DOLLAR DIPS AHEAD OF JOB REPORT, GBP/USD TECHNICAL OUTLOOK.Global markets rose on Wednesday, with the dollar hovering near a three-year low of 96, as investors considered the increasing likelihood of US interest rate reduction and the push for trade agreements ahead of President Donald Trump's July 9 tariff deadline.

Meanwhile on the radar, the U.S. official Job report would be on the wire later this week and as always, market participants would keenly pay attention to the reading which would give critical gauge of the labor market strength vis a vis the health of the economy. In view of the upcoming report, a strong report could reinforce confidence in the economy while a mixed print may reignite concerns over the slowing growth.

GBP/USD TECHNICAL OUTLOOK

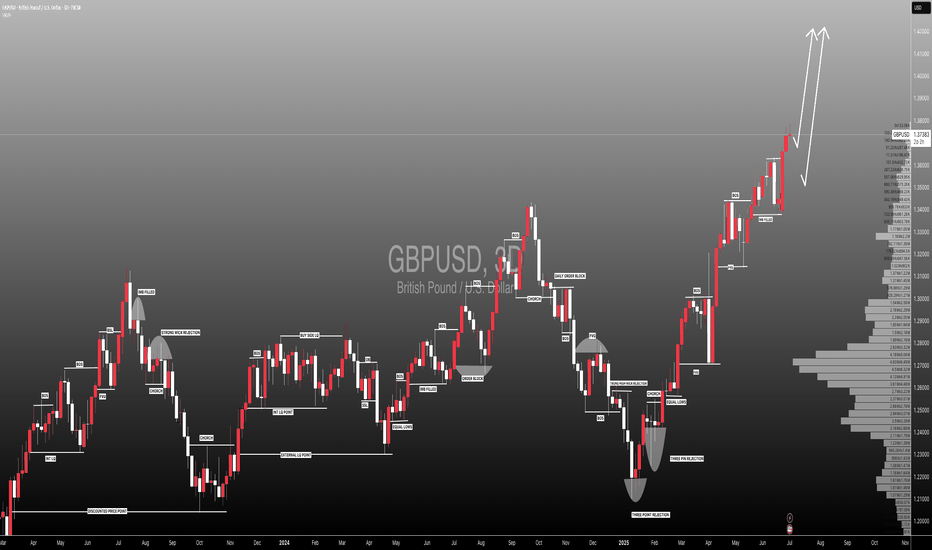

GBP/USD tested 1.3788 on Tuesday, its highest level since 1st of November 2021(approximately 44 months). However, the bears struggled to push prices before the close of the day.

Looking at the daily chart, the broader market structure remains bullish with price bouncing off the trendline multiple times hence acting as a dynamic support.

The pair is currently retracing, with potential target towards 50 level of the Fib. at 1.3588 which would likely act as a minor support, whereas a break below the 50 level would likely usher sellers to the next potential target around 78.6 level of 1.3469. Meanwhile, a break below 1.3380 would mean absolute BOS and then would signal that bearish momentum has prevailed hence sellers would potentially target 1.3176.

On the flip side, if bulls regain control near the trendline or within the Fibonacci zones, the key upside target remains the previous high at 1.3788, followed by a push toward the psychological 1.3800 barrier according to analysts. Breakouts in either direction remain possible in the coming weeks, especially amid heightened volatility and key macroeconomic drivers.

GBPUSD trade ideas

Proven Results | GBP/USD Trade Recap & Premium Signal AccessYesterday’s trades achieved 75% of all target levels, showcasing the consistency and precision behind my strategy. Today followed with another strong performance—first a successful long trade, then a clean short setup based on evolving price action and structure.

These aren’t random calls—they’re calculated, disciplined, and backed by real-time analysis.

If you're looking for reliable forex signals that actually deliver, my premium service offers:

🔔 Instant trade alerts with entry, stop-loss, and take-profit

📊 Clear trade breakdowns and market logic

💬 Direct access for questions and guidance

💵 Affordable plans designed for serious traders

Join a growing community of traders who are turning insights into results. 📲 Subscribe now and start trading with confidence.

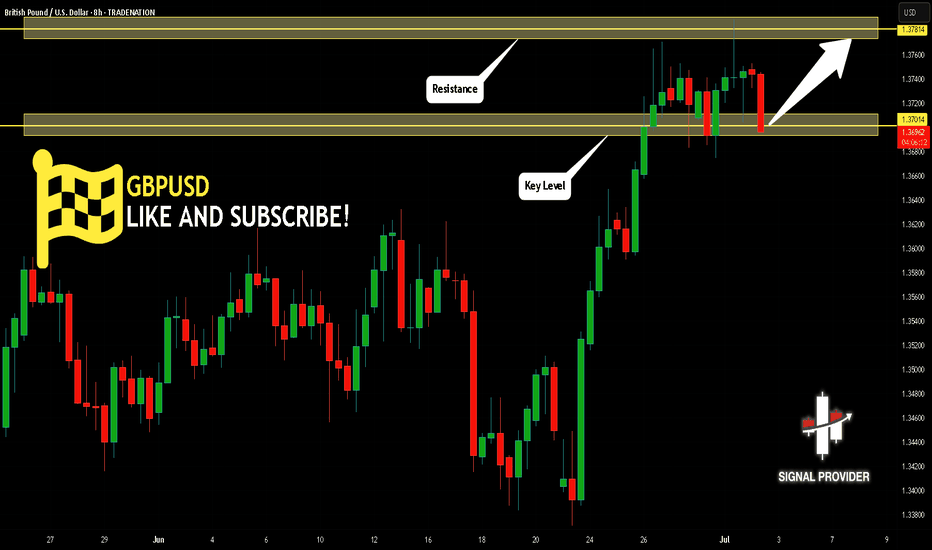

GBPUSD Will Go Up! Buy!

Take a look at our analysis for GBPUSD.

Time Frame: 8h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 1.370.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 1.378 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

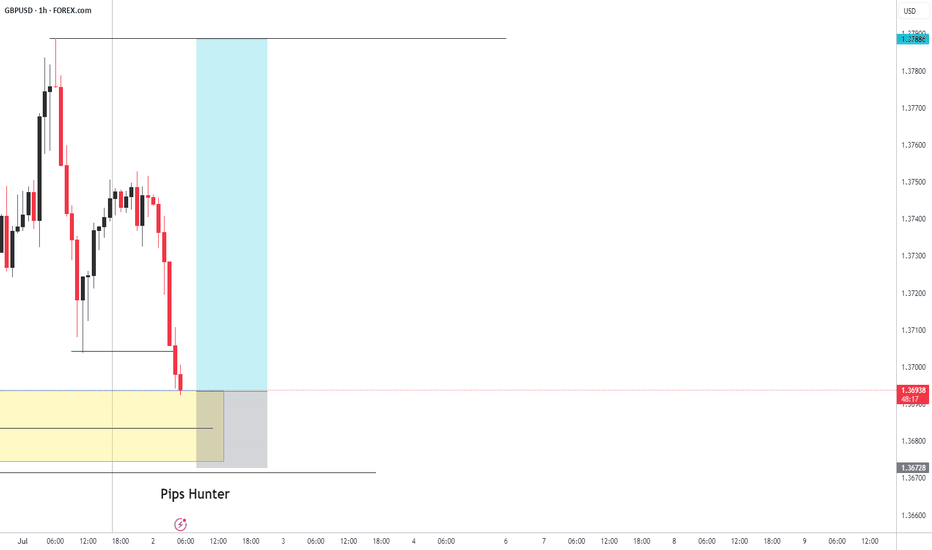

GBPUSD Bounced the Block — 1.3780 in Sight.Price is reacting off a strong support zone and the 200 EMA.

This move is also based on my expectation that upcoming U.S. data will come in weaker than forecasted, which should push USD lower and support GBP strength.

Target: 1.3780 📈

Let’s see how it plays out.

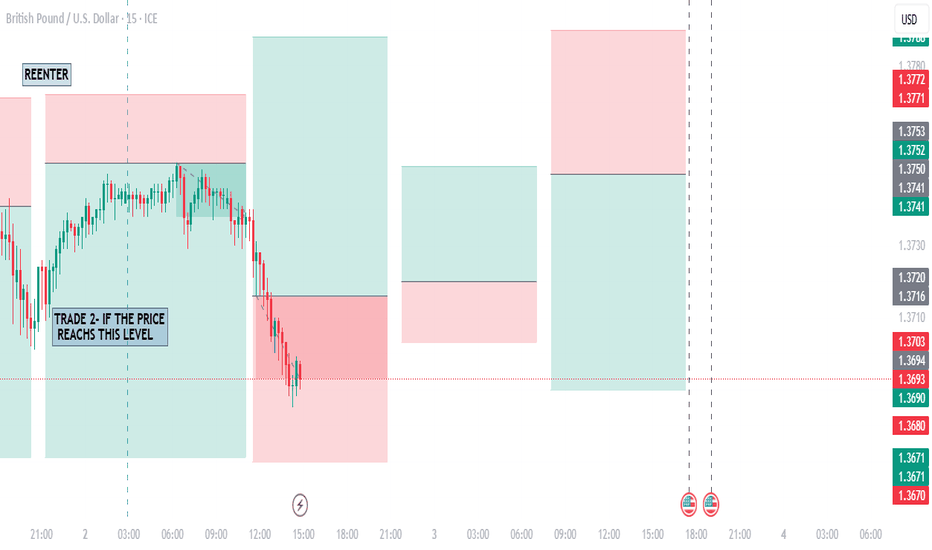

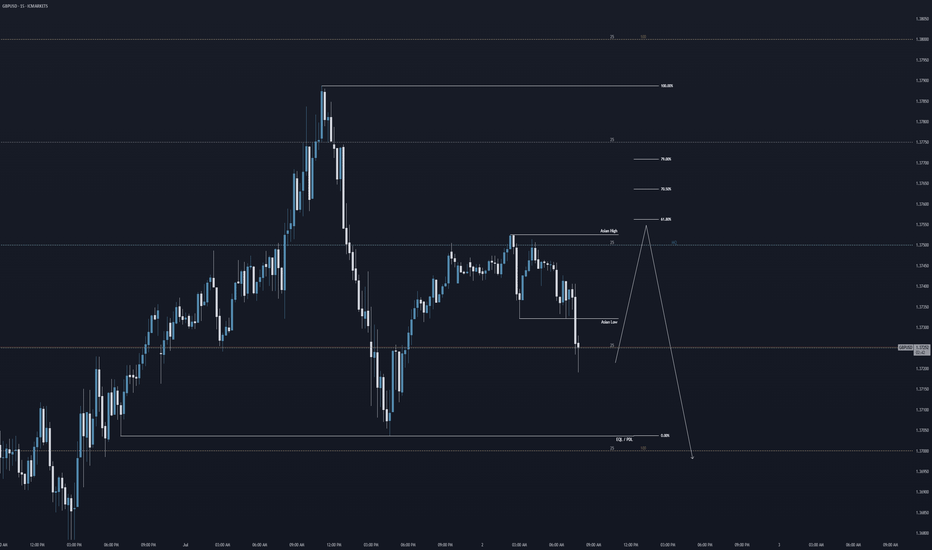

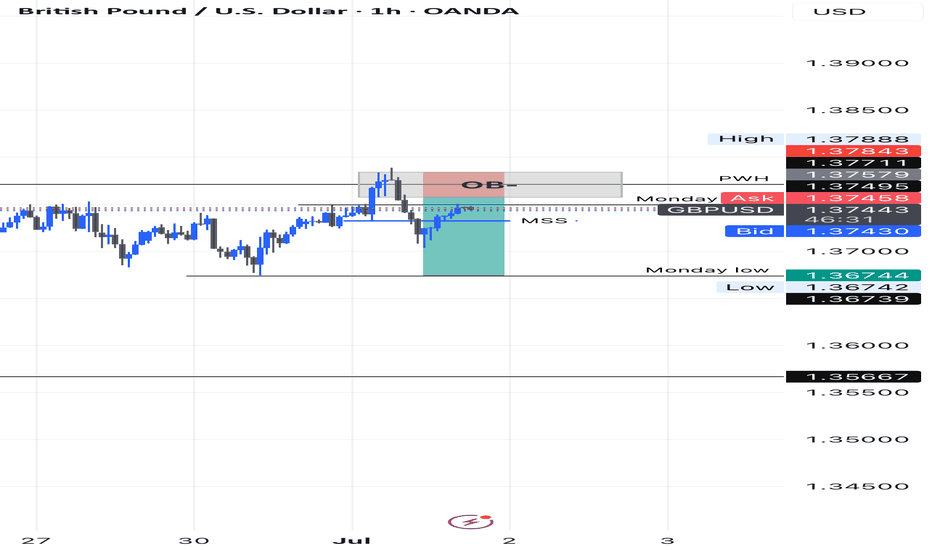

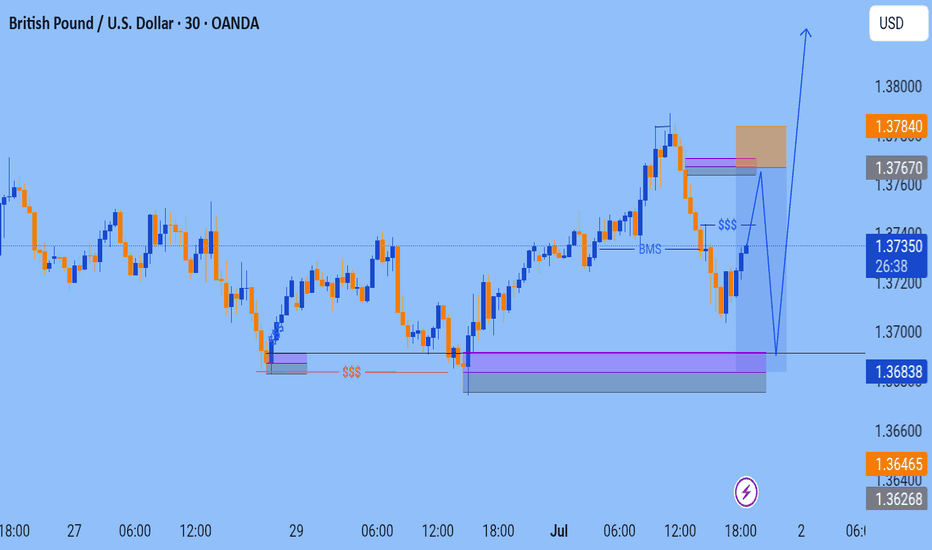

GU: Asian highs > Previous Day Low?Hi everyone,

Here is my forecast this morning for GBPUSD. Overall I'm thinking bearish, but I reckon that price could take out the Asian range highs first and then give us a bearish leg towards the previous day low.

Regards,

Aman | SMC Wolf FX

1-1 student onboarding is currently open (website in my signature & profile)

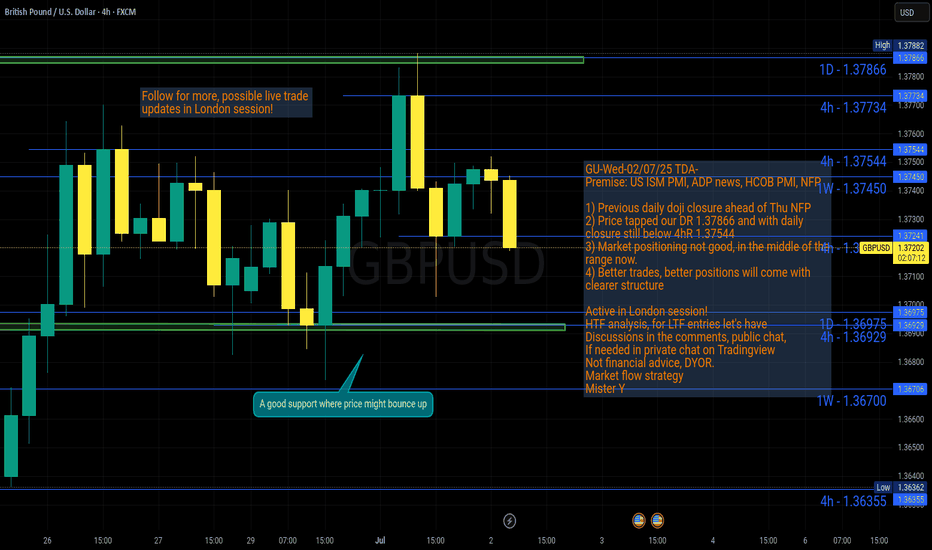

GU-Wed-02/07/25 TDA-Market positioning not the best atmAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

Another factor that plays huge your trade setups, ideas is

market positioning. Your ideas might be good, but with

bad market positioning there's high chance price might

stop you out before going to your direction.

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

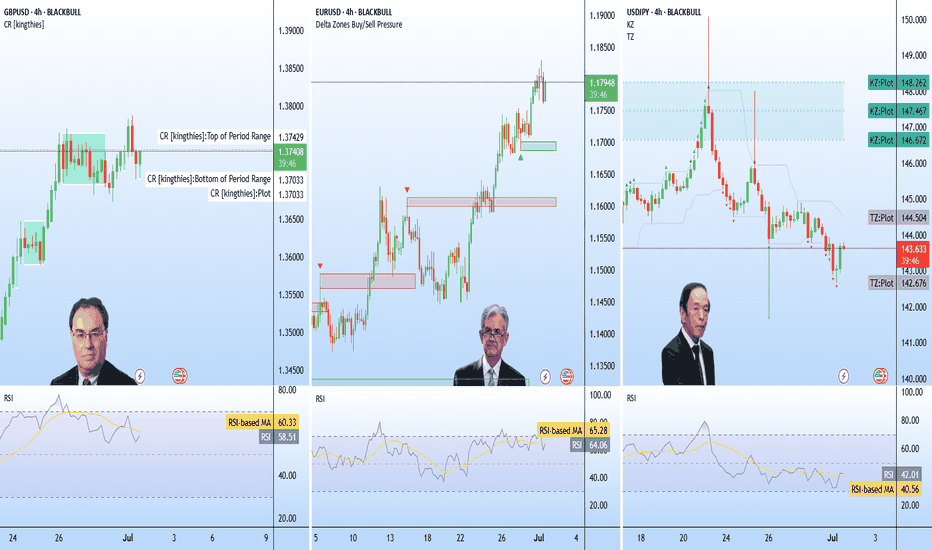

Fundamental Market Analysis for July 2, 2025 GBPUSDOn Wednesday, during the Asian trading session, the GBP/USD pair is trading unchanged at around 1.37450. However, dovish statements by US Federal Reserve Chairman Jerome Powell and growing concerns about the budget may put pressure on the dollar in the near term. Investors are awaiting the ADP report on US employment for June, which will be released later on Wednesday, in the hope of new momentum.

Powell said on Tuesday that the US central bank would be patient about further interest rate cuts, but did not rule out a rate cut at its July meeting, although the decision would depend on incoming data. According to the CME FedWatch tool, short-term interest rate futures now price in the probability of a rate cut in July at almost 1 in 4, up from less than 1 in 5 previously.

Investors are concerned about US President Donald Trump's massive tax and spending bill, which could increase the national debt by $3.3 trillion. The bill will return to the House of Representatives for final approval. Fiscal concerns could dampen optimism and contribute to a decline in the US dollar.

As for the pound sterling, Bank of England (BoE) Governor Andrew Bailey said last week that there are currently signs of a weakening UK labor market and stressed that interest rates are likely to continue to fall. The UK central bank is expected to cut interest rates three times by the end of 2025, bringing them to 3.5% to combat sluggish economic growth and a weakening labor market. Rate cuts are expected in August, September, and November 2025, with possible quarterly reductions.

Trading recommendation: SELL 1.37450, SL 1.37900, TP 1.36750

Bearish drop?The Cable (GBP/USD) is reacting off the pivot and could drop to the 1st support.

Pivot: 1.3749

1st Support: 1.3684

1st Resistance: 1.3788

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

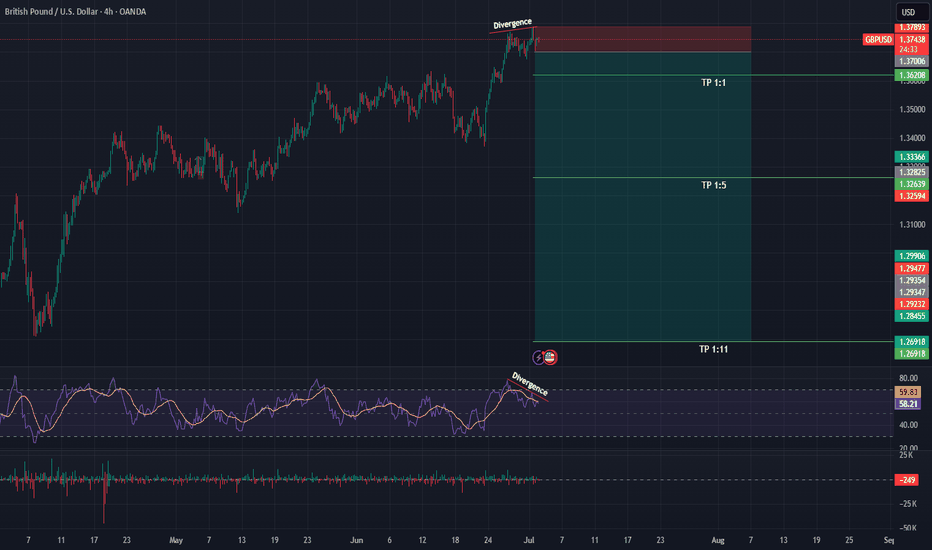

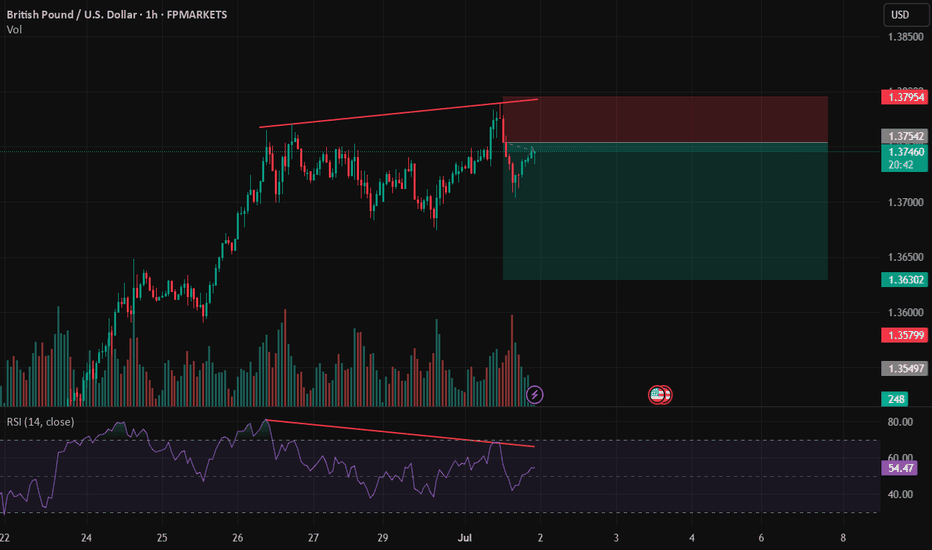

GBPUSD – Multi-Timeframe Bearish Divergence | Trend Weakening AcGBPUSD – Multi-Timeframe Bearish Divergence | Trend Weakening Across the Board 🐻📉

Hey traders 👋

GBPUSD is flashing clear signs of weakness, and this time it’s not just on the lower timeframes. We’re seeing bearish divergence on the 4H, Daily, and Weekly charts — a rare alignment that typically signals a bigger move is brewing.

📉 Technical Breakdown

4H: Price pushing higher, but RSI lagging = short-term exhaustion

Daily: Momentum fading, divergence forming against structure

Weekly: Long-term bearish divergence developing = macro weakness

That kind of multi-timeframe divergence doesn’t just whisper — it screams caution for bulls.

💵 DXY (Dollar Index) Just Hit 0.71 Level

DXY tapping into a key fib level (0.71) — suggesting a short-term correction or pullback

If DXY cools off temporarily, GBPUSD might fake a bounce or wick up

But once that correction is done, expect GBPUSD to resume its slide

This is where timing becomes everything.

🎯 Trade Strategy

Already short from current divergence signals? ✅ Good spot.

Stop-loss: Reasonable level above last high or structure break — no need to choke the trade

If SL gets hit: Don’t chase — wait for next bearish divergence or retest fail, then re-enter with structure confirmation

This is about patience, not prediction. The setup is clean — now it’s all about execution.

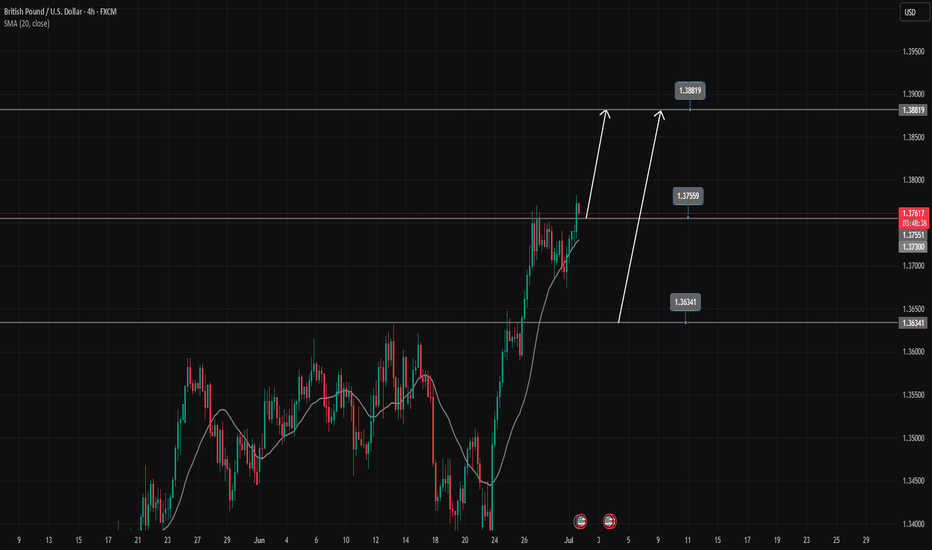

GBPUSD's strong uptrend continuesGBPUSD is in a strong uptrend, Price has just broken the resistance zone of 1.37500.

All the bullish momentum is heading towards the resistance zone of 1.388.

If there is a close of the h4 candle below the resistance zone of 1.375, there will likely be a Pullback to 1.363 to find more buying momentum towards the target at the resistance zone of 1.388

📈 Key Levels

Support: 1.375-1.363

Resistance: 1.388

📊 Recommended Trade Setups

BUY GBPUSD 1.375-1.373 Stoploss 1.37000

BUY GBPUSD 1.363-1.361 Stoploss 1.35800

SELL GBPUSD 1.388-1.390 Stoploss 1.39300

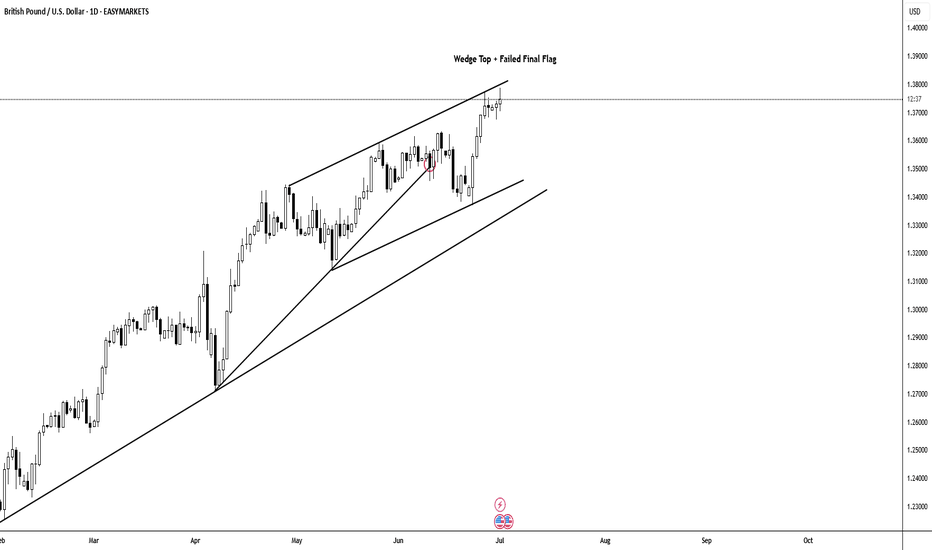

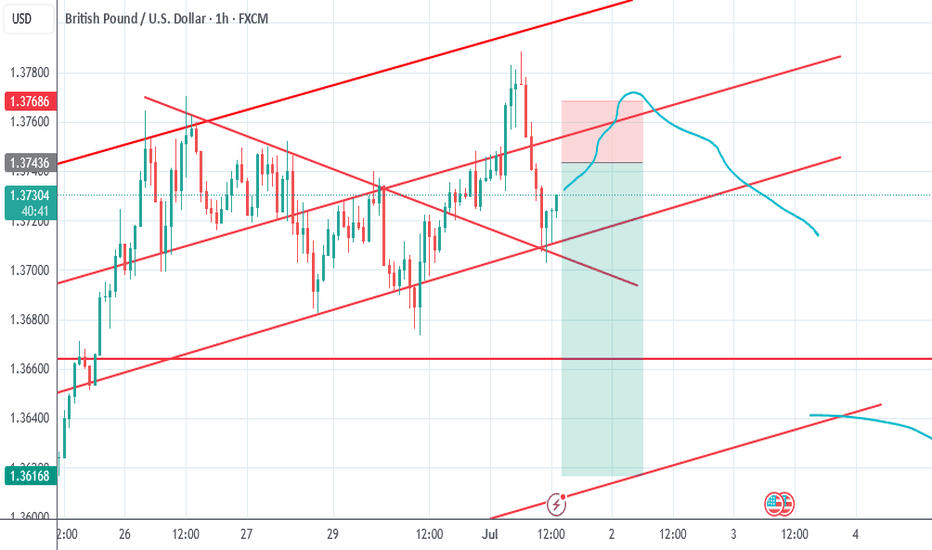

Short Scalp With Swing OpportunityGBPUSD formed a perfect wedge top, setting up a potential short opportunity in the next days.

1. The move is composed of a clear 3-Push Pattern.

2. The last push/leg is the strongest, indicating a possible exhaustion (Climatic Move).

3. At the top of the last leg, there's a sequence of 5 bars with lots of overlapping - Al Brooks' Final Flag Pattern

With a good bearish signal bar, it's worth scalping part of the position towards to the 20 EMA and swing the rest of it until the Bull TL.

Sintra Signals: Central Banks Stay Cautious The ECB Forum in Sintra brought together the heads of the world’s most influential central banks—Lagarde (ECB), Powell (Fed), Bailey (BOE), Ueda (BOJ), and Rhee (BOK).

Across the board, central banks are remaining cautious and data-driven, with no firm commitments on timing for rate changes.

Fed Chair Powell said the U.S. economy is strong, with inflation manageable despite expected summer upticks. He noted tariffs have delayed potential rate cuts and confirmed the Fed is proceeding meeting by meeting.

BOE’s Bailey highlighted signs of softening in the UK economy and said policy remains restrictive but will ease over time. He sees the path of rates continuing downward.

BOJ’s Ueda noted headline inflation is above 2%. Any hikes will depend on underlying core inflation which remains below target.

#GBPUSD: Detailed View Of Next Possible Price Move! GBPUSD exhibited a favourable movement after rejecting a pivotal level previously identified. We anticipate a smooth upward trajectory, potentially reaching approximately 1.45. Conversely, the US Dollar is on the brink of collapse around 90, which will directly propel the price into our take-profit range.

During GBPUSD trading, it is imperative to adhere to precise risk management principles. Significant news is scheduled to be released later this week.

We kindly request your support by liking, commenting, and sharing this idea.

Team Setupsfx_

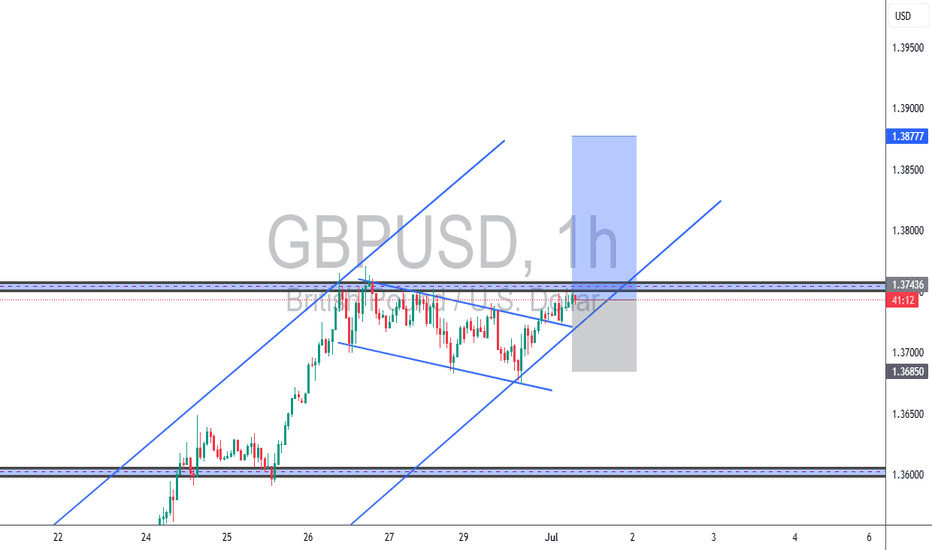

GBPUSD - Bullish Channel (TCB Strategy)📈 GBPUSD – Falling Wedge Breakout Within Bullish Channel (TCB Strategy)

Type: Trend → Countertrend → Breakout

Timeframe: 1H

Status: Trade Running

🔍 Analysis Summary:

GBPUSD is respecting a strong ascending channel, with a recent correction forming a textbook falling wedge pattern. Price has now broken out of the wedge with bullish momentum during the NY session, signaling a potential continuation toward the upper boundary of the channel.

This setup aligns perfectly with my TCB Strategy:

Trend: Bullish market structure intact

Countertrend: Falling wedge correction

Breakout: Clean bullish breakout above wedge resistance

🧠 Trade Plan:

Entry (EP1): 1.37350 (Breakout entry)

SL: 1.36850 (below wedge low)

TP1: 1.37600

TP2: 1.38200 (channel top)

🛠️ Checklist Score: ✅ 100%

All criteria met, including session timing, structure confluence, breakout candle quality, and risk-reward profile.

📌 Watching how price reacts around 1.37600. Clean break above that could open the path to 1.38200+.

Follow for updates.

#GBPUSD #ForexAnalysis #TCBStrategy #BreakoutSetup #FallingWedge #PriceAction

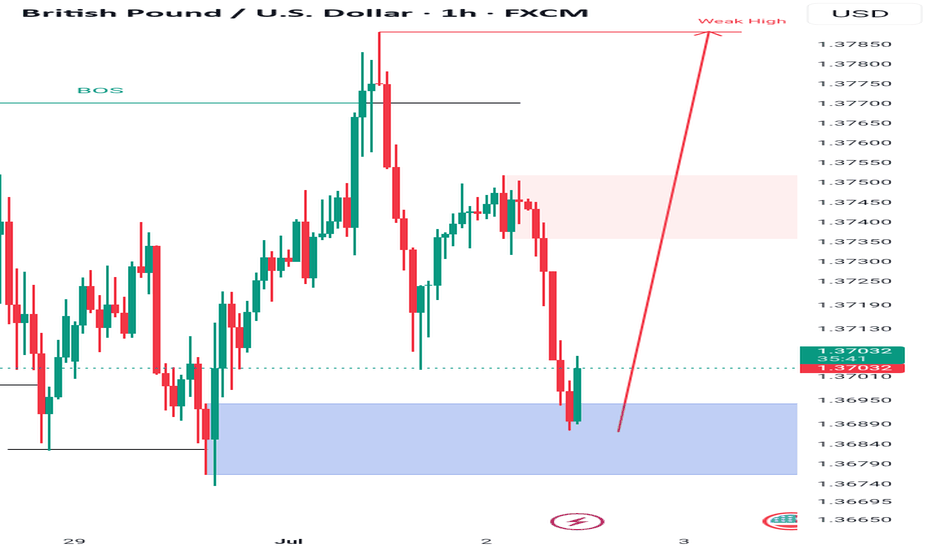

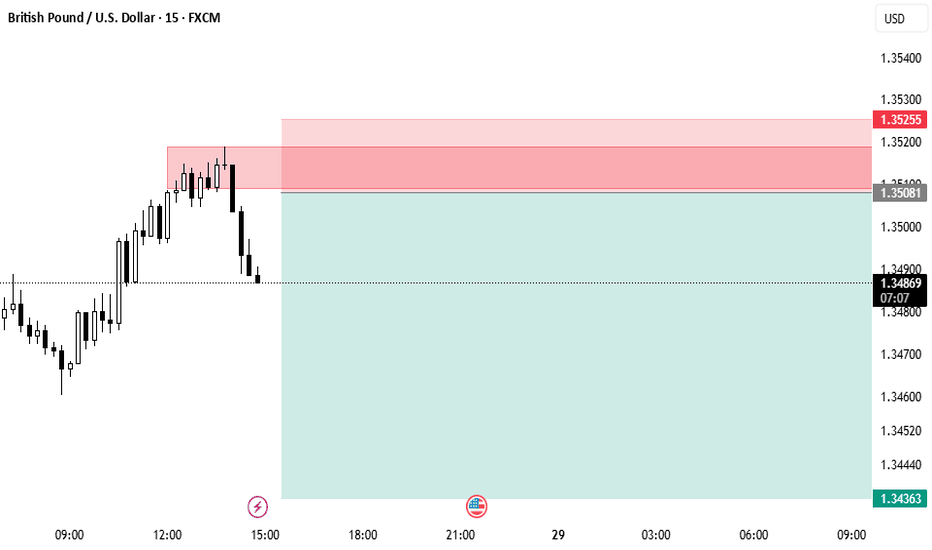

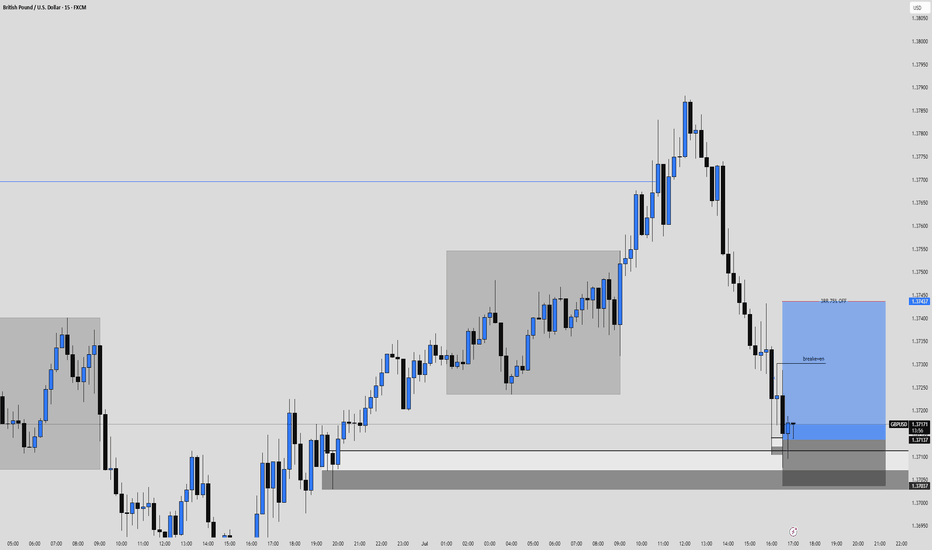

GBPUSD Long, 1 JulyPrice is reacting from a Daily bearish OB, but this setup aims to catch the pullback — making a long valid here despite HTF structure.

LTF gave a clean 15m BOS, followed by reaction from the extreme 15m OB.

Entry was taken after a confirmed 1m BOS + OB retrace, in alignment with structure and location.

🎯 Target: 30 pips (1:3 RR)

⚠️ No clear Asia target, but structure favors this move

📍Entry: 1m OB after BOS

📉 Risk: 0.5%

High-probability pullback play, executed with confirmation and clean structure.