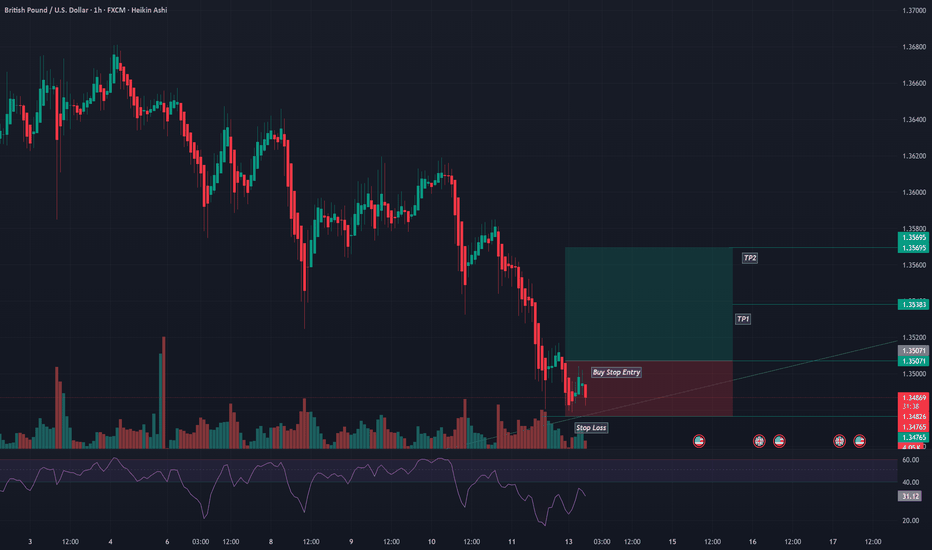

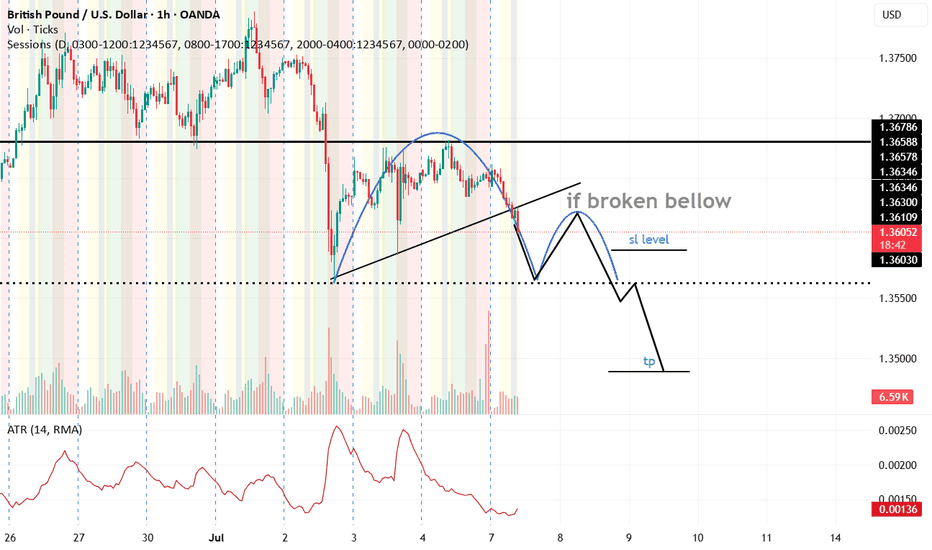

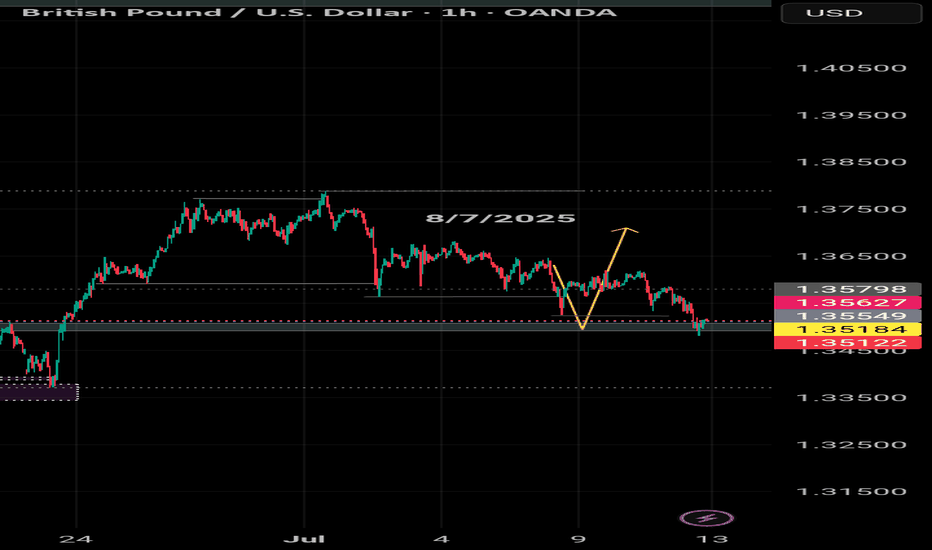

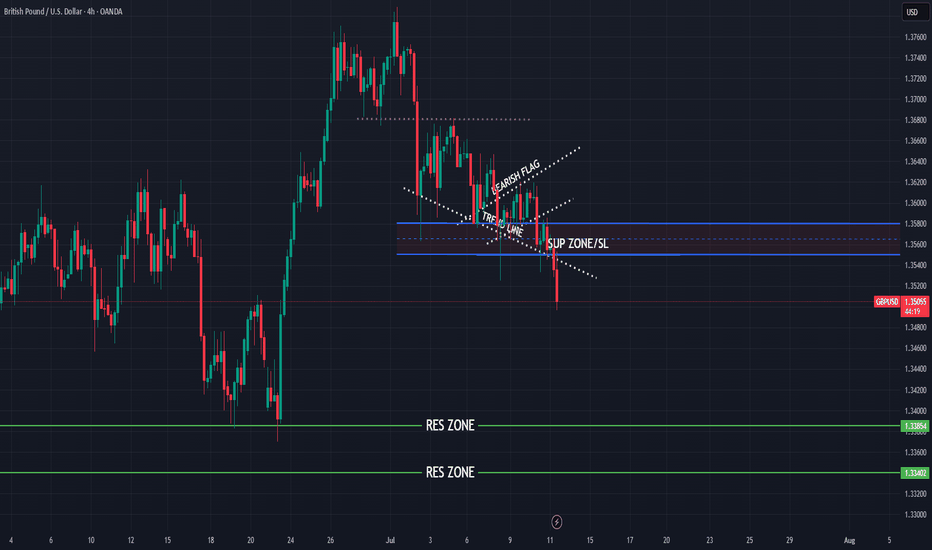

Skeptic | GBP/USD Update: Triggers Fired Up!Hey everyone, it’s Skeptic! ;) yesterday, the support at 1.35672 saw a fake breakout and snapped back into the 4-hour box we’ve been tracking. But bearish momentum is still strong, so here’s the play:

✔️ If you opened a short already , With the fake breakout signaling potential momentum shift, consider taking profits or closing if price consolidates above 1.36089. Why? The fakeout increases the chance of a momentum change.

✨ For new short positions , the 1.35672 break remains a valid trigger. If it breaks again, it could kickstart a major bearish leg, targeting lower supports at 1.35000 and 1.34227 —both strong reaction zones.

📊 The HWC is uptrend, so shorts need extra caution—reduce risk or take profits early.

📉 For longs , wait for a break and consolidation above 1.36406 . This level saw a strong rejection, signaling it’s a key resistance the market respects. A break here, liquidating short positions (which means buying), could spark a solid uptrend leg with great R/R potential.

🔔 Confirmation : Use RSI entering oversold for shorts or overbought for longs. The HWC uptrend means shorts carry higher risk, so tighten your risk management—stick to 1%–2% risk per trade.

🔼 Key Takeaway: Short at 1.35672 if it breaks again, long at 1.36406 with confirmation. Stay sharp for momentum shifts and keep stops tight. I’ll update if the market structure flips!

💬 Let’s Talk!

Which GBP/USD trigger are you locked on? Hit the comments, and let’s crush it together! 😊 If this update lit your fire, smash that boost—it fuels my mission! :)))

GBPUSD trade ideas

The Day Ahead China – June Trade Balance

Exports rose 5.8% year-on-year, beating expectations, as exporters rushed to ship goods before new U.S. tariffs.

Imports increased 1.1% year-on-year, recovering slightly from a previous drop.

Trade surplus expanded to $114.7 billion from $103.2 billion in May.

Takeaway: Export strength is driven by temporary factors. Weak imports still point to fragile domestic demand.

Japan – May Core Machinery Orders & Capacity Utilisation

Core machinery orders (a key CapEx gauge) fell 0.6% month-on-month — a softer decline than expected.

Orders were still up 4.4% year-on-year.

Broader machinery orders (including volatile sectors) rose 3.8% month-on-month.

Takeaway: Capital spending is holding up, but investment is uneven. Manufacturing remains cautious amid external uncertainties.

ECB – Vujčić & Cipollone Speeches

Vujčić: Inflation is near target; further rate cuts may not be needed unless data changes. He supports a patient approach.

Cipollone: Focused on the digital euro, stressing the need for secure and inclusive payment systems.

Takeaway: The ECB is moving into a “wait-and-see” mode. The digital euro remains a strategic priority.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

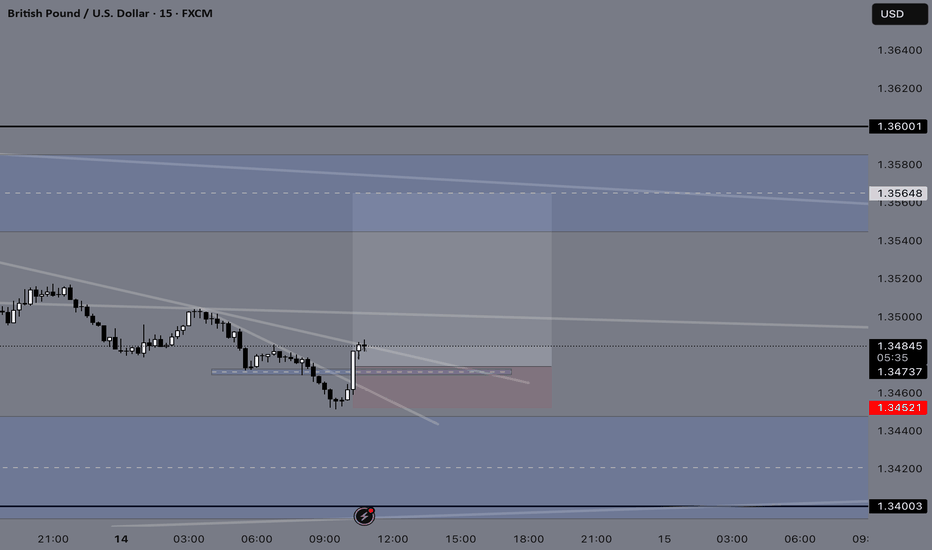

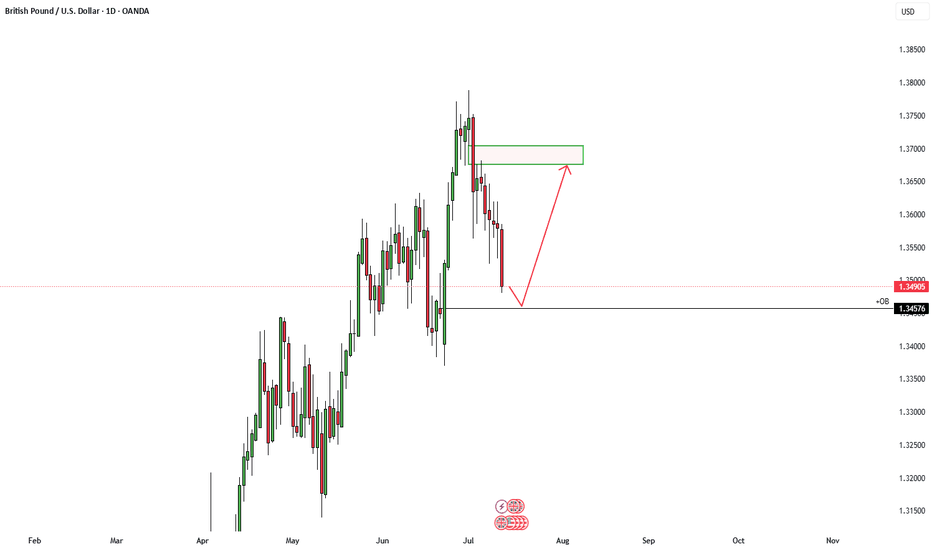

GBP/USD (GU) Weekly Outlook – July 15–19, 2025🔍 Price Enters Extreme Discount – Bounce or Breakdown?

After a clean break in structure and multiple bearish rejections, GBP/USD has entered extreme discount territory. Price is now testing a high-probability reaction zone near the weak low around 1.3440.

📊 Key Technical Zones:

🔻 Weak Low: 1.3440

🔵 1H OB (HP) below weak low: Potential liquidity draw

🔺 Retracement Targets:

0.25 = 1.3500

0.50 = 1.3535

0.75 = 1.3575

🟥 FVG resistance zone: 1.3575–1.3600

🧲 Draw on liquidity: Sub 1.3440 or PDH rejection area

🧠 Base Case:

📈 Expecting a short-term bullish reaction from the extreme discount zone

📉 Bias remains bearish overall unless structure shifts decisively

🎯 Weekly Trade Plan:

✅ Plan A: Watch for bullish CHoCH near 1.3440–1.3450

TP1: 1.3500

TP2: 1.3535–1.3575

🔁 Plan B: If price sweeps lower into OB (below 1.3440) → Look for bullish structure shift on LTF

❌ Invalidation: Sustained break and close below 1.3425 → opens path toward 1.3360s

📌 Price is deep into discount, but without confirmation there is no trade. Patience for reaction setups is key.

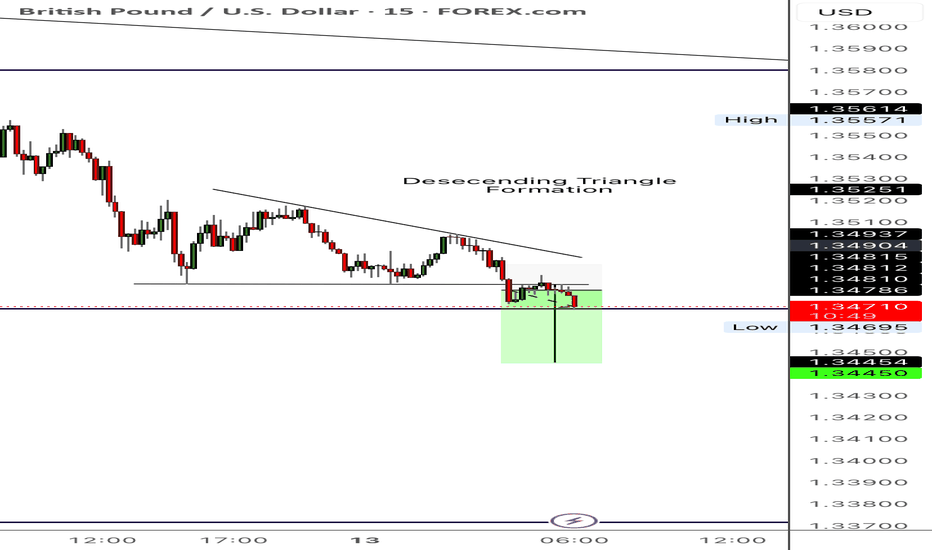

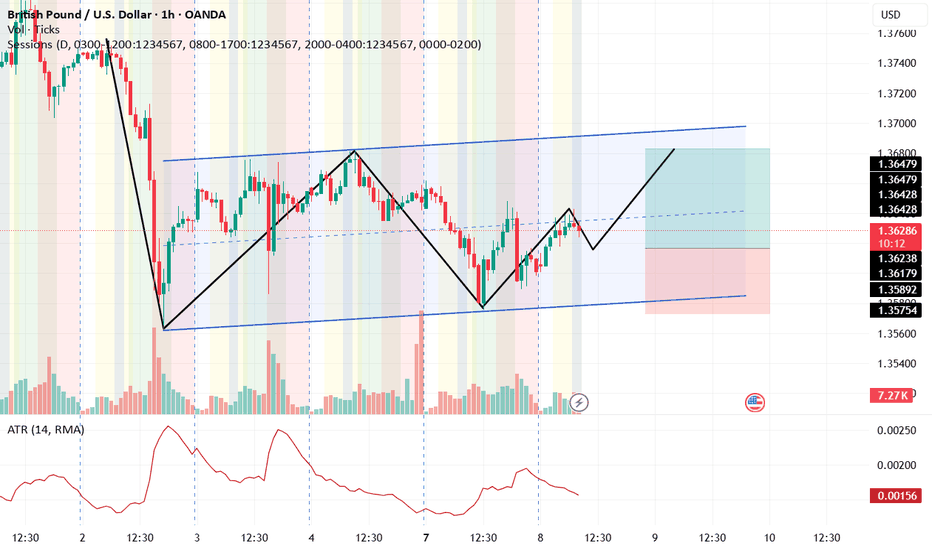

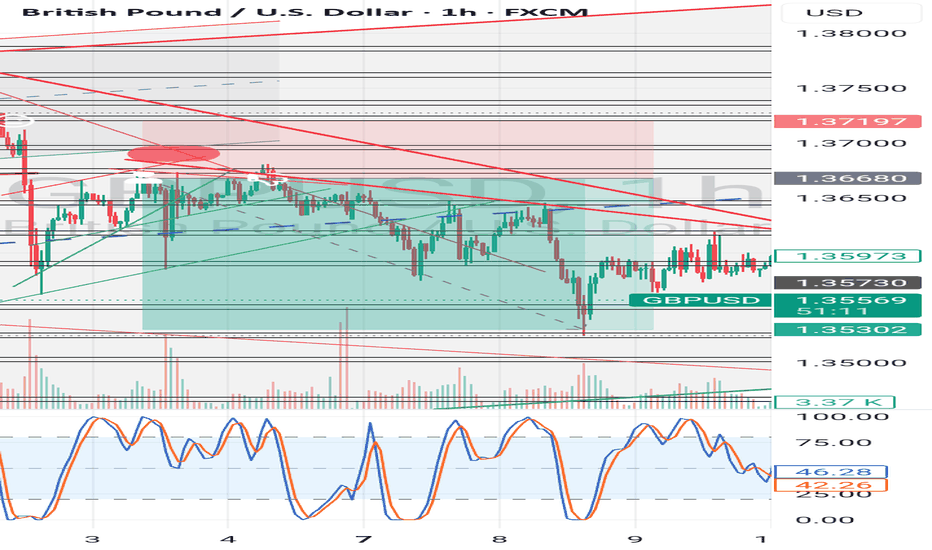

GBPUSD H1 Buy SetupHi Traders,

On the H1 timeframe, I’m observing potential signs of a trend reversal:

🔹 A double bottom has formed on the chart

🔹 Bullish divergence is visible on the RSI

These are strong reversal signals.

📌 A Buy Stop entry could be a solid opportunity if price breaks above the previous Lower High (LH).

As always, follow the trade according to your own risk-reward strategy.

Trade safe and stay disciplined!

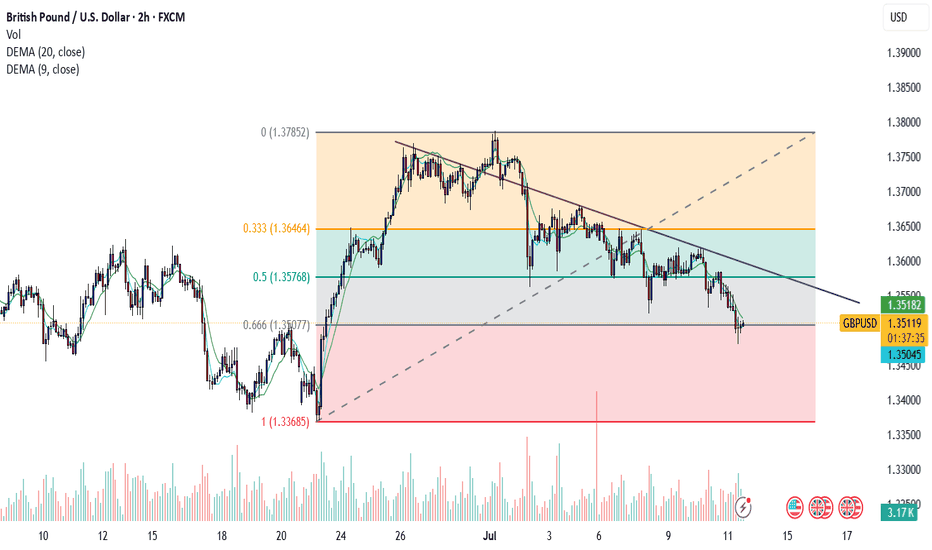

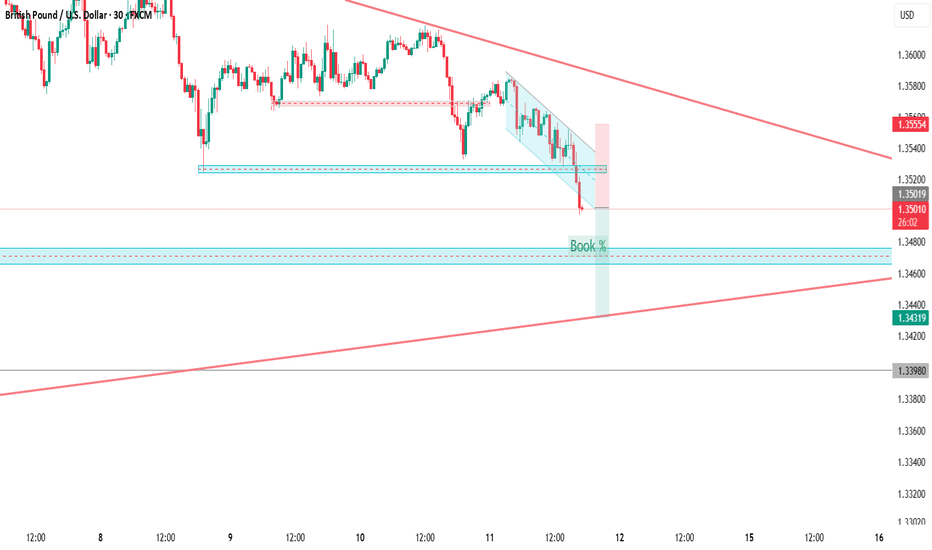

GBPUSD| - Bullish BiasHTF Overview (4H): Strong bullish structure in play, with multiple highs being broken and momentum firmly to the upside. Price is clearly respecting bullish order flow, suggesting continuation.

MTF Refinement (30M): Identified a 30M OB aligned with the trend. Waiting for price to mitigate this zone, as it could serve as the springboard for the next impulsive leg up.

Execution Plan: Once the 30M OB is mitigated, I’ll drop to LTF (1M/5M) to watch for confirmation — CHoCH, BOS, or microstructure shift — before executing longs.

Mindset: Bull momentum is intact — patience and confirmation are key to riding it with precision.

Bless Trading!

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

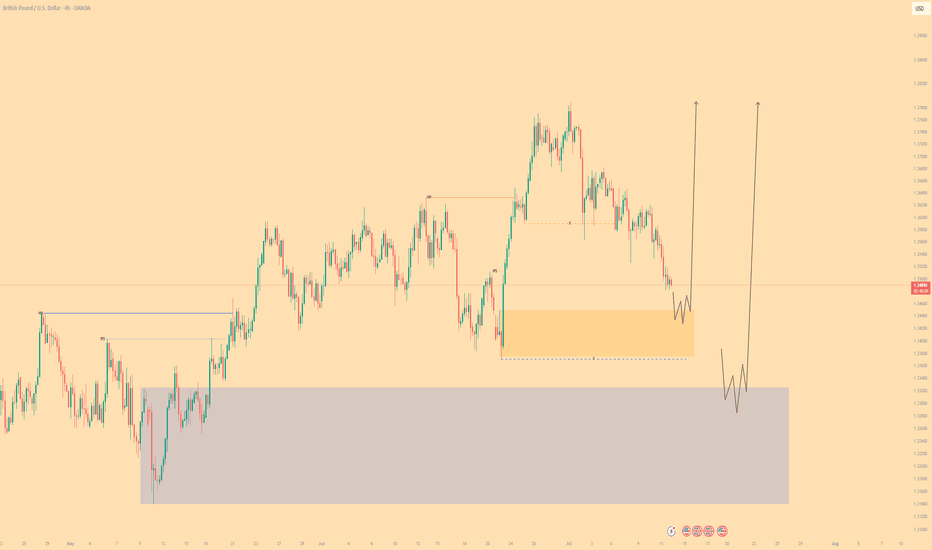

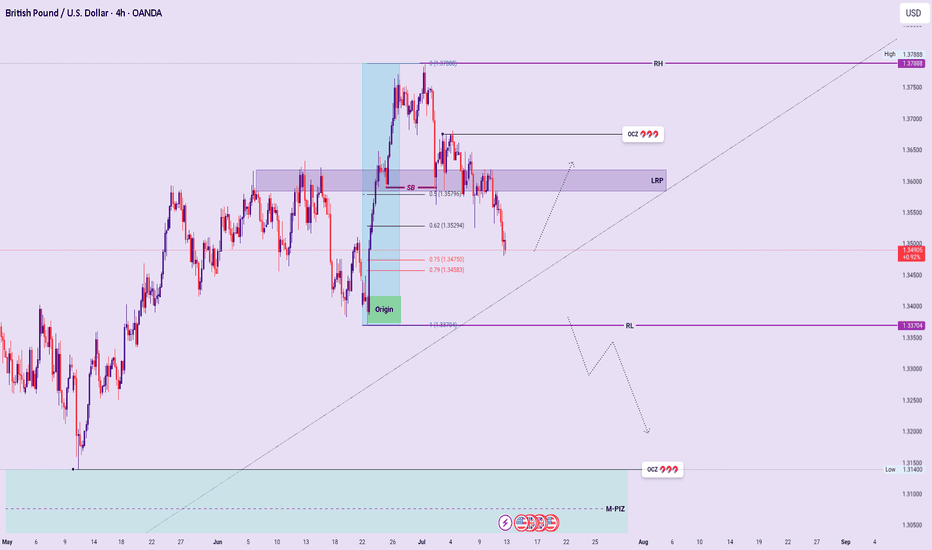

GBPUSD: NEW-WEEK TECHNICAL BIAS (MARKET OPEN) Higher Timeframe Bias:

Ascend Sequence remains valid on the Monthly, Weekly, and Daily structures, with the current Descend Sequence viewed as a pullback phase within broader bullish flow.

Structural Insight:

Despite recent sell-side pressure, price failed to break the Range Low during last week’s trading — suggesting possible defense of bullish territory.

Key Zones to Watch:

Focus remains on the Range Origin Zone. If respected, it may trigger a cautious rally toward the LRP or even the OCZ above.

A clean violation of the Range Origin would open downside toward 1.33704 (Range Low). A breach of this level could signal a Sequence Switch, confirming shift to Sell-Side Bias Environment (SBE) and initiating deeper exploration into the Monthly PIZ.

Execution Outlook:

If Range Origin holds: Lean toward tactical long setups with tight validation structure.

If broken: Bias shifts aggressively bearish — looking to short rallies in line with new descending flow.

Summary:

Still favoring HTF bullish structure unless Range Origin fails. Below that, sell-side becomes dominant, and rallies become shorting opportunities.

GBPUSD LONG TERM GBPUSD Live Trading Session/ GBPUSD analysis #forex #forextraining #forexHello Traders

In This Video GBPUSD HOURLY Forecast By World of Forex

today GBPUSD Analysis

This Video includes_ (GBPUSD market update)

GBPUSD Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on GBPUSD Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

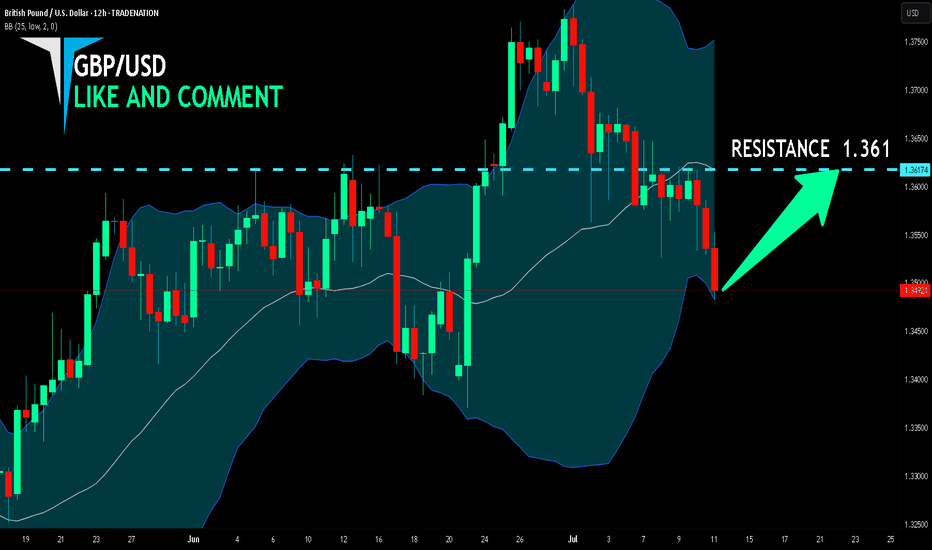

GBP/USD BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

It makes sense for us to go long on GBP/USD right now from the support line below with the target of 1.361 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

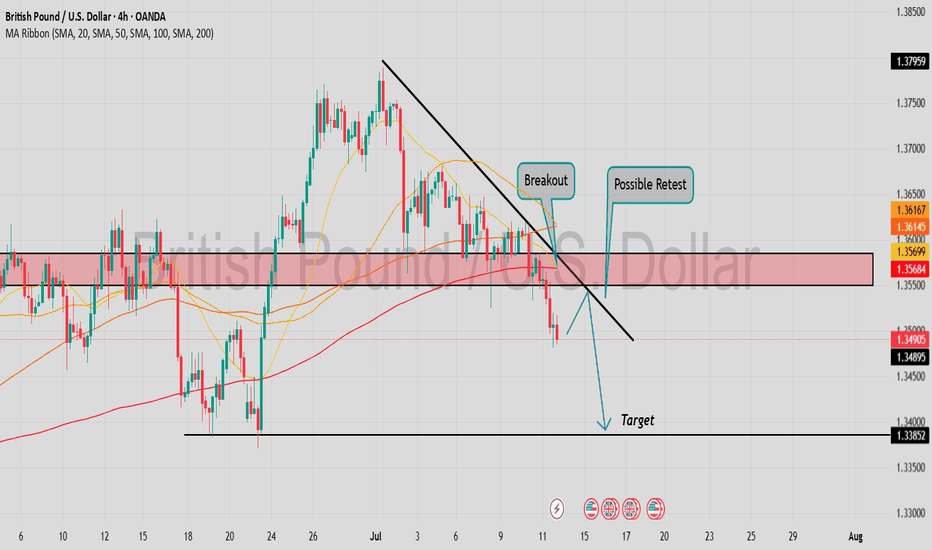

GBP USD SHORT RESULT Trend was still overall bearish and ongoing a minor pullback to continue downward movement also formed an ascending wedge pattern on the pullback which is also a strong indicator of bearish movement.

With all the conflunce above is why I took the short and it moved perfectly as predicted 🔥💪👌🎯

_THE_KLASSIC_TRADER_.🔥

GBP USD SHORT RESULT Price is in an overall bearish trend and also created a double top pattern at 4HTF Bearish Trendline and also holding minor resistance Trendline.

With all this Confluence was why I decided to open the Short position at the order block. Price just missing the set entry before rolling down to TP.

Better Set-ups to come 🔥💪

_THE_KLASSIC_TRADER_.

GBP/USD FUNDAMENTAL ANALYSISGBP/USD holds its winning streak for the fourth successive session, trading above 1.3700 in the European session on Thursday. The pair hangs close to three-year highs amid sustained US Dollar weakness, in light of US President Trump's fresh attack on the Fed's credibility. US data and BoE-speak awaited.