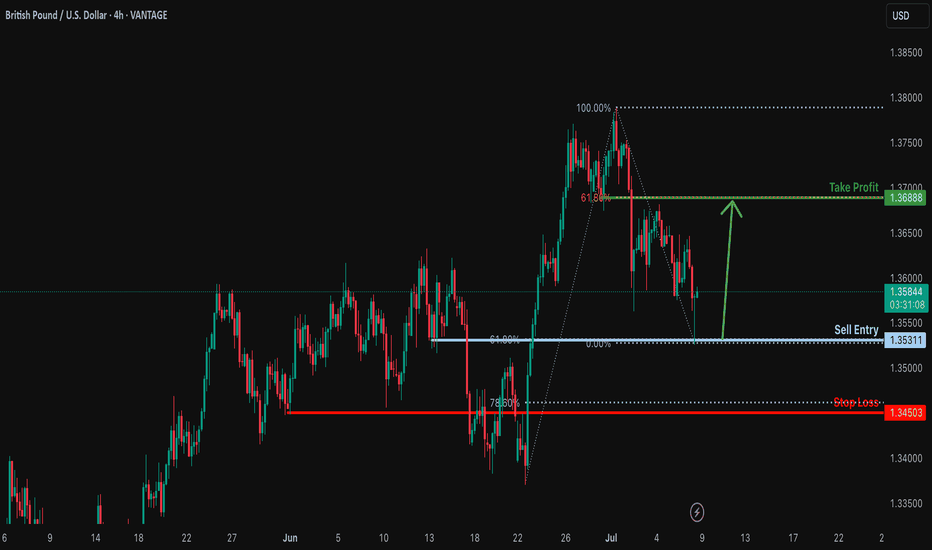

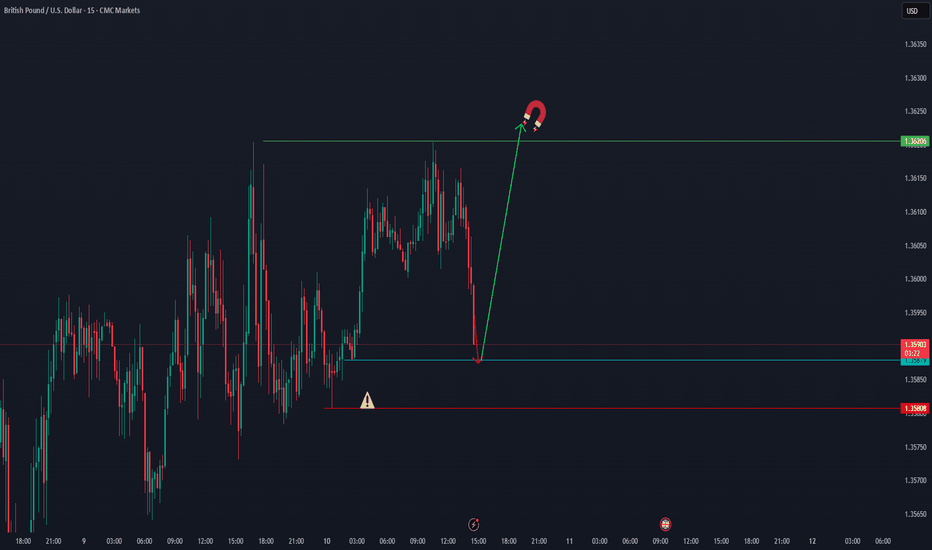

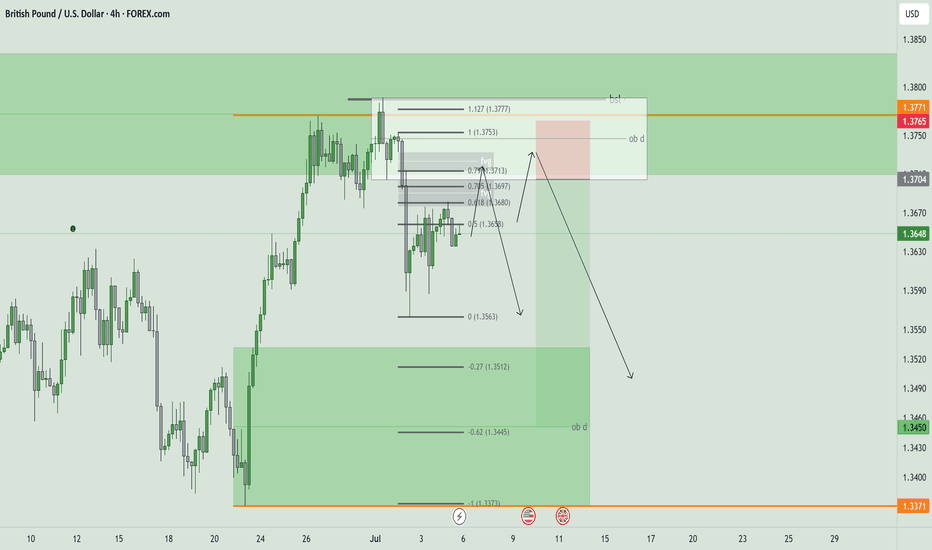

Bullish bounce?GBP/USD has bounced off the support level which is a pullback support that aligns with the 61.8% Fibonacci retracement and could rise from this level too ur take profit.

Entry: 1.3531

Why we like it:

There is a pullback support level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 1.3450

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci retracement.

Take profit: 1.3688

Why we like it:

There is an overlap resistance level that aligns with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPUSD trade ideas

GBPUSD LONG FORECAST Q3 D11 W28 Y25GBPUSD LONG FORECAST Q3 D11 W28 Y25

It’s Fun Coupon Friday! 💸🔥

Professional Risk Managers👋

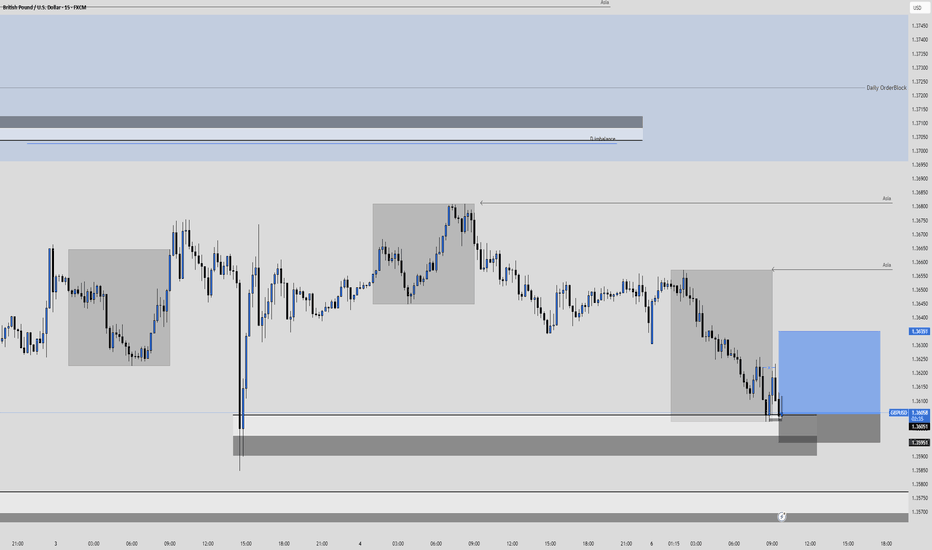

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Daily order block

✅1H Order block

✅Intraday breaks of structure

✅4H Order block

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

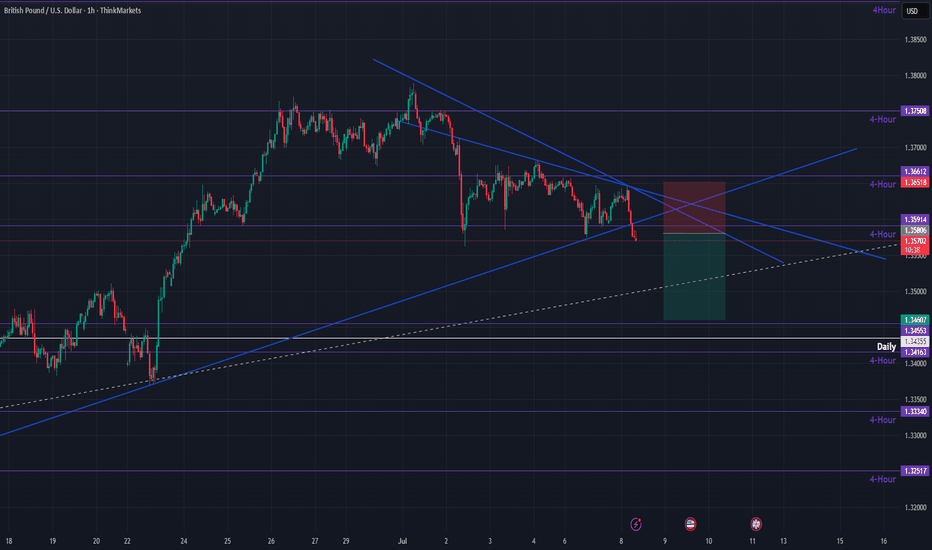

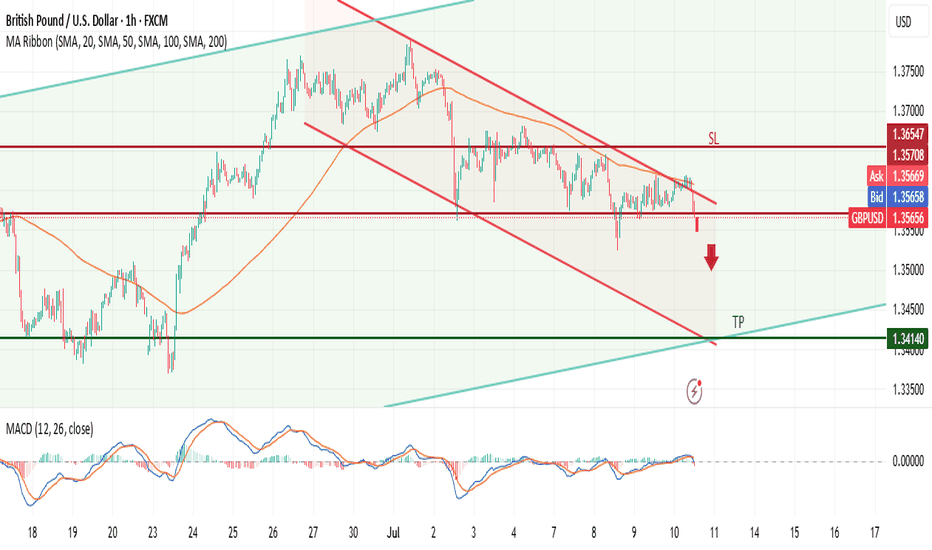

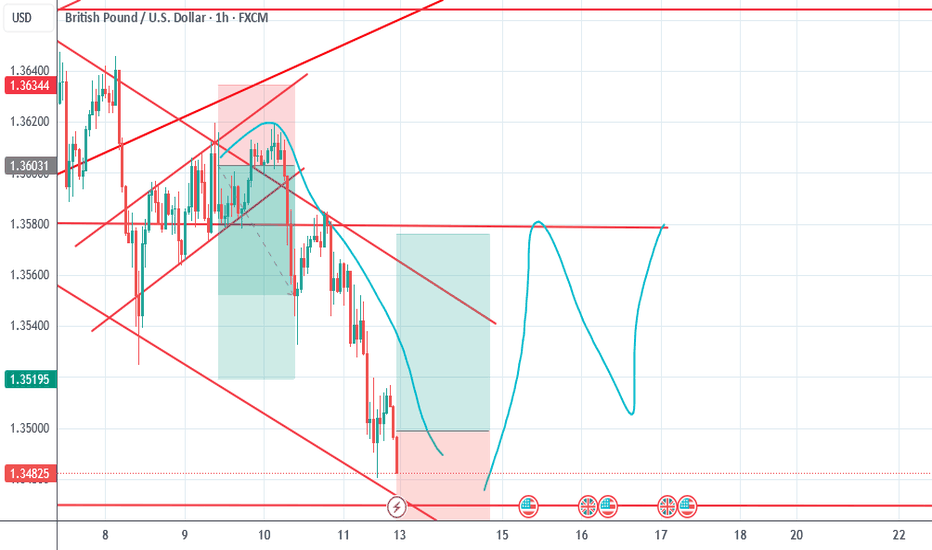

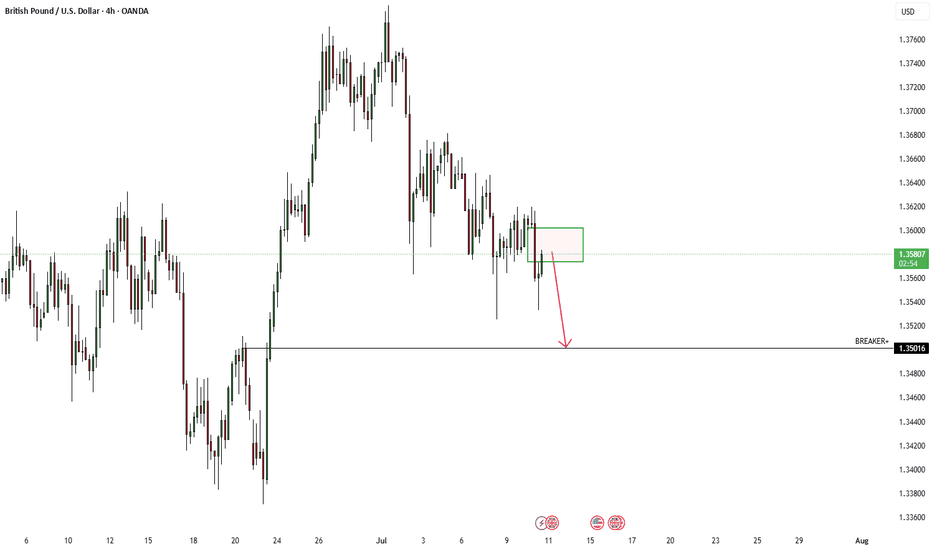

GBPUSD – Classic FRL setup unfoldingWe have a clear descending channel (wedge) on H1, with the price testing the neckline level after a corrective consolidation.

According to Fractal Reversal Law (FRL):

The neckline is drawn horizontally at the start of the last impulse, not on the top of the candle wicks.

The price has retested the neckline multiple times, forming a clean structure before potential continuation.

The 100 SMA is above the price, confirming the bearish structure and scale alignment.

Trade Plan:

🔻 Entry: Below the neckline on confirmation of breakout.

🔻 Stop Loss (SL): Above the upper boundary of the channel and last swing high (clearly marked on the chart).

🔻 Take Profit (TP): At the intersection of the lower channel line with the long-term ascending trendline (green support), around 1.34 area.

Confirmation:

• The MACD shows momentum fading, indicating a potential downside move aligning with the FRL setup.

• We expect a clean impulse downward after a tight consolidation, providing a high-probability entry.

Following the FRL principles, we wait for a clean breakout below the neckline to confirm the structure shift before entering.

Momentum’s Here. Don’t Miss Out.Opportunity favors the prepared. The market’s shifting, and this setup is your signal to rise. If you're aiming for growth, consistency, and a clear path forward — you're in the right place.

No more solo trades with shaky confidence. It’s time to align with a professional approach that focuses on results, not guesswork. I help traders navigate, structure, and succeed — and I’m here for those ready to take the next step.

🚀 Growth isn’t accidental. Let’s build it together.

#buysetup #forexmentor #tradingmindset #tradingconfidence #tradingeducation #consistentprofits

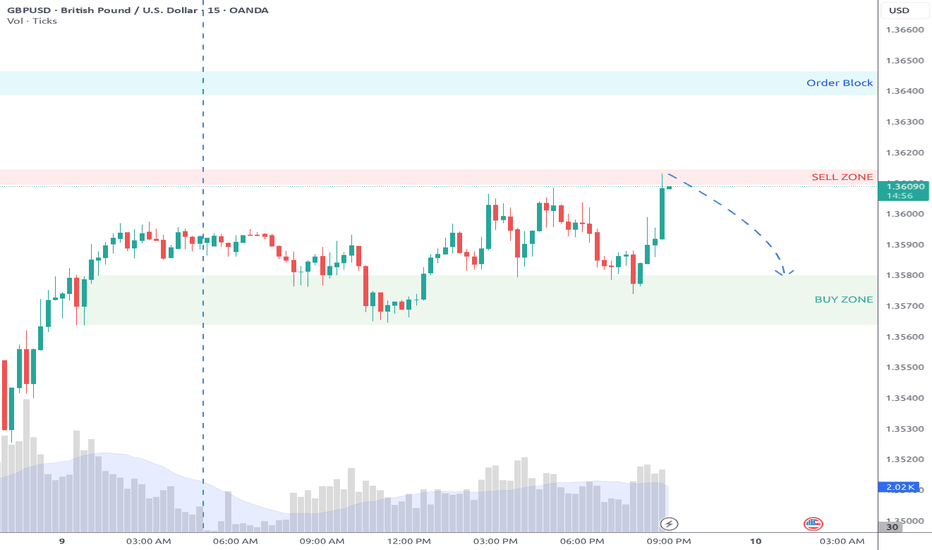

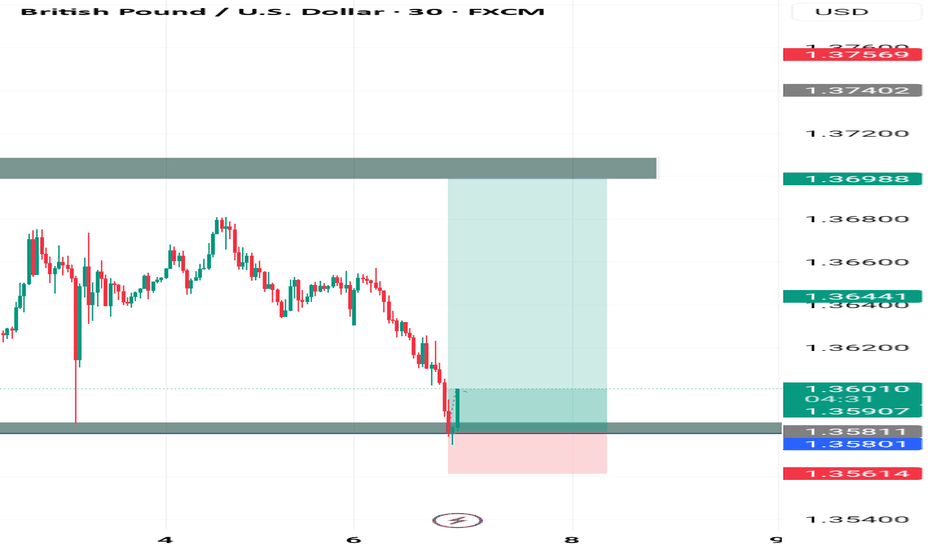

GBPUSD Long, 07 JulyAsia Fill Setup

This is a pure Asia Fill trade, backed by recent bullish LTF structure and a clean reaction from a 15m decisional OB. Although HTF isn’t perfectly aligned for longs, the momentum and intraday structure make this setup valid.

📍 Entry: 1m BOS from 15m OB, refined entry from 1m OB

📈 Confluence: Trend, structure, and Asia high as a clear target

🔁 Risk: SL doesn’t fully cover the OB, but BOS + clean reaction justifies the entry

🎯 Target: Asia High (1:3 RR), with BE secured quickly if price moves favorably

Not a perfect setup HTF-wise, but strong intraday alignment makes it worth the shot.

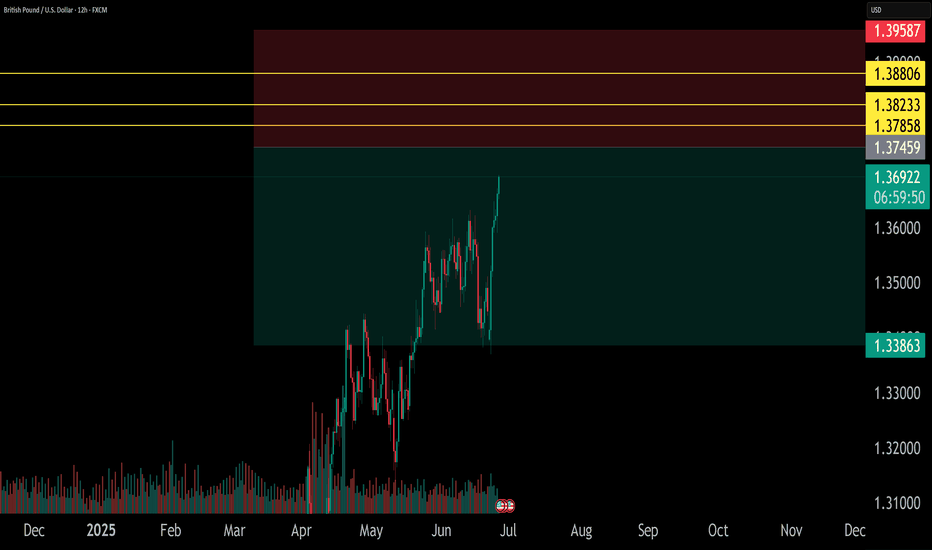

GBP/USD Short Idea Analysis : GBP/USD is approaching a critical resistance zone between 1.37850 and 1.38800 on the daily timeframe, presenting a potential short opportunity based on technical and fundamental factors.

Technical Analysis:

Price Action: The 1.37850–1.38800 zone aligns with prior highs and a strong resistance area, likely to trigger rejection or a bearish reversal pattern (e.g., double top or bearish engulfing).

Support/Target: Initial support at 1.3700, with a deeper target at 1.3600 if bearish momentum builds.

Indicators: RSI is approaching overbought territory (near 70), signaling potential exhaustion. MACD shows slowing bullish momentum, supporting a short bias.

Fibonacci: The 1.37850–1.38800 zone coincides with the 76.4%–88.6% Fibonacci retracement of the prior downmove, reinforcing resistance.

Fundamental Context:

UK economic data (e.g., weaker retail sales or PMI) suggests GBP vulnerability. Meanwhile, USD strength is bolstered by hawkish Fed expectations and resilient US economic indicators.

Risks: A breakout above 1.3900 could invalidate the setup. Monitor BoE rhetoric and US data releases for sudden shifts.

Conclusion: The 1.37850–1.38800 resistance zone offers a high-probability short setup for GBP/USD, supported by technical resistance and USD-favorable fundamentals. Use strict risk management due to potential volatility.

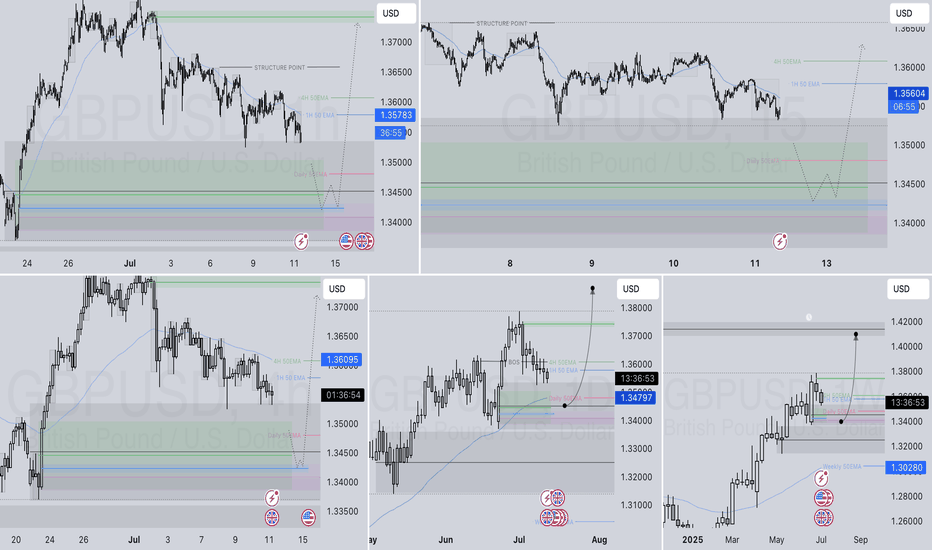

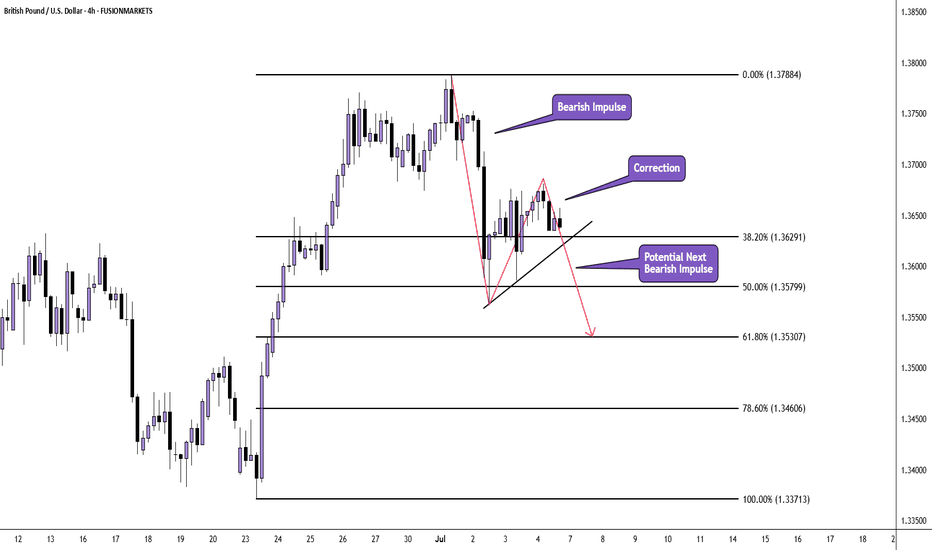

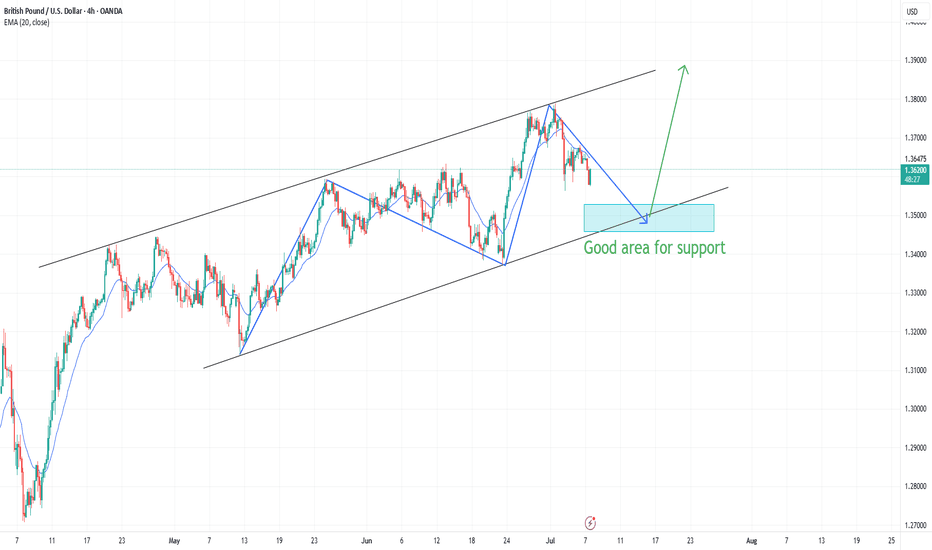

GBP/USD H4 AnlysisPrice appears to be correcting the huge bullish impulse move which originated on 23rd June 2025 and ended on 1st July 2025.

We have already seen an impulse from the sellers after price peaked at 1.37887 at the beginning of the month.

Current price action is taking the form of a correction and there is the potential of another move down.

If you agree with this analysis, look for a trade that meets your strategy rules.

Passing through alot on GBPUSD since yesterday i don really know if my psychology is playing pranks on me .or are we in a choppy market? ...i have been working the market to dance to my tune lol ...but this pair keeps doing what it wants ... holding trade for hours in blues for price to reverse and hit SL or BE ....wtf

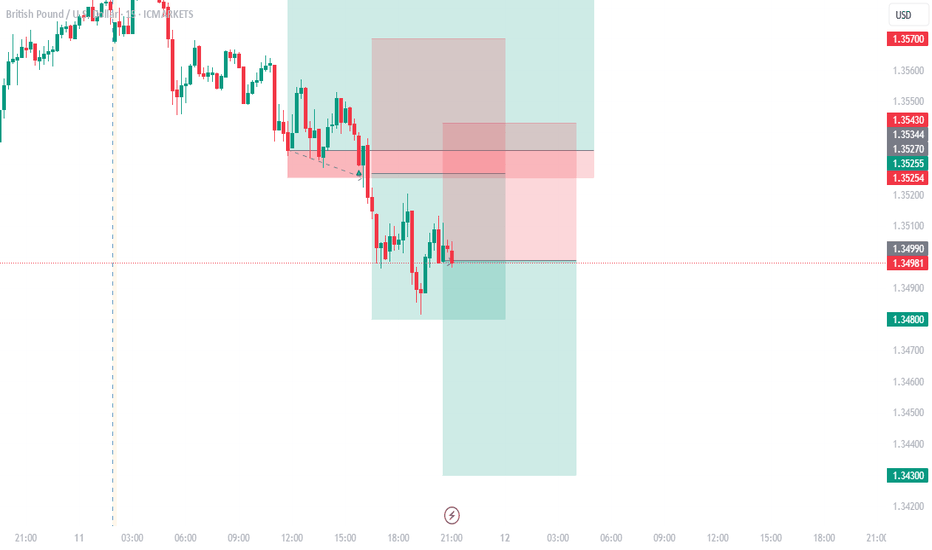

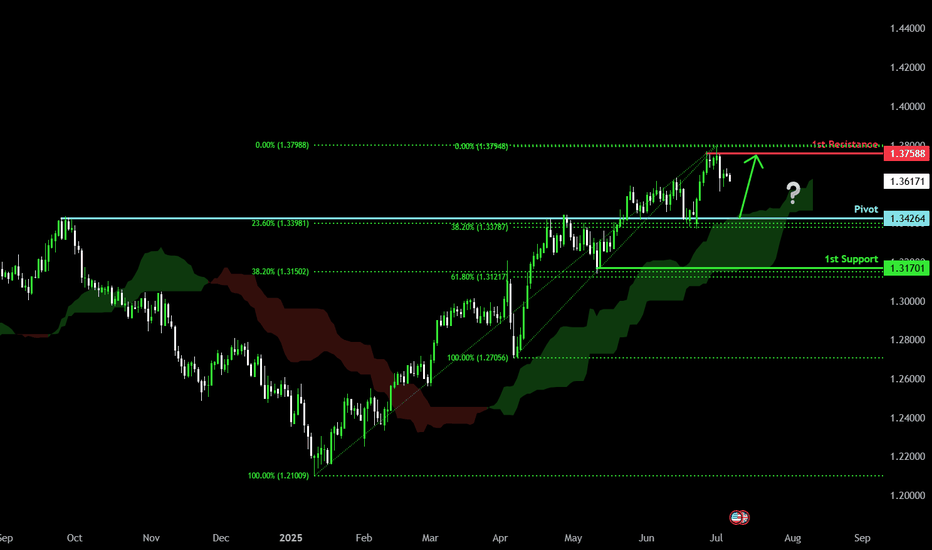

Bullish continuation?The Cable (GBP?USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 1.3426

1st Support: 1.3170

1st Resistance: 1.3758

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GBPUSD THIS WEEKGBPUSD this week going in level 61.8-70.2-79 or OTE and going for Sell in OB Daily.

RR 1:4 and Stoploss is above OB

Weekly hat 2 candle bearish and Daily it is Market structur shift for Bearish

Price going for retracment Fib and SELL

ALL this analysis its only my opinion not your to trade

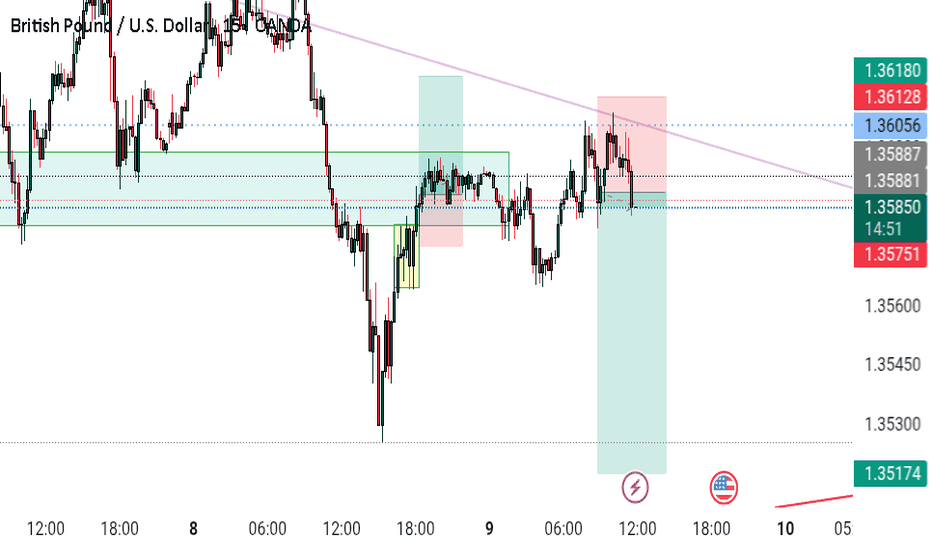

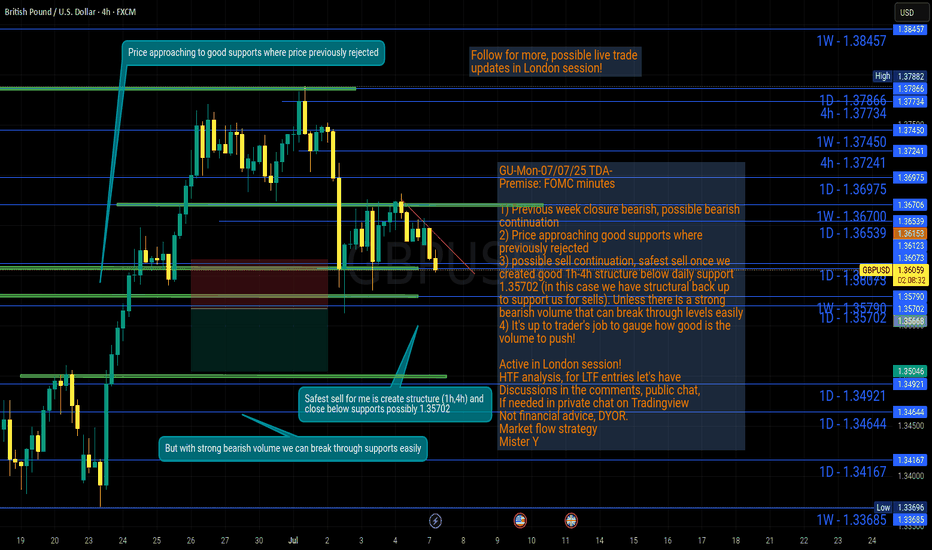

GU-Mon-07/07/25 TDA-Good support zone,but possible sell continueAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, lot size and replicate the move

over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

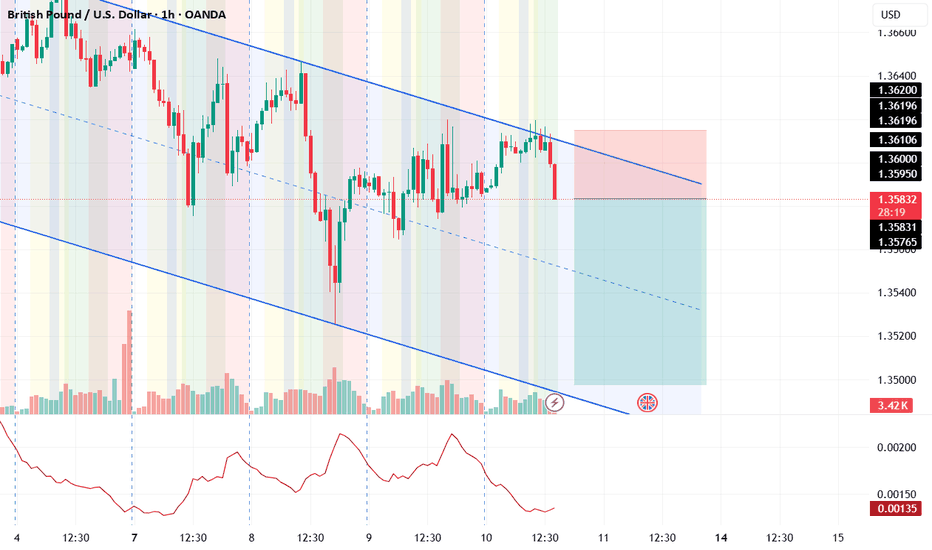

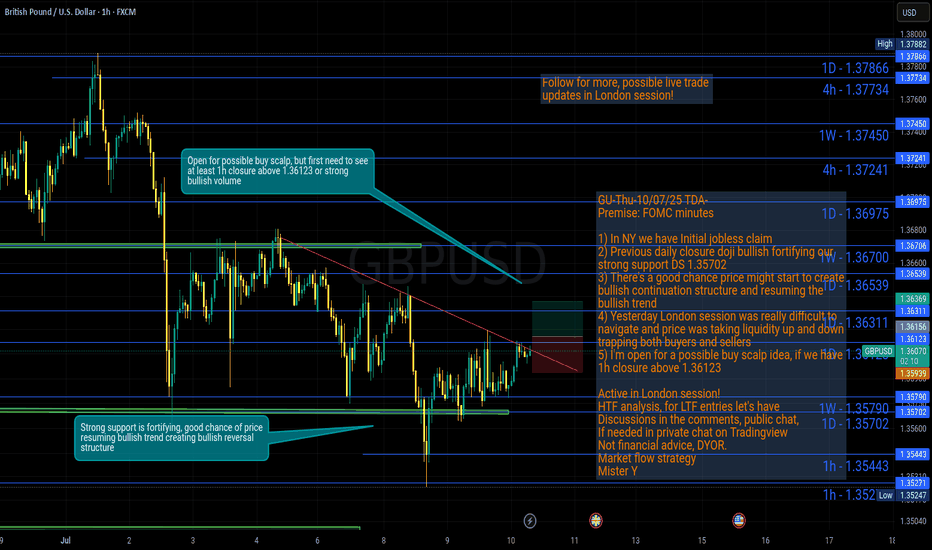

GU-Thu-10/07/25 TDA-GU resuming bullish trend?Analysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

For every trade I take, no matter if it's a loss or win, I always

do post trade analysis. It really helps to understand and

improve. You get to know or try to figure out why price

at this time specifically moved this way or that way.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

For example discussing on Tradingview public chat (and more).

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

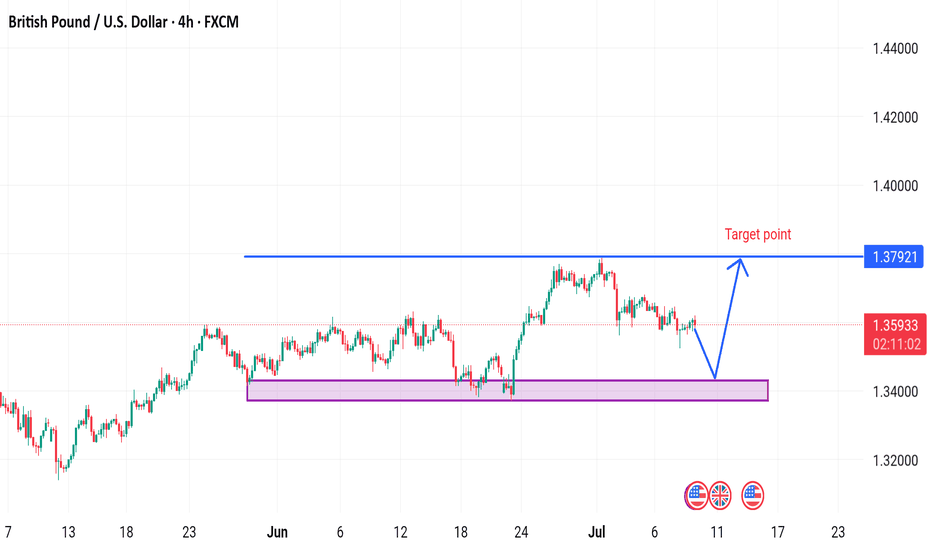

GBPUSD BUILDING TARGET GBP/USD Technical Analysis – 4H Timeframe (July 9, 2025)

This chart shows a technical analysis of the British Pound (GBP) versus the US Dollar (USD) on the 4-hour timeframe. The market is currently trading within a well-defined range, with a strong support zone (highlighted in purple) and a clear resistance level (marked in blue).

Key Levels:

Support Zone: 1.33700 – 1.34400

This zone has been tested multiple times and has acted as a strong demand area, where price has often reversed to the upside.

Current Price: 1.35991

The price is currently above the support zone but showing signs of bearish pressure.

Resistance / Target Point: 1.37921

This level has acted as a strong resistance in the past. If the price reverses from the support zone, this is the likely target point.

Analysis Summary:

The price is expected to drop down toward the support zone around 1.34000.

A bullish reversal is anticipated from this area.

If the reversal happens, the price may rally toward the target level at 1.37921.

Trading Perspective:

Buy Zone: Around 1.34000 (within the purple support box)

Target Zone: Around 1.37921

Suggested Stop-loss: Just below the support zone (e.g., around 1.33500)

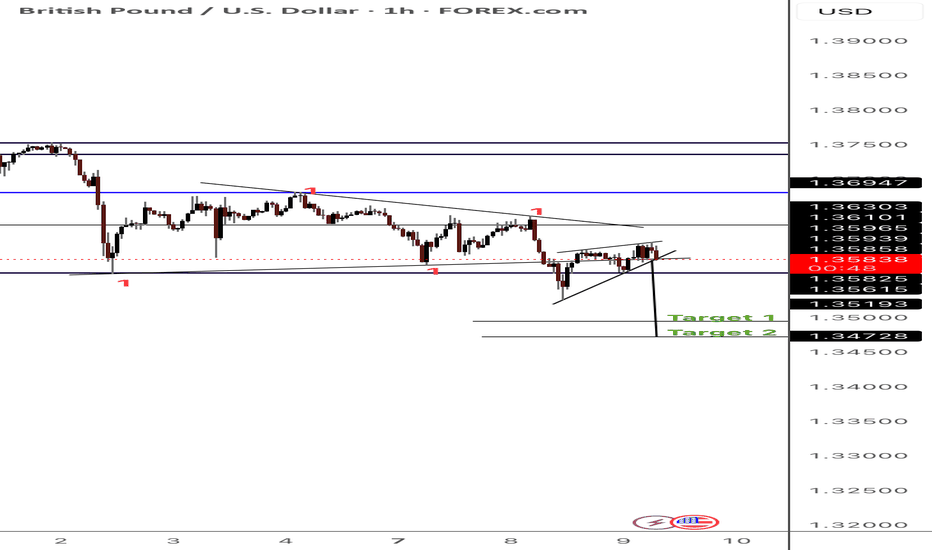

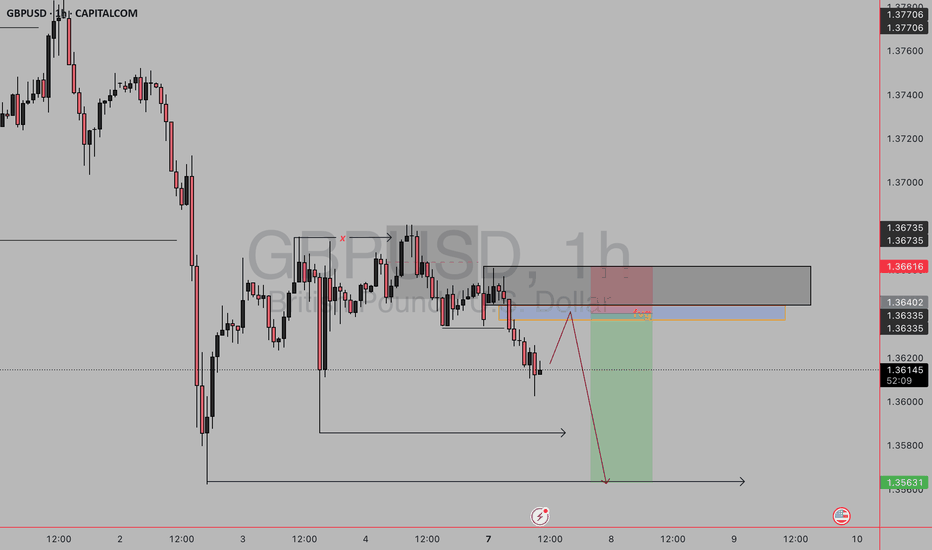

gbpusd sell setup🧠 Setup Summary:

You're anticipating a retracement into a supply zone (marked by the grey box) which contains a Fair Value Gap (FVG) before continuing the bearish move.

🧩 Key Components:

Supply Zone (Grey Box):

A previously mitigated zone where price dropped aggressively.

Likely institutional sell orders remain there.

Fair Value Gap (Orange Zone):

Price moved away fast and left an imbalance.

Your expectation: Price will return here, fill it, and then drop.

Entry Plan:

Sell when price taps into FVG or upper supply zone around 1.36420 – 1.36616.

Confirmation could be a bearish engulfing, liquidity sweep, or BOS on LTF.

Stop Loss: Above the supply zone — around 1.36680.

Take Profit (TP): A major low, likely 1.35631.

Risk-Reward: Strong RR (likely 1:3+), in line with institutional-style trading