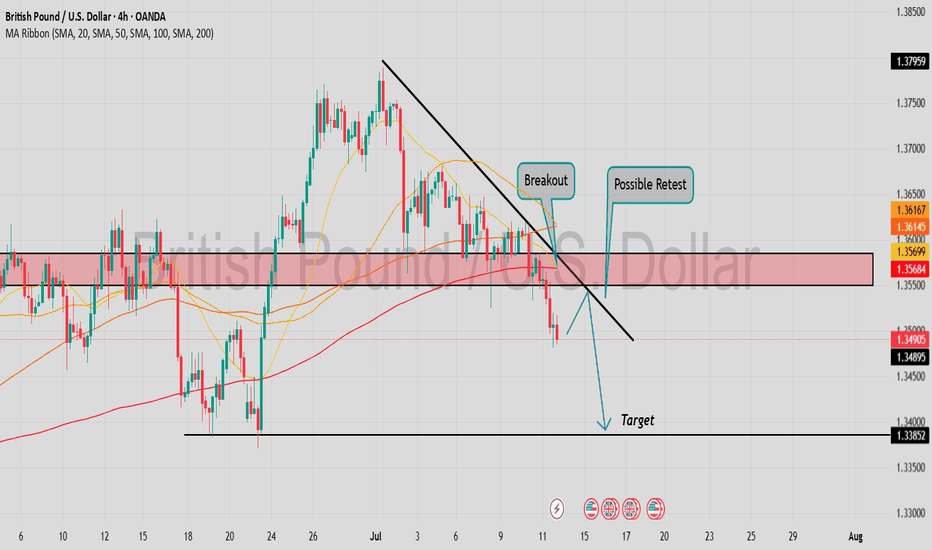

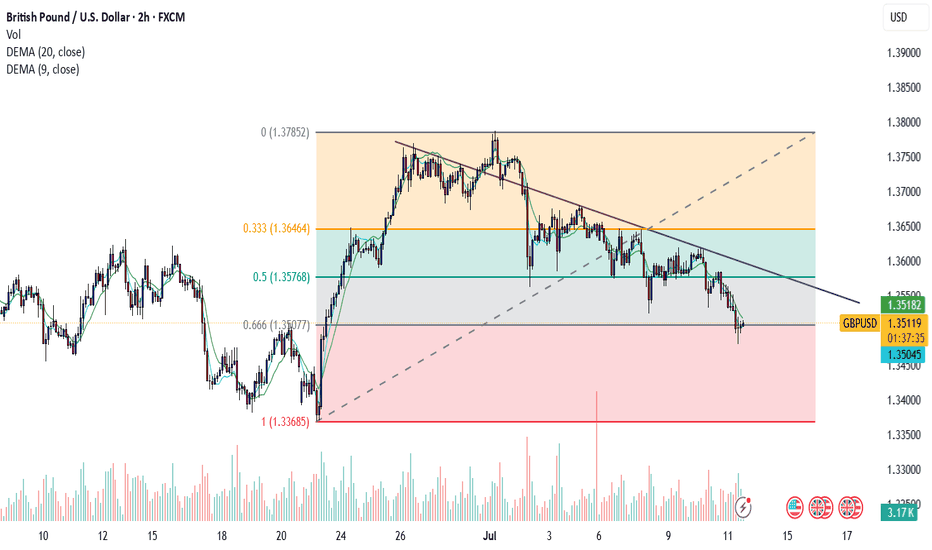

Cable H4 | Pullback resistance at 23.6% Fibonacci retracementCable (GBP/USD) is rising towards a pullback resistance and could potentially reverse off this level to drop lower.

Sell entry is at 1.3533 which is a pullback resistance that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 1.3630 which is a level that sits above the 50% Fibonacci retracement and an overlap resistance.

Take profit is at 1.3392 which is a multi-swing-low support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

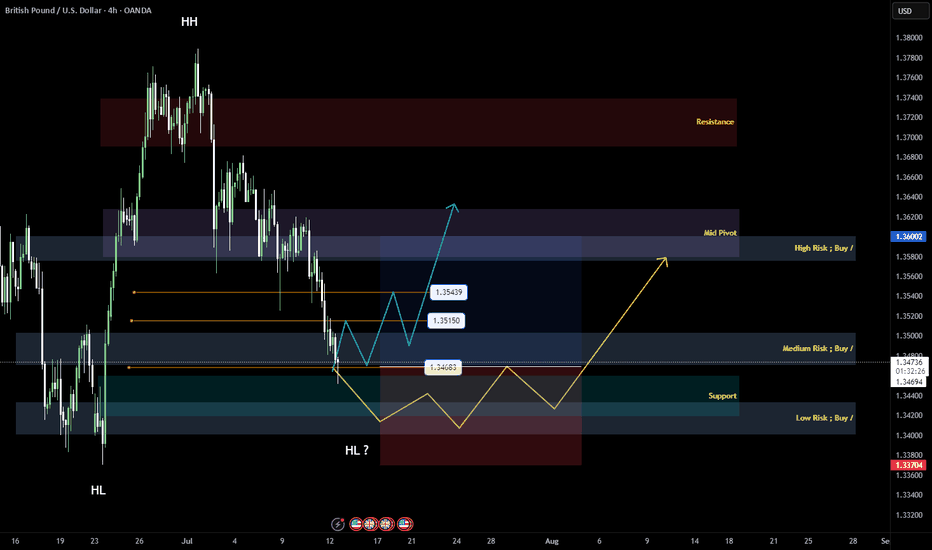

LONG - GBP/USDPrice has already reached my third reversal line and this is where I can expect to price to close above the reversal line to hint a possible change in the direction of the trend.

Currently right now I am waiting for the price to show me a bullish reversal candle for the price to give me confluence to possible change of trend.

I am still bias with the trend moving upwards base on the market structure given by the price action.

However I will not consider the 4th Key Point Market Structure as HL if it breaks the previous structure.

Entry - 1.34683

Stop Loss - 1.33704

Take Profit - 1.36002

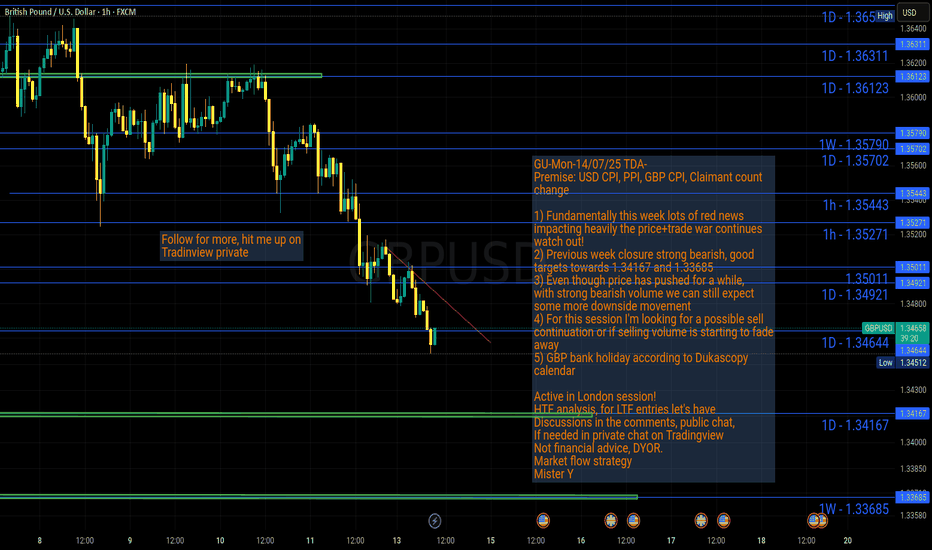

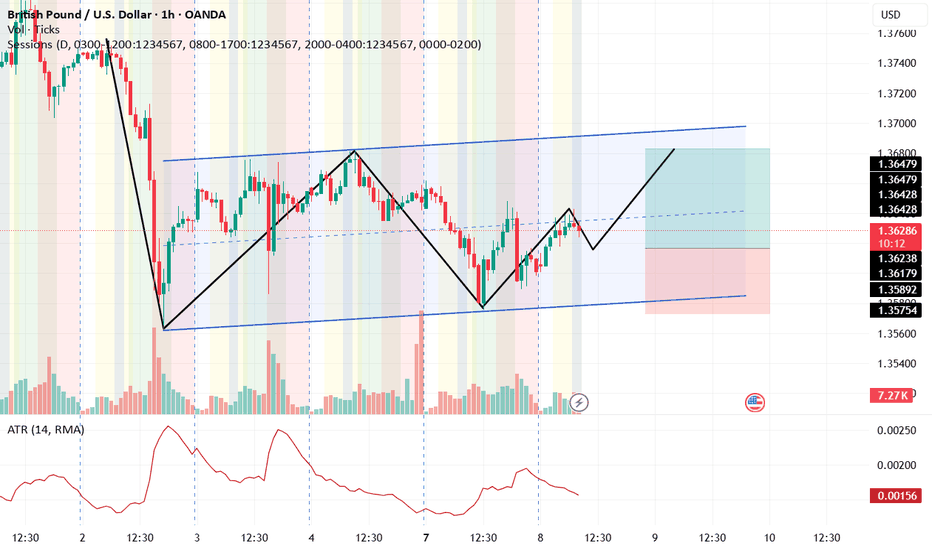

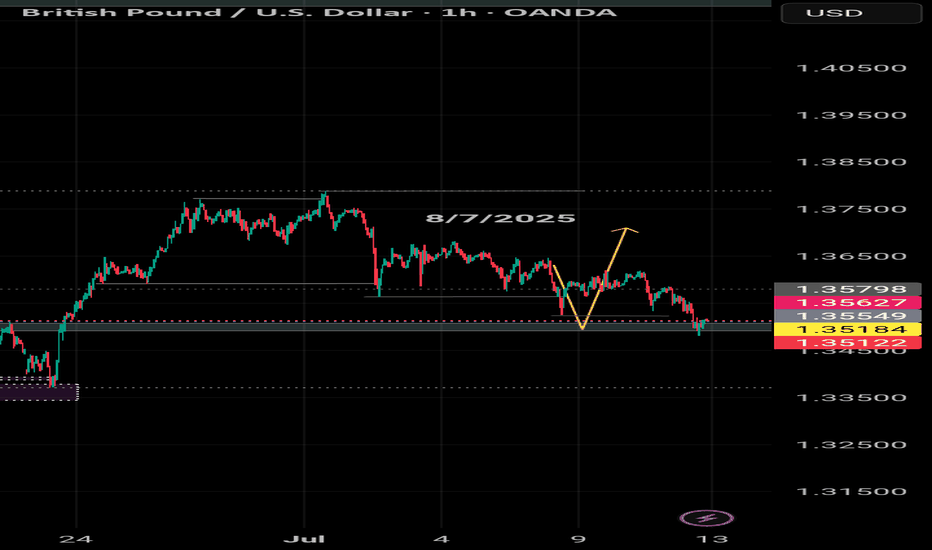

GU-Mon-14/07/25 TDA-USD CPI, GBP CPI+Trade war continuesAnalysis done directly on the chart

Follow for more, hit me up on Tradingview!

Make sure to follow up the calendar news (especially red folder ones).

As trade war continues, it's good to as well stay up to date,

to know what will happen and how it will influence the price!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

I want to find like minded traders, hit me up

privately here on Tradingview or other socials!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

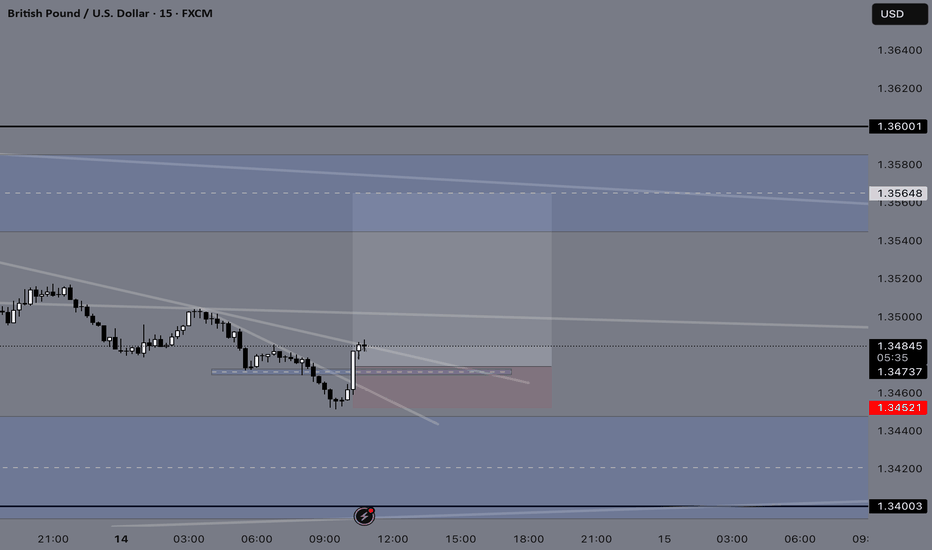

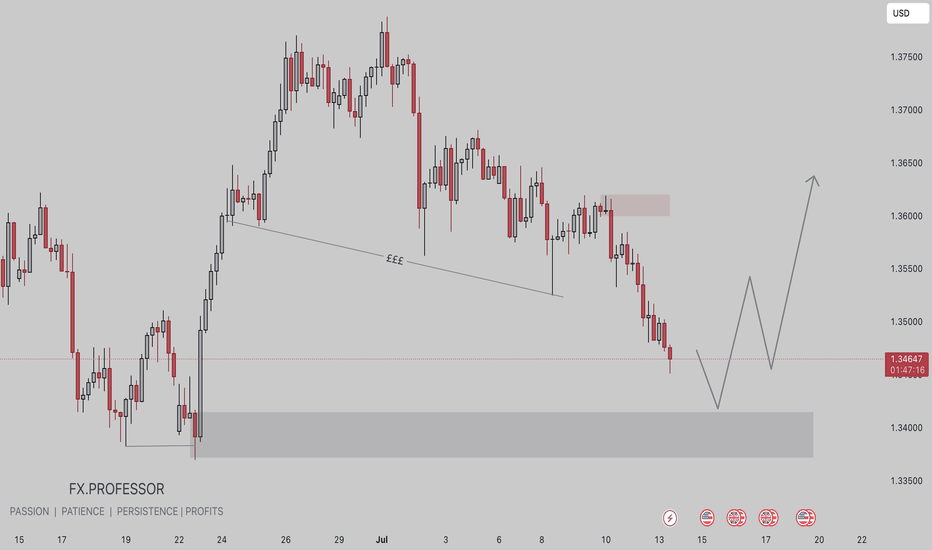

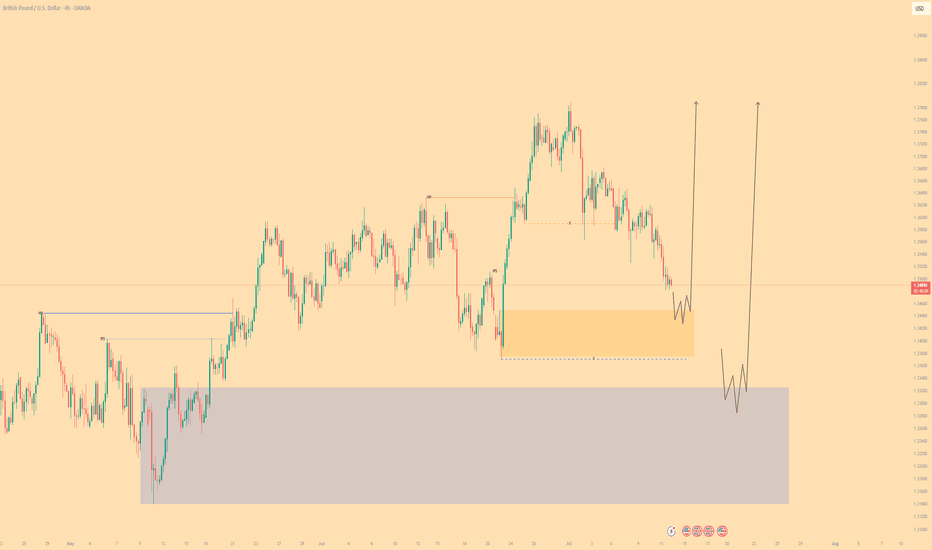

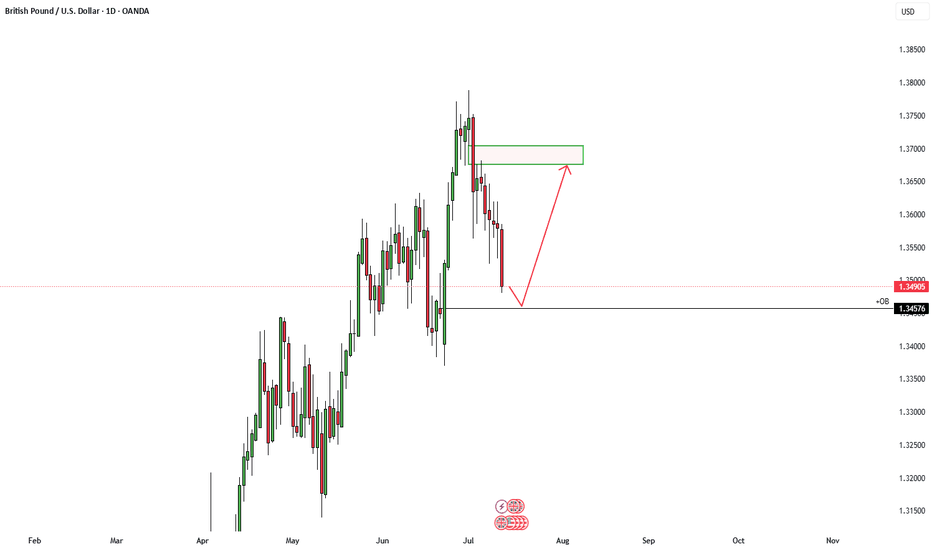

GBPUSD BUY IDEA • Descending Liquidity Sweep:

• Triple equal lows (₤₤₤) have been drawn and swept via a liquidity run, hinting at smart money accumulation.

• The price is pushing toward a higher-timeframe demand zone (~1.3380–1.3420), signaling a potential low-risk buy area.

• Bullish Scenario Outlook:

• Following the liquidity grab, the market is projected to form a higher low, suggesting an internal shift in market structure.

• Anticipating a multi-leg move toward the 1.3600+ level, likely retracing to a previous supply/imbalance zone.

• Ideal Entry Approach:

• Await price reaction within the demand zone.

• Confirmation of a micro-structure shift could provide a high-probability buy setup.

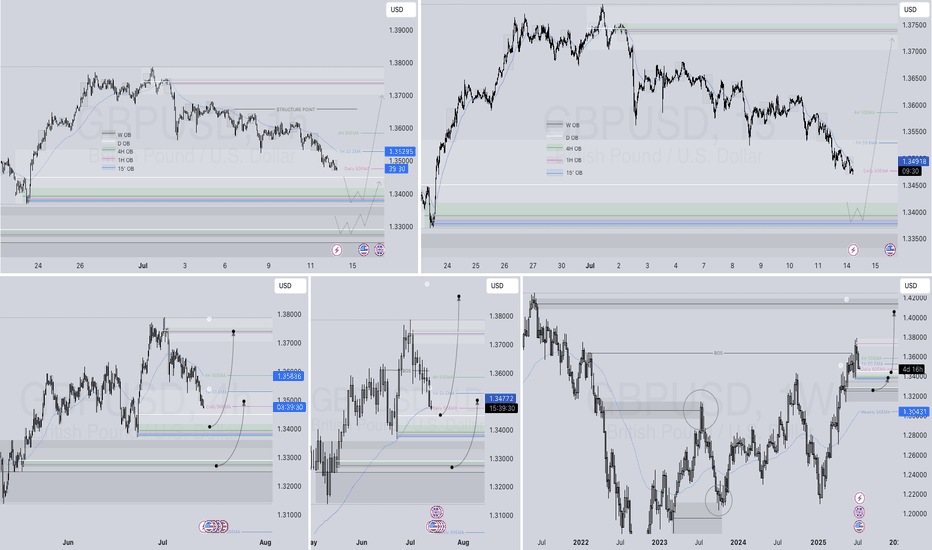

GBPUSD LONG FORECAST Q3 D14 W29 Y25GBPUSD LONG FORECAST Q3 D14 W29 Y25

Welcome back to the watchlist GBPUSD ! Let's go long ! Alignment across all time frames.

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅1H Order block

✅Intraday breaks of structure

✅4H Order block

📈 Risk Management Principles

🔑 Core Execution Rules

Max 1% risk per trade

Set alerts — let price come to your levels

Minimum 1:2 RR

Focus on process, not outcomes

🧠 Remember, the strategy works — you just need to let it play out.

🧠 FRGNT Insight of the Day

"The market rewards structure and patience — not emotion or urgency."

Execute like a robot. Manage risk like a pro. Let the chart do the talking.

🏁 Final Words from FRGNT

📌 GBPUSD is offering textbook alignment — structure, order flow, and confirmation all check out.

Let’s approach the trade with clarity, conviction, and risk-managed execution.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

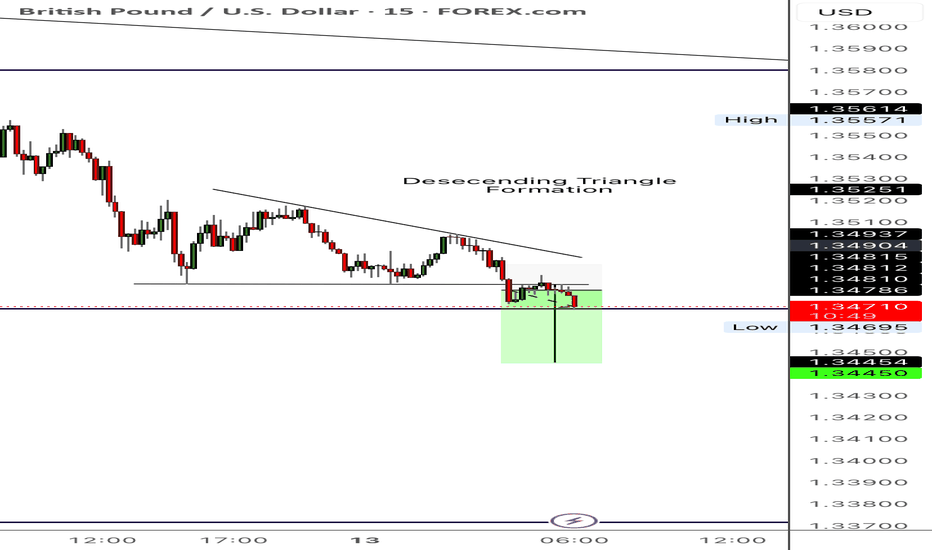

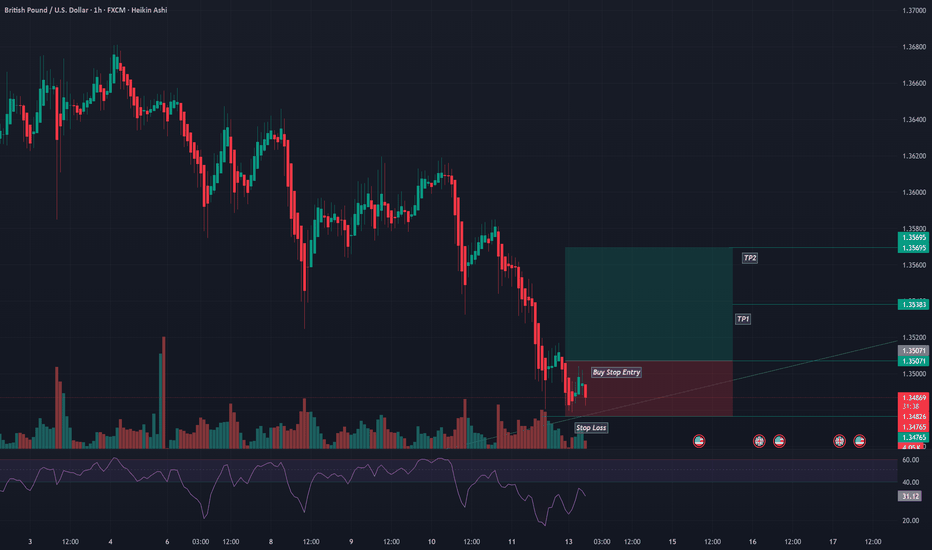

GBPUSD H1 Buy SetupHi Traders,

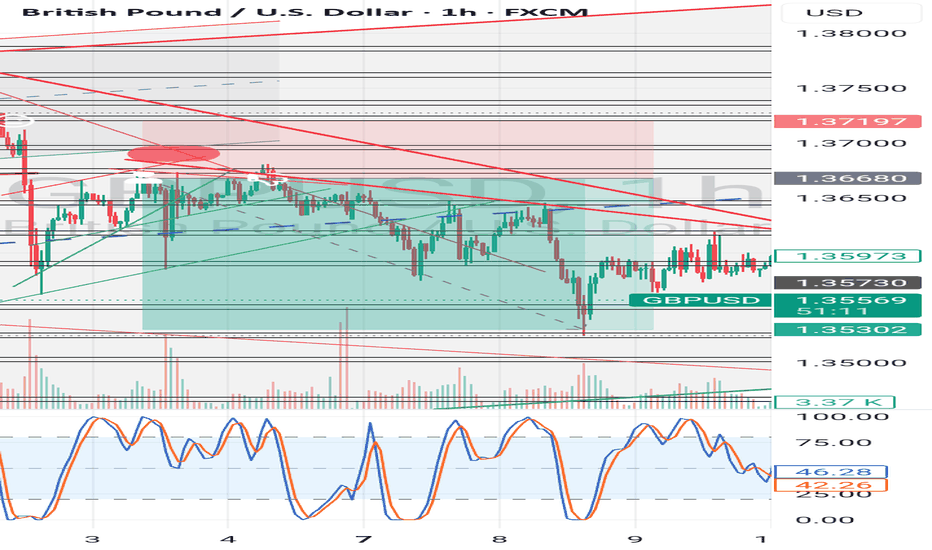

On the H1 timeframe, I’m observing potential signs of a trend reversal:

🔹 A double bottom has formed on the chart

🔹 Bullish divergence is visible on the RSI

These are strong reversal signals.

📌 A Buy Stop entry could be a solid opportunity if price breaks above the previous Lower High (LH).

As always, follow the trade according to your own risk-reward strategy.

Trade safe and stay disciplined!

GBPUSD| - Bullish BiasHTF Overview (4H): Strong bullish structure in play, with multiple highs being broken and momentum firmly to the upside. Price is clearly respecting bullish order flow, suggesting continuation.

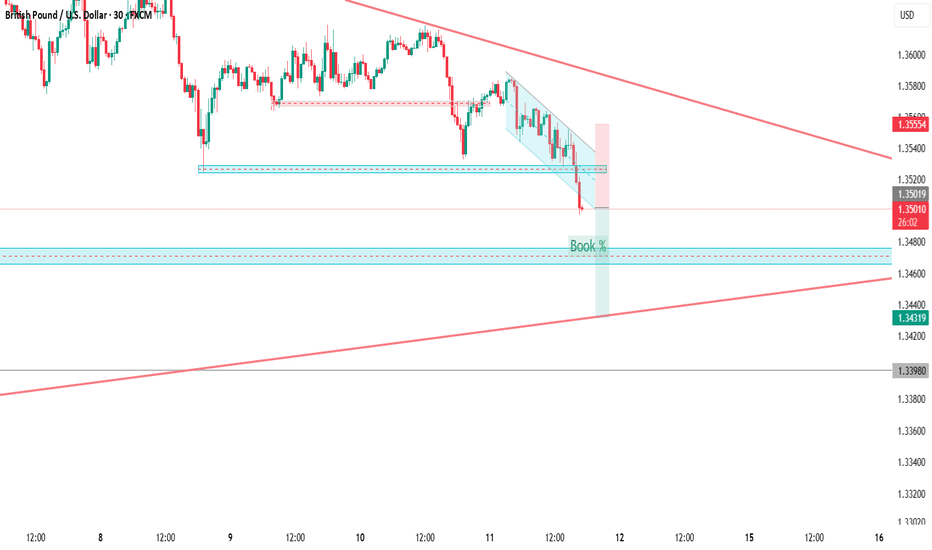

MTF Refinement (30M): Identified a 30M OB aligned with the trend. Waiting for price to mitigate this zone, as it could serve as the springboard for the next impulsive leg up.

Execution Plan: Once the 30M OB is mitigated, I’ll drop to LTF (1M/5M) to watch for confirmation — CHoCH, BOS, or microstructure shift — before executing longs.

Mindset: Bull momentum is intact — patience and confirmation are key to riding it with precision.

Bless Trading!

GBPUSD(20250714)Today's AnalysisMarket news:

① Fed's Goolsbee: The latest tariff threat may delay rate cuts. ② The Fed responded to the White House's "accusations": The increase in building renovation costs partly reflects unforeseen construction conditions. ③ "Fed's megaphone": The dispute over building renovations has challenged the Fed's independence again, and it is expected that no rate cuts will be made this month. ④ Hassett: Whether Trump fires Powell or not, the Fed's answer to the headquarters renovation is the key.

Technical analysis:

Today's buying and selling boundaries:

1.3518

Support and resistance levels:

1.3621

1.3583

1.3558

1.3479

1.3454

1.3415

Trading strategy:

If the price breaks through 1.3518, consider buying in, with the first target price at 1.3558

If the price breaks through 1.3479, consider selling in, with the first target price at 1.3454

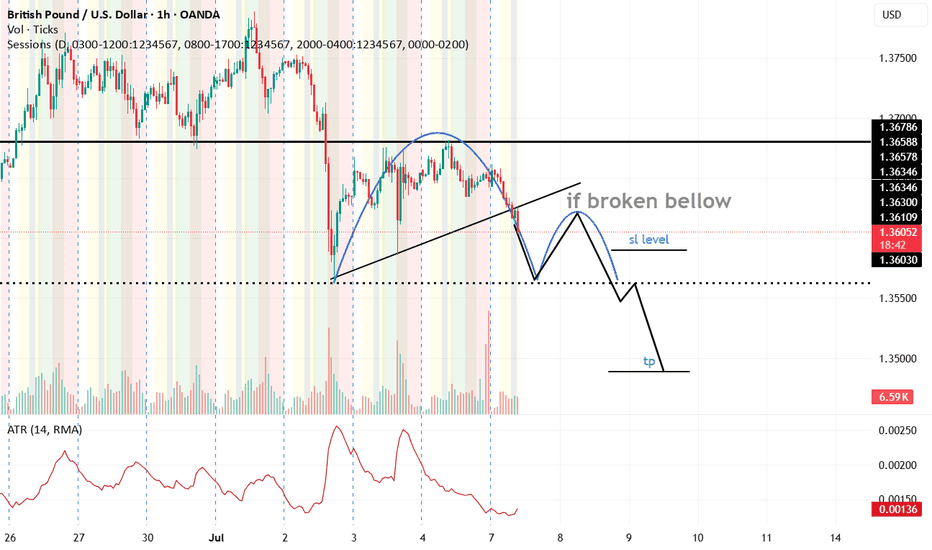

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

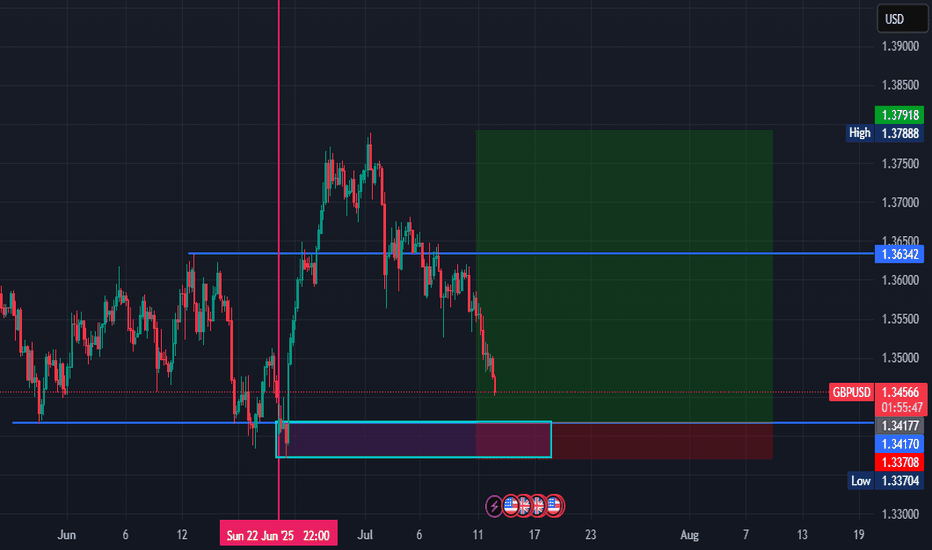

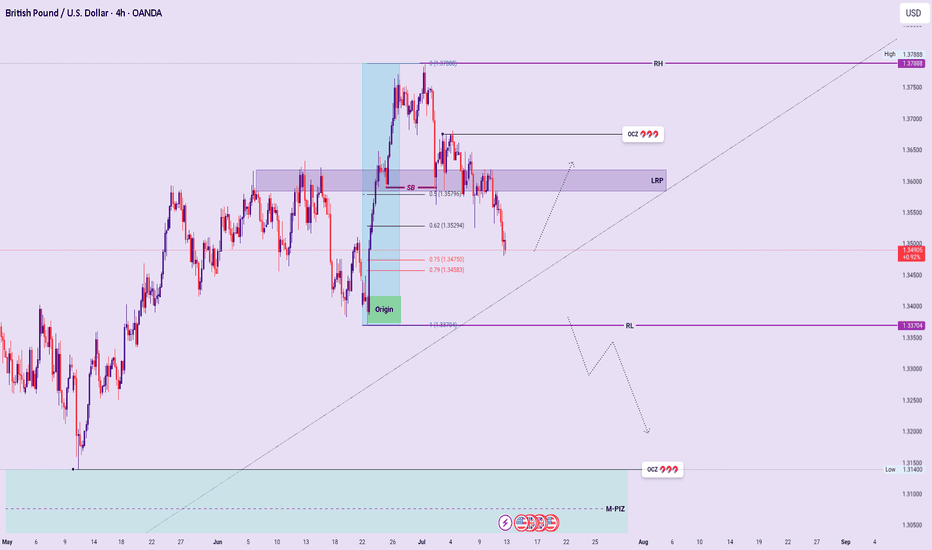

GBPUSD: NEW-WEEK TECHNICAL BIAS (MARKET OPEN) Higher Timeframe Bias:

Ascend Sequence remains valid on the Monthly, Weekly, and Daily structures, with the current Descend Sequence viewed as a pullback phase within broader bullish flow.

Structural Insight:

Despite recent sell-side pressure, price failed to break the Range Low during last week’s trading — suggesting possible defense of bullish territory.

Key Zones to Watch:

Focus remains on the Range Origin Zone. If respected, it may trigger a cautious rally toward the LRP or even the OCZ above.

A clean violation of the Range Origin would open downside toward 1.33704 (Range Low). A breach of this level could signal a Sequence Switch, confirming shift to Sell-Side Bias Environment (SBE) and initiating deeper exploration into the Monthly PIZ.

Execution Outlook:

If Range Origin holds: Lean toward tactical long setups with tight validation structure.

If broken: Bias shifts aggressively bearish — looking to short rallies in line with new descending flow.

Summary:

Still favoring HTF bullish structure unless Range Origin fails. Below that, sell-side becomes dominant, and rallies become shorting opportunities.

GBPUSD LONG TERM GBPUSD Live Trading Session/ GBPUSD analysis #forex #forextraining #forexHello Traders

In This Video GBPUSD HOURLY Forecast By World of Forex

today GBPUSD Analysis

This Video includes_ (GBPUSD market update)

GBPUSD Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on GBPUSD Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

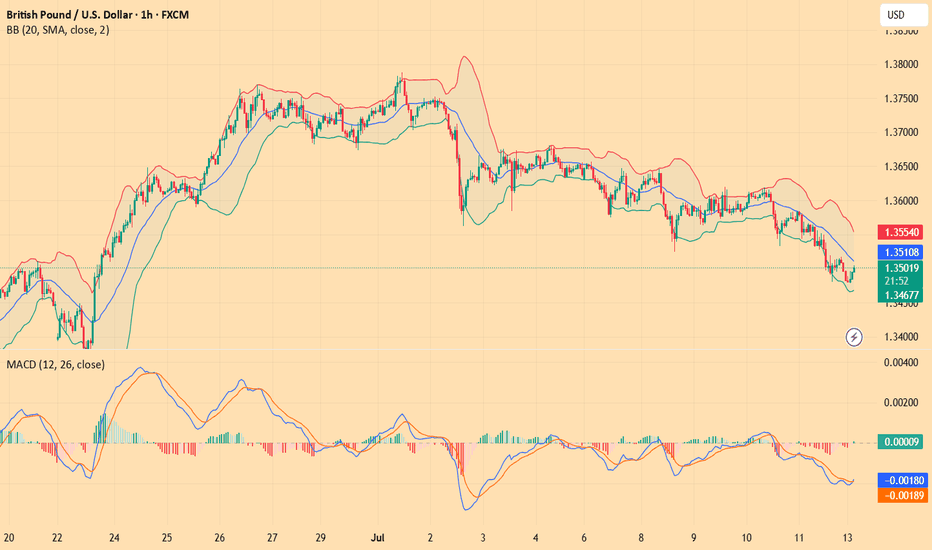

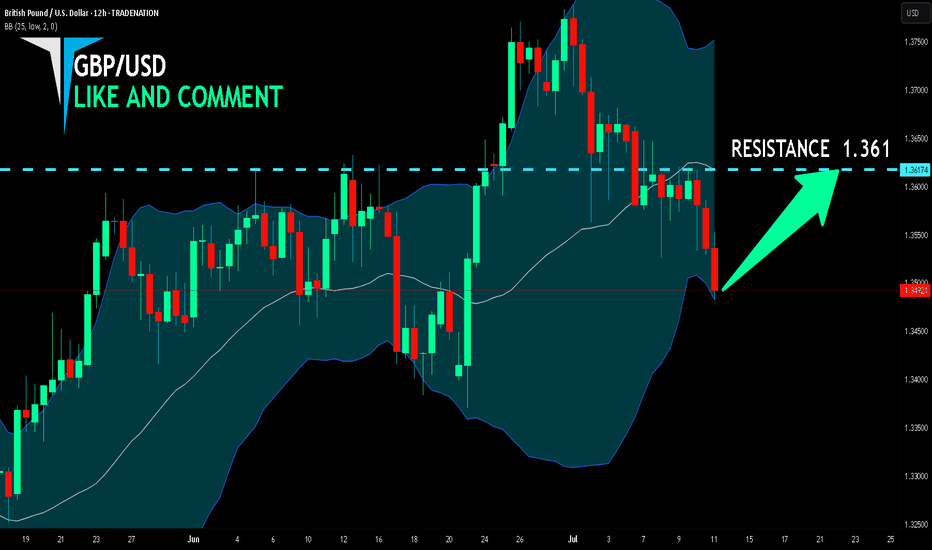

GBP/USD BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

It makes sense for us to go long on GBP/USD right now from the support line below with the target of 1.361 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

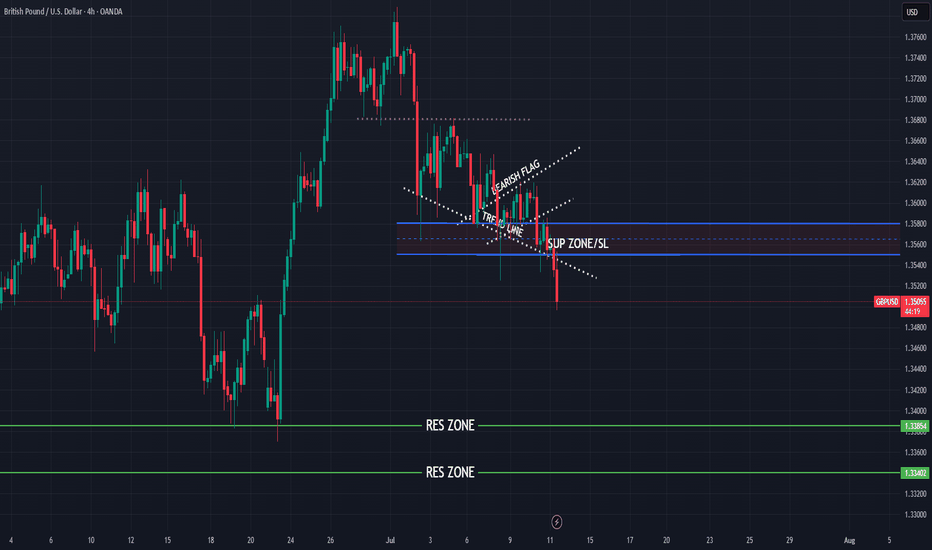

GBP USD SHORT RESULT Trend was still overall bearish and ongoing a minor pullback to continue downward movement also formed an ascending wedge pattern on the pullback which is also a strong indicator of bearish movement.

With all the conflunce above is why I took the short and it moved perfectly as predicted 🔥💪👌🎯

_THE_KLASSIC_TRADER_.🔥