GBP/USDPrice action trading is a methodology in financial markets where traders make decisions based on the actual price movements of an asset over time, rather than relying heavily on technical indicators or fundamental analysis. It involves observing and interpreting patterns and trends in price charts to predict future price movements.

GBPUSD trade ideas

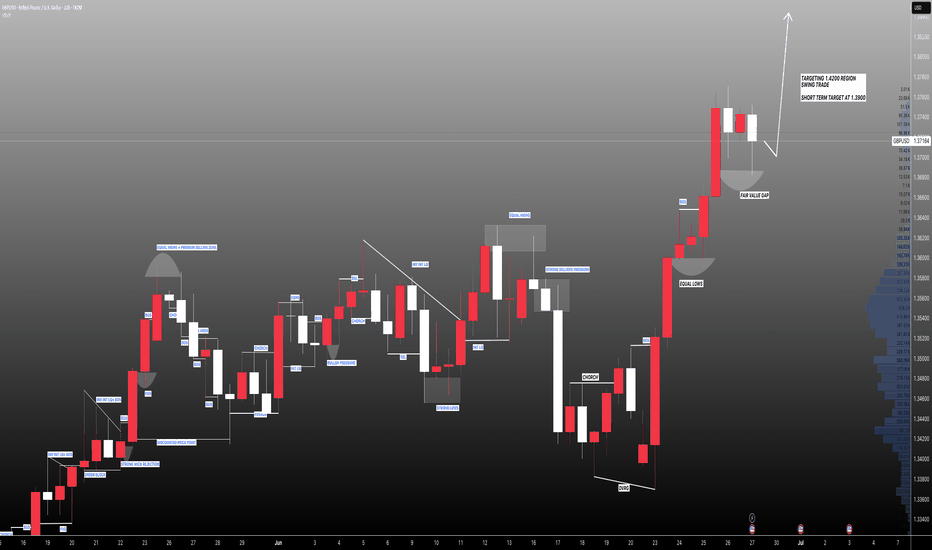

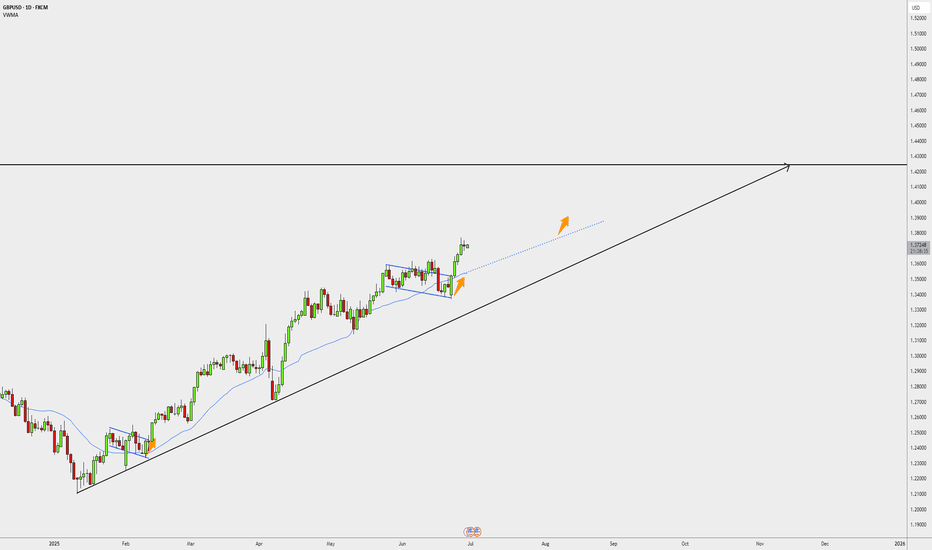

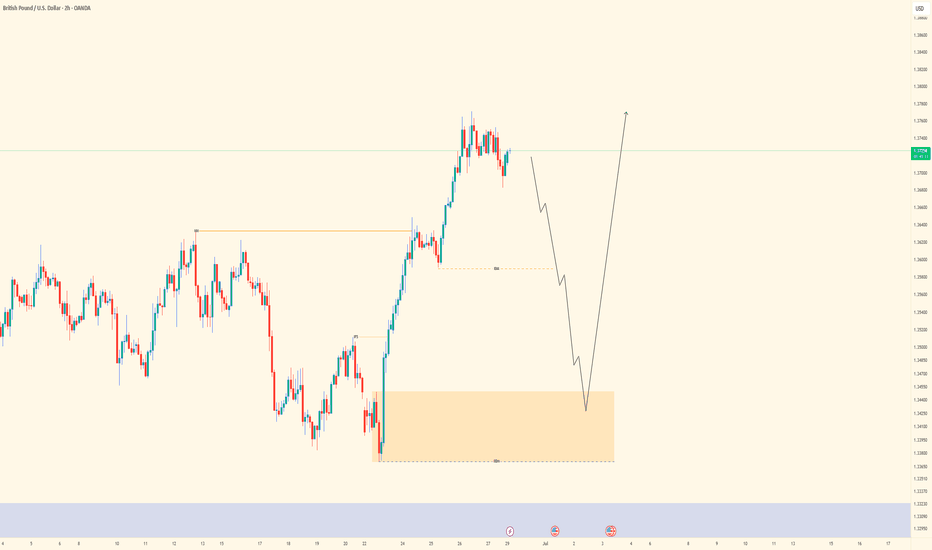

GBPUSD: Targeting 1.4200 Swing Move Target! Swing Trading GBPUSD: We’ve identified a key reversal zone where our long-term take-profit target is set at 1.4200. This is a long-term approach, but in the short term, we could target 1.3900, which is a reasonable take-profit area. Before taking any buying entry, please do your own analysis.

Good luck and trade safely!

Like

Comment

Share

Team Setupsfx_

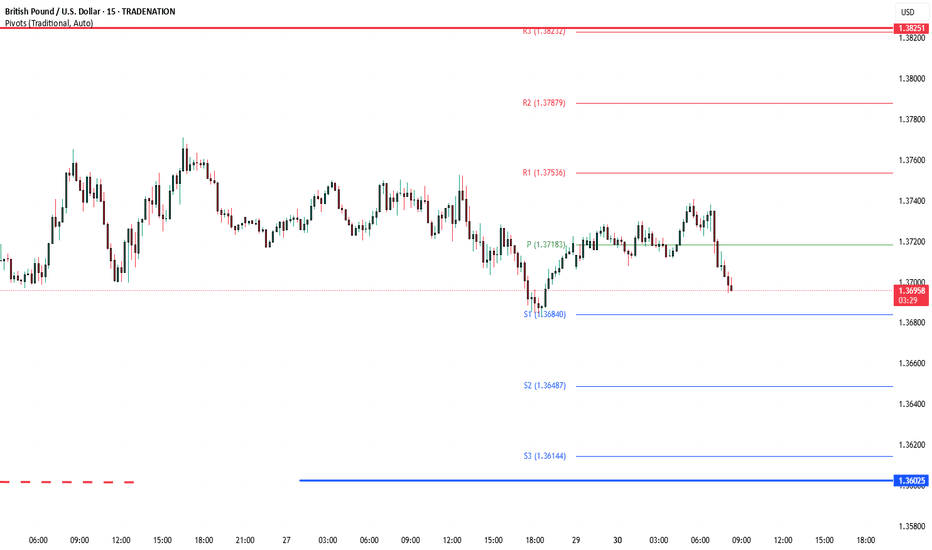

Smart Scalping on GBP/USD: 15-Minute Chart StrategyUnlock the power of precision trading with my exclusive GBP/USD 15-minute scalping strategy. This isn’t just another chart setup—it’s a battle-tested system built on real-time confluence: EMA crossovers, RSI confirmation, Supertrend alignment, and Fibonacci retracement zones. Every trade idea I share is backed by deep analysis, strict risk management, and a clear entry/exit plan.

Whether you're a beginner looking to learn or a trader seeking consistency, my strategy delivers clarity in the chaos of the markets. Join me to gain access to high-probability setups, live breakdowns, and mentorship that turns theory into profit.

💼 Ready to level up your trading? 💸 Invest in insights that pay for themselves. 📈 Let’s grow together—one smart trade at a time.

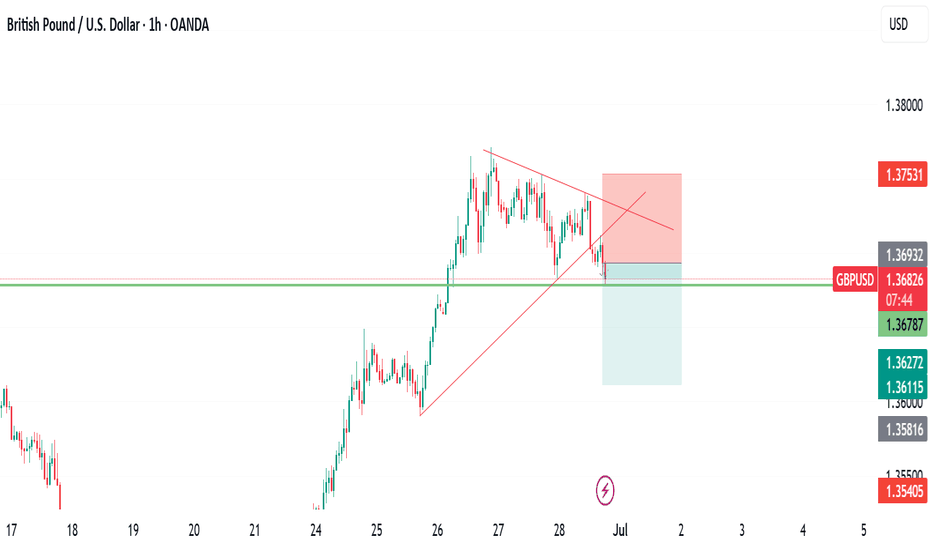

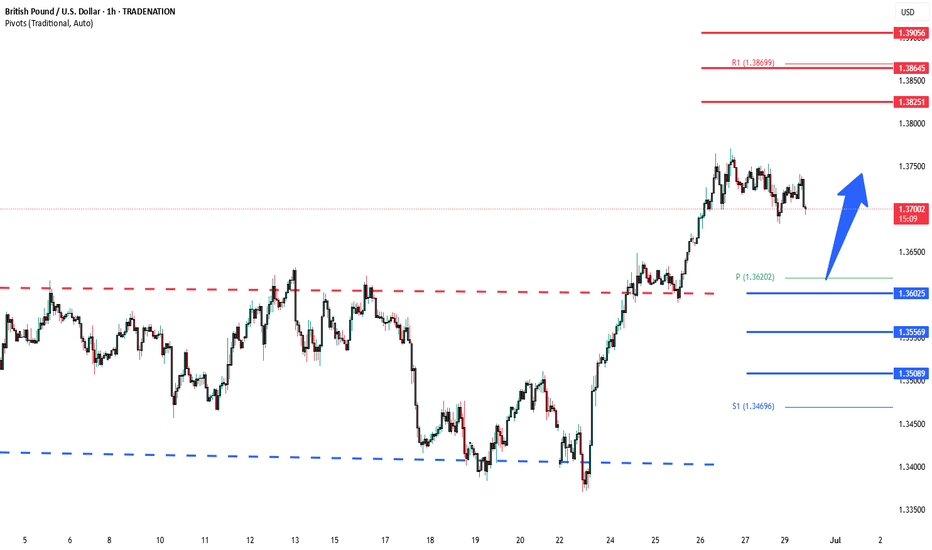

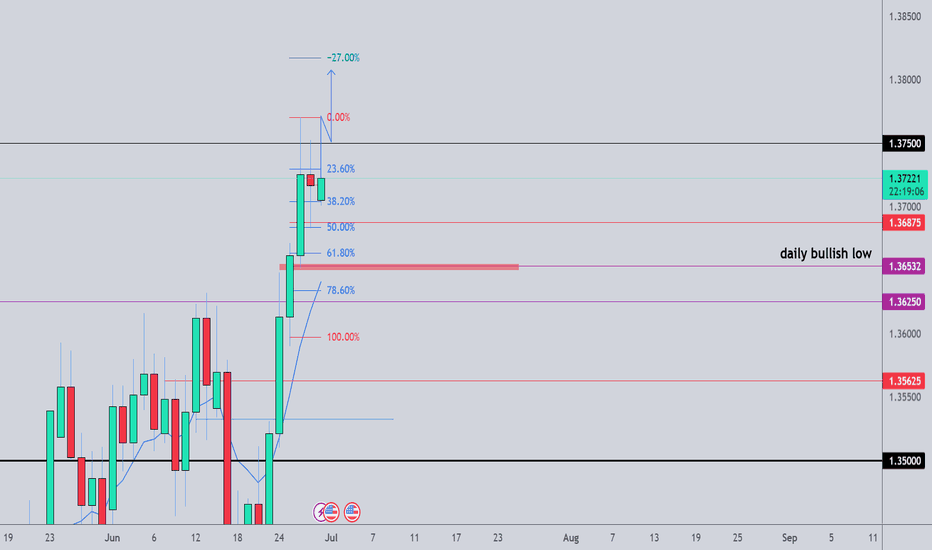

GBPUSD sideways consolidation support at 1.3550The GBPUSD currency pair continues to exhibit a bullish price action bias, supported by a sustained rising trend. Recent intraday movement reflects a sideways consolidation breakout, suggesting potential continuation of the broader uptrend.

Key Technical Level: 1.3600

This level marks the prior consolidation range and now acts as pivotal support. A corrective pullback toward 1.3600 followed by a bullish rejection would reinforce the bullish trend, targeting the next resistance levels at:

1.3825 – Near-term resistance

1.3865 – Minor swing high

1.3900 – Longer-term bullish objective

On the other hand, a decisive daily close below 1.3600 would invalidate the bullish setup, shifting the outlook to bearish in the short term. This could trigger a deeper retracement toward:

1.3550 – Initial support

1.3500 – Key downside target

Conclusion:

As long as 1.3600 holds as support, the technical outlook remains bullish, favoring long positions on dips. A confirmed break below this level would signal a shift in sentiment and open the door to a corrective pullback phase.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

The Day Ahead A packed data slate and central bank commentary will shape market sentiment today. Key focus will be on China’s official PMIs for June, offering the first major insight into the health of the global manufacturing cycle as Q3 begins. A soft print could amplify global growth concerns, while a surprise to the upside may support risk sentiment across Asia and commodities.

In the US, attention will turn to the June MNI Chicago PMI and the Dallas Fed manufacturing activity index for further clarity on the state of US industry after mixed regional data earlier this month. The consumer credit and M4 money supply data, along with Q1 current account figures, could influence the USD via their implications for domestic demand and external balances.

The UK sees the release of the Lloyds Business Barometer, which will provide a gauge of corporate confidence amid sticky inflation and persistent BoE rate cut speculation.

In the Eurozone, eyes will be on Germany’s June CPI flash estimate, retail sales, and import prices, all feeding into inflation expectations ahead of the ECB’s July policy meeting. Italy’s CPI and Eurozone May M3 will also be watched closely for signs of disinflation and liquidity trends.

From Japan, May industrial production and housing starts will help assess whether the domestic economy is managing to maintain momentum amid a weak yen and global headwinds.

On the central bank front, the ECB Forum in Sintra kicks off, running through July 2. President Christine Lagarde is due to speak, and any remarks on the rate path or inflation outlook will be closely parsed. Markets will also hear from Fed’s Bostic and Goolsbee, potentially offering clues on the FOMC’s stance amid rising speculation around a September cut.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

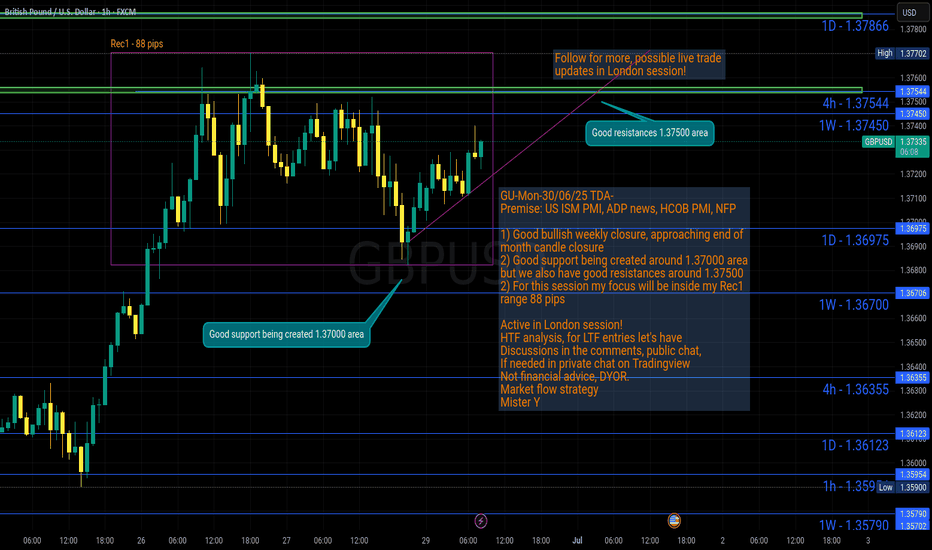

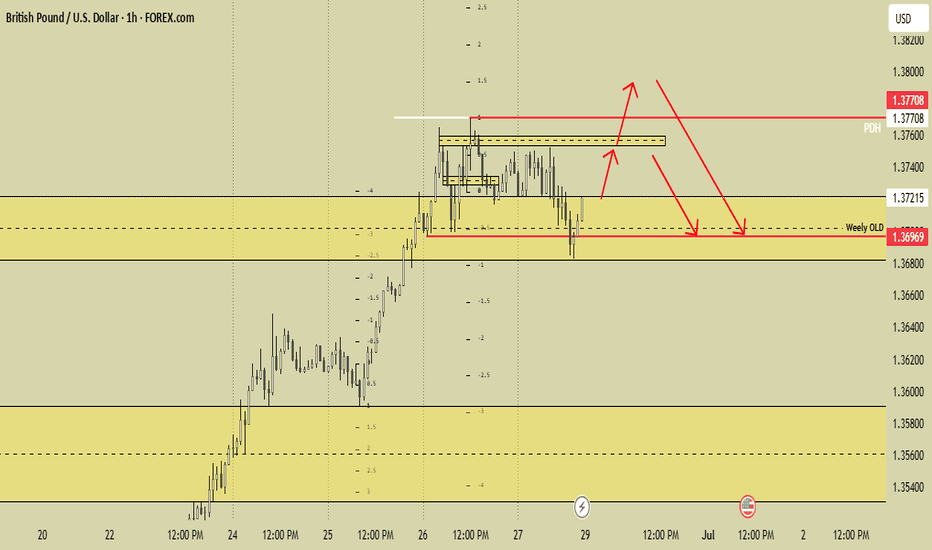

GU-Mon-30/06/25 TDA-Good support 1.37000&Good resistance 1.37500Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

The reality of life is that if you don't work for yourself,

you'll never achieve what you want.

Don't expect things to come, work for it, act on it.

Notice the difference between DOers and Dreamers.

Comment down below what do you think!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

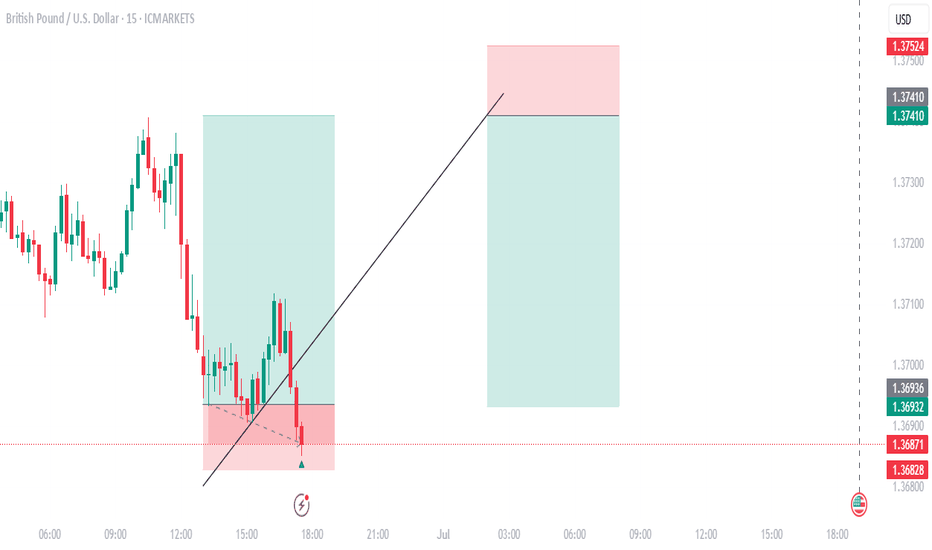

Bullish continuation?The Cable (GBP/USD) is falling towards the pivot, which acts as a pullback support and could bounce to the 1st resistance.

Pivot: 1.3617

1st Support: 1.3442

1st Resistance: 1.3795

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

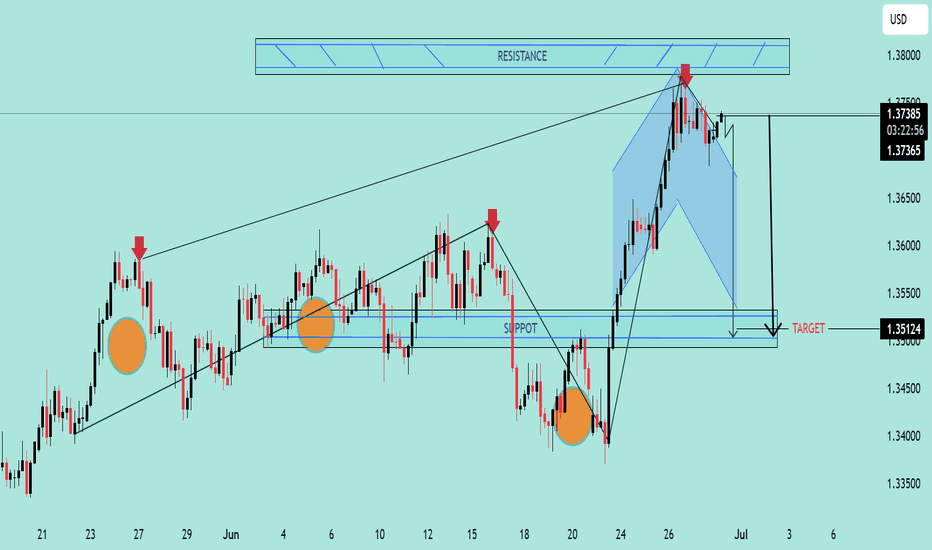

GBP/USD Bearish Reversal Pattern Detected GBP/USD Bearish Reversal Pattern Detected 🔻🦈

The chart illustrates a potential bearish Gartley pattern formation near the 1.3736 resistance zone, which has historically triggered price rejections (red arrows).

🔍 Key Observations:

📌 Price action completed a bearish harmonic pattern, suggesting a reversal setup.

💡 Multiple rejections at the upper resistance zone (1.3730–1.3780) highlight strong selling pressure.

📉 Break of trendline support confirms shift in structure.

🟠 Historical support zones (orange circles) now align with the projected target level: 1.3512.

🔽 A clean breakdown below 1.3650 could accelerate bearish momentum toward the target.

🎯 Target: 1.35124

🛑 Resistance: 1.3730–1.3780

✅ Support: 1.3510–1.3550 zone

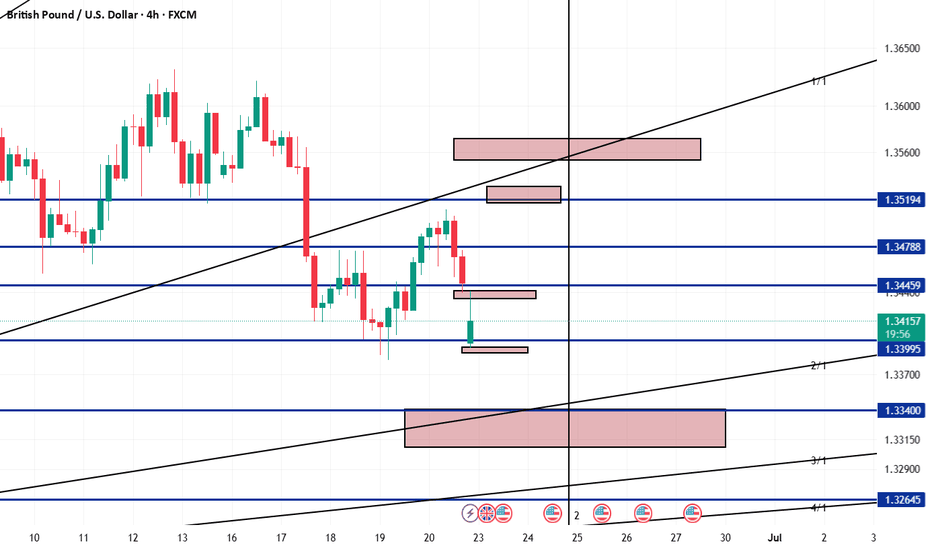

GBPUSD H4 I A short-term Bearish DropBased on the H4 chart analysis, we can see that the price is currently at our sell entry at 1.3723 which is an overlap resistance.

Our take profit will be at 1.3631 a pullback support that aligns closely with the 38.2% Fib retracement.

The stop loss will be placed at 1.3787, above a swing high resistance level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

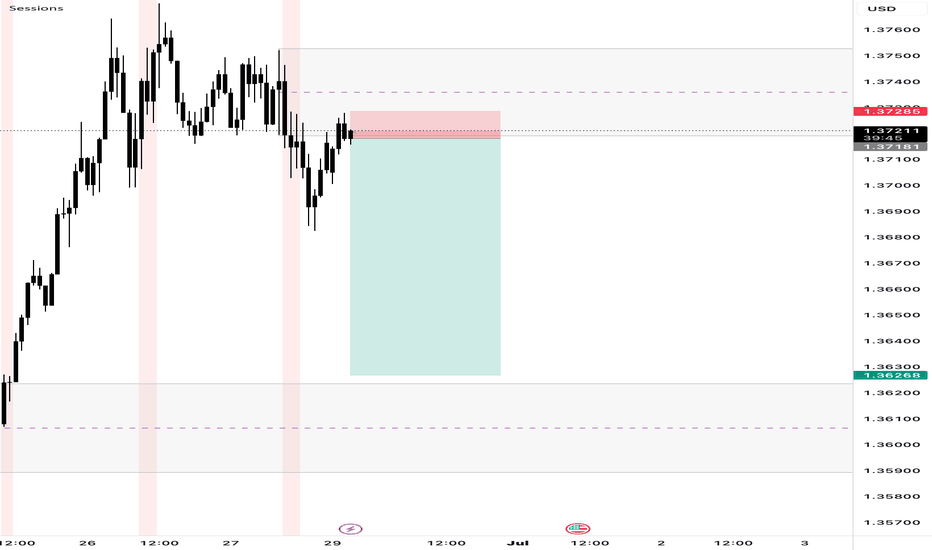

Bearish Reversal at Supply – GBP/USD🧠 Trade Breakdown:

Price broke structure cleanly to the downside, leaving behind a clear supply zone on the higher timeframes. Now we’re seeing a textbook pullback into that zone — slow, weak volume — signaling distribution before the next potential move down.

📍 Key Confluences:

• Higher timeframe supply zone respected

• Break of structure followed by clean pullback

• Consolidation + order buildup into the zone

• High reward-to-risk (estimated 7:1)

• Supply zone: 1.3718 – 1.3735

• Entry: 1.37206

• SL: Above 1.3735

• TP: 1.36275

📸 Trade Setup:

Waiting for a bearish reaction or engulfing confirmation from inside the purple supply zone. If rejection holds, I’m targeting the green demand zone below.

🧠 Mindset:

No chasing. No forcing. This is a sniper setup only. Full trust in my zone and risk management.

Trade Simple. Live Lavish.

— Quil Lavish

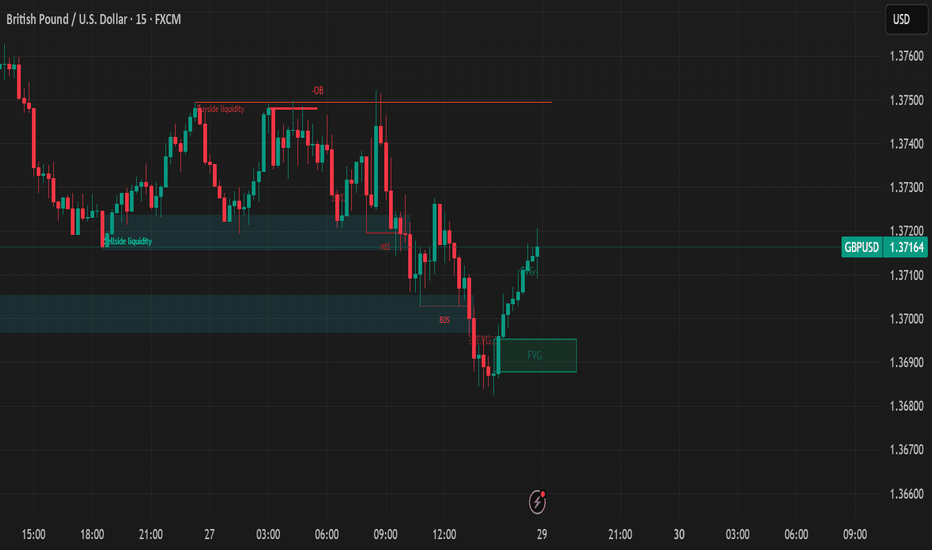

$GU (GBPUSD) 1H AnalysisPrice swept internal liquidity before dropping into a clear 1H Fair Value Gap (FVG), which acted as a draw on liquidity. Following the mitigation, GBPUSD is now retracing toward a high-probability supply zone.

Expect potential rejection as price rebalances inefficiency and seeks sell-side liquidity.

Watch for bearish confirmation inside the supply zone — ideal for intraday shorts if the structure shifts.

Pullbacks = short opportunities.

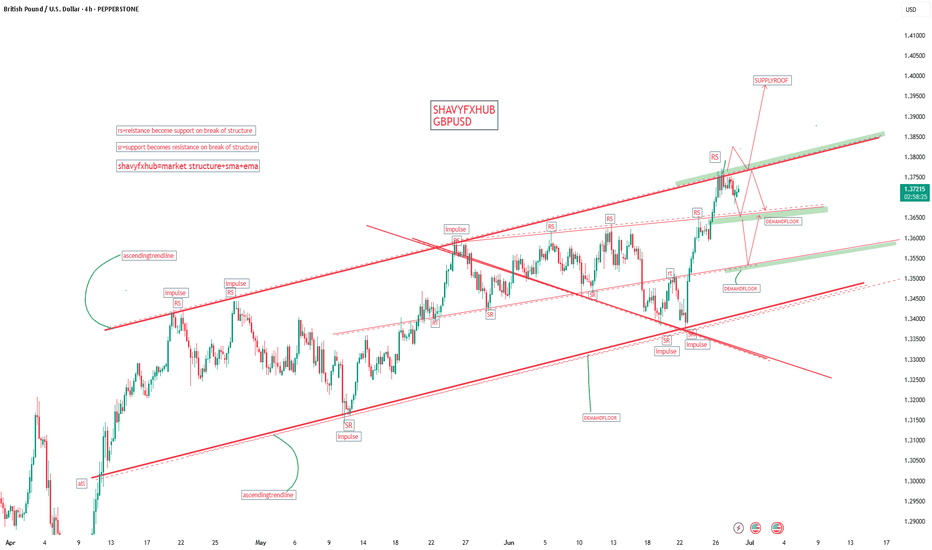

GBPUSD| - Riding the Bullish Wave with Precision📌 Pair: GBPUSD

📈 Bias: Bullish

🕰 HTF View (4H):

Major external structure (HH) broken to the upside — clear bullish intent from smart money. Strong momentum confirms continued interest in pushing price higher.

🧭 MTF View (30M → 2H clarity):

Refined bullish structure forming on 30M. Using the 2H to filter noise and spot deeper liquidity. Watching closely for a sell-side sweep into OB for cleaner, higher-probability LTF entries.

🎯 Entry Criteria:

CHoCH flip → Liquidity sweep → OB mitigation

Perfect sequence = greenlight for execution.

🎯 Target: Structure highs above

🧠 Mindset Note:

Sometimes the best entries come after everyone else gets taken out. Be the one who waits, confirms, then strikes with intention.

Bless Trading!

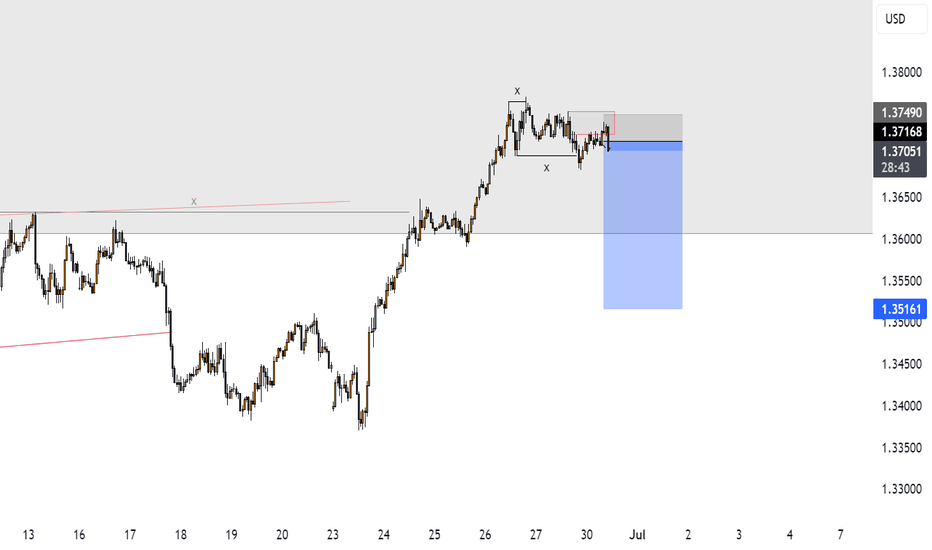

GBPUSD Next Week MondayThe GBP/USD pair has recently shown resilience, trading above 1.3700 and near multi-year highs, but technical and fundamental indicators suggest that a bearish tone could emerge early next week, particularly on Monday. While the pair is currently supported by a bullish bias according to some short-term indicators, there are several factors that could shift momentum to the downside.

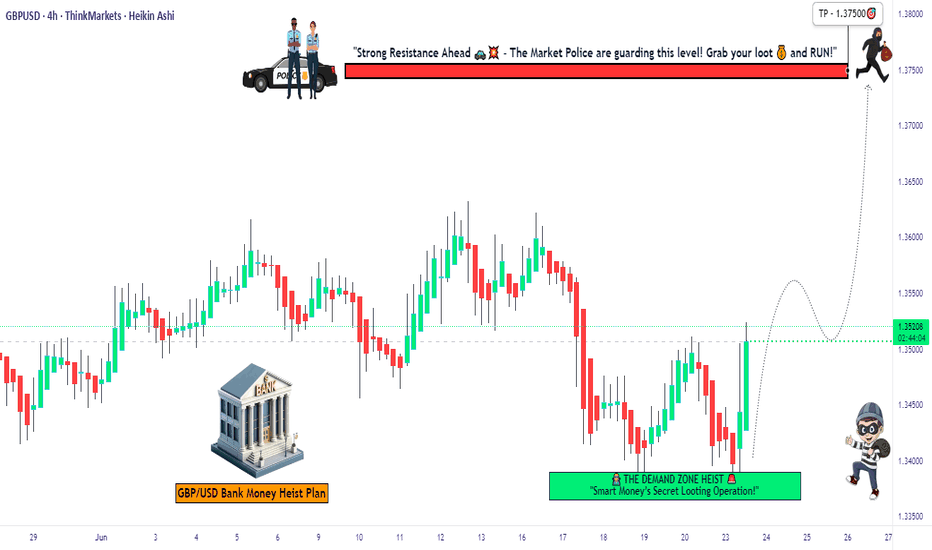

Exclusive: GBP/USD Swing Heist – Limited-Time Opportunity!🏴☠️ GBP/USD HEIST ALERT: Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Attention, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to swipe those pips!"

🔥 THIEF TRADING STRATEGY (Swing/Day) 🔥

Based on high-risk, high-reward technical & fundamental analysis, here’s the master plan to plunder GBP/USD ("The Cable")!

📈 ENTRY (Bullish Heist Zone)

"The vault is OPEN!" – Long at any price, but for precision:

Buy Limit orders preferred (15m-30m timeframe).

Pullback entries from recent swing lows/highs = sneakiest loot grab!

🛑 STOP LOSS (Escape Route)

Thief SL: Nearest swing low (4H chart).

Adjust based on: Risk tolerance, lot size, & number of orders.

"A good thief always has an exit plan!"

🎯 TARGETS

1.37500 (or escape early if the cops 🚓 (bearish traps) show up!).

Scalpers: Only long-side raids! Use trailing SL to lock profits.

💥 WHY THIS HEIST? (Bullish Momentum)

Technicals + Fundamentals align for a potential breakout.

Overbought? Risky? Yes—but the best loot is guarded!

📢 TRADING ALERT (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = police sirens!).

Trailing stops = Your getaway car. Protect profits!

🚀 BOOST THE HEIST!

💖 Hit "Like" & "Boost" to fuel our next raid!

💬 Comment your loot tally below!

"Stay sharp, thieves—see you at the next heist! 🤑🔥"

GBPUSD: The Big Short Opportunity?(Breakout Confirmation Needed)🚨 GBP/USD BANK HEIST ALERT: The Bearish Robbery Plan (Swing/Day Trade) 🚨

🔥 Steal Pips Like a Pro – Thief Trading Strategy Inside! 🔥

🌟 GREETINGS, MARKET PIRATES! 🌟

🤑 To all the Money Makers, Risk Takers & Midnight Breakers!

Based on our 🔥Thief Trading Style🔥 (a deadly mix of technical + fundamental + intermarket analysis), we’re plotting a massive bearish heist on GBP/USD ("The Cable").

This is not financial advice—just a strategic robbery plan for those who dare to trade smart.

📉 THE HEIST STRATEGY (SHORT ENTRY FOCUS)

🎯 Target Zone: 1.32300 (or escape earlier if the market turns)

⚡ High-Risk, High-Reward Play: Oversold market, consolidation, trend reversal setup.

💣 Trap Level: Where bullish traders get wrecked.

🔑 ENTRY RULES:

"The Heist is ON!" – Wait for breakout confirmation at 1.33800 before striking.

Sell Stop Orders below breakout MA OR Sell Limit Orders (15-30 min timeframe).

Retest Entry? Ideal if price retraces to recent low/high before dropping.

📌 ALERT SETUP: Don’t miss the breakout—set a chart alert!

🛑 STOP LOSS (Risk Management):

Thief SL at 1.34800 (Swing/Day Trade basis – 3H period).

🚨 Pro Tip: "Yo, rebels! You can place SL wherever you want… but if you ignore this level, don’t cry later. Your risk, your rules."

🎯 PROFIT TARGET:

First Take-Profit: 1.32300 (or bail earlier if momentum fades).

Scalpers: Ride the short side only. Use trailing SL to lock profits.

📰 FUNDAMENTAL BACKUP (Why This Heist Works)

Before executing, check:

✅ COT Report (Are big players dumping GBP?)

✅ Macro News (UK vs. USD economic strength)

✅ Intermarket Analysis (DXY, Bonds, Equities correlation)

✅ Sentiment & Seasonality (Is the crowd too bullish?)

⚠️ WARNING: NEWS & VOLATILITY ALERTS

Avoid new trades during high-impact news (unless you love gambling).

Use trailing stops to protect profits if the market flips.

💥 BOOST THIS HEIST! 💥

🚀 Like & Share to strengthen our Thief Trading Squad!

💸 More heists = More profits. Stay tuned for the next robbery plan!

🤑 See you on the profitable side, bandits! 🏴☠️

🔴 DISCLAIMER: This is entertainment, not financial advice. Trade at your own risk.

#Forex #GBPUSD #TradingStrategy #ThiefTrading #BankHeist #SwingTrading #DayTrading

💬 COMMENT BELOW: Are you joining the heist or waiting for a better setup? 🚨👇