GBPUSD trade ideas

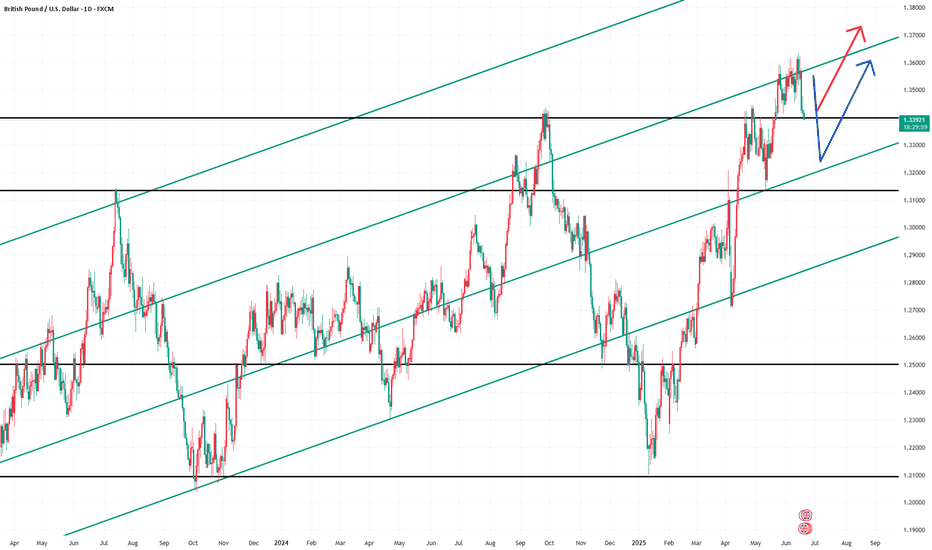

GBP-USD Swing Long! Buy!

Hello,Traders!

GBP-USD is trading in an

Uptrend along the strong

Long-term rising support

So after the pair falls down

To retest the rising support

We will be expecting a

Bullish rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPUSD SHORTThe GBP/USD pair has been showing signs of exhaustion after a recent rally, and I'm looking for a potential pullback to enter a short position.

While GBP/USD has shown resilience, the technical and fundamental setup suggests a potential short opportunity on a pullback. Confirmation through price action (e.g., bearish engulfing patterns, break of structure) will be crucial before entering.

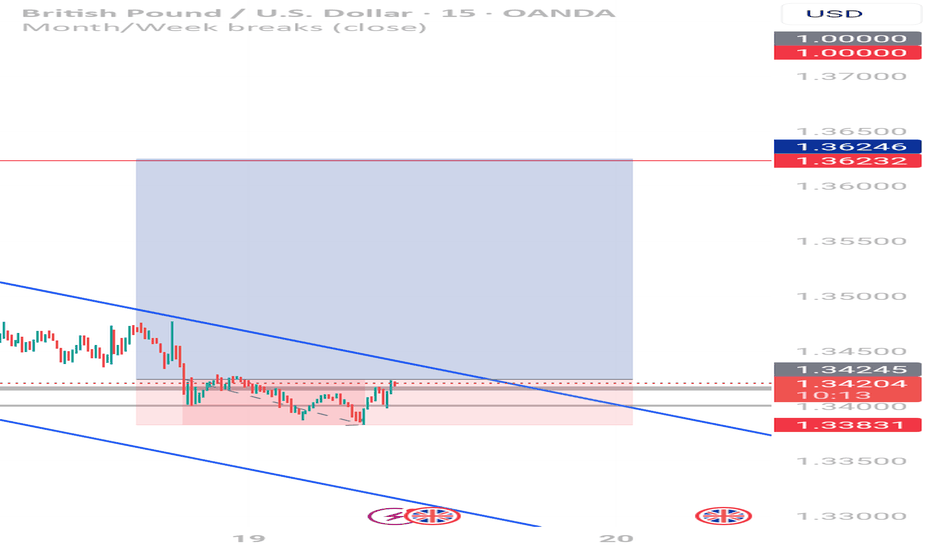

GBP/USD Buy Setup – SMC Break of Structure + Demand Zone RetestGBP/USD – Buy Signal Alert 🚀

📈 Trade Idea:

Pair: GBP/USD

Direction: Buy

Entry: 1.34245

Stop Loss: 1.33831

Take Profit: 1.36246

🔍 Analysis Summary:

Price has reacted strongly at a key demand zone, forming bullish confirmation on lower timeframes. The market structure supports a continuation to the upside, targeting the next major resistance area.

📌 Confirmation:

Break of structure + Retest of demand zone + Bullish candlestick confirmation

📊 Strategy Style:

Smart Money Concepts (SMC)

4H Structure | 15M Entry Confirmation

🕒 Use proper risk management.

✅ For educational purposes only – not financial advice.

#GBPUSD #BuySignal #ForexAnalysis #SmartMoneyConcepts #TradingViewIdeas #KellyWiseFX

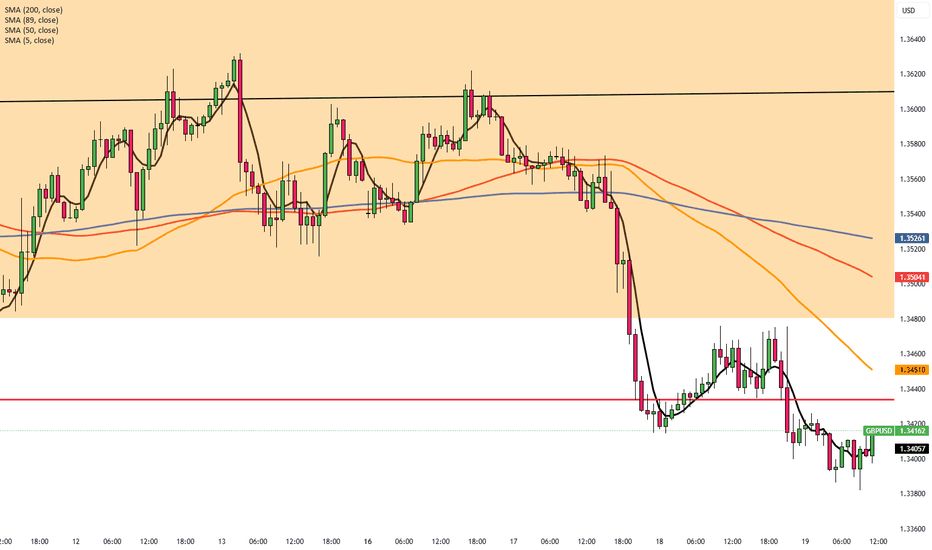

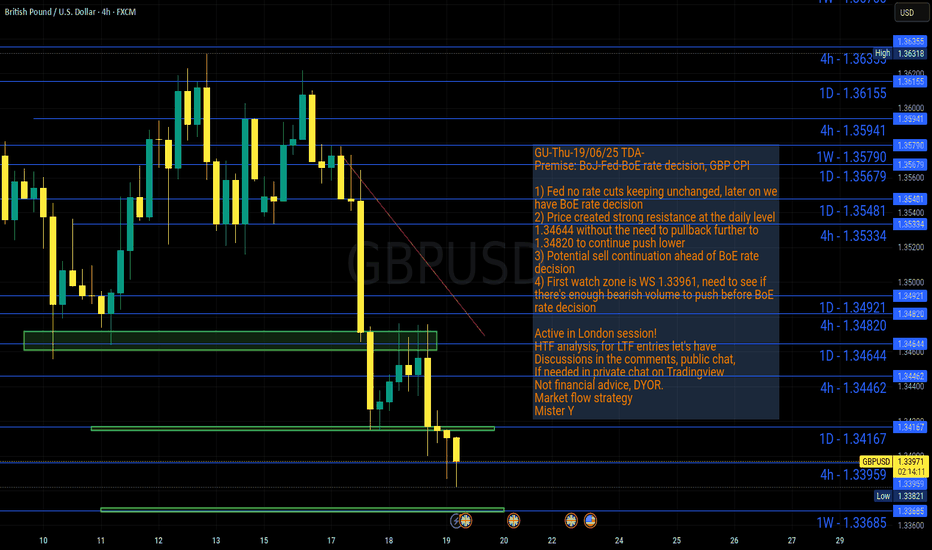

BoE in Focus as GBP/USD Nears 1.3410GBP/USD remains under pressure for a third day, trading near 1.3410 in Thursday’s Asian session, as safe-haven demand strengthens the US Dollar amid Israel-Iran tensions. The BoE is expected to hold rates at 4.25% today. UK inflation eased to 3.4% in May from 3.5%, in line with forecasts but still above the 2% target. Markets still price in about 48 basis points of BoE cuts by year-end.

Resistance is seen at 1.3440, while support holds at 1.3260.

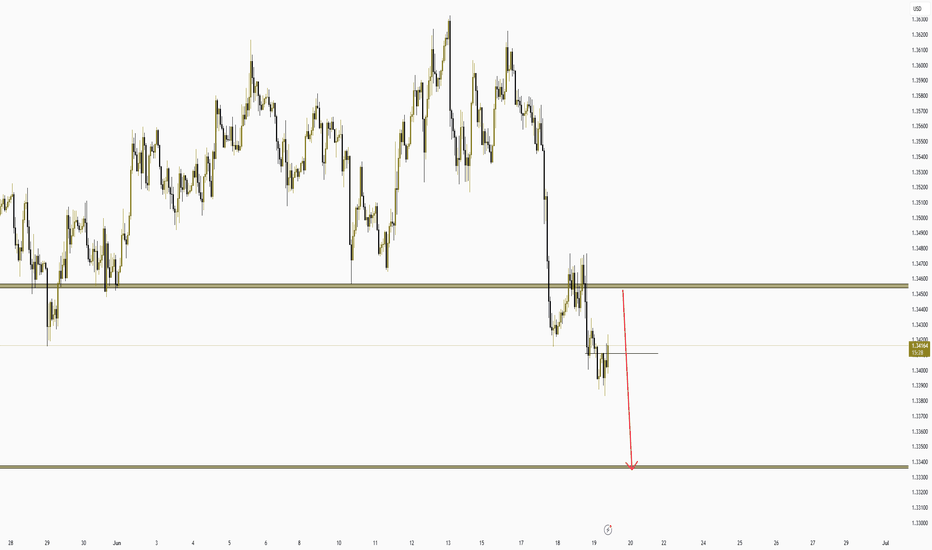

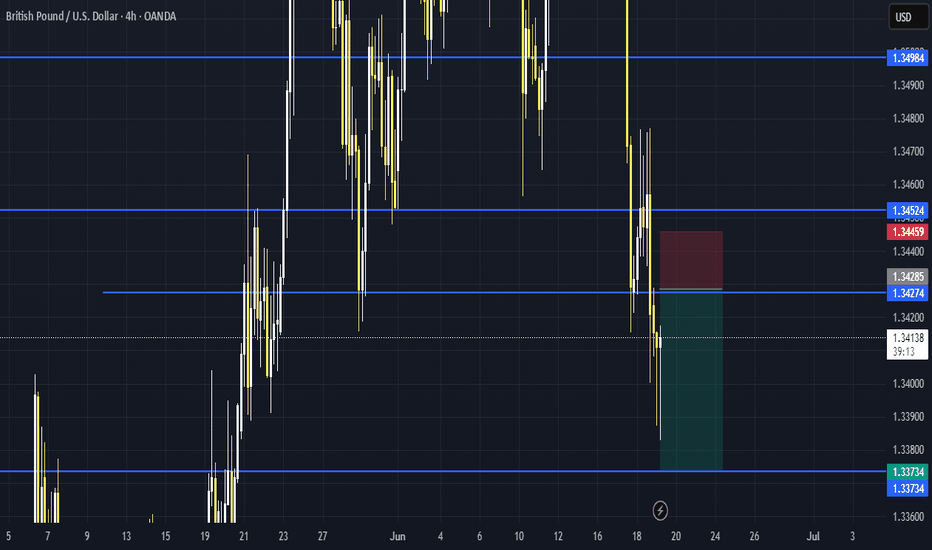

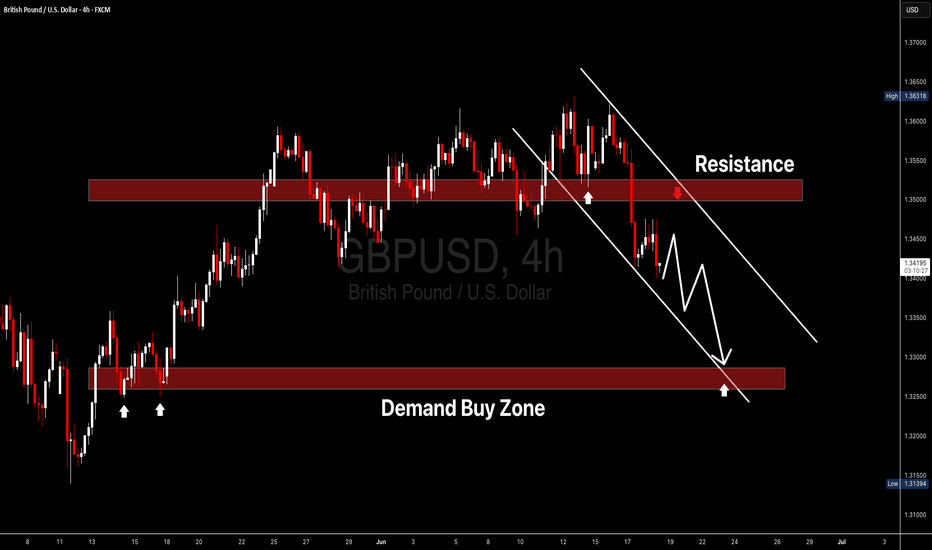

GBPUSD IS LOOKING WEAK FOR A HARD SELL OFF SWING TRADEOANDA:GBPUSD Has broken the bullish swing low on 4 Hour time frame with strong sell off bearish candles leaving behind a big bearish imbalances in price. Which extra confirm that price is extremely bearish on 4 Hour time frame.

Now that trend has shifted from bullish trend to a bearish one, am now bearish on GBPUSD.

Bearish shift in market structure that happened on OANDA:EURUSD EURUSD which is a correlating pair with GBPUSD extra confirm this bearish bias on GBPUSD.

likewise also, the Bullish Shift in Market Structure on OANDA:USDCAD USDCAD, which is an opposite correlating pair confirm this sell on GBPUSD.

So, my focus now is selling GBPUSD in every pullback or retest of key bearish levels.

I will update you as the trade develop.

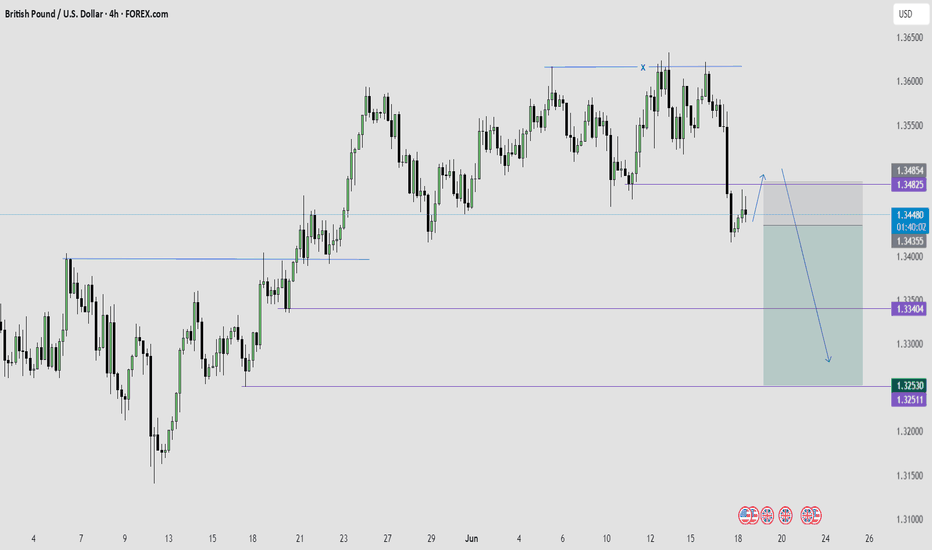

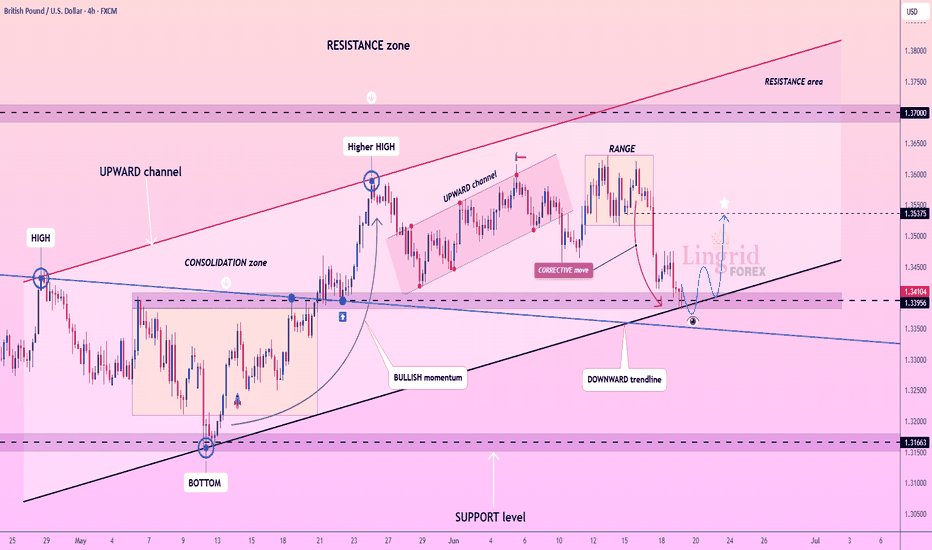

Lingrid | GBPUSD potential Long from the Support ZoneThe price perfectly fulfilled my previous idea . FX:GBPUSD SPREADEX:GBP has bounced off confluence support near 1.3395 where the upward trendline and horizontal structure intersect. A minor range formed after the recent corrective drop, hinting at possible accumulation. A breakout above the range and reclaiming 1.3450 would shift momentum back toward the 1.3537 resistance.

📈 Key Levels

Buy zone: 1.3390–1.3410

Sell trigger: breakdown below 1.3390

Target: 1.35375

Buy trigger: bullish breakout from current consolidation

💡 Risks

Failure to hold above the rising trendline could shift the trend short-term bearish

GBP remains sensitive to macroeconomic news—any surprises could disrupt this setup

Range failure and low volume may delay the expected move upward

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

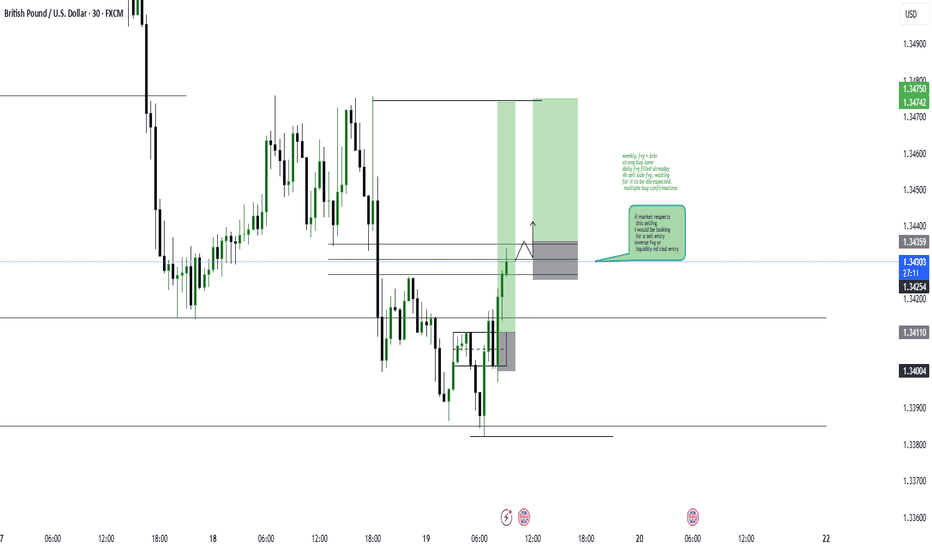

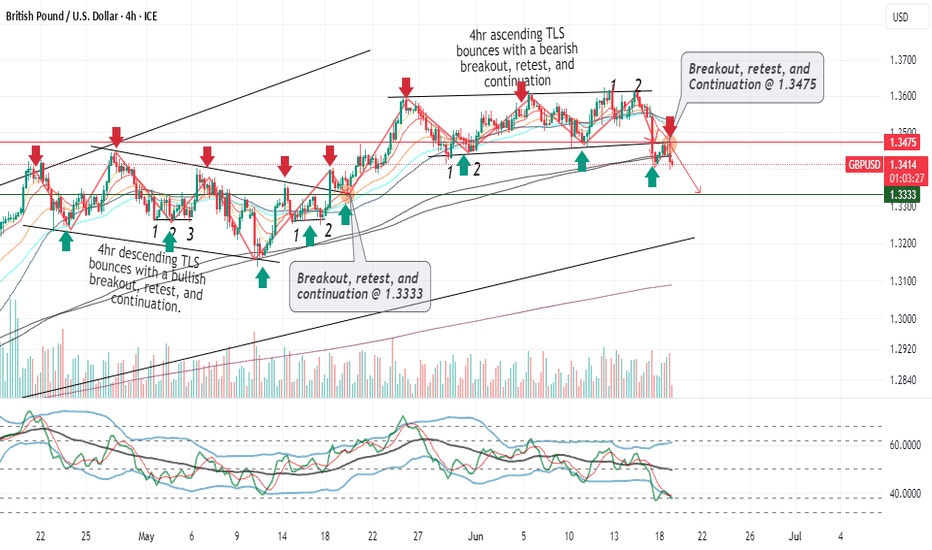

GU-Thu-19/06/25 TDA-Fed rate unchanged, now BoE rate decisionAnalysis done directly on the chart

Follow for more, possible live trades update!

Few beneficial things by posting public ideas

1) I improve a lot by doing this every single day

2) People can benefit from my analysis

3) Everyone can still trade their own style and

Strategy and having general idea on htf.

4) Taking myself accountable and be consistent in what I do

5) I can watch and rewatch as many times I

Want and learn more and more

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

GBPUSDGBPUSD giving us a sellers entry on bigger timeframe, this analysis is to spot the entry for that sell which based on the Trendline approach, the support has been broken out of and may have been retested, however due to the RSI Divergence I found on 5min TF, Im still hoping a few buyers can reap here before the sellers dive in. Note the current area is also a strong historic S/R Flip zone as from April 2025. Amen.

Fundamental Market Analysis for June 19, 2025 GBPUSDEvent to pay attention to today:

14:00 EET. GBP - Bank of England base rate decision

GBPUSD:

GBP/USD remains down for the third consecutive session, trading around 1.34100 in Asian trading on Thursday. The pair is struggling as the US dollar (USD) strengthens amid rising demand for safe-haven assets triggered by escalating tensions between Israel and Iran. In addition, the Bank of England (BoE) is widely expected to leave interest rates unchanged on Thursday.

In the UK, consumer price index inflation fell to 3.4% year-on-year in May, as expected, from 3.5% in April. However, this figure is still well above the BoE's target of 2%. Nevertheless, markets still expect rates to fall by around 48 basis points by the end of the year.

Bloomberg reported on Thursday that ‘US officials are preparing for a possible strike on Iran in the coming days.’ ‘US plans to attack Iran continue to evolve.’ Another Wall Street Journal report suggests that US President Trump approved plans to attack Iran on Tuesday but wanted to see if Tehran would abandon its nuclear programme.

In addition, the dollar was supported by comments from Federal Reserve Chairman Jerome Powell, who said that inflation remains slightly above target and may rise in the future, citing the impact of US President Donald Trump's tariffs.

The US Federal Reserve (Fed) decided at its June meeting on Wednesday, as expected, to leave the base rate unchanged in the range of 4.25-4.50%. The Federal Open Market Committee (FOMC) still forecasts interest rates to fall by about 50 basis points by the end of 2025.

Trading recommendation: SELL 1.34100, SL 1.34300, TP 1.33200

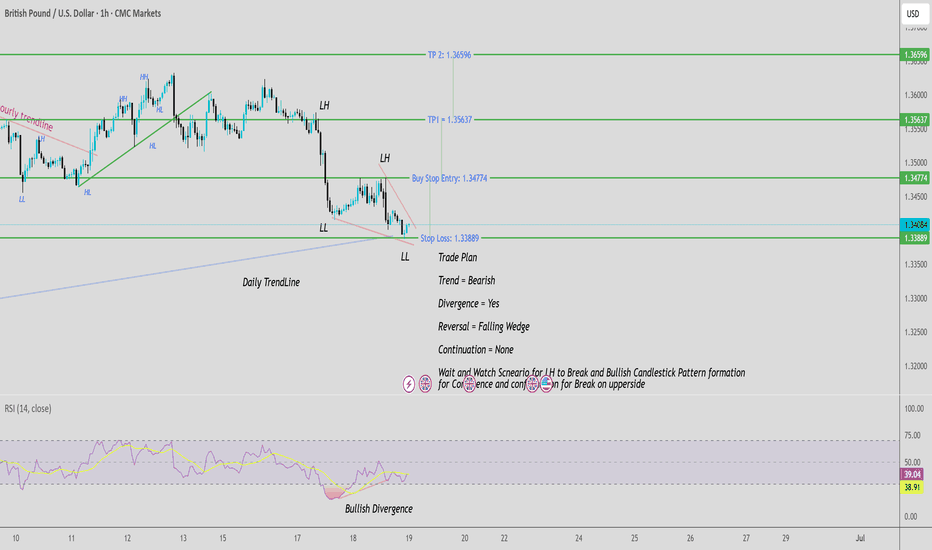

GBPUSD is forming a Potential Bullish Reversal pattern

Price formed a Potential Falling Wedge pattern with a waiting for break of LH as current Temporary Resistance.

• ✅ Entry is triggered only after a confirmation candle breaks above the LH.

• Buy Stop is placed to catch the momentum move.

• Stop Loss is at the recent lower Low (safe and logical placement).

• 🎯 Take Profit levels are based on measured move projections.

Trade Plan:

• Buy Stop = 1.34774

• Stop Loss = 1.33889

• Take Profit 1: 1.35637

• Take Profit 2: 1.36596

• Lot size : 1:2 Risk Reward Ratio

“Waiting for Lower High to break with Bullish confirmation candle” – this ensures you enter only on strong momentum.

GBPUSD is forming a Potential Bullish Reversal pattern with clear structure. A break of the neckline confirms the setup

Key Highlights:

• ✅ Pattern: Falling Wedge

• ⚠️ Confirmation: Break + Bullish candle

• 🔄 Risk Management: Tight SL, 2 TP levels

• 🧩 Confluence: Trendline Bounce + structure shift + RSI Divergence

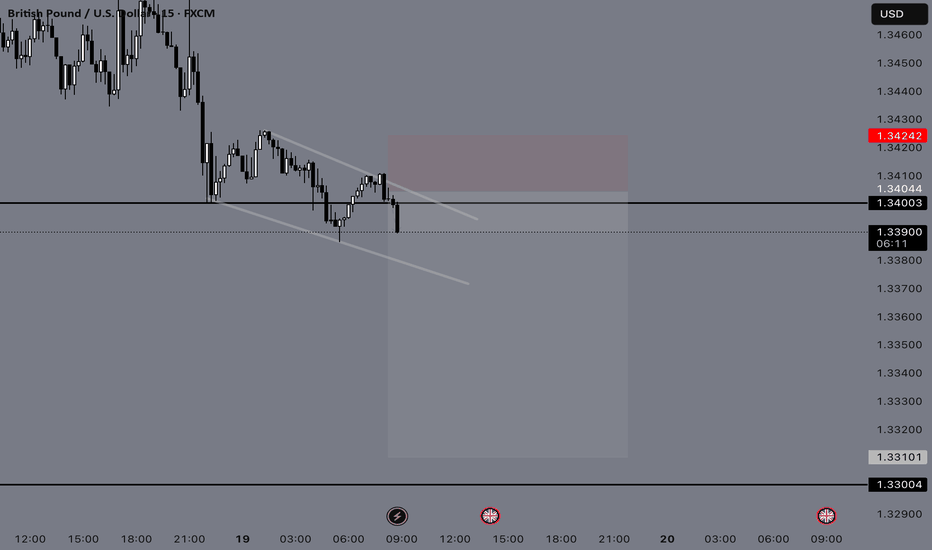

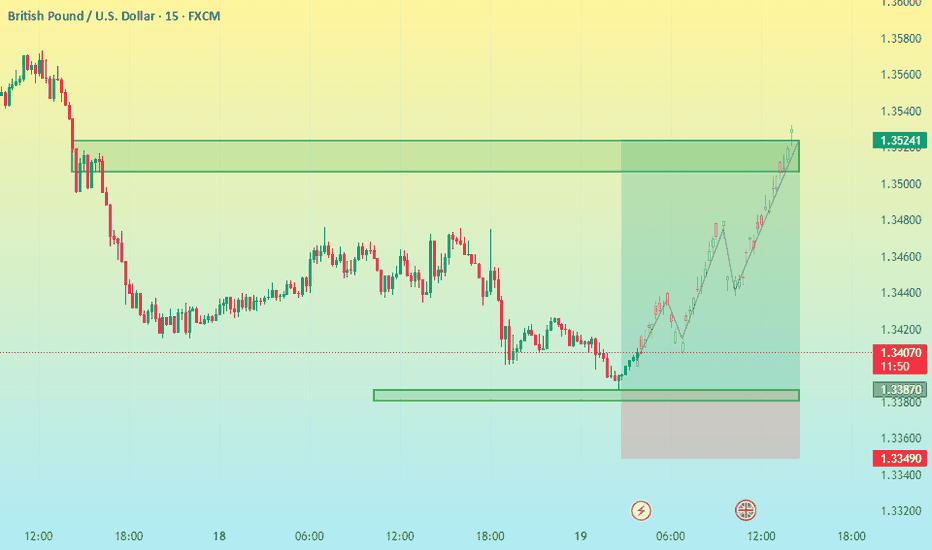

GBPUSD 15M CHART PATTERNHere's a structured summary of your GBP/USD trading signal:

---

📈 Trade Signal: GBP/USD – LONG (Buy)

Entry (Buy): 1.34000

Take Profit 1: 1.34400

Take Profit 2: 1.34800

Take Profit 3: 1.35230

Stop Loss: 1.33500

---

🧮 Risk-Reward Overview (per Take Profit level)

TP Level Reward (pips) Risk (pips) R:R Ratio

TP1 40 50 0.80

TP2 80 50 1.60

TP3 123 50 2.46

---

✅ You’re targeting multiple profit levels with a relatively tight stop loss.

⚠ R:R ratio improves as you aim for higher TPs. Make sure to trail your stop or scale out along the way.

Would you like me to generate a chart or risk management table for different lot sizes?

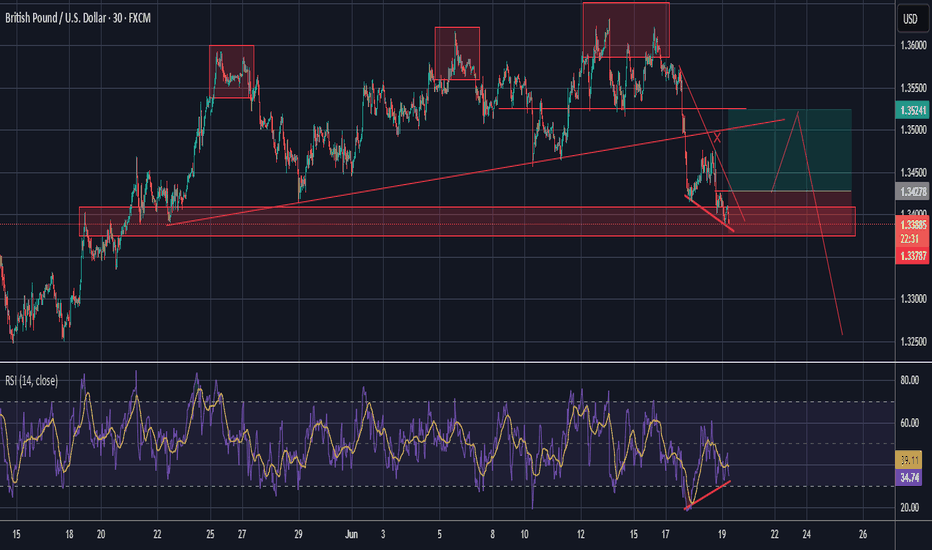

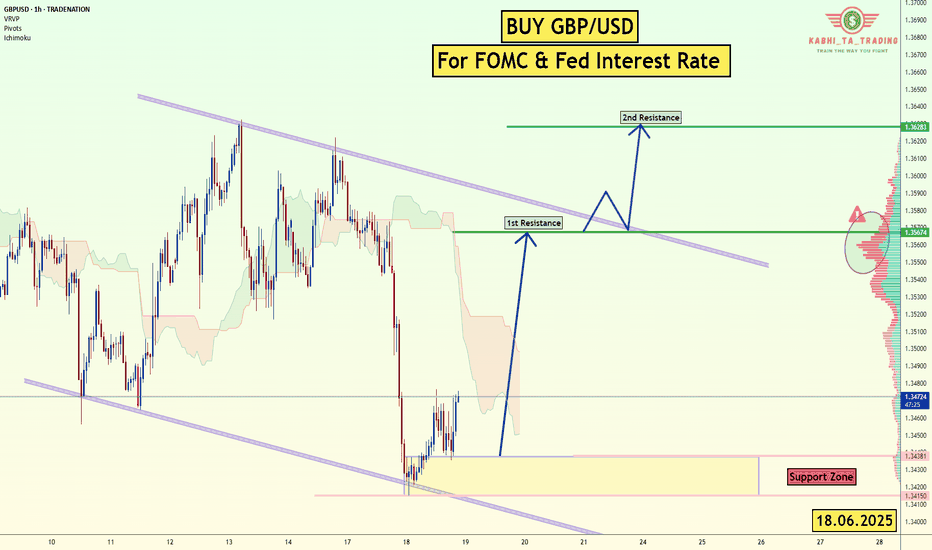

GBP/USD - For FOMC & Fed Interest RateThe GBP/USD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 1.3567

2nd Resistance – 1.3682

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

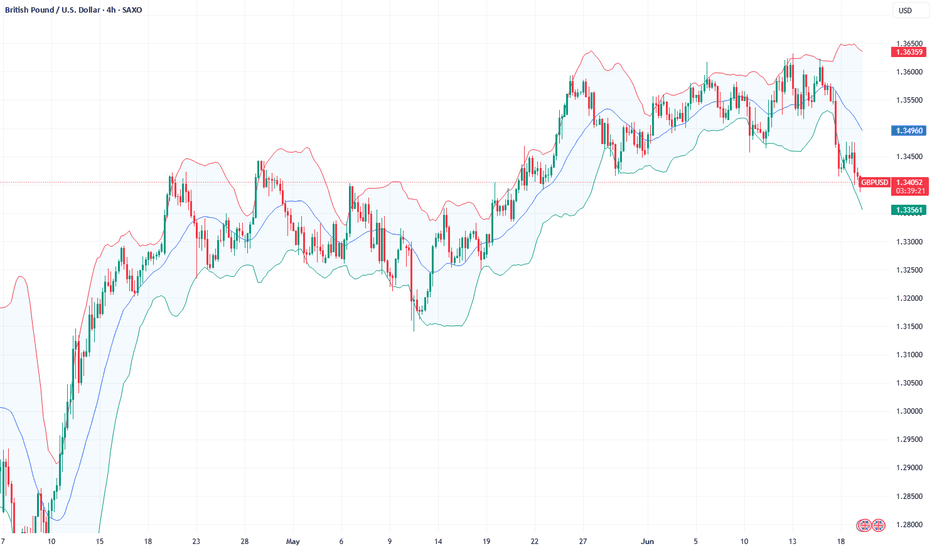

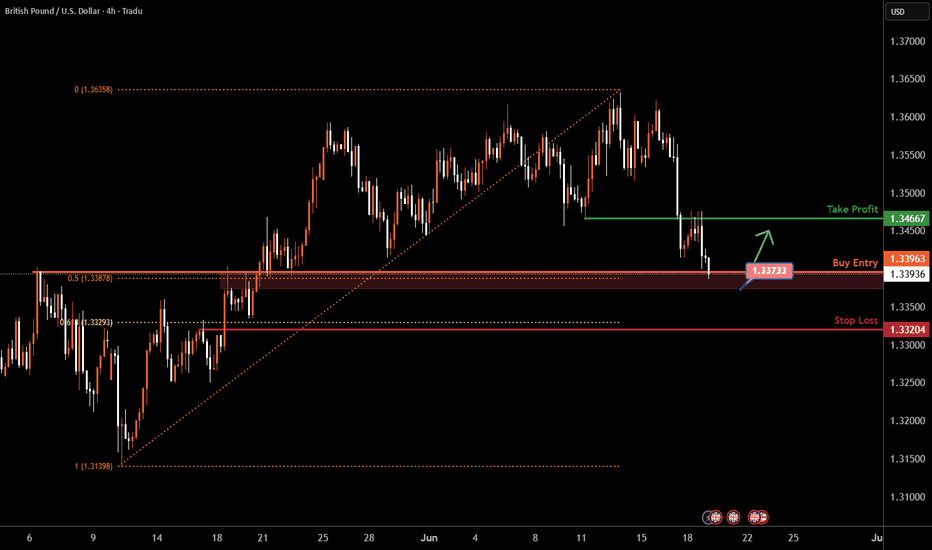

GBPUSD H4 I Bullish RiseBased on the H4 chart analysis, we can see that the price is trading near our buy entry at1.3373 -1.13396, which is a pullback support that aligns with the 50% Fib retracement.

Our take profit will be at 1.3466, which is an overlap resistance

The stop loss will be placed at 1.3320 which is a pullback support below the 61.8% Fib retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

GBPUSD InsightHello to all our subscribers,

Please feel free to share your personal opinions in the comments. We would appreciate your support through likes and subscriptions.

Key Points

- At the June FOMC meeting, the Federal Reserve revised its 2024 U.S. economic growth forecast down from 1.7% to 1.4%. It held the benchmark interest rate steady at 4.25–4.50%. The dot plot shows a divergence in opinions among Fed officials, but the median projection suggests two rate cuts within the year.

- Fed Chair Jerome Powell reaffirmed the stance that the current interest rate level will be maintained while observing the impact of tariffs more clearly.

- U.S. President Donald Trump, speaking to reporters at the White House, said it’s “not too late” if Iran wants to return to negotiations. Regarding potential military action against Iran, he stated, “We may or may not do it,” keeping the option open.

Key Economic Event This Week

+ June 19: Bank of England (BOE) interest rate decision

GBPUSD Chart Analysis

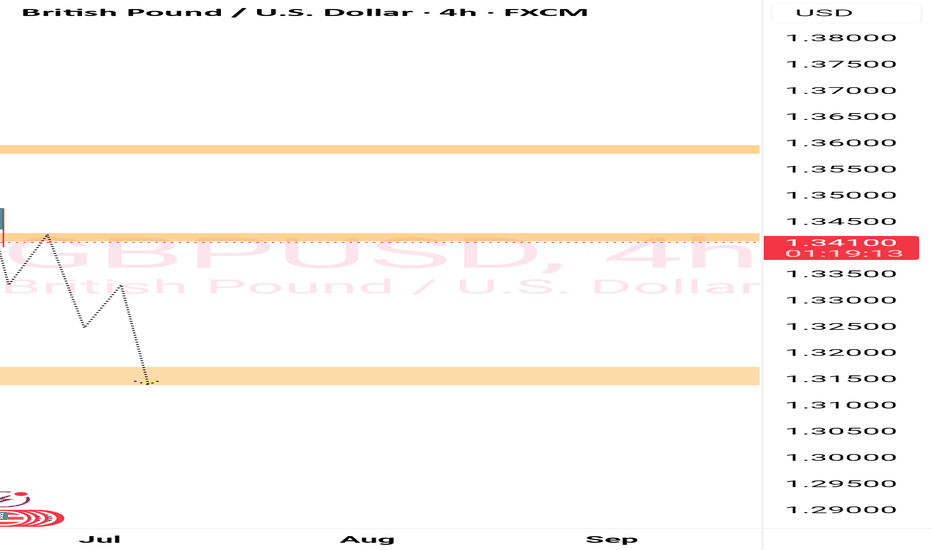

The pair has pulled back after facing resistance from the trendline. It has now reached the 1.34000 support level—a zone where a major trend reversal occurred previously—so a bullish reversal could be expected here. However, if this support breaks, the decline could extend toward the 1.32500 level. We recommend closely monitoring the movement around this area.

GBPUSD I Technical & Fundamental Forecast Welcome back! Let me know your thoughts in the comments!

** GB{USD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

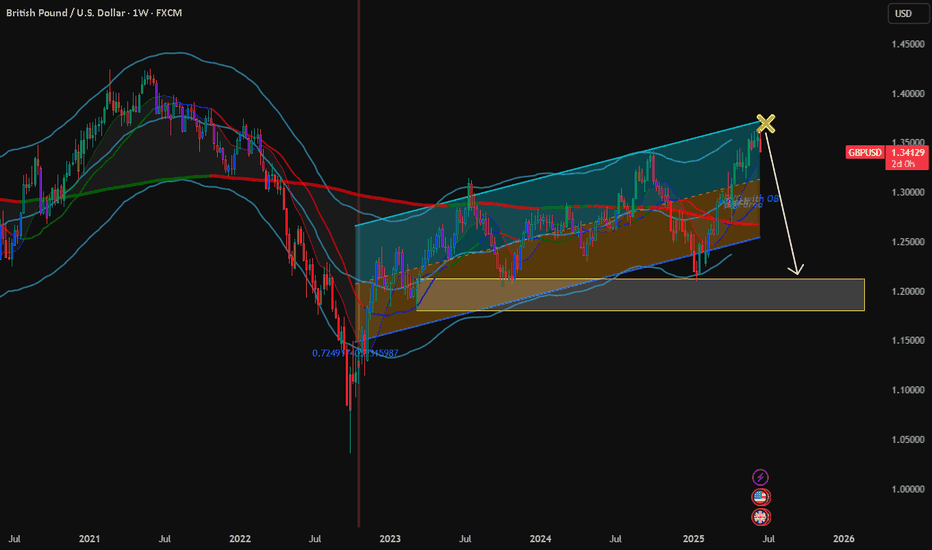

GBPUSD (swing)hello everyone, the price has reached major resistance on weekly tf, the price started of bearish with DXY being strong... this is a swing idea, you have to use smaller tf to get as high as possible to trade with proper risk management, price in past usually reversed from the trendline resistance, it's still in uptrend but price will likely go in correction if dxy goes bullish.. good luck

Pound recovers as UK CPI edges lowerThe British pound has stabilized on Wednesday. In the European session, GBP/USD is trading at 1.3551, up 0.28% on the day. The US dollar showed broad strength on Tuesday and GBP/USD declined 1.05% and fell to a three-week low.

UK inflation for May edged lower to 3.4% y/y, down from 3.5% in April and matching the market estimate. The driver behind the deceleration was lower airline prices and petrol prices. Services inflation, which has been persistently high, eased to 4.7% from 5.4%. Monthly, CPI gained 0.2%, much lower than the 1.2% gain in April and matching the market estimate.

Core CPI, which excludes food and energy, fell to 3.5% in May, down from 3.8% a month earlier and below the market estimate of 3.6%. Monthly, the core rate rose 0.2%, sharply lower than the 1.4% spike in April and in line with the market estimate. This marked the lowest monthly increase in four months.

The Bank of England will be pleased that core CPI moved lower but the inflation numbers are still too high for its liking. Headline CPI had been below 3% for a year but has jumped well above 3% in the past two months.

BoE policymakers won't have much time to digest today's inflation report as the central bank makes its rate announcement on Thursday. The markets are widely expecting the BoE to maintain the cash rate at 4.25%,

Investors will be keeping a close eye on the meeting, looking for hints of a rate cut later in the year. The UK economy contracted in April and with wages falling and unemployment rising, there is pressure for the BoE to lower rates, but that is risky with inflation well above the BoE's 2% inflation target.

US retail sales slumped in May, falling 0.9% m/m. This was well below the revised -0.1% reading in April and worse than the market estimate of -0.7%. Annually, retail sales fell to 3.3%, down sharply from a revised 5.0%.

Consumers are wary about the economy and anxiety over Trump's tariffs has weighed on consumer spending. If additional key US data heads lower, this will increase pressure on the Federal Reserve to lower interest rates.

GBP/US is putting pressure on resistance at 1.3480. Above, there is resistance at 1.3545

1.3364 and 1.3299 are providing support

GBPUSD Will FOMC and BOE Drive the Next Move?GBPUSD Will FOMC and BOE Drive the Next Move?

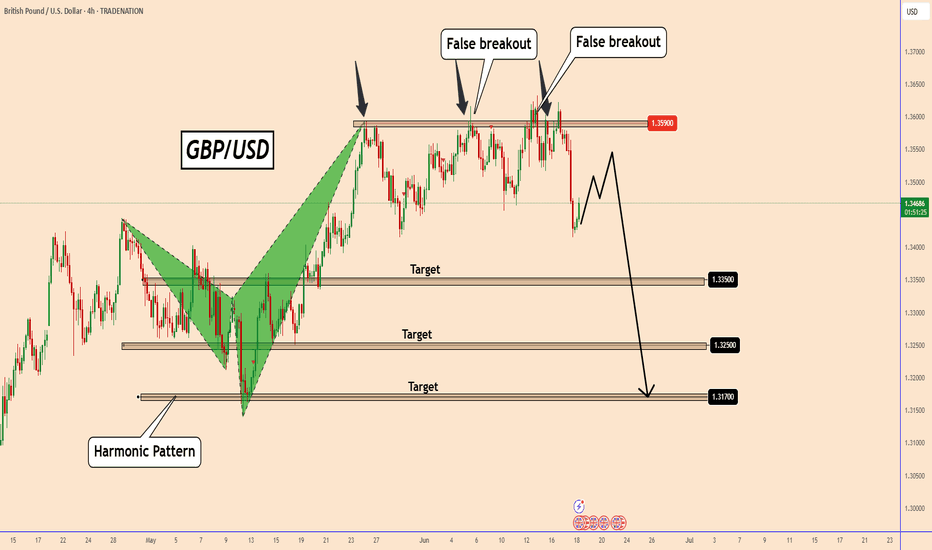

GBPUSD completed a bearish harmonic pattern near the end of May, signaling downside potential.

Despite multiple attempts to decline, rising geopolitical tensions in the Middle East and the FED’s reluctance to cut rates have kept price movements in check.

The pair repeatedly tested the 1.3600 resistance zone, but finally moved down by nearly 160 pips yesterday.

With the FOMC Interest Rate decision today and BOE’s rate announcement tomorrow, the market could see a rebound ahead of FOMC for a larger correction, potentially setting up for a decline tomorrow.

While this remains an assumption for now, as long as the harmonic pattern remains valid, further downside remains a possibility.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.